UAE Electric Vehicle Market Outlook (2022-2028) | Share, Size, Revenue, Value, Forecast, Trends, Growth, industry & COVID-19 IMPACT

Market Forecast By Vehicle Types (Passenger Vehicle, Two-Wheeler, Bus, and Truck), By Regions (Northern, Central, Southern), and by Competitive Landscape

| Product Code: ETC000608 | Publication Date: Feb 2023 | Updated Date: Jun 2024 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 71 | No. of Figures: 20 | No. of Tables: 4 | |

Latest (2024) Development of the UAE Electric Vehicle Market

The UAE Electric Vehicle Market Share has seen remarkable growth over the years, reflecting the nation's commitment to sustainable transportation solutions. With the government's supportive policies, including incentives for EV buyers and investment in charging infrastructure, the adoption rate of electric vehicles has accelerated significantly. Major cities like Dubai and Abu Dhabi have rolled out extensive charging networks, making it more convenient for EV owners to recharge their vehicles.

In addition to infrastructure improvements, the UAE has also welcomed new EV models from renowned manufacturers, catering to a wider range of consumer preferences and budgets. Local and international partnerships have been forged to enhance technology transfer and development, ensuring that the UAE remains at the forefront of the electric vehicle revolution. The transition to electric mobility aligns with the UAE's broader environmental goals, contributing to reduced carbon emissions and a greener future.

Topics Covered in the UAE Electric Vehicle Market

The UAE Electric Vehicle Market report thoroughly covers the market by product types and regions. UAE electric vehicle market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Latest 2023 Developments of the UAE Electric Vehicle Market

The UAE Electric Vehicle Market is the most popular and lucrative market and it will remain popular and lucrative in the years to come as many developments are happening in the sector. Recently, the RIT (Rochester Institute of Technology) in Dubai signed an essential agreement with ONE MOTO in order to increase the use of electric motorbikes in the logistics & delivery markets with the Net Zero 2050 strategy of UAE. The M Glory Holding Group launched a new $408 million electric vehicle manufacturing unit with a goal to produce 55,000 EVs a year owing to the growing demand for green mobility in the UAE.

In the UAE, One Moto is a manufacturer of electric vehicles that offers a fleet of vehicles like electric bikes, motorcycles, delivery and grocery vans, and scooters, catering to the urban commuters and last-mile industry. This manufacturer is anticipated to rule the market in the near future as it focuses on innovation. The industry is a pivotal part of the Middle East Electric Vehicle Market.

Electric Cars in UAE play a crucial role in the Electric Vehicle Market in UAE, and electric cars are preferred the most in the country. The players in the sector focus on battery-based electric vehicles as they are growing in demand in the country. With the constant development of EV applications and promotion in every field of urban mobility, EVs in carsharing has become very popular. Electric Vehicle in UAE has taken a significant place as most people these days prefer them and they will shape the future of the vehicle market in the nation.

UAE Electric Vehicle Market Synopsis

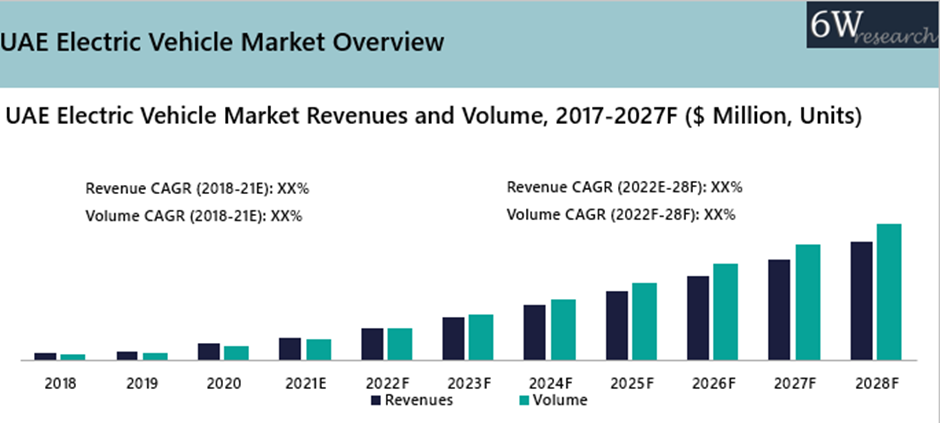

The UAE Electric Vehicle market is currently in its early stage and witnessed certain growth during the period 2018-2021 owing to the Electric Vehicle (EV) Green Charger initiative undertaken by the government of UAE. However, the COVID-19 pandemic affected market revenues during the year 2020 as the mobility restrictions led to supply chain disruptions for electric motors and halted manufacturing operations thereby resulting in a fall in market demand and hence the market revenues.

The UAE Electric Vehicle Market size is projected to grow at a CAGR of 24.2% in terms of revenues during 2022-2028. The UAE electric vehicle market would register growth during the forecast period on account of an increase in tourist footfall in the country which is going to expand the car rental business in the emirates, coupled with domestic consumption on the back of economic benefits provided by the government to promote the electric vehicle in the country. Rising penetration towards the development of renewable and emission-less vehicles is adding to the UAE Electric Vehicle Market Growth. Additionally, the low maintenance and the initial cost of an electric vehicle are proliferating the growth of the market.

Government Initiatives Introduced in the UAE Electric Vehicle Market

The government policies have been favorable for the electric vehicle market in the UAE. The UAE Vision 2021 strategy, launched in 2010, aims to achieve sustainable development in various sectors, including transportation. These activities have further strengthened the UAE electric vehicle market share. The strategy emphasizes green and sustainable transportation, which has led to the development of electric vehicle charging stations across the country. To encourage the adoption of EVs, the UAE government has also waived off charging fees for electric vehicles at public charging stations till the end of 2021.

Key Players in the UAE Electric Vehicle Market

The UAE EV market is gaining traction with increasing adoption rates by consumers and commercial sectors. The UAE government's efforts to promote the use of electric vehicles have also contributed to its growth. The market's key players are a mix of international and local brands, with a growing number of options available for consumers. Some of the major players include Tesla, Nissan, BMW, and Porsche. The major few companies hold crucial Middle East Electric Vehicle Market share. The potential growth opportunities within the commercial sector and the development of charging infrastructure will further accelerate the growth of the market.

Market by Vehicle Types Analysis

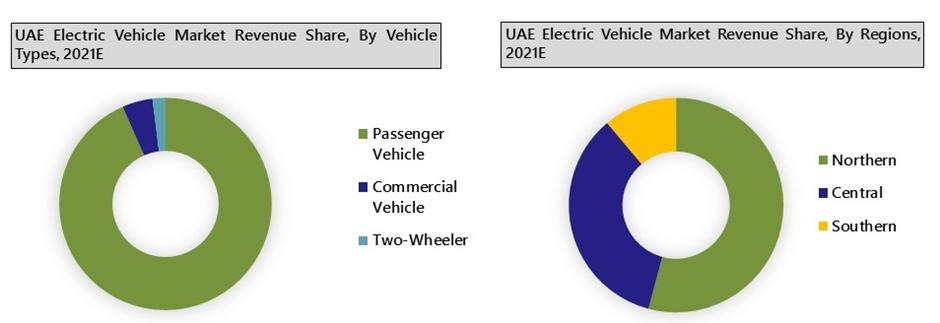

In terms of vehicle types, passenger vehicles contributed 95.1% of revenue in the UAE Electric Vehicle market share in 2021 owing to the increasing trend of rental car services in the country coupled with domestic residential buyers. Additionally, because of the limited scope for the implementation of commercial vehicles in the FMCG sector and transportation & logistic supply in UAE it holds the largest revenue share. However, in terms of volume two-wheeler segment is expected to grow during the forecasted period owing to gradual developments in logistics and food delivery services.

Market by Regions Analysis

In 2021, the Northern region acquired a 54.1% revenue share in the UAE electric vehicle market Revenue on account of rapid urbanization and the availability of charging infrastructure and maintenance centres in Dubai, Abu Dhabi. This trend is expected to persist in the coming years owing to the development of EV-supporting infrastructure such as charging stations and maintenance services increasing the number of EVs in the country.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2018 to 2020.

- Base Year: 2021

- Forecast Data until 2028.

- Key Performance Indicators Impacting the Market.

Key Highlights of the Report:

- UAE Electric Vehicle Market Overview

- UAE Electric Vehicle Market Outlook

- UAE Electric Vehicle Market Forecast

- Historical Data and Forecast of UAE Electric Vehicle Market Revenues, for the Period 2018-2028F

- Historical Data and Forecast of UAE Electric Vehicle Market Revenues, By Vehicle Type, for the Period 2018-2028F

- Historical Data and Forecast of UAE Electric Vehicle Market Revenues, By Region, for the Period 2018-2028F

- Historical Data and Forecast of UAE Electric Vehicle Market Volume, for the Period 2018-2028F

- Historical Data and Forecast of UAE Electric Vehicle Market Volume, By Vehicle Type, for the Period 2018-2028F

- Historical Data and Forecast of UAE Electric Vehicle Market Volume, By Region, for the Period 2018-2028F

- UAE Electric Vehicle Market Revenue Ranking, By Companies

- Covid-19 Impact on UAE Electric Vehicle Market

- Market Drivers and Restraints

- UAE Electric Vehicle Market Trends

- Industry life Cycle

- Porter’s Five Force Analysis

- Price Trend Analysis

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Vehicle Types

- Passenger Cars

- Two-Wheelers

- Commercial Vehicles

By Regions

- Northern

- Central

- Southern

UAE Electric Vehicle Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3Market Scope and Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. UAE Electric Vehicle Market Overview |

| 3.1 UAE Electric Vehicle Market Revenues and Volume (2018-2028F) |

| 3.2 UAE Electric Vehicle Market Industry Life Cycle |

| 3.3 UAE Electric Vehicle Market Porter’s Five Forces Model |

| 4. Impact Analysis of COVID-19 on UAE Electric Vehicle Market |

| 5. UAE Electric Vehicle Market Dynamics |

| 5.1 Impact Analysis |

| 5.2 Market Drivers |

| 5.3 Market Restraints |

| 6. UAE Electric Vehicle Market Trends & Evolution |

| 7. UAE Electric Vehicle Market Overview, By Vehicle Type |

| 7.1 UAE Electric Vehicle Market Revenue and Volume Share, By Vehicle Type (2021E & 2028F) |

| 7.2 UAE Electric Vehicle Market Revenue and Volume, By Vehicle Type (2018-2028F) |

| 7.2.1 UAE Electric Vehicle Market Revenues and Volume, By Passenger Cars (2018-2028F) |

| 7.2.2 UAE Electric Vehicle Market Revenues and Volume, By Two-Wheelers (2018-2028F) |

| 7.2.3 UAE Electric Vehicle Market Revenues and Volume, By Commercial Vehicles (2018-2028F) |

| 8. UAE Electric Vehicle Market Overview, By Region |

| 8.1 UAE Electric Vehicle Market Revenue and Volume Share, By Region (2021E & 2028F) |

| 8.2 UAE Electric Vehicle Market Revenue and Volume, By Region (2018 & 2028F) |

| 8.2.1 UAE Electric Vehicle Market Revenues and Volume, By Nothern (2018-2028F) |

| 8.2.2 UAE Electric Vehicle Market Revenues and Volume, By Central (2018-2028F) |

| 8.2.3 UAE Electric Vehicle Market Revenues and Volume, By Southern (2018-2028F) |

| 9. UAE Electric Vehicle Market - Key Performance Indicators |

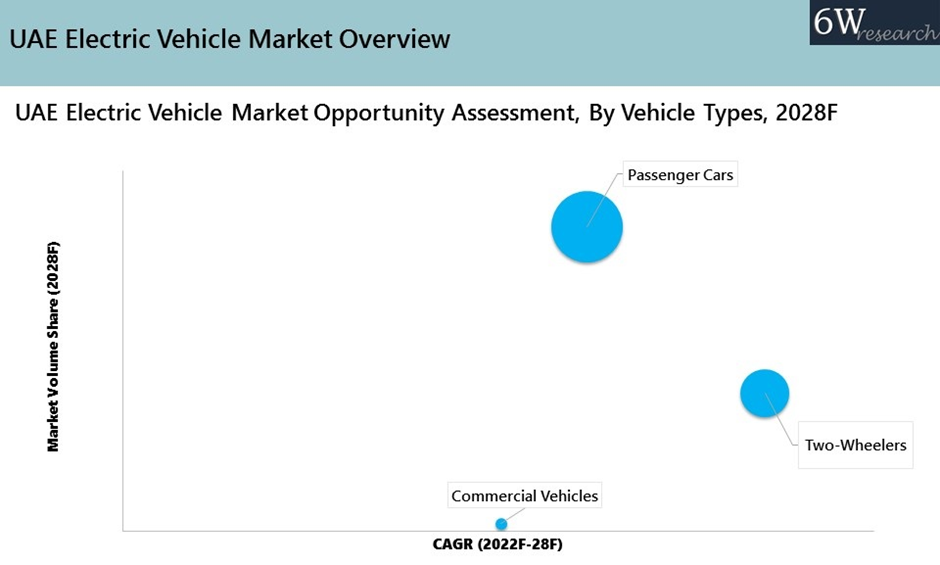

| 10. UAE Electric Vehicle Market - Opportunity Assessment |

| 10.1 UAE Electric Vehicle Market - Opportunity Assessment, By Vehicle Type (2028F) |

| 10.2 UAE Electric Vehicle Market - Opportunity Assessment, By Region (2028F) |

| 11. UAE Electric Vehicle Market - Price Trend Analysis |

| 12. UAE Electric Vehicle Market Competitive Landscape |

| 12.1 UAE Electric Vehicle Market Company Ranking, By Companies (2021E) |

| 12.2 UAE Electric Vehicle Market Key Companies Competitive Benchmarking, By Technical Parameters |

| 12.3 UAE Electric Vehicle Market Key Companies Competitive Benchmarking, By Operating Parameters |

| 13. Company Profiles |

| 13.1 Nissan Motor Co, Ltd. |

| 13.2 Tesla, Inc. |

| 13.3 Hyundai Motor Company |

| 13.4 Toyota Motor Corporation |

| 13.5 The Volkswagen AG |

| 13.6 General Motors Company |

| 13.7 Lucid Group, Inc., |

| 13.8 Zhengzhou Yutong Bus Co. Ltd. |

| 13.9 One Moto |

| 13.10 Morris Garage |

| 14. Key Strategic Recommendations |

| 15. Disclaimer |

| List of Figures |

| Figure 1: UAE Electric Vehicle Market Revenues & Volume, 2018-2028F ($ Million, Units) |

| Figure 2: UAE Cumulative Carbon Dioxide Emission, 2015-2020 (billion tonnes) |

| Figure 3. UAE Fuel Prices, 2021, (Dirham/Liter) |

| Figure 4: UAE Electric Vehicle Market Revenue Share, By Vehicle Type, 2021E & 2028F |

| Figure 5: UAE Electric Vehicle Market Volume Share, By Vehicle Type, 2021E & 2028F |

| Figure 6: UAE Electric Vehicle Market Revenue Share, By Region, 2021E & 2028F |

| Figure 7: UAE Electric Vehicle Market Volume Share, By Region, 2021E & 2028F |

| Figure 8: UAE Volume of Imports and Exports, 2019-2026F (% Change) |

| Figure 9: UAE GDP, 2016-2023F (In $ bn) |

| Figure 10: UAE Government Revenues vs Government Expenditure, 2019-2026F (% of GDP) |

| Figure 11: UAE Total Investment As Percent of GDP, 2019-2026F |

| Figure 12: Distribution of EV Connectors in 2021 |

| Figure 13: UAE Electric Vehicle Market Volume Opportunity Assessment, By Vehicle Type, 2028F |

| Figure 14: UAE Electric Vehicle Market Volume Opportunity Assessment, By Region, 2028F |

| Figure 15: UAE Electric Vehicle – Two-wheeler Average Selling Price Trend, In $, 2018-2028F |

| Figure 16: UAE Electric Vehicle – Passenger Vehicle Average Selling Price Trend, In 1000$, 2018-2028F |

| Figure 17: UAE Electric Vehicle – Commercial Vehicle Average Selling Price Trend, In 1000$, 2018-2028F |

| Figure 18: UAE Electric Vehicle Market Revenue Ranking, By Companies, 2021E |

| Figure 19: Abu Dhabi Residential Supply, 2018-2022F (Thousand Units) |

| Figure 20: Dubai Residential Supply, 2018-2022F (Thousand Units) |

| List of Tables |

| Table 1: UAE Electric Vehicle Market Revenues, By Vehicle Type 2018-2028F ($ Million) |

| Table 2: UAE Electric Vehicle Market Volumes, By Vehicle Type, 2018-2028F (Units) |

| Table 3: UAE Electric Vehicle Market Revenues, By Region 2018-2028F ($ Million) |

| Table 4: UAE Electric Vehicle Market Volumes, By Region, 2018-2028F (Units) |

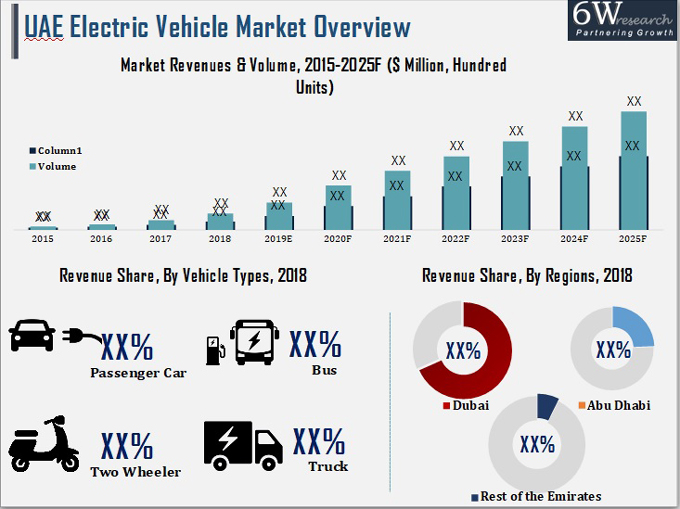

Market Forecast By Vehicle Types (Passenger Vehicle, Two-Wheeler, Bus, and Truck), By Regions (Dubai, Abu Dhabi and Rest of Emirates), and Competitive Landscape

| Product Code: ETC000608 | Publication Date: Nov 2021 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 75 | No. of Figures: 32 | |

Latest 2021 developments:

UAE Electric Vehicle Market has seen the latest developments that include the installation of solar rooftop panels across the Middle East including electric vehicle charging stations, fast-charging stations for EVs, and the introduction of the vehicle to grid smart charging systems to maximize energy optimization. There are two cable standards developed to support the EV market. With the use of smart charging devices, charging cables can be expected to supply both power and communication. Dubai, along with Abu Dhabi, has launched e-scooters in densely populated areas in the hopes of reducing congestion and encouraging residents towards sustainable methods of transportation. Saudi Electricity company signed a deal with Nissan Motor, Takaoka Tokyo, and Tokyo Electric Power Company for the first EV pilot project in Saudi Arabia.

Mergers and Acquisitions:

- In September 2020, General Motors acquired an 11 percent stake in the electric truck startup, Nikola.

- In December 2020, Hyundai Motor Group acquired a controlling interest in Boston Dynamics

To enquire about latest release please click here

Previous Release:

UAE has been a huge potential market for automobile makers as consumers spend extensively on vehicles in the country. Due to this, the electric vehicle market is gradually strengthening its footing in the automobile market of the UAE. Although, the gap in the charging infrastructure and the relatively low fuel prices may potentially hamper the growth of electric vehicles in the nation. However, rising environmental issues and lucrative offers and incentives by the government would drive electric vehicle penetration in the UAE over the next six years.

According to 6Wresearch, UAE Electric Vehicle Market size is projected to grow at a CAGR of 32.1% during 2019-25. Under UAE Vision 2021, the government is encouraging the adoption of electric vehicles in the country. In addition to this, Dubai Electricity and Water Authority (DEWA) and Road Transport Authority (RTA) are working together for the development of the electric vehicle market in the country by installing charging stations and providing incentives such as free parking and exemption from toll and registration fees.

Dubai acquired the highest UAE electric vehicle market share as compared to other Emirates in the country owing to the better electric vehicle supporting infrastructure such as charging stations. Additionally, authorities and private companies are working towards improving the charging technology which would reduce the charging time for electric vehicles. This, in turn, would create a suitable environment for the growth of electric vehicles across the country. Some of the key players in the UAE electric vehicle market include - Tesla, Inc., Hyundai Motor Company, Volkswagen Motor Company LTM, Bayerische Motoren Werke AG, and others.

The UAE electric vehicle market report comprehensively covers the market by vehicle types and regions. The UAE electric vehicle market outlook report provides an unbiased and detailed analysis of the UAE Electric vehicle market trends, opportunities, high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

UAE Electric Vehicle Market government policies support the private companies for the development of electric vehicle and there infrastructure drive the market in the UAE for electric vehicle. There are new models of the electric vehicle Peugeot and Nissan LEAF the demand for the electric vehicle is going to rise in the UAE market. There are more facilities for electric vehicles such as installing charging stations in the country, providing free parking, registration fees for electric vehicles in the country.

Key Highlights of the Report:

•UAE Electric Vehicle Market Overview

• UAE Electric Vehicle Market Outlook

• UAE Electric Vehicle Market Size and UAE Electric Vehicle Market Forecast, until 2025

• Historical Data of UAE Electric Vehicle Market Revenues for the Period, 2015-2018

• Market Size & Forecast of UAE Electric Vehicle Market Revenues, until 2025F

• Historical Data of UAE Electric Vehicle Market Revenues by Vehicle Type for the Period, 2015-2018

• Market Size & Forecast of UAE Electric Vehicle Market Revenues by Vehicle Type, until 2025F

• Historical Data of UAE Electric Vehicle Market Revenues by Region for the Period, 2015-2018

• Market Size & UAE Electric Vehicle Market Forecast by Region, until 2025F

• Market Drivers and Restraints

• UAE Electric Vehicle Market Trends

• UAE Electric Vehicle Market Overview on Competitive Benchmarking

• Competitive Landscape

• UAE Electric Vehicle Market Share, By Players

• Company Profiles

• Key Strategic Recommendations

Markets Covered

The UAE electric vehicle market report provides a detailed analysis of the following market segments:

• By Vehicle Types

o Passenger Vehicle

o Two-Wheeler

o Bus

o Truck

• By Regions

o Dubai

o Abu Dhabi

o Rest of Emirates

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero