India Building Automation and Control Market (2017-23) | Companies, Forecast, Revenue, Outlook, Trends, Share, Analysis, Size, Industry, Growth & Value

Market Forecast by Types (HVAC (Thermostat Controller, Zone & Climate Control, Temperature Sensor and Others), Lighting & Control System (Relay System & Controllable Breaker, Sensors & Dimming Systems and Others), Safety & Security System (Video Surveillance Systems, Access Control Systems, Intrusion Detection Systems, and Fire & Safety Equipment) and Others), Verticals (Government & Transportation, Retail, Commercial Offices, Residential, Healthcare & Hospitality, and Others), Regions (Northern, Eastern, Western and Southern) and Competitive Landscape.

| Product Code: ETC000373 | Publication Date: Nov 2021 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 98 | No. of Figures: 40 | No. of Tables: 14 |

Growing government initiatives, increasing construction market, rising demand for next-generation electronic security and lighting control systems are some of the key factors that have resulted in the overall growth of the building automation and control market in India. Building automation systems registered maximum installation across areas such as commercial offices, shopping centers, residential, hotels, and hospitals in 2016.

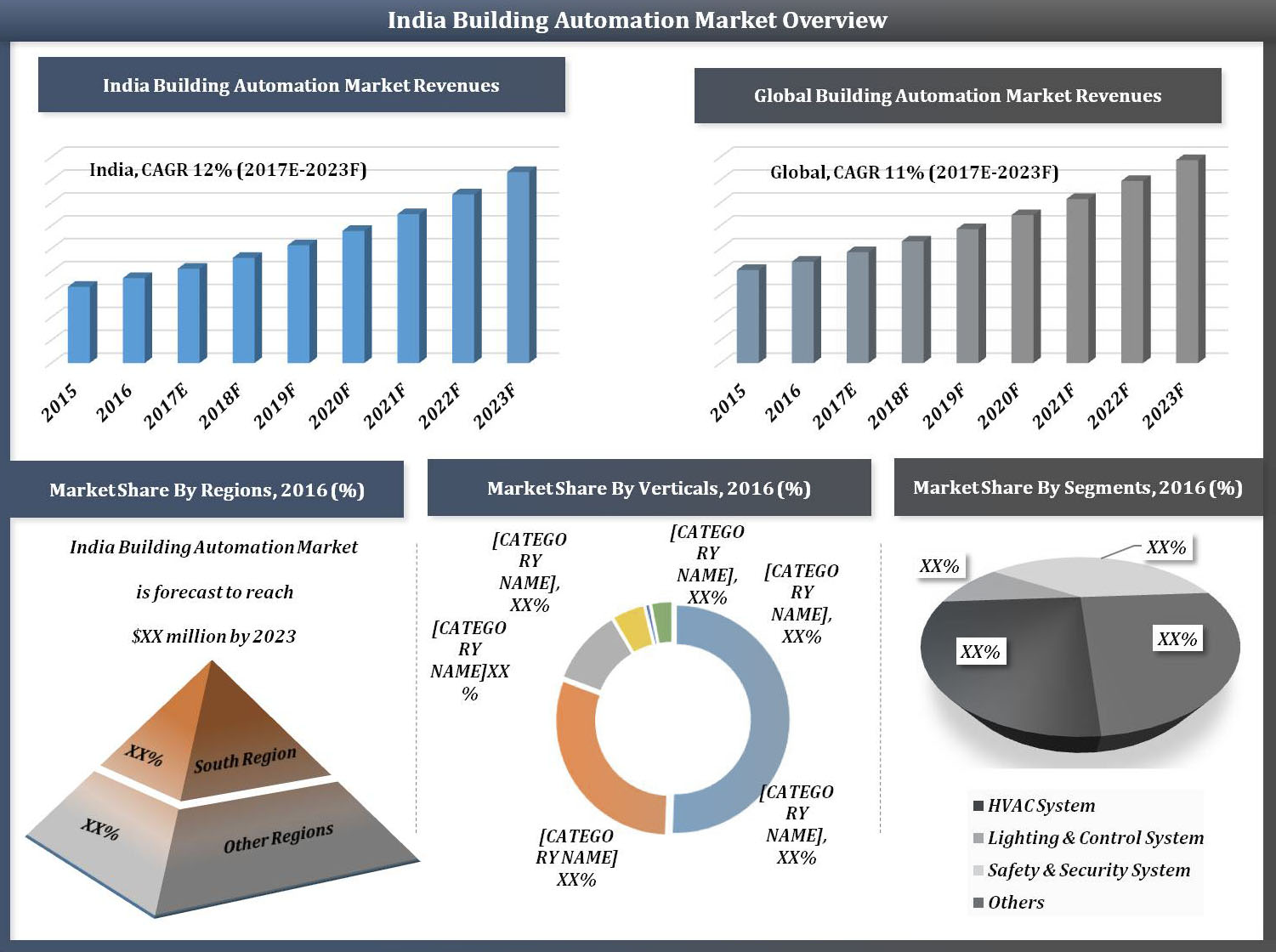

According to 6Wresearch, India building automation & control systems market size is expected to grow at a CAGR of over 12.5% during 2017-23. In India, safety & security systems contribute to the maximum revenue followed by HVAC systems and are expected to maintain their dominance in the market during the forecast period due to a huge amount of installation in the government & transportation, hospitality, and other verticals. In the safety & security segment, the fire & safety equipment led the market due to government regulation for mandatory installation of fire and safety systems in the commercial buildings, offices, metros, and airports.

The Government & transportation vertical acquired the majority of the India building automation & control systems market share in 2016 due to the installation of fire safety and surveillance systems.

The India building automation & control systems market report thoroughly covers the market by Building Automation System types, verticals, and regions. The India building automation & control systems market outlook report provides an unbiased and detailed analysis of the India building automation & control systems market trends, opportunities/high growth areas, market drivers which would help the stakeholders to device and align their market strategies according to the current and future market dynamics.

India building automation and control market is anticipated to register sound growth throughout the forecast period 2020-26F on the back of multiplying growth of the transportation and government vertical in the country, which is instigating high-end deployment of fire safety, management and surveillance systems. Building automation and control systems have been embedded as a contemporary built environment solution and are gaining traction in the overall Indian market. With an increase in the rise of the infrastructure and a spur in the construction activities in the country, the India building automation and control market is anticipated to embrace lucrative opportunities for growth in the coming years. Moreover, owing to the rising demand for energy and operational efficiency for better building management, along with an increase in sustainability, the India building automation and control market is anticipated to witness traction in the coming years. Also, owing to an increase in the management, automation, and field device level sustainability, the building automation, and control market is anticipated to embrace lucrative growth prospects in the coming years across the Indian borders.

Key Highlights of the Report:

- India Building Automation & Control Systems Market Overview

- India Building Automation & Control Systems Market Outlook

- India Building Automation & Control Systems Market Forecast

- Historical data of Global Building Automation System Market for the Period 2015-2016

- Market Size & Forecast of Global Building Automation System Market until 2023

- Historical data of India Building Automation System Market Revenues for the Period 2015-2016

- India Building Automation & Control Systems Market Size & India Building Automation & Control

- Systems Market Forecast of Revenues, until 2023

- Historical data of India HVAC System Market Revenues for the Period 2015-2016

- Market Size & Forecast of India HVAC System Market Revenues until 2023

- Historical data of India Lighting Control Market Revenues for the Period 2015-2016

- Market Size & Forecast of India Lighting Control Market Revenues until 2023

- Historical data of India Safety & Security Market Revenues for the Period 2015-2016

- Market Size & Forecast of India Safety & Security Market Revenues until 2023

- Historical data of India Building Automation & Control Systems Market Revenues for the Period 2015-2016

- Market Size & Forecast of India Building Automation & Control Systems Market Revenues, until 2023

- Historical data of India Building Automation System Market Revenues, By Regions for the Period 2015-2016

- Market Size & Forecast of India Building Automation System Regional Market Revenues until 2023

- India Building Automation & Control Systems Market Trends and Developments

- Market Opportunity Assessment

- India Building Automation & Control Systems Market Share by Players

- India Building Automation & Control Systems Market Overview on Competitive Landscape

- Recommendations

Markets Covered

The India building automation & control systems market report provides a detailed analysis of the following market segments:

Types:

- HVAC Systems

- Thermostat Controller

- Zone & Climate Control

- Temperature Sensors

- Others

2. Lighting & Control Systems

- Relay System & Controllable Breaker

- Sensors & Dimming Systems

- Others

3. Safety & Security Systems

- Video Surveillance Systems

- Access Control Systems

- Intrusion Detection Systems

- Fire & Safety Equipment Market

- Others

Verticals:

- Residential

- Government & Transportation

- Healthcare & Hospitality

- Commercial Offices & Buildings

- Retail

- Others (BFSI, Educational Institute, Industrial, etc.)

By Regions:

- Southern

- Northern

- Western

- Eastern

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary

2 Introduction

2.1 Key Highlights of the Report

2.2 Report Description

2.3 Market Scope & Segmentation

2.4 Research Methodology

2.5 Assumption

3 Global Building Automation Market Overview

3.1 Global Building Automation Market Revenues (2015-2023F)

3.2 Global Building Automation Market Revenue Share, By Regions (2016)

4 India Building Automation Market Overview

4.1 India Building Automation Market Revenues (2015-2023F)

4.2 India Building Automation Market Industry Life Cycle

4.3 India Building Automation Market Opportunistic Matrix, (2016)

4.4 India Building Automation Market Porter's Five Forces Model Analysis

4.5 India Building Automation Market Revenues Share, By Types (2016 & 2023F)

4.6 India Building Automation Market Revenues Share, By Verticals (2016 & 2023F)

4.7 India Building Automation Market Revenues Share, By Regions (2016 & 2023F)

5 India Building Automation Market Dynamics

5.1 Impact Analysis

5.2 Market Drivers

5.2.1 Energy Saving

5.2.2 Increase in Crime Rate

5.3 Market Restraints

5.3.1 High Cost & Low Awareness

6 India Building Automation Market Trends

6.1 Cloud-Based Technology

6.2 Voice-Controlled Systems

6.3 IP Video Surveillance Systems

6.4 Wireless or Hybrid System

7 India Building Automation HVAC System Market Overview

7.1 India HVAC System Market Revenues (2015-2023F)

7.2 India HVAC System Market Overview, By Types

7.2.1 India Thermostat Controllers Market Revenues (2015-2023F)

7.2.2 India Zone & Climate Controller Market Revenues (2015-2023F)

7.2.3 India Temperature Sensors Market Revenues (2015-2023F)

7.2.4 India Other HVAC Systems Market Revenues (2015-2023F)

8 India Building Automation Lighting Control System Market Overview

8.1 India Lighting Control System Market Revenues (2015-2023F)

8.2 India Lighting Control System Market Overview, By Types

8.2.1 India Relay System & Controllable Breaker Market Revenues (2015-2023F)

8.2.2 India Sensors & Dimming System Market Revenues (2015-2023F)

8.2.3 India Other Lighting Control System Market Revenues (2015-2023F)

9 India Building Automation Safety & Security Systems Market Overview

9.1 India Safety & Security Systems Market Revenues (2015-2023F)

9.2 India Safety & Security Systems Market Overview, By Types

9.2.1 India Video Surveillance System Market Revenues (2015-2023F)

9.2.2 India Access Control System Market Revenues (2015-2023F)

9.2.3 India Intrusion Detection System Market Revenues (2015-2023F)

9.2.4 India Fire & Safety Equipment Market Revenues (2015-2023F)

10 India Other Building Automation Systems Market Overview

10.1 India Other Building Automation Systems Market Revenues (2015-2023F)

11 India Building Automation Market Overview, By Verticals

11.1 India Government & Transportation Building Automation Market Revenues (2015-2023F)

11.2 India Retail Building Automation Market Revenues (2015-2023F)

11.3 India Commercial Offices & Buildings Automation Market Revenues (2015-2023F)

11.4 India Residential Building Automation Market Revenues (2015-2023F)

11.5 India Healthcare & Hospitality Building Automation Market Revenues (2015-2023F)

11.6 India Others Building Automation Vertical Market Revenues (2015-2023F)

12 India Building Automation Market Overview, By Regions

12.1 India North Region Building Automation Market Revenues (2015-2023F)

12.2 India South Region Building Automation Market Revenues (2015-2023F)

12.3 India West Region Building Automation Market Revenues (2015-2023F)

12.4 India East Region Building Automation Market Revenues (2015-2023F)

13 Competitive Landscape

13.1 Competitive Benchmarking, By Building Automation Solutions

14 Company Profiles

14.1 Honeywell Automation India Limited

14.2 Samsung India Electronics Private Limited

14.3 Siemens India Limited

14.4 Schneider Electric India Private Limited

14.5 Larsen Toubro Limited

14.6 Rockwell Automation India Pvt. Ltd.

14.7 Legrand (India) Private Limited

15 Key Strategic Pointers

16 Disclaimer

List of Figures

Figure 1 Global Building Automation Market Revenues, 2015-2023F ($ Billion)

Figure 2 Global Building Automation Market Revenue Share (2016)

Figure 3 India Building Automation Market, 2015-2023F ($ Million)

Figure 4 India Building Automation Market Revenue Share, By Types (2016)

Figure 5 India Building Automation Market Revenue Share, By Types (2023F)

Figure 6 India Building Automation Market Revenue Share, By Verticals (2016)

Figure 7 India Building Automation Market Revenue Share, By Verticals (2023F)

Figure 8 India Building Automation Market Revenue Share, By Regions (2016)

Figure 9 India Building Automation Market Revenue Share, By Regions (2023F)

Figure 10 Number of Property Crimes in India, 2012-15 (000' Units)

Figure 11 Rate of Cognizable Crime in Mega Cities, 2015

Figure 12 India Cloud Computing Market Revenues, 2014-2022F ($ Billion)

Figure 13 India HVAC System Market Revenues, 2015-2023F ($ Million)

Figure 14 India Thermostat Controller Market Revenues, 2015-2023F ($ Million)

Figure 15 India Zone & Climate Controller Market Revenues, 2015-2023F ($ Million)

Figure 16 India Temperature Sensors Market Revenues, 2015-2023F ($ Million)

Figure 17 India Other HVAC System Market Revenues, 2015-2023F ($ Million)

Figure 18 India Lighting Control System Market Revenue, 2015-2023F ($ Million)

Figure 19 India Relay System & Controllable Breaker Revenue Share (2017E-2023F)

Figure 20 India Relay System & Controllable System Market Revenues, 2015-2023F ($ Million)

Figure 21 India Sensor & Dimming System Market Revenues, 2015-2023F ($ Million)

Figure 22 India Other Lighting Control System Market Revenues, 2015-2023F ($ Million)

Figure 23 India Safety & Security System Market Revenues, 2015-2023F ($ Million)

Figure 24 India Video Surveillance System Market Revenues, 2015-2023F ($ Million)

Figure 25 India Access Control System Market Revenues, 2015-2023F ($ Million )

Figure 26 India Intrusion Detection System Market Revenues, 2015-2023F ($ Million)

Figure 27 India Fire & Safety Equipment Market Revenues, 2015-2023F ($ Million)

Figure 28 Other Building Automation System Market Revenues, 2015-2023F ($ Million)

Figure 29 India Government & Transportation Building Automation Market Revenues, 2015-2023F ($ Million)

Figure 30 India Retail Building Automation Market Revenues, 2015-2023F ($ Million)

Figure 31 India Commercial Offices & Buildings Automation Market Revenues, 2015-2023F ($ Million)

Figure 32 India Residential Building Automation Market Revenues, 2015-2023F ($ Million)

Figure 33 Urban Households in India, 2017 & 2023F (000' Units)

Figure 34 India Healthcare & Hospitality Building Automation Market Revenues, 2015-2023F ($ Million)

Figure 35 Number of Hotels in India, 2015-2019F (000' units )

Figure 36 Others Building Automation Vertical Market Revenues, 2015-2023F ($ Million)

Figure 37 India North Region Building Automation Market Revenues, 2015-2023F ($ Million)

Figure 38 India South Region Building Automation Market Revenues, 2015-2023F ($ Million)

Figure 39 India West Region Building Automation Market Revenues, 2015-2023F ($ Million)

Figure 40 India East Region Building Automation Market Revenues, 2015-2023F ($ Million)

List of Tables

Table 1 Upcoming Airports in India

Table 2 Upcoming Metro Project in India

Table 3 New Malls in India (2016)

Table 4 Commercial Buildings in India

Table 5 India Upcoming Independent Bungalow/ Villas

Table 6 India Upcoming Residential Buildings

Table 7 Upcoming Projects in the Northern Region

Table 8 Upcoming Projects in Southern Region

Table 9 Upcoming Projects in the Western Region

Table 10 Upcoming Projects in Eastern Region

Table 11 Competitive Benchmarking, By Building Automation Solutions

Table 12 Competitive Benchmarking, By HVAC Solutions

Table 13 Competitive Benchmarking, By Lighting & Control Solutions

Table 14 Competitive Benchmarking, By Safety & Security Solutions

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

- Kenya Road Stabilization Equipment Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- North America Sodium chloride Market (2025-2031) | Analysis, Revenue, Forecast, Trends, Companies, Size, Growth, Share, Industry, Outlook & Value

- North America Vinyl Flooring Market (2025-2031) | Value, Growth,Size, Analysis, Revenue, Industry, Forecast, Share, Outlook, Companies & Trends

- Tajikistan Thermal Camera Market (2025-2031) | Trends, Size, Growth, Share, Industry, Companies, Value, Analysis, Revenue, Forecast & Outlook

- Singapore Professional AV Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero