Saudi Arabia Power and Distribution Transformer Market (2018-2024) | Trends, Share, Size, Revenue, Analysis, Growth, industry, Outlook & COVID-19 IMPACT

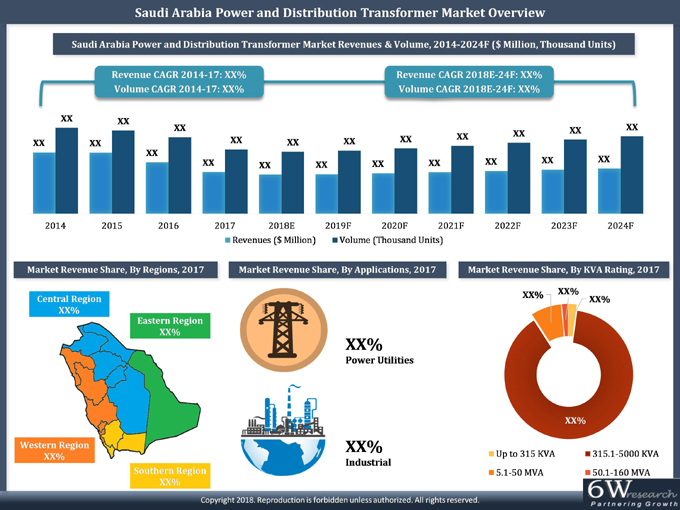

Market Forecast By Types (Power Transformer and Distribution Transformer), By Power Rating (Up to 315 KVA, 315.1 KVA - 5000 KVA, 5.1 MVA - 50 MVA and 50.1 MVA - 160 MVA), By Cooling System (Dry Type and Liquid Type), By Applications (Power Utilities and Industrial), By Regions (Central, Eastern, Western and Sothern), By Types of Services Offered (Intelligence Service, Repair Service, and Site Service), Service and Repair (Applications and Regions) and Competitive Landscape

| Product Code: ETC000433 | Publication Date: Feb 2023 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 169 | No. of Figures: 87 | No. of Tables: 12 |

Latest 2023 Development of the Saudi Arabia Power and Distribution Transformer Market

Saudi Arabia Power and Distribution Transformer Market are expected to grow in the forthcoming years owing to several growth aspects. Also, the market for power and distribution transformers is promising and growing simultaneously. Saudi Arabia has plenty of oil reserves which has led to increased demand for power generation. Additionally, the government of Saudi Arabia also provides incentives to companies that set up production facilities in the country. This factor is further fuelling the growth of Saudi Arabia Power and Distribution Transformer Industry. Moreover, the growth of the power and distribution transformer market is driven by industrialization and urbanization, rising demand for electricity, and a growing number of power plants.

However, the market has also encountered some challenges which hamper the market expansion. For instance, a lack of skilled labour force, poor infrastructure, limited access to capital, and inefficient government regulations have led to increased costs for consumers as well as suppliers. The increasing demand for power and distribution transformers has led to a surge in the production of power and distribution transformers.

Saudi Arabia power and distribution transformer market Synopsis

Increasing construction activities, the establishment of business hubs, industries, and infrastructure development have resulted in the development of power infrastructure, which has further amplified the demand for transformers all across the kingdom of Saudi Arabia. Further, government initiatives such as Saudi Arabia Vision 2030 and economic diversification policy would surge the transformer market in the forecast period.

According to 6Wresearch, Saudi Arabia power and distribution transformer market size is projected to grow at a CAGR of 2.4% during 2018-24. Saudi Arabian government is taking major steps to strengthen the non-oil sectors due to the recent decline in crude oil prices, which has adversely affected the market during the last 3 years. With the expected recovery of crude oil prices and growth in public infrastructure development over the next 5 years, the market would rebound during the forecast period.

Distribution transformers captured the leading volume share in the overall Saudi Arabia power and distribution transformer market share. The service and repair market of transformers has witnessed continuous growth in the country as servicing and repairing a transformer is a more economical and more feasible option than purchasing a new one as it can substantially reduce investment costs. Key players in Saudi Arabia Power and Distribution Transformer Market include ABB, GE, Hyundai Electric, Schneider, Siemens, Alfanar, Wahah Electric Supply Company Ltd., Arabian Transformers, United Transformers, and Saudi Transformers.

Saudi Arabia power and distribution transformer market report thoroughly covers the power and distribution transformer market by types, power rating, cooling system, service & repair, applications, and regions. Saudi Arabia power and distribution transformer market outlook report provides an unbiased and detailed analysis of the ongoing Saudi Arabia power and distribution transformer market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to device and align their market strategies according to the current and future market dynamics.

Key Highlights of the Report:

- Saudi Arabia Power and Distribution Transformer Market Overview

- Saudi Arabia Power and Distribution Transformer Market Outlook

- Saudi Arabia Power and Distribution Transformer Market Forecast

- Historical Data of Global Power and Distribution Transformer Market Revenues for the Period 2014-17.

- Market Size & Forecast of Global Power and Distribution Transformer Market Revenues until 2024.

- Saudi Arabia Power and Distribution Transformer Market Size and Saudi Arabia Power and Distribution Transformer Market Forecast Revenues until 2023

- Historical Data of Saudi Arabia Power and Distribution Transformer Market Revenues and Volume for the Period 2014-17.

- Market Size & Forecast of Saudi Arabia Power and Distribution Transformer Market Revenues and Volume until 2024.

- Historical Data of Saudi Arabia Power and Distribution Transformer Market Revenues and Volume, By Type for the Period 2014-17.

- Market Size & Forecast of Saudi Arabia Power and Distribution Transformer Market Revenues and Volume, By Type until 2024.

- Historical Data on Saudi Arabia Power and Distribution Transformer Market Revenues and Volume, By Power Rating for the Period 2014-17.

- Market Size & Forecast of Saudi Arabia Power and Distribution Transformer Market Revenues and Volume, By Power Rating until 2024.

- Historical Data of Saudi Arabia Power and Distribution Transformer Market Revenues, By Applications for the Period 2014-17.

- Market Size & Forecast of Saudi Arabia Power and Distribution Transformer Market Revenues, Applications until 2024.

- Historical Data on Saudi Arabia Power and Distribution Transformer Market Revenues, By Cooling System for the Period 2014-17.

- Market Size & Forecast of Saudi Arabia Power and Distribution Transformer Market Revenues, By Cooling System until 2024.

- Historical Data on Saudi Arabia Power and Distribution Transformer Market Revenues, By Regions for the Period 2014-17.

- Market Size & Forecast of Saudi Arabia Power and Distribution Transformer Market Revenues, By Regions until 2024.

- Historical Data of Saudi Arabia Power and Distribution Transformer Service and Repair Market Revenues for the Period 2014-17.

- Historical Data of Saudi Arabia Power and Distribution Transformer Service and Repair Market Revenues, By Type for the Period 2014-17.

- Market Size & Forecast of Saudi Arabia Power and Distribution Transformer Service and Repair Market Revenues, By Type until 2024.

- Historical Data of Saudi Arabia Power and Distribution Transformer Service and Repair Market Revenues, By Types of Services for the Period 2014-17.

- Market Size & Forecast of Saudi Arabia Power and Distribution Transformer Service and Repair Market Revenues, By Types of Services until 2024.

- Historical Data of Saudi Arabia Power and Distribution Transformer Service and Repair Market Revenues, By Applications for the Period 2014-17.

- Market Size & Forecast of Saudi Arabia Power and Distribution Transformer Service and Repair Market Revenues, By Applications until 2024.

- Historical Data of Saudi Arabia Power and Distribution Transformer Service and Repair Market Revenues, By Regions for the Period 2014-17.

- Market Size & Forecast of Saudi Arabia Power and Distribution Transformer Service and Repair Market Revenues, By Regions until 2024.

- Saudi Arabia Power and Distribution Transformer Market Drivers and Restraints.

- Saudi Arabia Power and Distribution Transformer Market Trends and Developments.

- Saudi Arabia Power and Distribution Transformer Market Key Performance Indicators.

- Saudi Arabia Power and Distribution Transformer Market Import Statistics.

- Saudi Arabia Power and Distribution Transformer Market Share, By Players.

- Saudi Arabia Power and Distribution Transformer Market Overview on Competitive Landscape.

- Company Profiles.

- Strategic Recommendations.

Markets Covered

Saudi Arabia power and distribution transformer market report provides a detailed analysis of the following market segments:

By Types:

- Power Transformer

- Distribution Transformer

By Power Ratings:

- Up to 315 KVA

- 315.1 KVA - 5000 KVA

- 5.1 MVA - 50 MVA

- 50.1 MVA - 160 MVA

By Cooling Systems:

- Dry Type

- Liquid Type

By Types of Services Offered:

- Intelligence Service

- Repair Service

- Site Service

By Applications:

- Power Utilities

- Industrial

By Regions:

- Central

- Eastern

- Western

- Southern

Saudi Arabia Power and Distribution Transformer Market: FAQs

|

1. Executive Summary |

|

2. Introduction |

|

2.1. Report Description |

|

2.2. Key Highlights of the Report |

|

2.3. Market Scope & Segmentation |

|

2.4. Methodology Adopted and Key Data Points |

|

2.5. Assumptions |

|

3. Global Power & Distribution Transformer Market Overview |

|

3.1.Global Power & Distribution Transformer Market Revenues, 2014-2024F |

|

3.2 Global Power Transformer Market Revenues, 2014-2024F |

|

3.3 Global Distribution Transformer Market Revenues, 2014-2024F |

|

3.4 Global Power & Distribution Transformer Market Revenue Share, By Regions |

|

4. Saudi Arabia Power & Distribution Transformer Market Overview |

|

4.1. Saudi Arabia Country Overview |

|

4.2. SWOT Analysis: Saudi Arabia |

|

4.3. Saudi Arabia Power & Distribution Transformer Market Revenues & Volume, 2014-2024F |

|

4.4. Industry Life Cycle |

|

4.5. Porter's Five Forces Model |

|

4.6. Saudi Arabia Power & Distribution Transformer Market Revenue Share, By Types, 2017 & 2024F |

|

4.7. Saudi Arabia Power & Distribution Transformer Market Revenue & Volume Share, By Power Rating, 2017 & 2024F |

|

4.8. Saudi Arabia Power & Distribution Transformer Market Revenue Share, By Cooling System, 2017 & 2024F |

|

4.9. Saudi Arabia Power & Distribution Transformer Market Revenue Share, By Applications, 2017 & 2024F |

|

4.10. Saudi Arabia Power and Distribution Transformer Market Revenue Share, By Regions, 2017 & 2024F |

|

5. Saudi Arabia Power & Distribution Transformer Market Dynamics |

|

5.1. Market Dynamics & Impact Analysis |

|

5.2. Market Drivers |

|

5.3. Market Restraints |

|

6. Saudi Arabia Power & Distribution Transformer Market Trends |

|

6.1. Smart Grid |

|

6.2. Green Transformers |

|

6.3. Smart Transformers |

|

7. Saudi Arabia Distribution Transformer Market Overview |

|

7.1. Saudi Arabia Distribution Transformer Market Revenues & Volume, 2014-2024F |

|

7.2. Saudi Arabia Distribution Transformer Market Revenue & Volume Share, By Power Rating, 2017 & 2024F |

|

7.2.1. Saudi Arabia Up to 315 KVA Distribution Transformer Market Revenues & Volume, 2014-2024F |

|

7.2.2. Saudi Arabia 315.1 KVA to 5 MVA Distribution Transformer Market Revenues & Volume, 2014-2024F |

|

8. Saudi Arabia Power Transformer Market Overview |

|

8.1. Saudi Arabia Power Transformer Market Revenues & Volume, 2014-2024F |

|

8.2. Saudi Arabia Power Transformer Market Revenue & Volume Share, By Power Rating, 2017 & 2024F |

|

8.2.1. Saudi Arabia 5.1 to 50 MVA Power Transformer Market Revenues & Volume, 2014-2024F |

|

8.2.2. Saudi Arabia Above 50 MVA Power Transformer Market Revenues & Volume, 2014-2024F |

|

9. Saudi Arabia Power & Distribution Transformer Market Overview, By Cooling System |

|

9.1. Saudi Arabia Liquid Type Power & Distribution Transformer Market Revenues, 2014-2024F |

|

9.2. Saudi Arabia Dry Type Power & Distribution Transformer Market Revenues, 2014-2024F |

|

10. Saudi Arabia Power & Distribution Transformer Market Overview, By Applications |

|

10.1. Saudi Arabia Power & Distribution Transformer Market Revenues, By Power Utilities Applications, 2014-2024F |

|

10.2. Saudi Arabia Power & Distribution Transformer Market Revenues, By Industrial Applications, 2014-2024F |

|

11. Saudi Arabia Power & Distribution Transformer Market Overview, By Regions |

|

11.1. Saudi Arabia Power & Distribution Transformer Market Revenues, By Regions, 2014-2024F |

|

12. Saudi Arabia Power & Distribution Transformer Market Price Trend |

|

13. Saudi Arabia Power & Distribution Transformer Market, Key Performance Indicators |

|

13.1. Saudi Arabia Oil & Gas Sector Market Outlook |

|

13.2. Saudi Arabia Government Spending Outlook |

|

13.3. Saudi Arabia Construction Market Outlook |

|

14. Saudi Arabia Power and Distribution Transformer Service and Repair Market Overview |

|

14.1. Power and Distribution Transformer Service and Repair Market Segmentation, By Types of Services Offered |

|

14.2. Saudi Arabia Power & Distribution Transformer Service and Repair Market Revenues, 2014-2024F |

|

14.3. Saudi Arabia Power & Distribution Transformer Service and Repair Market Overview, By Transformer Type |

|

14.3.1. Saudi Arabia Power Transformer Service and Repair Market Revenues, 2014-2024F |

|

14.3.2. Saudi Arabia Distribution Transformer Service and Repair Market Revenues, 2014-2024F |

|

14.4. Saudi Arabia Power & Distribution Transformer Service and Repair Market Overview, By Types of Services |

|

14.4.1. Saudi Arabia Power & Distribution Transformer Service and Repair Market Revenues, By Intelligence Service, 2014-2024F |

|

14.4.2. Saudi Arabia Power & Distribution Transformer Service and Repair Market Revenues, By Repairing Service, 2014-2024F |

|

14.4.3. Saudi Arabia Power & Distribution Transformer Service and Repair Market Revenues, By Site Service, 2014-2024F |

|

15. Saudi Arabia Power & Distribution Transformer Service and Repair Market Overview, By Applications |

|

15.1. Saudi Arabia Power & Distribution Transformer Service and Repair Market Revenues, By Power Utilities Applications, 2014-2024F |

|

15.2. Saudi Arabia Power & Distribution Transformer Service and Repair Market Revenues, |

|

By Industrial Applications, 2014-2024F |

|

16. Saudi Arabia Transformer Service and Repair Market Overview, By Regions |

|

16.1. Saudi Arabia Transformer Service and Repair Market Revenues, By Regions, 2014-2024F |

|

17. Saudi Arabia Power & Distribution Transformer Market Opportunity Assessment |

|

17.1. Saudi Arabia Power & Distribution Transformer Market Opportunity Assessment, By Applications, 2024 |

|

17.2. Saudi Arabia Power & Distribution Transformer Market Opportunity Assessment, By Power Rating, 2024 |

|

17.3. Saudi Arabia Transformer Service and Repair Market Opportunity Assessment, By Type of Services, 2024 |

|

17.4. Saudi Arabia Transformer Service and Repair Market Opportunity Assessment, By Applications, 2024 |

|

18. Saudi Arabia Power & Distribution Transformer Market Import Statistics |

|

18.1. Saudi Arabia Power & Distribution Transformer Imports, By Country, 2016 |

|

19. Competitive Landscape |

|

19.1. Saudi Arabia Power & Distribution Transformer Market Revenue Share, By Company, 2017 |

|

19.2. Saudi Arabia Power & Distribution Transformer Service and Repair Market Revenue Share, By Company, 2017 |

|

19.3. Competitive Benchmarking, By Power Ratings |

|

20. Company Profiles |

|

20.1. ABB Ltd. |

|

20.2. General Electric Company |

|

20.3. Siemens Ltd. Company |

|

20.4. Schneider Electric SE |

|

20.5. Alfanar Company Ltd. |

|

20.6. Wahah Electric Supply Company of Saudi Arabia Ltd. |

|

20.7. Arabian Transformer Co. |

|

20.8. United Transformers Electric Company |

|

20.9. The Saudi Transformers Company Ltd. |

|

20.10. Hyundai Electric & Energy Systems Co., Ltd. |

|

21. Strategic Recommendations |

|

22. Disclaimer |

|

List of Figures |

|

1. Global Power & Distribution Transformer Market Revenues, 2014-2024F ($ Billion) |

|

2. Global Power Transformer Market Revenues, 2014-2024F ($ Billion) |

|

3. Global Distribution Transformer Market Revenues, 2014-2024F ($ Billion) |

|

4. Global Power & Distribution Transformer Market Revenue Share, By Regions, 2017 |

|

5. Saudi Arabia Power & Distribution Transformer Market Revenues & Volume, 2014-2024F ($ Million, Thousand Units) |

|

6. Saudi Arabia Power & Distribution Transformer Market Industry Life Cycle |

|

7. Saudi Arabia Power & Distribution Transformer Market - Porter's Five Forces Model |

|

8. Saudi Arabia Power & Distribution Transformer Market Revenue Share, By Types, 2017 & 2024F |

|

9. Saudi Arabia Power & Distribution Transformer Market Volume Share, By Types, 2017 & 2024F |

|

10. Saudi Arabia Power & Distribution Transformer Market Revenue Share, By Power Rating, 2017 & 2024F |

|

11. Saudi Arabia Power & Distribution Transformer Market Volume Share, By Power Rating, 2017 & 2024F |

|

12. Saudi Arabia Power & Distribution Transformer Market Revenue Share, By Cooling System, 2017 & 2024F |

|

13. Saudi Arabia Power & Distribution Transformer Market Revenue Share, By Applications, 2017 & 2024F |

|

14. Saudi Arabia Power and Distribution Transformer Market Revenue Share, By Regions, 2017 & 2024F |

|

15. Objectives Under Saudi Vision 2030 |

|

16. Saudi Vision 2030 - Key Targets (Contd...) |

|

17. Saudi Arabia Power Generation Units - All Licensees, 2012-2016 (Units) |

|

18. Saudi Arabia Transmission Lines >= 110kV, 2012-2016 ('000 ckt. km) |

|

19. Saudi Arabia Distribution Lines < 110kV, 2012-2016 ('000 ckt. km) |

|

20. Saudi Arabia Actual and Projected Peak Load, 2010-2020F (GW) |

|

21. Saudi Arabia Electricity Consumption, KWh/ Capita, 2012-2016 |

|

22. Major Investments in Saudi Arabia Power Sector |

|

23. Saudi Arabia Overhead Transmission & Distribution Lines, 2012-2016 (ckt.km) |

|

24. Saudi Arabia Transmission and Distribution Networks 2016, By Regions (ckt. km) |

|

25. Saudi Arabia Electricity Consumers 2016, By Regions |

|

26. Net Value of Projects in Pre-execution in the GCC, By Country, 2016 |

|

27. Upcoming Transportation Projects in Saudi Arabia |

|

28. Upcoming Construction Projects in Saudi Arabia |

|

29. Upcoming Economic Cities in Saudi Arabia |

|

30. Saudi Arabia Non-Oil Revenues, 2012-2017E ($ Billion) |

|

31. Saudi Arabia Renewable Energy Contribution to Total Installed Power Capacity, 2015-2023F (GW) |

|

32. Brent Crude Oil Price Projections, 2014-2024F ($ per Barrel) |

|

33. Saudi Arabia Building Sector Construction Contracts Awards, 2013-2017 ($ Million) |

|

34. Saudi Arabia Pace of Project Cancellations, 2013-2017 ($ Billion) |

|

35. Saudi Arabia Distribution Transformer Market Revenues & Volume, 2014-2024F ($ Million, Thousand Units) |

|

36. Saudi Arabia Distribution Transformer Market Revenue Share, By Power Rating, 2017 & 2024F |

|

37. Saudi Arabia Distribution Transformer Market Volume Share, By Power Rating, 2017 & 2024F |

|

38. Saudi Arabia Up to 315 KVA Distribution Transformer Market Revenues & Volume, 2014-2024F ($ Million, Thousand Units) |

|

39. Saudi Arabia 315.1 KVA to 5 MVA Distribution Transformer Market Revenues & Volume, 2014-2024F ($ Million, Thousand Units) |

|

40. Saudi Arabia Power Transformer Market Revenues & Volume, 2014-2024F ($ Million, Units) |

|

41. Saudi Arabia Power Transformer Market Revenue Share, By Power Rating, 2017 & 2024F |

|

42. Saudi Arabia Power Transformer Market Volume Share, By Power Rating, 2017 & 2024F |

|

43. Saudi Arabia 5.1 to 50 MVA Power Transformer Market Revenues & Volume, 2014-2024F ($ Million, Units) |

|

44. Saudi Arabia Above 50 MVA Power Transformer Market Revenues & Volume, 2014-2024F ($ Million, Units) |

|

45. Saudi Arabia Power & Distribution Transformer Market Revenues, By Power Utilities Applications, 2014-2024F ($ Million) |

|

46. Saudi Arabia Power & Distribution Transformer Market Revenues, By Industrial Applications, 2014-2024F ($ Million) |

|

47. Saudi Arabia Liquid Type Power & Distribution Transformer Market Revenues, 2014-2024F ($ Million) |

|

48. Saudi Arabia Dry Type Power & Distribution Transformer Market Revenues, 2014-2024F ($ Million) |

|

49. Saudi Arabia Power & Distribution Transformer Market Revenues, By Regions, 2014-2024F ($ Million) |

|

50. Saudi Arabia Distribution Transformer Price Trend, Up to 100 KVA, 2014-2024F ($ Per Unit-ASP) |

|

51. Saudi Arabia Distribution Transformer Price Trend, 100.1-315 KVA, 2014-2024F ($ Per Unit-ASP) |

|

52. Saudi Arabia Distribution Transformer Price Trend, 315.1-5000 KVA, 2014-2024F ($ Per Unit-ASP) |

|

53. Saudi Arabia Power Transformer Price Trend, 5.1-50 MVA, 2014-2024F ($ Per Unit-ASP) |

|

54. Saudi Arabia Power Transformer Price Trend, 50.1-160 MVA, 2014-2024F ($ Per Unit-ASP) |

|

55. Saudi Arabia Power Transformer Price Trend, 160.1-350 MVA, 2014-2024F ($ Per Unit-ASP) |

|

56. Saudi Arabia Oil Revenues, 2012-2017E ($ Billion) |

|

57. Saudi Arabia Oil & Gas Construction Contracts Awards, 2013-2015 ($ Billion) |

|

58. Saudi Arabia Crude Oil and Natural Gas Production, 2005-2016 (Thousand barrels per day, Billion cubic meters) |

|

59. Saudi Arabia Actual Government Spending Vs Actual Government Revenues, 2012-2021F ($ Billion) |

|

60. Saudi Arabia Government Budget Spending Outlook, 2018 ($ Billion) |

|

61. Saudi Arabia Construction Contracts Awards, 2016-2017 ($ Million) |

|

62. Saudi Arabia Building Construction Projects Value by Status, 2017 |

|

63. Saudi Arabia Value of Awarded Contracts, 2013-1H 2016 ($ Billion) |

|

64. Value of Awarded Contracts by Sector During Q2'16 |

|

65. Riyadh Projected Hotel Supply, Number of Keys, 2015-2019F (Units) |

|

66. Jeddah Projected Hotel Supply, Number of Keys, 2015-2019F (Units) |

|

67. Makkah Projected Hotel Supply, Number of Keys, 2015-2019F (Units) |

|

68. Madinah Projected Hotel Supply, Number of Keys, 2015-2019F (Units) |

|

69. Khobar, Dammam and Dhahran Projected Hotel Supply, Number of Keys, 2015-2019F (Units) |

|

70. Saudi Arabia Power and Distribution Transformer Service and Repair Market Revenues, 2014-2024F ($ Million) |

|

71. Saudi Arabia Power Transformer Service and Repair Market Revenues, 2014-2024F ($ Million) |

|

72. Saudi Arabia Distribution Transformer Service and Repair Market Revenues, 2014-2024F ($ Million) |

|

73. Saudi Arabia Power and Distribution Transformer Service and Repair Market Revenues, By Intelligence Service, 2014-2024F ($ Million) |

|

74. Saudi Arabia Power and Distribution Transformer Service and Repair Market Revenues, By Repairing Service, 2014-2024F ($ Million) |

|

75. Saudi Arabia Power and Distribution Transformer Service and Repair Market Revenues, By Site Service, 2014-2024F ($ Million) |

|

76. Saudi Arabia Power and Distribution Transformer Service and Repair Market Revenues, By Power Utilities Applications, 2014-2024F ($ Million) |

|

77. Saudi Arabia Power and Distribution Transformer Service and Repair Market Revenues, By Industrial Applications, 2014-2024F ($ Million) |

|

78. Saudi Arabia Power and Distribution Transformer Service and Repair Market Revenues, By Regions, 2014-2024F ($ Million) |

|

79. Saudi Arabia Power and Distribution Transformer Market Opportunity Assessment, By Application |

|

80. Saudi Arabia Power and Distribution Transformer Market Opportunity Assessment, By Power Rating |

|

81. Saudi Arabia Power and Distribution Transformer Service and Repair Market Opportunity Assessment, By Type of Services |

|

82. Saudi Arabia Power and Distribution Transformer Service and Repair Market Opportunity Assessment, By Applications |

|

83. Saudi Arabia Power and Distribution Transformer Imports, By Country, 2016 ($ Million) |

|

84. Saudi Arabia Distribution Transformer Market Revenue Share, By Company, 2017 |

|

85. Saudi Arabia Power Transformer Market Revenue Share, By Company, 2017 |

|

86. Saudi Arabia Power and Distribution Transformer Service and Repair Market Revenue Share, By Company, 2017 |

|

87. Saudi Arabia Distribution Transformer Contribution to the Overall Transformer Market Revenues, 2014-2024F ($ Million) |

|

List of Tables |

|

1. 2020 energy sector targets in the National Transformation Program |

|

2. Saudi Arabia Upcoming Water and Utility Projects |

|

3. Saudi Arabia Number of Transmission Substations (Cumulative), 2011-2016 (Units) |

|

4. List of Upcoming Infrastructure Projects in Saudi Arabia |

|

5. Major Building Construction Projects in Saudi Arabia for Which Construction is Expected to Commence in 2017 |

|

6. Upcoming Residential Projects in Saudi Arabia |

|

7. Saudi Arabia Upcoming Renewable Energy Sector Projects |

|

8. a Total number of Operating Industrial Units, Total Finance, 2010 & 2017 3rd Quarter (Contd...) |

|

9. Saudi Arabia Future Projects in the Oil, Gas and Industrial Sector Projects Cont... |

|

10. Saudi Arabia Approved Budget Per Sector and Actual Expenses Up to the End of the Q3 of the fiscal year 2017, ($ Billion) |

|

11. List of Major Infrastructure Projects in Saudi Arabia (Cont..) |

|

12. Saudi Arabia Transformers Service and Repair Market Segmentation, By Types of Services Offered |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero