Saudi Arabia Industrial Pumps Market (2017-2023) | Size, Share, Growth, Revenue, Forecast, Trends, Analysis, industry & COVID-19 IMPACT

Market Forecast By Type (Centrifugal Pump and Positive Displacement Pump), By Centrifugal Type (Single-Stage Pump, Multi-Stage Pump, Axial & Mixed-Flow Pump, Submersible Pump, and Sealless & Circular Pump), By Positive Displacement Type (Reciprocating and Rotary), By Applications (Chemical, Construction, Oil & Gas, Water & Wastewater Treatment, Power and Others), By Regions (Central, Western, Southern and Eastern) and Competitive Landscape

| Product Code: ETC000423 | Publication Date: Sep 2022 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 90 | No. of Figures: 30 | No. of Tables: 8 |

Latest Development (2022) in Saudi Arabia Industrial Pumps Market

Saudi Arabia Industrial Pumps Market has seen the latest developments in terms of diversification and advancement of industrial pumps. Further, technological innovations have brought advancements in the centrifugal, turbine, and pneumatic pumps such as enhanced impeller, dry running sensor, and unique cartridge seal design. Moreover, the creation of digitalized pumps that can be monitored from afar and the use of integrated intelligence to detect and resolve clogging in the pumps and minimize energy have been the driving forces of the market.

Mergers and Acquisitions:

- In January 2021, Sulzer AG announced the acquisition of Nordic Water to strengthen Sulzer’s wastewater treatment.

- In September 2021, Grundfos Saudi Arabia Company Ltd. acquired Mechanical Equipment Company Ltd. (MECO) to reinforce their innovations.

Saudi Arabia Industrial Pumps Market Synopsis

Saudi Arabia industrial pumps market report thoroughly covers the market by types, applications, and regions. The Saudi Arabia industrial pumps market outlook report provides an unbiased and detailed analysis of the ongoing Saudi Arabia industrial pumps market trends, opportunities/ high growth areas, and market drivers which would help the stakeholders device and align their market strategies according to the current and future market dynamics.

The surging adoption of industrial pumps in various verticals and surging demand for waste treatment are proliferating the growth of the market. Increasing demand for water is also one of the major factors driving the focus on wastewater management. Moreover, the rising adverse effects of accumulated wastewater on the health of human beings and the environment are driving the growth of the market. Increasing investment in water pump facilities is also providing lucrative opportunities to the Saudi Arabia Industrial Pumps Market Share.

The slump in crude oil prices prompted the government of Saudi Arabia to slash its budget for 2016. This has further resulted in a decline in government spending and delayed payment to contractors leading to a halt of several projects across the region. Deployment of industrial pumps has been low and was primarily noticeable across industrial settlements which were established during the past in addition to petrochemical and oil & gas applications.

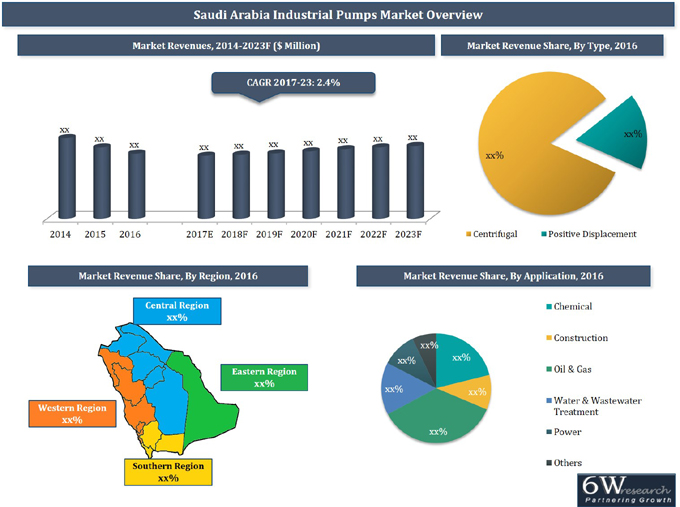

According to 6Wresearch, Saudi Arabia Industrial Pumps market size is projected to grow at a CAGR of 2.4% during 2017-2023. Following the decline in 2015 & 2016, a similar trend is expected in 2017 as well. However, the market is anticipated to recover post-2017 due to the expected recovery of oil prices, the rebound of the construction industry, exponential growth across the industrial sector, and the establishment of petrochemical industries, which would drive Saudi Arabia Industrial pump market forecast period revenues.

Market Analysis by Application

Amongst all applications, oil & gas and chemical primarily Petrochemical and Fertilizers (PCF) led Saudi Arabia industrial pumps market share. Significant growth lies ahead for chemical, power and water, and wastewater treatment applications.

Key players in Saudi Arabia Industrial Pumps Market

Some of the key players in Saudi Arabia Industrial Pumps Market are:

- Flowserve-Al Rushaid Company Ltd.

- ITT Saudi Co.

- Sulzer Saudi Pump Company LLC

- KSB Pumps Arabia Ltd.

- EBARA PUMPS SAUDI ARABIA LLC

- Grundfos Saudi Arabia Company Ltd.

- SPX Flow Saudi Arabia LLC

Key Highlights of the Report:

- Historical data of Global Industrial Pumps Market for the Period 2014-2016

- Market Size & Forecast of Global Industrial Pumps Market until 2023

- Saudi Arabia Industrial Pumps Market Size and Saudi Arabia Industrial Pumps Market Forecast

- Saudi Arabia Industrial Pumps Market Overview

- Saudi Arabia Industrial Pumps Market Outlook

- Historical data of Saudi Arabia Industrial Pumps Market Revenues & Volume for the Period 2014-2016

- Market Size & Forecast of Saudi Arabia Industrial Pumps Market Revenues & Volume until 2023

- Historic data of Saudi Arabia Centrifugal Industrial Pumps Market Revenues and Volume 2014-2016

- Market Size & Forecast of Saudi Arabia Centrifugal Industrial Pumps Revenues & Volume Market until 2023

- Historic data of Saudi Arabia Positive Displacement Industrial Pumps Market Revenues and Volume 2014-2016

- Market Size & Forecast of Saudi Arabia Positive Displacement Industrial Pumps Revenues & Volume Market until 2023

- Historical data and Forecast of Saudi Arabia Centrifugal Industrial Pumps Market Revenues, By Type Until 2023

- Historical data and Forecast of Saudi Arabia Positive Displacement Industrial Pumps Market Revenues, By Type Until 2023

- Historical data and Forecast of Saudi Arabia Industrial Pumps Market Revenues, By Application Until 2023

- Historical data and Forecast of Saudi Arabia Industrial Pumps Market Revenues, By Region Until 2023

- Market Drivers and Restraints

- Saudi Arabia Industrial Pumps Market Trends

- Saudi Arabia Industrial Pumps Market Share, By Players, Saudi Arabia Industrial Pumps Market Overview on Competitive Benchmarking, and Company Profiles

- Recommendations

Markets Covered

The Saudi Arabia Industrial Pumps Market report provides a detailed analysis of the following market segments:

By Type

- Centrifugal Pump

- Positive Displacement Pump

By Centrifugal Type

- Single-Stage Pump

- Multi-Stage Pump

- Axial & Mixed-Flow Pump

- Submersible Pump

- Sealless & Circular Pump

By Positive Displacement Type

- Reciprocating

- Rotary

By Applications

- Chemical

- Construction

- Oil & Gas

- Water & Wastewater Treatment

- Power

- Others

By Regions

- Central

- Western

- Southern

- Eastern

Saudi Arabia Industrial Pumps Market: FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Global Industrial Pumps Market Overview |

| 3.1 Global Industrial Pumps Market Revenues (2014-2023F) |

| 3.2 Global Industrial Pumps Market Revenue Share, By Region |

| 4 Saudi Arabia Industrial Pumps Market Overview |

| 4.1 Saudi Arabia Industrial Pumps Market Revenues (2014-2023F) |

| 4.2 Saudi Arabia Industrial Pumps Market Volume (2014-2023F) |

| 4.3 Saudi Arabia Industrial Pumps Market, Industry Life Cycle |

| 4.4 Saudi Arabia Industrial Pumps Market, Opportunity Matrix |

| 4.5 Saudi Arabia Industrial Pumps Market, Porters Five Forces |

| 4.6 Saudi Arabia Industrial Pumps Market Revenue Share, By Type |

| 4.7 Saudi Arabia Industrial Pumps Market Revenue Share, By Application |

| 4.8 Saudi Arabia Industrial Pumps Market Revenue Share, By Region |

| 5 Saudi Arabia Industrial Pumps Market Dynamics |

| 5.1 Impact Analysis |

| 5.2 Market Drivers |

| 5.2.1 Diversification of Economy & Expected Recovery of Oil Prices |

| 5.2.2 Emerging Manufacturing Hub |

| 5.3 Market Restraints |

| 5.3.1 Low Crude Oil Prices |

| 6 Saudi Arabia Industrial Pumps Market Trends |

| 6.1 Growing Demand for Energy Efficient Pumps |

| 7 Saudi Arabia Industrial Pumps Market Overview, By Type |

| 7.1 Saudi Arabia Centrifugal Industrial Pumps Market Revenues and Volume (2014-2023F) |

| 7.1.1 Saudi Arabia Centrifugal Industrial Pump Market Revenues, By Type (2014-2023F) |

| 7.2 Saudi Arabia Centrifugal Industrial Pumps Market Price Trend |

| 8 Saudi Arabia Positive Displacement Industrial Pumps Market Overview |

| 8.1 Saudi Arabia Positive Displacement Industrial Pumps Market Revenues and Volume (2014-2023F) |

| 8.1.1 Saudi Arabia Positive Displacement Pump Market Revenues, By Type (2014-2023F) |

| 8.2 Saudi Arabia Positive displacement Industrial Pumps Market Price Trend |

| 9 Saudi Arabia Industrial Pumps Market Overview, By Application |

| 9.1 Saudi Arabia Oil & Gas Industrial Pumps Market Revenues (2014-2023F) |

| 9.2 Saudi Arabia Water & Wastewater Treatment Industrial Pumps Market Revenues (2014-2023F) |

| 9.3 Saudi Arabia Power Industrial Pumps Market Revenues (2014-2023F) |

| 9.4 Saudi Arabia Chemical Industrial Pumps Market Revenues (2014-2023F) |

| 9.5 Saudi Arabia Construction Industrial Pumps Market Revenues (2014-2023F) |

| 9.6 Saudi Arabia Others Industrial Pumps Market Revenues (2014-2023F) |

| 10 Saudi Arabia Industrial Pumps Market Overview, By Region |

| 10.1 Saudi Arabia Industrial Pumps Market Revenues, By Central Region (2014-2023F) |

| 10.2 Saudi Arabia Industrial Pumps Market Revenues, By Western Region (2014-2023F) |

| 10.3 Saudi Arabia Industrial Pumps Market Revenues, By Eastern Region (2014-2023F) |

| 10.4 Saudi Arabia Industrial Pumps Market Revenues, By Southern Region (2014-2023F) |

| 11 Saudi Arabia Government Spending Outlook |

| 12 Saudi Arabia Industrial Pumps Market Overview, Competitive Landscape |

| 12.1 Saudi Arabia Industrial Pumps Market Revenue Share, By Company |

| 12.2 Market Competitive Benchmarking, By Operating Parameters |

| 13 Company Profiles |

| 13.1 Sulzer Saudi Pump Company LLC |

| 13.2 KSB Pumps Arabia Ltd. |

| 13.3 Flowserve-Al Rushaid Company Ltd. |

| 13.4 ITT Saudi Co. |

| 13.5 Grundfos Saudi Arabia Company Ltd. |

| 13.6 EBARA PUMPS SAUDI ARABIA LLC |

| 13.7 SPX Flow Saudi Arabia LLC |

| 14 Key Strategic Pointers |

| 15 Disclaimer |

| List of Figures |

| 1. Global Industrial Pumps Market Revenues, 2014-2023F ($ Billion) |

| 2. Global Industrial Pumps Market Revenue Share, By Region (2016) |

| 3. Saudi Arabia Industrial Pumps Market Revenues, 2014-2023F ($ Million) |

| 4. Saudi Arabia Industrial Pumps Market Volume, 2014-2023F (000' Units) |

| 5. Saudi Arabia Industrial Pumps Market Industry Life Cycle (2016 ) |

| 6. Saudi Arabia Industrial Pumps Market Opportunity Matrix, By Application (2016 ) |

| 7. Saudi Arabia Industrial Pumps Market Porter's Five Forces (2016 ) |

| 8. Saudi Arabia Industrial Pumps Market Revenue Share, By Type (2016 & 2023F ) |

| 9. Saudi Arabia Industrial Pumps Market Revenue Share, By Application (2016 &2023F) |

| 10. Saudi Arabia Industrial Pumps Market Revenue Share, By Region (2016 & 2023F) |

| 11. Saudi Arabia Value of Contracts Awarded, By Sector, Q2 2016 |

| 12. Average Brent Spot Crude Oil Price, 2012-2022F ($ per Barrel) |

| 13. Saudi Arabia Centrifugal Industrial Pumps Market Revenues, 2014-2023F ($ Million) |

| 14. Saudi Arabia Centrifugal Industrial Pumps Market Volume, 2014-2023F (Thousands Units) |

| 15. Saudi Arabia Centrifugal Industrial Pumps Market Revenue Share, By Type (2016) |

| 16. Saudi Arabia Single-Stage Centrifugal Industrial Pumps Market Revenues, 2014-2023F ($ Million) |

| 17. Saudi Arabia Multi-Stage Centrifugal Industrial Pumps Market Revenues, 2014-2023F ($ Million) |

| 18. Saudi Arabia Axial & Mixed Flow Centrifugal Industrial Pumps Market Revenues, 2014-2023F ($ Million) |

| 19. Saudi Arabia Submersible Centrifugal Industrial Pumps Market Revenues, 2014-2023F ($ Million) |

| 20. Saudi Arabia Sealless & Circular Centrifugal Industrial Pumps Market Revenues, 2014-2023F ($ Million) |

| 21. Saudi Arabia Centrifugal Industrial Pumps Price Trend, 2014-2023F ($ Per Unit) |

| 22. Saudi Arabia Positive Displacement Industrial Pumps Market Revenues, 2014-2023F ($ Million) |

| 23. Saudi Arabia Positive Displacement Industrial Pumps Market Volume, 2014-2023F (‘000 Units) |

| 24. Saudi Arabia Positive Displacement Pumps Market Revenue Share, By Type (2016) |

| 25. Saudi Arabia Reciprocating Positive Displacement Industrial Pumps Market Revenues, 2014-2023F ($ Million) |

| 26. Saudi Arabia Rotary Positive Displacement Industrial Pumps Market Revenues, 2014-2023F ($ Million) |

| 27. Saudi Arabia Positive Displacement Industrial Pumps Price Trend, 2014-2023F ($ Per Unit) |

| 28. Saudi Arabia Oil & Gas Industrial Pumps Market Revenues, 2014-2023F ($ Million) |

| 29. Saudi Arabia Water & Wastewater Treatment Industrial Pumps Market Revenues, 2014-2023F ($ Million) |

| 30. Saudi Arabia Power Industrial Pumps Market Revenues, 2014-2023F ($ Million) |

| 31. Saudi Arabia Chemical Industrial Pumps Market Revenues, 2014-2023F ($ Million) |

| 32. Saudi Arabia Construction Industrial Pumps Market Revenues, 2014-2023F ($ Million) |

| 33. Saudi Arabia Others Industrial Pumps Market Revenues, 2014-2023F ($ Million) |

| 34. Saudi Arabia Central Region Industrial Pumps Market Revenues, 2014-2023F ($ Million) |

| 35. Saudi Arabia Western Region Industrial Pumps Market Revenues, 2014-2023F ($ Million) |

| 36. Saudi Arabia Eastern Region Industrial Pumps Market Revenues, 2014-2023F ($ Million) |

| 37. Saudi Arabia Southern Region Industrial Pumps Market Revenues, 2014-2023F ($ Million) |

| 38. Saudi Arabia Actual Government Spending Vs Actual Government Revenues, 2012-2021F ($ Billion) |

| 39. Saudi Arabia Industrial Pumps Market Revenue, By Company, 2016 ($ Million) |

| 40. Saudi Arabia Industrial Pumps Market Revenue Share, By Company, 2016 |

| List of Tables |

| 1. List of Upcoming Projects in Saudi Arabia |

| 2. Total number of Operating Industrial Units, Total Finance, 2010 & 2016 1st Quarter |

| 3. Saudi Standards, Metrology and Quality Org. (SASO) Regulations for Low Voltage Electric Motors, 2016 & 2017 |

| 4. Oil & Gas Production & Consumption (Saudi Arabia 2015-2021F) |

| 5. Saudi Arabia Upcoming Oil & Gas Projects |

| 6. Saudi Arabia Upcoming Water and Wastewater Treatment Projects |

| 7. Saudi Arabia Upcoming Major Chemical Projects |

| 8. Saudi Arabia Construction Industry Value (2016-2023F) |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Kenya Road Stabilization Equipment Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- North America Sodium chloride Market (2025-2031) | Analysis, Revenue, Forecast, Trends, Companies, Size, Growth, Share, Industry, Outlook & Value

- North America Vinyl Flooring Market (2025-2031) | Value, Growth,Size, Analysis, Revenue, Industry, Forecast, Share, Outlook, Companies & Trends

- Tajikistan Thermal Camera Market (2025-2031) | Trends, Size, Growth, Share, Industry, Companies, Value, Analysis, Revenue, Forecast & Outlook

- Singapore Professional AV Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- Saudi Arabia Genset Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- India OOH Advertising Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- Vietnam Twisted Pair Cables Market (2024-2030) | Size & Revenue, Forecast, Share, Companies, Competitive Landscape, Analysis, Trends, Value, Segmentation, Outlook, Industry, Growth

- South Africa B2B Cleaning Market (2025-2031) | Size & Revenue, Forecast, Share, Companies, Competitive Landscape, Analysis, Trends, Value, Segmentation, Outlook, Industry, Growth

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero