UAE Fire Safety Systems and Equipment Market (2015-2021) | Industry, Share, Trends, Revenue, Outlook, Analysis, Companies, Size, Value, Growth & Forecast

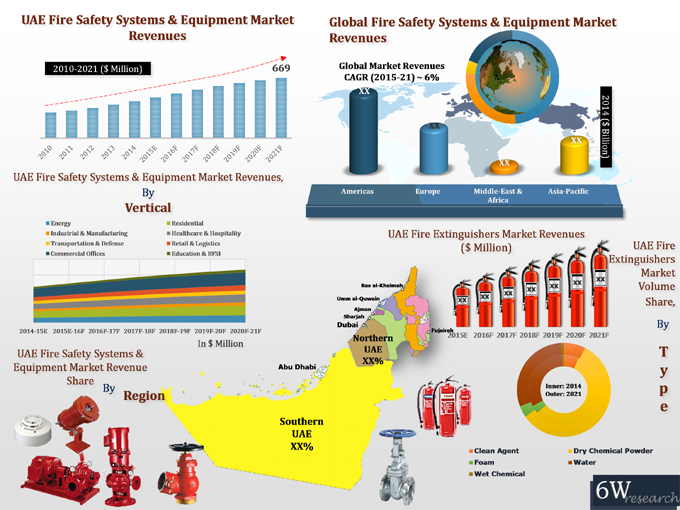

Market Forecast by Fire Protection Systems & Equipment (Fire Extinguishers, Fire Suppression Systems and Fire Pumps & Controllers), Fire Detection Systems & Equipment (Smoke Detectors, Heat Detectors, Flame Detectors, Gas Detectors and Emergency Lighting & Alarm Systems), Others (Bladder Tanks, Valves & Risers, Backpack/ Portable Fire Safety Equipment, Fire Cabinets, CAF Systems and Fire Sprinklers), Fire Extinguishers (Clean Agent Fire Extinguishers, Dry Chemical Fire Extinguishers, Foam Fire Extinguishers, Water Fire Extinguishers and Wet Chemical Fire Extinguishers), Verticals (Energy (Oil & Gas and Power Utilities), Residential, Industrial & Manufacturing, Healthcare & Hospitality, Transportation & Defense, Retail & Logistics, Commercial Offices and Education & BFSI) and Regions (Northern and Southern UAE)

| Product Code: ETC131543 | Publication Date: Jan 2016 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 183 | No. of Figures: 148 | No. of Tables: 38 |

UAE fire safety systems & equipment market can be broadly categorized into- Fire safety systems & equipment market types include fire protection systems & equipment (fire extinguishers, fire suppression systems, fire pumps, and fire pumps & controllers), fire detection systems & equipment (smoke detectors, heat detectors, flame detectors, gas detectors and emergency lighting & alarm systems) and others (bladder tanks, valves & risers, backpack/ portable fire safety equipment, fire cabinets, CAF systems, and fire sprinklers.

According to 6Wresearch, the UAE fire safety systems & equipment market is projected to reach nearly $669 million by 2021. The growing construction market (upcoming World Expo in 2020 is expected to spur growth in hospitality & healthcare, transportation, and industrial verticals over the next six years) has escalated the market of fire safety systems & equipment in UAE. Although, presently commercial offices and residential verticals accounted highest market revenue share.

In the overall fire safety systems & equipment market, the fire protection segment recorded the majority of the revenues, whereas the fire suppression systems sub-segment held the majority of the revenue share. In the fire detection systems & equipment segment, the smoke detectors sub-segment accounted for the highest share, followed by heat detectors and others

The report thoroughly covers the market by fire safety systems & equipment types, sub-types, by verticals, by regions, and competitive landscape. The report provides unbiased and detailed analysis of the on-going trends, opportunities/ high growth areas, market drivers, which would help stakeholders to device and align market strategies according to the current and future market dynamics.

Key Highlights of the Report:

• Historical data of Global Fire Safety Systems & Equipment Market for the Period 2010-2014

• Market Size & Forecast of Global Fire Safety Systems & Equipment Market until 2021

• Historical data of UAE Fire Safety Systems & Equipment Market Revenue & Volume for the Period 2010-2014

• Market Size & Forecast of UAE Fire Safety Systems & Equipment Revenue & Volume Market until 2021

• Historical data of UAE Fire Protection Systems & Equipment Market Revenue & Volume for the Period 2010-2014

• Market Size & Forecast of UAE Fire Protection Systems & Equipment Market Revenue & Volume until 2021

• Historical data of UAE Fire Protection Systems & Equipment Market Revenue & Volume By Type for the Period 2010-2014

• Market Size & Forecast of UAE Fire Protection Systems & Equipment Market Revenue & Volume By Type until 2021

• Historical data of UAE Fire Detection Systems & Equipment Market Revenue & Volume for the Period 2010-2014

• Market Size & Forecast of UAE Fire Detection Systems & Equipment Market Revenue & Volume until 2021

• Historical data of UAE Fire Detection Systems & Equipment Market Revenue & Volume By Type for the Period

2010-2014

• Market Size & Forecast of UAE Fire Detection Systems & Equipment Market Revenue & Volume By Type until 2021

• Historical data of UAE Fire Extinguishers Market Revenue & Volume By Type for the Period 2010-2014

• Market Size & Forecast of UAE Fire Extinguishers Market Revenue & Volume By Type until 2021

• Historical data of UAE Fire Safety Systems Equipment Vertical Market Revenue for the Period 2010-2014

• Market Size & Forecast of UAE Fire Safety Systems Equipment Vertical Market Revenue until 2021

• Historical data of UAE Fire Safety Systems Equipment Regional Market Revenue for the Period 2010-2014

• Market Size & Forecast of UAE Fire Safety Systems Equipment Regional Market Revenue until 2021

• Market Drivers and Restraints

• Market Trends

• Competitive Benchmarking

• Players Market Share

• Company Profiles

• Key Strategic Pointers

Markets Covered

The report provides a detailed analysis of the following market segments:

• Fire Protection Systems & Equipment

o Fire Extinguishers

o Fire Suppression Systems

o Fire Pumps & Controllers

• Fire Detection Systems & Equipment

o Smoke Detectors

o Heat Detectors

o Flame Detectors

o Gas Detectors

o Emergency Lighting & Alarm Systems

• Others

o Bladder Tanks

o Valves & Risers

o Backpack/ Portable Fire Safety Equipment

o Fire Cabinets

o CAF Systems

o Fire Sprinklers

• Fire Extinguishers

o Clean Agent Fire Extinguishers

o Dry Chemical Fire Extinguishers

o Foam Fire Extinguishers

o Water Fire Extinguishers

o Wet Chemical Fire Extinguishers

• Verticals

o Energy (Oil & Gas and Power Utilities)

o Residential

o Industrial & Manufacturing

o Healthcare & Hospitality

o Transportation & Defense

o Retail & Logistics

o Commercial Offices

o Education & BFSI

• Regions

o Northern UAE (Ajman, Dubai, Fujairah, Ras al-Khaimah, Sharjah, and Umm al- Quwain)

o Southern UAE (Abu Dhabi)

Frequently Asked Questions About the Market Study (FAQs):

TABLE OF CONTENTS

1 Executive Summary

2 Introduction

2.1 Key Highlights of the Report

2.2 Report Description

2.3 Market Scope & Segmentation

2.4 Assumptions & Methodology

3 Global Fire Safety Systems & Equipment Market Overview

3.1 Global Fire Safety Systems & Equipment Market Revenues (2010-2021F)

3.2 Global Fire Safety Systems & Equipment Market Volume (2010-2021F)

3.3 Global Fire Safety Systems & Equipment Market Revenue Share, By Region (2014)

4 UAE Fire Safety Systems & Equipment Market Overview

4.1 UAE Fire Safety Systems & Equipment Market Revenues (2010-2021F)

4.2 UAE Fire Safety Systems & Equipment Market Volume (2010-2021F)

4.3 Industry Life Cycle

4.4 Porter's Five Forces Model

5 UAE Fire Safety Systems & Equipment Market Dynamics

5.1 Market Drivers

5.2 Market Restraints

6 UAE Fire Safety Systems & Equipment Market Trends and Opportunities

7 UAE Fire Safety Systems & Equipment Market Price Point Analysis

8 UAE Fire Safety Systems & Equipment Market Overview

8.1 UAE Fire Protection Systems & Equipment Market Revenues (2010-2021F)

8.2 UAE Fire Protection Systems & Equipment Market Volume (2010-2021F)

8.3 UAE Fire Detection Systems & Equipment Market Revenues (2010-2021F)

8.4 UAE Fire Detection Systems & Equipment Market Volume (2010-2021F)

8.5 Other UAE Fire Safety Systems & Equipment Market Revenues (2010-2021F)

8.6 Other UAE Fire Safety Systems & Equipment Market Volume (2010-2021F)

9 UAE Fire Protection Systems & Equipment Market Overview

9.1 UAE Fire Extinguisher Market Revenues (2010-2021F)

9.2 UAE Fire Extinguisher Market Volume (2010-2021F)

9.3 UAE Fire Suppression Systems Market Revenues (2010-2021F)

9.4 UAE Fire Pumps & Controllers Market Revenues & Volume (2010-2021F)

10 UAE Fire Detection Systems & Equipment Market Overview

10.1 UAE Smoke Detectors Market Revenues (2010-2021F)

10.2 UAE Smoke Detectors Market Volume (2010-2021F)

10.3 UAE Heat Detectors Market Revenues (2010-2021F)

10.4 UAE Heat Detectors Market Volume (2010-2021F)

10.5 UAE Flame Detectors Market Revenues (2010-2021F)

10.6 UAE Flame Detectors Market Volume (2010-2021F)

10.7 UAE Gas Detectors Market Revenues (2010-2021F)

10.8 UAE Gas Detectors Market Volume (2010-2021F)

10.9 UAE Emergency Lighting & Alarm Systems Market Revenues (2010-2021F)

10.10 UAE Emergency Lighting & Alarm Systems Market Volume (2010-2021F)

11 Other UAE Fire Safety Systems & Equipment Market Overview

11.1 UAE Bladder Tanks Fire Safety Equipment Market Revenues & Volume (2010-2021F)

11.2 UAE Valves & Risers Fire Safety Equipment Market Revenues & Volume (2010-2021F)

11.3 UAE BackPack Fire Safety Equipment Market Revenues & Volume (2010-2021F)

11.4 UAE Fire Cabinet Safety Equipment Market Revenues & Volume (2010-2021F)

11.5 UAE CAF Fire Safety Systems Market Revenues & Volume (2010-2021F)

11.5.1 UAE CAF Fire Safety Systems Market Revenue & Volume Share, By Type (2014 & 2021F)

11.6 UAE Fire Sprinklers Safety Equipment Market Revenues & Volume (2010-2021F)

12 UAE Fire Extinguisher Market Overview, By Type

12.1 UAE Clean Agent Fire Extinguisher Market Revenues (2010-2021F)

12.1.1 UAE Clean Agent Fire Extinguisher Market Revenue Share, By Chemical Type {2014 & 2021F (CO2, FE-36, FE-25, FE-13, FE-227, HCFC-123, Halon-1301, Halon-1211 & Halon-2402)}

12.1.2 UAE Clean Agent Fire Extinguisher Market Revenue Share, By Structure Type (2014 & 2021F)

12.2 UAE Clean Agent Fire Extinguisher Market Volume (2010-2021F)

12.2.1 UAE Clean Agent Fire Extinguisher Market Volume Share, By Structure Type (2014 & 2021F)

12.3 UAE Dry Chemical Powder Fire Extinguisher Market Revenues (2010-2021F)

12.3.1 UAE Dry Chemical Powder Fire Extinguisher Market Revenue Share, By Chemical Type {2014 & 2021F (Monoammonium Phosphate, Sodium Bicarbonate, Potassium Bicarbonate & Sodium Chloride)}

12.3.2 UAE Dry Chemical Powder Fire Extinguisher Market Revenue Share, By Structure Type (2014 & 2021F)

12.4 UAE Dry Chemical Powder Fire Extinguisher Market Volume (2010-2021F)

12.4.1 UAE Dry Chemical Powder Fire Extinguisher Market Volume Share, By Structure Type (2014 & 2021F)

12.5 UAE Foam Fire Extinguisher Market Revenues (2010-2021F)

12.5.1 UAE Foam Fire Extinguisher Market Revenue Share, By Foam Type {2014 & 2021F (AFFF, AR-AFFF, Standard Fluoroprotein, FFFP and AR-FFFP)}

12.5.2 UAE Foam Fire Extinguisher Market Revenue Share, By Structure Type (2014 & 2021F)

12.6 UAE Foam Fire Extinguisher Market Volume (2010-2021F)

12.6.1 UAE Foam Fire Extinguisher Market Volume Share, By Structure Type (2014 & 2021F)

12.7 UAE Water Fire Extinguisher Market Revenues (2010-2021F)

12.7.1 UAE Water Fire Extinguisher Market Revenue Share, By Structure Type (2014 & 2021F)

12.8 UAE Water Fire Extinguisher Market Volume (2010-2021F)

12.8.1 UAE Water Fire Extinguisher Market Volume Share, By Structure Type (2014 & 2021F)

12.9 UAE Wet Chemical Fire Extinguisher Market Revenues (2010-2021F)

12.9.1 UAE Wet Chemical Fire Extinguisher Market Revenue Share, By Structure Type (2014 & 2021F)

12.10 UAE Wet Chemical Fire Extinguisher Market Volume (2010-2021F)

12.10.1 UAE Wet Chemical Fire Extinguisher Market Volume Share, By Structure Type (2014 & 2021F)

12.11 UAE Fire Extinguisher Market Price Point Analysis, By Types

13 UAE Fire Safety Systems & Equipment Vertical Market Overview

13.1 UAE Energy Fire Safety Systems & Equipment Market Revenues (2010-2021F)

13.2 UAE Residential Fire Safety Systems & Equipment Market Revenues (2010-2021F)

13.3 UAE Industrial & Manufacturing Fire Safety Systems & Equipment Market Revenues (2010-2021F)

13.4 UAE Healthcare & Hospitality Fire Safety Systems & Equipment Market Revenues (2010-2021F)

13.5 UAE Transportation & Defense Fire Safety Systems & Equipment Market Revenues (2010-2021F)

13.6 UAE Retail & Logistics Fire Safety Systems & Equipment Market Revenues (2010-2021F)

13.8 UAE Commercial Offices Fire Safety Systems & Equipment Market Revenues (2010-2021F)

13.9 UAE Education & BFSI Fire Safety Systems & Equipment Market Revenues (2010-2021F)

14 UAE Fire Safety Systems & Equipment Region Market Overview

14.1 Northern UAE Fire Safety Systems & Equipment Market Revenues (2010-2021F)

14.2 Southern UAE Fire Safety Systems & Equipment Market Revenues (2010-2021F)

15 Competitive Landscape

15.1 Competitive Benchmarking, By Technology

15.2 UAE Fire Safety Systems & Equipment Market Revenue Share, By Company

16 Company Profiles

16.1 Bristol Fire Engineering LLC

16.2 Dafoos Group

16.3 EI du Pont de Nemours and Co.

16.4 Emirates Fire Fighting Equipment Factory L.L.C.

16.5 Honeywell International Inc.

16.6 National Fire Fighting Manufacturing FZCO

16.7 New Age Company LLC

16.8 Tyco Fire & Security UAE LLC

16.9 Unisafe Fire Protection Specialists LLC

16.10 UTC Fire & Security

16.11 Viking Arabia FZE

17 Key Strategic Pointers

18 Disclaimer

List of Figures

Figure 1 Global Fire Safety Systems & Equipment Market Revenues, 2010-2014 ($ Billion)

Figure 2 Global Fire Safety Systems & Equipment Market Revenues, 2015E-2021F ($ Billion)

Figure 3 Global Fire Safety Systems & Equipment Market Volume, 2010-2021F (Million Units)

Figure 4 Global Fire Safety Systems & Equipment Market Revenue Share, By Region 2014

Figure 5 UAE Fire Safety Systems & Equipment Market Revenues, 2010-2014 ($ Million)

Figure 6 UAE Fire Safety Systems & Equipment Market Revenues, 2015E-2021F ($ Million)

Figure 7 UAE Fire Safety Systems & Equipment Market Volume, 2010-2014 (Thousand Units)

Figure 8 UAE Fire Safety Systems & Equipment Market Volume, 2015E-2021F (Thousand Units)

Figure 9 UAE Fire Safety Systems & Equipment Industry Life Cycle

Figure 10 UAE Construction Market 2013- 2021F ($ Billion)

Figure 11 UAE Announced Project Composition, 2014 (%)

Figure 12 UAE Building Automation and Control Market Revenues, 2010-2021F ($ Billion)

Figure 13 UAE Building Automation and Control Market Revenue Share, By Type (2014)

Figure 14 UAE Fire Protection Systems Price Trend, 2010-2021F ($ Per Unit)

Figure 15 UAE Fire Detection Systems Price Trend, 2010-2021F ($ Per Unit)

Figure 16 Other UAE Fire Safety Systems Price Trend, 2010-2021F ($ Per Unit)

Figure 17 UAE Fire Protection Systems & Equipment Market Revenues, 2010-2014 ($ Million)

Figure 18 UAE Fire Protection Systems & Equipment Market Revenues, 2015E-2021F ($ Million)

Figure 19 UAE Fire Protection Systems & Equipment Market Volume, 2010-2014 (Thousand Units)

Figure 20 UAE Fire Protection Systems & Equipment Market Volume, 2015E-2021F (Thousand Units)

Figure 21 UAE Fire Detection Systems & Equipment Market Revenues, 2010-2014 ($ Million)

Figure 22 UAE Fire Detection Systems & Equipment Market Revenues, 2015E-2021F ($ Million)

Figure 23 UAE Fire Detection Systems & Equipment Market Volume, 2010-2014 (Thousand Units)

Figure 24 UAE Fire Detection Systems & Equipment Market Volume, 2015E-2021F (Thousand Units)

Figure 25 Other UAE Fire Safety Systems & Equipment Market Revenues, 2010-2014 ($ Million)

Figure 26 Other UAE Fire Safety Systems & Equipment Market Revenues, 2015E-2021F ($ Million)

Figure 27 Other UAE Fire Safety Systems & Equipment Market Volume, 2010-2014 (Thousand Units)

Figure 28 Other UAE Fire Safety Systems & Equipment Market Volume, 2015E-2021F (Thousand Units)

Figure 29 UAE Fire Extinguisher Market Revenues, 2010-2014 ($ Million)

Figure 30 UAE Fire Extinguisher Market Revenues, 2015E-2021F ($ Million)

Figure 31 UAE Fire Extinguisher Market Volume, 2010-2014 (Thousand Units)

Figure 32 UAE Fire Extinguisher Market Volume, 2015E-2021F (Thousand Units)

Figure 33 UAE Fire Suppression Systems Market Revenues, 2010-2014 ($ Million)

Figure 34 UAE Fire Suppression Systems Market Revenues, 2015E-2021F ($ Million)

Figure 35 UAE Fire Pumps & Controllers Market Revenues, 2010-2014 ($ Million)

Figure 36 UAE Fire Pumps & Controllers Market Revenues, 2015E-2021F ($ Million)

Figure 37 UAE Fire Pumps & Controllers Market Volume, 2010-2014 ($ Million)

Figure 38 UAE Fire Pumps & Controllers Market Volume, 2015E-2021F ($ Million)

Figure 39 UAE Smoke Detectors Market Revenues, 2010-2014 ($ Million)

Figure 40 UAE Smoke Detectors Market Revenues, 2015E-2021F ($ Million)

Figure 41 UAE Smoke Detectors Market Revenue Share, 2014 & 2021F

Figure 42 UAE Smoke Detectors Market Volume, 2010-2014 (Thousand Units)

Figure 43 UAE Smoke Detectors Market Volume, 2015E-2021F (Thousand Units)

Figure 44 UAE Smoke Detectors Market Volume Share, 2014 & 2021F

Figure 45 UAE Heat Detectors Market Revenues, 2010-2014 ($ Million)

Figure 46 UAE Heat Detectors Market Revenues Market Revenues, 2015E-2021F ($ Million)

Figure 47 UAE Heat Detectors Market Revenue Share, 2014 & 2021F

Figure 48 UAE Heat Detectors Market Volume, 2010-2014 (Thousand Units)

Figure 49 UAE Heat Detectors Market Volume, 2015E-2021F (Thousand Units)

Figure 50 UAE Heat Detectors Market Volume Share, 2014 & 2021F

Figure 51 UAE Flame Detectors Market Revenues, 2010-2014 ($ Million)

Figure 52 UAE Flame Detectors Market Revenues, 2015E-2021F ($ Million)

Figure 53 UAE Flame Detectors Market Revenue Share, 2014 & 2021F

Figure 54 UAE Flame Detectors Market Volume, 2010-2014 (Thousand Units)

Figure 55 UAE Flame Detectors Market Volume, 2015E-2021F (Thousand Units)

Figure 56 UAE Flame Detectors Market Volume Share, 2014 & 2021F

Figure 57 UAE Gas Detectors Market Revenues, 2010-2014 ($ Million)

Figure 58 UAE Gas Detectors Market Revenues, 2015E-2021F ($ Million)

Figure 59 UAE Gas Detectors Market Revenue Share, 2014 & 2021F

Figure 60 UAE Gas Detectors Market Volume, 2010-2014 (Thousand Units)

Figure 61 UAE Gas Detectors Market Volume, 2015E-2021F (Thousand Units)

Figure 62 UAE Gas Detectors Market Volume Share, 2014 & 2021F

Figure 63 UAE Emergency Lighting & Alarm Systems Market Revenues, 2010-2014 ($ Million)

Figure 64 UAE Emergency Lighting & Alarm Systems Market Revenues, 2015E-2021F ($ Million)

Figure 65 UAE Emergency Lighting & Alarm Systems Market Revenue Share, 2014 & 2021F

Figure 66 UAE Emergency Lighting & Alarm Systems Market Volume, 2010-2014 (Thousand Units)

Figure 67 UAE Emergency Lighting & Alarm Systems Market Volume, 2015E-2021F (Thousand Units)

Figure 68 UAE Emergency Lighting & Alarm Systems Market Volume Share, 2014 & 2021F

Figure 69 UAE Bladder Tanks Fire Safety Equipment Market Revenues & Volume, 2010-2014 ($ Million & Thousand Units)

Figure 70 UAE Bladder Tanks Fire Safety Equipment Market Revenues & Volume, 2015E-2021F ($ Million & Thousand Units)

Figure 71 UAE Bladder Tanks Fire Safety Equipment Market Revenue Share (2014)

Figure 72 UAE Bladder Tanks Fire Safety Equipment Market Revenue Share (2021F)

Figure 73 UAE Valves & Risers Fire Safety Equipment Market Revenues & Volume, 2010-2014 ($ Million & Thousand Units)

Figure 74 UAE Valves & Risers Fire Safety Equipment Market Revenues & Volume, 2015E-2021F ($ Million & Thousand Units)

Figure 75 UAE Valves & Risers Fire Safety Equipment Market Revenue Share (2014)

Figure 76 UAE Valves & Risers Fire Safety Equipment Market Revenue Share (2021F)

Figure 77 UAE BackPack Fire Safety Equipment Market Revenues & Volume, 2010-2014 ($ Million & Thousand Units)

Figure 78 UAE BackPack Fire Safety Equipment Market Revenues & Volume, 2015E-2021F ($ Million & Thousand Units)

Figure 79 UAE BackPack Fire Safety Equipment Market Revenue Share (2014)

Figure 80 UAE BackPack Fire Safety Equipment Market Revenue Share (2021F)

Figure 81 UAE Fire Cabinet Safety Equipment Market Revenues & Volume, 2010-2014 ($ Million & Thousand Units)

Figure 82 UAE Fire Cabinet Safety Equipment Market Revenues & Volume, 2015E-2021F ($ Million & Thousand Units)

Figure 83 UAE Fire Cabinet Safety Equipment Market Revenue Share (2014)

Figure 84 UAE Fire Cabinet Safety Equipment Market Revenue Share (2021F)

Figure 85 UAE CAF Fire Safety Systems' Market Revenues & Volume, 2010-2014 ($ Million & Thousand Units)

Figure 86 UAE CAF Fire Safety Systems' Market Revenues & Volume, 2015E-2021F ($ Million & Thousand Units)

Figure 87 UAE CAF Fire Safety Systems' Market Revenue Share (2014)

Figure 88 UAE CAF Fire Safety Systems' Market Revenue Share (2021F)

Figure 89 UAE CAF Fire Safety Systems' Market Revenue Share, By Type (2014)

Figure 90 UAE CAF Fire Safety Systems' Market Revenue Share, By Type (2021F)

Figure 91 UAE CAF Fire Safety Systems' Market Volume Share, By Type (2014)

Figure 92 UAE CAF Fire Safety Systems' Market Volume Share, By Type (2021F)

Figure 93 UAE Fire Sprinklers Safety Equipment Market Revenues & Volume, 2010-2014 ($ Million & Thousand Units)

Figure 94 UAE Fire Sprinklers Safety Equipment Market Revenues & Volume, 2015E-2021F ($ Million & Thousand Units)

Figure 95 UAE Fire Sprinklers Safety Equipment Market Revenue Share (2014)

Figure 96 UAE Fire Sprinklers Safety Equipment Market Revenue Share (2021F)

Figure 97 UAE Clean Agent Fire Extinguisher Market Revenues, 2010-2021F ($ Million)

Figure 98 UAE Clean Agent Fire Extinguisher Market Revenue Share, By Chemical Type (2014)

Figure 99 UAE Clean Agent Fire Extinguisher Market Revenue Share, By Chemical Type (2021F)

Figure 100 UAE Clean Agent Fire Extinguisher Market Revenue Share, By Structure Type (2014)

Figure 101 UAE Clean Agent Fire Extinguisher Market Revenue Share, By Structure Type (2021F

Figure 102 UAE Clean Agent Fire Extinguisher Market Volume, 2010-2021F (Thousand Units)

Figure 103 UAE Clean Agent Fire Extinguisher Market Volume Share, By Structure Type (2014)

Figure 104 UAE Clean Agent Fire Extinguisher Market Volume Share, By Structure Type (2021F)

Figure 105 UAE Dry Chemical Powder Fire Extinguisher Market Revenues, 2010-2021F ($ Million)

Figure 106 UAE Dry Chemical Powder Fire Extinguisher Market Revenue Share, By Chemical Type (2014)

Figure 107 UAE Dry Chemical Powder Fire Extinguisher Market Revenue Share, By Chemical Type (2021F)

Figure 108 UAE Dry Chemical Powder Fire Extinguisher Market Revenue Share, By Structure Type (2014)

Figure 109 UAE Dry Chemical Powder Fire Extinguisher Market Revenue Share, By Structure Type (2021F)

Figure 110 UAE Dry Chemical Powder Fire Extinguisher Market Volume, 2010-2021F (Thousand Units)

Figure 111 UAE Dry Chemical Powder Fire Extinguisher Market Volume Share, By Structure Type (2014)

Figure 112 UAE Dry Chemical Powder Fire Extinguisher Market Volume Share, By Structure Type (2021F)

Figure 113 UAE Foam Fire Extinguisher Market Revenues, 2010-2021F ($ Million)

Figure 114 UAE Foam Fire Extinguisher Market Revenue Share, By Chemical Type (2014)

Figure 115 UAE Foam Fire Extinguisher Market Revenue Share, By Chemical Type (2021F)

Figure 116 UAE Foam Fire Extinguisher Market Revenue Share, By Structure Type (2014)

Figure 117 UAE Foam Fire Extinguisher Market Revenue Share, By Structure Type (2021F)

Figure 118 UAE Foam Fire Extinguisher Market Volume, 2010-2021F (Thousand Units)

Figure 119 UAE Foam Fire Extinguisher Market Volume Share, By Structure Type (2014)

Figure 120 UAE Foam Fire Extinguisher Market Volume Share, By Structure Type (2021F)

Figure 121 UAE Water Fire Extinguisher Market Revenues, 2010-2021F ($ Million)

Figure 122 UAE Water Fire Extinguisher Market Volume, 2010-2021F (Thousand Units)

Figure 123 UAE Water Fire Extinguisher Market Volume Share, By Structure Type (2014)

Figure 124 UAE Water Fire Extinguisher Market Volume Share, By Structure Type (2021F)

Figure 125 UAE Wet Chemical Fire Extinguisher Market Revenues, 2010-2021F ($ Million)

Figure 126 UAE Wet Chemical Fire Extinguisher Market Volume, 2010-2021F (Thousand Units)

Figure 127 UAE Wet Chemical Fire Extinguisher Market Volume Share, By Structure Type (2014)

Figure 128 UAE Wet Chemical Fire Extinguisher Market Volume Share, By Structure Type (2021F)

Figure 129 UAE Clean Agent Fire Extinguisher Market Price Trend, Portable Vs Trolley, 2010-2021F ($ Per Unit)

Figure 130 UAE Dry Chemical Powder Fire Extinguisher Market Price Trend, Portable Vs Trolley, 2010-2021F ($ Per Unit)

Figure 131 UAE Foam Fire Extinguisher Market Price Trend, Portable Vs Trolley, 2010-2021F ($ Per Unit)

Figure 132 UAE Water Fire Extinguisher Market Price Trend, Portable Vs Trolley, 2010-2021F ($ Per Unit)

Figure 133 UAE Wet Chemical Fire Extinguisher Market Price Trend, Portable Vs Trolley, 2010-2021F ($ Per Unit)

Figure 134 UAE Hospitality Market Revenues, 2010-2021F ($ Billion)

Figure 135 UAE Retail Market Revenues, 2010-2021F ($ Billion)

Figure 136 UAE SMEs Addition Per Year, 2012-2021 (in Thousand)

Figure 137 Northern UAE Fire Safety Systems & Equipment Market Revenues, 2010-2014 ($ Million)

Figure 138 Northern UAE Fire Safety Systems & Equipment Market Revenues, 2015E-2021F ($ Million)

Figure 139 Southern UAE Fire Safety Systems & Equipment Market Revenues, 2010-2014 ($ Million)

Figure 140 Southern UAE Fire Safety Systems & Equipment Market Revenues, 2015E-2021F ($ Million)

Figure 141 UAE Fire Safety Systems & Equipment Market Revenue Share, By Company (2014)

Figure 142 EI du Pont de Nemours and Co., Revenue Share by Business Segment (2014)

Figure 143 Honeywell International Inc., Revenue Share by Automation and Control Solutions Segment (2013 & 2014)

Figure 144 Nitin Fire Protection Industries Ltd., Revenue Share by Geography (2013 and 2014)

Figure 145 Tyco Fire & Security UAE LLC, Revenue Share by Operating Segment (2013 & 2014)

Figure 146 United Technologies Corporation, Revenue Share by Business Segment (2014)

Figure 147 UAE Oil Production & Refinery Capacities, 2005-2014 (Thousand Barrels Daily)

Figure 148 UAE Gas Production, 2005-2014 (Billion Cubic Meters)

List of Tables

Table 1 Upcoming Residential Housing Projects in UAE

Table 2 Fire Incidences in UAE (2013-2015)

Table 3 UAE Clean Agent Fire Extinguisher Market Revenues, By Structure Type, 2010-14 ($ Million)

Table 4 UAE Clean Agent Fire Extinguisher Market Revenues, By Structure Type, 2015E-21F ($ Million)

Table 5 UAE Clean Agent Fire Extinguisher Market Volume, By Structure Type, 2010-14 (Thousand Units)

Table 6 UAE Clean Agent Fire Extinguisher Market Volume, By Structure Type, 2015E-21F (Thousand Units)

Table 7 UAE Dry Chemical Powder Fire Extinguisher Market Revenues, By Structure Type, 2010-14 ($ Million)

Table 8 UAE Dry Chemical Powder Fire Extinguisher Market Revenues, By Structure Type, 2015E-21F ($ Million)

Table 9 UAE Dry Chemical Powder Fire Extinguisher Market Volume, By Structure Type, 2010-14 (Thousand Units)

Table 10 UAE Dry Chemical Powder Fire Extinguisher Market Volume, By Structure Type, 2015E-21F (Thousand Units)

Table 11 UAE Foam Fire Extinguisher Market Revenues, By Structure Type, 2010-14 ($ Million)

Table 12 UAE Foam Fire Extinguisher Market Revenues, By Structure Type, 2015E-21F ($ Million)

Table 13 UAE Foam Fire Extinguisher Market Volume, By Structure Type, 2010-14 (Thousand Units)

Table 14 UAE Foam Fire Extinguisher Market Volume, By Structure Type, 2015E-21F (Thousand Units)

Table 15 UAE Water Fire Extinguisher Market Volume, By Structure Type, 2010-14 (Thousand Units)

Table 16 UAE Water Fire Extinguisher Market Volume, By Structure Type, 2015E-21F (Thousand Units)

Table 17 UAE Wet Chemical Fire Extinguisher Market Volume, By Structure Type, 2010-14 (Thousand Units)

Table 18 UAE Wet Chemical Fire Extinguisher Market Volume, By Structure Type, 2015E-21F (Thousand Units)

Table 19 UAE Energy Fire Safety Systems & Equipment Market Revenues, 2010-14 ($ Million)

Table 20 UAE Energy Fire Safety Systems & Equipment Market Revenues, 2015E-21F ($ Million)

Table 21 UAE Residential Fire Safety Systems & Equipment Market Revenues, 2010-14 ($ Million)

Table 22 UAE Residential Fire Safety Systems & Equipment Market Revenues, 2015E-21F ($ Million)

Table 23 UAE Industrial & Manufacturing Fire Safety Systems & Equipment Market Revenues, 2010-14 ($ Million)

Table 24 UAE Industrial & Manufacturing Fire Safety Systems & Equipment Market Revenues, 2015E-21F ($ Million)

Table 25 UAE Healthcare & Hospitality Fire Safety Systems & Equipment Market Revenues, 2010-14 ($ Million)

Table 26 UAE Healthcare & Hospitality Fire Safety Systems & Equipment Market Revenues, 2015E-21F ($ Million)

Table 27 List of New Hotels Under Construction In UAE (2015)

Table 28 UAE Transportation & Defense Fire Safety Systems & Equipment Market Revenues, 2010-14 ($ Million)

Table 29 UAE Transportation & Defense Fire Safety Systems & Equipment Market Revenues, 2015E-21F ($ Million)

Table 30 UAE Retail & Logistics Fire Safety Systems & Equipment Market Revenues, 2010-14 ($ Million)

Table 31 UAE Retail & Logistics Fire Safety Systems & Equipment Market Revenues, 2015E-21F ($ Million)

Table 32 UAE Commercial Offices Fire Safety Systems & Equipment Market Revenues, 2010-14 ($ Million)

Table 33 UAE Commercial Offices Fire Safety Systems & Equipment Market Revenues, 2015E-21F ($ Million)

Table 34 UAE SME Market, By Sector (2014)

Table 35 UAE Education & BFSI Fire Safety Systems & Equipment Market Revenues, 2010-14 ($ Million)

Table 36 UAE Education & BFSI Fire Safety Systems & Equipment Market Revenues, 2015E-21F ($ Million)

Table 37 List Of On-Going Construction Projects In Abu Dhabi

Table 38 UAE Fire Safety Systems & Equipment Market Revenue Share of Top 3 Players, 2014 ($ Million)

UAE is one of the leading markets for fire safety systems & equipment in the Middle-East region. UAE fire safety systems & equipment market is buoyed by changing technology, increasing safety concerns, fire incidences, growing construction market, and increasing penetration of safety equipment for both commercial & residential verticals. Over the last four years, residential vertical registered higher growth in terms of deployment of fire safety systems & equipment, prior to 2012 mandating of installation of fire safety systems & equipment by the UAE government. For the residential vertical market, Abu Dhabi Emirate is emerging as a key growing region in the UAE market.

In terms of region share, the Northern region which includes Ras al-Khaimah, Umm al-Quwain, Ajman, Sharjah, Fujairah, and the Dubai Emirates captured the majority of the revenue share in UAE's fire safety systems & equipment market. Additionally, in the overall UAE fire safety systems & equipment market, fire detection systems & equipment sales dominate over fire protection, which included smoke & heat detectors followed by fire extinguishers. The upcoming World Expo 2020 in UAE would proliferate the demand for fire safety systems & equipment owing to major construction projects over the next six years.

The major companies in the UAE Fire safety systems & equipment market include- NAFFCO, FIREX, UTC Fire & Security, Al Arabia For Safety & Security, Bristol Fire Engineering, Dafoos Group, Unisafe Fire Protection Specialists, Honeywell, New Age Company, Viking Arabia, Tyco Fire & Security, and DuPont.

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

- Kenya Road Stabilization Equipment Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- North America Sodium chloride Market (2025-2031) | Analysis, Revenue, Forecast, Trends, Companies, Size, Growth, Share, Industry, Outlook & Value

- North America Vinyl Flooring Market (2025-2031) | Value, Growth,Size, Analysis, Revenue, Industry, Forecast, Share, Outlook, Companies & Trends

- Tajikistan Thermal Camera Market (2025-2031) | Trends, Size, Growth, Share, Industry, Companies, Value, Analysis, Revenue, Forecast & Outlook

- Singapore Professional AV Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero