UAE Power Rental Market (2025-2031) | Outlook, Industry, Companies, Growth, Value, Size, Trends, Analysis, Share, Revenue & Forecast

Market Forecast By Gensets Types (Diesel and Non-Diesel Gensets), By KVA Ratings (Below 100 KVA, 100.1 KVA- 350 KVA, 350.1 KVA-750 KVA, 750 KVA-1000 KVA and Above 1000 KVA), By Applications (Utilities, Oil & Gas, Industrial & Construction, Quarrying and Mining and others) and Regions (North and South)

| Product Code: ETC000225 | Publication Date: Jan 2015 | Updated Date: Sep 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

UAE Power Rental Market Highlights

| Report Name | UAE Power Rental Market |

| Forecast period | 2025-2031 |

| CAGR | 7% |

| Growing Sector | industrial |

Topics Covered in the UAE Power Rental Market Report

The UAE Power Rental Market report thoroughly covers the market by Gensets Types, by KVA Ratings, and by Applications. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

UAE Power Rental Market Synopsis

The UAE Power Rental Market is exhibiting robust growth, driven by the rising demand for reliable power supply, the evolving construction industry, and the influence of the oil & gas sector. This market includes a range of power rental solutions, catering to utilities, industrial & construction sectors, oil & gas, quarrying and mining, and others. As the UAE economy continues to transform, the power rental industry has become a significant part of both local and international markets, providing businesses and industries with reliable and flexible power solutions.

According to 6Wresearch, the UAE Power Rental Market revenue is projected to grow at a substantial CAGR of 7% during the forecast period 2025-2031. The Power Rental market in UAE is expanding due to increasing demand across various applications, driven by the need for reliable and flexible power solutions. Advances in genset technology, coupled with the need for dependable power supply, are shaping the industry. As companies seek diverse and dependable options, the demand for various gensets continues to rise, highlighting the importance of ongoing innovation to meet evolving power needs and stay aligned with market trends, further boosting UAE Power Rental Market growth. Despite growth, challenges remain, including the need to maintain high performance standards, address diverse power requirements, and manage complex operational and maintenance costs. Additionally, concerns about environmental impact and the necessity for sustainable power solutions may influence market growth.

UAE Power Rental Market Trends

The power rental market in UAE is experiencing significant growth, fueled by urbanization, increased infrastructure development, and energy-conscious consumer preferences. Power rentals are particularly in demand for their reliability and flexibility, especially in industries such as oil & gas and construction. Key features such as customizable power output, prompt service, and enhanced durability reflect a growing consumer interest in reliability and functionality over traditional power supplies.

Investment Opportunities in the UAE Power Rental Market

Industrial & Construction- The rise of infrastructure projects, particularly post-pandemic, offers significant growth opportunities. Enhancing power rental services with reliable gensets, efficient maintenance, and diverse options can capture the growing industry demand.

Local Power Rental Companies- UAE’s growing interest in local products and the integration of modern technology with reliable services present investment opportunities. Supporting local companies that prioritize quality and sustainability can appeal to both domestic and international markets.

Leading Players of the UAE Power Rental Market

The UAE power rental market is characterized by a diverse mix of international and regional players. Leading global companies such as Aggreko, Ashtead Group plc, and United Rentals, Inc. have established a significant presence, leveraging their extensive equipment portfolios and global expertise to cater to various customer needs. Regional firms like Altaaqa Global and Al Faris also play crucial roles, offering tailored solutions that address the specific demands of the Middle Eastern market. These companies collectively contribute to the market's growth by providing reliable temporary power solutions across sectors such as construction, oil and gas, and events.

Government Regulations in the UAE Power Rental Market

The UAE power rental market is regulated by government policies that ensure sustainability, efficiency, and compliance with environmental standards. The Emirates Authority for Standardization and Metrology (ESMA) mandates strict emissions regulations, promoting low-emission and fuel-efficient generators. The UAE Vision 2050 focuses on reducing reliance on fossil fuels, encouraging rental companies to integrate hybrid and renewable energy solutions. Dubai Electricity and Water Authority (DEWA) and Abu Dhabi Transmission and Despatch Company (TRANSCO) set operational guidelines, ensuring rental power aligns with national grid standards. The government also enforces stringent safety and maintenance regulations under the UAE Fire and Safety Code to prevent hazards in temporary power installations.

Future Insights of the UAE Power Rental Market

The future of UAE’s power rental industry looks promising, with continued growth driven by rising infrastructure development, industrialization, and a shift towards reliable and sustainable power supply solutions. Consumers are increasingly focused on reliability, durability, and eco-friendly options, creating opportunities for brands that align with these values. Additionally, power rental solutions are gaining popularity as UAE consumers increasingly seek reliable and flexible power supply options. With continued innovation and investment in sustainable solutions, the UAE power rental market is set for significant growth over the forecast period.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories

Diesel and Non-Diesel Gensets to Dominate the Market - By Gensets Types

According to Ravi Bhandari, Research Head, 6Wresearch, the Diesel and Non-Diesel Gensets are projected to dominate due to their high-volume demand. However, the non-residential sector is also expected to grow due to the increasing demand for comfortable and flexible sleep solutions in hospitals and hotels.

Various KVA Ratings dominate the Market - By KVA Ratings

In UAE’s power rental market, various KVA Ratings dominate. This is due to high consumer preference for efficient and reliable power solutions, supported by advancements in technology.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2031 to 2024

- Base Year 2024

- Forecast Data until 2031

- Key Performance Indicators Impacting the Market

- Major Upcoming Developments and Projects

Key Highlights of the Report:

- Historical data of Middle East Power Rental Market for the Period 2021-2031

- Market Size & Forecast of Middle East Power Rental Market until2031.

- Historical data of UAE Power Rental Market for the Period 2021-2031

- Market Size & Forecast of UAE Power Rental Market until2031.

- Market Size & Forecast of UAE Power Rental Market by Genset Types until2031.

- Market Size & Forecast of UAE Power Rental Market by KVA Ratings until2031.

- Market Size & Forecast of UAE Power Rental Market by Applications until2031.

- Market Size & Forecast of UAE Power Rental Market by Regions until2031.

- Market Drivers and Restraints.

- Market Trends.

- Competitive Landscape.

- Key Strategic Pointers.Markets Covered

Market Covered

The market report has been segmented and sub segmented into the following categories

By Genset Types

- Diesel

- Non-Diesel

By KVA Ratings

- Below 100KVA

- 100.1KVA- 350KVA

- 350.1KVA-750KVA

- 750KVA-1000KVA

- Above 1000KVA

By Applications

- Utilities

- Oil & Gas

- Industrial & Construction

- Quarrying and Mining

- Others

UAE Power Rental Market (2025-2031): FAQs

| Executive Summary |

| 1 Introduction |

| 1.1 Key Highlights of the Report |

| 1.2 Report Description |

| 1.3 Market Scope & Segmentation |

| 1.4 Assumptions and Methodology |

| 2 Middle East Power Rental Market Overview |

| 2.1 Middle East Power Rental Market Revenues |

| 3 UAE Power Rental Market Overview |

| 3.1 UAE Power Rental Market Revenues |

| 3.2 Industry Life Cycle |

| 3.3 Porter's 5 Forces Model |

| 3.4 UAE Power Rental Market Share, By Genset Types |

| 3.5 UAE Power Rental Market Share, By Genset Ratings |

| 4 UAE Power Rental Market Dynamics |

| 4.1 Market Drivers |

| 4.1.1 Increasing demand for temporary power solutions in construction projects |

| 4.1.2 Growing need for backup power solutions in industrial sectors |

| 4.1.3 Expansion of events and entertainment industry driving demand for temporary power services |

| 4.1.1 World Expo 2031 |

| 4.1.2 Increasing Construction Market |

| 4.1.3 Increasing Energy Demand |

| 4.2 Market Restraints |

| 4.2.1 High initial investment costs for power rental equipment |

| 4.2.2 Stringent regulations and environmental concerns impacting operations |

| 4.2.3 Fluctuating fuel prices affecting operational costs |

| 4.2.2 High Rental Cost |

| 5 UAE Power Rental Market Trends |

| 5.1 Growing ICT Industry |

| 5.2 Growing Market for Silent Gensets |

| 5.3 Import of Gensets |

| 5.4 Adoption of Green Gensets |

| 5.5 Fluctuation in Oil Prices |

| 6 UAE Diesel Genset Rental Market Overview |

| 6.1 UAE Diesel Genset Rental Market Revenues |

| 7 UAE Non-Diesel Genset Rental Market Overview |

| 7.1 UAE Non-Diesel Genset Rental Market Revenues |

| 8 UAE Power Rental Application Market Overview |

| 8.1 UAE Power Rental Market Share, By Applications |

| 8.2 Utilities Application Market Revenues |

| 8.3 Oil & Gas Application Market Revenues |

| 8.4 Industrial & Construction Application Market Revenues |

| 8.5 Quarrying and Mining Application Market Revenues |

| 8.6 Other Application Market Revenues |

| 9 UAE Power Rental Regional Market Overview |

| 9.1 UAE Power Rental Market Share, By Regions |

| 9.2 Northern Region Power Rental Market Revenues |

| 9.3 Southern Region Power Rental Market Revenues |

| 10 Power Rental Trends |

| 10.1 Below 100KVA Gensets Average Rental Price Trend |

| 10.2 100.1KVA-350KVA Gensets Average Rental Price Trend |

| 10.3 350.1KVA-750KVA Gensets Average Rental Price Trend |

| 10.4 750.1KVA-1000KVA Gensets Average Rental Price Trend |

| 10.5 Above 1000KVA Gensets Average Rental Price Trend |

| 11 Company Profiles |

| 11.1 Aggreko Middle East Ltd. |

| 11.2 AL-Futtaim Auto & Machinery Company LLC |

| 11.3 AL Masaood Power Engineering |

| 11.4 AL Faris Equipment Rentals |

| 11.5 AL SHOLA Rental Solutions |

| 11.6 Altaaqa Global |

| 11.7 Argonaut Corporation |

| 11.8 A.T. Generators |

| 11.9 Byrne Equipment Rental WLL |

| 11.10 JENGAN EST |

| 11.11 Jubaili Bros. |

| 11.12 Rental Solutions & Services LLC |

| 11.13 SMART Energy Solutions FZCO |

| 11.14 United Gulf Equipment Rentals LLC |

| 12 Key Strategic Pointers |

| 13 Disclaimer |

| List of Figures |

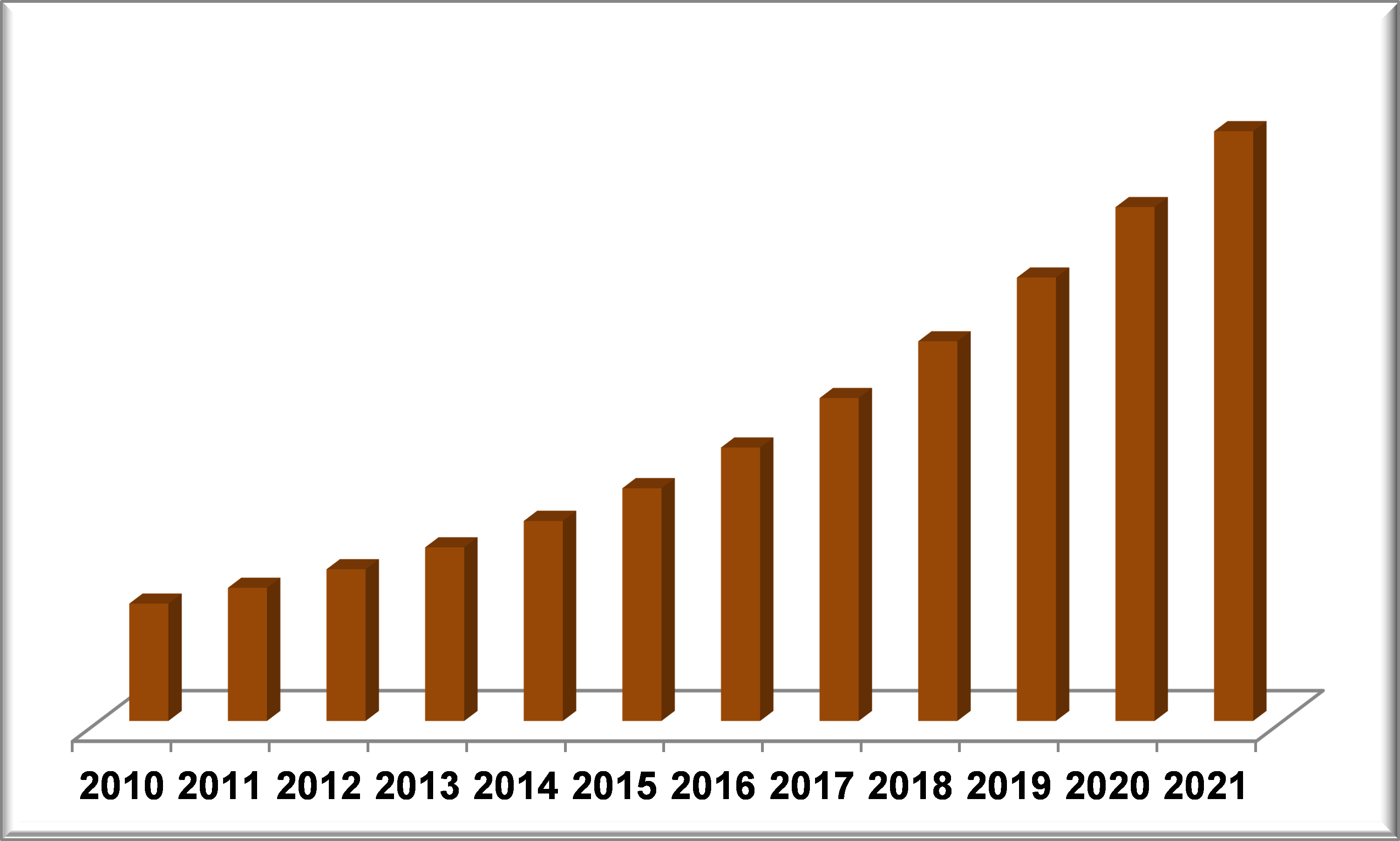

| Figure 1 Middle East Power Rental Market Revenues, 2010-2021 ($ Million) |

| Figure 2 GCC Construction Market Share, By Country, 2013 ($ Billion) |

| Figure 3 UAE Power Rental Market Revenues, 2010 - 2014 ($ Million) |

| Figure 4 UAE Power Rental Market Revenues, 2015 - 2021 ($ Million) |

| Figure 5 UAE Power Rental Market- Industry Life Cycle |

| Figure 6 UAE Power Rental Market- Porters 5 Forces Model |

| Figure 7 UAE Power Rental Market Share, By Revenue, By Genset Types (2014) |

| Figure 8 UAE Power Rental Market Share, By Revenue, By Genset Types (2021) |

| Figure 9 UAE Oil Production, 2009 - 2013 (Thousand Barrels Per Day) |

| Figure 10 UAE Natural Gas Production, 2005 - 2013 (Bcm) |

| Figure 11 UAE Power Rental Market Share, By Revenue, By Genset Ratings (2014) |

| Figure 12 UAE Power Rental Market Share, By Revenue, By Genset Ratings (2021) |

| Figure 13 UAE IT Market Revenues, 2013 - 2021 ($ Billion) |

| Figure 14UAE Power Rental Market Dynamics |

| Figure 15 UAE Construction Industry, 2013-2021 ($ Billion) |

| Figure 16 UAE Announced Project Composition (%) |

| Figure 17 UAE Electricity Production, 2005-2013 (TWh) |

| Figure 18 UAE Power Rental Market Trends |

| Figure 19 UAE ICT Market Revenues, 2011-2020 ($ Billion) |

| Figure 20 Average Brent Spot Crude Oil Price FOB, Jan-Dec 2014 ($ per Barrel) |

| Figure 21 Average Brent Spot Crude Oil Price FOB, 2012-2021 ($ per Barrel |

| Figure 22 UAE Diesel Genset Rental Revenues, 2010 - 2014 ($ Million) |

| Figure 23 UAE Diesel Genset Rental Revenues, 2015 - 2021 ($ Million) |

| Figure 24 UAE Hospitality Sector Revenues, 2012-2021 ($ Billion) |

| Figure 25 UAE Non-Diesel Genset Rental Revenues, 2010 - 2014 ($ Million) |

| Figure 26 UAE Non-Diesel Genset Rental Revenues, 2015 - 2021 ($ Million) |

| Figure 27 UAE Natural Gas Production, 2005-2013 (Bcm) |

| Figure 28 UAE Power Rental Market Share, By Revenue, By Applications (2014) |

| Figure 29 UAE Power Rental Market Share, By Revenue, By Applications (2021) |

| Figure 30 UAE Power Rental Market Revenues, By Utilities Application, 2010 - 2014 ($ Million) |

| Figure 31 UAE Power Rental Market Revenues, By Utilities Application, 2015 - 2021 ($ Million) |

| Figure 32 UAE Primary Energy, By Fuel Type (2013) |

| Figure 33 UAE Primary Energy, By Fuel Type (2013) |

| Figure 34 UAE Power Rental Market Revenues, By Oil & Gas Application, 2010 - 2014 ($ Million) |

| Figure 35 UAE Power Rental Market Revenues, By Oil & Gas Application, 2015 - 2021 ($ Million) |

| Figure 36 GCC Petrochemical Capacity Share, By Country |

| Figure 37 UAE Power Rental Market Revenues, By I & C Application, 2010 - 2014 ($ Million) |

| Figure 38 UAE Power Rental Market Revenues, By I & C Application, 2015 - 2021 ($ Million) |

| Figure 39 UAE Industry Plant By Category (2013) |

| Figure 40 UAE Primary Energy, By Fuel Type (2013) |

| Figure 41 UAE Power Rental Market Revenues, By Q & M Application, 2010 - 2014 ($ Million) |

| Figure 42 UAE Power Rental Market Revenues, By Q & M Application, 2015 - 2021 ($ Million) |

| Figure 43 UAE GDP Split, By Sector (2014) |

| Figure 44 UAE GDP Split, By Sector (2021) |

| Figure 45 UAE Power Rental Market Revenues, By Other Application, 2010 - 2014 ($ Million) |

| Figure 46 UAE Power Rental Market Revenues, By Other Application, 2015 - 2021 ($ Million) |

| Figure 47 UAE Mobile Subscribers, 2005-2013 (Million) |

| Figure 48 UAE Power Rental Market Share, By Revenue, By Region (2014) |

| Figure 49 UAE Power Rental Market Share, By Revenue, By Region (2021) |

| Figure 50 Northern UAE Power Rental Market Revenues, 2010 - 2014 ($ Million) |

| Figure 51 Northern UAE Power Rental Market Revenues, 2015 - 2021 ($ Million) |

| Figure 52 Southern UAE Power Rental Market Revenues, 2010 - 2014 ($ Million) |

| Figure 53 Southern UAE Power Rental Market Revenues, 2015 - 2021 ($ Million) |

| Figure 54 Abu Dhabi Non-Oil Sectors GDP Contribution (2013) |

| Figure 55 Below 100KVA Gensets Average Rental Price Trend, 2014 - 2021 ($) |

| Figure 56 100.1KVA-350KVA Gensets Average Rental Price Trend, 2014 - 2021 ($) |

| Figure 57 350.1KVA -750 KVA Gensets Average Rental Price Trend, 2014 - 2021 ($) |

| Figure 58 750.1KVA-1000KVA Gensets Average Rental Price Trend, 2014 - 2021 ($) |

| Figure 59 Above 1000KVA Gensets Average Rental Price Trend, 2014 - 2021 ($) |

| List of Tables |

| Table 1 UAE Major Infrastructure Projects |

| Table 2 UAE Power Rental Market Revenues, By KVA Ratings, 2010-2014 ($ Million) |

| Table 3 UAE Power Rental Market Revenues, By KVA Ratings, 2015-2021 ($ Million) |

UAE is one of the key contributing countries in Middle-East Power Rental Market. With increasing energy demand and growing infrastructure on account of World Expo 2020, power rental market in UAE is projected to grow at a CAGR of 16.8% during 2015-21. The gensets would primarily be used as continuous and back-up power source in UAE market for powering both public and private infrastructure.

In the country, the market is primarily driven by diesel genset rental market. Availability of diesel gensets, ease of storing diesel in the storage tanks and convenient to deploy in remote locations have driven diesel genset rental market in the country. Aggreko Middle East Ltd., AL-Futtaim Auto & Machinery Company LLC, AL Masaood Power Engineering, AL Faris Equipment Rentals, AL SHOLA Rental Solutions, Altaaqa Global, Argonaut Corporation, A.T. Generators, Byrne Equipment Rental WLL, JENGAN EST, Jubaili Bros., Rental Solutions & Services LLC, SMART Energy Solutions FZCO and United Gulf Equipment Rentals LLC.

The share of non-diesel genset rental market is miniscule when compared with the share of diesel genset rental market in the country. In non-diesel genset rental market, gas based gensets have accounted for majority of the market revenues. UAE, being natural gas rich country would exhibit higher growth for gas powered gensets than diesel powered gensets in the forecast period.

“UAE Power Rental Market (2015-2021)” report estimates and forecast overall Qatar power rental market by revenue, by generator types such as diesel and non-diesel generators. Market by KVA ratings- Below 100 KVA, 100.1 KVA- 350 KVA, 350.1 KVA-750 KVA, 750 KVA-1000 KVA and Above 1000 KVA. By applications such as utilities, oil & gas, industrial & construction, quarrying and Mining and others and by regions such as north and south. The report also gives the insights on competitive landscape, market trends, rental trends, company profiles, market drivers and restraints.

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero