India Air Conditioner (AC) Market (2024-2030) | Share, Size, Growth, Industry, Segmentation, Trends, Value, Revenue, Analysis & Outlook

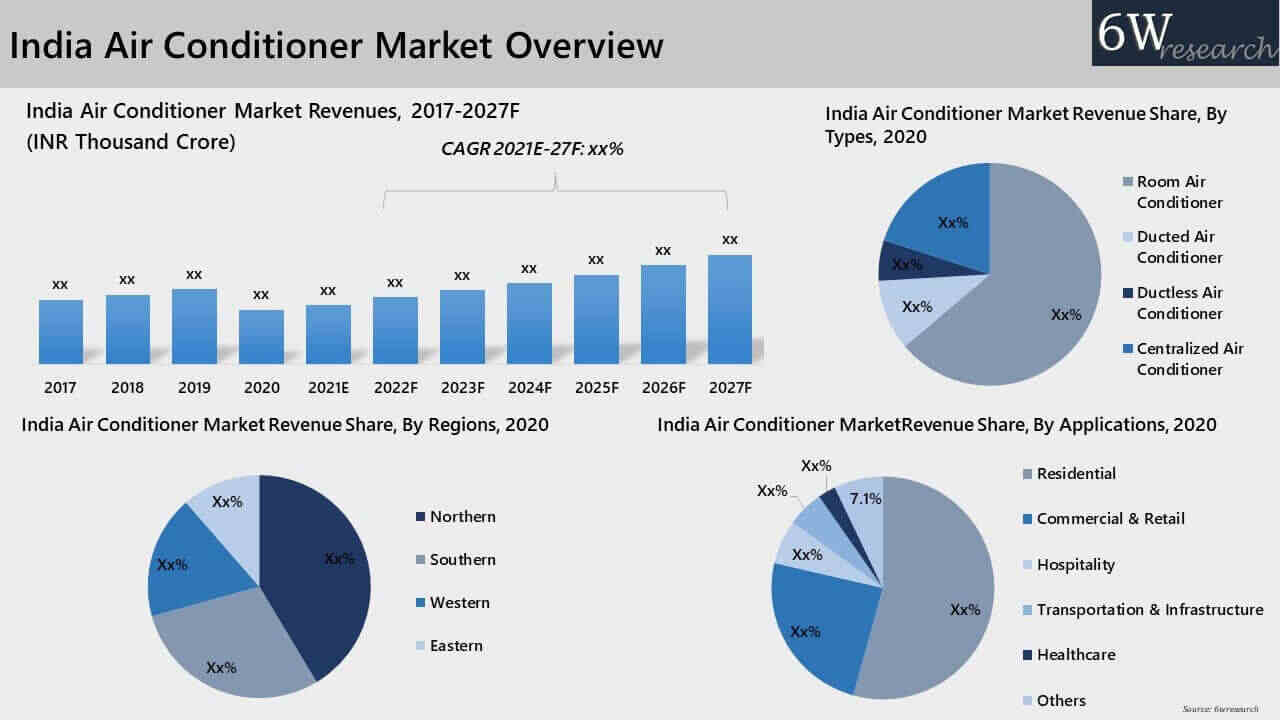

Market Forecast By Types (Room Air Conditioner (Window AC, Split AC), Ducted Air Conditioner (Ceiling Concealed AC, Unitary Packaged AC), Ductless Air Conditioner (Suspended AC, Floor Standing AC, Cassette AC), Centralized/ Applied Air Conditioner (AHU/FCU, Chiller, VRF & Other Components), By Applications (Residential, Healthcare, Commercial & Retail, Transportation & Infrastructure, Hospitality, & Others (Industrial, Oil & Gas, etc.), By Sales Channels (Online, Offline), By VRF (Compressor (Air Cooled, Water Cooled), Component (Indoor, Outdoor, Control System and Accessories), Heat Pump Systems (Ground-source, Air-source, Absorption), Heat Recovery Systems), By Regions (North Region, South Region, East Region, West Region) and Competitive Landscape

| Product Code: ETC060824 | Publication Date: Oct 2024 | Updated Date: May 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 135 | No. of Figures: 53 | No. of Tables: 28 | |

India Air Conditioner (AC) Market Highlights

| Report Name | India Air Conditioner (AC) Market |

| Forecast Periods | 2025-2029 |

| CAGR | 15.12% by 2029 |

| Growing Sector | Residential |

Topics Covered in the India Air Conditioner (AC) Market Report

India Air Conditioner (AC) market report thoroughly covers the market by types and applications. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

India Air Conditioner Market (AC) Synopsis

The AC market in India has been experiencing significant growth, underpinned by various growing factors such as increasing urbanization, increasing temperatures due to climate change, and improved standards of living. The demand for air conditioning units spans residential, commercial, and industrial sectors, contributing to an expansive market landscape. The market is branded by a spectrum of products ranging from window and split ACs to more advanced technologies such as inverter-based and energy-efficient models.

According to 6Wresearch, the India Air Conditioner Market (AC) revenue is expected to reach a significant CAGR of 9.8% during the forecast period 2024-2030. The growing middle class with higher income levels of the population resulted in enhanced purchasing power and lifestyle upgrades. Additionally, some government efforts , such as the 'Smart Cities Mission' and infrastructural developments, are propelling demand for air conditioners in the country. Changing consumer preferences for energy-efficient appliances are also fostering innovations and growth in this sector, leading to the India Air Conditioner Market growth. Despite the promising outlook, the market faces several challenges that could affect its growth. High electricity consumption rates of traditional air conditioning units pose financial burdens on consumers and contribute to environmental concerns. Moreover, fluctuating currency exchange rates and stringent government regulations on energy efficiency and emissions present obstacles for manufacturers. The industry is compelled to balance growth with sustainable practices and regulatory compliance to ensure long-term viability.

India Air Conditioner Market - Import Vs. Domestic Manufacturing Analysis

- The air conditioner market in India is dependent on both domestically produced output and imports, especially from China. The overall AC market of 4.9 million units in the year 2024 had a share of 35.2% of imported air conditioners.

- 75–80% of total imports are inverter ACs (CBUs), with a small portion being window ACs and the remaining being indoor units. In the inverter AC segment, 80% of the electronics are imported from China, whereas 20% are assembled locally by OEMs like LG and Daikin. In the residential AC segment, according to Mr. Nandi, who heads the industry body CEAMA, the manufacturers import 75% of components (by value), and the rest 25% is done through local value additions.

India Air Conditioner Market Import Vs Domestic, 2024

India Air Conditioner Market Import Vs Domestic, By Component, 2024

India Inverter AC Industry Breakdown (FY23)

India Air Conditioner (AC) Market Trends

One of the most significant trends is the increasing smart air conditioners, which are equipped with IoT technology, enabling users to control them remotely via smartphones. This lines up with the increasing consumer demand for convenience and modern living solutions. Additionally, the a rising shift towards eco-friendly appliances, with manufacturers introducing air conditioners using low global warming potential (GWP) refrigerants in response to environmental regulations and consumer awareness.

Investment Opportunities in the India Air Conditioner (AC) Market

Various opportunities are developing in the market such as Infrastructure development, coupled with the government's initiatives to boost urbanization, is creating a spectrum array of opportunities for investors. The introduction of energy-efficient funding schemes and incentives for manufacturers adopting sustainable practices are attractive to foreign and domestic investors alike. Further, the growing e-commerce sector is opening a new landscape for direct-to-consumer sales strategies, offering investors a chance to capitalize on the digital retail boom.

Leading Players of the India Air Conditioner (AC) Market

The India Air Conditioner Market is dominated by several key players who compete fiercely for market share and consumer preference. Among the top players are Daikin, LG, and Hitachi, known for their advanced technology, energy-efficient models, and robust after-sales service. Voltas, a Tata enterprise, has a significant presence and is highly regarded for its wide range of affordable options catering specifically to Indian climatic conditions.

Government Regulations Introduced in the India Air Conditioner (AC) Market

The Indian government has been implementing several regulations to ensure the air conditioning industry develops sustainably, keeping pace with environmental commitments and energy efficiency standards. Regulations dictate the use of low GWP refrigerants and adherence to energy efficiency ratings to reduce the carbon footprint. The government also encourages the 'Make in India' initiative, encouraging domestic manufacturing through subsidies and incentives, which supports industry growth. These regulations’ goal to balance the demand for cooling solutions with the overarching goal of environmental conservation.

Future Insights of the India Air Conditioner (AC) Market

The future of the India air conditioner industry appears optimistic, with several ongoing drivers for instance rapid urbanization, increased income levels, and rising awareness of climate change impacts. User experiences and product offerings are revolutionizing with continuous technological advancements such as AI-integrated climate control systems and smart connectivity features. Furthermore, the rising adoption of renewable energy-powered systems with a continuous shift towards sustainable innovation. As the industry adapts to these trends, it is estimated that there will be an extreme focus on personalized solutions catering to diverse climatic needs, ensuring the market remains dynamic and expansive.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

Room Air Conditioner (Split AC) to Dominate the Market - By Type

According to Ravi Bhandari, Research Head, 6wresearch, room air conditioners are leading in terms of sales volume and market share. This segment accounts for approximately 75% of the market due to high demand for residential use, driven by affordability and ease of installation. The growing urban middle class and increasing income levels have fueled this demand. The market size for room air conditioners is projected to reach over 13 million units by 2030, marking a significant growth in the sector.

Residential to dominate the market - By Application

Within the market, the residential application leads the market growth. As of recent estimates, the residential sector accounts for over 50% of the total market share, underpinned by the growing need for home cooling solutions in urban and semi-urban areas. The market size for residential air conditioners is estimated to be valued at approximately USD 6 billion by 2030, fueled by factors like rising temperatures, affordable housing projects, and consumer preference for energy-efficient appliances.

Key Attractiveness of the Report:

- 10 Years of Market Numbers.

- Historical Data Starting from 2020 to 2023.

- Base Year: 2023

- Forecast Data until 2030.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- India Air Conditioner Market Outlook

- Market Size of India Air Conditioner Market, 2023

- Forecast of India Air Conditioner Market, 2030

- Historical Data and Forecast of India Air Conditioner Revenues & Volume for the Period 2020-2030

- India Air Conditioner Market Trend Evolution

- India Air Conditioner Market Drivers and Challenges

- India Air Conditioner Price Trends

- India Air Conditioner Porter's Five Forces

- India Air Conditioner Industry Life Cycle

- Historical Data and Forecast of India Air Conditioner Market Revenues & Volume By Types for the Period 2020-2030

- Historical Data and Forecast of India Air Conditioner Market Revenues & Volume By Room Air Conditioner for the Period 2020-2030

- Historical Data and Forecast of India Air Conditioner Market Revenues & Volume By Ducted Air Conditioner for the Period 2020-2030

- Historical Data and Forecast of India Air Conditioner Market Revenues & Volume By Ductless Air Conditioner for the Period 2020-2030

- Historical Data and Forecast of India Air Conditioner Market Revenues & Volume By Centralized/ Applied Air Conditioner Applications for the Period 2020-2030

- Historical Data and Forecast of India Air Conditioner Market Revenues & Volume Residential for the Period 2020-2030

- Historical Data and Forecast of India Air Conditioner Market Revenues & Volume By Healthcare for the Period 2020-2030

- Historical Data and Forecast of India Air Conditioner Market Revenues & Volume By Commercial & Retail for the Period 2020-2030

- Historical Data and Forecast of India Air Conditioner Market Revenues & Volume By Transportation & Infrastructure for the Period 2020-2030

- Historical Data and Forecast of India Air Conditioner Market Revenues & Volume By Hospitality for the Period 2020-2030

- Historical Data and Forecast of India Air Conditioner Market Revenues & Volume By Others for the Period 2020-2030

- Historical Data and Forecast of India Air Conditioner Market Revenues & Volume By Sales Channels for the Period 2020-2030

- Historical Data and Forecast of India Air Conditioner Market Revenues & Volume By Online for the Period 2020-2030

- Historical Data and Forecast of India Air Conditioner Market Revenues & Volume By Offline for the Period 2020-2030

- Historical Data and Forecast of India Air Conditioner Market Revenues & Volume By VRF for the Period 2020-2030

- Historical Data and Forecast of India Air Conditioner Market Revenues & Volume By Compressor for the Period 2020-2030

- Historical Data and Forecast of India Air Conditioner Market Revenues & Volume By Component for the Period 2020-2030

- Historical Data and Forecast of India Air Conditioner Market Revenues & Volume By Heat Pump Systems for the Period 2020-2030

- Historical Data and Forecast of India Air Conditioner Market Revenues & Volume By Heat Recovery Systems for the Period 2020-2030

- Historical Data and Forecast of India Air Conditioner Market Revenues & Volume By Regions for the Period 2020-2030

- Historical Data and Forecast of India Air Conditioner Market Revenues & Volume By North Region for the Period 2020-2030

- Historical Data and Forecast of India Air Conditioner Market Revenues & Volume By South Region for the Period 2020-2030

- Historical Data and Forecast of India Air Conditioner Market Revenues & Volume By East Region for the Period 2020-2030

- Historical Data and Forecast of India Air Conditioner Market Revenues & Volume By West Region for the Period 2020-2030

- India Air Conditioner Import Export Trade Statistics

- Market Opportunity Assessment By Types

- Market Opportunity Assessment By Applications

- Market Opportunity Assessment By Sales Channels

- Market Opportunity Assessment By VRF

- Market Opportunity Assessment By Regions

- India Air Conditioner Top Companies Market Share

- India Air Conditioner Competitive Benchmarking By Technical and Operational Parameters

- India Air Conditioner Company Profiles

- India Air Conditioner Key Strategic Recommendations

Market Covered

By Types

- Room Air Conditioner

- Window AC

- Split AC

- Ducted Air Conditioner

- Ceiling Concealed AC

- Unitary Packaged AC

- Ductless Air Conditioner

- Suspended AC

- Floor Standing AC

- Cassette AC

- Centralized/ Applied Air Conditioner

- AHU/FCU

- Chiller

- VRF

- Other Components

By Applications

- Residential

- Healthcare

- Commercial & Retail

- Transportation & Infrastructure

- Hospitality

- Others (Industrial, Oil & Gas, etc.)

By Sales Channels

- Online

- Offline

By VRF

- Compressor

- Air Cooled

- Water Cooled

- Component

- Indoor

- Outdoor

- Control System and Accessories

- Heat Pump Systems

- Ground-source

- Air-source

- Absorption

- Heat Recovery Systems

By Regions

- North Region

- South Region

- East Region

- West Region

India Air Conditioner Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. India Air Conditioner (AC) Market Overview |

| 3.1. India Air Conditioner (AC) Market Revenues, 2020 - 2030F |

| 3.2. India Air Conditioner (AC) Market - Industry Life Cycle |

| 3.3. India Air Conditioner (AC) Market - Value Chain Analysis |

| 3.4. India Air Conditioner (AC) Market - SWOT Analysis |

| 3.5. India Air Conditioner (AC) Market Revenue Share, By Types, 2020 - 2030F |

| 3.6. India Air Conditioner (AC) Market Revenue Share, By Applications, 2020 - 2030F |

| 3.7 India Air Conditioner (AC) Market Revenue Share, By Sales Channels, 2020 - 2030F |

| 3.8. India Air Conditioner (AC) Market Revenue Share, By Regions, 2020 - 2030F |

| 4. India Air Conditioner (AC) Market - Impact Analysis of COVID-19 |

| 5. India Air Conditioner (AC) Market Dynamics |

| 5.1. Impact Analysis |

| 5.2. Market Drivers |

| 5.3. Market Restraints |

| 6. India Air Conditioner (AC) Market Trends and Evolution |

| 7. India Room Air Conditioner (AC) Market Overview |

| 7.1. India Room Air Conditioner (AC) Market Revenues & Volume, 2020 - 2030F |

| 7.2. India Room Air Conditioner (AC) Market Revenue & Volume Share, By Types, 2020 - 2030F |

| 7.2.1 India Window Air Conditioner (AC) Market Revenues & Volume, 2020 - 2030F |

| 7.2.2 India Split Air Conditioner (AC) Market Revenues & Volume, 2020 - 2030F |

| 8. India Ducted Air Conditioner (AC) Market Overview |

| 8.1. India Ducted Air Conditioner (AC) Market Revenues & Volume, 2020 - 2030F |

| 8.2. India Ducted Air Conditioner (AC) Market Revenue & Volume Share, By Types, 2020 - 2030F |

| 8.2.1 India Ceiling Concealed Air Conditioner (AC) Market Revenues & Volume, 2020 - 2030F |

| 8.2.2 India Unitary Packaged Air Conditioner (AC) Market Revenues & Volume, 2020 - 2030F |

| 9. India Ductless Air Conditioner (AC) Market Overview |

| 9.1. India Ductless Air Conditioner (AC) Market Revenues & Volume, 2020 - 2030F |

| 9.2. India Ductless Air Conditioner (AC) Market Revenue & Volume Share, By Types, 2020 - 2030F |

| 9.2.1 India Suspended Air Conditioner (AC) Market Revenues & Volume, 2020 - 2030F |

| 9.2.2 India Floor Standing Air Conditioner (AC) Market Revenues & Volume, 2020 - 2030F |

| 9.2.3 India Cassette Air Conditioner (AC) Market Revenues & Volume, 2020 - 2030F |

| 10. India Centralized/ Applied Air Conditioner (AC) Market Overview |

| 10.1. India Centralized/ Applied Air Conditioner (AC) Market Revenues & Volume, 2020 - 2030F |

| 10.2. India Centralized/ Applied Air Conditioner (AC) Market Revenue & Volume Share, By Components, 2020 - 2030F |

| 10.2.1 India AHU/FCU Market Revenues and Volume, 2020 - 2030F |

| 10.2.2 India Chiller Market Revenues and Volume, 2020 - 2030F |

| 10.2.3 India VRF Market Revenues and Volume, 2020 - 2030F |

| 10.2.4 India Other Components Market Revenues, 2020 - 2030F |

| 11. India Air Conditioner (AC) Market Overview, By Applications |

| 11.1. India Air Conditioner (AC) Market Revenues, By Residential Application, 2020 - 2030F |

| 11.2. India Air Conditioner (AC) Market Revenues, By Healthcare Application, 2020 - 2030F |

| 11.3. India Air Conditioner (AC) Market Revenues, By Commercial & Retail Application, 2020 - 2030F |

| 11.4. India Air Conditioner (AC) Market Revenues, By Transportation & Infrastructure Application, 2020 - 2030F |

| 11.5. India Air Conditioner (AC) Market Revenues, By Hospitality Application, 2020 - 2030F |

| 11.7. India Air Conditioner (AC) Market Revenues, By Other Applications, 2020 - 2030F |

| 12. India Air Conditioner (AC) Market Overview, By Sales Channels |

| 12.1. India Air Conditioner (AC) Market Revenues, By Online Channel, 2020 - 2030F |

| 12.2. India Air Conditioner (AC) Market Revenues, By Offline Channel, 2020 - 2030F |

| 13. India Air Conditioner (AC) Market Overview, By VRF |

| 13.1 India VRF Air Conditioner (AC) Market Overview, By Compressor |

| 13.1.1 India VRF Air Conditioner (AC) Market Revenues, By Air-Cooled, 2020 - 2030F |

| 13.1.2 India VRF Air Conditioner (AC) Market Revenues, By Water-Cooled, 2020 - 2030F |

| 13.2 India VRF Air Conditioner (AC) Market Overview, By Components |

| 13.2.1 India VRF Air Conditioner (AC) Market Revenues, By Indoor Units, 2020 - 2030F |

| 13.2.2 India VRF Air Conditioner (AC) Market Revenues, By Outdoor Units, 2020 - 2030F |

| 13.2.3 India VRF Air Conditioner (AC) Market Revenues, By Control System and Accessories, 2020 - 2030F |

| 13.3 India VRF Air Conditioner (AC) Market Overview, By System Types |

| 13.3.1 India VRF Air Conditioner (AC) Market Revenues, By Heat Pump System, 2020 - 2030F |

| 13.3.1.1 India VRF Air Conditioner (AC) Heat Pump System Market Revenue Share, By Types, 2020 & 2020 - 2030F |

| 13.3.1.2 India VRF Air Conditioner (AC) Market Revenues, By Ground-source, 2020 - 2030F |

| 13.3.1.3 India VRF Air Conditioner (AC) Market Revenues, By Air-source, 2020 - 2030F |

| 13.3.1.4 India VRF Air Conditioner (AC) Market Revenues, By Absorption, 2020 - 2030F |

| 13.3.1.5 India VRF Air Conditioner (AC) Market Revenues, By Heat Recovery System, 2020 - 2030F |

| 13.4 India VRF Air Conditioner (AC) Market Overview, By Applications |

| 13.4.1 India VRF Air Conditioner (AC) Market Revenues, By Residential Application, 2020 - 2030F |

| 13.4.2 India VRF Air Conditioner (AC) Market Revenues, By Industrial Application, 2020 - 2030F |

| 13.4.3 India VRF Air Conditioner (AC) Market Revenues, By Commercial Application, 2020 - 2030F |

| 13.5 India VRF Air Conditioner (AC) Market Overview, By Regions |

| 13.5.1 India VRF Air Conditioner (AC) Market Revenues, By Northern Region, 2020 - 2030F |

| 13.5.2 India VRF Air Conditioner (AC) Market Revenues, By Southern Region, 2020 - 2030F |

| 13.5.3 India VRF Air Conditioner (AC) Market Revenues, By Western Region, 2020 - 2030F |

| 13.5.4 India VRF Air Conditioner (AC) Market Revenues, By Eastern Region, 2020 - 2030F |

| 14. India Air Conditioner (AC) Market Overview, By Regions |

| 14.1. India Air Conditioner (AC) Market Revenues and Volume, By Northern Region, 2020 - 2030F |

| 14.2. India Air Conditioner (AC) Market Revenues and Volume, By Southern Region, 2020 - 2030F |

| 14.3. India Air Conditioner (AC) Market Revenues and Volume, By Eastern Region, 2020 - 2030F |

| 14.4. India Air Conditioner (AC) Market Revenues and Volume, By Western Region, 2020 - 2030F |

| 15. India Air Conditioner (AC) Market Import Vs. Domestic Manufacturing Analysis |

| 15.1. India Air Conditioner (AC) Market - Import Vs. Domestic Manufacturing Analysis |

| 15.2. India Domestic Manufactured Air Conditioner (AC) Market, 2020 - 2030F |

| 16. India Air Conditioner (AC) Market - Key Performance Indicators |

| 17. India Air Conditioner (AC) Market Overview, By Star Rating |

| 18. India Air Conditioner (AC) Market Overview, By Tonnage |

| 19. India Air Conditioner (AC) Market Overview, By BLDC Unit vs Normal AC Unit |

| 20. India Air Conditioner (AC) Market Overview, By Manufacturing VS Import Company Wise |

| 21. India Air Conditioner (AC) Market- Consumer Analysis |

| 22. India Air Conditioner (AC) Market Overview, By Top 10 States |

| 23. India Air Conditioner (AC) Market - Opportunity Assessment |

| 23.1. India Air Conditioner (AC) Market Opportunity Assessment, By Types, 2020 - 2030F |

| 23.2. India Air Conditioner (AC) Market Opportunity Assessment, By Applications, 2020 - 2030F |

| 23.3. India Air Conditioner (AC) Market Opportunity Assessment, By Sales Channels, 2020 - 2030F |

| 23.4. India Air Conditioner (AC) Market Opportunity Assessment, By Regions, 2020 - 2030F |

| 24. India Air Conditioner (AC) Market Competitive Landscape |

| 24.1. India Air Conditioner (AC) Market Volume Share, By Companies, 2020 - 2030F |

| 24.2. India Air Cooler Market Competitive Benchmarking, By Technical Parameters |

| 24.3. India Air Cooler Market Competitive Benchmarking, By Operating Parameters |

| 25. Company Profiles |

| 25.1. Voltas Limited |

| 25.2. Daikin Airconditioning India Pvt. Ltd. |

| 25.3. Havells India Limited (Lloyd) |

| 25.4. Blue Star Limited |

| 25.5. Panasonic Pvt. Ltd. |

| 25.6. Carrier Midea India Pvt. Ltd. |

| 25.7. Fujitsu Genera India Pvt. Ltd. |

| 25.8. Mitsubishi Electric India Pvt. Ltd. |

| 25.9. Haier Appliances India Pvt. Ltd. |

| 25.10. Hitachi India Pvt. Ltd. |

| 25.11. LG Electronics India Pvt. Ltd. |

| 25.12. Samsung India Electronics Pvt. Ltd. |

| 26. Key Strategic Recommendations |

| 27. Disclaimer |

| List of Figures |

| 1. Czech Republic Semiconductor Market Revenues and Volume, 2020 - 2030F ($ Million, Metric Tons) |

| 2. Czech Republic Semiconductor Market Revenue Share, By Components, 2020 - 2030F |

| 3. Czech Republic Semiconductor Market Revenue Share, By Applications, 2020 - 2030F |

| 4. Czech Republic Internet Penetration, 2020 - 2030F (% of Population) |

| 5. Czech Republic Automotive Sales, By Type, 2020 - 2030F |

| 6. Czech Republic Total Automotive Sales, 2020 - 2030F |

| 7. IoT Semiconductor Stack Diagram |

| 8. Silicon Metal Prices, 2020 - 2030F (US Cent /Pound) |

| 9. Czech Republic Memory Devices Market Revenues, 2020 - 2030F ($ Million) |

| 10. Czech Republic Logic Devices Market Revenues, 2020 - 2030F ($ Million) |

| 11. Czech Republic Analog IC Market Revenues, 2020 - 2030F ($ Million) |

| 12. Czech Republic MPU Market Revenues, 2020 - 2030F ($ Million) |

| 13. Czech Republic Discrete Power Devices Market Revenues, 2020 - 2030F ($ Million) |

| 14. Czech Republic MCU Market Revenues, 2020 - 2030F ($ Million) |

| 15. Czech Republic Others Component Market Revenues, 2020 - 2030F ($ Million) |

| 16. Czech Republic Networking & Communications Semiconductor Market Revenues, 2020 - 2030F ($ Million) |

| 17. Czech Republic Data Processing Semiconductor Market Revenues, 2020 - 2030F ($ Million) |

| 18. Czech Republic Industrial Semiconductor Market Revenues, 2020 - 2030F ($ Million) |

| 19. Czech Republic Consumer Electronics Semiconductor Market Revenues, 2020 - 2030F ($ Million) |

| 20. Czech Republic Automotive Semiconductor Market Revenues, 2020 - 2030F ($ Million) |

| 21. Czech Republic Government Market Revenues, 2020 - 2030F ($ Million) |

| 22. Czech Republic Semiconductor Import, 2020 - 2030F ($) |

| 23. Czech Republic Semiconductor Export, 2020 - 2030F ($) |

| 24. Czech Republic Manufacturing Value Added, 2020 - 2030F ($ Billion) |

| 25. Czech Republic Manufacturing Value Added Annual Growth Rate, 2020 - 2030F (in %) |

| 26. Czech Republic Annual Vehicle Sales, By Type 2020 - 2030F (Units) |

| 27. Czech Republic Annual Vehicle Sales Growth Rate, 2020 - 2030F (in %) |

| 28. Czech Republic ICT Investment, By Type 2020 - 2030F ($ Billion) |

| 29. Czech Republic ICT Equipment Investment Growth Rate, 2020 - 2030F (in %) |

| 30. Czech Republic Semiconductor Market Opportunity Assessment, By Components, 2020 - 2030F |

| 31. Czech Republic Semiconductor Market Opportunity Assessment, By Applications, 2020 - 2030F |

| 32. Czech Republic Semiconductor Market Company Rankings, By Companies, 2020 - 2030F |

Market Forecast By Types (Window AC, Split AC, Ceiling Concealed, Packaged AC, Floor Standing, Cassette Type and Centralized (VRF, AHU/FCU, Condensing Unit, Chiller, and Others)), By Applications (Residential, Commercial & Retail, Hospitality, Oil & Gas, Healthcare and Others), By Regions (Eastern, Western, Central and Southern) and Competitive Landscape

| Product Code: ETC060824 | Publication Date: May 2021 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 101 | No. of Figures: 37 | No. of Tables: 14 |

India Air Conditioner Market report comprehensively covers the market by types, applications and regions. The market report provides an unbiased and detailed analysis of the on-going trends, opportunities, high growth areas and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

India Air Conditioner Market Synopsis

India Air Conditioner Market witnessed a significant growth rate over the past few years owing to the growing retail and hospitality sectors, rising construction activities across airports, metros, and new housing societies along with the increasing establishment of SMEs and commercial hubs. Additionally, the growth in the construction market and increasing government spending towards public infrastructure would further spur the air conditioner market in the country in the coming years.

The COVID-19 pandemic has negatively affected the air conditioners industry in terms of lower demand in the peak summer season, strict lockdowns disrupting the supply chain, and rise in the prices of raw material as several manufacturers airlift components such as controllers, compressors, and other materials from China, Thailand, and Malaysia. However, companies are trying to balance the situation by offering various kinds of schemes such as EMI and seasonal discounts which are attracting the middle-class population of the country to purchase air conditioners.

According to 6Wresearch, India Air Conditioner Market size is projected to grow at CAGR of 10.7% during 2021-27. The air conditioner market in India is highly competitive and fragmented with the presence of domestic, international, and unorganized market participants. The market is broadly divided into four segments. Room air conditioners dominate the AC market share across all the segments due to the strengthening of the residential sector, rising construction of new housing societies along with the establishment of SMEs. Additionally, growth in the number of construction projects across metro & tier-2 cities would further increase the demand for room air conditioners in the country in the coming years. In terms of market segment by room types, the split ACs held the largest share within the room air conditioner market in both in the revenue as well as in the volume share in the year 2020 due to the changing preferences of the consumers towards adopting the energy-efficient products and their rising adoption in residential and SME segments.

Market Analysis by Type

Based on types, room air conditioners captured the largest market revenue share in 2020, owing to the increasing income levels, rising standard of living and urbanization. The growth in the room air conditioner market is majorly driven by the split ACs which held the majority share due to the changing preferences of the consumers towards adopting the energy-efficient products and their rising adoption of these type of ACs in residential and SME segments and the commercial spaces.

Market Analysis by Applications

Based on the applications, the residential sector accounted for the highest revenue share in the India air conditioner market registering more than 50% in the overall market revenues in 2020, followed by commercial and retail sectors. The increasing number of residential complexes and business parks in tier 1 and tier 2 cities, changing standard of living, rising rural development along with upcoming government-funded residential projects-Housing for All, Pradhan Mantri Awas Yojana (PMAY) and others would fuel the demand for air conditioners in the country over the coming years.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report

- India Air Conditioner Market Overview.

- India Air Conditioner Market Outlook.

- India Air Conditioner Market Forecast.

- Historical Data and Forecast of India Air Conditioner Market Revenues for the Period 2017-2027F

- Historical Data and Forecast of Market Revenues, By Types for the Period 2017-2027F

- Historical Data and Forecast of Market Revenues, By Applications for the Period 2017-2027F

- Historical Data and Forecast of Market Revenues, By Regions for the Period 2017-2027F

- Market Drivers, Restraints

- India Air Conditioner Market Trends

- Industry Life Cycle

- SWOT Analysis

- Market Opportunity Assessment

- India Air Conditioner Market Share, By Companies

- Market Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

- By Product Types:

- Window AC

- Split AC

- Ceiling Concealed AC

- Unitary Packaged AC

- Suspended AC

- Floor Standing AC

- Cassette AC

- AHU/FCU

- Chiller

- VRF

- Other Components

- Room Air Conditioner

- Ducted Air Conditioner

- Ductless Air Conditioner

- Centralized/ Applied Air Conditioner

- By Applications:

- Residential

- Healthcare

- Commercial & Retail Application

- Transportation & Infrastructure

- Hospitality

- Others (Industrial, Oil & Gas, etc.)

- By Regions:

- North Region

- South Region

- East Region

- West Region

Frequently Asked Questions About the Market Study:

- Does the report consider COVID-19 impact?The report not only has considered COVID-19 impact but also current market dynamics, trends and KPIs into consideration.

- How much growth is expected in the India Air Conditioner over the coming years?

The India Air Conditioner revenue is anticipated to record a CAGR of 10.7% during 2021-27.

- Which segment has captured key share of the market?

Room air conditioner has dominated the market revenues led by the growing demand of the product in cold storage industry.

- Which segment is exhibited to gain traction over the forecast period?

Residential sector would record key growth throughout the forecast period 2021-27. - Who are key the key players of the market?

The key players of the market include- Voltas Limited, Daikin Airconditioning India Private Limited, Havells India Limited (Lloyd), Blue Star Limited, Panasonic, Carrier Midea India Private Limited, Fujitsu Genera India Private Limited, Mitsubishi Electric India Private Limited, Haier Appliances India Private Limited, Hitachi India Private limited - Is customization available in the market study?

Yes, we can do customization as per your requirements. Please feel free to write to us sales@6wresearch.com for any customized or any other requirements

- We also want to have market reports for other countries/regions.

6Wresearch has the database of more than 60 countries globally, which can make us your first choice of all your research needs.

Other Key Reports Available:

- Japan Air Conditioner Market (2021-2027F)

- China Air Conditioner Market (2021-2027F)

- Australia Air Conditioner Market (2021-2027F)

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero