UAE Video Surveillance Market (2015-2021) | Growth, Industry, Companies, Share, Forecast, Revenue, Value, Analysis, Outlook, Trends & Size

Market Forecast By Surveillance Type (Analog & IP Surveillance), Software (Video Management Software, Video Analytics and Others), By Components (Cameras (Analog and IP)), DVR/NVR, Encoders/Decoders, By Applications (Government & Transportation, Banking & Financial, Retail & Logistics, Industrial & Manufacturing, Commercial Offices, Residential, Hospitality & Healthcare, Educational Institutions) and Regions (Northern UAE and Southern UAE)

| Product Code: ETC000229 | Publication Date: Sep 2015 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 01 | No. of Figures: 01 | No. of Tables: 01 |

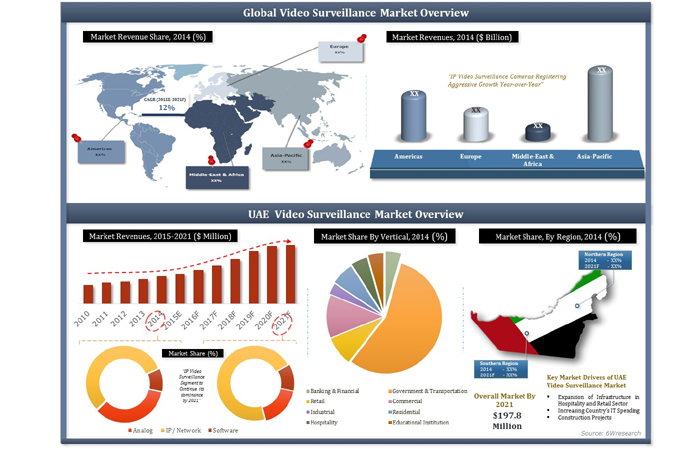

The rising infrastructure, government initiatives, funding and rules & regulations are some of the few factors that have spurred the market for video surveillance in UAE. The advantages of surveillance systems over physical security such as ability to allow remote monitoring and continuous monitoring have resulted for their wide deployment across UAE. UAE video surveillance market is majorly controlled by the IP based surveillance systems. The IP surveillance system is expected to register higher growth in the forecast period as well. IP based surveillance systems are finding their space across industry verticals namely: government & transportation, banking & financial, retail, commercial, industrial and residential.According to 6Wresearch, UAE Video Surveillance market is projected to reach $197.8 million by 2021. In 2014, IP based surveillance systems have accounted for majority of the market share in overall market and is expected to grow further with relatively higher CAGR during 2015-21 as compare to the analog based surveillance system. In 2014, vertical markets, government & transportation, commercial and retail verticals captured key share of the market; however, other verticals such as banking & finance, residential, hospitality and industrial are expected to grow significantly.The report thoroughly covers the market by surveillance types, verticals and regions. The report provides the unbiased and detailed analysis of the on-going trends, opportunities/high growth areas, market drivers which would help the stakeholders to device and align their market strategies according to the current and future market dynamics.

Key Highlights of the Report:

• Historical data of Global Video Surveillance Market for the Period 2010-2014.

• Historical data of Global Video Surveillance Market for the Period 2010-2014.

• Market Size & Forecast of Global Video Surveillance Market until 2021.

• Historical data of UAE Video Surveillance Market for the Period 2010-2014.

• Market Size & Forecast of UAE Video Surveillance Market until 2021.

• Historical data of UAE Analog Video Surveillance Market for the Period 2010-2014.

• Market Size & Forecast of UAE Analog Video Surveillance Market until 2021.

• Historical data of UAE IP Video Surveillance Market for the Period 2010-2014.

• Market Size & Forecast of UAE IP Video Surveillance Market until 2021.

• Historical data of UAE Video Surveillance Application Market for the Period 2010-2014.

• Market Size & Forecast of UAE Video Surveillance Application Market until 2021.

• Historical data of UAE Video Surveillance Regional Market for the Period 2010-2014.

• Market Size & Forecast of UAE Video Surveillance Regional Market until 2021.

• Market Drivers and Restraints.

• Market Trends.

• Competitive Landscape.

• Key Strategic Pointers.Markets Covered

The report provides the detailed analysis of following market segments:

• Video Surveillance System Types:

o Analog based surveillance systems

o IP based surveillance systems

o Surveillance System Software

• Application

o Government & Transportation

o Banking and Financial

o Retail

o Industrial

o Commercial

o Residential

o Hospitality

o Educational Institutions

• Regions:

o Northern UAE

o Southern UAE

Frequently Asked Questions About the Market Study (FAQs):

TABLE OF CONTENTS

Acronyms Used

Executive Summary

1 Introduction

1.1 Key Highlights of the Report

1.2 Report Description

1.3 Markets Segmentation

1.4 Methodology Adopted and Key Data Points

1.5 Assumptions

2 Global Video Surveillance Market Overview

3 UAE Video Surveillance Market Overview

3.1 UAE Video Surveillance Market Revenues

3.2 UAE Video Surveillance Market Volume

3.2 Industry Life Cycle

3.3 UAE Video Surveillance Vertical Market: Opportunistic Matrix

3.4 Porter's Five Forces Analysis

3.5 UAE Security Regulatory Agencies

3.6 UAE Video Surveillance Market Share, By Surveillance Types

3.7 UAE Video Surveillance Market Share, By Verticals

3.8 UAE Video Surveillance Market Share, By Regions

4 UAE Video Surveillance Market Dynamics

4.1. Market Drivers

4.1.1 Increasing construction Market

4.1.2 Growing Tourism

4.1.3 Presence of skilled IT Consultants

4.1.4 Government Initiatives

4.2. Market Restraints

4.2.1 High Cost

4.2.2 Complexity in Installation

4.3. Market Opportunity

4.3.1 Addition Of New Features

5 UAE Video Surveillance Market Trends

5.1 High Definition Cameras to Propel Video Surveillance

5.2 Cloud-based Video Surveillance

5.3 Microphones Enabled CCTV Cameras

5.4 Wireless Surveillance Systems

6 UAE Analog Video Surveillance Market Overview

6.1. UAE Analog Video Surveillance Market Revenues

6.1.1 UAE Analog Video Surveillance Market Revenues, By Product Type

6.2. UAE Analog Video Surveillance Market Volume

6.2.1 UAE Analog Video Surveillance Market Volume, By Product Type

6.3. UAE Analog Video Surveillance Market Share, By Verticals

6.4 UAE Analog Video Surveillance Market Revenues, By Verticals

6.5 UAE Analog Video Surveillance Market Price Trend

7 UAE IP Video Surveillance Market Overview

7.1. UAE IP Video Surveillance Market Revenues

7.1.1 UAE IP Video Surveillance Market Revenues, By Product Type

7.2 UAE IP Video Surveillance Market Volume

7.2.1 UAE IP Video Surveillance Market Volume, By Product Type

7.3 UAE IP Video Surveillance Market Share, By Verticals

7.4 UAE IP Video Surveillance Market Revenues, By Verticals

7.5 UAE IP Video Surveillance Market Price Trend

8 UAE Video Surveillance Software Market Overview

8.1 UAE Video Surveillance Software Market Revenues

8.2 UAE Video Analytics Software Market Revenues

8.3 UAE Video Management Software Market Revenues

8.4 UAE Other Video Surveillance Software Market Revenues

8.5 UAE Video Surveillance Software Market Revenue, By Verticals

9 UAE Video Surveillance Vertical Market Overview

9.1 Banking & Financial

9.2 Government & Transportation

9.3 Retail

9.4 Commercial

9.5 Industry

9.6 Residential

9.7 Hospitality

9.8 Educational Institution

10 UAE Video Surveillance Regional Market Overview

10.1 Northern UAE

10.2 Southern UAE

11 Competitive Landscape

11.1 Competitive Positioning

11.2 Company share

11.3 Competitive Benchmarking, By Technology

11.4 Competitive Benchmarking, By Operating Parameters

12 Company Profiles

12.1 Axis Communication AB

12.2 Pelco Inc

12.3 Hangzhou Hikvision Digital Technology Co. Ltd.

12.4 Milestone Systems A/S

12.5 IndigoVision

12.6 Avigilon Corporation

12.8 Bosch Security Systems, Inc.

12.9 Samsung Techwin Co Ltd.

12.10 FLIR Systems Inc.

12.11 Honeywell International Inc.

12.12 Panasonic Marketing Middle East & Africa FZE

13 Key Strategic Pointers

14 Disclaimer

List of Figures

Figure 1 Evolution of Video Surveillance Systems

Figure 2 Global Video Surveillance Market Revenues, 2010-2021 ($ Billion)

Figure 3 Global Video Surveillance Market Volume, 2010-2021 (Million Units)

Figure 4 UAE Video Surveillance Market Revenues, 2010 - 2014 ($ Million)

Figure 5 UAE Video Surveillance Market Revenues, 2015 - 2021 ($ Million)

Figure 6 UAE IT Spending Market, 2013-2020 ($ Billion)

Figure 7 UAE Video Surveillance Market Volume, 2010 - 2021 (Million Units)

Figure 8 UAE Video Surveillance Market- Industry Life Cycle

Figure 9 Mark-tunity Matrix

Figure 10 UAE Video Surveillance Market Share, By Revenue, By Types (2014)

Figure 11 UAE Video Surveillance Market Share, By Revenue, By Types(2021)

Figure 12 UAE Video Surveillance Market Share, By Revenue, By Verticals (2014)

Figure 13 UAE Video Surveillance Market Share, By Revenue, By Verticals (2021)

Figure 14 UAE Video Surveillance Market Share, By Region (2014 & 2021)

Figure 15 UAE Construction Market 2013- 2021 ($ Billion)

Figure 16 UAE Announced Project Composition (%)

Figure 17 UAE IP surveillance Market as %age of UAE Video Surveillance Market, 2010-2021

Figure 18 UAE Analog Video Surveillance Market Revenues, 2010 - 2014 ($ Million)

Figure 19 UAE Analog Video Surveillance Market Revenues, 2015 - 2021 ($ Million)

Figure 20 UAE Analog Video Surveillance Market Volume, 2010 - 2013 (Million)

Figure 21 UAE Analog Video Surveillance Market Volume, 2015 - 2021 (Million)

Figure 22 UAE Analog Video Surveillance Market Share, By Revenue, By Verticals (2014)

Figure 23 UAE Analog Video Surveillance Market Share, By Revenue, By Verticals (2021)

Figure 24 UAE Analog Surveillance Camera ASP, 2010-2021 ($)

Figure 25 UAE DVR ASP, 2010-2021 ($)

Figure 26 UAE IP Video Surveillance Market Revenues, 2010 - 2014 ($ Million)

Figure 27 UAE IP Video Surveillance Market Revenues, 2015 - 2021 ($ Million)

Figure 28 UAE IP Video Surveillance Market Volume, 2010 - 2014 (Million)

Figure 29 UAE IP Video Surveillance Market Volume, 2015 - 2021 (Million)

Figure 30 UAE IP Video Surveillance Market Share, By Revenue, By Verticals (2014)

Figure 31 UAE IP Video Surveillance Market Share, By Revenue, By Verticals (2021)

Figure 32 UAE IP Surveillance Camera ASP, 2010-2021 ($)

Figure 33 UAE NVR ASP, 2010-2021 ($)

Figure 34 UAE IP Surveillance Encoder/ Decoder ASP, 2010-2021 ($)

Figure 35 UAE Video Surveillance Software Market Revenues, 2010 - 2014 ($ Million)

Figure 36 UAE Video Surveillance Software Market Revenues, 2015 - 2021 ($ Million)

Figure 37 UAE Video Analytics Software Market Revenues, 2010 - 2014 ($ Million)

Figure 38 UAE Video Analytics Software Market Revenues, 2015 - 2021 ($ Million)

Figure 39 UAE Video Management Software Market Revenues, 2010 - 2014 ($ Million)

Figure 40 UAE Video Management Software Market Revenues, 2015 - 2021 ($ Million)

Figure 41 UAE Other Video Surveillance Software Market Revenues, 2010 - 2014 ($ Million)

Figure 42 UAE Other Video Surveillance Software Market Revenues, 2015 - 2021 ($ Million)

Figure 43 UAE Video Surveillance Market, By Vertical (2014)

Figure 44 UAE Banking & Financial Video Surveillance Market Revenues , 2010 - 2014 ($ Million)

Figure 45 UAE Banking & Financial Video Surveillance Market Revenues, 2015 - 2021 ($ Million)

Figure 46 UAE Government & Transportation Vertical Market Revenues, 2010 - 2014 ($ Million)

Figure 47 UAE Government & Transportation Vertical Market Revenues , 2015 - 2021($ Million)

Figure 48 UAE Retail Video Surveillance Market Revenues, 2010 - 2014 ($ Million)

Figure 49 UAE Retail Video Surveillance Market Revenues, 2015 - 2021 ($ Million)

Figure 50 UAE Retail Market 2010 - 2021 ($ Billion)

Figure 51 UAE Commercial Video Surveillance Market Revenues, 2010 - 2014 ($ Million)

Figure 52 UAE Commercial Video Surveillance Market Revenues, 2015 - 2021 ($ Million)

Figure 53 UAE Industrial Video Surveillance Market Revenues, 2010 - 2014 ($ Million)

Figure 54 UAE Industrial Video Surveillance Market Revenues, 2015 - 2021 ($ Million)

Figure 55 UAE Residential Video Surveillance Market Revenues, 2010 - 2014 ($ Million)

Figure 56 UAE Residential Video Surveillance Market Revenues, 2015 - 2021 ($ Million)

Figure 57 UAE Hospitality Video Surveillance Market Revenues, 2010 - 2014 ($ Million)

Figure 58 UAE Hospitality Video Surveillance Market Revenues, 2015 - 2021 ($ Million)

Figure 59 UAE Hospitality Market Revenues, 2010 - 2021 ($ Billion)

Figure 60 UAE Educational Institutions Video Surveillance Market Revenues, 2010 - 2014 ($ Million)

Figure 61 UAE Educational Institutions Video Surveillance Market Revenues, 2015 - 2021 ($ Million)

Figure 62 Northern UAE Video Surveillance Market Revenues, 2010 - 2014 ($ Million)

Figure 63 Northern UAE Video Surveillance Market Revenues, 2015- 2021 ($ Million)

Figure 64 Southern UAE Video Surveillance Market Revenues, 2010 - 2014 ($ Million)

Figure 65 Southern UAE Video Surveillance Market Revenues, 2015 - 2021 ($ Million)

Figure 66 UAE Video Surveillance Market Revenues Share, By Companies (2014) ($ Million)

List of Tables

Table 1 UAE Emirate Wise Security Agencies

Table 2 UAE Analog Video Surveillance Market Revenues, By Product Type, 2010-2014 ($ Million)

Table 3 UAE Analog Video Surveillance Market Revenues, By Product Type, 2015-2021 ($ Million)

Table 4 UAE Analog Video Surveillance Market Volume, By Product Type, 2010-2014 (Million)

Table 5 UAE Analog Video Surveillance Market Volume, By Product Type, 2015-2021 (Million)

Table 6 UAE Analog Video Surveillance Market Revenues, By Verticals, 2010-2014 ($ Million)

Table 7 UAE Analog Video Surveillance Market Revenues, By Verticals, 2015-2021 ($ Million)

Table 8 UAE IP Video Surveillance Market Revenues, By Product Type, 2010-2014 (Million)

Table 9 UAE IP Video Surveillance Market Revenues, By Product Type, 2015-2021 (Million)

Table 10 UAE IP Video Surveillance Market Volume, By Product Type, 2010-2014 (Million)

Table 11 UAE IP Video Surveillance Market Volume, By Product Type, 2015-2021 (Million)

Table 12 UAE IP Video Surveillance Market Revenues, By Verticals, 2010-2014 ($ Million)

Table 13 UAE IP Video Surveillance Market Revenues, By Verticals, 2015-2021 ($ Million)

Table 14 UAE Video Surveillance Software Market Revenues, By Verticals, 2010-2014 ($ Million)

Table 15 UAE Video Surveillance Software Market Revenues, By Verticals, 2015-2021 ($ Million)

Table 16 UAE Video Surveillance Market Revenues of Top 3 Players, 2014 ($ Million)

Table 17 Axis Communication AB Financial Statements, 2010-2013 (USD Million)

Table 18 Hangzhou Hikvision Digital Technology Co. Financial Statements, 2011-2014 ($ Million)

Table 19 IndigoVision Group Financial Statements, 2011-2014 ($ Million)

Table 20 Avigilon Corporation. Financial Statements, 2011-2013 ($ Million)

Table 21 Robert Bosch Financial Statements, 2011-2014 ($ Billion)

Table 22 Samsung Techwin Co. Financial Statements, 2011-2013 ($ Billion)

Table 23 FLIR Systems Financial Statements, 2011-2013 ($ Million)

UAE is one of the key growing Video Surveillance markets in the Middle East region. Rising need for intelligent security systems and government initiatives for security are the key factors that are spurring the market for Video Surveillance Systems in UAE.

In the country, the market is primarily driven by IP based surveillance system followed by the analog based surveillance system. The IP based surveillance system market is expected to experience further growth in the forecast period due to the increasing awareness regarding the benefits of IP based surveillance system, favourable regulatory impositions and rising security concern in the country. The key players in the market include: Axis Communications AB, Bosch Security Systems, Pelco Inc, Milestone Systems, HikVision Digital, Honeywell International, Panasonic Marketing Middle East & Africa FZE, IndigoVision, Avigilon Corporation, Tyco Fire & Security, Samsung Techwin Co and FLIR Systems Inc.

Also, Dubai is hosting World Expo 2020, where around 25 million visitors are expected to visit the country. For the event, expansion of public infrastructure, construction of trade centers, hotels and shopping malls are anticipated over the next six years. Growth of these infrastructures would result into deployment of surveillance cameras at various locations in the city.

“UAE Video Surveillance Market (2015-2021)” report estimates and forecast overall UAE Video Surveillance market by revenue, by Video surveillance system type such as Analog based, IP based, and Software systems, by application, and Video Surveillance system by region such as Northern UAE and Southern UAE. The report also gives the insights on competitive landscape, market share by companies, market trends, company profiles, market drivers and restraints.

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

- Kenya Road Stabilization Equipment Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- North America Sodium chloride Market (2025-2031) | Analysis, Revenue, Forecast, Trends, Companies, Size, Growth, Share, Industry, Outlook & Value

- North America Vinyl Flooring Market (2025-2031) | Value, Growth,Size, Analysis, Revenue, Industry, Forecast, Share, Outlook, Companies & Trends

- Tajikistan Thermal Camera Market (2025-2031) | Trends, Size, Growth, Share, Industry, Companies, Value, Analysis, Revenue, Forecast & Outlook

- Singapore Professional AV Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero