Middle East Chocolate Market (2017-2023) | Analysis, Size, Share, Segmentation, Growth, Value, Revenue, Industry & Outlook

Market Forecast By Categories (Milk Chocolate, Dark Chocolate and White Chocolate), By Distribution Channels (Hypermarkets & Supermarkets, Convenience Stores, Specialist Retailers and Others (e-Commerce, Pharmacy, and Dollar Stores)), By Packaging (Flexible, Rigid, and Paper & Board), By Countries (Saudi Arabia, UAE, Qatar, Kuwait, Jordan, and Lebanon) and Competitive Landscape

| Product Code: ETC000395 | Publication Date: Sep 2022 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 207 | No. of Figures: 115 | No. of Tables: 7 |

Latest 2022 Developments

Middle East Chocolate Market is increasing because of a diverse range of flavors in the chocolate. One of the major flavors adopted in the region is camel milk chocolate. The companies are trying to build a new product to give consumers a local palette flavor by mixing chocolate with dates which are the staple fruit of the Middle East region. Furthermore, some other flavor that is developed in the duration is the lotus Biscoff flavored chocolate. The companies are trying to build their products during the duration of Ramadan which will attract consumers.

Mergers and Acquisitions:

In September 2020, the board of directors of Agthia Group, an Abu Dhabi-listed food and beverage firm, authorized a deal to acquire a 100 percent indirect ownership in confectionary and healthy foods maker BMB Group.

In March 2021, Havelock One Interiors executed the retail shopfitting and bespoke unit manufacture for Patchi's boutique concept location in Bahrain City Centre successfully.

Middle East Chocolate Market Synopsis

Middle East Chocolate Market is anticipated to gain momentum during the upcoming years owing to increasing penetration towards confectionery. The rising adoption of chocolates as a gifting option for almost all age groups is adding to the Middle East Chocolate Market Growth. The rising risk of cardiovascular disease along with increasing awareness regarding the benefits associated with the consumption of dark chocolate is driving the development of the industry. Moreover, a high number of antioxidants present in the chocolates is one of the key factors providing lucrative opportunities for market growth. The rising launch of innovative products by the manufacturers such as diet and low-calorie chocolate is adding to the Middle East Chocolate Market Share.

The report thoroughly covers the Middle East chocolate market which is a part of Global Chocolate Market report by categories, distribution channels, and packaging. The report provides an unbiased and detailed analysis of the ongoing trends, opportunities in high-growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Chocolate is consumed across the globe and is considered one of the most profitable confectionery products. The Middle East region is the key potential market for chocolate players. In the Middle East region-wide varieties of chocolates are available targeting different age and income groups.

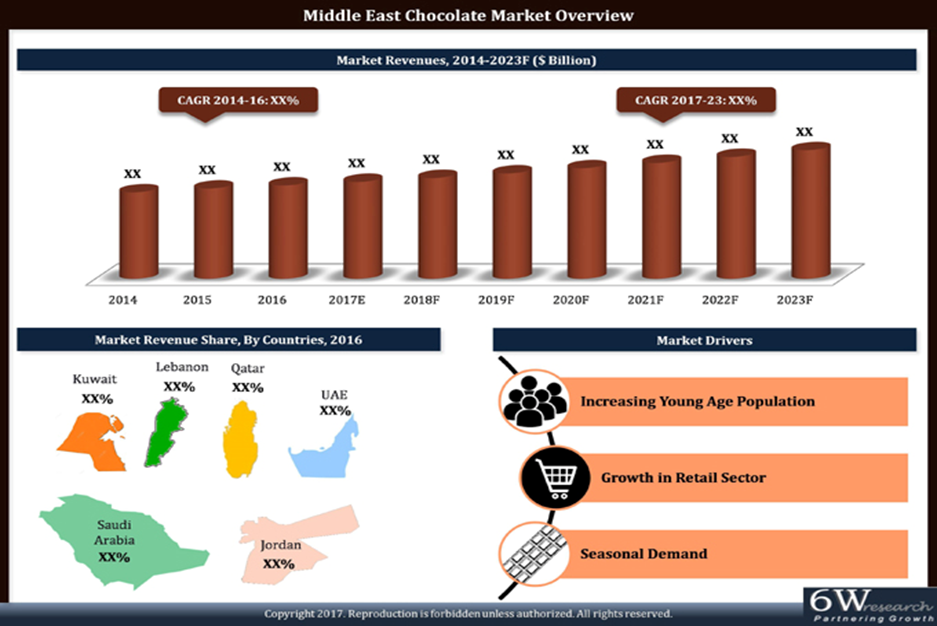

According to 6Wresearch, Middle East Chocolate Market is projected to grow at a CAGR of 4.8% in revenue terms during 2017-2023. The chocolate market is anticipated to register strong growth in the forecast period owing to high consumer spending on food products despite the slow economic growth. The chocolate market in the region is thriving due to the change in eating preferences and the availability of chocolate as a derived product for mousse, rolls, fudge, etc.

The health benefits offered by chocolate such as slow aging and prevention of certain diseases such as cardiac arrest surges the demand for chocolates. Further, the growing demand for customized chocolate is surging the chocolate market in the region.

Key players in the Market

Some of the key players in the Middle East chocolate market include-

- Mars

- Nestle

- Ferrero

- Mondelez

- Hershey

Market Analysis By Categories

On the basis of categories, the milk chocolate segment is expected to generate significant revenues during the upcoming years on account of increasing health benefits such as help in boosting memory.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2013 to 2016.

- Base Year: 2016.

- Forecast Data until 2023

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Historical Data of Middle East Chocolate Market Revenues and Volume for the Period 2014-2016.

- Market Size & Forecast of Middle East Chocolate Market Revenues and Volume until 2023.

- Historical Data of Saudi Arabia, UAE, Qatar, Kuwait, Jordan, and Lebanon Chocolate Market Revenues and Volume for the Period 2014-2016.

- Market Size & Forecast of Saudi Arabia, UAE, Qatar, Kuwait, Jordan, and Lebanon Chocolate Market Revenues and Volume until 2023.

- Historical Data of Saudi Arabia, UAE, Qatar, Kuwait, Jordan, and Lebanon Chocolate Market Revenues by Categories for the Period 2014-2016.

- Market Size & Forecast of Saudi Arabia, UAE, Qatar, Kuwait, Jordan, and Lebanon Chocolate Market Revenues by Categories until 2023.

- Historical Data of Saudi Arabia, UAE, Qatar, Kuwait, Jordan, Lebanon, and Chocolate Market Revenues by Distribution Channel for the Period 2014-2016.

- Market Size & Forecast of Saudi Arabia, UAE, Qatar, Kuwait, Jordan, and Lebanon Chocolate Market Revenues by Distribution Channel until 2023.

- Historical Data of Saudi Arabia Chocolate, UAE, Qatar, Kuwait, Jordan, and Lebanon Market Revenues by Packaging for the Period 2014-2016.

- Market Size & Forecast of Saudi Arabia, UAE, Qatar, Kuwait, Jordan, and Lebanon Chocolate Market Revenues by Packaging until 2023.

- Market Drivers and Restraints.

- Market Trends and Developments.

- Player Market Share and Competitive Landscape.

- Company Profiles.

- Key Strategic Pointers.

Markets Covered:

By Categories

- Milk chocolate

- Dark Chocolate

- White chocolate

By Distribution Channels

- Hypermarkets & Supermarkets

- Convenience Stores

- Specialist Retailers

- Others (e-commerce, pharmacy, dollar store)

By Packaging

- Flexible

- Rigid

- Paper & Board

By Countries

- Saudi Arabia

- UAE

- Qatar

- Kuwait

- Jordan

- Lebanon

Middle East Chocolate Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Methodology Adopted and Key Data Points |

| 2.5. Assumptions |

| 3. Global Chocolate Market Overview |

| 3.1. Global Chocolate Market Revenues (2014-2023F) |

| 4. Middle East Chocolate Market Overview |

| 4.1. Middle East Chocolate Market Revenues (2014-2023F) |

| 4.2. Middle East Chocolate Market Value Chain |

| 4.3. Middle East Chocolate Market Industry Life Cycle |

| 4.4. Middle East Chocolate Market Porter's Five Forces Model |

| 5. Middle East Chocolate Market Dynamics |

| 5.1. Impact Analysis |

| 5.2. Market Drivers |

| 5.3. Market Restraints |

| 6. Middle East Chocolate Market Trends |

| 7. Saudi Arabia Chocolate Market Overview |

| 7.1. Saudi Arabia Chocolate Market Revenues (2014-2023F) |

| 7.2. Saudi Arabia Chocolate Market Volume (2014-2023F) |

| 7.3. Saudi Arabia Chocolate Market Revenue Share, By Categories (2016 & 2023F) |

| 7.4. Saudi Arabia Chocolate Market Revenue Share, By Distribution Channel (2016 & 2023F) |

| 7.5. Saudi Arabia Chocolate Market Revenue Share, By Packaging (2016 & 2023F) |

| 8. Saudi Arabia Chocolate Market Overview, By Categories |

| 8.1. Saudi Arabia Milk Chocolate Market Revenues (2016 & 2023F) |

| 8.2. Saudi Arabia Dark Chocolate Market Revenues (2016 & 2023F) |

| 8.3. Saudi Arabia White Chocolate Market Revenues (2016 & 2023F) |

| 9. Saudi Arabia Chocolate Market Overview, By Distribution Channel |

| 9.1. Saudi Arabia Chocolate Market Revenues, By Hypermarkets & Supermarkets (2016 & 2023F) |

| 9.2. Saudi Arabia Chocolate Market Revenues, By Convenience Stores (2016 & 2023F) |

| 9.3. Saudi Arabia Chocolate Market, By Specialist Retailers (2016 & 2023F) |

| 9.4. Saudi Arabia Chocolate Market, By Other Distribution Channels (2016 & 2023F) |

| 10. Saudi Arabia Chocolate Market Overview, By Packaging |

| 10.1. Saudi Arabia Chocolate Market Revenues, By Flexible Packaging (2016 & 2023F) |

| 10.2. Saudi Arabia Chocolate Market Revenues, By Rigid Packaging (2016 & 2023F) |

| 10.3. Saudi Arabia Chocolate Market Revenues, By Paper & Board Packaging (2016 & 2023F) |

| 11. Saudi Arabia Chocolate Market Opportunity Assessment |

| 11.1. Saudi Arabia Chocolate Market Opportunity Assessment |

| 12. UAE Chocolate Market Overview |

| 12.1. UAE Chocolate Market Revenues (2014-2023F) |

| 12.2. UAE Chocolate Market Volume (2014-2023F) |

| 12.3. UAE Chocolate Market Revenue Share, By Categories (2016 & 2023F) |

| 12.4. UAE Chocolate Market Revenue Share, By Distribution Channel (2016 & 2023F) |

| 12.5. UAE Chocolate Market Revenue Share, By Packaging (2016 & 2023F) |

| 13. UAE Chocolate Market Overview, By Categories |

| 13.1. UAE Milk Chocolate Market Revenues (2016 & 2023F) |

| 13.2. UAE Dark Chocolate Market Revenues (2016 & 2023F) |

| 13.3. UAE White Chocolate Market Revenues (2016 & 2023F) |

| 14. UAE Chocolate Market Overview, By Distribution Channel |

| 14.1. UAE Chocolate Market Revenues, By Hypermarkets & Supermarkets (2016 & 2023F) |

| 14.2. UAE Chocolate Market Revenues, By Convenience Stores (2016 & 2023F) |

| 14.3. UAE Chocolate Market, By Specialist Retailers (2016 & 2023F) |

| 14.4. UAE Chocolate Market, By Other Distribution Channels (2016 & 2023F) |

| 15. UAE Chocolate Market Overview, By Packaging |

| 15.1. UAE Chocolate Market Revenues, By Flexible Packaging (2016 & 2023F) |

| 15.2. UAE Chocolate Market Revenues, By Rigid Packaging (2016 & 2023F) |

| 15.3. UAE Chocolate Market Revenues, By Paper & Board Packaging (2016 & 2023F) |

| 16. UAE Chocolate Market Opportunity Assessment |

| 16.1. UAE Chocolate Market Opportunity Assessment |

| 17. Qatar Chocolate Market Overview |

| 17.1. Qatar Chocolate Market Revenues (2014-2023F) |

| 17.2. Qatar Chocolate Market Volume (2014-2023F) |

| 17.3. Qatar Chocolate Market Revenue Share, By Categories (2016 & 2023F) |

| 17.4. Qatar Chocolate Market Revenue Share, By Distribution Channel (2016 & 2023F) |

| 17.5. Qatar Chocolate Market Revenue Share, By Packaging (2016 & 2023F) |

| 18. Qatar Chocolate Market Overview, By Categories |

| 18.1. Qatar Milk Chocolate Market Revenues (2016 & 2023F) |

| 18.2. Qatar Dark Chocolate Market Revenues (2016 & 2023F) |

| 18.3. Qatar White Chocolate Market Revenues (2016 & 2023F) |

| 19. Qatar Chocolate Market Overview, By Distribution Channel |

| 19.1. Qatar Chocolate Market Revenues, By Hypermarkets & Supermarkets (2016 & 2023F) |

| 19.2. Qatar Chocolate Market Revenues, By Convenience Stores (2016 & 2023F) |

| 19.3. Qatar Chocolate Market, By Specialist Retailers (2016 & 2023F) |

| 19.4. Qatar Chocolate Market, By Other Distribution Channels (2016 & 2023F) |

| 20. Qatar Chocolate Market Overview, By Packaging |

| 20.1. Qatar Chocolate Market Revenues, By Flexible Packaging (2016 & 2023F) |

| 20.2. Qatar Chocolate Market Revenues, By Rigid Packaging (2016 & 2023F) |

| 20.3. Qatar Chocolate Market Revenues, By Paper & Board Packaging (2016 & 2023F) |

| 21. Qatar Chocolate Market Opportunity Assessment |

| 21.1. Qatar Chocolate Market Opportunity Assessment |

| 22. Jordan Chocolate Market Overview |

| 22.1. Jordan Chocolate Market Revenues (2014-2023F) |

| 22.2. Jordan Chocolate Market Volume (2014-2023F) |

| 22.3. Jordan Chocolate Market Revenue Share, By Categories (2016 & 2023F) |

| 22.4. Jordan Chocolate Market Revenue Share, By Distribution Channel (2016 & 2023F) |

| 22.5. Jordan Chocolate Market Revenue Share, By Packaging (2016 & 2023F) |

| 23. Jordan Chocolate Market Overview, By Categories |

| 23.1. Jordan Milk Chocolate Market Revenues (2016 & 2023F) |

| 23.2. Jordan Dark Chocolate Market Revenues (2016 & 2023F) |

| 23.3. Jordan White Chocolate Market Revenues (2016 & 2023F) |

| 24. Jordan Chocolate Market Overview, By Distribution Channel |

| 24.1. Jordan Chocolate Market Revenues, By Hypermarkets & Supermarkets (2016 & 2023F) |

| 24.2. Jordan Chocolate Market Revenues, By Convenience Stores (2016 & 2023F) |

| 24.3. Jordan Chocolate Market, By Specialist Retailers (2016 & 2023F) |

| 24.4. Jordan Chocolate Market, By Other Distribution Channels (2016 & 2023F) |

| 25. Jordan Chocolate Market Overview, By Packaging |

| 25.1. Jordan Chocolate Market Revenues, By Flexible Packaging (2016 & 2023F) |

| 25.2. Jordan Chocolate Market Revenues, By Rigid Packaging (2016 & 2023F) |

| 25.3. Jordan Chocolate Market Revenues, By Paper & Board Packaging (2016 & 2023F) |

| 26. Jordan Chocolate Market Opportunity Assessment |

| 26.1. Jordan Chocolate Market Opportunity Assessment |

| 27. Lebanon Chocolate Market Overview |

| 27.1. Lebanon Chocolate Market Revenues (2014-2023F) |

| 27.2. Lebanon Chocolate Market Volume (2014-2023F) |

| 27.3. Lebanon Chocolate Market Revenue Share, By Categories (2016 & 2023F) |

| 27.4. Lebanon Chocolate Market Revenue Share, By Distribution Channel (2016 & 2023F) |

| 27.5. Lebanon Chocolate Market Revenue Share, By Packaging (2016 & 2023F) |

| 28. Lebanon Chocolate Market Overview, By Categories |

| 28.1. Lebanon Milk Chocolate Market Revenues (2016 & 2023F) |

| 28.2. Lebanon Dark Chocolate Market Revenues (2016 & 2023F) |

| 28.3. Lebanon White Chocolate Market Revenues (2016 & 2023F) |

| 29. Lebanon Chocolate Market Overview, By Distribution Channel |

| 29.1. Lebanon Chocolate Market Revenues, By Hypermarkets & Supermarkets (2016 & 2023F) |

| 29.2. Lebanon Chocolate Market Revenues, By Convenience Stores (2016 & 2023F) |

| 29.3. Lebanon Chocolate Market, By Specialist Retailers (2016 & 2023F) |

| 29.4. Lebanon Chocolate Market, By Other Distribution Channels (2016 & 2023F) |

| 30. Lebanon Chocolate Market Overview, By Packaging |

| 30.1. Lebanon Chocolate Market Revenues, By Flexible Packaging (2016 & 2023F) |

| 30.2. Lebanon Chocolate Market Revenues, By Rigid Packaging (2016 & 2023F) |

| 30.3. Lebanon Chocolate Market Revenues, By Paper & Board Packaging (2016 & 2023F) |

| 31. Lebanon Chocolate Market Opportunity Assessment |

| 31.1. Lebanon Chocolate Market Opportunity Assessment |

| 32. Kuwait Chocolate Market Overview |

| 32.1. Kuwait Chocolate Market Revenues (2014-2023F) |

| 32.2. Kuwait Chocolate Market Volume (2014-2023F) |

| 32.3. Kuwait Chocolate Market Revenue Share, By Categories (2016 & 2023F) |

| 32.4. Kuwait Chocolate Market Revenue Share, By Distribution Channel (2016 & 2023F) |

| 32.5. Kuwait Chocolate Market Revenue Share, By Packaging (2016 & 2023F) |

| 33. Kuwait Chocolate Market Overview, By Categories |

| 33.1. Kuwait Milk Chocolate Market Revenues (2016 & 2023F) |

| 34.2. Kuwait Dark Chocolate Market Revenues (2016 & 2023F) |

| 34.3. Kuwait White Chocolate Market Revenues (2016 & 2023F) |

| 34. Kuwait Chocolate Market Overview, By Distribution Channel |

| 34.1. Kuwait Chocolate Market Revenues, By Hypermarkets & Supermarkets (2016 & 2023F) |

| 34.2. Kuwait Chocolate Market Revenues, By Convenience Stores (2016 & 2023F) |

| 34.3. Kuwait Chocolate Market, By Specialist Retailers (2016 & 2023F) |

| 34.4. Kuwait Chocolate Market, By Other Distribution Channels (2016 & 2023F) |

| 35. Kuwait Chocolate Market Overview, By Packaging |

| 35.1. Kuwait Chocolate Market Revenues, By Flexible Packaging (2016 & 2023F) |

| 35.2. Kuwait Chocolate Market Revenues, By Rigid Packaging (2016 & 2023F) |

| 35.3. Kuwait Chocolate Market Revenues, By Paper & Board Packaging (2016 & 2023F) |

| 36. Kuwait Chocolate Market Opportunity Assessment |

| 36.1. Kuwait Chocolate Market Opportunity Assessment |

| 37. Middle East Chocolate Market Competitive Landscape |

| 37.1. Middle East Chocolate Market Revenue Share, By Company |

| 37.2. Middle East Competitive Benchmarking |

| 38. Company Profiles |

| 38.1. Mondelez International |

| 38.2. Nestle S.A. |

| 38.3. Ferrero SPA |

| 38.4. The Hershey Company |

| 38.5. Lindt & Sprüngli Group |

| 38.6. Gandour |

| 38.7. Mars, Incorporated |

| 38.8. Patchi |

| 38.9. Godiva Chocolatier |

| 38.10. International Foodstuffs Co. |

| 39. Strategic Recommendations |

| 40. Disclaimer |

| List of Figures |

| 1. Global Chocolates Market Revenues, 2014-2023F ($ Billion) |

| 2. Middle East Chocolate Market Revenues, 2014-2023F ($ Billion) |

| 3. Middle East Chocolate Market Value Chain |

| 4. Middle East Chocolate Market Industry Life Cycle |

| 5. Middle East Chocolate Market Porter's Five Forces Model |

| 6. Middle East Population Statistics, By Country, 2012-2023 (Million) |

| 7. Middle East Population Distribution, By Age Group (2017-2023) |

| 8. International Cocoa Prices, 2017 ($/ton) |

| 9. Saudi Arabia Chocolate Market Revenues, 2014-2023F ($ Million) |

| 10. Saudi Arabia Chocolate Market Volume, 2014-2023F (Thousand Tonnes) |

| 11. Saudi Arabia Chocolate Market Revenue Share, By Categories, 2016 & 2023F |

| 12. Saudi Arabia Chocolate Market Revenue Share, By Distribution Channel, 2016 & 2023F |

| 13. Saudi Arabia Chocolate Market Revenue Share, By Packaging, 2016 & 2023F |

| 14. Saudi Arabia Milk Chocolate Market Revenues, 2014-2023F ($ Million) |

| 15. Saudi Arabia Dark Chocolate Market Revenues, 2014-2023F ($ Million) |

| 16. Saudi Arabia White Chocolate Market Revenues, 2014-2023F ($ Million) |

| 17. Saudi Arabia Chocolate Market Revenues, By Hypermarkets & Supermarkets, 2014-2023F ($ Million) |

| 18. Saudi Arabia Chocolate Market Revenues, By Convenience Stores, 2014-2023F($ Million) |

| 19. Saudi Arabia Chocolate Market Revenues, By Specialist Retailers, 2014-2023F ($ Million) |

| 20. Saudi Arabia Chocolate Market Revenues, By Other Distribution Channels, 2014-2023F ($ Million) |

| 21. Saudi Arabia Chocolate Market Revenues, By Flexible Packaging, 2014-2023F ($ Million) |

| 22. Saudi Arabia Chocolate Market Revenues, By Rigid Packaging, 2014-2023F ($ Million) |

| 23. Saudi Arabia Chocolate Market Revenues, By Paper & Board Packaging, 2014-2023F ($ Million) |

| 24. Saudi Arabia Chocolate Market Opportunity Assessment, By Categories |

| 25. UAE Chocolate Market Revenues, 2014-2023F ($ Million) |

| 26. UAE Chocolate Market Volume, 2014-2023F (Thousand Tonnes) |

| 27. UAE Chocolate Market Revenue Share, By Categories, 2016 & 2023F |

| 28. UAE Chocolate Market Revenue Share, By Distribution Channel, 2016 & 2023F |

| 29. UAE Chocolate Market Revenue Share, By Packaging, 2016 & 2023F |

| 30. UAE Milk Chocolate Market Revenues, 2014-2023F ($ Million) |

| 31. UAE Dark Chocolate Market Revenues, 2014-2023F ($ Million) |

| 32. UAE White Chocolate Market Revenues, 2014-2023F ($ Million) |

| 33. UAE Chocolate Market Revenues, By Hypermarkets & Supermarkets, 2014-2023F ($ Million) |

| 34. UAE Chocolate Market Revenues, By Convenience Stores, 2014-2023F($ Million) |

| 35. UAE Chocolate Market Revenues, By Specialist Retailers, 2014-2023F ($ Million) |

| 36. UAE Chocolate Market Revenues, By Other Distribution Channels, 2014-2023F ($ Million) |

| 37. UAE Chocolate Market Revenues, By Flexible Packaging, 2014-2023F ($ Million) |

| 38. UAE Chocolate Market Revenues, By Rigid Packaging, 2014-2023F ($ Million) |

| 39. UAE Chocolate Market Revenues, By Paper & Board Packaging, 2014-2023F ($ Million) |

| 40. UAE Chocolate Market Opportunity Assessment, By Categories |

| 41. Qatar Chocolate Market Revenues, 2014-2023F ($ Million) |

| 42. Qatar Chocolate Market Volume, 2014-2023F (Thousand Tonnes) |

| 43. Qatar Chocolate Market Revenue Share, By Categories, 2016 & 2023F |

| 44. Qatar Chocolate Market Revenue Share, By Distribution Channel, 2016 & 2023F |

| 45. Qatar Chocolate Market Revenue Share, By Packaging, 2016 & 2023F |

| 46. Qatar Milk Chocolate Market Revenues, 2014-2023F ($ Million) |

| 47. Qatar Dark Chocolate Market Revenues, 2014-2023F ($ Million) |

| 48. Qatar White Chocolate Market Revenues, 2014-2023F ($ Million) |

| 49. Qatar Chocolate Market Revenues, By Hypermarkets & Supermarkets, 2014-2023F ($ Million) |

| 50. Qatar Chocolate Market Revenues, By Convenience Stores, 2014-2023F($ Million) |

| 51. Qatar Chocolate Market Revenues, By Specialist Retailers, 2014-2023F ($ Million) |

| 52. Qatar Chocolate Market Revenues, By Other Distribution Channels, 2014-2023F ($ Million) |

| 53. Qatar Chocolate Market Revenues, By Flexible Packaging, 2014-2023F ($ Million) |

| 54. Qatar Chocolate Market Revenues, By Rigid Packaging, 2014-2023F ($ Million) |

| 55. Qatar Chocolate Market Revenues, By Paper & Board Packaging, 2014-2023F ($ Million) |

| 56. Qatar Chocolate Market Opportunity Assessment, By Categories |

| 57. Jordan Chocolate Market Revenues, 2014-2023F ($ Million) |

| 58. Jordan Chocolate Market Volume, 2014-2023F (Thousand Tonnes) |

| 59. Jordan Chocolate Market Revenue Share, By Categories, 2016 & 2023F |

| 60. Jordan Chocolate Market Revenue Share, By Distribution Channel, 2016 & 2023F |

| 61. Jordan Chocolate Market Revenue Share, By Packaging, 2016 & 2023F |

| 62. Jordan Milk Chocolate Market Revenues, 2014-2023F ($ Million) |

| 63. Jordan Dark Chocolate Market Revenues, 2014-2023F ($ Million) |

| 64. Jordan White Chocolate Market Revenues, 2014-2023F ($ Million) |

| 65. Jordan Chocolate Market Revenues, By Hypermarkets & Supermarkets, 2014-2023F ($ Million) |

| 66. Jordan Chocolate Market Revenues, By Convenience Stores, 2014-2023F($ Million) |

| 67. Jordan Chocolate Market Revenues, By Specialist Retailers, 2014-2023F ($ Million) |

| 68. Jordan Chocolate Market Revenues, By Other Distribution Channels, 2014-2023F ($ Million) |

| 69. Jordan Chocolate Market Revenues, By Flexible Packaging, 2014-2023F ($ Million) |

| 70. Jordan Chocolate Market Revenues, By Rigid Packaging, 2014-2023F ($ Million) |

| 71. Jordan Chocolate Market Revenues, By Paper & Board Packaging, 2014-2023F ($ Million) |

| 72. Jordan Chocolate Market Opportunity Assessment, By Categories |

| 73. Lebanon Chocolate Market Revenues, 2014-2023F ($ Million) |

| 74. Lebanon Chocolate Market Volume, 2014-2023F (Thousand Tonnes) |

| 75. Lebanon Chocolate Market Revenue Share, By Categories, 2016 & 2023F |

| 76. Lebanon Chocolate Market Revenue Share, By Distribution Channel, 2016 & 2023F |

| 77. Lebanon Chocolate Market Revenue Share, By Packaging, 2016 & 2023F |

| 78. Lebanon Milk Chocolate Market Revenues, 2014-2023F ($ Million) |

| 79. Lebanon Dark Chocolate Market Revenues, 2014-2023F ($ Million) |

| 80. Lebanon White Chocolate Market Revenues, 2014-2023F ($ Million) |

| 81. Lebanon Chocolate Market Revenues, By Hypermarkets & Supermarkets, 2014-2023F ($ Million) |

| 82. Lebanon Chocolate Market Revenues, By Convenience Stores, 2014-2023F($ Million) |

| 83. Lebanon Chocolate Market Revenues, By Specialist Retailers, 2014-2023F ($ Million) |

| 84. Lebanon Chocolate Market Revenues, By Other Distribution Channels, 2014-2023F ($ Million) |

| 85. Lebanon Chocolate Market Revenues, By Flexible Packaging, 2014-2023F ($ Million) |

| 86. Lebanon Chocolate Market Revenues, By Rigid Packaging, 2014-2023F ($ Million) |

| 87. Lebanon Chocolate Market Revenues, By Paper & Board Packaging, 2014-2023F ($ Million) |

| 88. Lebanon Chocolate Market Opportunity Assessment, By Categories |

| 88. Lebanon Chocolate Market Opportunity Assessment, By Categories |

| 89. Kuwait Chocolate Market Revenues, 2014-2023F ($ Million) |

| 90. Kuwait Chocolate Market Volume, 2014-2023F (Thousand Tonnes) |

| 91. Kuwait Chocolate Market Revenue Share, By Categories, 2016 & 2023F |

| 92. Kuwait Chocolate Market Revenue Share, By Distribution Channel, 2016 & 2023F |

| 93. Kuwait Chocolate Market Revenue Share, By Packaging, 2016 & 2023F |

| 94. Kuwait Milk Chocolate Market Revenues, 2014-2023F ($ Million) |

| 95. Kuwait Dark Chocolate Market Revenues, 2014-2023F ($ Million) |

| 96. Kuwait White Chocolate Market Revenues, 2014-2023F ($ Million) |

| 97. Kuwait Chocolate Market Revenues, By Hypermarkets & Supermarkets, 2014-2023F ($ Million) |

| 98. Kuwait Chocolate Market Revenues, By Convenience Stores, 2014-2023F($ Million) |

| 99. Kuwait Chocolate Market Revenues, By Specialist Retailers, 2014-2023F ($ Million) |

| 100. Kuwait Chocolate Market Revenues, By Other Distribution Channels, 2014-2023F ($ Million) |

| 101. Kuwait Chocolate Market Revenues, By Flexible Packaging, 2014-2023F ($ Million) |

| 102. Kuwait Chocolate Market Revenues, By Rigid Packaging, 2014-2023F ($ Million) |

| 103. Kuwait Chocolate Market Revenues, By Paper & Board Packaging, 2014-2023F ($ Million) |

| 104. Kuwait Chocolate Market Opportunity Assessment, By Categories |

| 105. Saudi Arabia Chocolate Market Revenue Share, By Company, 2016 |

| 106. UAE Chocolate Market Revenue Share, By Company, 2016 |

| 107. Qatar Chocolate Market Revenue Share, By Company, 2016 |

| 108. Kuwait Chocolate Market Revenue Share, By Company, 2016 |

| 109. Jordan Chocolate Market Revenue Share, By Company, 2016 |

| 110. Lebanon Chocolate Market Revenue Share, By Company, 2016 |

| 111. Dammam Retail Supply, 2013-2018F (GLA 000's sq.m.) |

| 112. Jeddah Retail Supply, 2013-2018F (GLA 000's sq.m.) |

| 113. Riyadh Retail Supply, 2013-2018F (GLA 000's sq.m.) |

| 114. Dubai Retail Supply, 2012-2017F (GLA* (000') sq. m) |

| 115. Abu Dhabi Retail Supply, 2012-2017F (GLA* (000') sq. m) |

| List of Tables |

| 1. Saudi Arabia Upcoming Malls, 2018-2020 |

| 2. Upcoming Malls in UAE |

| 3. Kuwait Upcoming Retail Sector Projects |

| 4. Qatar Upcoming Retail Sector Projects |

| 5. Lebanon Upcoming Retail Sector Projects |

| 6. Fees to be paid by Saudi Arabian Company for Non-Saudi Employee (SAR) |

| 7. Saudi Arabia Dependent Fees for Non-Saudi Employees (SAR) |

- Single User License$ 4,560

- Department License$ 5,055

- Site License$ 5,595

- Global License$ 6,000

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Kenya Road Stabilization Equipment Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- North America Sodium chloride Market (2025-2031) | Analysis, Revenue, Forecast, Trends, Companies, Size, Growth, Share, Industry, Outlook & Value

- North America Vinyl Flooring Market (2025-2031) | Value, Growth,Size, Analysis, Revenue, Industry, Forecast, Share, Outlook, Companies & Trends

- Tajikistan Thermal Camera Market (2025-2031) | Trends, Size, Growth, Share, Industry, Companies, Value, Analysis, Revenue, Forecast & Outlook

- Singapore Professional AV Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- Saudi Arabia Genset Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- India OOH Advertising Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- Vietnam Twisted Pair Cables Market (2024-2030) | Size & Revenue, Forecast, Share, Companies, Competitive Landscape, Analysis, Trends, Value, Segmentation, Outlook, Industry, Growth

- South Africa B2B Cleaning Market (2025-2031) | Size & Revenue, Forecast, Share, Companies, Competitive Landscape, Analysis, Trends, Value, Segmentation, Outlook, Industry, Growth

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero