UAE Power Tools Market (2018-2024) | Forecast, Value, Trends, Share, Outlook, Companies, Size, Analysis, Growth, Industry & Revenue

Market Forecast By Technology (Electric Power Tool and Pneumatic Power Tool), By Tool Types (Metal Segment, Concrete Segment, Wood Working Segment and Others), By Verticals (Construction, Automotive, Manufacturing and Others), By Regions (Northern and Southern) and Competitive Landscape

| Product Code: ETC000473 | Publication Date: Dec 2021 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 100 | No. of Figures: 42 | No. of Tables: 5 |

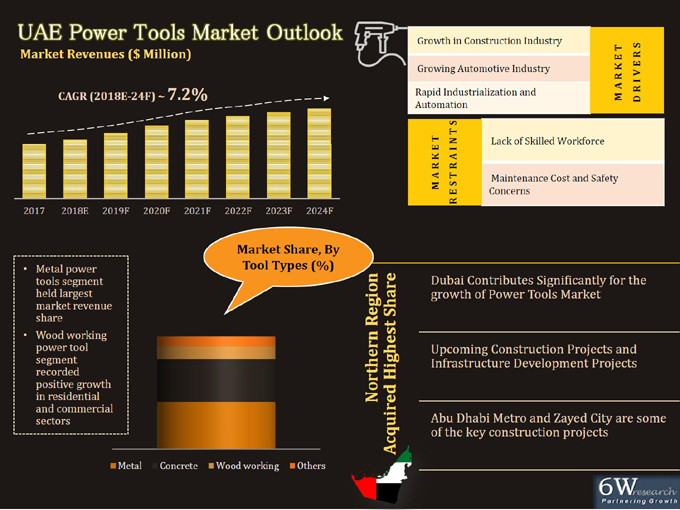

Increasing construction projects, rise in the sale of vehicles, and growing urbanization buoyed the overall growth in the power tools market of UAE. International events, particularly, World Expo 2020 in Dubai and developmental plans by the UAE government such as UAE Vision 2021, Abu Dubai Vision 2030, would result in growth in the construction sector especially, in retail and hospitality sectors; posting positive demand for power tools in UAE over the coming years. The electric tool segment generated the majority of the market revenues due to its utilization in the industrial, manufacturing, and residential sectors as well.

According to 6Wresearch, the UAE power tool market size is projected to reach over $163 million by 2024. The market registered healthy growth in revenues during 2014-17, owing to a surge in demand for metal and concrete segment power tools. Drilling cordless tools with lithium-ion batteries under the metal segment tool type are majorly in demand due to its deployment in the residential sector along with construction and automation sectors.

Abu Dhabi Vision 2030 affect the growth of the construction market and boost the power tools over the coming years. 2018-24 UAE power tool market attributed increasing construction market as well as governmental spending on infrastructure development projects.

In UAE, the Northern region held the majority of the UAE power tools market share on the back of increasing construction activities in Dubai due to World Expo 2020, increasing vehicle sales, and urbanization. The southern region is expected to register healthy growth during the forecast period 2018-24 due to an increase in infrastructural and railway projects in Abu Dhabi.

The UAE power tools market report thoroughly covers the market of power tools by tool type, technology type, verticals, and regions. The UAE power tools market outlook report provides an unbiased and detailed analysis of the UAE power tools market trends, opportunities/high growth areas, market drivers, which would help stakeholders to device and align market strategies according to the current and future market dynamics. UAE power tools market is the mark as the healthy growth due to this increase in the construction market as well as there are many projects is running government also spending in the infrastructure. Coming years there is a lot of key factor such as increase in the automotive sector, commercial and residential sector, development with the power tool. Power tool market working on the many factors for increasing infrastructure.

UAE power tools market is anticipated to gain traction in the upcoming six years on the back of the increasing use of the product in the residential sector at times of renovation process especially. Additionally, the emerging growth of the hospitality sector with the growing tourist influx every year along with rising domestic population base in the country, has led to demand for retrofitting coupled with infrastructure development of the hotels or restaurants is likely to institute the demand for power tools during construction and this is estimated to act as a catalyst for the growth of the UAE power tools market in the upcoming six years.

Key Highlights of the Report:

• UAE Power Tools Market Overview

• UAE Power Tools Market Outlook

• UAE Power Tools Market Forecast

• Historical Data of Global Power Tools Market for the Period 2014-2017

• Market Size & Forecast of Global Power Tools Market until 2024

• Historical Data of UAE Power Tools Market for the Period 2014-2017

• UAE Power Tools Market Size and UAE Power Tools Market Forecast of Revenues, until 2024

• Historical Data of UAE Power Tools Market Revenues - By Tools Types for the Period, 2014-2017

• Market Size & Forecast of UAE Power Tools Market Revenues - By Tools Types, until 2024

• Historical Data of UAE Power Tools Market Revenues - By Technology Types 2014-2017

• Market Size & Forecast of UAE Power Tools Market Revenues- By Technology Types until 2024

• Historical Data of UAE Power Tools Market Revenues- By Verticals for the Period 2014-2017

• Market Size & Forecast of UAE Power Tools Market Revenues - By Verticals until 2024

• Historical Data of UAE Power Tools Market Revenues - By Regions for the period 2014-2017

• Market Size & Forecast of UAE Power Tools Market Revenues - By Regions until 2024

• Market Drivers and Restraints

• UAE Power Tools Market Trends

• UAE Power Tools Market Share, By Players

• UAE Power Tools Market Overview on Competitive Benchmarking

• Recommendations

Markets Covered:

The UAE Power Tools Market report provides a detailed analysis of the following market segments:

• By Technology:

o Electric Power Tool

o Pneumatic Power Tool

• By Tool Types:

o Metal Segment

o Concrete Segment

o Wood Working Segment

o Others

• By Verticals:

o Construction

o Automotive

o Manufacturing

o Others

• By Regions:

o Northern

o Southern

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary

2 Introduction

2.1 Key Highlights of the Report

2.2 Report Description

2.3 Market Scope & Segmentation

2.4 Research Methodology

2.5 Assumptions

3 Global Power Tool Market Overview

3.1 Global Power Tool Market Revenues (2014-24F)

3.1 Global Power Tool Market

3.2 Global Power Tool Market Revenue Share - By Region (2017)

4 UAE Power Tool Market Overview

4.1 Overview & Analysis

4.2 UAE Power Tool Market Revenues & Volume (2014-24F)

4.3 UAE Power Tool Market, Industry Life Cycle

4.4 UAE Power Tool Market, Value Chain Analysis

4.5 UAE Power Tool Market, Porters Five Forces

4.6 UAE Power Tool Market Revenue Share, By Technology Types (2017 & 2024F)

4.7 UAE Power Tool Market Revenue Share, By Tools Type (2017 & 2024F)

4.8 UAE Power Tool Market Revenue Share, By Verticals (2017 & 2024F)

4.9 UAE Power Tool Market Revenue Share, By Regions (2017 & 2024F)

5 UAE Power Tool Market Dynamics

5.1 Impact Analysis

5.2 Market Drivers

5.3 Market Restraints

6 UAE Power Tool Market Trends

7 UAE Power Tool Market Overview, By Tools Type

7.1 Overview & Analysis

7.2 UAE Metal Segment Power Tool Market Revenues & Volume (2014-24F)

7.3 UAE Concrete Segment Power Tool Market Revenue & Volume (2014-24F)

7.4 UAE Woodworking segment Tool Market Revenues & Volume (2014-24F)

7.5 UAE Other Power Tool Market Revenues &Volume (2014-24F)

7.6 UAE Power Tool Market, Opportunity Matrix, By Tools Types (2024F)

8 UAE Power Tool Market Overview, By Technology Type

8.1 Overview & Analysis

8.2 UAE Electric and Pneumatic Power Tool Market Revenues (2014-24F)

8.3 UAE Power Tool Market, Opportunity Matrix, By Technology Types (2024F)

9 UAE Power Tool Vertical Market Overview

9.1 UAE Construction Vertical Power Tool Market Revenues (2014-24F)

9.2 UAE Manufacturing Industry Vertical Power Tool Market Revenues (2014-24F)

9.3 UAE Automotive Industry Vertical Power Tool Market Revenues (2014-24F)

9.4 UAE Other Verticals Power Tool Market Revenues (2014-24F)

9.5 UAE Power Tool Market, Opportunity Matrix, By Vertical (2024F)

10 UAE Power Tool Regional Market Overview

10.1 UAE Regional Power Tool Market

10.2 UAE Northern and Southern Regional Power Tool Market Revenues (2014-24F)

11 Competitive Landscape

11.1 UAE Power Tool Market Revenues Share, By Companies (2017)

11.2 Competitive Benchmarking, By Operating Parameters

12 Company Profiles

12.1 Robert Bosch Middle East

12.2 Hitachi Sales Middle East FZE

12.3 Makita Gulf FZE

12.4 Atlas Copco Services Middle East

12.5 Hilti Emirates LLC

12.6 Black and Decker GMBH

12.7 Techtronic Industries FZCO

12.8 Metabo Middle East

13 Recommendations

14 Disclaimer

List of Figures

1. Global Power Tools Market Revenues, 2014-2024F ($ Billion)

2. Global Sale of New Vehicles (all type), 2014-2017 (Thousand Units)

3. Global Power Tools Market Revenue Share, By Regions (2016)

4. UAE Power Tools Market Revenues, 2014-2024F ($ Million)

5. UAE Power Tools Market Volume, 2014-2024F (Thousand units)

6. UAE Power Tools Market Revenue Share, By Technology Types (2017 & 2024F)

7. UAE Power Tools Market Revenue Share, By Tools Types (2017 & 2024F)

8. UAE Power Tools Market Revenue Share, By Verticals (2017)

9. UAE Power Tools Market Revenue Share, By Regions (2017 & 2024F)

10. UAE Residential supply, 2014-2019F (Thousand Units)

11. UAE Sale of new vehicles (all type), 2014-2016 (Thousand Units)

12. UAE Power Tools Market Revenues- By Metal Type, 2014-2024F ($ Million)

13. UAE Power Tools Market Volume- By Metal Type, 2014-2024F (Thousand Units)

14. UAE Power Tools Market Revenues- By Concrete Type, 2014-2024F ($ Million)

15. UAE Power Tools Market Volume- By Concrete Type, 2014-2024F (Thousand Units)

16. UAE Power Tools Market Revenues- By Woodworking Type, 2014-24F ($ Million)

17. UAE Power Tools Market Volume- By Woodworking Type, 2014-24F (Thousand Units)

18. UAE Other Segment Power Tools Revenues, 2014-2024F ($ Million)

19. UAE Other Segment Power Tools Volume, 2014-2024F (Thousand Units)

20. UAE Power Tools Market Opportunity Matrix, By Tools Type (2017)

21. UAE Power Tools Market Revenue Share, By Technology Types, 2017 & 2024F (Percentage)

22. UAE Electric Power Tools Market Revenues, 2014-2024F ($ Million)

23. UAE Pneumatic Power Tools Market Revenues, 2014-2024F ($ Million)

24: UAE Power Tools Market Opportunity Matrix, By Technology Type (2017)

25. UAE Construction Power Tools Market Revenues, 2014-2024F ($ Million)

26. UAE Construction Market Revenue, 2011-2019F ($ Billion)

27. Residential Supply in UAE, 2014-2019F (Thousand Units)

28. UAE Number of Retail Units in Key cities, 2013-2018E (Million sq. m)

29. UAE Number of a commercial office in Key cities, 2013-2018E (Million sq. m)

30. UAE Construction Market Breakdown, By status (2018)

31. UAE Manufacturing Market Revenues, 2014-2024F ($ Million)

32. UAE Automotive Market Revenues, 2014-24F ($ Million)

33. UAE Sale of new vehicles, By Types, 2005-2017 (Thousand Units)

34. UAE Other Power Tools Market Revenues, 2014-2024F ($ Million)

35. UAE Fleet Size Statistics, 2011-2017

36. UAE Power Tools Market Opportunity Matrix, By Verticals (2017)

37. UAE Northern Region Power Tools Market Revenue Share, 2017 (Percentage)

38. UAE Southern Region Power Tools Market Revenue Share, 2017 (Percentage)

39. UAE Northern Region Power Tools Market Revenues, 2014-2024F ($ Million)

40. UAE Southern Region Power Tools Market Revenues, 2014-2024F ($ Million)

41. UAE Power Tools Market Revenue, By Companies, 2017 ($ Million )

42. UAE Power Tools Market Revenue Share, By Companies (2017)

List of Tables

1. List of Residential High-rise Building Construction Projects in UAE

2. List of Commercial High-rise Building Construction Projects in UAE

3. Upcoming construction projects in Dubai

4. Upcoming construction projects in Abu Dhabi

5. Upcoming construction projects in Sharjah

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

- Kenya Road Stabilization Equipment Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- North America Sodium chloride Market (2025-2031) | Analysis, Revenue, Forecast, Trends, Companies, Size, Growth, Share, Industry, Outlook & Value

- North America Vinyl Flooring Market (2025-2031) | Value, Growth,Size, Analysis, Revenue, Industry, Forecast, Share, Outlook, Companies & Trends

- Tajikistan Thermal Camera Market (2025-2031) | Trends, Size, Growth, Share, Industry, Companies, Value, Analysis, Revenue, Forecast & Outlook

- Singapore Professional AV Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- Saudi Arabia Genset Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- India OOH Advertising Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- Vietnam Twisted Pair Cables Market (2024-2030) | Size & Revenue, Forecast, Share, Companies, Competitive Landscape, Analysis, Trends, Value, Segmentation, Outlook, Industry, Growth

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero