India Biscuit Market Outlook (2021-2027) | Share, industry, Opportunities, Size, Growth, Revenue, Forecast, Outlook & COVID-19 IMPACT

Market Forecast By Category (Sweet Biscuit (Chocolate Coated Biscuits, Cookies, Filled Biscuits, Plain Biscuits, Others), Savory & Crackers (Plain, Flavored), Wafer, Functional/Energetic), By Distribution Channel (Online, Offline (Hypermarkets & Supermarkets, Specialist Retailers, Convenience Stores, Others)), By Packaging Type (Flexible, Rigid, Paper & Board), By Product Type (Premium, Non- Premium), By Regions (North, South, Central, East, West) and competitive landscape

| Product Code: ETC000414 | Publication Date: Aug 2023 | Updated Date: Feb 2024 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 86 | No. of Figures: 23 | No. of Tables: 9 | |

India Biscuit Market Shipment Analysis

India Biscuit Market registered a growth of 40.78% in value shipments in 2022 as compared to 2021 and an increase of 8.27% CAGR in 2022 over a period of 2017. In Biscuit Market India is becoming more competitive as the HHI index in 2022 was 2588 while in 2017 it was 2905. Herfindahl Index measures the competitiveness of exporting countries. The range lies from 0 to 10000, where a lower index number represents a larger number of players or exporting countries in the market while a large index number means less numbers of players or countries exporting in the market. India has reportedly relied more on domestic production to meet its growing demand in Biscuit Market.

India is unable to meet its increasing needs of this product with domestic production hence we see the trend is shifting towards import shipment to meet its demand The import factor of Biscuit Market in 2022 was 0.05 while in 2017 it was 0.04. Indonesia, Malaysia, Bangladesh, Singapore and Belgium were among the top players of the market in 2022, where Indonesia acquired the largest market share of 39.32% with a shipment value of 5.46 million USD in 2022 Indonesia also offered the product below the average market price thus having a competitive advantage over others In 2017 Malaysia had the largest market share of 48.14% with the shipment value of 2.95 million USD. The country was offering its product with an average price which is higher than the average market price offered in the country. Although Malaysia offers its product above the market average price, it remained at the leadership position indicating the brand value it holds in the India Biscuit Market in 2017.

India Biscuit Market Competition 2023

India Export Potential Assessment For Biscuit Market (USD Values in Thousand)

India Biscuit Market report thoroughly covers the market by distribution channel. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

India Biscuit Market Synopsis

India biscuit market grew in 2017-2020 owing to the change in lifestyle, increase in the working population and increase in the demand for ready-to-eat food products. Furthermore, government decisions such as Retail and Wholesale Trade in MSMEs, allowing 100% FDI in the retail sector and funding the Production Linked Incentive (PLI) for enhancing manufacturing capabilities and exports would give a tremendous boost to the retail, food, hospitality and commercial sectors. These sectors in turn would lead to the growth in hypermarkets, supermarkets and retail stores, thus bolstering the aforesaid market in the region.

Additionally, during the COVID-19 lockdown panic behaviour and stockpiling necessities by consumers, positively impacted the demand for biscuit products in the country in 2020.

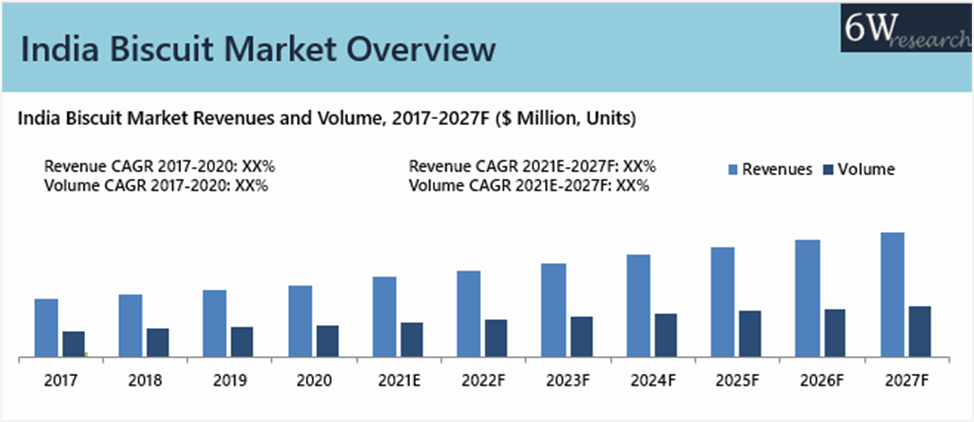

According to 6Wresearch, India biscuit market revenue size is projected to grow at a CAGR of 9.0% during 2021-2027. The demand for biscuit would increase on account of the increasing demand for healthy & nutritional ready-to-eat food products and the manifestation of the demographic window in forthcoming years. Furthermore, varieties of biscuits and innovations in taste such as fruit biscuits, cream biscuits, and sweet biscuits coupled with an increase in demand during festivals such as Diwali and Ramadan would bolster demand for the biscuit segment over the coming years.

Market by Distribution Channel Analysis

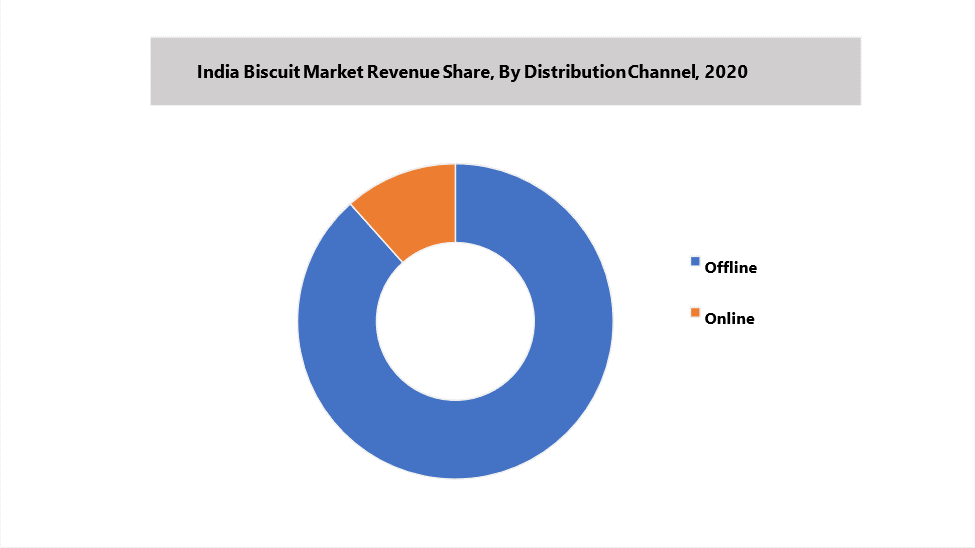

In terms of distribution channels, the offline segment has captured 88.4% of the market revenues in 2020. Offline distribution channels accounted for a major share in 2020 due to the rise in hypermarkets & supermarkets and increased demand for packaged food in the country.

Biscuit Market Share in India

The Biscuit Market in India is one of the most prominent markets and there are many factors driving the growth of the market in the country. The major factors driving the growth of the market are the rise in the working population, the rise in food products that are ready-to-eat, and the transformation in lifestyle. The biscuit market share in India is continuously rising, as this sector is an inseparable part of the Asia Pacific Biscuit Market, and it shows the sector in the country has been accomplishing growth.

There are a number of players in the India Biscuit Market, which are Britannia Industries Limited, Parle Products Private Ltd, ITC Limited, Surya Food & Agro Ltd, Mondelez India Foods Private Limited, Mrs Bector’s Food Specialties Ltd., pladis Foods Ltd, Ravi Foods Pvt. Ltd., Saj Food Products Private Limited. The share of the sector is driven by the driving factors and the efforts made by the key players operating in the market. The sector is flourishing at a faster pace and it will continue to flourish the same way in the near future.

The popular brands in Biscuit Industry in India come up with innovations in the design and taste of biscuits, which support the growth of the market. Innovation in design and taste attracts more people, which helps expand the India biscuit market share. The sector has been propelling in the market as the share of the sector is growing. The biscuit market size in India will continue to grow at XXX in the near future owing to the essential role the market play in the country.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report

- India Biscuit Market Overview

- India Biscuit Market Outlook

- India Biscuit Market Forecast

- Historical Data and Forecast of India Biscuit Market Revenues and Volume for the Period 2017-2027F

- Historical Data and Forecast of India Biscuit Market Revenues and Volume, By Category, for the Period 2017-2027F

- Historical Data and Forecast of India Biscuit Market Revenues, By Distribution Channel, for the Period 2017-2027F

- Historical Data and Forecast of India Biscuit Market Revenues, By Packaging Type, for the Period 2017-2027F

- Historical Data and Forecast of India Biscuit Market Revenues, By Product Type, for the Period 2017-2027F

- Historical Data and Forecast of India Biscuit Market Revenues, By Regions, for the Period 2017-2027F

- Market Drivers and Restraints

- Industry Life Cycle

- Porter’s Five Force Analysis

- Impact Analysis of COVID-19

- Market Trends

- India Biscuit Market Revenue Share, By Companies

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Category

-

- Sweet Biscuit

- Chocolate Coated Biscuits

- Cookies

- Filled Biscuits

- Plain Biscuits

- Others

- Savory & Crackers

- Plain

- Flavoured

- Wafer

- Functional/Energetic

By Distribution Channel

- Online

- Offline

- Hypermarkets & Supermarkets

- Specialist Retailers

- Convenience Stores

- Others

- Sweet Biscuit

By Packaging Type

- Flexible

- Rigid

- Paper & Board

By Product Type

- Premium

- Non- Premium

By Regions

- North

- South

- Central

- East

- West

India Biscuit Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. India Biscuit Market Overview |

| 3.1 India Biscuit Market Revenues and Volume, 2017-2027F |

| 3.2 India Medical Biscuit Market - Industry Life Cycle |

| 3.3 India Biscuit Market - Porter’s Five Forces |

| 3.4 India Biscuit Market Revenue and Volume Share, By Category, 2020 & 2027F |

| 3.6 India Biscuit Market Revenue Share, By Distribution Channel, 2020 & 2027F |

| 3.7 India Biscuit Market Revenue Share, By Packaging Type, 2020 & 2027F |

| 3.8 India Biscuit Market Revenue Share, By Product Type, 2020 & 2027F |

| 3.9 India Biscuit Market Revenue Share, By Regions, 2020 & 2027F |

| 4. Impact Analysis of COVID-19 on India Biscuit Market |

| 5. India Biscuit Market Dynamics |

| 5.1 Impact Analysis |

| 5.2 Market Drivers |

| 5.3 Market Drivers |

| 5.4 Market Restraints |

| 6. India Biscuit Market Trends and Evolution |

| 7. India Biscuit Market Overview, By Category |

| 7.1 India Biscuit Market Revenues and Volume, By Sweet Biscuit, 2017-2027F |

| 7.1.1 India Biscuit Market Revenue Share, By Sweet Biscuit, 2020 & 2027F |

| 7.1.1.1 India Sweet Biscuit Market Revenues, By Chocolate Coated Biscuits, 2017-2027F |

| 7.1.1.2 India Sweet Biscuit Market Revenues, By Cookies, 2017-2027F |

| 7.1.1.3 India Sweet Biscuit Market Revenues, By Filled Biscuits, 2017-2027F |

| 7.1.1.4 India Sweet Biscuit Market Revenues, By Plain Biscuits, 2017-2027F |

| 7.1.1.5 India Sweet Biscuit Market Revenues, By Others, 2017-2027F |

| 7.2 India Biscuit Market Revenues and Volume, By Savory & Crackers, 2017-2027F |

| 7.2.1 India Biscuit Market Revenue Share, By Savory & Crackers, 2020 & 2027F |

| 7.2.1.1 India Savory & Crackers Biscuit Market Revenues, By Plain, 2017-2027F |

| 7.2.1.2 India Savory & Crackers Biscuit Market Revenues, By Flavored, 2017-2027F |

| 7.3 India Biscuit Market Revenues and Volume, By Wafer, 2017-2027F |

| 7.4 India Biscuit Market Revenues and Volume, By Functional/Energetic, 2017-2027F |

| 8. India Biscuit Market Overview, By Distribution Channel |

| 8.1 India Biscuit Market Revenues, By Online, 2017-2027F |

| 8.2 India Biscuit Market Revenues, By Offline, 2017-2027F |

| 8.2.1 India Biscuit Market Revenue Share, By Offline, 2020 & 2027F |

| 8.2.1.1 India Offline Biscuit Market Revenues, By Hypermarkets & Supermarkets, 2017-2027F |

| 8.2.1.2 India Offline Biscuit Market Revenues, By Specialist Retailers, 2017-2027F |

| 8.2.1.3 India Offline Biscuit Market Revenues, By Convenience Stores, 2017-2027F |

| 8.2.1.4 India Offline Biscuit Market Revenues, By Others, 2017-2027F |

| 9. India Biscuit Market Overview, By Packaging Type |

| 9.1 India Biscuit Market Revenues, By Flexible, 2017-2027F |

| 9.2 India Biscuit Market Revenues, By Rigid, 2017-2027F |

| 9.3 India Biscuit Market Revenues, By Paper and Board, 2017-2027F |

| 10. India Biscuit Market Overview, By Product Type |

| 10.1 India Biscuit Market Revenues, By Premium, 2017-2027F |

| 10.2 India Biscuit Market Revenues, By Non-Premium, 2017-2027F |

| 11. India Biscuit Market Overview, By Regions |

| 11.1 India Biscuit Market Revenues, By Southern Region, 2017-2027F |

| 11.2 India Biscuit Market Revenues, By Northern Region, 2017-2027F |

| 11.3 India Biscuit Market Revenues, By Western Region, 2017-2027F |

| 11.4 India Biscuit Market Revenues, By Eastern Region, 2017-2027F |

| 12. India Biscuit Market - Key Performance Indicators |

| 13. India Biscuit Market - Government Taxes and Regulations Including Import Tax Structure, 2020 |

| 14. India Biscuit Market Opportunity Assessment |

| 14.1 India Biscuit Market Opportunity Assessment, By Category, 2027F |

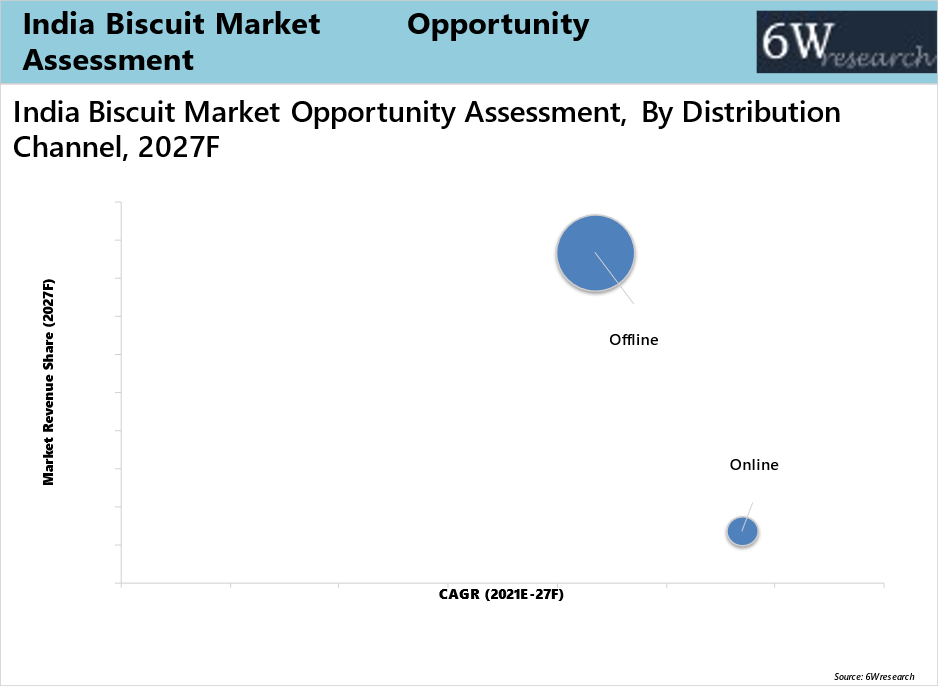

| 14.2 India Biscuit Market Opportunity Assessment, By Distribution Channel, 2027F |

| 14.3 India Biscuit Market Opportunity Assessment, By Packaging Type, 2027F |

| 14.4 India Biscuit Market Opportunity Assessment, By Product Type, 2027F |

| 14.5 India Biscuit Market Opportunity Assessment, By Regions, 2027F |

| 15. India Biscuit Market Competitive Landscape |

| 15.1 India Biscuit Market Volume Share, By Companies, 2020 |

| 15.2 India Biscuit Market Price Positioning Analysis, By Key Companies (2020) |

| 15.3 India Biscuit Market Competitive Benchmarking, By Operating Parameters |

| 15.4 India Biscuit Market Competitive Benchmarking, By Technical Parameters |

| 16. Company Profiles |

| 16.1. Parle Products Private Ltd |

| 16.2. Britannia Industries Limited |

| 16.3. ITC LIMITED |

| 16.4. Surya Food & Agro Ltd |

| 16.5. Mondelez India Foods Private Limited |

| 16.6. Anmol Industries Limited |

| 16.7. Mrs. Bector’s Food Specialties Ltd. |

| 16.8. pladis Foods Ltd |

| 16.9. Saj Food Products Private Limited |

| 16.10. Ravi Foods Pvt. Ltd. |

| 17. Key Strategic Recommendations |

| 18. Disclaimer |

| List of Figure |

| Figure 1. India Biscuit Market Revenues and Volume, 2017-2027F (USD Billion, Million Tonnes) |

| Figure 2. India Biscuit Market Revenue Share, By Category, 2020 & 2027F |

| Figure 3. India Biscuit Market Volume Share, By Category, 2020 & 2027F |

| Figure 4. India Biscuit Market Revenue Share, By Distribution Channel, 2020 & 2027F |

| Figure 5. India Biscuit Market Revenue Share, By Packaging Type, 2020 & 2027F |

| Figure 6. India Biscuit Market Revenue Share, By Product Type, 2020 & 2027F |

| Figure 7. India Biscuit Market Revenue Share, By Region, 2020 & 2027F |

| Figure 8 Working age population projection for the year 2020 and 2027F, (Millions) |

| Figure 9. Frequency of buying biscuits by Indian population |

| Figure 10. India Sweet Biscuit Market Revenues Share, By Sweet Biscuit Types, 2020 & 2027F |

| Figure 11. India Savoury & Crackers Biscuit Market Revenues Share, By Savoury & Crackers Types, 2020 & 2027F |

| Figure 12. India Offline Biscuit Market Revenue Share, By Offline Channel, 2020 & 2027F |

| Figure 13. Major Sector-Wise FMCG Market Share in India, 2020 (in %) |

| Figure 14. FMCG Market in India, 2018 vs 2021E (INR Billion) |

| Figure 15. FMCG Market in India, 2018 vs 2025F (INR Billion) |

| Figure 16. Market Size of the Indian Retail Industry, 2016-2026F (USD Billion) |

| Figure 17. Market Share of the Indian Retail Industry, 2019 & 2021E |

| Figure 18. India Biscuit Market Opportunity Assessment, By Category, 2027F |

| Figure 19. India Biscuit Market Opportunity Assessment, By Distribution Channel, 2027F |

| Figure 20. India Biscuit Market Opportunity Assessment, By Packaging Type, 2027F |

| Figure 21. India Biscuit Market Opportunity Assessment, By Product Type, 2027F |

| Figure 22. India Biscuit Market Opportunity Assessment, By Regions, 2027F |

| Figure 23. India Biscuit Market Revenue Share, By Companies, 2020 |

| List of Table |

| Table 1. India Biscuit Market Revenues, By Category, 2017-2027F (USD Billion) |

| Table 2. India Biscuit Market Volume, By Category, 2017-2027F (Million Tonnes) |

| Table 3. India Sweet Biscuit Market Revenues, By Sweet Biscuit Types, 2017-2027F (USD Billion) |

| Table 4. India Savoury & Crackers Biscuit Market Revenues, By Savoury & Crackers Types, 2017-2027F (USD Billion) |

| Table 5. India Biscuit Market Revenues, By Distribution Channel, 2017-2027F (USD Billion) |

| Table 6. India Offline Biscuit Market Revenues, By Offline Channel, 2017-2027F (USD Billion) |

| Table 7. India Biscuit Market Revenues, By Packaging Type, 2017-2027F (USD Billion) |

| Table 8. India Biscuit Market Revenues, By Product Type, 2017-2027F (USD Billion) |

| Table 9. India Biscuit Market Revenues, By Region, 2017-2027F (USD Billion) |

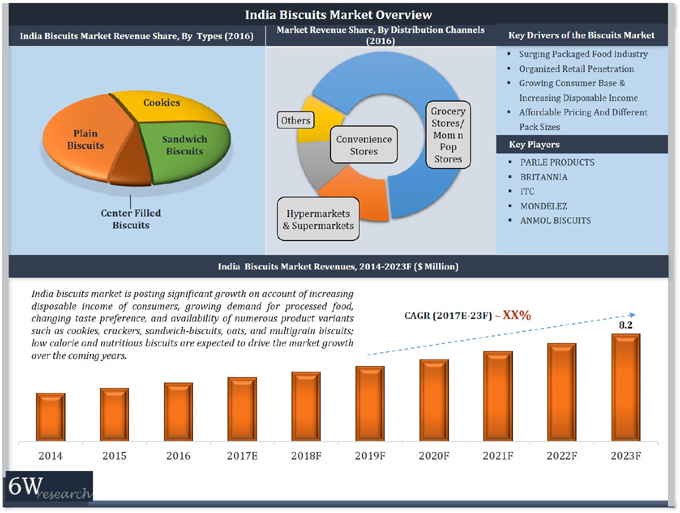

Market Forecast By Types (Plain Biscuits, Cookies, Sandwich Biscuits and Center-filled Biscuits), By Category (Premium Biscuits and Non-Premium Biscuits), By Distribution Channels (Grocery & Mom-and-Pop Stores, Hypermarkets & Supermarkets, Convenience Stores and Others (E-commerce, Drug Stores), By Regions (Northern, Western, Eastern and Southern) and Competitive Landscape

| Product Code: ETC000414 | Publication Date: Nov 2021 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 115 | No. of Figures: 30 | No. of Tables: 9 |

Latest 2021 Developments:

India Biscuit Market has seen development and innovation on the basis of flavor, format, and authenticity. The companies are mixing exotic fruits, for instance, hazelnuts, cranberries, banana, pears, and others, to their existing biscuit to give them a natural flavoring. Furthermore, there is a reduction in the amount of artificial color and preservatives because consumers are becoming more health-conscious. The companies are expanding their product market by combing chocolate and biscuits together, for instance, Cadbury 5Star Oreo. Additionally, for making biscuits healthier the companies are increasing the amount of anti-oxidant-rich fiber, such as whole grain oats.

Mergers and Acquisitions:

- On 11 May 2021, Ruchi Soya announces that it has acquired a biscuit business from Patanjali Natural Biscuit Pvt Ltd. in a crash sale for Rs. 60.02 crores. The objective of this acquisition is to expand the product share of the existing business.

- In March 2021, Mondelez international acquired Gourmet Food Holdings Pvt Ltd, an Australian food firm that produces gourmet biscuits and crackers. Through this acquisition, Mondelez gains expansion in snacking market of Australia and New Zealand.

To enquire about latest release please click here

Previous Release:

Increasing disposable income, changing consumer taste preferences, rising demand for processed food as well as the availability of numerous product variants have buoyed the growth of the biscuits market in India. Additionally, the introduction of healthy, sugar-free, digestive, multigrain & oat biscuits is further contributing to the growth of this market. India biscuits market is largely driven by demand originating from the urban population; however, with improving purchasing power of rural consumers, market players are making efforts to reach the untapped rural market by taking certain key initiatives such as offering low priced products (starting from $0.17) and smaller packs coupled with improving distribution network.

According to 6Wresearch, India biscuits market size is projected to reach $8.2 billion by 2023. Plain biscuits segment acquired the highest India biscuits market share in 2016, however, with changing taste preferences of consumers, the cookies segment India is expected to witness the highest India biscuits market forecast revenues over the coming years. Moreover, the gifting trends of high-end premium cookies have been recorded in metro cities.

Among various distribution channels, grocery stores led the market due to their high presence in both rural and urban areas. However, with a growing number of organized retail formats in the country, hypermarkets and supermarkets are likely to exhibit the highest growth rate over the coming years. Also, with the rising preference for online shopping, the e-retailing of biscuits is emerging as a critical media platform for expanding the product portfolio.

The India biscuits market report thoroughly covers the biscuits market by category, types, distribution channels, and regions. The India biscuits market outlook report provides an unbiased and detailed analysis of the India biscuits market trends, opportunities/ high growth areas, market drivers which would help the stakeholders to decide and align their market strategies according to the current and future market dynamics. India Biscuits market is growing in a significant way in the forecast period. Now a day the consumer lifestyle change and according to that taste also changes, preferences, and consumers now day becoming health conscious. The biscuit industry is one of the largest food industries in India.

India Biscuits market is projected to secure tremendous growth during the forecast period 2017-23F backed by the rising consumption rate in the country. Further, the rising distribution channels, especially the opening of retail outlets like supermarkets that contain a wide range of biscuits has led to attracting children, as a result, is likely to accelerate the demand for biscuits in the market and impact positively on the market growth. In the country, biscuits are the main in the breakfast and sometimes in the evening as well taken with tea is estimated to boost the biscuits sales and is estimated to bolster the growth of the India biscuits market in the upcoming six years.

Key Highlights of the Report

• India Biscuits Market Overview

• India Biscuits Market Outlook

• Historical data of Global Biscuits Market for the Period 2014-2016

• Market Size & Forecast of Global Biscuits Market until 2023

• Historical data of India Biscuits Market for the Period 2014-2016

• India Biscuits Market Size & India Biscuits Market Forecast Revenues, until 2023

• Historical data of India Biscuits Market, By Types for the Period 2014-2016

• Market Size & Forecast of India Biscuits Market, By Types until 2023

• Historical data of India Biscuits Market Revenues, By Category for the Period 2014-2016

• Market Size & Forecast of India Biscuits Market Revenues, By Category until 2023

• Historical data of India Biscuits Market, By Distribution Channels for the Period 2014-2016

• Market Size & Forecast of India Biscuits Market, By Distribution Channels until 2023

• Historical data of India Biscuits Market, By Regions for the Period 2014-2016

• Market Size & Forecast of India Biscuits Market, By Regions until 2023

• Market Drivers and Restraints

• India Biscuits Market Trends and Opportunities

• Industry Life Cycle and Value Chain Analysis

• Porter's Five Forces Analysis

• India Biscuits Market Share by Players

• India Biscuits Market Overview on Competitive Benchmarking

• Company Profiles

• Recommendations

Markets Covered

The India biscuits market report provides a detailed analysis of the following market segments:

• By Types

o Plain Biscuits

o Cookies

o Sandwich Biscuits

o Center-filled Biscuits

• By Category

o Premium Biscuits

o Non-Premium Biscuits

• By Distribution Channels

o Grocery & Mom-and-Pop Stores

o Hypermarkets & Supermarkets

o Convenience Stores

o Others (E-commerce, Drug Stores)

• By Regions

o Northern

o Western

o Eastern

o Southern

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- India LV Switchgear Market (2024-2030) | Share, Trends, Value, Analysis, Outlook, Forecast, Growth, Industry, Companies, Size & Revenue

- Hungary Air Conditioner Market (2024-2030) | Size, Trends, Industry, Forecast, Share, Growth, Value, Revenue, Analysis, Outlook & COVID-19 IMPACT

- Australia Cyber Security Market (2024-2030) | Companies, industry, Size, Revenue, Forecast, Trends, Growth, Analysis, Outlook

- Australia Endpoint Detection and Response Market (2024-2030) | Outlook, Analysis, Size, Value, Industry, Forecast, Revenue, Companies, Growth, Share & Trends

- Egypt Commercial Stainless Steel Refrigerator Market (2024-2030) | Share, Trends, Value, Analysis, Outlook, Forecast, Growth, Industry, Companies, Size & Revenue

- India Mixer Grinder Market (2023-2029) | Segmentation, Growth, Companies, Revenue, Trends, Share, Outlook, Forecast, Industry, Analysis, Value & Size

- GCC PVC Additives Market (2024-2030) | Share, Trends, Value, Analysis, Outlook, Forecast, Growth, Industry, Companies, Size & Revenue

- Iraq ICE & Electric Passenger Vehicle Market (2024-2030) | Share, Trends, Value, Analysis, Outlook, Forecast, Growth, Industry, Companies, Size & Revenue

- UAE Corrugated Board Packaging Market (2024-2030) | Size, Trends, Segmentation, Revenue, Outlook, Companies, Share, Growth, Analysis, Value, Industry & Forecast

- India Biopolymer Market (2024-2030) | Segmentation, Growth, Companies, Revenue, Trends, Share, Outlook, Forecast, Industry, Analysis, Value & Size

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- India's Printer Market Faces 20.7% Decline in Q4 2023: Epson and HP Lead Amidst Downturn

- India's Camera Market Sees 8.9% Decline in Q4 2023; Canon Leads with 38.4% Share

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- The future of gaming industry in the Philippines