Vietnam Switchgear Market (2024-2030) | Growth, Trends, Size, Revenue, Forecast, Share, Value, Industry, Analysis, Outlook & Companies

Market Forecast By Voltage (Low Voltage Switchgear, Medium Voltage Switchgear, High Voltage Switchgear), By Insulation (Medium Voltage Switchgear (Air Insulated, Gas Insulated), High Voltage Switchgear (Air Insulated, Gas Insulated), Low Voltage Switchgear (MCB, MCCB, C&R, ACB, COS, Others)), By Applications (Residential, Commercial, Industrial, Power Utilities) And Competitive Landscape

| Product Code: ETC000465 | Publication Date: Dec 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

Topics Covered in the Vietnam Switchgear Market Report

The Vietnam Switchgear Market report thoroughly covers the market by voltage, by insulation, by applications and competitive Landscape. The report provides an unbiased and detailed analysis of the on-going market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Vietnam Switchgear Market Synopsis

Vietnam’s recent fast-paced economic growth has fueled the demand for switchgear products in the country, with increasing investments in the energy sector, particularly in the transmission and distribution of electricity. Furthermore, the positive outlook of the construction industry has marked a new market opportunity for switchgear products. Additionally, the adoption of smart grid technology is increasing in the country, and it is expected to increase the demand for digital switchgear products such as circuit breakers, switchboards, and other digital protection equipment. However, the Vietnam switchgear industry faces several challenges such as many local companies lack the skills and knowledge for providing high-quality products due to inadequate training and development programs. To meet the growing demand, vendors need to focus on skills development programs to build highly skilled engineers and technicians. Similarly, low financial investments in technology development slows down Vietnam's switchgear product development as compared to other countries within the region. Moreover, another challenge includes the high cost of quality raw materials. The country's manufacturing process requires high-quality raw materials that are not readily available locally, which leads to a higher cost of production. Reliance on imported raw materials heavily affects the production cost, leading to a lower profit margin for the industry players.

According to 6Wresearch, Vietnam switchgear market size is projected to grow at a CAGR of 12.6% during 2024-2030. The growth is driven by increasing investment in energy and infrastructure development to meet the growing demand for electricity across the country. Additionally, in recent years, Vietnam has witnessed a surge of infrastructure projects, including new airports, deep-sea ports, highways, and power plants, which has led to a marked increase in demand for reliable electricity supply. The infrastructure projects have created a high demand for switchgear equipment, which is necessary for the distribution of electricity to new and existing infrastructure. Moreover, Vietnam has an abundance of untapped sources of natural energy. The government is encouraging the adoption of renewable energy sources such as solar, wind, and hydropower to meet the demand for electricity. The use of renewable sources of energy requires sophisticated switchgear equipment that can handle the intermittent power supply and ensure the safety of electrical systems. This demand for specialized switchgear equipment has led to the growth of the Vietnam switchgear market.

Government Initiatives Introduced in the Vietnam Switchgear Market

The Vietnamese government is playing a crucial role in the development of the country's electrical infrastructure, with several initiatives aimed at modernizing and expanding the power grid. One of the most significant initiatives is the Rural Electrification Program, which seeks to increase access to electricity in rural areas of the country. The program has already connected millions of households to the power grid, improving their quality of life and promoting economic development. Correspondingly, these activities have reinforced the Vietnam Switchgear Market Share. Further, another government initiative is the National Energy Development Strategy, which aims to diversify the country's energy sources and reduce its reliance on fossil fuels. The strategy includes plans to increase the share of renewable energy in the country's power mix to 10.7% by 2030, up from just 0.5% in 2015. This push towards renewable energy will require significant investment in the country's electrical infrastructure, including the adoption of advanced switchgear technologies.

Key Players in the Vietnam Switchgear Market

The Vietnam switchgear market boasts key players who are all competing positively in one way or the other to provide quality power equipment to the emerging market. Schneider Electric, Siemens, ABB, and General Electric are just a few players to keep an eye on as the country's power infrastructure continues to evolve and mature. Moreover, some of the key firms occupy widespread Vietnam Switchgear Market Revenues. As Vietnam works to modernize its power generation, transmission, and distribution infrastructure, these key players will be vital in delivering the reliable, efficient, and high-quality power equipment solutions that the country needs. solutions.

Market by Voltage

According to Ravi Bhandari, Research Head, 6Wresearch, one significant aspect of this market is the different voltage types of switchgear available, namely Low Voltage (LV), Medium Voltage (MV), and High Voltage (HV) Switchgear. Additionally, the medium Voltage (MV) Switchgear, on the other hand, handles voltages ranging from 1kV to 72.5kV and is primarily used for electric power transmission and distribution. Because of its voltage capacity, MV switchgear requires more insulation, making it more expensive than LV counterpart but nevertheless essential for efficient energy management. The improved electrical coordination and safety features of MV switchgear make it an ideal choice for industrial and utility applications in Vietnam where reliability and safety is paramount. Further, the high Voltage (HV) Switchgear can handle voltages above 72.5kV, and it's mainly used for large-scale power transmission. This type of switchgear is often used in grid infrastructure and power plants where high levels of power need to be distributed rapidly over a long distance. HV switchgear requires highly specialized knowledge and equipment to install and maintain, and therefore it's only produced by a limited number of manufacturers.

Market by Application

The commercial sector requires switchgear to support the electrical infrastructure of commercial buildings, such as shopping malls, hospitals, and office buildings. The switchgear used in the commercial sector includes air circuit breakers, molded-case circuit breakers, and miniature circuit breakers. In Vietnam, the demand for commercial switchgear is high due to the growing number of commercial buildings being constructed as the economy prospers. The government's initiatives to promote foreign investments, increase employment, and improve the overall economic conditions will further drive the demand for switchgear in the commercial sector. Additionally, the industrial sector is the most significant application area for switchgear and is responsible for the high demand for switchgear in Vietnam. The sector requires switchgear for power generation, transmission, and distribution of electricity. The switchgear used in the industrial sector includes low voltage and medium voltage switchgear, and high voltage switchgear. Vietnam's increased industrialization, growth of manufacturing industries, and development of special economic zones are driving the demand for industrial switchgear. Moreover, the government's initiatives to attract foreign investments in the manufacturing sector are expected to boost the demand for switchgear even further.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2020 to 2023.

- Base Year: 2023

- Forecast Data until 2030.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

s

- Vietnam Switchgear Market Overview

- Vietnam Switchgear Market Outlook

- Vietnam Switchgear Market Forecast

- Historical Data of Vietnam Switchgear Market Revenues & Volume for the Period 2020-2030

- Vietnam Switchgear Market Size and Vietnam Switchgear Market Forecast of Revenues & Volume, Until 2030

- Historical Data of Vietnam Switchgear Market Revenues & Volume, By Voltage, for the Period 2020-2030

- Market Size & Forecast of Vietnam Switchgear Market Revenues & Volume, By Voltage, Until 2030

- Historical Data of Vietnam Switchgear Market Revenues & Volume, By Insulation, for the Period 2020-2030

- Market Size & Forecast of Vietnam Switchgear Market Revenues & Volume, By Insulation, Until 2030

- Historical Data of Vietnam Switchgear Market Revenues & Volume, By Applications, for the Period 2020-2030

- Market Size & Forecast of Vietnam Switchgear Market Revenues & Volume, By Applications, Until 2030

- Market Drivers and Restraints

- Vietnam Switchgear Market Price Trends

- Vietnam Switchgear Market Trends and Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- Vietnam Switchgear Market Share, By Players

- Vietnam Switchgear Market Share, By Regions

- Vietnam Switchgear Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Voltage

- Low Voltage Switchgear

- Medium Voltage Switchgear

- High Voltage Switchgear

By Insulation

Medium Voltage Switchgear

- Air Insulated

- Gas Insulated

High Voltage Switchgear

- Air Insulated

- Gas Insulated

Low Voltage Switchgear

- MCB

- MCCB

- C&R

- ACB

- COS

- Others

By Applications

- Residential

- Commercial

- Industrial

- Power Utilities

Vietnam Switchgear Market (2024-2030): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of The Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Vietnam Switchgear Market Overview |

| 3.1 Vietnam Country Indicators |

| 3.2 Vietnam Switchgear Market Revenues & Volume 2020-2030F |

| 3.3 Vietnam Switchgear Market Revenue Share, By Voltage, 2020 & 2030F |

| 3.4 Vietnam Switchgear Market Revenue Share, By Insulation, 2020 & 2030F |

| 3.5 Vietnam Switchgear Market Revenue Share, By Application, 2020 & 2030F |

| 3.6 Vietnam Switchgear Market - Industry Life Cycle |

| 3.7 Vietnam Switchgear Market - Porter’s Five Forces |

| 4. Vietnam Switchgear Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing urbanization and industrialization in Vietnam leading to higher demand for electricity and power infrastructure. |

| 4.2.2 Government initiatives to upgrade and expand the country's power grid. |

| 4.2.3 Growing investments in renewable energy projects driving the need for modern and efficient switchgear solutions. |

| 4.3 Market Restraints |

| 4.3.1 High initial costs associated with installing switchgear systems. |

| 4.3.2 Lack of skilled workforce for the maintenance and operation of switchgear equipment. |

| 4.3.3 Vulnerability to supply chain disruptions impacting the availability of switchgear components. |

| 5. Vietnam Switchgear Market Trends |

| 6. Vietnam Switchgear Market Overview, By Voltage |

| 6.1 Vietnam Switchgear Market Revenues & Volume, By Low Voltage Switchgear 2020-2030F |

| 6.2 Vietnam Switchgear Market Revenues & Volume, By Medium Voltage Switchgear 2020-2030F |

| 6.3 Vietnam Switchgear Market Revenues & Volume, By High Voltage Switchgear 2020-2030F |

| 7. Vietnam Switchgear Market Overview, By Insulation |

| 7.1 Vietnam Switchgear Market Revenues, By Medium Voltage Switchgear, 2020-2030F |

| 7.2 Vietnam Switchgear Market Revenues, By High Voltage Switchgear, 2020-2030F |

| 7.3 Vietnam Switchgear Market Revenues, By Low Voltage Switchgear, 2020-2030F |

| 8. Vietnam Switchgear Market Overview, By Application |

| 8.1 Vietnam Switchgear Market Revenues & Volume, By Residential, 2020-2030F |

| 8.2 Vietnam Switchgear Market Revenues & Volume, By Commercial, 2020-2030F |

| 8.3 Vietnam Switchgear Market Revenues & Volume, By Industrial, 2020-2030F |

| 8.4 Vietnam Switchgear Market Revenues & Volume, By Power Utilities, 2020-2030F |

| 9. Vietnam Switchgear Market - Key Performance Indicators |

| 9.1 Average age of existing switchgear infrastructure in Vietnam. |

| 9.2 Number of new power generation projects in the pipeline. |

| 9.3 Percentage of grid modernization projects utilizing advanced switchgear technologies. |

| 9.4 Frequency of maintenance and servicing of switchgear systems. |

| 9.5 Adoption rate of smart switchgear solutions in key industries. |

| 10. Vietnam Switchgear Market - Opportunity Assessment |

| 10.1 Vietnam Switchgear Market Opportunity Assessment, By Voltage 2030F |

| 10.2 Vietnam Switchgear Market Opportunity Assessment, By Insulation 2030F |

| 10.3 Vietnam Switchgear Market Opportunity Assessment, By Application, 2030F |

| 11. Vietnam Switchgear Market Competitive Landscape |

| 11.1 Vietnam Switchgear Market Revenue Share, By Company, 2023 |

| 11.2 Vietnam Switchgear Market Competitive Benchmarking, By Operating & Technical Parameters |

| 12. Company Profiles |

| 13. Key Recommendations |

| 14. Disclaimer |

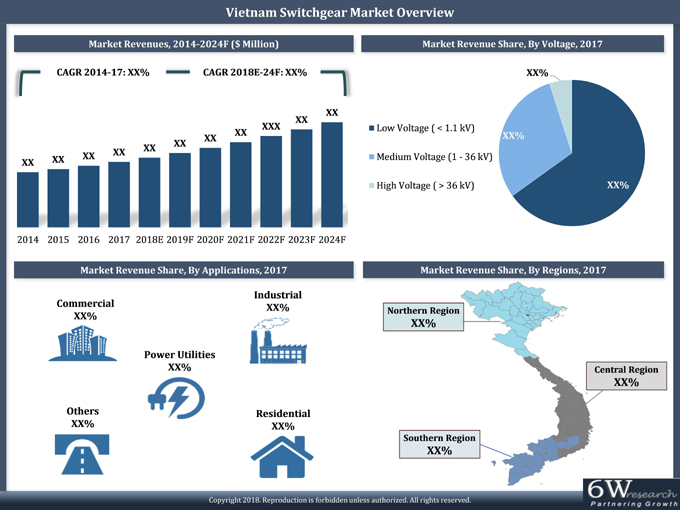

Market Forecast By Voltage (Low Voltage (< 1.1 kV), Medium Voltage (1.1 kV - 36 kV) and High Voltage (> 36 kV)), By Insulation (Medium Voltage (AIS, GIS, and Others) and High Voltage (AIS, GIS, and Others)), By Types (Low Voltage (MCB, MCCB, C&R, ACB, COS, and Others) and Medium Voltage (ISG, OSG, and Others)), By Verticals (Residential, Commercial, Industrial, Power Utilities and Others), By Regions (Central, Northern, and Southern) and Competitive Landscape

| Product Code: ETC000465 | Publication Date: Dec 2021 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 155 | No. of Figures: 67 | No. of Tables: 28 |

Growing urban population, rising construction activities, and industrialization would be some of the key drivers behind the growth of the Vietnam switchgear market during the forecast period. Further, the revised Power Development Plan (PMP VII) 2011-2020 and the government's focus on improving transport infrastructure would surge the demand for switchgears in the country over the next six years.

According to 6Wresearch, the Vietnam switchgear market size is projected to grow with a CAGR of 7.1% during 2018-24. According to Vietnam Electricity (EVN), the demand for electricity is expected to double between 2014-20 and is expected to attract investments worth $7.5 billion per year during the same period. Government plans such as National Transport Master Plan (2011-20) and the $121 billion Ho Chi Minh City Master Transport Plan are likely to create huge opportunities for switchgear companies as these would lead to infrastructural development across the country. According to the Government of Vietnam (GVN), the manufacturing and processing sectors are expected to flourish and contribute significantly to the industrial segment of Vietnam on account of growing foreign investments in the country. Further, the government's target to reach 100% rural electrification by 2020 would also drive the demand for switchgears in the country during 2018-24.

Power utilities acquired maximum revenue share in the overall Vietnam switchgear market share in 2017 due to the integration of renewable energy plants and continuous expansion of power transmission & distribution networks across the country. The development of urban and low-income housing residential units would be key factors on account of which residential segment would register the highest CAGR during 2018-24.

The Vietnam switchgear market report comprehensively covers the Vietnam Switchgear Market by voltage, insulation, types, applications, and regions. The Vietnam switchgear market outlook report provides an unbiased and detailed analysis of the Vietnam switchgear market trends, opportunities/high growth areas, market drivers which would help the stakeholders to device and align their market strategies according to the current and future market dynamics.

Key Highlights of the Report:

• Vietnam Switchgear Market Overview

• Vietnam Switchgear Market Outlook

• Vietnam Switchgear Market Forecast

• Historical Data of Global Switchgear Market Revenues for the Period 2014-2017

• Market Size & Forecast of Global Switchgear Market Revenues until 2024

• Historical Data of Vietnam Switchgear Market Revenues for the Period 2014-2017

• Vietnam Switchgear Market Size & Vietnam Switchgear Market Forecast of Revenues, until 2024

• Historical Data of Vietnam Low Voltage Switchgear Market Revenues for the Period 2014-2017

• Market Size & Forecast of Vietnam Low Voltage Switchgear Market Revenues until 2024

• Historical Data of Vietnam Medium Voltage Switchgear Market Revenues & Volume for the Period 2014-2017

• Market Size & Forecast of Vietnam Medium Voltage Switchgear Market Revenues & Volume until 2024

• Historical Data of Vietnam High Voltage Switchgear Market Revenues & Volume for the Period 2014-2017

• Market Size & Forecast of Vietnam High Voltage Switchgear Market Revenues & Volume until 2024

• Historical Data of Vietnam Switchgear Market Revenues for the Period 2014-2017, By Applications

• Market Size & Forecast of Vietnam Switchgear Market Revenues until 2024, By Applications

• Historical & Forecast Data of Vietnam Switchgear Regional Market Revenues for the Period 2014-2024

• Market Drivers and Restraints

• Vietnam Switchgear Market Trends and Developments

• Vietnam Switchgear Market Share by Players

• Vietnam Switchgear Market Overview on Competitive Landscape

• Company Profiles

• Strategic Recommendations

Markets Covered

The Vietnam switchgear market report provides a detailed analysis of the following market segments:

• By Voltage

o Low Voltage (< 1.1 kV)

o Medium Voltage (1.1 kV - 36 kV)

o High Voltage (> 36 kV)

• By Insulation

o Medium Voltage

■ AIS

■ GIS

■ Others

o High Voltage

■ AIS

■ GIS

■ Others

• By Types

o Low Voltage

■ MCB

■ MCCB

■ C&R

■ ACB

■ COS

■ Others

o Medium Voltage

■ ISG

■ OSG

■ Others

• By Verticals

o Residential

o Commercial

o Industrial

o Power Utilities

o Others

• By Regions

o Central

o Northern

o Southern

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero