UAE Coffee Market (2026-2032) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation, Outlook

Market Forecast By Bean Types (Arabica, Robusta, Others (Liberica and Excelsa)),By Coffee Types (Ground Coffee, Instant Coffee, Whole Bean, Coffee Pod & Capsules),By Distribution Channel (Hypermarkets/Supermarkets,Online Platform, Cafe and Food Services, Others (General store, Mom & Pop stores, Local Stores)),By Applications (Hot Coffee, Cold Coffee), By Regions (Dubai, Abu Dhabi, Sharjah, Other Emirates (Ajman, Fujairah etc.)) and competitive landscape

| Product Code: ETC002790 | Publication Date: Feb 2023 | Updated Date: Feb 2026 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 89 | No. of Figures: 36 | No. of Tables: 1 |

UAE Coffee Market Growth Rate

According to 6Wresearch internal database and industry insights, the UAE Coffee Market is projected to grow at a compound annual growth rate (CAGR) of 5.8% during the forecast period (2026-2032).

Five-Year Growth Trajectory of the UAE Coffee Market with Core Drivers

Below mentioned is the evaluation of year-wise growth rate along with key growth drivers:

|

Year |

Est. Annual Growth (%) |

Growth Drivers |

|

2021 |

3.1% |

Rising café culture and increasing coffee consumption among the young population |

|

2022 |

3.8% |

Expansion of international coffee chains across urban centres |

|

2023 |

4.4% |

Growth of premium and speciality coffee consumption |

|

2024 |

5% |

Increasing adoption of home brewing equipment and speciality beans |

|

2025 |

5.5% |

Strong growth of e-commerce and ready-to-drink coffee products |

Topics Covered in the UAE Coffee Market Report

The UAE Coffee Market report thoroughly covers the market by Bean Types, Coffee Types, Distribution Channel, Applications and Regions. The market report provides an unbiased and detailed analysis of ongoing market trends, opportunities/high growth areas, and market drivers, which help stakeholders devise and align their market strategies according to the current and future market dynamics.

UAE Coffee Market Highlights

| Report Name | UAE Coffee Market |

| Forecast Period | 2026–2032 |

| CAGR | 5.8% |

| Growing Sector | Specialty Coffee & Café Chains |

UAE Coffee Market Synopsis

The UAE Coffee Market is going through a gradual expansion phase propelled by the deeply rooted coffee drinking culture, a surge in demand for premium beverages, and the increasing footprint of international, as well as regional, caf chains in major cities. Having high disposable income and a lifestyle, as well as changing consumer demand for specialty, ethical, and artisanal forms of coffee, are some of the contributing factors for this increased growth. This rapid growth in home consumption, enabled by advanced coffee machines and online platforms, has been changing the way consumers are buying. Besides that, the hospitality and tourism industries will still be instrumental in coffee demand. The innovative, e.g. cold brews and ready, to, drink formats, product offerings are, besides strengthening the overall market attractiveness, also appealing to diverse consumer segments.

Evaluation of Growth Drivers in the UAE Coffee Market

Below mentioned are some prominent drivers and their influence on the market dynamics:

| Drivers | Primary Segments Affected | Why it Matters (Evidence) |

| Expanding Café Culture | Café & Food Services, Hot Coffee | Rising café outlets increase daily consumption and brand exposure |

| Premiumization of Coffee | Arabica, Whole Bean | Consumers prefer high-quality and specialty coffee experiences |

| Growth of E-commerce Platforms | Online Platform, Coffee Pods | Digital retail improves accessibility and convenience |

| Rising Home Brewing Trend | Ground Coffee, Coffee Capsules | Increased sales of machines encourage at-home consumption |

| Tourism and Hospitality Expansion | Hot & Cold Coffee, Cafés | Hotels and restaurants boost consistent demand |

UAE Coffee Market is expected to grow at the CAGR of 5.8% during the forecast period of 2026-2032. Growth is supported by the steady adoption of premium coffee products, a deeply rooted café culture, and the rapid expansion of online sales channels across the UAE. Consumers increasingly associate coffee consumption with lifestyle and social experiences, which continues to strengthen demand within cafés, restaurants, and hospitality venues. Besides tourism, influenced purchasing is also significantly contributing to the situation as hotels, airports, and recreational spots are the main points where coffee is sold in large quantities. Continual development of coffee presentation types, such as speciality coffee blends, cold brews, and easily accessible capsule-based coffee, is elevating the intensity of attraction of the market. Furthermore, the lifestyle of choosing and consuming coffee that is ethically sourced, sustainably produced, and of high quality is changing the way people buy in both residential and commercial spheres, thus being a factor for long-term market expansion and value creation.

Evaluation of Restraints in the UAE Coffee Market

Below mentioned are some major restraints and their influence on the market dynamics:

| Restraints | Primary Segments Affected | What This Means (Evidence) |

| High Import Dependency | All Bean Types | Coffee price volatility impacts profit margins |

| Premium Product Pricing | Specialty Coffee, Cafés | High prices limit mass-market penetration |

| Intense Market Competition | All Segments | Brand differentiation becomes challenging |

| Changing Consumer Preferences | Instant Coffee | Shifting tastes affect traditional segments |

| Sustainability Compliance Costs | Arabica, Capsules | Ethical sourcing increases operational costs |

UAE Coffee Market Challenges

The UAE Coffee Market has experienced strong demand conditions on one hand, it is being confronted with the issues of import dependency, constantly changing global coffee prices, and the fierce competition both among international and local brands. Besides that, a steady implementation of quality standards goes hand in hand with the requirement to be environmentally friendly, which thus necessitates a persistent inflow of funds. On the other hand, the abrupt changes in consumer tastes for the high-end and speciality products impose additional challenges on the normal coffee formats. In particular, the difficulties in the supply of speciality beans and the increase in running costs of the coffee industry have put an additional layer of problems on profitability, hence, the necessity for market players to come up with new solutions constantly, while at the same time they have to refine their strategies in terms of sourcing, branding, and distribution

UAE Coffee Market Trends

Key trends shaping the UAE Coffee Market include:

- Premium Speciality Coffee Growth: Consumers across the UAE are increasingly shifting toward speciality and single-origin coffee as they seek superior taste, authenticity, and curated café experiences. This trend is driving higher spending per cup and encouraging cafés and retailers to expand premium product portfolios.

- Cold Brew Popularity: Cold coffee formats are gaining strong traction due to the country’s warm climate and evolving lifestyle patterns. Ready-to-drink cold brews and iced speciality beverages are becoming mainstream choices among younger consumers.

- Sustainable Sourcing Focus: Ethical Sourcing and Environmentally Friendly Farming are increasingly becoming important with many brands stressing the need for transparency and sustainability in building long-term trust with consumers.

- Smart Coffee Machines Adoption: Rising ownership of advanced coffee machines at home is increasing demand for compatible capsules, pods, and high-quality whole beans.

Investment Opportunities in the UAE Coffee Market

The most prestigious investment avenues in the coffee sector of the UAE are:

- Speciality Cafe Expansion: Opening elite cafes, especially in the most frequented urban areas, brings the potential of creating a powerful turnover driven by the experience of consumption along with premium price setting.

- Private Label Coffee Brands: Various retailers and groups from the hospitality industry can come up with their exclusive coffee brands to delight their customers and, at the same time, enhance the profit margins.

- E-commerce Coffee Platforms: Developing direct-to-consumer online channels will allow the business to have a wider market, offer subscription services, and provide personalised product offerings.

- Ready-to-Drink Coffee Production: Creating bottled and canned coffee beverages is a good way to tap into the area of consumers who want convenient products for their consumption while on the move.

Top 5 Leading Players in the UAE Coffee Market

Leading players operating in the UAE Coffee Market include:

Nestlé S.A.

| Company Name | Nestlé S.A. |

|---|---|

| Established Year | 1866 |

| Headquarters | Vevey, Switzerland |

| Official Website | Click Here |

Nestlé plays a strong role in the UAE Coffee Market through instant coffee and capsule brands, leveraging wide distribution networks and continuous innovation to address evolving consumer taste preferences.

JDE Peet’s

| Company Name | JDE Peet’s |

|---|---|

| Established Year | 2015 |

| Headquarters | Amsterdam, Netherlands |

| Official Website | Click Here |

JDE Peet’s supplies premium and mainstream coffee products across retail and foodservice channels, strengthening its position through consistent quality and strong brand portfolios.

Starbucks Corporation

| Company Name | Starbucks Corporation |

|---|---|

| Established Year | 1971 |

| Headquarters | Seattle, USA |

| Official Website | Click Here |

Starbucks drives café culture growth in the UAE Coffee Market by offering premium beverages, experiential retail spaces, and seasonal innovations tailored to regional preferences.

Lavazza Group

| Company Name | Lavazza Group |

|---|---|

| Established Year | 1895 |

| Headquarters | Turin, Italy |

| Official Website | Click Here |

Lavazza contributes to the premium segment through high-quality Italian coffee blends, expanding its footprint in hospitality and specialty retail outlets.

Illycaffè S.p.A.

| Company Name | Illycaffè S.p.A. |

|---|---|

| Established Year | 1933 |

| Headquarters | Trieste, Italy |

| Official Website | Click Here |

Illycaffè focuses on super-premium coffee offerings, emphasizing sustainability, consistent quality, and strong presence within luxury hotels and upscale cafés.

Government Regulations Introduced in the UAE Coffee Market

According to UAE Government Data, various initiatives support food and beverage sector development, including coffee. For example, the UAE National Food Security Strategy advocates for a diversified food import portfolio and the expansion of value-added processing in the food industry, thereby promoting sustainable sourcing and efficient supply chain management. Besides that, Dubai Municipality food safety regulations set standards for the quality of coffee from the time of import to roasting and selling. Moreover, the provision of free zone incentives and the availability of SME support programs are making it easy for cafe startups and speciality coffee roasting businesses to enter the market, thus improving market competitiveness as well as consumer confidence and sector stability in the long run.

Future Insights of the UAE Coffee Market

The UAE Coffee Market is estimated to record a continuous growth supported by various factors, including the surge in speciality coffee consumption, the incorporation of advanced technology in coffee making, and the trend of opting for premium experiences. The ongoing growth in tourism, changing cafe ideas, and the increasing online shopping are expected to be significant factors in the next demand development patterns. Furthermore, initiatives towards environmentally friendly sourcing, private label creation, and ready-to-drink product innovations will probably be the key to new expansion opportunities, thereby establishing the UAE as the foremost coffee consumption and trading centre in the region.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

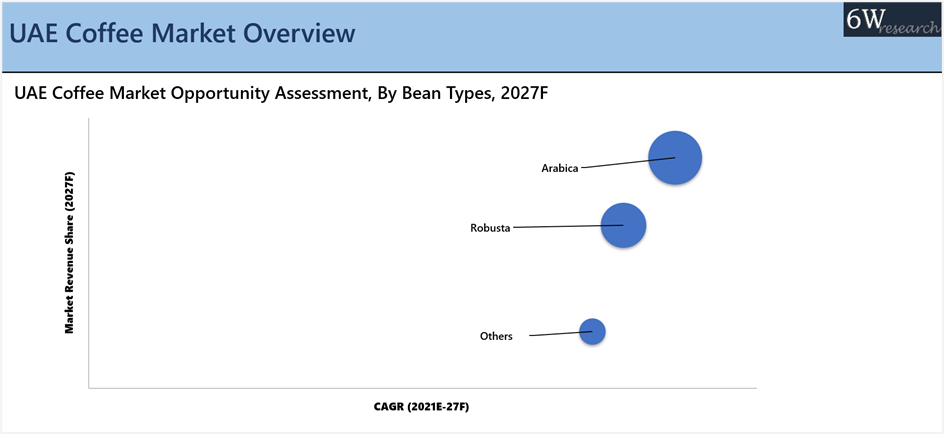

Arabica to Dominate the Market – By Bean Types

According to Preeti, Senior Research Analyst, 6Wresearch, Arabica dominates the UAE Coffee Market due to its refined flavor profile, smooth aroma, and strong association with premium coffee experiences across the country. The preference for high, quality beverages among consumers in the UAE is on the rise, which has led local cafs, specialty coffee houses, and hotels to place the production of Arabica beans at the top of their agenda, even ahead of other varieties. Additionally, the rise in demand for single, origin coffee and the use of traceable sourcing methods fit perfectly with Arabicas image, as the bean is commonly associated with ethical farming and sustainable cultivation. Moreover, the increase in disposable incomes, the experience of international coffee cultures, and a well, informed consumer base that keeps growing still help to raise the demand for Arabica beans, especially in the metropolitan areas of Dubai and Abu Dhabi, where the trend of premium consumption is still quite strong.

Cafés and Food Services to Dominate – By Distribution Channel

Café and Food Services dominate the UAE Coffee Market as coffee consumption in the country is deeply connected to lifestyle, social interaction, and experiential dining habits. The UAE has witnessed rapid expansion of international café chains alongside the emergence of local boutique cafés, creating a vibrant and competitive foodservice environment. In addition, the demand for various goods and services businesses to hotels, restaurants, and leisure destinations resulting from tourism can sometimes be considered a very strong and steady support for coffee demand being maintained at very high levels throughout the entire year. Moreover, it is common knowledge that cafes, apart from being considered as the first point of sale for food and beverages, also play the role of social hubs where both residents and visitors spend their time thus ensuring that the consumption of the products will be repeated and brand loyalty will be established. Besides that, the continuous introduction of new dishes, the offering of top, class drinks, and the provision of customer experience which is tailored to an individual by the cafe and foodservice outlet personnel have all helped greatly in consolidating their position at the top, hence making this particular channel the main driving force behind the overall coffee market revenues generation in the UAE.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2022 to 2025.

- Base Year: 2025.

- Forecast Data until 2032.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- UAE Coffee Market Overview

- UAE Coffee Market Outlook

- UAE Coffee Market Forecast

- Historical Data and Forecast ofUAE Coffee MarketRevenues for the Period 2022-2032F

- Historical Data and Forecast ofUAE Coffee MarketRevenues By Bean Types for the Period 2022-2032F

- Historical Data and Forecast ofUAE Coffee MarketRevenues By Coffee Types for the Period 2022-2032F

- Historical Data and Forecast ofUAE Coffee MarketRevenues By Distribution Channel for the Period 2022-2032F

- Historical Data and Forecast ofUAE Coffee MarketRevenues By Applications for the Period 2022-2032F

- Historical Data and Forecast ofUAE Coffee MarketRevenues By Regions for the Period 2022-2032F

- Market Drivers

- Market Restraints

- Market Trends

- Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- Market Player’s Revenue Shares

- Market Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By Bean Types

- Arabica

- Robusta

- Others (Liberica and Excelsa)

By Coffee Types

- Ground Coffee

- Instant Coffee

- Whole Bean

- Coffee Pod & Capsules

By Distribution Channel

- Hypermarkets/Supermarkets

- Online Platform

- Cafe and Food Services

- Others (General store, Mom & Pop stores, Local Stores)

By Applications

- Hot Coffee

- Cold Coffee

By Regions

- Dubai

- Abu Dhabi

- Sharjah

- Other Emirates (Ajman, Fujairah etc.)

UAE Coffee Market (2026-2032) : FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 UAE Coffee Market Overview |

| 3.1 UAE Macro Economic Indicators |

| 3.2 UAE Coffee Market Revenues & Volume, 2022 & 2032F |

| 3.3 UAE Coffee Market – Industry Life Cycle |

| 3.4 UAE Coffee Market – Porter’s Five Forces Analysis |

| 3.5 UAE Coffee Market Revenues & Volume Share, By Bean Type, 2022 & 2032F |

| 3.6 UAE Coffee Market Revenues & Volume Share, By Coffee Type, 2022 & 2032F |

| 3.7 UAE Coffee Market Revenues & Volume Share, By Distribution Channel, 2022 & 2032F |

| 3.8 UAE Coffee Market Revenues & Volume Share, By Application, 2022 & 2032F |

| 3.9 UAE Coffee Market Revenues & Volume Share, By Region, 2022 & 2032F |

| 4 UAE Coffee Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Rising coffee consumption culture across cafés and food service outlets |

| 4.2.2 Growing demand for premium and specialty coffee products |

| 4.2.3 Expansion of online platforms and organized retail in the UAE |

| 4.3 Market Restraints |

| 4.3.1 Volatility in raw coffee bean prices |

| 4.3.2 Dependence on coffee imports |

| 4.3.3 High operational costs for cafés and food service providers |

| 5 UAE Coffee Market Trends |

| 6 UAE Coffee Market, By Segmentation |

| 6.1 UAE Coffee Market, By Bean Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 UAE Coffee Market Revenues & Volume, By Bean Type, 2022–2032F |

| 6.1.3 UAE Coffee Market Revenues & Volume, By Arabica, 2022–2032F |

| 6.1.4 UAE Coffee Market Revenues & Volume, By Robusta, 2022–2032F |

| 6.1.5 UAE Coffee Market Revenues & Volume, By Others (Liberica & Excelsa), 2022–2032F |

| 6.2 UAE Coffee Market, By Coffee Type |

| 6.2.1 Overview and Analysis |

| 6.2.2 UAE Coffee Market Revenues & Volume, By Ground Coffee, 2022–2032F |

| 6.2.3 UAE Coffee Market Revenues & Volume, By Instant Coffee, 2022–2032F |

| 6.2.4 UAE Coffee Market Revenues & Volume, By Whole Bean, 2022–2032F |

| 6.2.5 UAE Coffee Market Revenues & Volume, By Coffee Pod & Capsules, 2022–2032F |

| 6.3 UAE Coffee Market, By Distribution Channel |

| 6.3.1 Overview and Analysis |

| 6.3.2 UAE Coffee Market Revenues & Volume, By Hypermarkets/Supermarkets, 2022–2032F |

| 6.3.3 UAE Coffee Market Revenues & Volume, By Online Platform, 2022–2032F |

| 6.3.4 UAE Coffee Market Revenues & Volume, By Café & Food Services, 2022–2032F |

| 6.3.5 UAE Coffee Market Revenues & Volume, By Others (General Store, Mom & Pop Stores, Local Stores), 2022–2032F |

| 6.4 UAE Coffee Market, By Application |

| 6.4.1 Overview and Analysis |

| 6.4.2 UAE Coffee Market Revenues & Volume, By Hot Coffee, 2022–2032F |

| 6.4.3 UAE Coffee Market Revenues & Volume, By Cold Coffee, 2022–2032F |

| 7 UAE Coffee Market Import–Export Trade Statistics |

| 7.1 UAE Coffee Market Exports to Major Countries |

| 7.2 UAE Coffee Market Imports from Major Countries |

| 8 UAE Coffee Market Key Performance Indicators |

| 8.1 Average coffee consumption per capita in the UAE |

| 8.2 Growth rate of specialty coffee outlets |

| 8.3 Penetration of online coffee sales |

| 9 UAE Coffee Market – Opportunity Assessment |

| 9.1 UAE Coffee Market Opportunity Assessment, By Bean Type, 2022 & 2032F |

| 9.2 UAE Coffee Market Opportunity Assessment, By Coffee Type, 2022 & 2032F |

| 9.3 UAE Coffee Market Opportunity Assessment, By Distribution Channel, 2022 & 2032F |

| 9.4 UAE Coffee Market Opportunity Assessment, By Application, 2022 & 2032F |

| 9.5 UAE Coffee Market Opportunity Assessment, By Region, 2022 & 2032F |

| 10 UAE Coffee Market – Competitive Landscape |

| 10.1 UAE Coffee Market Revenue Share, By Companies, 2022 & 2032F |

| 10.2 UAE Coffee Market Competitive Benchmarking, By Operating and Strategic Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

Market Forecast By Bean Types (Arabica, Robusta & Others), By Coffee Types (Ground Coffee, Instant Coffee, Whole-Bean, Coffee Pod and Capsules), By Distribution Channel (Hypermarkets/ Supermarkets, Online Channels, Cafes, and Food Services & Others), By Applications (Hot Drinks, Ready to Drink, Flavoured Beverages & Others) and competitive landscape

| Product Code: ETC002790 | Publication Date: Feb 2023 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 80 | No. of Figures: 36 | No. of Tables: 1 |

UAE Coffee Market Latest Development (2023)

The UAE Coffee Market has developed as a coffee trading hub in the Middle East and a number of initiatives have been taken in order to develop the country as the major trading hub of different kinds of coffee. The Coffee Market in UAE in 2023 is growing at a rapid pace. This helped in the development of the Coffee Market in the UAE. This one key factor gave rise to the demand for sprat-dried as well as freeze-dried types of instant coffee in the nation. The coffee market in the country has been rising and developing at a rapid pace in the most effortless manner. Instant coffee is one of the new types of coffee products in the country, which is becoming increasingly popular and giving a boost to this sector as the number of people who consume this coffee product is increasingly growing since it is very easy to prepare instant coffee as the name itself suggests it.

Coffee brands in the market are constantly rising, which attracts a new generation to the country. New brands in the market come up with new types of coffee with a better taste which attracts people, and this, in turn, gives rise to the market. The latest coffee brands have been developing in this sector at a faster pace. The population in the nation is growing with a rising appetite for western culture as well as brands which are leading to higher demand for branded coffee in the country.

The e-commerce industry in the country has shaped this sector. Coffee is one of the number one e-commerce product products in the country, which is developing this sector rapidly. Social reforms and strong government investment have created significant opportunities for both international as well as domestic coffee chains in the country which is supporting the development of the sector. This study only focuses on the developments made in the sector in 2023 and it is not applicable in any other year.

UAE Coffee Market Synopsis

The UAE coffee market experienced significant growth on account of a diverse population and varying preferences of the country along with strong growth in the urban population of the country and rising tourism & hospitality sector. The demand for coffee witnessed an upward growth trajectory mainly attributed to rising demand from urban consumers as they are more inclined toward the western culture where coffee has a higher preference.

However, Covid-19 resulted in complete turmoil for the tourism & hospitality sector due to the social distancing measures adopted to curb the spread of coronavirus, which in turn led to lower international visitors and the shutdown of cafes and restaurants in the country. Although the market was suffering initially, the retail sector of the country pushed the sales of coffee owing to the increasing demand from the consumers as they were spending most of their time at home during the lockdowns due to the restrictions imposed nationwide. The E-commerce sector witnessed a boom in coffee sales during the year 2020. Moreover, once the lockdown was lifted, the tourism & hospitality sector started to operate with safety precautions leading to an influx of international visitors to the country.

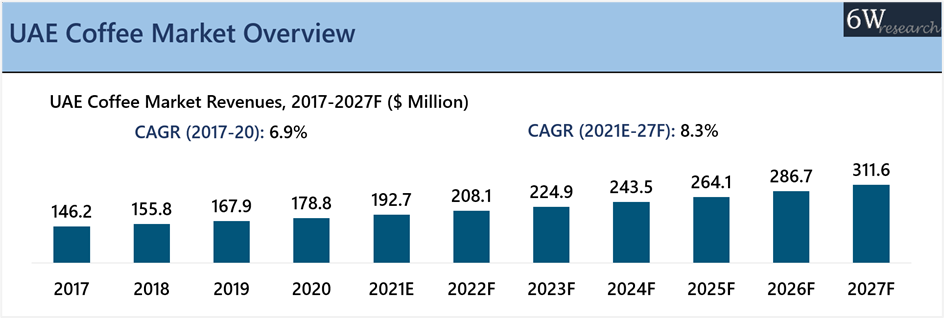

According to 6Wresearch, UAE Coffee Market size is projected to grow at a CAGR of 8.3% during 2021-2027. The increasing influence of western culture and higher living standards in cities like Dubai, Abu Dhabi, and Sharjah are also some of the major factors driving the growth of the UAE coffee market. The projected growth of the UAE coffee market can also be attributed to the variety of people residing in the major cities of UAE from different origins resulting in the adoption of multinational coffee chains and cafes in the country. Import of Brazilian and Ethiopian coffee is also on a rise recently owing to their higher preference amongst international visitors to UAE.

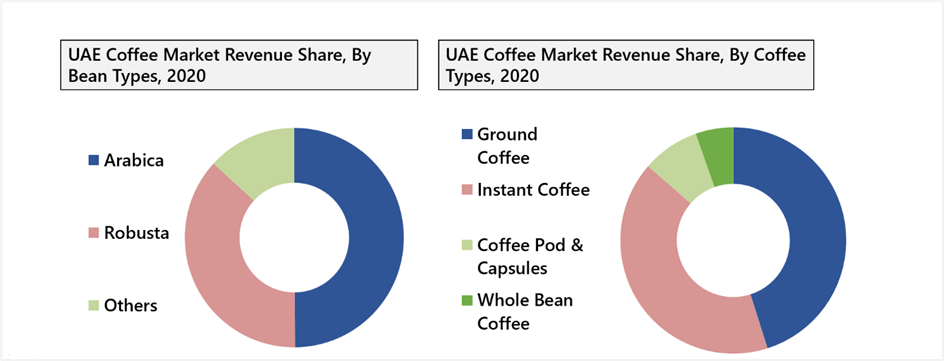

Market by Bean Types Analysis

In terms of bean type, the arabica segment has captured above 45% of the market revenues in 2020. Arabica garnered the majority UAE coffee market share on account of its good taste and high availability in the country. This trend would continue to persist in the coming years as well owing to the increasing preference of people from all age groups due to its sweet taste.

Market by Coffee Type Analysis

In UAE Coffee Market, ground coffee has led the overall market revenues accounting for more than 45% of the market revenues in 2020. Ground coffee has dominated the UAE coffee market as it has high anti-oxidants which makes it the most preferred coffee amongst consumers. Moreover, ground coffee has fewer processing stages which makes it easily available for cafes, restaurants, and other food outlets.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market

Key Highlights of the Report

- UAE Coffee Market Overview

- UAE Coffee Market Outlook

- UAE Coffee Market Forecast

- Historical Data and Forecast of UAE Coffee Market Revenues for the Period 2017-2027F

- Historical Data and Forecast of UAE Coffee Market Revenues By Bean Types for the Period 2017-2027F

- Historical Data and Forecast of UAE Coffee Market Revenues By Coffee Types for the Period 2017-2027F

- Historical Data and Forecast of UAE Coffee Market Revenues By Distribution Channel for the Period 2017-2027F

- Historical Data and Forecast of UAE Coffee Market Revenues By Applications for the Period 2017-2027F

- Historical Data and Forecast of UAE Coffee Market Revenues By Regions for the Period 2017-2027F

- Market Drivers

- Market Restraints

- Market Trends

- Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Bean Types:

- Arabica

- Robusta

- Others (Liberica and Excelsa)

By Coffee Types:

- Ground Coffee

- Instant Coffee

- Whole Bean

- Coffee Pod & Capsules

By Distribution Channel:

- Hypermarkets/Supermarkets

- Online Platform

- Cafe and Food Services

- Others (General stores, Mom & Pop stores, Local Stores)

By Applications:

- Hot Coffee

- Cold Coffee

By Regions:

- Dubai

- Abu Dhabi

- Sharjah

- Other Emirates (Ajman, Fujairah, etc.)

Market Forecast By Bean Types (Arabica, Robusta & Others), By Coffee Types (Ground Coffee, Instant Coffee, Whole-Bean, Coffee Pod and Capsules), By Distribution Channel (Hypermarkets/ Supermarkets, Online Channels, Cafes and Food Services & Others), By Applications (Hot Drinks, Ready to Drink, Flavoured Beverages & Others) and competitive landscape

| Product Code: ETC002790 | Publication Date: May 2020 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

The UAE coffee market is projected to show significant growth during the forecast period. UAE is a prominent and most developed coffee market in the Middle East region. The emirate’s status as the global business and tourism hub has drawn the attention of global food and beverage (F&B) chains in the country. A rapidly growing expatriate population and increasing appetite for western culture and brands have led to the higher demand for branded coffee in the emirate in recent years. The increasing influx of specialty brands, rapidly growing coffee houses and cafes along innovative coffee products available in the market would further drive the demand for coffee in UAE in the coming years.

According to 6Wresearch, the UAE Coffee Market size is anticipated to register growth during 2020-2026. Seeing the robust demand, the DMCC coffee center developed at Dubai Multi Commodities Centre (DMCC) for the coffee processing and distribution facility to boost the international trade has witnessed considerable responses and provided enough scope to consumers with differentiated coffee products. The increasing trend of health and wellness factors associated with coffee over other aerated rinks could be easily identified with the government support to promote coffee by imposing excise taxes of 50% on sugary soft drinks and 100% on further energy drinks. This move has resulted in an upsurge in the demand for coffee and related products in the country. However, currently, the market is witnessing a period of slow growth due to the prolonged wide lockdown imposed in the wake of the COVID-19 outbreak during the initial months of 2020.

By distribution channel, the cafes and food services segment has gained traction in the country over the past few years on the back of changing lifestyles and the trend of café-oriented culture prevailing in the country. By bean types, the Arabica segment held the maximum revenue share in the UAE coffee market in 2019. The high segment growth is attributed to its higher production and increased demand and consumption on account of its aroma, sweet texture, and freshness.

The UAE coffee report thoroughly covers the market by bean types, coffee types, distribution channels, and applications. The UAE coffee market report outlook provides an unbiased and detailed analysis of the on-going UAE coffee market trends, UAE coffee market share, opportunities/high growth areas, market drivers, which would help stakeholders to device and align market strategies according to the current and future market dynamics.

UAE Coffee market is estimated to register sound revenues in the coming timeframe backed by the rising trend of cafe culture in the country which fascinates couples to celebrate multiple occasions in cafes. Further, rising foreign flavors and the inclination of a large population towards coffee encourage various restaurants and the introduction of innovative coffee products is estimated to generate lucrative opportunities during the forecast period. Further, the rise in skin concerns is estimated to dominate the overall market share due to increased demand for better skin solution where coffee-based products are satisfying large population extremely by removing obstinate skin tanning is anticipated to leave a positive impact on the product demand and is beneficial the UAE coffee market garner potential growth in the upcoming six years.

The UAE coffee market is anticipated to find its true potential in the market underpinned by an increased introduction of western flavors. Additionally, Dubai consisting of a large expansion of coffee hubs and cafes coupled with a rising international expatriate population urges to taste countries' popular coffee, where Arabic cardamom and saffron-infused coffee being in the top list of the population which is expected to leave a positive impact on the coffee market landscape. The variety of coffee consumption relies on the weather, therefore the changing weather is estimated to be another factor for the growth of the Dubai coffee market and as a result, it would contribute towards the growth of the UAE coffee market in the coming timeframe.

Key Highlights of the Report

- UAE Coffee Market Overview

- UAE Coffee Market Outlook

- UAE Coffee Market Forecast

- Historical Data of UAE Coffee Market Revenues for the Period 2016-2019

- UAE Coffee Market Size and UAE Coffee Market Forecast of Revenues until 2026

- Historical Data of UAE Coffee Market Revenues, By Bean Types, for the period 2016-2019

- Market Size and Forecast of UAE Coffee Market Revenues, By Bean Types, until 2026

- Historical Data of UAE Coffee Market Revenues, By Coffee Types, for the period 2016-2019

- Market Size and Forecast of UAE Coffee Market Revenues, By Coffee Types, until 2026

- Historical Data of UAE Coffee Market Revenues, By Distribution Channel, for the period 2016-2019

- Market Size and Forecast of UAE Coffee Market Revenues, By Distribution Channel, until 2026

- Historical Data of UAE Coffee Market Revenues, By Applications, for the period 2016-2019

- Market Size and Forecast of UAE Coffee Market Revenues, By Applications, until 2026

- UAE Coffee Market Drivers & Restraints

- UAE Coffee Market Trends & Evolution

- UAE Coffee Market Industry Life Cycle

- UAE Coffee Market Opportunity Assessment

- UAE Coffee Market Share, By Players

- UAE Coffee Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Markets Covered

The UAE coffee market report provides a detailed analysis of the following market segments:

By Bean Types

- Arabica

- Robusta

- Others

By Coffee Types

- Ground Coffee

- Instant Coffee

- Whole-Bean

- Coffee Pod and Capsules

By Distribution Channel

- Hypermarkets/ Supermarkets

- Online Channels

- Cafes and Food Services

- Others

By Applications

- Hot Drinks

- Ready to Drink

- Flavored Beverages

- Others

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero