India Automotive Stamping Market (2025-2031) | Industry, Forecast, Size, Trends, Revenue, Share, Analysis, Value, Outlook, Segmentation.

Market Forecast By Vehicle (Two-Wheeler, Three-Wheeler, Passenger Car, Commercial Vehicle), By Material (Steel, Aluminium, Others), By Process (Progressive Die Stamping, Tandem Stamping, Transfer Stamping), By Product (Body Stamping, BIW Parts, Chassis, Non-Body Stamping, Engine Parts, Transmission and Steering Parts, Braking and Suspension Parts, Electrical Parts) And Competitive Landscape

| Product Code: ETC431660 | Publication Date: Oct 2022 | Updated Date: Nov 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 |

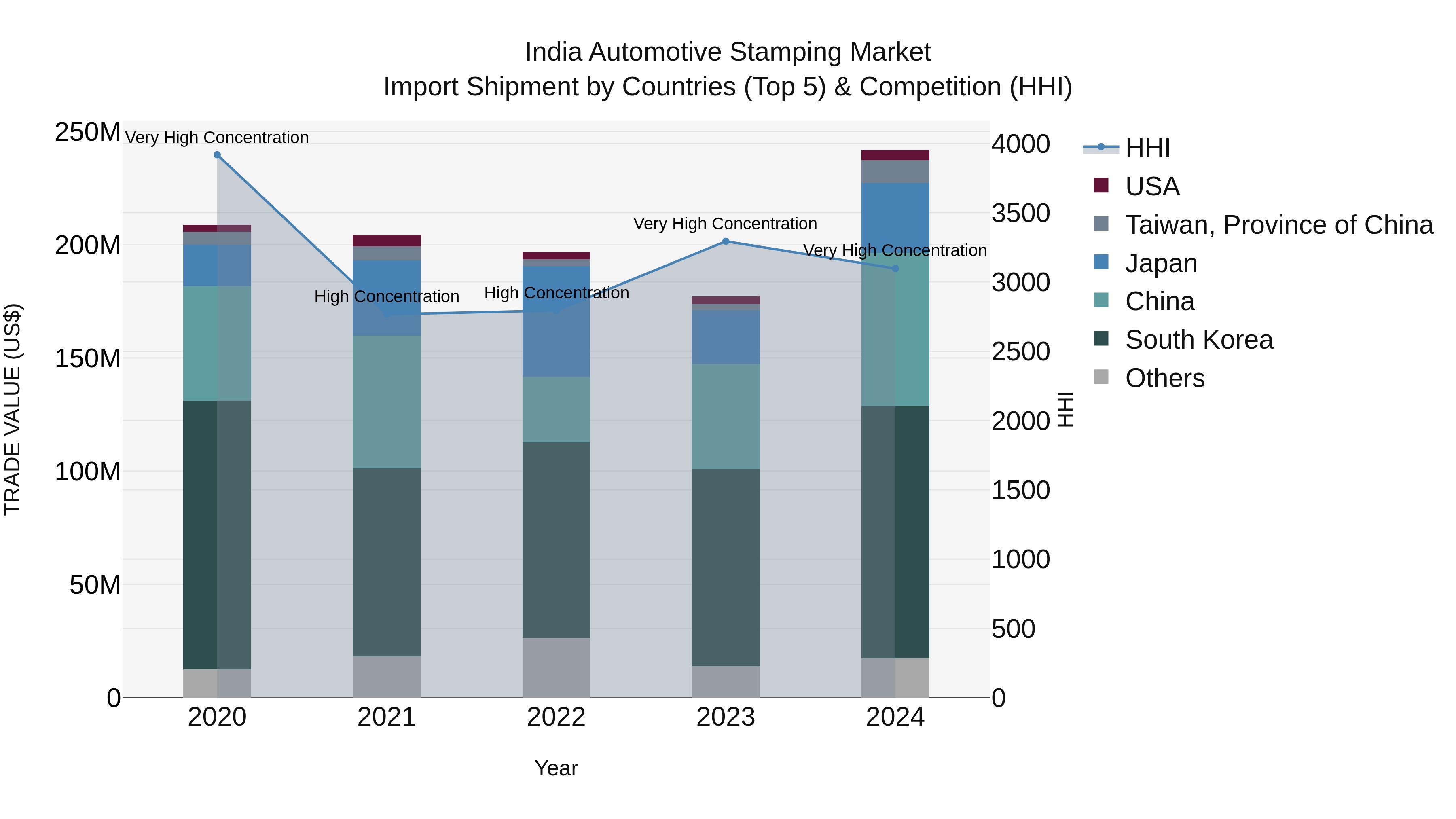

India Automotive Stamping Market Top 5 Importing Countries and Market Competition (HHI) Analysis

In 2024, India`s automotive stamping import shipments continued to be dominated by key players such as South Korea, China, and Japan, showcasing a high Herfindahl-Hirschman Index (HHI) concentration. The Compound Annual Growth Rate (CAGR) from 2020 to 2024 stood at a steady 3.75%, with a notable growth rate of 36.47% from 2023 to 2024. This indicates a strong demand for automotive stamping imports in India, with top exporting countries playing a significant role in meeting this demand and contributing to the industry`s growth.

India Automotive Stamping Market Highlights

| Report Name | India Automotive Stamping Market |

| Forecast period | 2025-2031 |

| CAGR | 7.5% |

| Growing Sector | Automotive Manufacturing |

Topics Covered in the India Automotive Stamping Market Report

The India Automotive Stamping Market report thoroughly covers the market by Vehicle, Material, Process, Product. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers, which would help the stakeholders devise and align their market strategies according to the current and future market dynamics.

India Automotive Stamping Market Synopsis

The India Automotive Stamping Industry is poised for significant expansion thanks to dynamic changes in the automotive landscape. Innovations in stamping technologies and the accelerating shift toward sustainable mobility are shaping the market's trajectory. Increased demand for lightweight, high-precision components to improve vehicle efficiency aligns with trends favouring electric and hybrid models. Additionally, advancements in automation and localised production strategies are fostering cost-effective and streamlined manufacturing processes. With favourable policy frameworks and an expanding domestic ecosystem, the industry is emerging as a pivotal player in the global automotive supply chain.

According to 6Wresearch, the India Automotive Stamping Market is estimated to reach a CAGR of 7.5% during the forecast period 2025-2031. The growth of the India Automotive Stamping industry is driven by several critical factors. Increasing consumer preference for fuel-efficient and lightweight vehicles has augmented the demand for high-quality stamped components, paving the way for market expansion. Furthermore, the development of advanced materials like high-strength steel and aluminium alloys is enabling manufacturers to meet the intricate demands of modern automotive designs. Growing investments in research and development to innovate stamping processes further contribute to industry advancement. The India Automotive Stamping Market share is also bolstered by rising exports of stamped components as global manufacturers seek cost-efficient sourcing partners in India.

However, the industry faces challenges such as fluctuating raw material prices and the need for substantial capital investments to adopt high-tech stamping technologies. Another critical concern involves ensuring skilled labour availability to operate advanced machinery. Despite these obstacles, the increasing emphasis on localised manufacturing and government support under initiatives like "Make in India" are expected to sustain growth. With expanding domestic demand and evolving market preferences, the India Automotive Stamping Market size is anticipated to experience steady growth in the coming years.

India Automotive Stamping Market Trends

The India Automotive Stamping Market continues to evolve, driven by various dynamic trends shaping its trajectory. Below are the key trends influencing the industry:

- Advanced Stamping Technologies: Increased adoption of robotic and automation systems is streamlining production processes, improving efficiency, and enhancing precision in large-scale manufacturing.

- Lightweight Material Demand: The shift toward lightweight vehicle components, driven by the need for fuel efficiency and reduced emissions, is propelling innovations in material usage.

- EV Component Manufacturing Surge: With the growing adoption of electric vehicles (EVs), the demand for stamped components tailored to EV designs is significantly rising.

- Export Growth Opportunities: Export of stamped components continues to provide a strong boost to India Automotive Stamping Market revenue, particularly as international manufacturers favour cost-competitive suppliers.

- Sustainability Initiatives: Focus on environmentally friendly manufacturing practices is gaining prominence, aligning with global sustainability goals.

These trends underscore the optimistic outlook for India Automotive Stamping Market growth, highlighting potential breakthroughs and sustained market expansion.

Investment Opportunities in the India Automotive Stamping Market

The India Automotive Stamping Market presents a promising landscape for investors, with its steady growth and evolving dynamics. Strategic investments in this sector can unlock significant returns driven by innovation, demand, and global trends. Key opportunities include:

- Technological Advancements: Investing in cutting-edge stamping technologies, such as laser cutting and 3D stamping, can cater to the increasing need for precision and efficiency in manufacturing.

- Expansion of EV Market: Capitalizing on the rising demand for electric vehicles by producing custom-stamped components specifically designed for EV architecture.

- Collaborations with OEMs: Building partnerships with original equipment manufacturers ensures a consistent demand for stamped components, enhancing India Automotive Stamping Market share.

- Domestic and Export Growth: Leveraging government schemes promoting "Made in India" automotive components can boost both domestic sales and exports.

- Sustainability-Focused Production: Establishing eco-friendly stamping units aligned with global sustainability standards can attract eco-conscious automakers and expand their market presence.

These investment areas spotlight the sector’s potential to deliver financial returns while contributing to the broader development trajectory of the Indian automotive industry.

Leading Players in the India Automotive Stamping Market

The India Automotive Stamping Market is home to several prominent players driving innovation, efficiency, and revenue growth. These companies have established themselves as leaders through advanced technologies and strategic collaborations.

- JBM Group: Known for its extensive focus on sustainability and advanced manufacturing techniques, JBM Group contributes significantly to the sector's evolution.

- Vanderlande Industries: Renowned for high-precision metal stamping, this company caters to the growing demand for premium automotive components.

- KLT Automotive & Tubular Products Limited: With expertise in lightweight and customized components, KLT Automotive strengthens its position in the market.

- Tata Autocomp Systems: Leveraging diverse capabilities, Tata Autocomp delivers innovative solutions tailored to meet OEM requirements.

- Mahindra CIE Automotive: A major player focusing on efficiency and exports, enhancing India Automotive Stamping Market revenue growth.

These key players collectively reinforce the market's global competitiveness, driving its expansion and innovation while meeting the automotive industry's dynamic demands.

Government Regulations

The India Automotive Stamping industry is heavily influenced by government regulations aimed at promoting sustainability, safety, and innovation. Stringent policies related to emission standards, like Bharat Stage VI, have compelled manufacturers to adopt cleaner and more efficient production methods. Additionally, tax incentives and subsidies for the adoption of electric vehicles have encouraged companies to invest in advanced stamping techniques to meet evolving design and performance requirements. Regulations concerning labour laws and industrial safety standards also play a significant role in shaping manufacturing practices, ensuring safer working environments. Furthermore, government initiatives such as "Make in India" foster the localisation of automotive component production, boosting domestic innovation and reducing dependency on imports. These regulations collectively ensure the industry's adherence to global standards while driving its growth.

Future Insights of the India Automotive Stamping Market

The India Automotive Stamping Market size is projected to expand significantly, driven by rising demand for lightweight and high-performance vehicle components. With the growing adoption of electric and hybrid vehicles, manufacturers are increasingly focusing on developing precision stamping techniques to meet emerging design and efficiency standards. Advances in material science, including the use of high-strength alloys, are expected to play a pivotal role in improving the durability and safety of stamped parts. Additionally, the push towards automation and smart manufacturing technologies, such as AI-driven quality checks and robotics, is set to revolutionise production efficiency and consistency. Export opportunities are also likely to grow as Indian manufacturers align with international benchmarks, capitalising on global partnerships and trade agreements. This optimistic outlook highlights the potential for innovative growth across the industry in the years to come.

Market Segmentation Analysis

The Report offers a comprehensive study of the subsequent market segments and their leading categories.

Body Stamping to Dominate Market-By Vehicle

Body stamping is expected to lead the market in the vehicle segment, particularly for passenger cars and commercial vehicles. The increasing demand for lightweight and aerodynamic vehicle structures has driven the adoption of advanced body stamping techniques. Passenger cars require precision body components for improved safety and aesthetics, which further boosts demand. Additionally, the rise of electric vehicles (EVs) has amplified the need for specialised stamped body parts to support battery integration. Manufacturers are focusing on innovative designs and high-strength materials to cater to both domestic and export markets.

Steel to Dominate Market-By Material

Steel remains the most widely used material in automotive stamping, largely due to its durability, cost-effectiveness, and versatility. High-strength steel alloys, in particular, offer superior performance, ensuring safety and structural integrity in vehicles. Its adaptability for diverse applications such as body-in-white (BIW) parts, chassis, and engine components further enhances its dominance. Automation in steel stamping processes has also improved production efficiency while reducing waste. Increased investments in advanced steel processing technologies are reinforcing the material's leadership in this segment.

Progressive Die Stamping to Dominate Market-By Process

Progressive die stamping is poised to dominate due to its ability to mass-produce components with precision and minimal material wastage. This process is especially beneficial for manufacturing complex parts such as transmission and braking components. Automotive manufacturers favour progressive die stamping for its high-speed production and cost-effectiveness over long production runs. The growing integration of robotic automation in this process is further improving efficiency and quality. Its adaptability across both conventional and EV applications ensures sustained growth in this market segment.

BIW Parts to Dominate Market-By Product

According to Suryakant, Senior Research Analyst, 6Wresearch, Body-in-white (BIW) parts are projected to dominate the product segment due to their critical role in defining vehicle structure and safety. These parts form the skeletal framework of automobiles, making their precision and strength essential for crashworthiness and durability. Growing consumer preference for lighter vehicles without compromising safety is driving innovation in BIW manufacturing. The production of advanced BIW parts from high-strength steel and aluminium is helping automakers achieve regulatory compliance. This trend is expected to continue as global and domestic markets demand safer and more efficient vehicles.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- India Automotive Stamping Market Outlook

- Market Size of India Automotive Stamping Market, 2024

- Forecast of India Automotive Stamping Market, 2031

- Historical Data and Forecast of India Automotive Stamping Revenues & Volume for the Period 2021 - 2031

- India Automotive Stamping Market Trend Evolution

- India Automotive Stamping Market Drivers and Challenges

- India Automotive Stamping Price Trends

- India Automotive Stamping Porter's Five Forces

- India Automotive Stamping Industry Life Cycle

- Historical Data and Forecast of India Automotive Stamping Market Revenues & Volume By Vehicle for the Period 2021 - 2031

- Historical Data and Forecast of India Automotive Stamping Market Revenues & Volume By Two-Wheeler for the Period 2021 - 2031

- Historical Data and Forecast of India Automotive Stamping Market Revenues & Volume By Three-Wheeler for the Period 2021 - 2031

- Historical Data and Forecast of India Automotive Stamping Market Revenues & Volume By Passenger Car for the Period 2021 - 2031

- Historical Data and Forecast of India Automotive Stamping Market Revenues & Volume By Commercial Vehicle for the Period 2021 - 2031

- Historical Data and Forecast of India Automotive Stamping Market Revenues & Volume By Material for the Period 2021 - 2031

- Historical Data and Forecast of India Automotive Stamping Market Revenues & Volume By Steel for the Period 2021 - 2031

- Historical Data and Forecast of India Automotive Stamping Market Revenues & Volume By Aluminium for the Period 2021 - 2031

- Historical Data and Forecast of India Automotive Stamping Market Revenues & Volume By Others for the Period 2021 - 2031

- Historical Data and Forecast of India Automotive Stamping Market Revenues & Volume By Process for the Period 2021 - 2031

- Historical Data and Forecast of India Automotive Stamping Market Revenues & Volume By Progressive Die Stamping for the Period 2021 - 2031

- Historical Data and Forecast of India Automotive Stamping Market Revenues & Volume By Tandem Stamping for the Period 2021 - 2031

- Historical Data and Forecast of India Automotive Stamping Market Revenues & Volume By Transfer Stamping for the Period 2021 - 2031

- Historical Data and Forecast of India Automotive Stamping Market Revenues & Volume By Product for the Period 2021 - 2031

- Historical Data and Forecast of India Automotive Stamping Market Revenues & Volume By Body Stamping for the Period 2021 - 2031

- Historical Data and Forecast of India Automotive Stamping Market Revenues & Volume By BIW Parts for the Period 2021 - 2031

- Historical Data and Forecast of India Automotive Stamping Market Revenues & Volume By Chassis for the Period 2021 - 2031

- Historical Data and Forecast of India Automotive Stamping Market Revenues & Volume By Non-Body Stamping for the Period 2021 - 2031

- Historical Data and Forecast of India Automotive Stamping Market Revenues & Volume By Engine Parts for the Period 2021 - 2031

- Historical Data and Forecast of India Automotive Stamping Market Revenues & Volume By Transmission and Steering Parts for the Period 2021 - 2031

- Historical Data and Forecast of India Automotive Stamping Market Revenues & Volume By Braking and Suspension Parts for the Period 2021 - 2031

- Historical Data and Forecast of India Automotive Stamping Market Revenues & Volume By Electrical Parts for the Period 2021 - 2031

- India Automotive Stamping Import Export Trade Statistics

- Market Opportunity Assessment By Vehicle

- Market Opportunity Assessment By Material

- Market Opportunity Assessment By Process

- Market Opportunity Assessment By Product

- India Automotive Stamping Top Companies Market Share

- India Automotive Stamping Competitive Benchmarking By Technical and Operational Parameters

- India Automotive Stamping Company Profiles

- India Automotive Stamping Key Strategic Recommendations

Market Segmentation Analysis

The Report offers a comprehensive study of the subsequent market segments and their leading categories.

By Vehicle

- Two-Wheeler

- Three-Wheeler

- Passenger Car

- Commercial Vehicle

By Material

- Steel

- Aluminium and Others

By Process

- Progressive Die Stamping

- Tandem Stamping

- Transfer Stamping

By Product

- Body Stamping

- BIW Parts

- Chassist

- Non-Body Stamping

- Engine Parts

- Transmission And Steering Parts

- Braking And Suspension Parts and Electrical Parts

India Automotive Stamping Market (2025-2031) : FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 India Automotive Stamping Market Overview |

| 3.1 India Country Macro Economic Indicators |

| 3.2 India Automotive Stamping Market Revenues & Volume, 2021 & 2031 |

| 3.3 India Automotive Stamping Market - Industry Life Cycle |

| 3.4 India Automotive Stamping Market - Porter's Five Forces |

| 3.5 India Automotive Stamping Market Revenues & Volume Share, By Vehicle, 2021 & 2031 |

| 3.6 India Automotive Stamping Market Revenues & Volume Share, By Material, 2021 & 2031 |

| 3.7 India Automotive Stamping Market Revenues & Volume Share, By Process, 2021 & 2031 |

| 3.8 India Automotive Stamping Market Revenues & Volume Share, By Product, 2021 & 2031 |

| 4 India Automotive Stamping Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Growing demand for automobiles in India |

| 4.2.2 Technological advancements in automotive stamping processes |

| 4.2.3 Increasing investments in the automotive sector in India |

| 4.3 Market Restraints |

| 4.3.1 Fluctuating raw material prices |

| 4.3.2 Regulatory challenges in the automotive industry |

| 4.3.3 Competition from alternative manufacturing processes |

| 5 India Automotive Stamping Market Trends |

| 6 India Automotive Stamping Market, By Types |

| 6.1 India Automotive Stamping Market, By Vehicle |

| 6.1.1 Overview and Analysis |

| 6.1.2 India Automotive Stamping Market Revenues & Volume, By Vehicle, 2021 - 2031 |

| 6.1.3 India Automotive Stamping Market Revenues & Volume, By Two-Wheeler, 2021 - 2031 |

| 6.1.4 India Automotive Stamping Market Revenues & Volume, By Three-Wheeler, 2021 - 2031 |

| 6.1.5 India Automotive Stamping Market Revenues & Volume, By Passenger Car, 2021 - 2031 |

| 6.1.6 India Automotive Stamping Market Revenues & Volume, By Commercial Vehicle, 2021 - 2031 |

| 6.2 India Automotive Stamping Market, By Material |

| 6.2.1 Overview and Analysis |

| 6.2.2 India Automotive Stamping Market Revenues & Volume, By Steel, 2021 - 2031 |

| 6.2.3 India Automotive Stamping Market Revenues & Volume, By Aluminium, 2021 - 2031 |

| 6.2.4 India Automotive Stamping Market Revenues & Volume, By Others, 2021 - 2031 |

| 6.3 India Automotive Stamping Market, By Process |

| 6.3.1 Overview and Analysis |

| 6.3.2 India Automotive Stamping Market Revenues & Volume, By Progressive Die Stamping, 2021 - 2031 |

| 6.3.3 India Automotive Stamping Market Revenues & Volume, By Tandem Stamping, 2021 - 2031 |

| 6.3.4 India Automotive Stamping Market Revenues & Volume, By Transfer Stamping, 2021 - 2031 |

| 6.4 India Automotive Stamping Market, By Product |

| 6.4.1 Overview and Analysis |

| 6.4.2 India Automotive Stamping Market Revenues & Volume, By Body Stamping, 2021 - 2031 |

| 6.4.3 India Automotive Stamping Market Revenues & Volume, By BIW Parts, 2021 - 2031 |

| 6.4.4 India Automotive Stamping Market Revenues & Volume, By Chassis, 2021 - 2031 |

| 6.4.5 India Automotive Stamping Market Revenues & Volume, By Non-Body Stamping, 2021 - 2031 |

| 6.4.6 India Automotive Stamping Market Revenues & Volume, By Engine Parts, 2021 - 2031 |

| 6.4.7 India Automotive Stamping Market Revenues & Volume, By Transmission and Steering Parts, 2021 - 2031 |

| 6.4.8 India Automotive Stamping Market Revenues & Volume, By Electrical Parts, 2021 - 2031 |

| 6.4.9 India Automotive Stamping Market Revenues & Volume, By Electrical Parts, 2021 - 2031 |

| 7 India Automotive Stamping Market Import-Export Trade Statistics |

| 7.1 India Automotive Stamping Market Export to Major Countries |

| 7.2 India Automotive Stamping Market Imports from Major Countries |

| 8 India Automotive Stamping Market Key Performance Indicators |

| 8.1 Scrap rate in automotive stamping processes |

| 8.2 Overall equipment effectiveness (OEE) in stamping operations |

| 8.3 Adoption rate of advanced stamping technologies |

| 8.4 Supplier performance in delivering raw materials on time |

| 8.5 Rate of new product development in the automotive stamping market |

| 9 India Automotive Stamping Market - Opportunity Assessment |

| 9.1 India Automotive Stamping Market Opportunity Assessment, By Vehicle, 2021 & 2031 |

| 9.2 India Automotive Stamping Market Opportunity Assessment, By Material, 2021 & 2031 |

| 9.3 India Automotive Stamping Market Opportunity Assessment, By Process, 2021 & 2031 |

| 9.4 India Automotive Stamping Market Opportunity Assessment, By Product, 2021 & 2031 |

| 10 India Automotive Stamping Market - Competitive Landscape |

| 10.1 India Automotive Stamping Market Revenue Share, By Companies, 2024 |

| 10.2 India Automotive Stamping Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero