Brazil Biometrics Market (2014-2020) | Companies, Industry, Forecast, Outlook, Value, Analysis, Trends, Growth, Size, Revenue & Share

Market Forecast By Technologies (Fingerprint, Face, Iris, Hand, Voice, and Signature), Applications (Government, Security, Travel & Transportation, Banking & Finance, Healthcare and Consumer Electronics) and Regions (North, South, North-East, Central-West, and South-East)

| Product Code: ETC000209 | Publication Date: Oct 2014 | Updated Date: May 2024 | Product Type: Report | |

| Publisher: 6Wresearch | ||||

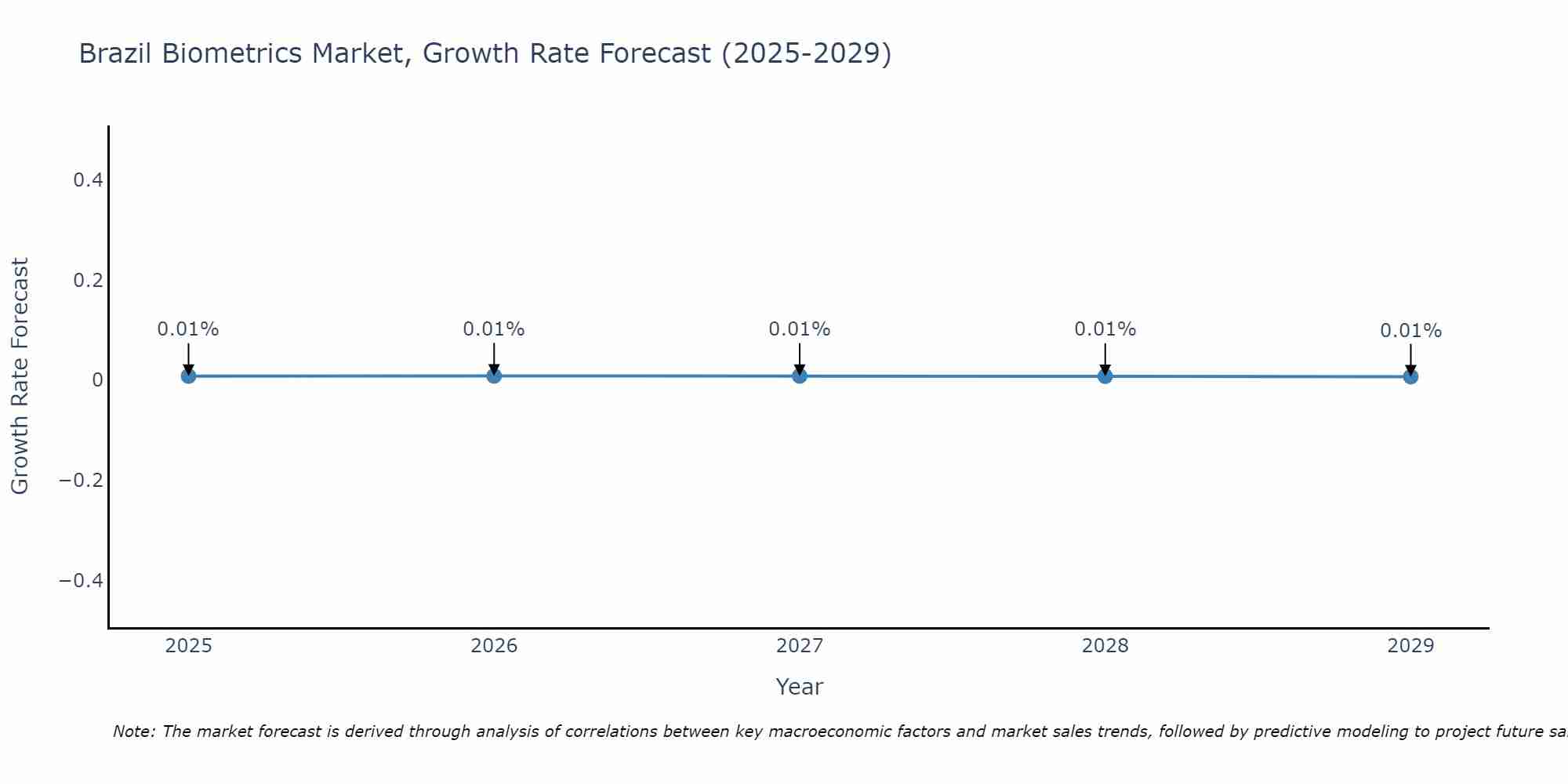

Brazil Biometrics Market Size Growth Rate

The Brazil Biometrics Market is projected to witness mixed growth rate patterns during 2025 to 2029. Growth accelerates to 0.01% in 2026, following an initial rate of 0.01%, before easing to 0.01% at the end of the period.

Government, security, travel & transportation applications have generated the majority of the market revenues in Brazil's biometrics market. Though, the market is still in the nascent stage but is anticipated to gain tremendous growth over the next five years.

Brazil is among the major forerunners in economic and infrastructure development across the globe and thus presents a wide opportunity for all the players active across the value chain such as component manufacturers, system manufacturers, technology developers, software providers, integrators, distributors, retailers, and aftermarket service providers.

Brazil biometric market being in the early phase of the industry cycle is less organized domestically and much of the market demand is supplied by foreign company products. However, in near future with growing awareness and increasing demand, new domestic players are likely to emerge and new product developments could be witnessed in the region.

According to 6Wresearch, Brazil Biometrics Market is projected to reach $1.3 billion by 2020. Amongst all biometrics technologies, fingerprint biometrics technology has captured the majority of the market share. However, higher growth of iris biometrics technology is expected during 2014-20.

Brazil biometrics market is anticipated to register sound revenues in the forthcoming years on the back of the rising need to maintain security in commercial and residential sectors as well. Additionally, the mobile segment is estimated to generate accumulated sales owing to the introduction of mobile access by apples like touch id, facial recognition, and iris recognition and is estimated to boost at the fastest pace with the rising apple phone users and is likely to remain to continue growing coupled with Alexa and Siri also using voice recognition as biometric Identifier. Not only electronics but the biometrics proved useful to catch the thief by identity the security recognition feature used thereby cops and is estimated to register the tremendous growth of the brazil biometrics market in the coming years.

Key features of the report:

• Market Dynamics including Drivers, Restraints, Opportunities in Brazil Biometric Systems Market

• Historical Market Revenue & Volume trends for Brazil Biometrics Market (2010 - 2013)

• Market Volume and Revenue Trends of various Technologies

• Market Revenue Trends of End-User Industries

• Market Volume and Revenue Forecast and Estimations by technologies till 2020

• Market Revenue Forecast and Estimations by End-User Industries

• Market Revenue Trends and Forecast by Regions

• Market Trends

• Overview of Value Chain

• Porter's Five Forces Analysis

• Price Point Analysis

• Company-wise Market Share

• Company Profiles

Frequently Asked Questions About the Market Study (FAQs):

TABLE OF CONTENTS

1 Executive Summary

2 Introduction

2.1 Key Highlights of the Report

2.2 Report Description

2.3 Market Scope & Segmentation

2.4 Assumptions and Methodology

3 Market Overview

3.1 Global Biometrics Market

3.2 Biometric Technologies Comparison

3.3 Industry Lifecycle

3.4 Opportunistic Matrix

3.5 Market Share

3.5.1 Market Share By Type

3.5.2 Market Share By Industry

3.5.3 Market Share By Region

3.6 Biometric Device Average Price

3.6.1 Fingerprint Scanners

3.6.2 Face Recognition Device

3.6.3 Hand Geometry Device

3.6.4 IRIS Recognition Device

3.6.5 Voice Recognition Device

3.6.6 Signature Scanning Device

4 Market Dynamics

4.1 Drivers

4.1.1 Growing Security Concerns

4.1.2 Growing Scope of Applications

4.1.3 Emergence of e-passports and Visas

4.1.4 Easy Storage and Retrieval

4.2 Restraints

4.2.1 High Cost of Technologies

4.2.2 Competition within Biometric Technologies

4.3 Opportunities

4.3.1 Enhancing Gaming Experience

4.3.2 Integration with existing authorization systems

4.4 Trends

4.4.1 Fingerprint Technology Trending in Banking Application

4.4.2 National ID

4.4.3 Educational Institutions Implementing Biometric Systems

4.5 Value Chain

4.6 Porter's Analysis

5 Market By Type

5.1 Introduction

5.2 Fingerprint Recognition Market

5.3 Face Recognition Market

5.4 Hand Geometry Market

5.5 IRIS Recognition Market

5.6 Voice recognition

5.7 Signature Scanning Market

6 Market By Industry

6.1 Introduction

6.2 Government

6.3 Travel Security and Transport

6.4 Banking and Finance

6.5 Healthcare

6.6 Consumer Electronics

7 Market By Region

7.1 Introduction

7.2 North

7.3 North East

7.4 South East

7.5 Mid West

7.6 South East

8 Competitive Landscape

8.1 Market Share Analysis by Company

8.2 Company Profiles

8.2.1 3M do Brasil Ltda.

8.2.2 Morpho Cards do Brasil SA

8.2.3 Griaule Biometrics Ltda.

8.2.4 Neokoros Brasil Ltda.

8.2.5 Dimas de Melo Pimenta Sistemas de Ponto e Acesso Ltda. (Dimep Sistemas)

8.2.6 Madis Rodbel Soluções de Ponto e Acesso Ltda.

8.2.7 Suprema Inc.

8.2.8 HID Global Corporation

8.2.9 KL Industry and Trade Control Equipment Time Ltda.

8.2.10 RSL Technology Ltda.

9 Outlook

10 Appendix

List of Figures

Figure 1 Brazil Biometrics Market Revenues*, By CAGR (14-20), By Technology (in %age)

Figure 2 Brazil Biometrics Market Revenues*, By CAGR (14-20), By Industry (in %age)

Figure 3 Brazil Biometrics Market Revenue Share, By Technology (2013)

Figure 4 Brazil Biometrics Market Revenue Share, By Industry (2013)

Figure 5 Brazil Biometrics Market Revenue and Volume, 2010 - 2020F

Figure 6 Brazil Biometrics Market Revenue, By Types, 2013 Vs. 2020F ($ Million)

Figure 7 Brazil Biometric Market Revenue, By Industry, 2013 Vs. 2020F ($ Million)

Figure 8 Global Biometrics Market, 2010 - 2020F ($ Billion)

Figure 9 Biometrics Market Share by Geography, 2012

Figure 10 Industry Life Cycle

Figure 11 Brazil Biometrics Market Revenue Share, By Types (2020F)

Figure 12 Brazil Biometrics Market Volume Share, By Types (2020F)

Figure 13 Brazil Biometrics Market Revenue Share, By Industry (2020F)

Figure 14 Brazil Biometrics Market Revenue Share, By Region (2020F)

Figure 15 Fingerprint Device Price, 2010 - 2020F ($ Per Unit)

Figure 16 Face Recognition Device Price, 2010 - 2020F ($ Per Unit)

Figure 17 Hand Geometry Device Price, 2010 - 2020F ($ Per Unit)

Figure 18 IRIS Recognition Device Price, 2010 - 2020F ($ Per Unit)

Figure 19 Voice Recognition Device Price, 2010 - 2020F ($ Per Unit)

Figure 20 Signature Scanner Device Price, 2010 - 2020F ($ Per Unit)

Figure 21 Brazil Fingerprint Biometrics Market Revenues, 2010-2020F ($ Million)

Figure 22 Brazil Fingerprint Biometrics Market Volume, 2010-2020F (‘000 Units)

Figure 23 Brazil Face Recognition Biometrics Market Revenues, 2010-2020F ($ Million)

Figure 24 Brazil Face Recognition Biometrics Market Volume, 2010-2020F (‘000 Units)

Figure 25 Brazil Hand Geometry Biometrics Market Revenues, 2010-2020F ($ Million)

Figure 26 Brazil Hand Geometry Biometrics Market Volume, 2010-2020F (‘000 Units)

Figure 27 Brazil IRIS Recognition Biometrics Market Revenues, 2010-2020F ($ Million)

Figure 28 Brazil IRIS Recognition Biometrics Market Volume, 2010-2020F (‘000 Units)

Figure 29 Brazil Voice Recognition Biometrics Market Revenues, 2010-2020F ($ Million)

Figure 30 Brazil Voice Recognition Biometrics Market Volume, 2010-2020F (‘000 Units)

Figure 31 Brazil Signature Recognition Biometrics Market Revenues, 2010-2020F ($ Million)

Figure 32 Brazil Signature Recognition Biometrics Market Volume, 2010-2020F (‘000 Units)

Figure 33 Government Sector Biometrics Market, 2010 - 2020F ($ Million)

Figure 34 Security Travel & Transport Biometrics Market Revenues, 2010-2020F ($ Million)

Figure 35 Banking and Finance Biometrics Market Revenues, 2010-2020F($ Million)

Figure 36 Healthcare Biometrics Market Revenues, 2010-2020F($ Million)

Figure 37 Consumer Electronics Biometrics Market Revenues, 2010-2020F($ Million)

Figure 38 Brazil Biometrics Market, By Region, 2013 & 2020F ($ Million)

Figure 39 southeast Brazil Biometrics Market Revenue, 2010 - 2020F ($ Million)

Figure 40 North East Brazil Biometrics Market Revenue, 2010- 2020F ($ Million)

Figure 41 South Brazil Biometrics Market Revenue, 2010- 2020F ($ Million)

Figure 42 Central West Brazil Biometrics Market Revenue, 2010 - 2020F ($ Million)

Figure 43 North Brazil Biometrics Market Revenue, 2010- 2020F ($ Million)

Figure 44 Brazil Biometrics Market Revenue Share, By Company (2012 Vs 2013)

List of Tables

Table 1 Brazil Biometrics Market Revenue, By Types, 2010 - 2020F ($ Million)

Table 2 Brazil Biometrics Market Volume, By Types, 2010 - 2020F (‘000 Unit)

Table 3 Brazil Biometrics Market Revenue, By Industry, 2010 - 2020F ($ Million)

Table 4 Brazil Biometrics Market Revenue, By Region 2010 - 2020F ($ Million)

Table 5 Brazil Crime Index By Major Cities (2014)

Table 6 3M Co. Financial Statement, 2010-2013 (USD Billion)

Table 7 Safran Sa Financial Statement, 2010-2013 (USD Billion)

Table 8 Suprema Inc. Financial Statement, 2010-2013 (USD Million)

Table 9 Assa Abloy Ab-B Financial Statement, 2010-2013 (USD Billion)

Biometrics has emerged as a new wave in the security market, which uses unique physical characteristics of individuals for access control and authorization. There are various technologies available in the market namely- fingerprint, iris, hand geometry, face recognition, voice, and signature.

These technologies have varied applications across different end-user industries. Major applications of biometrics comprise timekeeping, attendance, authorization, individual identification, and surveillance. The government sector is the largest end-user segment followed by security travel & transport, banking and finance, healthcare, and consumer electronics. According to 6Wresearch, the Brazil Biometrics market is projected to reach $1.3 billion by 2020. Declining prices, sporting of international events such as FIFA World Cup'2014 and Olympics'2016, increasing private investments, increasing government security spending, growing IT/ITeS, BFSI, and hospitality segments are some of the main contributing factors and driving the growth of biometrics in the Brazilian market.

In Brazil's biometrics market, fingerprint biometrics technology has dominated and is anticipated to maintain its dominance in the forecast period as well. Ease of usage, low cost, and benefits over smart card-based access control systems have fuelled the growth of fingerprint biometrics systems in the country. However, higher growth of iris biometrics technology is expected due to higher reliability and lower FAR & FRR.

The report, “Brazil Biometrics Market (2014-2020)” estimates and forecasts, overall Brazil biometrics market by revenue & volume, by technologies such as fingerprint, face, iris, hand, voice, and signature. Market by applications such as government, security, travel & transportation, banking & finance, healthcare, and consumer electronics and regions such as North, South, North-East, Central-West, and South-East. The report also gives the insights on competitive landscape, market share by company, price point analysis, company profiles, latest market trends, drivers, restraints, and opportunities.

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero