India Transport (Bus, Truck and Rail) Air Conditioner and Refrigeration Market (2016-2022) | Size, Companies, Growth, Revenue, Trends, Share, Outlook, Value, Industry, Analysis & Forecast

Market Forecast by Segments (Bus (12-20 Seater, 21-25 Seater, 26-35 Seater and 36-45 Seater), Rail (Indian Railway and Metro) and Truck (Milk and Dairy Products, Fruits And Vegetables, Meat & Fish and Pharmaceuticals & Chemicals)), Services (New Installation, Modernization and Maintenance), Regions (North, South, East and West) and Competitive Landscape

| Product Code: ETC000337 | Publication Date: Nov 2016 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 108 | No. of Figures: 58 | No. of Tables: 8 |

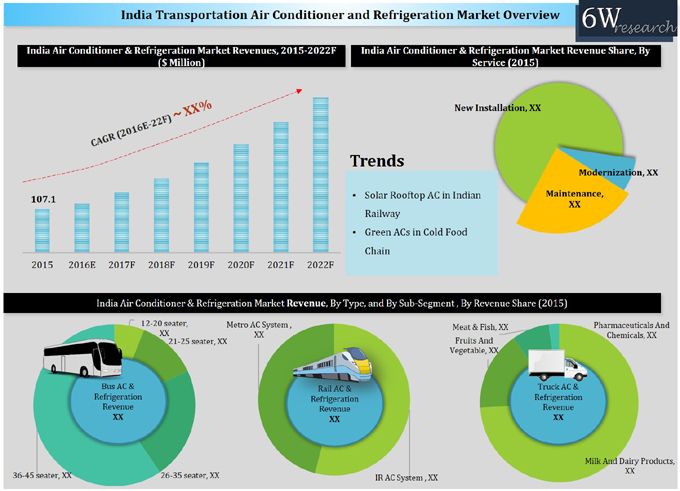

India is emerging as one of the fastest growing transport air conditioner & refrigeration markets in the Asia-Pacific region. Owing to government infrastructure projects such as metro rails, expansion of state & national highways and rising disposable income on travelling, adoption of comfortable lifestyle are expected to fuel the market for transport air conditioner & refrigeration market in India. Increasing number of tourists, school & institutional buses and reefer trucks usage in cold chain industry would boost the demand for transport air conditioner & refrigeration systems in the country. According to 6Wresearch, India Transport Air Conditioner and Refrigeration market (includes bus, rail and truck air conditioner & refrigeration system) market touched $107 million in 2015. In India Transport Air Conditioner & Refrigeration market, rail segment market accounted for majority of the revenue share followed by the bus segment. In service market, new installation segment held key market revenue share followed by the maintenance and modernization service market. New installation market is expected to maintain its market leadership through the forecast period. The report thoroughly covers the market by types, verticals, and regions. The report provides unbiased and detailed analysis of the on-going trends, opportunities, high growth areas, and market drivers, which would help stakeholders to device and align market strategies according to the current and future market dynamics.

Key Highlights of the Report:

• Historical Data of India Transport Air Conditioner & Refrigeration Market Revenues for the Period 2012-2015.

• Market Size & Forecast of India Transport Air Conditioner & Refrigeration Market Revenues until 2022F.

• Historical Data of India Transport Air Conditioner & Refrigeration Market Revenues

by Application Segment for the Period 2012-2015.

• Market Size & Forecast of India Transport Air Conditioner & Refrigeration Market Revenues

by Application Segment until 2022F.

• Historical Data of India Bus Air Conditioner & Refrigeration Market Revenues by Seating

Capacity for the Period 2012-2015.

• Market Size & Forecast of India Bus Air Conditioner & Refrigeration Market Revenues by

Seating Capacity until 2022F.

• Historical Data of India Rail Air Conditioner & Refrigeration Market by End-User

for the Period 2012-2015.

• Market Size & Forecast of India Rail Air Conditioner & Refrigeration Market Revenues by End-User until 2022F.

• Historical Data of India Truck Air Conditioner & Refrigeration Market by Perishable Goods for

the Period 2012-2015.

• Market Size & Forecast of India Truck Air Conditioner & Refrigeration Market Revenues by

Perishable Goods until 2022F.

• Historical Data of India Transport Air Conditioner & Refrigeration Market by Services for the Period 2012-2015.

• Market Size & Forecast of India Transport Air Conditioner & Refrigeration Market

Revenues by Services until 2022F.

• Historical Data of India Transport Air Conditioner & Refrigeration Market by Regions for

the Period 2012-2015.

• Market Size & Forecast of India Transport Air Conditioner & Refrigeration Market

Revenues by Regions until 2022F.

• Market Drivers and Restraints.

• India Transport Air Conditioner & Refrigeration Market-Opportunity Matrix

• India Transport Air Conditioner & Refrigeration Market Trends

• India Transport Air Conditioner & Refrigeration Market - Industry Life Cycle

• Porter's Five Forces Analysis

• Competitive Benchmarking

• Company Profiles

• Key Strategic Pointers

Markets Covered

The report provides the detailed analysis of the following market segments:

• By Segments:

o Bus Air Conditioner & Refrigeration

• 12-20 Seater

• 21-25 Seater

• 26-35 Seater

• 36-45 Seater

o Rail Air Conditioner & Refrigeration

• Indian Railway

• Metro

o Truck Air Conditioner & Refrigeration

• Milk and Dairy Products

• Fruits And Vegetables

• Meat & Fish

• Pharmaceuticals And Chemicals

• By Services:

o New Installation

o Modernization

o Maintenance

• By Regions:

o Northern Region

o Southern Region

o Western Region

o Eastern Region

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary

2 Introduction

2.1 Key Highlights

2.2 Report Description

2.3 Market Scope & Segmentation

2.4 Research Methodology

2.5 Assumptions

3 India Transport Air Conditioner & Refrigeration Market Overview

3.1 Country Overview

3.2 India Transport Air Conditioner & Refrigeration Market, By Revenues (2012-2022)

3.3 Industry Life Cycle

3.4 Porter Five Forces Model

3.5 Opportunity Matrix

3.6 India Transport Air Conditioner & Refrigeration Market Revenues, By Types (2015)

3.7 India Transport Air Conditioner & Refrigeration Market Revenues, By Services (2015)

3.8 India Transport Air Conditioner & Refrigeration Market Revenues, By Regions (2015)

4 India Transport Air Conditioner & Refrigeration Market Dynamics

4.1 Market Dynamics-Impact Analysis

4.2 Drivers

4.2.1 Government Initiative to Uplift Cold Chain Infrastructure

4.2.2 Increasing Demand for Better Driving and Travelling Comfort

4.3 Restraints

4.3.1 Environmental Effects Of Refrigerants Used In Automotive Air

Conditioning Resulting Into High Ownership Cost

4.3.2 Increase in Bus Fare Resulting Into Decline In Demand For AC Buses

5 India Transport Air Conditioner & Refrigeration Market Trends

5.1 Solar Rooftop AC in Indian Railway

5.2 Green ACs in Cold Food Chain

6 India Bus Air Conditioner Market Overview

6.1 India Bus Air Conditioner Market Revenues, 2012-2022F ($ Million)

6.2 India Bus Air Conditioner Market Revenues, By Types

6.2.1 India 12-20 Seater Bus Air Conditioner Market Revenues Vs. Volume (2012-2022)

6.2.2 India 20-25 Seater Bus Air Conditioner Market Revenues Vs. Volume(2012-2022)

6.2.3 India 25-35 Seater Bus Air Conditioner Market Revenues Vs. Volume (2012-2022)

6.2.4 India 35-45 Seater Bus Air Conditioner Market Revenues Vs. Volume (2012-2022)

7 India Rail Air Conditioner Market Overview

7.1 India Rail Air Conditioner Market Revenues, 2012-2022F ($ Million)

7.2 India Rail Air Conditioner Market Revenue Share, By Types (2015)

7.2.1 India Railway Air Conditioner Market Revenues Vs. Volume (2012-2022)

7.2.2 India Metro Air Conditioner Market Revenues Vs Volume (2012-2022)

8 India Truck Air Conditioner and Refrigeration Market Overview

8.1 India Truck Air Conditioner and Refrigeration Market Revenues, 2012-2022F ($ Million)

8.2 India Truck Air Conditioner and Refrigeration Market Revenue Share, By Types (2015)

8.2.1 Milk and Dairy Products

8.2.2 Fruits And Vegetables

8.2.3 Meat & Fish

8.2.4 Pharmaceuticals And Chemicals

9 India Transport Air Conditioner & Refrigeration Market Overview, By Services (2012-2022)

9.1 New Installation

9.2 Maintenance

9.3 Modernization

10 India Transport Air Conditioner & Refrigeration Market Overview, By Regions (2012-2022)

10.1 Northern

10.2 Southern

10.3 Western

10.4 Eastern

11 India Transport Air Conditioner & Refrigeration Market, Competitive Landscape

11.1 Competitive Benchmarking, By Applications

11.2 India Transport Air Conditioner And Refrigeration Company Revenue Market Share (2015)

12 Company Profiles

12.1 Carrier Airconditioning and Refrigeration Ltd.

12.2 Eberspächer Sütrak GmbH & Co. KG

12.3 Emerson Electric Corporation

12.4 Guangzhou Jingyi Automobile Air Conditioner Co. Ltd.

12.5 The Lloyd Group

12.6 Sidwal Refrigeration Industries Limited

12.7 Spheros Gmbh

12.8 Subros Ltd.

12.9 Thermo King Corporation

12.10 Toshiba Corporation

13 Key Strategic Pointers

14 Disclaimer

List of Figures

Figure 1 India Transport Air Conditioner & Refrigeration Market Revenues, 2012-2015 ($ Million)

Figure 2 India Transport Air Conditioner & Refrigeration Market Revenues, 2016E-2022F ($ Million)

Figure 3 India Transport Air Conditioner & Refrigeration Market Industry Life Cycle (2015)

Figure 4 India Transport Air Conditioner & Refrigeration Market - Opportunistic Matrix, (2015)

Figure 5 India Transport Air Conditioner & Refrigeration Market Revenue Share, By Type (2015)

Figure 6 India Transport Air Conditioner & Refrigeration Market Revenue Share, By Type (2022F)

Figure 7 India Transport Air Conditioner & Refrigeration Market Revenue Share, By Services (2015)

Figure 8 India Transport Air Conditioner & Refrigeration Market Revenue Share, By Services (2022F)

Figure 9 India Transport Air Conditioner & Refrigeration Market Revenue Share, By Region (2015)

Figure 10 Temperature Controlled Vehicles Market in India

Figure 11 India Milk Production (In Million Tons)

Figure 12 India Egg Production (In 10 Million Numbers)

Figure 13 India Meat Production (In “000” Tons)

Figure 14 India Fish Production (In “000” Tons )

Figure 15 India Food Industry, 2014- 2018 ($ Billion)

Figure 16 India Bus Air Conditioner & Refrigeration Market Revenues, 2012-2015 ($ Million)

Figure 17 India Bus Air Conditioner & Refrigeration Market Revenues, 2016E-2022F ($ Million)

Figure 18 Growth in Average Bus Fleet Held and operated By STU's per year (2010-2014)

Figure 19 India Bus Air Conditioner & Refrigeration Market Revenues, By Type (2015)

Figure 20 India 12-20 Seater Bus Air Conditioner & Refrigeration Market Revenues, 2012-2022F ($ Million)

Figure 21 India 12-20 Seater Bus Air Conditioner Market Volume, 2012-2022F (Units)

Figure 22 India 21-25 Seater Bus Air Conditioner Market Revenues, 2012-2022F ($ Million)

Figure 23 India 21-25 Seater Bus Air Conditioner Market Volume, 2012-2022F (Units)

Figure 24 India 26-35 Seater Bus Air Conditioner Market Revenues, 2012-2022F ($ Million)

Figure 25 India 26-35 Seater Bus Air Conditioner Market Volume, 2012-2022F (Units)

Figure 26 India 36-45 Seater Bus Air Conditioner Market Revenues, 2012-2022F ($ Million)

Figure 27 India 36-45 Seater Bus Air Conditioner Market Volume, 2012-2022F (Units)

Figure 28 India Rail Air Conditioner Market Revenues, 2012-2015 ($ Million)

Figure 29 India Rail Air Conditioner Market Revenues, 2016E-2022F ($ Million)

Figure 30 India Rail Air Conditioner Market Revenue Share, By Type (2015 & 2022F)

Figure 31 India Railway Air Conditioner Market Revenues, 2012-2022F ($ Million)

Figure 32 India Railway Air Conditioner Market Volume, 2012-2022F (Units)

Figure 33 Number of Train Passengers in India ( In Million)

Figure 34 India Railway Financial-Working Results ($ Billion)

Figure 35 India Rapid Metro Air Conditioner Market Revenues, 2012-2022F ($ Million)

Figure 36 India Rapid Metro Air Conditioner Market Volume, 2012-2022F (Units)

Figure 37 India Truck Air Conditioner And Refrigeration Market Revenues, 2012-2015 ($ Million)

Figure 38 India Truck Air Conditioner And Refrigeration Market Revenues, 2016E-2022F ($ Million)

Figure 39 India Truck Air Conditioner & Refrigeration Market Revenue Share, By Types (2015 & 2022F)

Figure 40 India Milk and Dairy Product Trucks Air Conditioner & Refrigeration Market Revenues , 2012-2022F ($ Million)

Figure 41 India Milk and Dairy Product Truck Air Conditioner & Refrigeration Market Volume, 2012-2022F (000'Units)

Figure 42 India Fruits And Vegetables Trucks Air Conditioner & Refrigeration Market Revenues , 2012-2022F ($ Million)

Figure 43 India Fruits And Vegetables Truck Air Conditioner & Refrigeration Market Volume, 2012-2022F (Units)

Figure 44 India Meat And Fish Trucks Air Conditioner & Refrigeration Market Revenues , 2012-2022F ($ Million)

Figure 45 India Meat And Fish Truck Air Conditioner & Refrigeration Market Volume, 2012-2022F (Units)

Figure 46 India Pharmaceuticals And Chemicals Trucks Air Conditioner & Refrigeration Market Revenues , 2012-2022F ($ Million)

Figure 47 India Pharmaceuticals And Chemicals Truck Air Conditioner & Refrigeration Market Volume, 2012-2022F (Units)

Figure 48 India Pharmaceuticals Market , 2012-2022F ($ Billion)

Figure 49 India Transport Air Conditioner And Refrigeration Market Revenue, By Services, 2015 & 2022F ($ Million)

Figure 50 India Transport Air Conditioner And Refrigeration New Installation Market Revenues , 2012-2022F ($ Million)

Figure 51 India Transport Air Conditioner And Refrigeration Maintenance Market Revenues , 2012-2022F ($ Million)

Figure 52 India Transport Air Conditioner And Refrigeration Modernization Market Revenues , 2012-2022F ($ Million)

Figure 53 India Southern Region Transport Air Conditioner And Refrigeration Market Revenues , 2012-2022F ($ Million)

Figure 54 India Northern Region Transport Air Conditioner And Refrigeration Market Revenues , 2012-2022F ($ Million)

Figure 55 India Western Region Transport Air Conditioner And Refrigeration Market Revenues , 2012-2022F ($ Million)

Figure 56 India Eastern Region Transport Air Conditioner And Refrigeration Market Revenues , 2012-2022F ($ Million)

Figure 57 India Transport Air Conditioner And Refrigeration Company Revenue Market Share (2015)

Figure 58 Top Polluted Urban Cities in India with Air Pollution Index Number (2014)

List of Tables

Table 1 Segment-wise Size & Products in Food Processing Industry

Table 2 Technical Option to Replace HFC-134a in Automobile Air Conditioning

Table 3 Benefits of Solar Power

Table 4 India Metropolitan Transport Outlay, 2015-16 ($ Million)

Table 5 10 Upcoming Metro in India

Table 6 Recommended storage conditions for Fruits and Vegetables

Table 7 India Transport Air Conditioner And Refrigeration Average Maintenance Cost in India

Table 8 Competitive Benchmarking, By Application

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

- Kenya Road Stabilization Equipment Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- North America Sodium chloride Market (2025-2031) | Analysis, Revenue, Forecast, Trends, Companies, Size, Growth, Share, Industry, Outlook & Value

- North America Vinyl Flooring Market (2025-2031) | Value, Growth,Size, Analysis, Revenue, Industry, Forecast, Share, Outlook, Companies & Trends

- Tajikistan Thermal Camera Market (2025-2031) | Trends, Size, Growth, Share, Industry, Companies, Value, Analysis, Revenue, Forecast & Outlook

- Singapore Professional AV Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero