Morocco Construction Equipment Market (2023-2029) | Size, Share, Trends, Revenue, Analysis, Growth, industry, outlook & COVID-19 IMPACT

Market Forecast by Types (Crane, Bulldozer and Construction Tractor, Earthmoving Equipment, Material Handling Equipment, Dump Truck, Aerial Work Platform, Road Construction Equipment), by Applications (Construction, Mining, Oil & Gas, Others (Municipality, Road Construction, etc.))And Competitive Landscape

| Product Code: ETC4377993 | Publication Date: Feb 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 90 | No. of Figures: 24 | No. of Tables: 21 |

Topics Covered in Morocco Construction Equipment Market Report

The Morocco construction equipment market report thoroughly covers the market by types, and applications. Sudan construction equipment market outlook report provides an unbiased and detailed analysis of the ongoing Sudan construction equipment market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Morocco Construction Equipment Market Synopsis

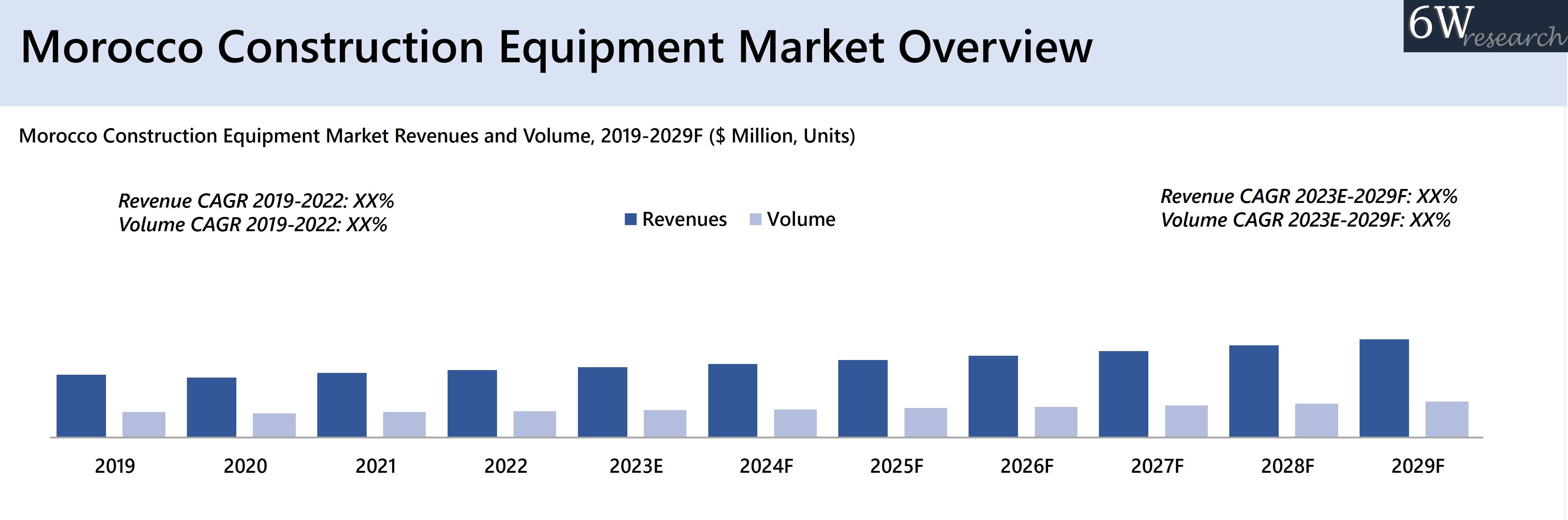

The Morocco Construction Equipment Market is estimated to grow at a rapid pace during the forecast period. However, the industry in 2020 observed decline due to pandemic as the economic were halted to curb the spread of COVID as the government enforced lockdown therefore, the construction activities were stopped, and the construction industry recorded decline of 3.8% in real terms thereby declining the demand for construction equipment in Morocco.

The market started to recover slightly in 2021 as the effect of the pandemic subsided and the construction industry registered growth of 10.6% in real terms in 2021. Furthermore, in 2022, 18 hotel projects comprising of 2,743 rooms opened that led to increase in demand for construction equipment in the period 2021-22.

According to 6Wresearch, Morocco Construction Equipment Market revenue size is anticipated to grow at a CAGR of 5.7% during 2023-2029. The $4.16 billion annual infrastructure budget announced in 2020 till 2030 by Ministry of Equipment, Transport, Logistics, and Water is expected to drive the market for construction equipment in Morocco. The initiatives such as Airports Development 2030, 2040 Rail strategy along with the construction of hotel projects such as Waldorf Astoria Tanger, Lincoln Casablanca would grow the Morocco construction equipment market in the upcoming years. In the upcoming years, the Morocco construction equipment market is expected to witness growth on the back of construction of hotels such as Waldorf Astoria Tanger, DoubleTree by Hilton Ben Guerirour Seasons Hotel Rabat. Moreover, in 2020, The Ministry of Equipment, Transport, Logistics, and Water of Morocco approved a $4.16 billion yearly infrastructure budget till 2030 that would further boost the market for construction equipment in Morocco.

According to 6Wresearch, Morocco Construction Equipment Market revenue size is anticipated to grow at a CAGR of 5.7% during 2023-2029. The $4.16 billion annual infrastructure budget announced in 2020 till 2030 by Ministry of Equipment, Transport, Logistics, and Water is expected to drive the market for construction equipment in Morocco. The initiatives such as Airports Development 2030, 2040 Rail strategy along with the construction of hotel projects such as Waldorf Astoria Tanger, Lincoln Casablanca would grow the Morocco construction equipment market in the upcoming years. In the upcoming years, the Morocco construction equipment market is expected to witness growth on the back of construction of hotels such as Waldorf Astoria Tanger, DoubleTree by Hilton Ben Guerirour Seasons Hotel Rabat. Moreover, in 2020, The Ministry of Equipment, Transport, Logistics, and Water of Morocco approved a $4.16 billion yearly infrastructure budget till 2030 that would further boost the market for construction equipment in Morocco.

The majority of Morocco Construction Equipment Industry which is a key part of Africa Construction Equipment Market rely on outdated equipment that have an average lifecycle of 9 years however, the machinery used in Morocco are quite old. The demand for old machines in Morocco also gains prominence as old machines are much cheaper compared to the newer construction machines. Moreover, in Morocco there is absence of regulatory framework to monitor the old equipment used in the construction sector therefore the construction equipment even after they become obsolete are still being used. Henceforth, the sale of the new construction equipment would suffer in Morocco.

Morocco Construction Equipment Industry: Key Players

The first key player in the Moroccan construction equipment market is STOMIL, which is a subsidiary of the Polish company POL-MOT. The company produces equipment such as graders, bulldozers, and excavators. STOMIL's heavy equipment is widely used in the construction industry. The second key player in this market is Caterpillar, an American multinational corporation that produces construction equipment. Caterpillar's equipment is considered some of the best in the industry and is used in various markets worldwide. Another player worth mentioning is JLG Industries, an American company that produces aerial work platforms, including scissor lifts, boom lifts, and telehandlers.

Construction Equipment Market in Morocco: Government Policies

Government initiatives to facilitate the growth of the construction equipment market promote investment in construction. For instance, the government collaborates with a range of stakeholders - including the private sector - to garner support for projects that will bolster the country's infrastructure and promote the construction industry's growth. Additionally, the government has initiated new laws to ensure that the equipment is of high quality and meets industry standards. In addition to the efforts mentioned above, the Moroccan government also focuses on technology transfer and innovation in the construction equipment industry. This is done by organizing conferences and workshops to encourage the exchange of information among researchers and manufacturers. Furthermore, there are ongoing efforts to collaborate with international organizations - like the World Bank, International Finance Corporation (IFC), and the European Investment Bank - to obtain funding support for investments in the construction equipment industry.

Market by Types

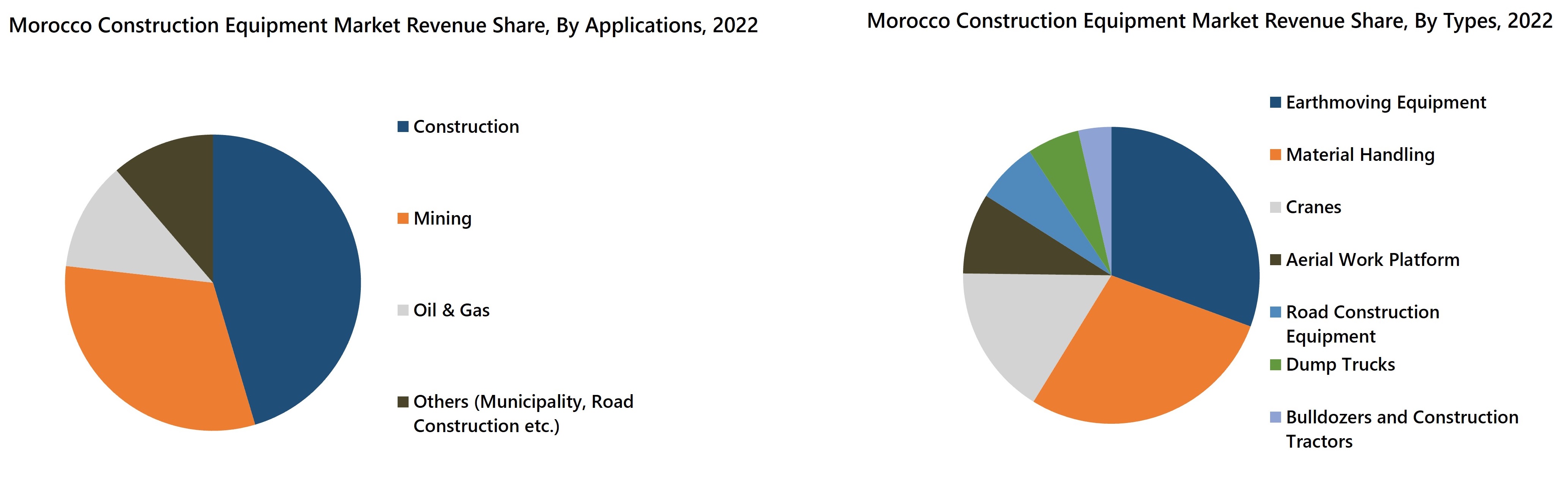

Cconstruction equipment market in Morocco in 2022 in terms of revenue was dominated by earth moving equipment on the back of Tiznit-Dakhla highway project that is under construction and expected to be completed by 2023.

Material handling equipment acquired the maximum volume share in 2022 on the back of rise in infrastructure projects including hotels, roads etc.

Market by Applications

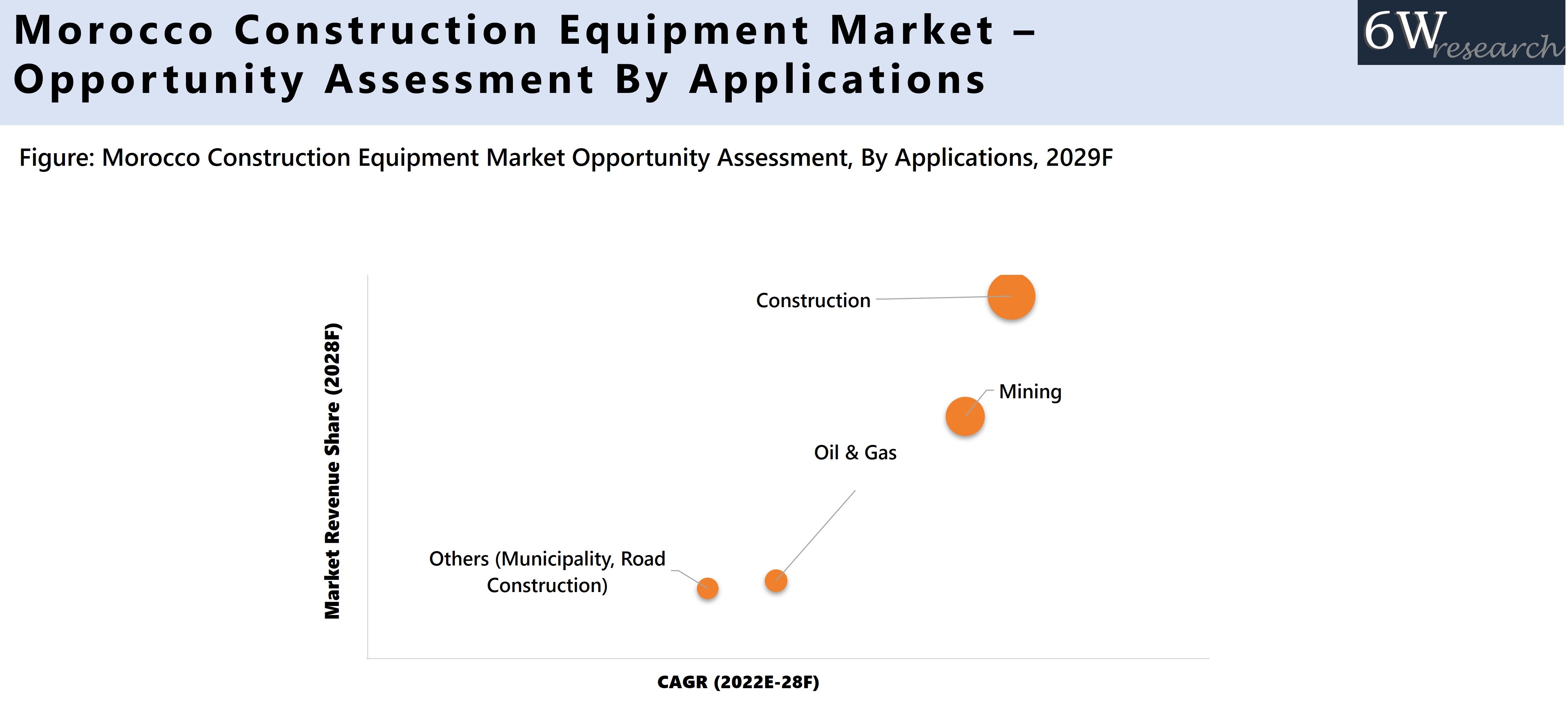

Construction is expected to achieve maximum growth in the forecasted period owing to the construction of highways, strong hotel pipeline, commercial buildings. The upcoming hospitality projects such as Waldorf Astoria Tanger, Lincoln Casablanca would further grow the revenue share of construction sector in the subsequent years.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 11 Years Market Numbers.

- Historical Data Starting from 2019 to 2022.

- Base Year: 2022

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Morocco Construction Equipment Market Outlook

- Market Size of Morocco Construction Equipment Market, 2022

- Forecast of Morocco Construction Equipment Market, 2029

- Historical Data and Forecast of Morocco Construction Equipment Market Revenues & Volume for the Period 2019 - 2029

- Morocco Construction Equipment Market Trend Evolution

- Morocco Construction Equipment Market Drivers and Challenges

- Morocco Construction Equipment Price Trends

- Morocco Construction Equipment Porter's Five Forces

- Morocco Construction Equipment Industry Life Cycle

- Historical Data and Forecast of Morocco Construction Equipment Market Revenues and volume by Type for the Period 2019 – 2029

- Historical Data and Forecast of Morocco Construction Equipment Market Revenues and Volume by Cranes for the Period 2019 - 2029

- Historical Data and Forecast of Morocco Construction Equipment Market Revenues and volume by Construction Tractor and Bulldozer for the Period 2019 - 2029

- Historical Data and Forecast of Morocco Construction Equipment Market Revenues and volume by Earthmoving Equipment for the Period 2019 - 2029

- Historical Data and Forecast of Morocco Construction Equipment Market Revenues and volume by Aerial Work Equipment for the Period 2019 - 2029

- Historical Data and Forecast of Morocco Construction Equipment Market Revenues and volume by Material Handling Equipment for the Period 2019 - 2029

- Historical Data and Forecast of Morocco Construction Equipment Market Revenues and volume by Dump Trucks for the Period 2019 - 2029

- Historical Data and Forecast of Morocco Construction Equipment Market Revenues and volume by Road Construction Equipment for the Period 2019 - 2029

- Historical Data and Forecast of Morocco Construction Equipment Market Revenues and volume by Application for the Period 2019 - 2029

- Historical Data and Forecast of Morocco Construction Equipment Market Revenues and volume by Construction for the Period 2019 - 2029

- Historical Data and Forecast of Morocco Construction Equipment Market Revenues and volume by Oil and Gas for the Period 2019 - 2029

- Historical Data and Forecast of Morocco Construction Equipment Market Revenues and volume by Mining for the Period 2019 - 2029

- Historical Data and Forecast of Morocco Construction Equipment Market Revenues and volume by Others for the Period 2019 – 2029

- Morocco Construction Equipment Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Application

- Morocco Construction Equipment Top Companies Market Share

- Morocco Construction Equipment Competitive Benchmarking By Technical and Operational Parameters

- Morocco Construction Equipment Company Profiles

- Morocco Construction Equipment Key Strategic Recommendation

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By Types

- Crane

- Bulldozer and Construction Tractor

- Earthmoving Equipment

- Material Handling Equipment

- Dump Truck

- Aerial Work Platform

- Road Construction Equipment

By Applications

- Construction

- Mining

- Oil & Gas

- Others (Municipality, Road Construction etc.)

Morocco Construction Equipment Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Morocco Construction Equipment Market Overview |

| 3.1 Morocco Construction Equipment Market Revenues and Volume, 2019-2029F |

| 3.2 Morocco Construction Equipment Market - Industry Life Cycle |

| 3.3 Morocco Construction Equipment Market - Porter’s Five Forces |

| 4. Morocco Construction Equipment Market COVID-19 Impact Analysis |

| 5. Morocco Construction Equipment Market Dynamics |

| 5.1 Impact Analysis |

| 5.2 Market Drivers |

| 5.2.1 Increasing government investments in infrastructure projects |

| 5.2.2 Growth in the real estate sector |

| 5.2.3 Rise in urbanization and industrialization in Morocco |

| 5.3 Market Restraints |

| 5.3.1 Fluctuating raw material prices |

| 5.3.2 Regulatory challenges and compliance requirements |

| 5.3.3 Economic instability and currency fluctuations |

| 6. Morocco Construction Equipment Market Trends |

| 7. Morocco Construction Equipment Market Overview, By Types |

| 7.1 Morocco Construction Equipment Market Revenue Share and Volume Share, By Types, 2022 & 2029F |

| 7.2 Morocco Construction Equipment Market Revenues, By Types |

| 7.2.1 Morocco Construction Equipment Market Revenues, By Mobile Crane, 2019-2029F |

| 7.2.2 Morocco Construction Equipment Market Revenues, By Construction Tractors / Bulldozers, 2019-2029F |

| 7.2.3 Morocco Construction Equipment Market Revenues, By Earth Moving Equipment, 2019-2029F |

| 7.2.4 Morocco Construction Equipment Market Revenues, By Material Handling Equipment, 2019-2029F |

| 7.2.5 Morocco Construction Equipment Market Revenues, By Dump Truck, 2019-2029F |

| 7.2.6 Morocco Construction Equipment Market Revenues, By Aerial Work Platform, 2019-2029F |

| 7.2.7 Morocco Construction Equipment Market Revenues, By Road Construction Equipment, 2019-2029F |

| 7.3 Morocco Construction Equipment Market Volume, By Types |

| 7.3.1 Morocco Construction Equipment Market Volume, By Mobile Crane, 2019-2029F |

| 7.3.2 Morocco Construction Equipment Market Volume, By Construction Tractors / Bulldozers, 2019-2029F |

| 7.3.3 Morocco Construction Equipment Market Volume, By Earth Moving Equipment, 2019-2029F |

| 7.3.4 Morocco Construction Equipment Market Volume, By Material Handling Equipment, 2019-2029F |

| 7.3.5 Morocco Construction Equipment Market Volume, By Dump Truck, 2019-2029F |

| 7.3.6 Morocco Construction Equipment Market Volume, By Aerial Work Platform, 2019-2029F |

| 7.3.7 Morocco Construction Equipment Market Volume, By Road Construction Equipment, 2019-2029F |

| 8. Morocco Construction Equipment Market Overview, By Cranes |

| 8.1 Morocco Cranes Revenue Share and Revenues, 2019-2029F |

| 8.1.1 Morocco Cranes Market Revenues, By Mobile Crane, 2019-2029F |

| 8.1.2 Morocco Cranes Market Revenues, By Tower Crane, 2019-2029F |

| 8.1.3 Morocco Earth Moving Equipment Market Revenues, By Crawler Crane, 2019-2029F |

| 8.2 Morocco Cranes Volume Share and Volume, 2019-2029FF |

| 8.2.1 Morocco Cranes Market Volume, By Mobile Crane, 2019-2029F |

| 8.2.2 Morocco Cranes Market Volume, By Tower Crane, 2019-2029F |

| 8.2.3 Morocco Earth Moving Equipment Market Revenues, By Crawler Crane, 2019-2029F |

| 9. Morocco Construction Equipment Market Overview, By Earth Moving Equipment |

| 9.1 Morocco Earth Moving Equipment Revenue Share and Revenues, 2019-2029F |

| 9.1.1 Morocco Earth Moving Equipment Market Revenues, By Loader, 2019-2029F |

| 9.1.2 Morocco Earth Moving Equipment Market Revenues, By Excavator, 2019-2029F |

| 9.1.3 Morocco Earth Moving Equipment Market Revenues, By Motor Grader, 2019-2029F |

| 9.2 Morocco Earth Moving Equipment Market Revenue Share and Revenues, By Loader, 2019-2029F |

| 9.2.1 Morocco Loader Market Revenues, By Wheeled Loader, 2019-2029F |

| 9.2.2 Morocco Loader Market Revenues, By Skid Steer Loader, 2019-2029F |

| 9.2.3 Morocco Loader Market Revenues, By Backhoe Loader, 2019-2029F |

| 9.2.4 Morocco Loader Market Revenues, By Compact Track Loader, 2019-2029F |

| 9.3 Morocco Earth Moving Equipment Market Revenue Share and Revenues, By Excavators, 2019-2029F |

| 9.3.1 Morocco Excavator Market Revenues, By Tracked Excavator, 2019-2029F |

| 9.3.2 Morocco Excavator Market Revenues, By Wheeled Excavator, 2019-2029F |

| 9.3.3 Morocco Excavator Market Revenues, By Mini Excavator, 2019-2029F |

| 9.4 Morocco Earth Moving Equipment Volume Share and Volume, 2019-2029F |

| 9.4.1 Morocco Earth Moving Equipment Market Volume By Loader, 2019-2029F |

| 9.4.2 Morocco Earth Moving Equipment Market Volume, By Excavator, 2019-2029F |

| 9.4.3 Morocco Earth Moving Equipment Market Volume, By Motor Grader, 2019-2029F |

| 9.5 Morocco Loader Volume Share and Volume, 2019-2029F |

| 9.5.1 Morocco Loader Market Volume, By Wheeled Loader, 2019-2029F |

| 9.5.2 Morocco Loader Market Volume, By Skid Steer Loader, 2019-2029F |

| 9.5.3 Morocco Loader Market Volume, By Backhoe Loader, 2019-2029F |

| 9.5.4 Morocco Loader Market Volume, By Compact Track Loader, 2019-2029F |

| 9.6 Morocco Earth Moving Equipment Market Volume Share and Volume, By Excavators, 2019-2029F |

| 9.6.1 Morocco Excavator Market Volume, By Tracked Excavator, 2019-2029F |

| 9.6.2 Morocco Excavator Market Volume, By Wheeled Excavator, 2019-2029F |

| 9.6.3 Morocco Excavator Market Volume, By Mini Excavator, 2019-2029F |

| 10. Morocco Construction Equipment Market Overview, By Material Handling Equipment |

| 10.1 Morocco Material Handling Equipment Revenue Share and Revenues, 2019-2029F |

| 10.1.1 Morocco Material Handling Market Revenues, By Forklift, 2019-2029F |

| 10.1.2 Morocco Material Handling Market Revenues, By Telescopic Handler, 2019-2029F |

| 10.2 Morocco Material Handling Equipment Volume Share and Volume, 2019-2029F |

| 10.2.1 Morocco Material Handling Market Volume, By Forklift, 2019-2029F |

| 10.2.2 Morocco Material Handling Market Volume, By Telescopic Handler, 2019-2029F |

| 11. Morocco Construction Equipment Market Overview, By Aerial Equipment |

| 11.1 Morocco Aerial Equipment Revenue Share and Revenues, 2019-2029F |

| 11.1.1 Morocco Aerial Equipment Revenues, By Telescopic Handler, 2019-2029F |

| 11.1.2 Morocco Aerial Equipment Revenues, By Articulated Boomlift, 2019-2029F |

| 11.1.3 Morocco Aerial Equipment Revenues, By Scissor Lift, 2019-2029F |

| 11.2 Morocco Aerial Equipment Volume Share and Volume, 2019-2029F |

| 11.2.1 Morocco Aerial Equipment Volume, By Telescopic Handler, 2019-2029F |

| 11.2.2 Morocco Aerial Equipment Volume, By Articulated Boomlift, 2019-2029F |

| 11.2.3 Morocco Aerial Equipment Volume, By Scissor Lift, 2019-2029F |

| 12. Morocco Construction Equipment Market Overview, By Road Construction Equipment |

| 12.1 Morocco Road Construction Equipment Revenue Share and Revenues, 2019-2029F |

| 12.1.1 Morocco Road Construction Equipment Revenues, By Pavers, 2019-2029F |

| 12.1.2 Morocco Road Construction Equipment Revenues, By Road Rollers, 2019-2029F |

| 12.2 Morocco Road Construction Equipment Volume Share and Volume, 2019-2029F |

| 12.2.1 Morocco Road Construction Equipment Volume, By Pavers, 2019-2029F |

| 12.2.2 Morocco Road Construction Equipment Volume, By Road Rollers, 2019-2029F |

| 13. Morocco Construction Equipment Market Overview, By Applications |

| 13.1 Morocco Construction Equipment Market Revenues, By Applications, 2019-2029F |

| 13.1.1 Morocco Construction Equipment Market Revenues, By Construction, 2019-2029F |

| 13.1.2 Morocco Construction Equipment Market Revenues, By Mining, 2019-2029F |

| 13.1.3 Morocco Construction Equipment Market Revenues, By Oil & Gas, 2019-2029F |

| 13.1.4 Morocco Construction Equipment Market Revenues, By Others, 2019-2029F |

| 14. Morocco Construction Equipment Market – Key Performance Indicators |

| 14.1 Construction equipment utilization rate |

| 14.2 Average equipment age in the market |

| 14.3 Number of construction permits issued |

| 14.4 Infrastructure project pipeline |

| 14.5 Industry-specific workforce skills development metrics |

| 15. Morocco Construction Equipment Market – Opportunity Assessment |

| 15.1 Morocco Construction Equipment Market Opportunity Assessment, By Types |

| 15.2 Morocco Construction Equipment Market Opportunity Assessment, By Applications |

| 16. Morocco Construction Equipment Market – Competitive Landscape |

| 16.1 Morocco Construction Equipment Market Company Ranking, By Companies, 2022 |

| 16.2 Morocco Construction Equipment Market Competitive Benchmarking, By Operating Parameters |

| 17. Company Profiles |

| 17.1 Caterpillar Inc. |

| 17.2 Komatsu Ltd. |

| 17.3 Volvo Construction Equipment |

| 17.4 Hyundai Doosan Infracore Co., Ltd. |

| 17.5 Sany Group |

| 17.6 Joseph Cyril Bamford Excavators Ltd. |

| 17.7 Hitachi Construction Machinery Co., Ltd. |

| 17.8 Kalmar Global |

| 17.9 Liebherr Group |

| 18. Key Strategic Recommendations |

| 19. Disclaimer |

| List of Figures |

| 1. Morocco Construction Equipment Market Revenues and Volume, 2019-2029F ($ Million, Units) |

| 2. Morocco Construction Equipment Market Revenue Share, By Types, 2022 & 2029F |

| 3. Morocco Construction Equipment Market Volume Share, By Types, 2022 & 2029F |

| 4. Morocco Construction Equipment Market Revenue Share, By Crane, 2022 & 2029F |

| 5. Morocco Construction Equipment Market Volume Share, By Crane,2022 & 2029F |

| 6. Morocco Construction Equipment Market Revenue Share, By Earth Moving Equipment, 2022 & 2029F |

| 7. Morocco Construction Equipment Market Revenue Share, By Loaders, 2022 & 2029F |

| 8. Morocco Construction Equipment Market Revenue Share, By Excavators, 2022 & 2029F |

| 9. Morocco Construction Equipment Market Revenue Share, By Earth Moving Equipment, 2022 & 2029F |

| 10. Morocco Construction Equipment Market Volume Share, By Loaders, 2022 & 2029F |

| 11. Morocco Construction Equipment Market Volume Share, By Excavators, 2022 & 2029F |

| 12. Morocco Construction Equipment Market Revenue Share, By Material Handling Equipment, 2022 & 2029F |

| 13. Morocco Construction Equipment Market Volume Share, By Material Handling Equipment,2022 & 2029F |

| 14. Morocco Construction Equipment Market Revenue Share, By Material Handling Equipment, 2022 & 2029F |

| 15. Morocco Construction Equipment Market Volume Share, By Aerial Equipment, 2022 & 2029F |

| 16. Morocco Construction Equipment Market Revenue Share, By Road Construction Equipment, 2022 & 2029F |

| 17. Morocco Construction Equipment Market Volume Share, By Road Construction Equipment, 2022 & 2029F |

| 18. Morocco Construction Equipment Market Revenue Share, By Applications, 2021 & 2028F |

| 19. Morocco Road Infrastructure Investment, 2020-2040F ($ Billion) |

| 20. Morocco Airport Infrastructure Investment, 2020-2040F ($ Million) |

| 21. Export Value of Phosphate in Morocco, 2018-2021, ($Million) |

| 22. Morocco Construction Equipment Market Opportunity Assessment, By Types, 2029F |

| 23. Morocco Construction Equipment Market Opportunity Assessment, By Applications, 2029F |

| 24. Morocco Construction Equipment Market Company Rankings, By Companies, 2022 |

| List of Tables |

| 1. Morocco Upcoming Hospitality Sector Projects |

| 2. Morocco Upcoming Infrastructure Projects |

| 3. Morocco Construction Equipment Market Revenues, By Types, 2019-2029F ($ Million) |

| 4. Morocco Construction Equipment Market Volume, By Types, 2019-2029F (Units) |

| 5. Morocco Construction Equipment Market Revenues, By Crane, 2019-2029F ($ Million) |

| 6. Morocco Construction Equipment Market Volume, By Crane, 2019-2029F (Units) |

| 7. Morocco Construction Equipment Market Revenues, By Earth Moving Equipment, 2019-2029F ($ Million) |

| 8. Morocco Construction Equipment Market Revenue Share, By Loaders, 2022 & 2029F |

| 9. Morocco Construction Equipment Market Revenues, By Excavators, 2019-2029F ($ Million) |

| 10. Morocco Construction Equipment Market Volume, By Earth Moving Equipment, 2019-2029 (Units) |

| 11. Morocco Construction Equipment Market Volume, By Loaders, 2019-2029F (Units) |

| 12. Morocco Construction Equipment Market Volume, By Excavators, 2019-2029F (Units) |

| 13. Morocco Construction Equipment Market Revenues, By Material Handling Equipment, 2019-2029F ($ Million) |

| 14. Morocco Construction Equipment Market Volume, By Material Handling Equipment, 2019-2029F (Units) |

| 15. Morocco Construction Equipment Market Revenues, By Material Handling Equipment, 2019-2029F ($ Million) |

| 16. Morocco Construction Equipment Market Volume, By Aerial Equipment, 2019-2029F (Units) |

| 17. Morocco Construction Equipment Market Revenues, By Road Construction Equipment, 2019-2029F ($ Million) |

| 18. Morocco Construction Equipment Market Volume, By Road Construction Equipment, 2019-2029F (Units) |

| 19. Morocco Construction Equipment Market Revenues, By Applications, 2019-2029F ($ Million) |

| 20. Morocco Major Construction Projects |

| 21. Upcoming Mining Plans in Morocco |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2026-2032) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero