Middle East Biscuit Market (2021-2027) | Analysis, Size, Share, Revenue, Trends, Growth, Forecast, Outlook & COVID-19 IMPACT

Market Forecast By Category (Sweet, Savoury & Crackers and Functional/Energetic), By Distribution Channels (Hypermarkets & Supermarkets, Convenience Stores, Specialist Retailers and Others (e-Commerce, Pharmacy, and Dollar Store)), By Packaging (Flexible, Paper& Board and Rigid), By Countries (Saudi Arabia, UAE, Qatar, Kuwait, Lebanon and Jordan) and Competitive Landscape

| Product Code: ETC054276 | Publication Date: Mar 2023 | Product Type: Report | ||

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 129 | No. of Figures: 59 | No. of Tables: 22 |

Latest 2023 Development of the Middle East Biscuit Market

The Consumers in the Middle East biscuit market are becoming increasingly health-conscious and are demanding biscuits made with natural and healthy ingredients. Biscuit manufacturers are responding to this trend by introducing healthier and more natural options. Additionally, there is a growing demand for premium biscuits in the Middle East, particularly among affluent consumers who are willing to pay a premium price for high-quality biscuits. Manufacturers are responding to this trend by introducing premium and artisanal biscuits with unique flavours and packaging. Further, several biscuit manufacturers in the Middle East are expanding their production facilities to meet the growing demand for biscuits and enhance their market share. For example, in July 2021, the Saudi Arabia-based Almarai Company announced that it was investing SAR 2.1 billion ($560 million) to expand its biscuit production facilities.

The Middle East biscuit industry has also witnessed increased investment in marketing and advertising. As Biscuit manufacturers in the Middle East are investing heavily in marketing and advertising to increase brand awareness and drive sales. This includes digital marketing campaigns, social media promotions, and in-store displays and promotions. Moreover, with the COVID-19 pandemic accelerating the shift to online shopping, biscuit manufacturers in the Middle East are increasingly focusing on e-commerce sales. Many manufacturers are partnering with e-commerce platforms and developing their own online stores to reach a wider audience and offer a more convenient shopping experience for consumers.

Middle East Biscuit Market Synopsis

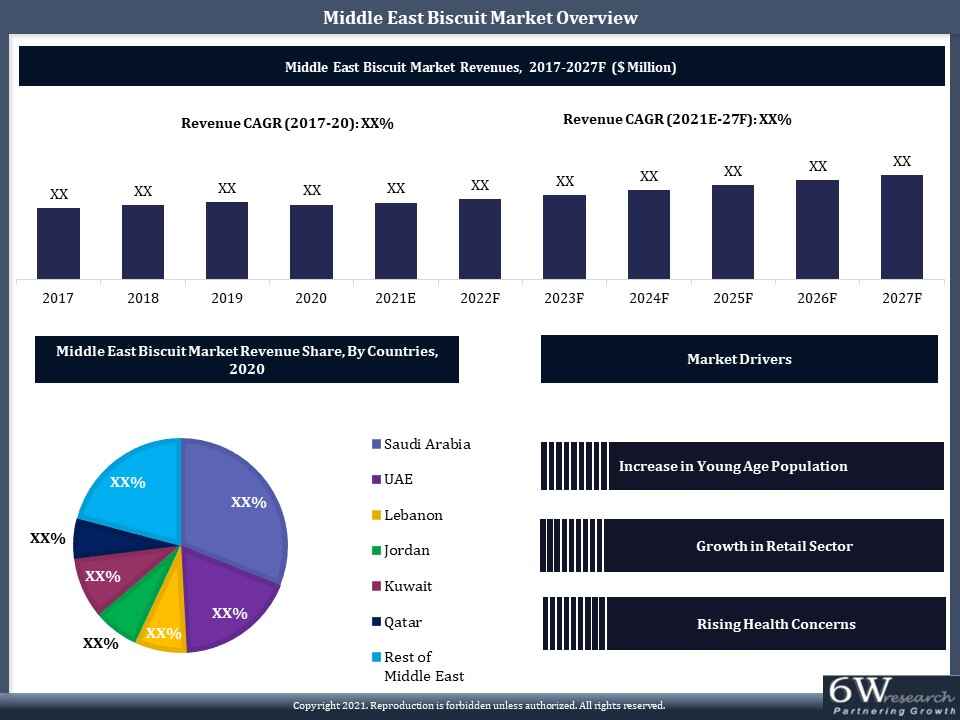

Middle East Biscuit Market is expected to register significant growth over the coming years on account of urbanization and the worldwide increase in the working population which has increased the demand for ready-to-eat food products. Furthermore, initiatives such as Saudi Vision 2030, Dubai Economic Strategy 2030, and Qatar Vision 2030 would lead to economic development thereby giving a tremendous boost to the retail, food, hospitality, and commercial sectors. These sectors in turn would lead to the growth in hypermarkets, supermarkets, and retail stores, thus bolstering the aforesaid market in the region. Further, the spread of the COVID-19 pandemic resulted in nationwide lockdown, leading to a temporary halt in activities in all the major sectors which impacted the biscuit market in the region for the first three quarters of the year 2020, however, stockpiling necessities by the consumers increased the demand for biscuit products in the region.

However, the onset of the COVID-19 pandemic has influenced the market for biscuits in the Middle East positively. In order to stockpile eatables, owing to the restrictions regarding moving out of homeplace as a restriction to be followed to combat the spread of the novel coronavirus has led to a spur in the purchase of the product.

According to 6Wresearch, Middle East Biscuit Market size is projected to grow at a CAGR of 5.3% during 2021-27. Middle East biscuit market is anticipated to register significant growth over the coming years owing to the growth in the retail sector coupled with the increase in the young age population in the region. Additionally, government initiatives such as Qatar National Vision 2030, Saudi Vision 2021, and Dubai Vision 2030 would give a remarkable thrust to the development of a non-oil economy leading to the development of tourism, food, and hospitality, thereby, propelling the growth of biscuit market in the region over the forthcoming period. However, the spread of the COVID-19 pandemic has resulted in the slowdown of the overall economy leading to a halt in many projects across the region and the supply chain system was completely shut, which result in the decline in the biscuit market in the year 2020.

Market Analysis By Distribution Channels

Based on distribution channels, the Others Segment which includes an online platform is anticipated to register the fastest growth during the forecast period in the region owing to the growing e-commerce sector as it is associated with low operational costs & capital requirements and availability of a wide range of choices, doorstep delivery and competitive pricing. Additionally, the rising technological innovations have further given a boost to the e-commerce segment.

Market Analysis By Category

Based on category, sweet biscuits accounted for the major market revenue share in 2020 and Sweet Biscuits are anticipated to maintain the same over the forthcoming years owing to their taste which makes them a popular option among consumers. Furthermore, varieties of biscuits available in sweet categories such as plain, wafer and cream coupled with the increase in demand during festivals such as Ramadan and Eid would drive the sweet biscuit segment over the coming years. Additionally, new product development in sweet biscuits would further surge the market in the region. Eating habits of consumers have changed and they are becoming more particular about the calorie content being consumed, thereby, expanding demand for healthy snacks and increasing preference for snacking would further drive the aforementioned market in the years to come.

Market Analysis By Geography

By geography, Saudi Arabia Biscuit Market garnered the major market revenue share in the biscuit market in the Middle East region for the year 2020 owing to the rising proliferation of hypermarkets and supermarkets that would in turn pave the way for ready-to-eat foot items, thereby giving a tremendous thrust to the biscuit market in the country. Additionally, the country has been enduring to enjoy robust growth, due to its solid base of domestic consumers and growing youth population with high disposable income and a high consumer confidence index. Due to these factors, the demand for food products is increasing in the country, which would eventually increase the demand for biscuits. Saudi Arabia Vision 2030 aims to diversify the country’s economy and focus on non-oil sectors such as tourism, hospitality, commercial, residential, and entertainment. The country is a growing market for high-value food products with a greater desire to try new foods. The hospitality sector of KSA is expected to attract 30 million visitors by 2030, which would create demand for food products. Along with that, there is a population of over 10 million expatriates in Saudi Arabia creating a demand for a greater diversity of foreign foods. Upcoming projects such as the Red Sea Project and Qiddiya Entertainment City would aid in increasing the urbanization rate and attract more expatriate populations.

Key Highlights of the Report:

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Middle East Biscuit Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Middle East Biscuit Market Overview |

| 3.1. Middle East Biscuit Market Revenues (2017-2027F) |

| 3.2. Middle East Biscuit Market Industry Life Cycle |

| 3.3. Middle East Biscuit Market Porter’s Five Forces Model |

| 3.4. Middle East Biscuit Market Revenue Share, By Countries (2020 & 2027F) |

| 4. Middle East Biscuit Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.3. Market Restraints |

| 5. Middle East Biscuit Market Trends |

| 6. Saudi Arabia Biscuit Market Overview |

| 6.1. Saudi Arabia Biscuit Market Revenues & Volume (2017-2027F) |

| 6.2. Saudi Arabia Biscuit Market Revenue Share, By Category (2020 & 2027F) |

| 6.2.1. Saudi Arabia Sweet Biscuit Market Revenues (2017-2027F) |

| 6.2.2. Saudi Arabia Savoury & Crackers Biscuit Market Revenues (2017-2027F) |

| 6.2.3. Saudi Arabia Functional/Energy Biscuit Market Revenues (2017-2027F) |

| 6.3. Saudi Arabia Biscuit Market Revenue Share, By Distribution Channels (2020 & 2027F) |

| 6.3.1. Saudi Arabia Biscuit Market Revenues, By Hypermarkets & Supermarkets (2017-2027F) |

| 6.3.2. Saudi Arabia Biscuit Market Revenues, By Convenience Stores (2017-2027F) |

| 6.3.3. Saudi Arabia Biscuit Market, By Specialist Retailers (2017-2027F) |

| 6.3.4. Saudi Arabia Biscuit Market, By Other Distribution Channels (2017-2027F) |

| 6.4. Saudi Arabia Biscuit Market Revenue Share, By Packaging (2020 & 2027F) |

| 6.4.1. Saudi Arabia Biscuit Market Revenues, By Flexible Packaging (2017-2027F) |

| 6.4.2. Saudi Arabia Biscuit Market Revenues, By Rigid Packaging (2017-2027F) |

| 6.4.3. Saudi Arabia Biscuit Market Revenues, By Paper & Board Packaging (2017-2027F) |

| 6.5. Saudi Arabia Biscuit Market Key Performance Indicators |

| 7. UAE Biscuit Market Overview |

| 7.1. UAE Biscuit Market Revenues & Volume (2017-2027F) |

| 7.2. UAE Biscuit Market Revenue Share, By Category (2020 & 2027F) |

| 7.2.1. UAE Sweet Biscuit Market Revenues (2017-2027F) |

| 7.2.2. UAE Savoury & Crackers Biscuit Market Revenues (2017-2027F) |

| 7.2.3. UAE Functional/Energy Biscuit Market Revenues (2017-2027F) |

| 7.3. UAE Biscuit Market Revenue Share, By Distribution Channels (2020 & 2027F) |

| 7.3.1. UAE Biscuit Market Revenues, By Hypermarkets & Supermarkets (2017-2027F) |

| 7.3.2. UAE Biscuit Market Revenues, By Convenience Stores (2017-2027F) |

| 7.3.3. UAE Biscuit Market, By Specialist Retailers (2017-2027F) |

| 7.3.4. UAE Biscuit Market, By Other Distribution Channels (2017-2027F) |

| 7.4. UAE Biscuit Market Revenue Share, By Packaging (2020 & 2027F) |

| 7.4.1. UAE Biscuit Market Revenues, By Flexible Packaging (2017-2027F) |

| 7.4.2. UAE Biscuit Market Revenues, By Rigid Packaging (2017-2027F) |

| 7.4.3. UAE Biscuit Market Revenues, By Paper & Board Packaging (2017-2027F) |

| 7.5. UAE Biscuit Market Key Performance Indicators |

| 8. Qatar Biscuit Market Overview |

| 8.1. Qatar Biscuit Market Revenues & Volume (2017-2027F) |

| 8.2. Qatar Biscuit Market Revenue Share, By Category (2020 & 2027F) |

| 8.2.1. Qatar Sweet Biscuit Market Revenues (2017-2027F) |

| 8.2.2. Qatar Savoury & Crackers Biscuit Market Revenues (2017-2027F) |

| 8.2.3. Qatar Functional/Energy Biscuit Market Revenues (2017-2027F) |

| 8.3. Qatar Biscuit Market Revenue Share, By Distribution Channels (2020 & 2027F) |

| 8.3.1. Qatar Biscuit Market Revenues, By Hypermarkets & Supermarkets (2017-2027F) |

| 8.3.2. Qatar Biscuit Market Revenues, By Convenience Stores (2017-2027F) |

| 8.3.3. Qatar Biscuit Market, By Specialist Retailers (2017-2027F) |

| 8.3.4. Qatar Biscuit Market, By Other Distribution Channels (2017-2027F) |

| 8.4. Qatar Biscuit Market Revenue Share, By Packaging (2020 & 2027F) |

| 8.4.1. Qatar Biscuit Market Revenues, By Flexible Packaging (2017-2027F) |

| 8.4.2. Qatar Biscuit Market Revenues, By Rigid Packaging (2017-2027F) |

| 8.4.3. Qatar Biscuit Market Revenues, By Paper & Board Packaging (2017-2027F) |

| 8.5. Qatar Biscuit Market Key Performance Indicators |

| 9. Kuwait Biscuit Market Overview |

| 9.1. Kuwait Biscuit Market Revenues & Volume (2017-2027F) |

| 9.2. Kuwait Biscuit Market Revenue Share, By Category (2020 & 2027F) |

| 9.2.1. Kuwait Sweet Biscuit Market Revenues (2017-2027F) |

| 9.2.2. Kuwait Savoury & Crackers Biscuit Market Revenues (2017-2027F) |

| 9.2.3. Kuwait Functional/Energy Biscuit Market Revenues (2017-2027F) |

| 9.3. Kuwait Biscuit Market Revenue Share, By Distribution Channels (2020 & 2027F) |

| 9.3.1. Kuwait Biscuit Market Revenues, By Hypermarkets & Supermarkets (2017-2027F) |

| 9.3.2. Kuwait Biscuit Market Revenues, By Convenience Stores (2017-2027F) |

| 9.3.3. Kuwait Biscuit Market, By Specialist Retailers (2017-2027F) |

| 9.3.4. Kuwait Biscuit Market, By Other Distribution Channels (2017-2027F) |

| 9.4. Kuwait Biscuit Market Revenue Share, By Packaging (2020 & 2027F) |

| 9.4.1. Kuwait Biscuit Market Revenues, By Flexible Packaging (2017-2027F) |

| 9.4.2. Kuwait Biscuit Market Revenues, By Rigid Packaging (2017-2027F) |

| 9.4.3. Kuwait Biscuit Market Revenues, By Paper & Board Packaging (2017-2027F) |

| 9.5. Kuwait Biscuit Market Key Performance Indicators |

| 10. Jordan Biscuit Market Overview |

| 10.1. Jordan Biscuit Market Revenues & Volume (2017-2027F) |

| 10.2. Jordan Biscuit Market Revenue Share, By Category (2020 & 2027F) |

| 10.2.1. Jordan Sweet Biscuit Market Revenues (2017-2027F) |

| 10.2.2. Jordan Savoury & Crackers Biscuit Market Revenues (2017-2027F) |

| 10.2.3. Jordan Functional/Energy Biscuit Market Revenues (2017-2027F) |

| 10.3. Jordan Biscuit Market Revenue Share, By Distribution Channels (2020 & 2027F) |

| 10.3.1. Jordan Biscuit Market Revenues, By Hypermarkets & Supermarkets (2017-2027F) |

| 10.3.2. Jordan Biscuit Market Revenues, By Convenience Stores (2017-2027F) |

| 10.3.3. Jordan Biscuit Market, By Specialist Retailers (2017-2027F) |

| 10.3.4. Jordan Biscuit Market, By Other Distribution Channels (2017-2027F) |

| 10.4. Jordan Biscuit Market Revenue Share, By Packaging (2020 & 2027F) |

| 10.4.1. Jordan Biscuit Market Revenues, By Flexible Packaging (2017-2027F) |

| 10.4.2. Jordan Biscuit Market Revenues, By Rigid Packaging (2017-2027F) |

| 10.4.3. Jordan Biscuit Market Revenues, By Paper & Board Packaging (2017-2027F) |

| 10.5. Jordan Biscuit Market Key Performance Indicators |

| 11. Lebanon Biscuit Market Overview |

| 11.1. Lebanon Biscuit Market Revenues & Volume (2017-2027F) |

| 11.2. Lebanon Biscuit Market Revenue Share, By Category (2020 & 2027F) |

| 11.2.1. Lebanon Sweet Biscuit Market Revenues (2017-2027F) |

| 11.2.2. Lebanon Savoury & Crackers Biscuit Market Revenues (2017-2027F) |

| 11.2.3. Lebanon Functional/Energy Biscuit Market Revenues (2017-2027F) |

| 11.3. Lebanon Biscuit Market Revenue Share, By Distribution Channels (2020 & 2027F) |

| 11.3.1. Lebanon Biscuit Market Revenues, By Hypermarkets & Supermarkets (2017-2027F) |

| 11.3.2. Lebanon Biscuit Market Revenues, By Convenience Stores (2017-2027F) |

| 11.3.3. Lebanon Biscuit Market, By Specialist Retailers (2017-2027F) |

| 11.3.4. Lebanon Biscuit Market, By Other Distribution Channels (2017-2027F) |

| 11.4. Lebanon Biscuit Market Revenue Share, By Packaging (2020 & 2027F) |

| 11.4.1. Lebanon Biscuit Market Revenues, By Flexible Packaging (2017-2027F) |

| 11.4.2. Lebanon Biscuit Market Revenues, By Rigid Packaging (2017-2027F) |

| 11.4.3. Lebanon Biscuit Market Revenues, By Paper & Board Packaging (2017-2027F) |

| 11.5. Lebanon Biscuit Market Key Performance Indicators |

| 12. Rest of Middle East Biscuit Market Overview |

| 12.1. Rest of Middle East Biscuit Market Revenues (2017-2027F) |

| 13. Middle East Biscuit Market Opportunity Assessment |

| 13.1. Saudi Arabia Biscuit Market Opportunity Assessment |

| 13.1.1 Saudi Arabia Biscuit Market Opportunity Assessment, By Category (2027F) |

| 13.1.2. Saudi Arabia Biscuit Market Opportunity Assessment, By Distribution Channels (2027F) |

| 13.2. UAE Biscuit Market Opportunity Assessment |

| 13.2.1 UAE Biscuit Market Opportunity Assessment, By Category (2027F) |

| 13.2.2. UAE Biscuit Market Opportunity Assessment, By Distribution Channels (2027F) |

| 13.3. Qatar Biscuit Market Opportunity Assessment |

| 13.3.1 Qatar Biscuit Market Opportunity Assessment, By Category (2027F) |

| 13.3.2. Qatar Biscuit Market Opportunity Assessment, By Distribution Channels (2027F) |

| 13.4. Kuwait Biscuit Market Opportunity Assessment |

| 13.4.1 Kuwait Biscuit Market Opportunity Assessment, By Category (2027F) |

| 13.4.2. Kuwait Biscuit Market Opportunity Assessment, By Distribution Channels (2027F) |

| 13.5. Jordan Biscuit Market Opportunity Assessment |

| 13.5.1 Jordan Biscuit Market Opportunity Assessment, By Category (2027F) |

| 13.5.2. Jordan Biscuit Market Opportunity Assessment, By Distribution Channels (2027F) |

| 13.6. Lebanon Biscuit Market Opportunity Assessment |

| 13.6.1 Lebanon Biscuit Market Opportunity Assessment, By Category (2027F) |

| 13.6.2. Lebanon Biscuit Market Opportunity Assessment, By Distribution Channels (2027F) |

| 14. Middle East Biscuit Market Competitive Landscape |

| 14.1. Middle East Biscuit Market Revenue Share, By Company |

| 14.1.1. Saudi Arabia Biscuit Market Revenue Share, By Company (2020) |

| 14.1.2. UAE Biscuit Market Revenue Share, By Company (2020) |

| 14.1.3. Qatar Biscuit Market Revenue Share, By Company (2020) |

| 14.1.4. Kuwait Biscuit Market Revenue Share, By Company (2020) |

| 14.1.5. Jordan Biscuit Market Revenue Share, By Company (2020) |

| 14.1.6. Lebanon Biscuit Market Revenue Share, By Company (2020) |

| 14.2. Middle East Biscuit Market Competitive Benchmarking, By Operating Parameters |

| 15. Company Profiles |

| 15.1. Mondelez International Inc. |

| 15.2. Y?ld?z Holding Inc. |

| 15.3. United Food Industries Corporation Ltd. |

| 15.4. Gandour |

| 15.5. National Biscuits Confectionery Co. Ltd. |

| 15.6. International Foodstuffs Co. |

| 15.7. Britannia Industries |

| 15.8. Nestl S.A. |

| 15.9. A. Loacker AG |

| 15.10. Binzagr CO-RO Ltd. |

| 16. Key Strategic Recommendations |

| 17. Disclaimer |

| List of Tables |

| 1. Upcoming Retail Sector Projects in Middle East countries |

| 2. Saudi Arabia Biscuit Market Revenues, By Category, 2017-2027F ($ Million) |

| 3. Saudi Arabia Biscuit Market Revenues, By Distribution Channels, 2017-2027F ($ Million) |

| 4. Saudi Arabia Biscuit Market Revenues, By Packaging, 2017-2027F ($ Million) |

| 5. List of Major Infrastructure Projects in Saudi Arabia |

| 6. UAE Biscuit Market Revenues, By Category, 2017-2027F ($ Million) |

| 7. UAE Biscuit Market Revenues, By Distribution Channels, 2017-2027F ($ Million) |

| 8. UAE Biscuit Market Revenues, By Packaging, 2017-2027F ($ Million) |

| 9. Ongoing/ Upcoming Hospitality Projects in UAE |

| 10. Qatar Biscuit Market Revenues, By Category, 2017-2027F ($ Million) |

| 11. Qatar Biscuit Market Revenues, By Distribution Channels, 2017-2027F ($ Million) |

| 12. Qatar Biscuit Market Revenues, By Packaging, 2017-2027F ($ Million) |

| 13. Kuwait Biscuit Market Revenues, By Category, 2017-2027F ($ Million) |

| 14. Kuwait Biscuit Market Revenues, By Distribution Channels, 2017-2027F ($ Million) |

| 15. Kuwait Biscuit Market Revenues, By Packaging, 2017-2027F ($ Million) |

| 16. Jordan Biscuit Market Revenues, By Category, 2017-2027F ($ Million) |

| 17. Jordan Biscuit Market Revenues, By Distribution Channels, 2017-2027F ($ Million) |

| 18. Jordan Biscuit Market Revenues, By Packaging, 2017-2027F ($ Million) |

| 19. Lebanon Biscuit Market Revenues, By Category, 2017-2027F ($ Million) |

| 20. Lebanon Biscuit Market Revenues, By Distribution Channels, 2017-2027F ($ Million) |

| 21. Lebanon Biscuit Market Revenues, By Packaging, 2017-2027F ($ Million) |

| 22. Lebanon Investments for Tourism Sector |

| List of Figures |

| 1. Middle East Biscuit Market Revenues, 2017-2027F ($ Billions) |

| 2. Middle East Biscuit Market - Industry Life Cycle |

| 3. Middle East Biscuit Market Revenue Share, By Countries, 2020 & 2027F |

| 4. Population Statistics, By Country, 20012-2023 (Million) |

| 5. Population Distribution, By Age Group, 2017-2023 |

| 6. Consumer Preference for Consumption of Healthy Biscuits in Middle East, 2020 |

| 7. Saudi Arabia Biscuit Market Revenues and Volume, 2017-2027F ($ Million, Thousand Units) |

| 8. Saudi Arabia Biscuit Market Revenue Share, By Category, 2020 & 2027F |

| 9. Saudi Arabia Biscuit Market Revenue Share, By Distribution Channels, 2020 & 2027F |

| 10. Saudi Arabia Biscuit Market Revenue Share, By Packaging, 2020 & 2027F |

| 11. Highlights of Saudi Arabia’s Food and Beverages Sector |

| 12. Saudi Arabia Existing and Upcoming Quality Hotel Supply (2020-2022) |

| 13. Saudi Arabia Upcoming Hotel Projects (No. of Projects) |

| 14. Province-wise Saudi Arabia Upcoming Hotel Projects (No. of Projects) |

| 15. UAE Biscuit Market Revenues and Volume, 2017-2027F ($ Million, Thousand Units) |

| 16. UAE Biscuit Market Revenue Share, By Category, 2020 & 2027F |

| 17. UAE Biscuit Market Revenue Share, By Distribution Channels, 2020 & 2027F |

| 18. UAE Biscuit Market Revenue Share, By Packaging, 2020 & 2027F |

| 19. Highlights of UAE’s Food and Beverages Sector |

| 20. Qatar Biscuit Market Revenues and Volume, 2017-2027F ($ Million, Thousand Units) |

| 21. Qatar Biscuit Market Revenue Share, By Category, 2020 & 2027F |

| 22. Qatar Biscuit Market Revenue Share, By Distribution Channels, 2020 & 2027F |

| 23. Qatar Biscuit Market Revenue Share, By Packaging, 2020 & 2027F |

| 24. F&B Projected Market Size (QAR Million, 2016-2026) |

| 25. Qatar Hotel Supply, 2017-2021E (No. of Keys) |

| 26. Kuwait Biscuit Market Revenues and Volume, 2017-2027F ($ Million, Thousand Units) |

| 27. Kuwait Biscuit Market Revenue Share, By Category, 2020 & 2027F |

| 28. Kuwait Biscuit Market Revenue Share, By Distribution Channels, 2020 & 2027F |

| 29. Kuwait Biscuit Market Revenue Share, By Packaging, 2020 & 2027F |

| 30. Kuwait Ongoing Mall Projects |

| 31. Highlights of Kuwait’s Food and Beverages Sector |

| 32. Jordan Biscuit Market Revenues and Volume, 2017-2027F ($ Million, Thousand Units) |

| 33. Jordan Biscuit Market Revenue Share, By Category, 2020 & 2027F |

| 34. Jordan Biscuit Market Revenue Share, By Distribution Channels, 2020 & 2027F |

| 35. Jordan Biscuit Market Revenue Share, By Packaging, 2020 & 2027F |

| 36. Jordan Ongoing Major Commercial Projects |

| 37. Lebanon Biscuit Market Revenues and Volume, 2017-2027F ($ Million, Thousand Units) |

| 38. Lebanon Biscuit Market Revenue Share, By Category, 2020 & 2027F |

| 39. Lebanon Biscuit Market Revenue Share, By Distribution Channels, 2020 & 2027F |

| 40. Lebanon Biscuit Market Revenue Share, By Packaging, 2020 & 2027F |

| 41. Rest of Middle East Biscuit Market Revenues, 2017-2027F ($ Million) |

| 42. Saudi Arabia Biscuit Market Opportunity Assessment, By Category (2027F) |

| 43. Saudi Arabia Biscuit Market Opportunity Assessment, By Distribution Channels (2027F) |

| 44. UAE Biscuit Market Opportunity Assessment, By Category (2027F) |

| 45. UAE Biscuit Market Opportunity Assessment, By Distribution Channels (2027F |

| 46. Qatar Biscuit Market Opportunity Assessment, By Category (2027F) |

| 47. Qatar Biscuit Market Opportunity Assessment, By Distribution Channels (2027F) |

| 48. Kuwait Biscuit Market Opportunity Assessment, By Category (2027F) |

| 49. Kuwait Biscuit Market Opportunity Assessment, By Distribution Channels (2027F) |

| 50. Jordan Biscuit Market Opportunity Assessment, By Category (2027F) |

| 51. Jordan Biscuit Market Opportunity Assessment, By Distribution Channels (2027F) |

| 52. Lebanon Biscuit Market Opportunity Assessment, By Category (2027F) |

| 53. Lebanon Biscuit Market Opportunity Assessment, By Distribution Channels (2027F) |

| 54. Saudi Arabia Biscuit Market Revenue Share, By Company (2020) |

| 55. UAE Biscuit Market Revenue Share, By Company (2020) |

| 56. Qatar Biscuit Market Revenue Share, By Company (2020) |

| 57. Kuwait Biscuit Market Revenue Share, By Company (2020) |

| 58. Jordan Biscuit Market Revenue Share, By Company (2020) |

| 59. Lebanon Biscuit Market Revenue Share, By Company (2020) |

| 60. Saudi Arabia Retail Supply Stock, Q2 2020-2022F (Sq. mt. GLA) |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 4,560

- Department License$ 5,055

- Site License$ 5,595

- Global License$ 6,000

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Switchgear Market Outlook (2026 - 2032) | Size, Share, Trends, Growth, Revenue, Forecast, Analysis, Value, Outlook

- Pakistan Contraceptive Implants Market (2025-2031) | Demand, Growth, Size, Share, Industry, Pricing Analysis, Competitive, Strategic Insights, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Companies, Challenges

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero