Saudi Arabia Air Conditioner Market (2018-2024) | Share, Size, Leader, Growth, Revenue, Analysis, Forecast. Trends, industry & Outlook

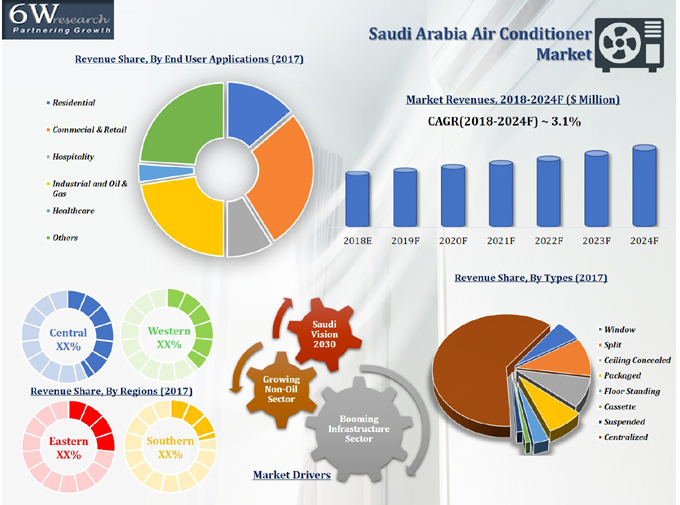

Market Forecast By Types (Window AC, Split AC, Ceiling Concealed, Packaged AC, Floor Standing, Cassette Type and Centralized (VRF, AHU/FCU, Condensing Unit, Chiller, and Others)), By Applications (Residential, Commercial & Retail, Hospitality, Oil & Gas, Healthcare and Others), By Regions (Eastern, Western, Central and Southern) and Competitive Landscape

| Product Code: ETC000511 | Publication Date: Aug 2022 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 140 | No. of Figures: 108 | No. of Tables: 16 | |

Latest Development (2022) in Saudi Arabia Air Conditioner Market

Saudi Arabia Air Conditioner Market is anticipated to project momentum during the upcoming increasing disposable income. The surging level of temperature coupled with rising humidity is driving the Saudi Arabia Air Conditioner Market Growth. Moreover, improvement in the standard of living coupled with the population explosion is driving the development of the market. An increasing number of high-rise buildings along with the establishment of commercial spaces, shopping malls, and government institutions is driving the demand for air conditioner in Saudi Arabia. Growing penetration towards vehicular comfort owing to the unfavourable environmental condition. Furthermore, increasing construction sector projects are also accelerating the growth in the market.

The Saudi Arabia air conditioner market report is a part of the Middle East Air Conditioner Market report thoroughly covers the air conditioner market by AC types, applications, and regions. The Saudi Arabia air conditioner market outlook report provides an unbiased and detailed analysis of the Saudi Arabia air conditioner market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to decide and align their market strategies according to the current and future market dynamics.

Saudi Arabia Air Conditioner Market Synopsis

Saudi Arabia Air Conditioner Market dominates the overall GCC air conditioner market. The country is expected to shift its focus toward non-oil sectors in the coming years, which is exhibited to drive development in the areas of retail, transportation, entertainment & leisure, and hospitality. Further, the anticipated growth of the residential sector would drive the demand for air conditioners in the country.

According to 6Wresearch, Saudi Arabia air conditioner market size is forecast to reach $1.3 billion by 2024. Slumping oil prices and dependence of the country on the oil sector majorly impacted the country's spending on infrastructure development during 2014-17. Further, many of the projects during this period were delayed or cancelled, which led to the downfall air conditioners market in Saudi Arabia.

Rising emphasis of government on the advancement of technology. Moreover, Saudi Vision 2030 aims at enhancing the economy by developing the hospitality and tourism sector which is further proliferating the Saudi Arabia AC Market. However, high initial and maintenance cost is expected to restrain the growth of the market.

The Saudi Arabia air conditioner market is anticipated to witness potential growth in the upcoming six years owing to the changing weather conditions in the country, rising per capita income of the Arabians along with rising buoyancy of the construction industry. Despite some regional differences and recession in the Saudi economy, significant demand projections are anticipated to be registered for the air conditioning systems in the near future with the highest demand expected to be registered from Riyadh, Jeddah, and Dammam regions. Also, the Saudi government will be able to sustain sound investment in the construction industry and multiplication in the construction of commercial as well as residential buildings would lead to an increased demand for air conditioners in the coming years in the country and would benefit sound growth of the Saudi Arabia air conditioner market share throughout the forecast period 2020-26F.

Saudi Arabia air conditioner market is estimated to gain traction in the foreseeable future on the back of the rising tourism sector in the country. Increased private sector investment in the hospitality sector such as hotels coupled with tourism seeks better accommodation with all essential facilities and is expected to be a market proliferating factor in the coming timeframe for the Saudi Arabia air conditioner market in the next five to ten years. Additionally, rising disposable income impelled the suburban population to increase air conditioner installation in the house this key component is leading to a flourishing residential sector, and as a result, is estimated to support the massive growth of the Saudi Arabia air conditioner market in the upcoming six years.

Saudi Arabia air conditioner market is projected to register sound revenues in the upcoming six years backed by rising construction projects in the country which directly instigate the new installations of the air conditioner in households one of the ongoing projects in the country is Aqua tower in Jeddah which consist of residential building infrastructure in the country. As the growing Residential building infrastructure is estimated to propel significant demand for air conditioners to fulfil basic necessities This emerging product demand in the residential sector, as a result, is estimated to spur the massive growth of the Saudi Arabia conditioner market in the coming timeframe. Moreover, the rising commercial sector like offices and malls where instigating the adoption of air conditioners as a cooler working environment helps workers to work efficiently is expected to propel the significant demand for air conditioners and would instigate the progressive growth of Saudi Arabia air conditioner market in the coming years.

Saudi Arabia air conditioner market is anticipated to proliferate in the years ahead owing to the rising expansion of construction projects in the country like the Red Sea, Neom, Jeddah tower, and Qiddiya are estimated to support the growth and development of the commercial and hospitality sector and would secure a massive rate for air conditioner installation in the coming years and would bring in opportunities for them to be investors to widen the market landscape and is estimated to secure Saudi Arabia Air Conditioner Market Growth in the forthcoming years.

Market Analysis by Type

In Saudi Arabia, the centralized air conditioner segment has captured the majority of the Saudi Arabia air conditioner market share, whereas the VRF segment is expected to witness the highest Saudi Arabia air conditioner market forecast revenues over the coming years.

Market Analysis by Application

On the basis of application, Residential, commercial, and retail applications garnered the maximum revenue share from air conditioner sales due to the rapid growth of large-scale projects. Over the coming years, applications such as hospitality and retail sectors are projected to grow at a relatively higher CAGR during 2018-24.

Key players in the market

Some of the key players in Saudi Arabia Air Conditioner Market are:

- Johnson Controls International plc.

- LG Electronics Inc.

- Gree Electric Appliances Inc. ...

- Trane Technologies plc.

- Danfoss A/S.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2014 to 2017.

- Base Year: 2017.

- Forecast Data until 2024.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Saudi Arabia Air Conditioner Market Overview

- Saudi Arabia Air Conditioner Market Outlook

- Saudi Arabia Air Conditioner Market Size & Saudi Arabia Air Conditioner Market Forecast of Revenues for the Period 2014-2024

- Historical & Forecast data of Global Air Conditioner Market for the Period 2014-2024

- Historical & Forecast data of Saudi Arabia Air Conditioner Market Revenue for the Period 2014-2024

- Historical & Forecast data of Saudi Arabia Window AC Market Revenue & Volume for the Period 2014-2024

- Historical & Forecast data of Saudi Arabia Split AC Market Revenue & Volume for the Period 2014-2024

- Historical & Forecast data of Saudi Arabia Packaged AC Market Revenue & Volume for the Period 2014-2024

- Historical & Forecast data of Saudi Arabia Ducted Split/Ceiling Concealed AC Market Revenue & Volume for the Period 2014-2024

- Historical & Forecast data of Saudi Arabia Floor Standing AC Market Revenue & Volume for the Period 2014-2024

- Historical & Forecast data of Saudi Arabia Cassette AC Market Revenue & Volume for the Period 2014-2024

- Historical & Forecast data of Saudi Arabia Ceiling Suspended AC Market Revenue & Volume for the Period 2014-2024

- Historical & Forecast data of Saudi Arabia Centralized AC Market Revenue for the Period 2014-2024

- Historical & Forecast data of Saudi Arabia Centralized AC Market Revenue, By Components for the Period 2014-2024

- Historical & Forecast data of Saudi Arabia Air Conditioner Market Revenue, by Applications for the period 2014-2024

- Historical & Forecast data of Saudi Arabia Air Conditioner Market Revenue, by Regions for the Period 2014-2024

- Saudi Arabia Air Conditioner Market Drivers

- Saudi Arabia Air Conditioner Market Opportunities and Restraints

- Saudi Arabia Air Conditioner Market Price and Volume Analysis

- Saudi Arabia Air Conditioner Market Trends

- Saudi Arabia Air Conditioner Market Share, by Players

- Saudi Arabia Air Conditioner Market Overview on Competitive Landscape

- Company Profiles

- Strategic Recommendations

Markets Covered

TheSaudi Arabia air conditioner marketreport provides a detailed analysis of the following market segments:

By Types

- Window AC

- Split AC

- Ceiling Concealed

- Packaged AC

- Floor Standing

- Suspended

- Cassette

- Centralized

- VRF

- AHU/FCU

- Condensing Unit

- Chiller & Others

By Applications

- Residential

- Commercial & Retail

- Hospitality

- Oil & Gas

- Healthcare

- Others

By Regions

- Eastern

- Western

- Central

- Southern

Saudi Arabia Air Conditioner Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Key Highlights of the Report |

| 2.2. Report Description |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Global Air Conditioner Market Outlook |

| 3.1. Global Air Conditioner Market Revenues (2014-2024F) |

| 3.2. Global Air Conditioner Market Revenue Share, By Regions (2017 & 2024F) |

| 4. Saudi Arabia PEST Analysis |

| 5. Saudi Arabia Air Conditioner Market Outlook |

| 5.1. Saudi Arabia Air Conditioner Market Revenues & Volume (2014-2024F) |

| 5.2. Saudi Arabia Air Conditioner Market - Industry Life Cycle |

| 5.3. Saudi Arabia Air Conditioner Market - Porter's Five Forces |

| 5.4. Saudi Arabia Air Conditioner Market - Opportunistic Matrix |

| 5.5. Saudi Arabia Air Conditioner Market - Value Chain Analysis |

| 5.6 Saudi Arabia Air Conditioner Market Revenue Share, By Types (2017 & 2024F) |

| 5.7. Saudi Arabia Air Conditioner Market Revenue Share, By End User Applications (2017 & 2024F) |

| 5.8. Saudi Arabia Air Conditioner Market Revenue Share, By Regions (2017 & 2024F) |

| 6. Saudi Arabia Air Conditioner Market Dynamics |

| 6.1. Impact Analysis |

| 6.2. Market Drivers |

| 6.2.1 Increasing demand for air conditioners due to extreme weather conditions in Saudi Arabia |

| 6.2.2 Growing construction industry driving the demand for air conditioning systems in residential and commercial buildings |

| 6.2.3 Technological advancements leading to the introduction of energy-efficient and smart air conditioning solutions |

| 6.3. Market Restraints |

| 6.3.1 Fluctuations in oil prices impacting consumer spending power and overall economic conditions in Saudi Arabia |

| 6.3.2 High initial costs associated with purchasing and installing air conditioning systems |

| 6.3.3 Environmental concerns and regulations regarding the use of refrigerants in air conditioners |

| 7. Saudi Arabia Air Conditioner Market Trends |

| 8. Saudi Arabia Room Air Conditioner Market Outlook, By Types |

| 8.1. Overview & Analysis |

| 8.2. Room Air Conditioner Market Revenues & Volume (2014-2024F) |

| 8.3. Window Air Conditioner Market Revenues & Volume (2014-2024F) |

| 8.4. Split Air Conditioner Market Revenues & Volume (2014-2024F) |

| 9. Saudi Arabia Ducted Air Conditioner Market Outlook, By Types |

| 9.1. Overview & Analysis |

| 9.2. Ducted Air Conditioner Market Revenues & Volume (2014-2024F) |

| 9.3. Ceiling Concealed Air Conditioner Market Revenues & Volume (2014-2024F) |

| 9.4. Packaged Air Conditioner Market Revenues & Volume (2014-2024F) |

| 10. Saudi Arabia Ductless Air Conditioner Market Outlook, By Types |

| 10.1. Overview & Analysis |

| 10.2. Ductless Air Conditioner Market Revenues & Volume (2014-2024F) |

| 10.3. Suspended Type Air Conditioner Market Revenues & Volume (2014-2024F) |

| 10.4. Floor Standing Air Conditioner Market Revenues & Volume (2014-2024F) |

| 10.5. Cassette Air Conditioner Market Revenues & Volume (2014-2024F) |

| 11. Saudi Arabia Centralized Air Conditioner Market Outlook |

| 11.1. Overview & Analysis |

| 11.2. Centralized Air Conditioner Market Revenues (2014-2024F) |

| 11.3 Centralized Air Conditioner Market Revenues, By Chiller & VRF (2014-2024F) |

| 12. Saudi Arabia Air Conditioner Market Outlook, By End User Applications |

| 12.1. Residential Air Conditioner Market Revenues (2014-2024F) |

| 12.2. Commercial & Retail Air Conditioner Market Revenues (2014-2024F) |

| 12.3. Hospitality Air Conditioner Market Revenues (2014-2024F) |

| 12.4. Industrial & Oil and Gas Air Conditioner Market Revenues (2014-2024F) |

| 12.5. Healthcare Air Conditioner Market Revenues (2014-2024F) |

| 12.6. Other End User Applications Air Conditioner Market Revenues (2014-2024F) |

| 13. Saudi Arabia Air Conditioner Market Outlook, By Regions |

| 13.1. Central Region Air Conditioners Market Revenues (2014-2024F) |

| 13.2. Southern Region Air Conditioners Market Revenues (2014-2024F) |

| 13.3. Western Region Air Conditioners Market Revenues (2014-2024F) |

| 13.4. Eastern Region Air Conditioners Market Revenues (2014-2024F) |

| 14. Saudi Arabia Air Conditioner Market Opportunity Assessment (Target/Focus Area) |

| 14.1. Saudi Arabia Air Conditioner Market Opportunity Assessment, By Types |

| 14.2. Saudi Arabia Air Conditioner Market Opportunity Assessment, By End User Applications |

| 14.3. Saudi Arabia Air Conditioner Market Opportunity Assessment, By Regions |

| 15. Saudi Arabia Air Conditioner Market - Price Point Analysis |

| 16. Saudi Arabia Air Conditioner Market - Competitive Landscape |

| 16.1. Market Players' Revenue Share Analysis, By Product Type (2017) |

| 16.2. Competitive Benchmarking, By Product Type |

| 16.3. Competitive Benchmarking, By Operating Parameters |

| 17. Company Profiles |

| 17.1. AHI Carrier FZC |

| 17.2. Fujitsu General (Middle East) FZE |

| 17.3. Zamil Air Conditioner (ZAC) |

| 17.4. Daikin Air Conditioning Saudi Arabia LLC |

| 17.5. LG Electronics Gulf FZE |

| 17.6. S.K.M Air Conditioning LLC |

| 17.7. Trane INC. |

| 17.8. Al Salem Johnson Controls (York) |

| 17.9. GREE Electric Appliances Inc. |

| 17.10. Mitsubishi Electric Corporation |

| 18. Strategic Recommendations |

| 19. Disclaimer |

| List of Figures |

| 1. Global Air Conditioner Market Revenues, 2014-2024F ($ Billion) |

| 2. Global Air Conditioner Market Revenue Share, By Regions (2017) |

| 3. Saudi Arabia Population, 2014-2023F (In Million) |

| 4. Unemployment Rate in Saudi Arabia, 2011-2016 (% of the economically active population) |

| 5. Saudi Arabia Consumer Expenditure, 2012-2017 (In $ Billion) |

| 6. Expatriates Population in Saudi Arabia, 2013-2017 (In Million) |

| 7. Internet User in Saudi Arabia (In Million) |

| 8. Saudi Arabia Volume of Imports and Exports, 2014-2023F (% change) |

| 9. Saudi Arabia GDP, 2014-2023F (In $ Billion) |

| 10. Saudi Arabia Government Revenue vs. Government Expenditure, 2014 -2023 (% of GDP) |

| 11. Saudi Arabia Total investment, 2014 & 2023F (% of GDP) |

| 12. Saudi Arabia Oil Production, 2014-2020 (Thousand Barrels/Day) |

| 13. Saudi Arabia Oil Revenues, 2010-2018E ($ Billion) |

| 14. Saudi Arabia Oil & Gas Spending, 2014-2020 ($ Billion) |

| 15. Saudi Arabia Budget Allocation for Financial Year, 2015-2017 ($ Million) |

| 16. Saudi Arabia Air Conditioner Market Revenues, 2014-2024F ($ Million) |

| 17. Saudi Arabia Air Conditioner Market Revenue Share, By Types (2017 & 2024F) |

| 18. Saudi Arabia Air Conditioner Market Revenue Share, By End User Applications (2017 & 2024F) |

| 19. Saudi Arabia Air Conditioner Market Revenue Share, By Regions (2017 & 2024F) |

| 20. Saudi Arabia Air Conditioner Market Revenue Share, By Types (2017 & 2024F) |

| 21. Saudi Arabia Air Conditioner Market Revenue Share, By End User Applications (2017 & 2024F) |

| 22. Saudi Arabia Air Conditioner Market Revenue Share, By Regions (2017 & 2024F) |

| 23. Saudi Vision 2030 Goals for Non-Oil Sector |

| 24. Saudi Arabia Non-Oil Revenues, 2012-2017E ($ Billion) |

| 25. Upcoming Construction Projects in Saudi Arabia |

| 26. Upcoming Economic Cities in Saudi Arabia |

| 27. Saudi Arabia Average Crude Oil Prices in, 2012-2018 ($/Barrel) |

| 28. Saudi Arabia Building Sector Construction Contracts Awards, 2013-2017 ($ Million) |

| 29. Saudi Arabia Pace of Project Cancellations, 2013-2017 ($ Billion) |

| 30. Saudi Arabia Room Air Conditioner Market Revenue Share (2017 & 2024F) |

| 31. Saudi Arabia Room Air Conditioner Market Revenues, 2014-2024F ($ Million) |

| 32. Saudi Arabia Room Air Conditioner Market Revenues, 2014-2024F ($ Million) |

| 33. Saudi Arabia Window Air Conditioner Market Revenues, 2014-2024F ($ Million) |

| 34. Saudi Arabia Window Air Conditioner Market Volume, 2014-2024F ('000 Units) |

| 35. Saudi Arabia Split Air Conditioner Market Revenues, 2014-2024F ($ Million) |

| 36. Saudi Arabia Split Air Conditioner Market Volume, 2014-2024F ('000 Units) |

| 37. Saudi Arabia Ducted Air Conditioner Market Revenue Share, By Types, 2017 & 2024F |

| 38. Saudi Arabia Ducted Air Conditioner Market Revenues, 2014-2024F ($ Million) |

| 39. Saudi Arabia Ducted Air Conditioner Market Volume, 2014-2024F ('000 Units) |

| 40. Saudi Arabia Ceiling Concealed Air Conditioner Market Revenues, 2014-2024F ($ Million) |

| 41. Saudi Arabia Ceiling Concealed Air Conditioner Market Volume, 2014-2024F ('000 Units) |

| 42. Saudi Arabia Packaged Air Conditioner Market Revenues, 2014-2024F ($ Million) |

| 43. Saudi Arabia Packaged Air Conditioner Market Volume, 2014-2024F ('000 Units) |

| 44. Saudi Arabia Ductless Air Conditioner Market Revenue Share, 2017 & 2024F |

| 45. Saudi Arabia Ductless Air Conditioner Market Revenues, 2014-2024F ($ Million) |

| 46. Saudi Arabia Ductless Air Conditioner Market Volume, 2014-2024F ('000 Units) |

| 47. Saudi Arabia Suspended Type Air Conditioner Market Revenues, 2014-2024F ($ Million) |

| 48. Saudi Arabia Suspended Type Air Conditioner Market Volume, 2014-2024F ('000 Units) |

| 49. Saudi Arabia Floor Standing Air Conditioner Market Revenues, 2014-2024F ($ Million) |

| 50. Saudi Arabia Floor Standing Air Conditioner Market Volume, 2014-2024F ('000 Units) |

| 51. Saudi Arabia Cassette Air Conditioner Market Revenues, 2014-2024F ($ Million) |

| 52. Saudi Arabia Cassette Air Conditioner Market Volume, 2014-2024F ('000 Units) |

| 53. Saudi Arabia Centralized Air Conditioner Market Revenue Share, By Types (2017 & 2024F) |

| 54. Saudi Arabia Centralized Air Conditioner Market Revenues, 2014-2023F ($ Million) |

| 55. Saudi Arabia Chiller Air Conditioner Market Revenues, 2014-2024F ($ Million) |

| 56. Saudi Arabia VRF Air Conditioner Market Revenues, 2014-2024F ($ Million) |

| 57. Saudi Arabia Residential Air Conditioner Market Revenues, 2014- 2024F ($ Million) |

| 58. Riyadh Residential Supply, 2014-2019F ('000 Units) |

| 59. Jeddah Residential Supply, 2014-2019F ('000 Units) |

| 60. Dammam Residential Supply, 2014-2019F ('000 Units) |

| 61. Makkah Residential Supply, 2014-2019F ('000 Units) |

| 62. Saudi Arabia Commercial & Retail Air Conditioner Market Revenues, 2014- 2024F ($ Million) |

| 63. Riyadh Office Supply, 2014-2019F ('000 Sq. m.) |

| 64. Jeddah Office Supply, 2014-2019F ('000 Sq. m.) |

| 65. Dammam Office Supply, 2014-2019F ('000 Sq. m.) |

| 66. Makkah Office Supply, 2014-2019F ('000 Sq. m.) |

| 67. Riyadh Retail Supply, 2014-2019F ('000 Sq. m.) |

| 68. Jeddah Retail Supply, 2014-2019F ('000 Sq. m.) |

| 69. Dammam Retail Supply, 2014-2019F ('000 Sq. m.) |

| 70. Makkah Retail Supply, 2014-2019F ('000 Sq. m.) |

| 71. Riyadh Hotel Supply, 2014-2019F (No. of Rooms) |

| 72. Jeddah Hotel Supply, 2014-2019F (No. of Rooms) |

| 73. Saudi Arabia Hospitality Air Conditioner Market Revenues, 2014- 2024F ($ Million) |

| 74. Riyadh Hotel Supply (Keys), 2014-2019F (Units) |

| 75. Jeddah Hotel Supply (Keys), 2014-2019F (Units) |

| 76. Dammam Hotel Supply (Keys), 2014-2019F (Units) |

| 77. Makkah Hotel Supply (Keys), 2014-2019F (Units) |

| 78. Saudi Arabia Industrial & Oil and Gas Air Conditioner Market Revenues, 2014- 2024F ($ Million) |

| 79. Saudi Arabia Healthcare Air Conditioner Market Revenues, 2014- 2024F ($ Million) |

| 80. Major Upcoming Healthcare Projects in Saudi Arabia |

| 81. Saudi Arabia Other End User Applications Air Conditioner Market Revenues, 2014-2024F ($ Million) |

| 82. Saudi Arabia Air Conditioners Market Revenues, By Central Region, 2014-2024F ($ Million) |

| 83. Saudi Arabia Air Conditioner Market Revenue Share, By Central Region (2017 & 2024F) |

| 84. Saudi Arabia Air Conditioners Market Revenues, By Southern Region, 2014-2024F ($ Million) |

| 85. Saudi Arabia Air Conditioner Market Revenue Share, By Southern Region (2017 & 2024F) |

| 86. Saudi Arabia Air Conditioners Market Revenues, By Western Region, 2014-2024F ($ Million) |

| 87. Saudi Arabia Air Conditioner Market Revenue Share, By Western Region (2017 & 2024F) |

| 88. Saudi Arabia Air Conditioners Market Revenues, By Eastern Region, 2014-2024F ($ Million) |

| 89. Saudi Arabia Air Conditioner Market Revenue Share, By Eastern Region (2017 & 2024F) |

| 90. Saudi Arabia Air Conditioner Market Opportunity Matrix, By Types (2024F) |

| 91. Saudi Arabia Air Conditioner Market Opportunity Matrix, By Applications (2024F) |

| 92. Saudi Arabia Air Conditioner Market Opportunity Matrix, By Regions (2024F) |

| 93. Saudi Arabia Air Conditioner Market Price Trend, By Window (2014-2024F) |

| 94. Saudi Arabia Air Conditioner Market Price Trend, By Split (2014-2024F) |

| 95. Saudi Arabia Air Conditioner Market Price Trend, By Ceiling Concealed (2014-2024F) |

| 96. Saudi Arabia Air Conditioner Market Price Trend, By Packaged (2014-2024F) |

| 97. Saudi Arabia Air Conditioner Market Price Trend, By Cassette (2014-2024F) |

| 98. Saudi Arabia Air Conditioner Market Price Trend, By Floor Standing (2014-2024F) |

| 99. Saudi Arabia Air Conditioner Market Price Trend, By Suspended (2014-2024F) |

| 100. Saudi Arabia Window Air Conditioner Market Revenue Share, By Company (2017) |

| 101. Saudi Arabia Split Air Conditioner Market Revenue Share, By Company (2017) |

| 102. Saudi Arabia Ceiling Concealed Air Conditioner Market Revenue Share, By Company (2017) |

| 103. Saudi Arabia Packaged Air Conditioner Market Revenue Share, By Company (2017) |

| 104. Saudi Arabia Floor Standing Air Conditioner Market Revenue Share, By Company (2017) |

| 105. Saudi Arabia Cassette Air Conditioner Market Revenue Share, By Company (2017) |

| 106. Saudi Arabia Suspended Air Conditioner Market Revenue Share, By Company (2017) |

| 107. Saudi Arabia VRF Air Conditioner Market Revenue Share, By Company (2017) |

| 108. Saudi Arabia Chiller Air Conditioner Market Revenue Share, By Company (2017) |

| List of Tables |

| 1. Tax on Business Income in Saudi Arabia |

| 2. SASO Energy Labeling And Minimum Energy Performance Requirements For Air-conditioners |

| 3. Energy Efficiency Label Licensing Procedure For Imported And Locally Manufactured Air-conditioners - SASO |

| 4. Enforcement Mechanism Of The Modified Standard And Sampling Plan At Border/Ports Of Entry - Saudi Customs |

| 5. Enforcement Mechanism For Locally Manufactured Air-conditioners At Production Line - MOCI |

| 6. Large Capacity Air Conditioners -Performance Requirements And Methods Of Testing |

| 7. Minimum Energy Performance Standards for Condensing Units |

| 8. Minimum Energy Performance Standards for Chiller |

| 9. Minimum Energy Performance Standards for Variable-refrigerant-flow (VRF) |

| 10. Major Upcoming Infrastructure Projects in Saudi Arabia |

| 11. Saudi Arabia Upcoming Residential Projects |

| 12. List of Major Infrastructure Projects in Saudi Arabia |

| 13. List of Major Projects Announced in Saudi Arabia |

| 14. Upcoming Hotel Projects in Saudi Arabia |

| 15. Saudi Arabia Oil & Gas Projects |

| 16. List of Major Infrastructure Projects in Saudi Arabia |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero