UAE Kitchen Hood Market (2018-2024) | Growth, Trends, Revenue, Forecast, Companies, Value, Share, Size, Analysis, Outlook & Industry

Market Forecast By Installation Type (Wall Mounted, Island Mounted and Under-Cabinet), By Applications (Residential and Commercial), By Fitting Type (Ducted/Extracting and Ductless/Recirculated), By Regions (Dubai, Abu Dhabi and Northern Emirates), and Competitive Landscape

| Product Code: ETC000464 | Publication Date: Dec 2021 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 102 | No. of Figures: 58 | |

Growing standard of living, awareness towards health, increase adoption of modular kitchens and replacement of existing kitchen hoods are some of the factors leading to the rising kitchen hood demand. Also, with the upcoming event 'World Expo 2020' in Dubai and consequently burgeoning tourism, hospitality, and residential sectors to further propel the market of kitchen hoods in the country.

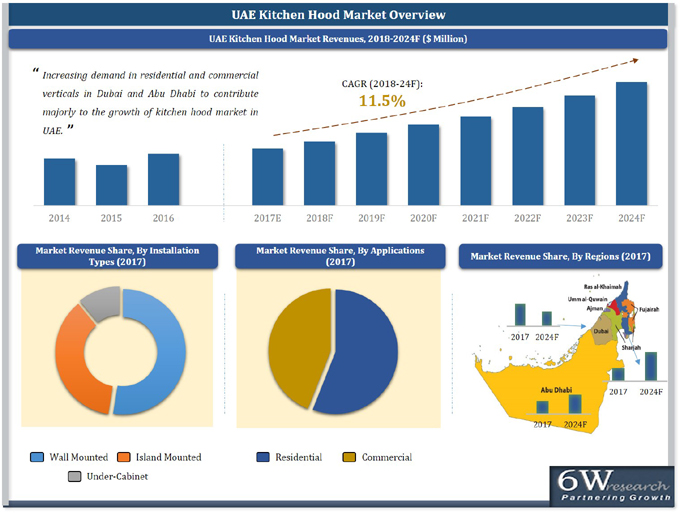

According to 6Wresearch, the UAE kitchen hood market size is projected to grow at a CAGR of 11.5% from 2018 to 2024. The market registered slow growth in revenues during 2015-16 owing to a slump in oil prices, which primarily affected both government spending and the disposable income of households. UAE recorded a decline in kitchen hood's sales in 2015 as compared to 2014, resulting in the overall weakening of UAE Kitchen hood market revenues in 2015; however, the market is anticipated to bounce back with the recovery of oil prices post 2017, majorly due to burgeoning construction activities leading to the rising number of hotels, hotel apartments, QSR, cafes, and others.

UAE kitchen hood market registered slowdown as a result of the oil price crisis over the last few years. Nowadays come up with new residential supply units, an increasing number of hotels, restaurants, and quick-service restaurants (QSRs) along with rising consumer awareness towards health, rising modern lifestyle, adoption for smart living as well as attractive kitchen solutions particularly modular kitchens.

In the UAE, the Dubai region accounted for the largest revenue share in the overall UAE kitchen Hood market share, followed by Abu Dhabi and Northern regions. Major construction projects across commercial and residential verticals, coupled with increasing health awareness among consumers are the key factors leading to the growth of the kitchen hood market. Some of the key players in the UAE Kitchen hood market- BSH Home Appliances, Elica, Faber, Teka, Whirlpool, AB Electrolux, CNA Group, Elba, Miele Appliances, and Candy.

The UAE kitchen hood market report thoroughly covers the market of kitchen hoods in UAE by installation types, fitting types, applications, and regions. The UAE kitchen hood market outlook report provides an unbiased and detailed analysis of the UAE kitchen hood market trends, opportunities/high growth areas, market drivers, which would help stakeholders to device and align market strategies according to the current and future market dynamics.

UAE kitchen hood market is estimated to register sound revenues in the upcoming six years on the back of the rising hospitality sector. Increased hotels and restaurants set up especially in Dubai and Abu Dhabi where owners believe in investing in intelligent kitchen hood installation is capable of control over excess heat and smoke and is anticipated to boost the product demand in the foreseeable future. Additionally, rising disposable income indicates a high standard of living and is stimulating customers to afford smart kitchen hoods is estimated to leave a positive impact on the country and would benefit the UAE kitchen hood market in the coming years.

Key Highlights of the Report:

• UAE kitchen hood market Overview

• UAE kitchen hood market Outlook

• UAE kitchen hood market Forecast

• Historical Data of GCC Kitchen Hood market for the Period 2014-2017

• Market Size & Forecast of GCC Kitchen Hood Market until 2024

• Historical Data of UAE Kitchen Hood Market Revenues for the Period 2014-2017

• UAE Kitchen Hood Market Size & UAE Kitchen Hood Market Forecast, until 2024

• Historical Data of UAE Wall Mounted Kitchen Hood Market for the Period 2014-2017

• Market Size & Forecast of UAE Wall Mounted Kitchen Hood Market until 2024

• Historical Data of UAE Island Mounted Kitchen Hood Market for the Period 2014-2017

• Market Size & Forecast of UAE Island Mounted Kitchen Hood Market until 2024

• Historic Data of UAE Kitchen Under-Cabinet Kitchen Hood Market for the Period 2014-2017

• Market Size & Forecast of UAE Under-Cabinet Kitchen Hood Market until 2024

• Historical Data and Forecast of UAE Kitchen Hood Market, By Applications 2014-2024

• Historical Data and Forecast of UAE Kitchen Hood Market, By Regions 2014-2024

• Historical Data and Forecast of UAE Kitchen Hood Market, By Fitting Types for the Period 2014-2024

• Market Drivers and Restraints

• UAE Kitchen Hood Market Trends and Developments

• UAE Kitchen Hood Market Share, by Players

• UAE Kitchen Hood Market Overview on Competitive Benchmarking

• Key Strategic RecommendationsMarkets Covered:

The UAE Kitchen hood market report provides a detailed analysis of the following market segments:

• By Installation Type:

o Wall Mounted

o Island Mounted

o Under-Cabinet

• By Applications:

o Residential

o Commercial

• By Fitting Type:

o Ducted/Extracting

o Ductless/Recirculated

• By Regions:

o Dubai

o Abu Dhabi

o the Northern Emirates

Frequently Asked Questions About the Market Study (FAQs):

1. Executive Summary

2. Introduction

2.1. Key Highlights of the Report

2.2. Report Description

2.3. Market Scope & Segmentation

2.4. Research Methodology

2.5. Assumptions

3. GCC Kitchen Hood Market Overview

3.1. GCC Kitchen Hood Revenues (2014-2024F)

3.2. GCC Kitchen Hood Revenues, By Regions (2014-2024F)

4. UAE Kitchen Hood Market Overview

4.1. UAE Kitchen Hood Market Volumes & Revenues (2014-2024F)

4.2. UAE Kitchen Hood Market Industry Life Cycle

4.3. UAE Kitchen Hood Market Porter's Five Forces Model

4.4. UAE Kitchen Hood Opportunity Matrix

4.5. UAE Kitchen Hood Market Revenue Share, By Installation Type (2014-2024F)

4.6. UAE Kitchen Hood Market Revenue Share, By Application (2014-2024F)

4.7. UAE Kitchen Hood Market Revenue Share, By Regions (2014-2024F)

4.8. UAE Kitchen Hood Market Revenue Share, By Fitting Types (2014-2024F)

5. UAE Kitchen Hood Market Dynamics

5.1. Impact Analysis

5.2. Market Drivers

5.3. Market Restraints

6. UAE Kitchen Hood Market Trends

7. UAE Kitchen Hood Market Overview, By Installation Type

7.1. UAE Wall Mounted kitchen Hood Market Overview (2014-2024F)

7.1.1. UAE Wall Mounted Kitchen Hood Market Revenues & Volumes (2014-2024F)

7.2. UAE Island Mounted Kitchen Hood Overview (2014-2024F)

7.2.1. UAE Island Mounted kitchen Hood Market Volumes & Revenues (2014-2024F)

7.3. UAE Under - Cabinet Kitchen Hood Market (2014 & 2024F)

7.3.1. UAE Undercabinet Kitchen Hood Market Volumes & Revenues (2014-2024F)

8. UAE Kitchen Hoods Market overview By Application

8.1. UAE Residential Kitchen Hood market overview (2014-2024F)

8.1.1. UAE Residential Kitchen Hood Market Volumes & Revenues (2014-2024F)

8.2. UAE Commercial Kitchen Hood Market Overview (2014-2024F)

8.2.1. UAE Commercial Kitchen Hood Market Volumes & Revenues (2014-2024F)

9. UAE Kitchen Hood Market Overview By Regions

9.1. Dubai Kitchen Hood Market Overview (2014-2024F)

9.1.1. Dubai Kitchen Hood Market Revenues (2014-2024F)

9.2. Abu Dhabi Kitchen Hood Market Overview ( 2014-2024F)

9.2.1.Abu Dhabi Kitchen Hood Market Revenues (2014-2024F)

9.3. Northern Emirates Kitchen Hood Market Overview (2014-2024F)

9.3.1. Northern Emirates Kitchen Hood Market Revenues (2014-2024F)

10. UAE Kitchen Hood Market Overview, By Fitting types

10.1.Ductless Kitchen Hood Market Overview (2014-2024F)

10.1.1.Ductless Kitchen Hood Market Volumes & Revenues (2014-2024F)

10.2.Ducted Kitchen Hood Market Overview (2014-2024F)

10.2.1.Ducted Kitchen Hood Market Volumes & Revenues (2014-2024F)

11. Competitive Landscape

11.1. Market Player's Revenue

11.2. Competitive Benchmarking, By operating parameters

11.3. Competitive Benchmarking, By Technology

12. Company Profiles

12.1. BSH Home Appliances FZE

12.2. AB Electrolux (publ)

12.3. Fisher & Paykel Appliances Italy S.p.A

12.4. Teka Kuchentechnik UAE LLC

12.5. Miele Appliances Ltd.

12.6. Elica S.p.A

12.7. Franke L.L.C

12.8. Whirlpool MEA S.p.A

12.9. CNA Group SA

12.10. Candy Hoover Srl

13. Recommendations

14. Disclaimer

List of Figures

1. GCC Kitchen Hood Market Revenues for the period, 2014-2024F ($ Billion)

2. GCC contracts awarded for building construction in 2016 & 2017 (in $ Billions)

3. Supply of residential units in major cities of Saudi Arab and UAE for the Period (2015-2019F)

4. GCC Hospitality sector Market Revenues, 2013-2020F ($ Billion)

5. Food consumption in the GCC Market (2012-2015)

6. UAE Kitchen hoods Market Volumes 2014-2024F (in Units)

7. UAE Kitchen hoods Market Revenues 2014-2024F (in $ Millions)

8. UAE Kitchen Hood Market Revenue Share, By Installation Type (2017-2024F )

9. UAE Kitchen Hood Market Revenue Share, By Application (2017-2024F )

10. UAE Kitchen Hood Market Revenue Share, By Region (2017-2024F)

11. Dubai Residential supply units Volume, 2014-2019 (Thousand Units)

12. Abu Dhabi Residential supply units Volume, 2014-2019 (Thousand Units)

13. UAE per capita Income (PPP), 2014-2021 (In $)

14.UAE Kitchen Hood Market Revenue Share, By Wall Mounted (2017 )

15. UAE Kitchen Hood Market Revenue Share, By Wall Mounted (2024F )

16. UAE Wall mounted Kitchen Hood Market Volume, 2014- 2024F (in 000' Units)

17. UAE Wall Mounted Kitchen Hood Market Revenues, 2014-2024F ($ Million)

18. UAE Kitchen Hood Market Revenue Share, By Island Mounted (2017)

19. UAE Kitchen Hood Market Revenue Share, By Island Mounted (2024F)

20.UAE Island Mounted Kitchen Hood Market Volume, 2014- 2024F (in 000' Units)

21. UAE Island Mounted Kitchen Hood Market Revenues 2014-2024F ($ Million)

22. UAE Kitchen Hood Market Revenue Share, By Under-cabinet (2017)

23. UAE kitchen Hood Market Volume Share, By Under-Cabinet (2024F)

24. UAE Under-Cabinet Kitchen Hood Market Volume, 2014- 2024F (in 000' Units)

25. UAE Under-Cabinet Kitchen Hood Market Revenues, 2014-2024F ($ Million)

26. Kitchen Hood Revenue Share, By Residential Application (2017)y

27. Kitchen Hood Revenue Share, By Residential Application (2024F)

28. UAE Kitchen Hood Market Volume, 2014-2024F (in 000' units)

29. UAE Kitchen Hood Market Revenues, 2014-2024F (in $ Millions)

30. Kitchen Hood Revenue Share, By Commercial Application (2017)

31. Kitchen Hood Revenue Share, By Commercial Application (2024F)

32. UAE Commercial Kitchen Hood Market Volume, 2014-2024F (in 000' units)

33. UAE Commercial Kitchen Hood Market Revenues, 2014-2024F (in $ Million)

34. Increasing number of hotel rooms in Dubai (2014-2019F )

35. Dubai No. of Residential Units Supply Each Year from 2013-2019

36. Quality of Overall Transport and Infrastructure in 2017- 2018 (7=BEST)

37. Source of Visitors to Dubai for the Year 2016 & 2017 (in 000')

38. Source of Visitors to Dubai by Region in 2017

39. UAE Dubai Kitchen Hood Market Revenues, 2014-2024F (in $ Million)

40. Kitchen Hood Revenue Share, By Dubai Region (2017)

41. Kitchen Hood Revenue Share, By Dubai Region (2024F)

42. Abu Dhabi No. of Residential Units Supply Each Year from 2013-2019

43. Abu Dhabi Kitchen Hood Market Revenues, 2014-2024F ($ Million)

44. Kitchen Hood Revenue Share, By Abu Dhabi Region (2017)

45. Kitchen Hood Revenue Share by Abu Dhabi Region (2024F)

46. Sharjah No. of Residential Units Supply Each Year from 2013 to 2019 (in 000' units)

47. Northern Kitchen Hood Market Revenues, 2014-2024F ($ Million)

48. Kitchen Hood Revenue Share, By Northern Emirates Region (2017)

49. Kitchen Hood Revenue Share, By Northern Emirates Region (2024F)

50. Kitchen Hood Volume Share, By Ductless Fitting types (2017)

51. Kitchen Hood Revenue Share, By Ductless Fitting types (2024F)

52. Ductless Kitchen Hood Market Volume, 2014-2024F (in 000' Units)

53. Ductless Kitchen Hood Market Revenues, 2014-2024F (in $ Millions)

54. Kitchen Hood Volume Share, By Ducted Fitting Types (2017)

55. Kitchen Hood Volume Share, By Ducted Fitting Types (2024F)

56. Ductless Kitchen Hood Market Volume, 2014-2024F (in 000' Units)

57. Ductless Kitchen Hood Market Revenues, 2014-2024F (in $ Millions)

58. UAE kitchen Hood Market Players' Revenues (2017)

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

- Kenya Road Stabilization Equipment Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- North America Sodium chloride Market (2025-2031) | Analysis, Revenue, Forecast, Trends, Companies, Size, Growth, Share, Industry, Outlook & Value

- North America Vinyl Flooring Market (2025-2031) | Value, Growth,Size, Analysis, Revenue, Industry, Forecast, Share, Outlook, Companies & Trends

- Tajikistan Thermal Camera Market (2025-2031) | Trends, Size, Growth, Share, Industry, Companies, Value, Analysis, Revenue, Forecast & Outlook

- Singapore Professional AV Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero