India Vacuum Pump Market (2022-2028) | Trends, Value, Revenue, Outlook, Forecast, Size, Analysis, Growth, Industry, Share, Segmentation & COVID-19 IMPACT

Market Forecast By Lubrication (Dry, Wet), By Technology (Gas Capture/Binding Pumps, Gas Transfer Pumps), By Product Type (Low vacuum pumps, Medium vacuum pumps, High vacuum pumps), By End-Users (Chemical & pharmaceutical, Semiconductor & electronics, Oil & gas, Food & beverages, Wood, paper & pulp, Other) And Competitive Landscape

| Product Code: ETC025664 | Publication Date: Feb 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 105 | No. of Figures: 38 | No. of Tables: 31 |

India Vacuum Pump Market Synopsis

The India Vacuum Pump Market is anticipated to grow during the forecast period on the back of investments by the government and companies majorly in the chemical, pharmaceutical, semiconductor & electronics industries. In 2021, the government introduced the Production Linked Incentive scheme “National Programme on Advanced Chemistry Cell (ACC) Battery Storage” for manufacturing ACC batteries in India along with the promotion of electric vehicles, with an outlay of INR 18,100 crores (USD 2.3 Billion). Additionally, the market was impacted by COVID-19 and experienced a downshift in the first two quarters of FY 2020-21 as the government imposed a nationwide lockdown which halted trading activities and foreign trade as a result import of vacuum pumps was affected. However, As the lockdown measures were lifted by the government, the market bounced back in the second half of the year and witnessed rapid growth on account of an increase in demand for vacuum pumps in key sectors.

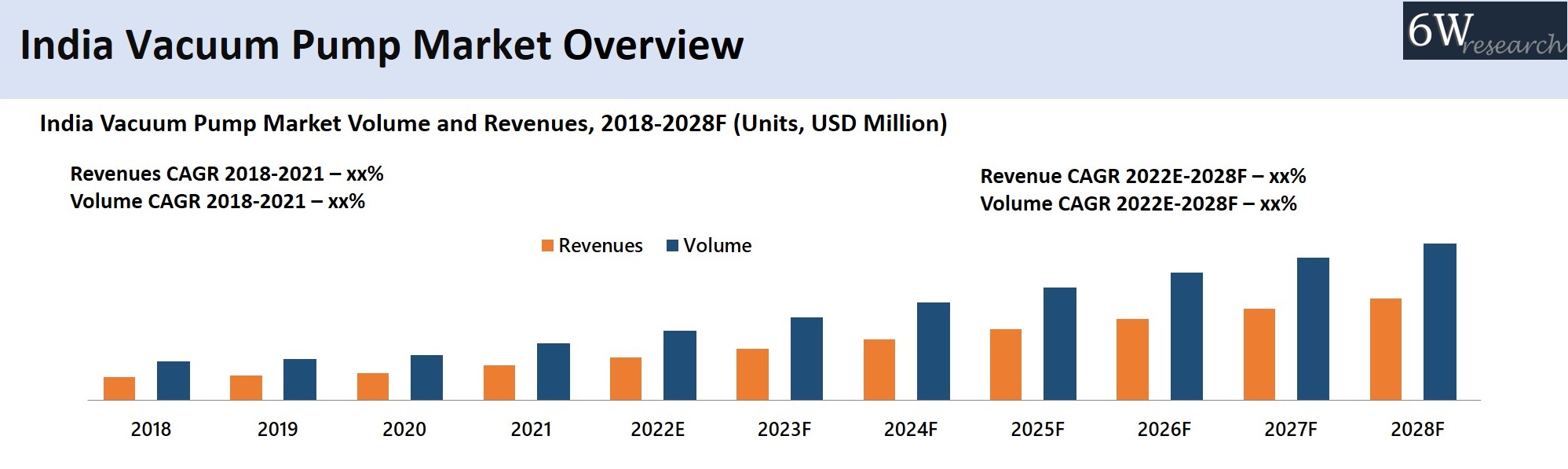

According to 6Wresearch, the India Vacuum Pump Market revenue is projected to grow at a CAGR of 15.5% from 2022-2028. India Vacuum Pump Market witnessed rapid growth during past years owing to strong policy support from the government in the chemical & pharmaceutical, oil & gas industry and continuous expansion of the automobile fleet. In addition, the Indian government had announced an investment of INR 1 lakh crores (USD 12.5 Billion) for oil & gas projects. The rising investment in key application industries would further fuel the India vacuum pump market growth in the forthcoming period. The Vacuum Pump Market in India has been rising effectively and the future of the is very promising. This sector in India is one of the most vital parts of the Asia Pacific Vacuum Pump Market.

Market by Lubrication Types

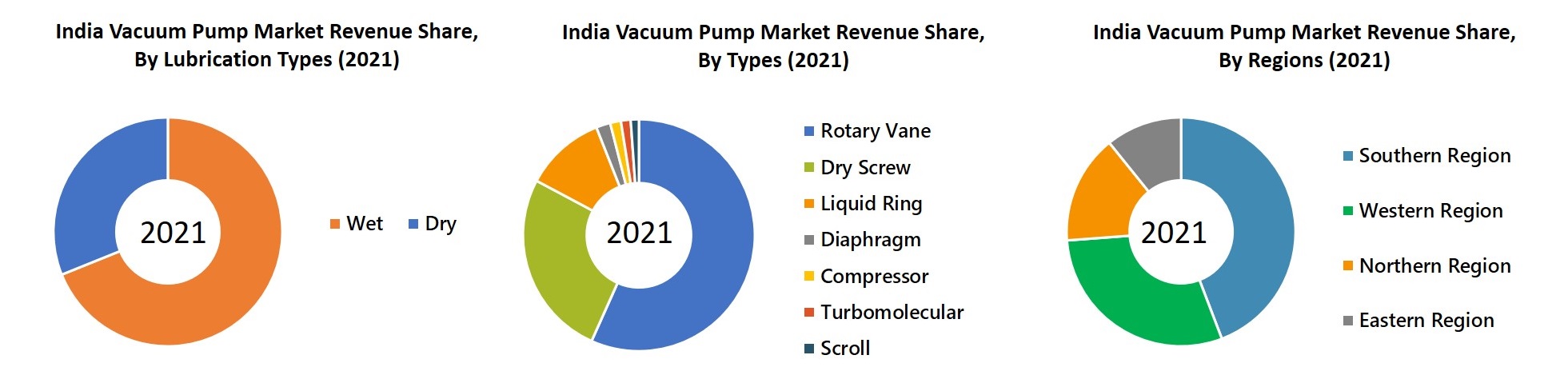

In 2021 By lubrication types, Wet vacuum pumps accounted for the majority of revenue share owing to their low maintenance cost and affordability compared to dry vacuum pumps. A similar trend is expected in the forthcoming years on the back of their applicability in the oil & gas, and power generation industry. Dry vacuum pumps are also anticipated to grow.

Market by Types

Rotary vane acquired a significant chunk of revenues and volume in the India vacuum pump market by types in 2021, owing to its timeless operations, reliability, and economic efficiency. Further, rotary vane vacuum pumps are widely used in crystallization, drying, distillation, and vacuum filtration in the chemical & pharmaceutical sector. A similar drift is anticipated in the upcoming years on the back of considerable demand from various end-user industries such as semiconductors, solar, and chemical industries.

Market by End Users

The Chemical & Pharmaceutical industry garnered significant market revenue and volume share in 2021 owing to the broad applicability of vacuum pumps as they are an essential part of the production and packaging of drugs such as tablets and capsules. The same segment will continue to dominate the India Vacuum Pump Industry.

Market by Regions

In 2021, Southern region acquired the majority of revenue share in India vacuum pumps market as majority of pharmaceuticals companies are situated in south India, for instance, Telangana and Andhra Pradesh have the most pharma manufacturing in the country. Furthermore, South India has the highest food products and beverages manufacturing output. A similar trend is anticipated to continue in the coming years, with USD 1 billion investment by the semiconductor manufacturing company in Tamil Nadu, the demand for vacuum pumps from the southern region is expected to rise.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 11 Years Market Numbers.

- Historical Data Starting from 2018 to 2021.

- Base Year: 2022

- Forecast Data until 2028.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Historical Data and Forecast of India Vacuum Pump Market Volume and Revenues for the Period 2018-2028F

- Historical Data and Forecast of India Vacuum Pump Market Volume and Revenues, By Lubrication Types for the Period 2018-2028F

- Historical Data and Forecast of India Vacuum Pump Market Volume and Revenues, By Types for the Period 2018-2028F

- Historical Data and Forecast of India Vacuum Pump Market Volume and Revenues, By End Users for the Period 2018-2028F

- Historical Data and Forecast of India Vacuum Pump Market Revenues, By Regions for the Period 2018-2028F

- Market Drivers, Restraints

- Market Evolution and Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- Market Competitive Landscape

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By Lubrication Types

- Dry

- Wet

By Types

- Rotary Vane

- Scroll

- Diaphragm

- Liquid Ring

- Turbomolecular

- Dry Screw

- Compressor

By End Users

- Oil and Gas

- Semiconductor & Electronics

- Chemical & Pharmaceutical

- Food & Beverages

- Ceramics Sanitary Industry

- Automotive

- Power & Energy

- Healthcare

- Others (Paper & Printing, Rubber & Plastics, Textile etc.)

By Regions

- Northern

- Southern

- Eastern

- Western

India Vacuum Pump Market : FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. India Vacuum Pump Market Overview |

| 3.1. India Vacuum Pump Market Volume and Revenues (2018-2028F) |

| 3.2. India Vacuum Pump Market Industry Life Cycle |

| 3.3. India Vacuum Pump Market Porter’s Five Forces Model |

| 3.4. India Vacuum Pump Market Volume and Revenues Share, By Lubrication Types (2021 & 2028F) |

| 3.5. India Vacuum Pump Market Volume and Revenues Share, By Types (2021 & 2028F) |

| 3.6. India Vacuum Pump Market Volume and Revenues Share, By End-Users (2021 & 2028F) |

| 3.7. India Vacuum Pump Market Revenue Share, By Regions (2021 & 2028F) |

| 4. Impact Analysis of COVID-19 on India Vacuum Pump Market |

| 5. India Vacuum Pump Market Dynamics |

| 5.1. Impact Analysis |

| 5.2. Market Drivers |

| 5.2.1 Increasing adoption of vacuum pumps in industries such as pharmaceuticals, food processing, and electronics for various applications |

| 5.2.2 Growing investments in infrastructure development and manufacturing sectors in India |

| 5.2.3 Technological advancements and innovations in vacuum pump designs leading to improved efficiency and performance |

| 6. India Vacuum Pump Market Trends & Evolution |

| 7. India Vacuum Pump Market Overview, By Lubrication Types |

| 7.1. India Vacuum Pump Market Volume and Revenues, By Dry, (2018-28F) |

| 7.2. India Vacuum Pump Market Volume and Revenues, By Wet, (2018-28F) |

| 8. India Vacuum Pump Market Overview, By Types |

| 8.1. India Vacuum Pump Market Volume and Revenues, By Rotary Vane, (2018-28F) |

| 8.2. India Vacuum Pump Market Volume and Revenues, By Diaphragm Vane, (2018-28F) |

| 8.3. India Vacuum Pump Market Volume and Revenues, By Liquid Ring, (2018-28F) |

| 8.4. India Vacuum Pump Market Volume and Revenues, By Scroll, (2018-28F) |

| 8.5. India Vacuum Pump Market Volume and Revenues, By Turbomolecular, (2018-28F) |

| 8.6. India Vacuum Pump Market Volume and Revenues, By Dry Screw, (2018-28F) |

| 8.7. India Vacuum Pump Market Volume and Revenues, By Compressor, (2018-28F) |

| 9. India Vacuum Pump Market Overview, By End-Users |

| 9.1. India Vacuum Pump Market Volume and Revenues, By Oil & Gas, (2018-28F) |

| 9.2. India Vacuum Pump Market Volume and Revenues, By Semiconductor and Electronics, (2018-28F) |

| 9.3. India Vacuum Pump Market Volume and Revenues, By Chemical & Pharmaceutical, (2018-28F) |

| 9.4. India Vacuum Pump Market Volume and Revenues, By Food & Beverages, (2018-28F) |

| 9.5. India Vacuum Pump Market Volume and Revenues, By Ceramics Sanitary Industry, (2018-28F) |

| 9.6. India Vacuum Pump Market Volume and Revenues, By Automotive, (2018-28F) |

| 9.7. India Vacuum Pump Market Volume and Revenues, By Power and Energy, (2018-28F) |

| 9.8. India Vacuum Pump Market Volume and Revenues, By Healthcare, (2018-28F) |

| 9.9. India Vacuum Pump Market Volume and Revenues, By Others, (2018-28F) |

| 10. India Vacuum Pump Market Overview, By Regions |

| 10.1. India Vacuum Pump Market Revenues, By Northern Region, (2018-28F) |

| 10.2. India Vacuum Pump Market Revenues, By Southern Region, (2018-28F) |

| 10.3. India Vacuum Pump Market Revenues, Eastern Region, (2018-28F) |

| 10.4. India Vacuum Pump Market Revenues, Western Region, (2018-28F) |

| 11. India Vacuum Pump Market Overview, By End Users & By Types |

| 11.1. India Vacuum Pump Market Volume, By End Users & By Types, 2021 |

| 11.1. India Vacuum Pump Market Revenues, By End Users & By Types, 2021 |

| 12. India Vacuum Pump Market – Import and Export Statistics, 2021 |

| 13. India Vacuum Pump Market Opportunity Assessment |

| 13.1. India Vacuum Pump Market Opportunity Assessment, By Lubrication Types |

| 13.2. India Vacuum Pump Market Opportunity Assessment, By Types |

| 13.3. India Vacuum Pump Market Opportunity Assessment, By End-Users |

| 13.4. India Vacuum Pump Market Opportunity Assessment, By Regions |

| 14. India Vacuum Pump Market - Competitive Landscape |

| 14.1. India Vacuum Pump Market Revenue Share, 2021 |

| 14.2. India Vacuum Pump Market Competitive Benchmarking, By Technical Parameters |

| 14.3. India Vacuum Pump Market Competitive Benchmarking, By Operating Parameters |

| 15. Company Profiles |

| 15.1. Atlas Copco India |

| 15.2. Busch Vacuum India Pvt Ltd. |

| 15.3. Gardner Denver- Nash |

| 15.4. Gebr Becker India Vacuum Pumps Pvt. Ltd. |

| 15.5. ULVAC Inc. |

| 15.6. Pfeiffer Vacuum India Private Limited |

| 15.7. Flowserve Corporation |

| 15.8. Everest Vacuum |

| 15.9. Economy Process Solutions Private Limited |

| 15.10. Toshniwal Instruments (Madras) Pvt. Ltd. |

| 16. Key Strategic Recommendations |

| 17. Key Projects and Potential Clients |

| 18. Disclaimer |

| List of Figures |

| 1. India Vacuum Pump Market Volume and Revenues, 2018-2028F (Units, USD Million) |

| 2. India Vacuum Pump Market Revenue Share, By Lubrication Types, 2021 & 2028F |

| 3. India Vacuum Pump Market Volume Share, By Lubrication Types, 2021 & 2028F |

| 4. India Vacuum Pump Market Revenue Share, By Types, 2021 & 2028F |

| 5. India Vacuum Pump Market Volume Share, By Types, 2021 & 2028F |

| 6. India Vacuum Pump Market Revenue Share, By End-Users, 2021 & 2028F |

| 7. India Vacuum Pump Market Volume Share, By End-Users, 2021 & 2028F |

| 8. India Vacuum Pump Market Revenue Share, By Regions, 2021 & 2028F |

| 9. Indian Pharmaceutical Market, 2017-21 (USD Billion) |

| 10. Pharma Exports from India, 2018-21 (USD Million) |

| 11. India Passenger Car Market Value, 2021-2027F (Billion USD) |

| 12. Investment in Electric Vehicles Industry in India, 2021-2027F (Billion USD) |

| 13. India Pharmaceutical Bulk Drug & Formulation Facilities, By Regions |

| 14. India Export of Pharmaceuticals Sector, 2020-2021, (Billion USD) |

| 15. India Pharmaceutical Sector Revenues, 2021-2030F, (Billion USD) |

| 16. India Pharmaceuticals Market Value, 2021-2027F (Billion USD) |

| 17. Consumption of Natural Gas in India (BCM), 2021-2027F |

| 18. Domestic Gas Production Plus Imports (BCM),2016-2022E |

| 19. India Packaging Sector Hubs, 2021 |

| 20. India Packaging Industry End-Users’ Volume Share, 2021 |

| 21. India Packaging Market Size, 2020 & 2025 (Billion USD) |

| 22. India Food Processing Market, 2019 & 2025F (Billion USD) |

| 23. India Food and Beverage Market Value (Billion USD) |

| 24. Total Power Generation in India (including renewable sources), 2011-2022E (Billion Units) |

| 25. Region Wise Distribution of Solar Capacity in India, 2021 |

| 26. India Installed Renewable Capacity Breakup (GW), April – 2022 |

| 27. India Installed Renewable Energy Capacity (GW), 2016-2030F |

| 28. India Semiconductor Market Share By Sector in 2021 |

| 29. India Semiconductor Consumption, 2020-2030F (USD Billion) |

| 30. Average Import Tariff in India (%age), 2014-21 |

| 31. India Vacuum Pump Market Opportunity Assessment, By Lubrication Types, 2028F |

| 32. India Vacuum Pump Market Opportunity Assessment, By Types, 2028F |

| 33. India Vacuum Pump Market Opportunity Assessment, By End-Users, 2028F |

| 34. India Vacuum Pump Market Opportunity Assessment, By Region, 2028F |

| 35. India Vacuum Pump Market Revenue Share, By Companies, 2021 |

| 36. India Pharmaceutical Sector Revenues, 2021-2030F, (Billion USD) |

| 37. India Locally Sourced Semiconductor Market Share, 2021-2026F |

| 38. India Lithium-Ion Battery Annual Addition ,FY2020 – FY2030 (Capacity GWh) |

| List of Tables |

| 1. R&D spending by Top Pharma Companies in FY20 (Million USD) |

| 2. Top-10 Semiconductors companies in India |

| 3. India proposed route for hyperloop, by companies |

| 4. Import Tariffs And Distributors Margin While importing with HS Code 84141000 |

| 5. India Vacuum Pump Market Revenues, By Lubrication Type, 2018-2028F (USD million) |

| 6. India Vacuum Pump Market Volume, By Lubrication Type, 2018-2028F (Units) |

| 7. India Vacuum Pump Market Revenues, By Types, 2018-2028F (USD million) |

| 8. India Vacuum Pump Market Volume, By Types, 2018-2028F (Units) |

| 9. India Vacuum Pump Market Revenues, By Types, 2018-2028F (USD million) |

| 10. India Vacuum Pump Market Volume, By Types, 2018-2028F (Units) |

| 11. India Vacuum Pump Market Revenues, By Regions, 2018-2028F (USD million) |

| 12. India Vacuum Pump Market Volume, By Industry By Pump Types, (2021, Units) |

| 13. India Vacuum Pump Market Revenues, By Industry By Pump Types, (2021, USD Million) |

| 14. India Vacuum Pump Market Import Values (USD), By Major Companies (2021) |

| 15. India Vacuum Pump Market Import Values (USD), By Major Countries (2021) |

| 16. India Vacuum Pump Market Export Values (USD), By Major Companies (2021) |

| 17. India Vacuum Pump Market Export Values (USD), By Major Countries (2021) |

| 18. Schemes for Pharmaceutical Manufacturing Incentives (USD Million) |

| 19. Schemes and Projects for Semiconductor and Electronics Industry Incentives, (USD Billion) |

| 20. India Lithium-Ion Battery Manufacturing Planned Investments, January 2022 |

| 21. Projects for Oil and Gas Industry, (USD Billion |

| 22. Leading Pharma Companies in India |

| 23. Leading Chemical Companies in India |

| 24. Upcoming Major Pharmaceutical Projects and their Estimated Cost (USD Million). |

| 25. Major Oil and Gas Companies in India |

| 26. Ongoing Major Oil and Gas Projects and their Estimated Cost (USD Million). |

| 27. India Hyperloop Technology Companies & Contact details. |

| 28. Solar PV Manufacturers in India |

| 29. Lithium-Ion Battery Manufacturing Companies in India |

| 30. Semiconductor Manufacturing Companies in India |

| 31. Projects and Schemes for Semiconductor Manufacturers in India, (USD Million) |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Switchgear Market Outlook (2026 - 2032) | Size, Share, Trends, Growth, Revenue, Forecast, Analysis, Value, Outlook

- Pakistan Contraceptive Implants Market (2025-2031) | Demand, Growth, Size, Share, Industry, Pricing Analysis, Competitive, Strategic Insights, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Companies, Challenges

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero