Saudi Arabia Earth Moving Equipment Market (2015-2021) | Analysis, Forecast, Trends, Size, Industry, Growth, Outlook, Value, Companies, Share & Revenue

Earth Moving Equipment Types (Excavators, Loaders and Construction Tractors), Applications (Agriculture, Construction and Mining) and Regions (Southern, Eastern, Western and Central)

| Product Code: ETC000237 | Publication Date: Apr 2015 | Updated Date: May 2024 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 129 | No. of Figures: 70 | No. of Tables: 22 | |

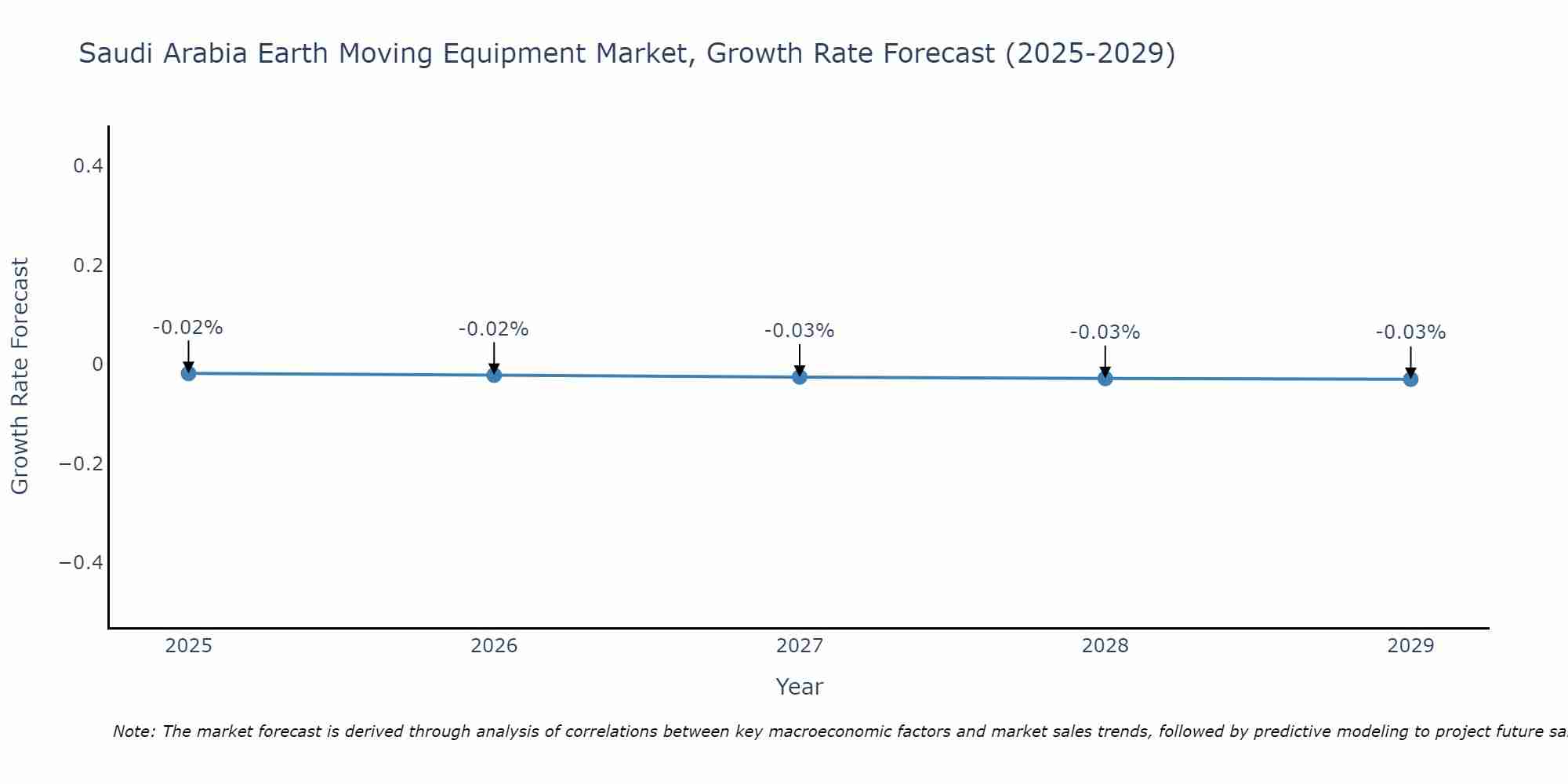

Saudi Arabia Earth Moving Equipment Market Size Growth Rate

The Saudi Arabia Earth Moving Equipment Market may undergo a gradual slowdown in growth rates between 2025 and 2029. Beginning strongly at -0.02% in 2025, growth softens to -0.03% in 2029.

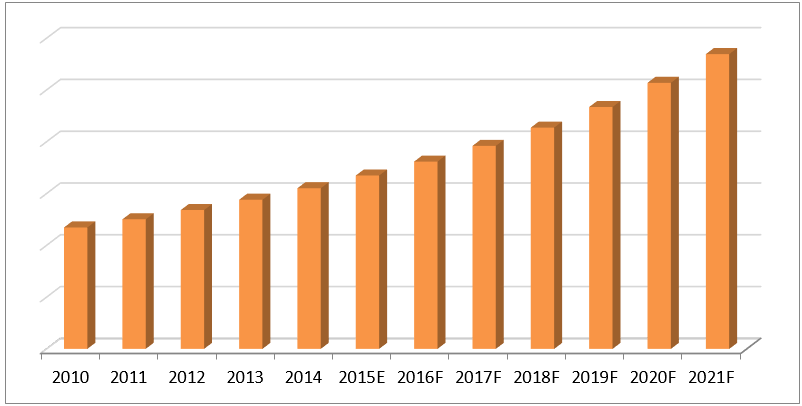

Growing construction market, expansion of metros & airports, upcoming of new hotels & malls and growing mining are the few factors that have resulted in the growth of the Earthmoving Equipment market in Saudi Arabia. Further, growth in government expenditure on infrastructure development has impacted the wide utilization of earthmoving equipment in the construction industry across Saudi Arabia. According to 6Wresearch, Saudi Arabia's Earthmoving Equipment market is projected to grow at a CAGR of 9.2% during 2015-21. In 2014, loaders accounted for major share of the market pie followed by construction tractors. During 2015-21, the loaders segment is expected to maintain its market dominance and would further contribute to the growth of the market.Amongst all verticals, construction vertical accounted for around 60% of the market share and is expected to lead in the forecast period due growing investments and construction activities in the country.The report thoroughly covers the market by Earthmoving Equipment types, verticals, and regions. The report provides the unbiased and detailed analysis of the on-going trends, opportunities/high growth areas, market drivers which would help the stakeholders to device and align their market strategies according to the current and future market dynamics.

Key Highlights of the Report:

• Historical data of Global Earthmoving Equipment Market for the Period 2010-2014.

• Market Size & Forecast of Global Earthmoving Equipment Market until 2021.

• Historical data of Saudi Arabia Earthmoving Equipment Market Revenue & Volume for the Period

2010-2014.

• Market Size & Forecast of Saudi Arabia Earthmoving Equipment Revenue & Volume Market until 2021.

• Historical data of Saudi Arabia Excavators Market Revenue & Volume for the Period

2010-2014.

• Market Size & Forecast of Saudi Arabia Excavators Market Revenue & Volume until 2021.

• Historical data of Saudi Arabia Loaders Market Revenue & Volume for the Period 2010-2014.

• Market Size & Forecast of Saudi Arabia Loaders Market Revenue & Volume until 2021.

• Historical data of Saudi Arabia Construction Tractors Market Revenue & Volume for the Period 2010-2014.

• Market Size & Forecast of Saudi Arabia Construction Tractors Market Revenue & Volume until 2021.

• Historical data of Saudi Arabia Earthmoving Equipment Application Market Revenue & Volume for the Period

2010-2014.

• Market Size & Forecast of Saudi Arabia Earthmoving Equipment Application Market Revenue & Volume until 2021.

• Historical data of Saudi Arabia Earthmoving Equipment Regional Market Revenue & Volume for the Period

2010-2014.

• Market Size & Forecast of Saudi Arabia Earthmoving Equipment Regional Market Revenue & Volume until 2021.

• Market Drivers and Restraints.

• Market Trends.

• Players Market Share and Competitive Landscape.

• Key Strategic PointersMarkets Covered:

The report provides the detailed analysis of following market segments:

• Earthmoving Equipment Types:

o Excavators

o Loaders

o Construction Tractors

• Application

o Agriculture

o Construction Industry

o Mining Industry

• Regions:

o Southern Region

o Eastern Region

o Western Region

o Central Region

Frequently Asked Questions About the Market Study (FAQs):

TABLE OF CONTENTS

1 Executive Summary

2 Introduction

2.1 Key Highlights of the Report

2.2 Report Description

2.3 Market Scope & Segmentation

2.4 Mythology Adopted & Key Data Points

2.5 Assumptions & Methodology

3 Global Earthmoving Equipment Market Overview

3.1 Global Earthmoving Equipment Market Revenues

3.2 Global Earthmoving Equipment Market, By Region

4 Saudi Arabia Earthmoving Equipment Market

4.1 Saudi Arabia Earthmoving Equipment Market Revenues (2010-2021F)

4.2 Saudi Arabia Earthmoving Equipment Market Volume (2010-2021F)

4.3 Industry Life Cycle

4.4 Opportunity Matrix

4.5 Porters 5 Forces Model

4.6 Saudi Arabia Earthmoving Equipment Market, By Types

4.7 Saudi Arabia Earthmoving Equipment Market, By Vertical

4.8 Saudi Arabia Earthmoving Equipment Market, By Region

5 Saudi Arabia Earthmoving Equipment Market Dynamics

5.1 Drivers

5.1.1 Sustained Growth of Construction industry

5.1.2 Growing Tourism and Hospitality Industry

5.1.3 Growing Public Infrastructures

5.1.4 Growth in the Mining Industry

5.2 Restraints

5.2.1 High Cost

6 Saudi Arabia Earthmoving Equipment Market Trends

6.1 Growth in Earthmoving Equipment Rental Market

6.2 Rise in Demand for Energy Efficient Equipment

6.3 Availability of Attractive Financing Options

6.4 Growth in huge used Earth Moving Equipment Market

6.5 Growing Imports of Earthmoving Equipment

7 Saudi Arabia Excavators Market Overview

7.1 Saudi Arabia Excavators Market Revenue

7.2 Saudi Arabia Excavators Market Volume

7.3 Saudi Arabia Excavators Market , By Types

7.3.1 Saudi Arabia Wheeled Excavators Market Revenue and Volume

7.3.2 Saudi Arabia Wheeled Excavators Market Price Point Analysis

7.3.3 Saudi Arabia Mini Excavators Market Revenue and Volume

7.3.4 Saudi Arabia Mini Excavators Market Price Point Analysis

7.4 Saudi Arabia Excavators Market , By Application

7.4.1 Saudi Arabia Excavators Market Revenue, By Application

7.4.2 Saudi Arabia Excavators Market Volume, By Application

8 Saudi Arabia Loaders Market Overview

8.1 Saudi Arabia Loaders Market Revenue

8.2 Saudi Arabia Loaders Market Volume

8.3 Saudi Arabia Loaders Market, By Types

8.3.1 Saudi Arabia Backhoe Loaders Market Revenue and Volume

8.3.2 Saudi Arabia Backhoe Loaders Market Price Point Analysis

8.3.3 Saudi Arabia Wheeled Loaders Market Revenue and Volume

8.3.4 Saudi Arabia Wheeled Loaders Market Price Point Analysis

8.3.5 Saudi Arabia Skid Steer Loaders Market Revenue and Volume

8.3.6 Saudi Arabia Skid Steer Loaders Market Price Point Analysis

8.4 Saudi Arabia Loaders Market, By Application

8.4.1 Saudi Arabia Loaders Market Revenue, By Application,

8.4.2 Saudi Arabia Loaders Market Volume, By Application

9 Saudi Arabia Construction Tractors Market Overview

9.1 Saudi Arabia Construction Tractors Revenue

9.2 Saudi Arabia Construction Tractors Market Volume

9.3 Saudi Arabia Construction Tractors Market, By Types

9.3.1 Saudi Arabia Bulldozer Market Revenue and Volume

9.3.2 Saudi Arabia Bulldozers/ Crawler Tractors Market Price Point Analysis

9.3.3 Saudi Arabia Wheeled Tractors Market Revenue and Volume

9.3.4 Saudi Arabia Wheeled Tractors Market Price Point Analysis

9.4 Saudi Arabia Construction Tractors Market Revenue, By Application

9.4.1 Saudi Arabia Construction Tractors Market Revenue, By Application

9.4.2 Saudi Arabia Construction Tractors Market Volume, By Application

10 Saudi Arabia Earthmoving Equipment Market, By Application

10.1 Saudi Arabia Agriculture Earthmoving Equipment Market Revenue

10.2 Saudi Arabia Agriculture Earthmoving Equipment Market Volume

10.3 Saudi Arabia Construction Earthmoving Equipment Market Revenue

10.4 Saudi Arabia Construction Earthmoving Equipment Market Volume

10.5 Saudi Arabia Mining Earthmoving Equipment Market Revenue

10.6 Saudi Arabia Mining Earthmoving Equipment Market Volume

11 Saudi Arabia Earthmoving Equipment Market, By Region

11.1 Southern Region

11.2 Eastern Region

11.3 Western Region

11.4 Central Region

12 Competitive Landscape

12.1 Saudi Arabia Earthmoving Equipment Market Revenue Share, By Company

12.2 Competitive Positioning

13 Company Profile

13.1 Caterpillar Inc

13.2 BEML Limited

13.3 AB Volvo

13.4 Komatsu

13.5 Hitachi Construction Machinery Limited

13.6 Doosan Infracore

13.7 Mitsubishi Corporation

13.8 JCB

13.9 Hyundai Heavy Industries

13.10 Saudi Liebherr Company Limited

14 Key Strategic Pointers

15 Disclaimer

List of Figures

Figure 1 Global Earthmoving Equipment Market Revenues, 2010-2014 ($ Billion)

Figure 2 Global Earthmoving Equipment Market Revenues, 2015E-2021F ($ Billion)

Figure 3 Global Earthmoving Equipment Market Share, By Region (2014)

Figure 4 Middle East Earthmoving Equipment Market Revenue, 2010-21F ($ Billion)

Figure 5 Saudi Arabia Earthmoving Equipment Market Revenues, 2010-2014 ($ Billion)

Figure 6 Saudi Arabia Earthmoving Equipment Market Revenues, 2015E-2021F ($ Billion)

Figure 7 GCC Construction Projects, By Countries (2014)

Figure 8 Saudi Arabia Earthmoving Equipment Market Volume, 2010-2014 (Units)

Figure 9 Saudi Arabia Earthmoving Equipment Market Volume, 2015E-2021F (Units)

Figure 10 Saudi Arabia Earthmoving Equipment Market-Industry life Cycle

Figure 11 Mark- tunity Matrix

Figure 12 Saudi Arabia Earthmoving Equipment Market Share, By Type (2014-21F)

Figure 13 Saudi Arabia Earthmoving Equipment Market Share, By Verticals, 2014

Figure 14 Saudi Arabia Earthmoving Equipment Market Share, By Verticals, 2021

Figure 15 Saudi Arabia Earthmoving Equipment Market Revenue, By Region, 2014 & 2021 ($ Billion)

Figure 16 Saudi Arabia Construction Market, 2012-2014 ($ Billion)

Figure 17 Saudi Arabia Construction Market Share, By Value, By Sector (2013)

Figure 18 Saudi Arabia Mining Industry Market, 2012-2021F ($ Billion)

Figure 19 Saudi Arabia Earthmoving Equipment Rental Market, 2012-2021F ($ Billion)

Figure 20 Saudi Arabia Excavators Market Revenues, 2010-2014 ($ Million)

Figure 21 Saudi Arabia Excavators Market Revenues, 2015-2021F ($ Million)

Figure 22 Saudi Arabia Excavators Market Volume, 2010-2014 (Units)

Figure 23 Saudi Arabia Excavators Market Volume, 2015-2021F (Units)

Figure 24 Saudi Arabia Excavators Market Share, By Types (2014)

Figure 25 Saudi Arabia Wheeled Excavators Market Revenue and Volume (2010-2021F)

Figure 26 Saudi Arabia Wheeled Excavators Market Price Point Analysis ($ Per Unit)

Figure 27 Saudi Arabia Mini Excavators Market Revenue and Volume (2010-2021F)

Figure 28 Saudi Arabia Mini Excavators Market Price Point Analysis ($ Per Unit)

Figure 29 Saudi Arabia Excavators Market Revenue, By Application, 2014 & 2021 (%)

Figure 30 Saudi Arabia Loaders Market Revenues, 2010-2014 ($ Billion)

Figure 31 Saudi Arabia Loaders Market Revenues, 2015-2021F ($ Billion)

Figure 32 Saudi Arabia Loaders Market Volume, 2010-2014 (Units)

Figure 33 Saudi Arabia Loaders Market Volume, 2015-2021F (Units)

Figure 34 Saudi Arabia Loaders Market Revenue, By Types 2014 & 2021 ($ Billion)

Figure 35 Saudi Arabia Backhoe Loaders Market Revenue and Volume, 2010-2021F

Figure 36 Saudi Arabia Backhoe Loaders Market Price Point Analysis ($ Per Unit)

Figure 37 Saudi Arabia Wheeled Loaders Market Revenue and Volume (2010-2021F)

Figure 38 Saudi Arabia Wheeled Loaders Market Price Point Analysis ($ Per Unit)

Figure 39 Saudi Arabia Skid Steer Loaders Market Revenue and Volume (2010-2021F)

Figure 40 Saudi Arabia Skid Steer Loaders Market Price Point Analysis ($ Per Unit)

Figure 41 Saudi Arabia Loaders Market Revenue, By Application, 2014 & 2021 (%)

Figure 42 Saudi Arabia Construction Tractors Market Revenues, 2010-2014 ($ Billion)

Figure 43 Saudi Arabia Construction Tractors Market Revenues, 2015-2021F ($ Billion)

Figure 44 Saudi Arabia Construction Tractors Market Volume, 2010-2014 (Units)

Figure 45 Saudi Arabia Construction Tractors Market Volume, 2015-2021F (Units)

Figure 46 Saudi Arabia Construction Tractors Market Share By Types

Figure 47 Saudi Arabia Bulldozer Market Revenue and Volume (2010-2021F)

Figure 48 Saudi Arabia Bulldozers/ Crawler Tractors Market Price Point Analysis ($ Per Unit)

Figure 49 Saudi Arabia Wheeled Tractors Market Revenue and Volume, 2010-2021F

Figure 50 Saudi Arabia Wheeled Tractors Market Price Point Analysis ($ Per Unit)

Figure 51 Saudi Arabia Construction Tractors Market Revenue, By Application, 2014 & 2021 (%)

Figure 52 Saudi Arabia Earthmoving Equipment Market CAGR, By Industry, 2010-2014

Figure 53 Saudi Arabia Agriculture Earthmoving Equipment Market Revenue 2010-2014 ($ Million)

Figure 54 Saudi Arabia Agriculture Earthmoving Equipment Market Revenue 2015-2021F ($ Million)

Figure 55 Saudi Arabia Agriculture Earthmoving Equipment Market Volume 2010-2021F (Units)

Figure 56 Saudi Arabia Construction Earthmoving Equipment Market Revenue 2010-2014 ($ Billion)

Figure 57 Saudi Arabia Construction Earthmoving Equipment Market Revenue 2015-21F ($ Billion)

Figure 58 Saudi Arabia Construction Earthmoving Equipment Market Volume 2010-21F (Units)

Figure 59 Saudi Arabia Mining Earthmoving Equipment Market Revenue 2010-2014 ($ Billion)

Figure 60 Saudi Arabia Mining Earthmoving Equipment Market Revenue 2015-21 ($ Billion)

Figure 61 Saudi Arabia Mining Earthmoving Equipment Market Volume 2010-2021F (Units)

Figure 62 Saudi Arabia Southern Earthmoving Equipment Market Revenue 2010-2014 ($ Million)

Figure 63 Saudi Arabia Southern Earthmoving Equipment Market Revenue 2015-21F ($ Million)

Figure 64 Saudi Arabia Eastern Earthmoving Equipment Market Revenue 2010-2014 ($ Million)

Figure 65 Saudi Arabia Eastern Earthmoving Equipment Market Revenue 2015-2021F ($ Million)

Figure 66 Saudi Arabia Western Earthmoving Equipment Market Revenue 2010-2014 ($ Billion)

Figure 67 Saudi Arabia Western Earthmoving Equipment Market Revenue 2015-21F ($ Billion)

Figure 68 Saudi Arabia Central Earthmoving Equipment Market Revenue 2010-2014 ($ Billion)

Figure 69 Saudi Arabia Central Earthmoving Equipment Market Revenue 2015-21F ($ Billion)

Figure 70 Saudi Arabia Earthmoving Equipment Market Revenue Share, By Company, 2014

List of Tables

Table 1 Earthmoving Equipment Prices of Used Products

Table 2 Saudi Arabia Excavators Market Revenue, By Application, 2010-2014 ($ Million)

Table 3 Saudi Arabia Excavators Market Revenue, By Application, 2015-21 ($ Million)

Table 4 Saudi Arabia Excavators Market Volume, By Application, 2010-2014 ($ Million)

Table 5 Saudi Arabia Excavators Market Volume, By Application, 2015-21 ($ Million)

Table 6 Saudi Arabia Loaders Market Revenue, By Application, 2010-2014 ($ Million)

Table 7 Saudi Arabia Loaders Market Revenue, By Application, 2015-2021 ($ Million)

Table 8 Saudi Arabia Loaders Market Volume, By Application, 2010-2014 (Units)

Table 9 Saudi Arabia Loaders Market Volume, By Application, 2015-2021 (Units)

Table 10 Saudi Arabia Construction Tractors Market Revenue, By Application, 2010-2014 ($ Million)

Table 11 Saudi Arabia Construction Tractors Market Revenue, By Application, 2015-21 ($ Million)

Table 12 Saudi Arabia Construction Tractors Market Volume, By Application, 2010-2014 (Units)

Table 13 Saudi Arabia Construction Tractors Market Volume, By Application, 2015-21 (Units)

Table 14 Saudi Arabia Earthmoving Equipment Market Revenues of Top 6 Players, 2014 ($ Million)

Table 15 Caterpillar Inc. Financial Statement, 2011-2014 ($ Million)

Table 16 BEML Limited Financial Statement, 2011-2014 ($ Million)

Table 17 AB Volvo Financial Statement, 2011-2014 ($ Billion)

Table 18 Komatsu Financial Statement, 2011-2014 ($ Billion)

Table 19 Hitachi Ltd Financial Statement, 2011-2014 ($ Million)

Table 20 Doosan Infracore Financial Statement, 2011-2014 ($ Million)

Table 21 Mitsubishi Corp Financial Statement, 2011-2014 ($ Million)

Table 22 Hyundai Heavy Industries Financial Statement, 2011-2014 ($ Million)

Saudi Arabia is one of the key growing Earthmoving Equipment Market. Growing construction market, mining industry and growing spending on construction of public infrastructure in the country are the key factors that are spurring the market for Earthmoving Equipment in Saudi Arabia.

In the Earthmoving Equipment market, loaders accounts for the major share followed by the Construction Tractors and Excavators. In the forecast period, share of construction tractors is expected marginally to excavators due to availability of attachment with the excavators and growing construction in the housing sector. The key players in the market include: Caterpillar Inc., AB Volvo, BEML Limited, Komatsu Middle East FZE, Hitachi Construction Machinery Ltd, Doosan Infracore Co. Ltd, Mitsubishi Corporation, JCB Bamford Excavators Limited, Hyundai Heavy Industries, and Saudi Liebherr Company Ltd.

“Saudi Arabia Earthmoving Equipment Market (2015-2021)” report estimates and forecast overall Saudi Arabia Earthmoving Equipment market by revenue, by Earthmoving Equipment type such as excavators, loaders and construction tractors, by application, and by regions such as Southern region, eastern region, western region and central region. The report also gives the insights on competitive landscape, market share by companies, market trends, company profiles, market drivers and restraints.

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero