Saudi Arabia Cold Storage Market (2018-2024) | Analysis, Size, Revenue, Trends, Growth, Forecast, industry, Outlook & Segmentation

Market Forecast By Types (Chiller, Freezer, and Blast Freezer), By End-User (Fish, Meat & Seafood, Dairy, Pharmaceuticals, Fruits & Vegetables, Processed/Frozen Food, Industrial Chemicals, and Others), By Verticals (Government & Transportation, Healthcare & Hospitality, Industry & Manufacturing, and Retail & Logistics), By Storage Type (Refrigerated Containers, Refrigerator Ships, Warehousing, Air Cargo, Refrigerated Trucks, and Other Storage Type), By Regions (Central, Eastern, Western and Southern) and Competitive Landscape

| Product Code: ETC000495 | Publication Date: Dec 2021 | Updated Date: May 2023 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 120 | No. of Figures: 77 | No. of Tables: 9 | |

Latest 2023 Developments of the Saudi Arabia Cold Storage Market

Saudi Arabia Cold Storage Market witnessed recent development includesGRP sheet for truck bodies further enhances refrigeration and also helps in reducing weight. Directly enhances the carrying capacity for these small trucks. Performance monitoring systems pitch in. They are cheap, provide critical data, enable better decision-making, and above all keep the cold storage’s customers updated and assured that the stock is safe and stored under ambient conditions. When blockchain is introduced in the cold chain it can lead to staggering efficiency improvements and better monitoring. IoT companies could be the immediate knights to save the day for their companies in the cold chains.

Mergers and Acquisitions:

Lineage Logistics acquired Ontario Refrigerators on July 24, 2020.

Saudi Arabia Cold Storage Market Synopsis

Projected growth in the retail market, upcoming new hotels & shopping malls, demand for packaged food items along increasing FDI inflow in the construction and retail sectors are some of the key factors shaping the cold storage market in Saudi Arabia. In Saudi Arabia cold storage market, the retail cold storage vertical segment accounted for the highest market revenues owing to the availability of supporting infrastructure and increasing installation in organized retail units, particularly, hypermarkets and supermarkets.

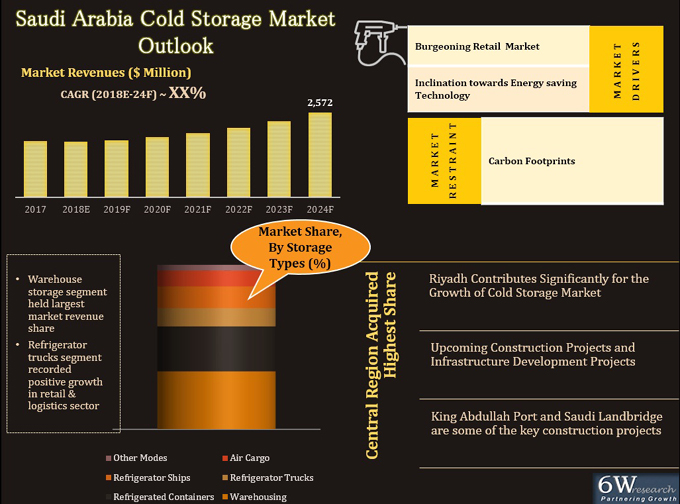

According to 6Wresearch, Saudi Arabia cold storage market size is projected to reach $2,572 million by 2024. Saudi Arabia market registered a decline in demand during 2014-16 due to deteriorating economic conditions owing to a fall in oil prices. However, the market is anticipated to bounce back with the recovery of oil prices post-2017. Further, growing concerns over food wastage and the increasing population in Saudi Arabia are expected to boost the growth of the cold storage market during the forecast period. Amongst all the verticals, the retail & logistics segment acquired the highest revenue share of the market. Additionally, the hospitality & healthcare, along with government & transportation verticals are expected to witness the highest Saudi Arabia Cold Storage Market forecast revenues over the coming years.

In Saudi Arabia, the Central region held the majority of the Saudi Arabia cold storage market share in terms of revenue on the back of increasing infrastructure development activities, especially in the industrial & manufacturing verticals. The Central region is expected to maintain its market share during the forecast period as well.

The Saudi Arabia cold storage market report thoroughly covers the market by cold storage types, technology, verticals, end-user, and regions. The Saudi Arabia cold storage market outlook report provides an unbiased and detailed analysis of the Saudi Arabia cold storage market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics. Saudi Arabia Cold Storage Market, the concept of the cold storage need is generated products keep fresh while controlling the temperature and level of humidity to keep the things fresh in the cold storage. There are many features of the cols storage long time span, able to keep the packaged food, fruits, vegetables, meat, fish, the dairy product that’s why nowadays day by day demand for packed food items rising consumers can keep it for a long time.

Saudi Arabia, the cold storage market is projected to witness potential growth in the coming timeframe on the back of rising retail outlets and supermarkets in the country as a result of the massive development of the retail sector. Additionally, increased demand for ready-to-eat food and frozen food among the population is estimated to elevate the demand for cold storage systems in order to preserve perishable products for a long time. The rising number of restaurants is expected to generate lucrative opportunities in the market owing to increased demand for frozen desserts which is anticipated to spur the prominent growth of Saudi Arabia cold storage market during the forecast period.

Saudi Arabia cold storage market is anticipated to register sound revenues during the forecast period 2020-26F on the back of the increase in the consumption rate of frozen fruits among the health-conscious population. Further, the rise in the expansion of construction projects in the country like the Red Sea, Neom, Jeddah tower, and Qiddiya are estimated to support the growth and development of the commercial and hospitality sector is estimated to instigate cold storage adoption in the coming year and would bring in opportunities for them to be investors to widen the market landscape and is estimated to secure tremendous growth of the Saudi Arabia cold storage market in the forthcoming years.

Key Highlights of the Report:

• Saudi Arabia Cold Storage Market Overview

• Saudi Arabia Cold Storage Market Outlook

• Historical Data of Global Cold Storage Market for the Period 2014-2017

• Market Size & Forecast of Global Cold Storage Market until 2024

• Historic Data of Saudi Arabia Cold Storage Market for the Period 2014-2017

• Saudi Arabia Cold Storage Market Size & Saudi Arabia Cold Storage Market Forecast of Revenues until 2024

• Historic Data of Saudi Arabia Cold Storage Market Revenues, By Technology for the Period 2014-2017

• Market Size & Forecast of Saudi Arabia Cold Storage Market Revenues, By Technology until 2024

• Historic Data of Saudi Arabia Cold Storage Market Revenues, By Storage Type for the Period 2014-2017

• Market Size & Forecast of Saudi Arabia Cold Storage Market Revenues, By Storage Type until 2024

• Historic Data of Saudi Arabia Cold Storage Market, By End-Use for the Period 2014-2017

• Market Size & Forecast of Saudi Arabia Cold Storage Market, By End-Use until 2024

• Historic Data of Saudi Arabia Cold Storage Market, By Verticals for the Period 2014-2017

• Market Size & Forecast of Saudi Arabia Cold Storage Market, By Verticals until 2024

• Historic Data of Saudi Arabia Cold Storage Market, By Regions for the Period 2014-2017

• Market Size & Forecast of Saudi Arabia Cold Storage Market, By Regions until 2024

• Saudi Arabia Cold Storage Market Drivers and Restraints

• Saudi Arabia Cold Storage Market Trends and Developments

• Saudi Arabia Cold Storage Market Share by Players

• Saudi Arabia Cold Storage Market Overview on Competitive Benchmarking

• Company Profiles and Key Strategic Pointers

Markets Covered

The Saudi Arabia cold storage market report provides a detailed analysis of the following market segments:

By Types:

- Chiller

- Freezer

- Blast Freezer

By End-User:

- Fish, Meat & Seafood

- Dairy

- Pharmaceuticals

- Fruits & Vegetables

- Processed/Frozen Food

- Industrial Chemicals

- Others

By Verticals:

- Government & Transportation

- Healthcare & Hospitality

- Industry & Manufacturing

- Retail & Logistics

By Storage Type:

- Refrigerated Containers

- Refrigerator Ships

- Warehousing

- Air Cargo

- Refrigerated Trucks

- Other Storage Type

By Regions:

- Central

- Eastern

- Western

- Southern

Frequently Asked Questions About the Market Study (FAQs):

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Saudi Arabia Cold Storage Market Overview |

| 3.1 Saudi Arabia Cold Storage Market Revenues (2014-2024F) |

| 3.2 Saudi Arabia Cold Storage Market Revenue Share - By Regions (2017) |

| 4. Saudi Arabia Cold Storage Market Overview |

| 4.1 Saudi Arabia Cold Storage Market Revenues (2014-2024F) |

| 4.2 Saudi Arabia Cold Storage Market, Industry Life Cycle |

| 4.3 Saudi Arabia Cold Storage Market, Opportunity Matrix |

| 4.4 Saudi Arabia Cold Storage Market, Porters Five Forces |

| 4.5 Saudi Arabia Cold Storage Market Revenue Share, By Verticals (2017 & 2024F) |

| 4.6 Saudi Arabia Cold Storage Market Revenue Share, By Regions (2017 & 2024F) |

| 5. Saudi Arabia Cold Storage Market Dynamics |

| 5.1 Impact Analysis |

| 5.2 Market Drivers |

| 5.3 Market Restraints |

| 6. Saudi Arabia Cold Storage Market Trends |

| 7. Saudi Arabia Cold Storage Market Overview, By Storage Type |

| 7.1 Saudi Arabia Cold Storage Market Revenues, By Warehousing (2014-2024F) |

| 7.2 Saudi Arabia Cold Storage Market Revenues, By Refrigerated Container (2014-2024F) |

| 7.3 Saudi Arabia Cold Storage Market Revenues, By Refrigerator Trucks (2014-2024F) |

| 7.4 Saudi Arabia Cold Storage Market Revenues, By Refrigerated Ships (2014-2024F) |

| 7.5 Saudi Arabia Cold Storage Market Revenues, By Air Cargo (2014-2024F) |

| 7.6 Saudi Arabia Cold Storage Market Revenues, By Other Transportation Modes (2014-2024F) |

| 8. Saudi Arabia Cold Storage Market Overview, By Technology |

| 8.1 Saudi Arabia Chiller Cold Storage Market Revenues (2014-2024F) |

| 8.2 Saudi Arabia Freezer Cold Storage Market Revenue Share (2017 & 2024F) |

| 8.3 Saudi Arabia Blast Freezer Cold Storage Market Revenue Share (2017 & 2024F) |

| 9. Saudi Arabia Cold Storage Market Overview, By Verticals |

| 9.1 Saudi Arabia Cold Storage Market Revenues, By Industrial and Manufacturing (2014-2024F) |

| 9.2 Saudi Arabia Cold Storage Market Revenues, By Government & Transportation (2014-2024F) |

| 9.3 Saudi Arabia Cold Storage Market Revenues, By Retail (2014-2024F) |

| 9.4 Saudi Arabia Cold Storage Market Revenues, By Hospitality & Healthcare (2014-2024F) |

| 10. Saudi Arabia Cold Storage Market Overview, By End-Use |

| 10.1 Saudi Arabia Cold Storage Market Revenues, By Meat, Fish & Seafood (2014-2024F) |

| 10.2 Saudi Arabia Cold Storage Market Revenues, By Dairy Produits (2014-2024F) |

| 10.3 Saudi Arabia Cold Storage Market Revenues, By Pharmaceuticals (2014-2024F) |

| 10.4 Saudi Arabia Cold Storage Market Revenues, By Fruits & Vegetables (2014-2024F) |

| 10.5 Saudi Arabia Cold Storage Market Revenues, By Processed/Frozen Foods (2014-2024F) |

| 10.6 Saudi Arabia Cold Storage Market Revenues, By Industrial Chemicals (2014-2024F) |

| 10.7 Saudi Arabia Cold Storage Market Revenues, By Others (2014-2024F) |

| 10.8 Saudi Arabia Cold Storage End-Use Application Market - Key Performance Indicators |

| 11. Saudi Arabia Cold Storage Market Overview, By Regions |

| 11.1 Saudi Arabia Central and Southern Region Cold Storage Market Revenues (2014-2024F) |

| 11.2 Saudi Arabia Western and Eastern Region Cold Storage Market Revenues (2014-2024F) |

| 12. Saudi Arabia Cold Storage Market Overview - Competitive Landscape |

| 12.1 Saudi Arabia Cold Storage Market Players Revenues Share (2017) |

| 12.2 Competitive Benchmarking, By Operating Parameters |

| 13. Company Profiles |

| 13.1 Makkah Cold Stores |

| 13.2 Able Logistics Group |

| 13.3 Wared Logistics |

| 13.4 Cold Stores Group of Saudi Arabia |

| 13.5 Stork |

| 13.6 Himmah Logistics |

| 13.7 RSAGlobal |

| 13.8 Vacker |

| 13.9 TSSC Ltd. |

| 13.10 Gulf Drug LLC |

| 14. Key Strategic Pointers |

| 15. Disclaimer |

| List of Figures |

| 1. Global Cold Storage Market Revenues, 2014-2023F ($ Billion) |

| 2. Top Five Cold Storage Revenue-Generating Countries' Market Share (2017) |

| 3. Global Cold Storage Market Revenue Share, By Regions (2017) |

| 4. Saudi Arabia Cold Storage Market Revenues, 2014-2023F ($ Billion) |

| 5. Saudi Arabia Cold Storage Market Revenue Share, By Verticals (2017 & 2024F) |

| 6. Saudi Arabia Cold Storage Market Revenue Share, By Regions (2017 & 2024F) |

| 7. Saudi Arabia Cold Storage Market Revenue Share, By Storage Type (2017 & 2024F ) |

| 8. Saudi Arabia Cold Storage Market Revenue Share, By Warehousing, 2014-2024F ($ Million) |

| 9. Saudi Arabia Cold Storage Market Revenue Share, By Warehousing (2017 & 2024F) |

| 10. Saudi Arabia Cold Storage Market Revenue Share, By Refrigerated Containers, 2014-2024F ($ Million) |

| 11. Saudi Arabia Cold Storage Market Revenue Share, By Refrigerated Containers (2017 & 2024F) |

| 12. Saudi Arabia Cold Storage Market Revenue Share, By Refrigerated Trucks, 2014-2024F ($ Million) |

| 13. Saudi Arabia Cold Storage Market Revenue Share, By Refrigerated Trucks (2017 & 2024F) |

| 14. Saudi Arabia Cold Storage Market Revenue Share, By Refrigerator Ships, 2014-2024F ($ Million) |

| 15. Saudi Arabia Cold Storage Market Revenue Share, By Refrigerator Ships (2017 & 2024F) |

| 16. Saudi Arabia Cold Storage Market Revenue Share, By Air Cargo, 2014-2024F ($ Million) |

| 17. Saudi Arabia Cold Storage Market Revenue Share, By Air Cargo (2017 & 2024F) |

| 18. Saudi Arabia Cold Storage Market Revenue Share, By Other Storage Type, 2014-2024F ($ Million) |

| 19. Saudi Arabia Cold Storage Market Revenue Share, By Other Storage Type (2017 & 2024F) |

| 20. Saudi Arabia Cold Storage Market Revenues, By Chiller Technology, 2014-2024F ($ Million) |

| 21. Saudi Arabia Cold Storage Market Revenue Share, By Chiller Technology (2017 & 2024F) |

| 22. Saudi Arabia Cold Storage Market Revenues, By Freezer Technology, 2014-2024F ($ Million) |

| 23. Saudi Arabia Cold Storage Market Revenue Share, By Freezer Technology (2017 & 2024F) |

| 24. Saudi Arabia Cold Storage Market Revenues, By Blast Freezer Technology, 2014-2024F ($ Million) |

| 25. Saudi Arabia Cold Storage Market Revenue Share, By Blast Freezer Technology (2017 & 2024F) |

| 26. Saudi Arabia Industrial & Manufacturing Cold Storage Market Revenues, 2014-2024F ($ Million) |

| 27. Saudi Arabia Cold Storage Market Revenue Share, By Industrial & Manufacturing (2017 & 2024F) |

| 28. Number of Industrial & Manufacturing Units in Saudi Arabia (2011-2018F) |

| 29. Total Number of Manufacturing Facilities in Saudi Arabia (Q1-Q3, 2017) |

| 30. Saudi Arabia Government & Transportation Cold Storage Market Revenues, 2014-2024F ($ Million) |

| 31. Saudi Arabia Value of Contracts Awarded, By Sector, 2015-2018E ($ Billion) |

| 32. Saudi Arabia Cold Storage Market Revenue Share, By Government & Transportation (2017 & 2024F) |

| 33. Saudi Arabia Sale of New Commercial Vehicles, 2011-2017 (Thousand Units) |

| 34. Saudi Arabia Retail & Logistics Cold Storage Market Revenues, 2014-2024F ($ Million) |

| 35. Number of Hypermarkets in Saudi Arabia, 2013-2018 |

| 36. Number of Supermarkets in Saudi Arabia, 2013-2018 |

| 37. Saudi Arabia Cold Storage Market Revenue Share, By Retail & Logistics (2017 & 2024F) |

| 38. Saudi Arabia Retail Coverage, 2015-2019F (Million sq. m) |

| 39. Saudi Arabia Healthcare & Hospitality Cold Storage Market Revenues, 2014-2024F ($ Million) |

| 40. Saudi Arabia Cold Storage Market Revenue Share, By Healthcare & Hospitality (2017 & 2024F) |

| 41. Saudi Arabia Number of Hotel Rooms, 2013-2018F (Per Thousand Keys) |

| 42. Saudi Arabia Number of Hospital Beds, 2013-2017 (Per Thousand Beds) |

| 43. Saudi Arabia Meat, Fish & Seafood Cold Storage Market Revenues, 2014-2024F ($ Million) |

| 44. Saudi Arabia Cold Storage Market Revenue Share, By Meat, Fish & Seafood End-Use Application (2017 & 2024F) |

| 45. Saudi Arabia Dairy Cold Storage Market Revenues, 2014-2024F ($ Million) |

| 46. Saudi Arabia Cold Storage Market Revenue Share, By Dairy End-Use Application (2017 & 2024F) |

| 47. Saudi Arabia Pharmaceuticals Cold Storage Market Revenues, 2014-2024F ($ Million) |

| 48. Saudi Arabia Cold Storage Market Revenue Share, By Pharmaceuticals End-Use Application (2017 & 2024F) |

| 49. Saudi Arabia Fruits & Vegetables Cold Storage Market Revenues, 2014-2024F ($ Million) |

| 50. Fruits & Vegetables Cold Storage Market Revenues, 2014-2024F ($ Million) |

| 51. Saudi Arabia Frozen & Processed Cold Storage Market Revenues, 2014-2024F ($ Million) |

| 52. Saudi Arabia Cold Storage Market Revenue Share, By Frozen & Processed End-Use Application (2017 & 2024F) |

| 53. Saudi Arabia Industrial Chemicals Cold Storage Market Revenues, 2014-2024F ($ Million) |

| 54. Saudi Arabia Cold Storage Market Revenue Share, By Industrial Chemicals End-Use Application (2017 & 2024F) |

| 55. Saudi Arabia Other Cold Storage End-Use Applications Market Revenues, 2014-2024F ($ Million |

| 56. Saudi Arabia Cold Storage Market Revenue Share, By Other End-Use Applications (2017 & 2024F) |

| 57. Import & Export of Meat and Edible Meat Offal in Saudi Arabia, 2013-2017 ($ Million) |

| 58. Import & Export of Fish and Crustaceans Molluscs and Other Aquatic Invertebrates in Saudi Arabia, 2013-2017 ($ Million) |

| 59. Import & Export of Dairy Produce in Saudi Arabia, 2013-2017 ($ Million) |

| 60. Import & Export of Edible Vegetables and Certain Roots and Tubers in Saudi Arabia, 2013-2017 ($ Million) |

| 61. Import & Export of Edible Fruit and Nuts; Peel of Citrus Fruit or Melons in Saudi Arabia, 2013-2017 ($ Million) |

| 62. Import & Export of Cereals in Saudi Arabia, 2013-2017 ($ Million) |

| 63. Import & Export of Sugars and Sugar Confectionery in Saudi Arabia, 2013-2017 ($ Million) |

| 64. Import & Export of Inorganic Chemicals in Saudi Arabia, 2013-2017 ($ Million) |

| 65. Import & Export of Pharmaceutical Products in Saudi Arabia, 2013-2017 ($ Million) |

| 66. Import & Export of Organic chemicals in Saudi Arabia, 2013-2017 ($ Million) |

| 67. Import & Export of Preparations of Cereals, Flour, Starch or Milk; Pastrycooks' Products in Saudi Arabia, 2013-2017 ($ Million) |

| 68. Saudi Arabia Central Region Cold Storage Market Revenues, 2014-2024F ($ Million) |

| 69. Saudi Arabia Central Region Cold Storage Market Revenue Share (2017 & 2024F) |

| 70. Saudi Arabia Southern Region Cold Storage Market Revenues, 2014-2024F ($ Million) |

| 71. Saudi Arabia Southern Region Cold Storage Market Revenue Share (2017 & 2024F) |

| 72. Saudi Arabia Western Region Cold Storage Market Revenues, 2014-2024F ($ Million) |

| 73. Saudi Arabia Western Region Cold Storage Market Revenue Share (2017 & 2024F) |

| 74. Saudi Arabia Eastern Region Cold Storage Market Revenues, 2014-2024F ($ Million) |

| 75. Saudi Arabia Eastern Region Cold Storage Market Revenue Share (2017 & 2024F) |

| 76. Saudi Arabia Cold Storage Market Revenue, By Companies, 2017 ($ Million) |

| 77. Saudi Arabia Cold Storage Market Revenue Share, By Companies (2017) |

| List of Tables |

| 1. Saudi Arabia Key Infrastructure Construction Projects |

| 2. Saudi Arabia Construction Industry Revenues (2016-2023F) |

| 3. Number of Electric Cars Sold in Saudi Arabia (2012-2017) |

| 4. Number of Electric Vehicle Charging Stations in Saudi Arabia (2012-2017) |

| 5. Emission from the Logistics Sector in Saudi Arabia, 2014-2020F (Million Metric Tons) |

| 6. Under Construction Manufacturing Units in Saudi Arabia (2017) |

| 7. Upcoming Manufacturing Plants in Saudi Arabia |

| 8. List of Construction Projects in Saudi Arabia |

| 9. Saudi Arabia Hospitality & Healthcare Sector Major Construction Projects |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

- Kenya Road Stabilization Equipment Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- North America Sodium chloride Market (2025-2031) | Analysis, Revenue, Forecast, Trends, Companies, Size, Growth, Share, Industry, Outlook & Value

- North America Vinyl Flooring Market (2025-2031) | Value, Growth,Size, Analysis, Revenue, Industry, Forecast, Share, Outlook, Companies & Trends

- Tajikistan Thermal Camera Market (2025-2031) | Trends, Size, Growth, Share, Industry, Companies, Value, Analysis, Revenue, Forecast & Outlook

- Singapore Professional AV Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero