Philippines Power Rental Market (2018-2024) | Growth, Outlook, Share, Analysis, Value, Revenue, Trends, Size, Companies, Forecast & Industry

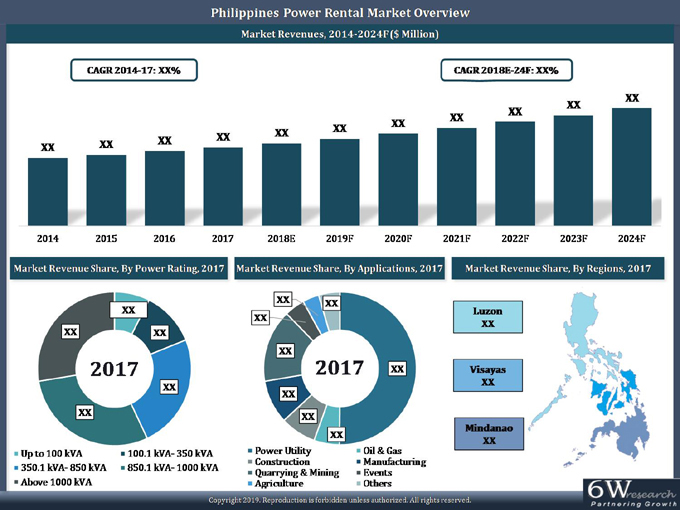

Market Forecast By Power Rating (Up to 100 KVA, 100.1 KVA- 350 KVA, 350.1 KVA-850 KVA, 850.1 KVA-1000 KVA and Above 1000 KVA), By Applications (Power Utilities, Oil & Gas, Construction, Manufacturing, Agriculture, Quarrying and Mining, Events and Others including Hospitality, Retail, Hospital, Educational Institutes, and Commercial), By Regions (Luzon, Visayas, and Mindanao) and Competitive Landscape.

| Product Code: ETC131542 | Publication Date: Nov 2021 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 160 | No. of Figures: 94 | No. of Tables: 17 |

Philippines Power Rental Market is expected to experience a surge in industrial and construction activities under various government initiatives such as "Build Build Build and Philippines Power Development Plan. Additionally, factors such as inadequate grid connectivity in several islands and frequent power outages in the country on account of adverse weather conditions would further help the power rental market in the Philippines to grow over the coming years.

According to 6Wresearch, Philippines Power Rental Market size is projected to grow at a CAGR of 6.1% during 2018-24. The utility sector occupied major revenue in the total Philippines power rental market share owing to a larger need for power backup during the grid maintenance process or as a direct power solution across the areas that are poorly connected to the grid. Further, with several upcoming projects approved by the government in the utility segment, the Philippines power rental market forecast revenues are expected to surge in the coming years.

Growing construction activities on account of several infrastructure development plans as well as increasing investment to back such undertakings in the country are expected to spur the growth of the construction sector and would significantly increase the demand for power rental solutions in the Philippines.

The Philippines power rental market report thoroughly covers the market by power rating, types, applications, and regions. The Philippines power rental market outlook report provides an unbiased and detailed analysis of the ongoing Philippines power rental market trends, opportunities/high growth areas, and market drivers, which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Key Highlights of the Report:

• Philippines Power Rental Market Overview

• Philippines Power Rental Market Outlook

• Philippines Power Rental Market Size and Philippines Power Rental Market Forecast for the period 2018-2024F.

• Historical Data of Philippines Power Rental Market Revenues, By Power Rating for the Period 2014-2017.

• Market Size & Forecast of Philippines Power Rental Market Revenues, By Power Rating for the Period 2018-2024F.

• Historical Data of Philippines Power Rental Market Revenues, By Applications for the Period 2014-2017.

• Market Size & Forecast of Philippines Power Rental Market Revenues, By Applications for the Period 2018-2024F.

• Historical Data of Philippines Power Rental Market Revenues, By Regions for the Period 2014-2017.

• Market Size & Forecast of Philippines Power Rental Market Revenues, By Regions for the Period 2018-2024F.

• Market Drivers and Restraints.

• Philippines Power Rental Market Trends and Developments.

• Philippines Power Rental Market Share, By Players.

• Philippines Power Rental Market Overview on Competitive Benchmarking.

• Company Profiles

• Strategic Recommendations

Market Segmentation

The Philippines Power Rental Market report offers a detailed analysis of the following market segments:

• By Power Rating

o Up to 100 KVA

o 100.1 KVA- 350 KVA

o 350.1 KVA-850 KVA

o 850.1 KVA-1000 KVA

o Above 1000 KVA

• By Applications

o Power Utilities

o Oil & Gas

o Construction

o Manufacturing

o Agriculture

o Quarrying and Mining

o Events

o Others (Hospitality, Retail, Hospital, Educational Institutes, Commercial)

• By Regions

o Luzon

o Visayas

o Mindanao

Frequently Asked Questions About the Market Study (FAQs):

1. Executive Summary

2. Introduction

2.1 Report Description

2.2 Key Highlights of The Report

2.3 Market Scope & Segmentation

2.4 Research Methodology

2.5 Assumptions

3. Philippines Power Rental Market Overview

3.1 Philippines Country Indicators

3.2 Philippines Power Rental Market Revenues, 2014-2024F

3.3 Philippines Power Rental Market Revenue Share, By Power Rating, 2017 & 2024F

3.4 Philippines Power Rental Market Revenue Share, By Applications, 2017 & 2024F

3.5 Philippines Power Rental Market Revenue Share, By Regions, 2017 & 2024F

3.6 Philippines Power Rental Market TAM Analysis

3.7 Philippines Power Rental Market - Industry Life Cycle, 2017

3.8 Philippines Power Rental Market - Porter's Five Forces, 2017

4. Philippines Power Rental Market Dynamics

4.1 Impact Analysis

4.2 Market Drivers

4.3 Market restraints

5. Philippines Power Rental Market Trends

6. Philippines Power Rental Market Distribution Channel Analysis

7. Philippines Power Rental Market Overview, By Power Rating

7.1 Philippines Upto 100 kVA Power Rental Market Revenues, 2014-2024F

7.1.1 Philippines Upto 100 kVA Power Rental Market Revenue Share, By Applications, 2017 & 2024F

7.1.2 Philippines Upto 100 kVA Power Rental Market Revenues, By Applications, 2014-2024F

7.1.3 Philippines Upto 100 kVA Power Rental Market Revenue Share, By Brands, 2017

7.2 Philippines 100.1 kVA- 350 kVA Power Rental Market Revenues, 2014-2024F

7.2.1 Philippines 100.1 kVA- 350 kVA Power Rental Market Revenue Share, By Applications, 2017 & 2024F

7.2.2 Philippines 100.1 kVA- 350 kVA Power Rental Market Revenues, By Applications, 2014-2024F

7.2.3 Philippines 100.1 kVA- 350 kVA Power Rental Market Revenue Share, By Brands, 2017

7.3 Philippines 350.1 kVA- 850 kVA Power Rental Market Revenues, 2014-2024F

7.3.1 Philippines 350.1 kVA- 850 kVA Power Rental Market Revenue Share, By Applications, 2017 & 2024F

7.3.2 Philippines 350.1 kVA- 850 kVA Power Rental Market Revenues, By Applications, 2014-2024F

7.3.3 Philippines 350.1 kVA- 850 kVA Power Rental Market Revenue Share, By Brands, 2017

7.4 Philippines 850.1 kVA- 1000 kVA Power Rental Market Revenues, 2014-2024F

7.4.1 Philippines 850.1 kVA- 1000 kVA Power Rental Market Revenue Share, By Applications, 2017 & 2024F

7.4.2 Philippines 850.1 kVA- 1000 kVA Power Rental Market Revenues, By Applications, 2014-2024F

7.4.3 Philippines 850.1 kVA- 1000 kVA Power Rental Market Revenue Share, By Brands, 2017

7.5 Philippines Above 1000 kVA Power Rental Market Revenues, 2014-2024F

7.5.1 Philippines Above 1000 kVA Power Rental Market Revenue Share, By Applications, 2017 & 2024F

7.5.2 Philippines Above 1000 kVA Power Rental Market Revenues, By Applications, 2014-2024F

7.5.3 Philippines Above 1000 kVA Power Rental Market Revenue Share, By Brands, 2017

8. Philippines Power Rental Market Overview, By Applications

8.1 Philippines Power Utility Application Power Rental Market Revenues, 2014-2024F

8.1.1 Philippines Power Sector Overview

8.1.2 Philippines Power Utility Application Power Rental Market Revenue Share, By Brands, 2017

8.2 Philippines Oil & Gas Application Power Rental Market Revenues, 2014-2024F

8.2.1 Philippines Oil & Gas Application Power Rental Market Revenue Share, By Brands, 2017

8.3 Philippines Construction Application Power Rental Market Revenues, 2014-2024F

8.3.1 Philippines Construction Sector Overview

8.3.2 Philippines Construction Application Power Rental Market Revenue Share, By Brands, 2017

8.4 Philippines Manufacturing Application Power Rental Market Revenues, 2014-2024F

8.4.1 Philippines Manufacturing Sector Overview

8.4.2 Philippines Construction Application Power Rental Market Revenue Share, By Brands, 2017

8.5 Philippines Events Application Power Rental Market Revenues, 2014-2024F

8.5.1 Philippines Upcoming Events

8.5.2 Philippines Events Application Power Rental Market Revenue Share, By Brands, 2017

8.6 Philippines Agriculture Application Power Rental Market Revenues, 2014-2024F

8.6.1 Philippines Agriculture Sector Overview

8.6.2 Philippines Agriculture Application Power Rental Market Revenue Share, By Brands, 2017

8.7 Philippines Quarrying & Mining Utility Application Power Rental Market Revenues, 2014-2024F

8.1.1 Philippines Quarrying & Mining Overview

8.1.2 Philippines Quarrying & Mining Application Power Rental Market Revenue Share, By Brands, 2017

8.8 Philippines Others Application Power Rental Market Revenues, 2014-2024F

8.8.1 Philippines Others Application Power Rental Market Revenue Share, By Brands, 2017

9. Philippines Power Rental Market Overview, By Regions

9.1 Philippines Power Rental Market Revenues, By Luzon Region, 2014-2024F

9.1.1 Philippines Luzon Region Power Rental Market Revenue Share, By Key Cities, 2017 & 2024F

9.1.2 Philippines Luzon Region Power Rental Market Revenues, By Key Cities, 2017-2024F

9.1.3 Philippines Luzon Region Power Rental Market Revenue Share, By Brands, 2017

9.2 Philippines Power Rental Market Revenues, By Visayas Region, 2014-2024F

9.2.1 Philippines Visayas Region Power Rental Market Revenue Share, By Key Cities, 2017 & 2024F

9.2.2 Philippines Visayas Region Power Rental Market Revenues, By Key Cities, 2017-2024F

9.1.3 Philippines Visayas Region Power Rental Market Revenue Share, By Brands, 2017

9.3 Philippines Power Rental Market Revenues, By Mindanao Region, 2014-2024F

9.3.1 Philippines Mindanao Region Power Rental Market Revenue Share, By Key Cities, 2017 & 2024F

9.3.2 Philippines Mindanao Region Power Rental Market Revenues, By Key Cities, 2017-2024F

9.3.3 Philippines Mindanao Region Power Rental Market Revenue Share, By Brands, 2017

10. Philippines Power Rental Market Outlook, By Identification of Potential Cities

10.1 Philippines Power Rental Market Key Potential Regions

10.2 Philippines Power Rental Market Key Potential Cities

10.3 Philippines Power Rental Market Key Potential Regions Overview

11. Key Performance Indicators

11.1 Philippines Government Spending Outlook

11.2 Philippines Industrial Sector Overview

11.3 Philippines Power Rental Market Key Potential Regions Overview

12. Opportunity Assessment

12.1 Philippines Power Rental Market Opportunity Assessment, By Power Rating, 2024F

12.2 Philippines Power Rental Market Opportunity Assessment, By Applications, 2024F

12.3 Philippines Power Rental Market Opportunity Assessment, By Regions, 2024F

13. Competitive Landscape

13.1 Philippines Power Rental Market Revenue Share, By Brands, 2017

13.2 Competitive Benchmarking, Rental Gensets, By Power Rating

14. Company Profiles

14.1 Aggreko Plc

14.2 Hastings Motor Corp

14.3 Atlas Copco (Philippines) Inc

14.4 Monark Equipment Corporation

14.5 Alta Maxpower Co. Inc.

14.6 Jgentech Enterprises

14.7 Guzent Inc

14.8 United Power & Resources Pte Ltd

15. Strategic Recommendations

16. Disclaimer

List of Figures

1. Philippines Power Rental Market Revenues, 2014-2024F ($ million)

2. Philippines Power Rental Revenue Share, By Power Rating, 2017 & 2024F

3. Philippines Power Rental Market Revenue Share, By Applications, 2017 & 2024F

4. Philippines Power Rental Market Revenue Share, By Regions, 2017 & 2024F

5. Philippines Power Rental TAM Analysis for 2017 & 2024F ($ Million)

6. Philippines Power Rental Market - Industry Life Cycle 2017

7. Philippines Regions With Highest Number of Construction Projects (Q2, 2018)

8. RLB Construction Market Activity Cycle (Q2, 2018)

9. Philippines Combined Risk to Geographical Disasters

10. Philippines Power Capacity Expansion, 2018-2040 (MW)

11. Philippines Upto 100 kVA Power Rental Market Revenues, 2014-2024F ($ Thousand)

12. Philippines Upto 100 kVA Power Rental Market Revenue Share, By Applications, 2017 & 2024F

13. Philippines Upto 100 kVA Power Rental Revenue Share, By Brands, 2017

14. Philippines 100.1 kVA-350 kVA Power Rental Market Revenues, 2014-2024F ($ Thousand)

15. Philippines 100.1 kVA- 350 kVA Power Rental Market Revenue Share, By Applications, 2017 & 2024F

16. Philippines 100.1 kVA- 350 kVA Power Rental Revenue Share, By Brands, 2017

17. Philippines 350.1 kVA-850 kVA Power Rental Market Revenues, 2014-2024F ($ Thousand)

18. Philippines 350.1 kVA -850 kVA Power Rental Revenue Share, By Applications, 2017 & 2024F

19. Philippines 350.1 kVA- 850 kVA Power Rental Revenue Share, By Brands, 2017

20. Philippines 850.1 kVA- 1000 kVA Power Rental Market Revenues, 2014-2024F ($ Thousand)

21. Philippines 850.1 kVA- 1000 kVA Power Rental Revenue Share, By Applications, 2017 & 2024F

22. Philippines 850.1 kVA- 1000 kVA Power Rental Revenue Share, By Brands, 2017

23. Philippines Above 1000 kVA Power Rental Revenue Share, By Applications, 2017 & 2024F

24. Philippines Above 1000 kVA Power Rental Revenue Share, By Applications, 2017 & 2024F ($ Thousand)

25. Philippines Above 1000 kVA Power Rental Revenue Share, By Brands, 2017

26. Philippines Power Utility Application Power Rental Market Revenues, 2014-2024F ($ Thousand)

27. Philippines Electricity Consumption in MWh for 2017

28. Philippines Grid Power System Overview for 2017

29. Philippines off-Grid Power System Overview for 2017

30. Renewable Energy Mix in 2017

31. Power Generation and Consumption, By Regions, 2017

32. Electricity Consumption (Sales, Utility Use, System Loss) in MWh for 2017

33. Philippines Power Utility Application Power Rental Market Revenue Share, By Brands, 2017

34. Philippines Oil & Gas Application Power Rental Market Revenues, 2014-2024F ($ Thousand)

35. Philippines Oil & Gas Application Power Rental Market Revenue Share, By Brands, 2017

36. Philippines Construction Application Power Rental Market Revenues, 2014-2024F ($ Thousand)

37. Construction Statistics From Approved Building Permits, first sem, 2018 (Units)

38. Distribution of Construction Units, By Regions (Q2, 2018)

39. Philippines Construction Application Power Rental Market Revenue Share, By Brands, 2017

40. Philippines Manufacturing Application Power Rental Market Revenues, 2014-2024F ($ Thousand)

41. Philippines Stock Exchange Market Capitalization by Sector for June 2018

42. Philippines manufacturing Sector Approved Investments (PHP Billion)

43. Philippines Manufacturing Application Power Rental Market Revenue Share, By Brands, 2017

44. Philippines Events Application Power Rental Market Revenues, 2014-2024F ($ Thousand)

45. Philippines Upcoming Events, 2019

46. Philippines Event Application Power Rental Market Revenue Share, By Brands, 2017

47. Philippines Agriculture Application Power Rental Market Revenues, 2014-2024F ($ Thousand)

48. Philippines Agricultural Growth Production, 2017- Q3, 2018

49. Philippines Agricultural Output Growth, 2017- Q3, 2018

50. Agricultural Production Distribution, By Subsector, 2017

51. Agricultural Production Output Growth, By Subsector, 2017-2018

52. Philippines Agriculture Application Power Rental Market Revenue Share, By Brands, 2017

53. Philippines Quarrying & Mining Application Power Rental Market Revenues, 2014-2024F ($ Thousand)

54. Philippines Growth Rate of Gross National Product, Quarrying & Mining Sector, 2014-2017

55. Philippines Quarrying & Mining Application Power Rental Market Revenue Share, By Brands, 2017

56. Philippines Other application Power Rental Market Revenues, 2014-2024F ($ Thousand)

57. Philippines Other Application Power Rental Market Revenue Share, By Brands, 2017

58. Philippines Luzon Region Power Rental Market Revenues, 2014-2017 ($ Thousand)

59. Philippines Luzon Region Power Rental Market Revenues, 2018E-2024F ($ Thousand)

60. Philippines Luzon Region Power Rental Market Revenue Share, By Key Cities, 2017 & 2024F

61. Philippines Manila City Power Rental Market Revenues, 2014 - 2024F ($ Thousand)

62. Philippines Quezon City Power Rental Market Revenues, 2014 - 2024F ($ Thousand)

63. Philippines Caloocan City Power Rental Market Revenues, 2014 - 2024F ($ Thousand)

64. Philippines Taguig City Power Rental Market Revenues, 2014 - 2024F ($ Thousand)

65. Philippines Other Cities Power Rental Market Revenues, 2014 - 2024F ($ Thousand)

66. Philippines Luzon Region Power Rental Market Revenue Share, By Brands, 2017

67. Philippines Visayas Region Power Rental Market Revenues, 2014-2017 ($ Thousand)

68. Philippines Visayas Region Power Rental Market Revenues, 2018E-2024F ($ Thousand)

69. Philippines Visayas Region Power Rental Market Revenue Share, By Key Cities, 2017 & 2024F

70. Philippines Cebu City Power Rental Market Revenues, 2014 - 2024F ($ Thousand)

71. Philippines Bacolod City Power Rental Market Revenues, 2014 - 2024F ($ Thousand)

72. Philippines Batangas City Power Rental Market Revenues, 2014 - 2024F ($ Thousand)

73. Philippines Iloilo City Power Rental Market Revenues, 2014 - 2024F ($ Thousand)

74. Philippines Other Cities Power Rental Market Revenues, 2014 - 2024F ($ Thousand)

75. Philippines Visayas Region Power Rental Market Revenue Share, By Brands, 2017

76. Philippines Mindanao Region Power Rental Market Revenues, 2014-2017 ($ Thousand)

77. Philippines Mindanao Region Power Rental Market Revenues, 2018E-2024F ($ Thousand)

78. Philippines Mindanao Region Power Rental Market Revenue Share, By Key Cities, 2017 & 2024F

79. Philippines Davao City Power Rental Market Revenues, 2014 - 2024F ($ Thousand)

80. Philippines Cagayan De Oro City Power Rental Market Revenues, 2014 - 2024F ($ Thousand)

81. Philippines Zambounga City Power Rental Market Revenues, 2014 - 2024F ($ Thousand)

82. Philippines General Santos City Power Rental Market Revenues, 2014 - 2024F ($ Thousand)

83. Philippines Other Cities Power Rental Market Revenues, 2014 - 2024F ($ Thousand)

84. Philippines Mindanao Region Power Rental Market Revenue Share, By Brands, 2017

85. Philippines Power Rental Market Key Potential Regions

86. Philippines Power Rental Market Key Potential Cities

87. Opportunities in Philippines Regions

88. Philippines Regional Budget Allocations, 2018 (PhP Billion)

89. Government Actual Government Spending Vs Actual Government Revenues, 2015-2023F (PHP Trillion)

90. Government Budget Expenditure by Sector, 2018 ($ Billion)

91. Philippines Power Rental Market Opportunity Assessment, By Power Rating, 2024F

92. Philippines Power Rental Market Opportunity Assessment, By Applications, 2024F

93. Philippines Power Rental Market Opportunity Assessment, By Regions, 2024F

94. Philippines Power Rental Market Revenue Share, By Brands, 2017

List of Tables

1. Cumulative Target for Solar Installations, 2016-2030F (MW)

2. Philippines Upto 100 kVA Power Rental Revenue, By Applications, 2014-2024F ($ Thousand)

3. Philippines 100.1 kVA- 350 kVA Power Rental Revenues, By Applications, 2014-2024F ($ Thousand)

4. Philippines 350.1 kVA- 850 kVA Power Rental Revenue, By Applications, 2014-2024F ($ Thousand)

5. Philippines 850.1 kVA- 1000 kVA Power Rental Revenues, By Applications, 2017-2024F ($ Thousand)

6. Philippines Above 1000 kVA Power Rental Revenue Share, By Applications, 2017 & 2024F ($ Thousand)

7. Power Consumption by Regions, 2010-2017 (GWh)

8. Power Consumption by Sectors, 2010-2017 (GWh)

9. Monthly System Peak Demand in Luzon in MW, 2010-2017

10. Monthly System Peak Demand in Visayas in MW, 2010-2017

11 Monthly System Peak Demand in Mindanao in MW, 2010-2017

12. Philippines Growth Rate of GNP, Quarrying & Mining Sector, 2014-2017

13. Philippines Number of Approved and Registered Mines, as on June, 2018

14. Philippines Number of Mines Applications Under Process, as on June, 2018

15. Top department/ Recipients in National Budget, 2018-2019E (Billion Pesos)

16. Philippines Upcoming Infrastructure Projects

17. Philippines Programs and Projects Investments Targets, By Islands, 2017-2022 (Peso Million)

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Italy Textile Auxiliaries Market (2025-2031) | Outlook, Value, Companies, Share, Industry, Growth, Trends, Revenue, Forecast, Analysis & Size

- Tajikistan Diesel Genset (Generator) Market (2025-2031) | Value, Industry, Forecast, Revenue, Trends, Outlook, Share, Size, Companies, Growth & Analysis

- China Diesel Genset (Generator) Market (2025-2031) | Growth, Size, Trends, Industry, Value, Share, Analysis, Revenue, Segmentation & Outlook

- China Low Voltage Electric Motor Market (2025-2031) | Analysis, Size, Share, Trends, Growth, Revenue, industry, Forecast, Outlook & Segmentation

- Thailand Low Voltage Electric Motor Market (2025-2031) | Outlook, Revenue, Share, Value, Industry, Growth, Trends, Forecast, Analysis, Size & Companies

- India Wallpaper Market (2025-2031) | Forecast, Revenue, Industry, Companies, Outlook, Size, Analysis, Value, Growth, Share, Trends

- Thailand Artificial Flower Market (2025-2031) | Value, Industry, Outlook, Trends, Forecast, Size, Revenue, Companies, Analysis, Share & Growth

- United Arab Emirates Nitrogenous Fertilizers Market (2025-2031) | Outlook, Analysis, Industry, Forecast, Trends, Companies, Growth, Value, Size, Share & Revenue

- Germany Genset Rental Market (2025-2031) | Analysis, Share, Industry, Growth, Revenue, Companies, Trends, Outlook, Forecast, Value & Size

- Ethiopia Genset Rental Market (2025-2031) | Trends, Analysis, Companies, Revenue, Size, Forecast, Value, Outlook, Growth, Industry & Share

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- India's Printer Market Faces 20.7% Decline in Q4 2023: Epson and HP Lead Amidst Downturn

- India's Camera Market Sees 8.9% Decline in Q4 2023; Canon Leads with 38.4% Share

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- The future of gaming industry in the Philippines