Africa Advertising Market Outlook (2023-2029) | Analysis, Value, COVID-19 IMPACT, Forecast, Revenue, Trends, Industry, Size, Companies, Share & Growth

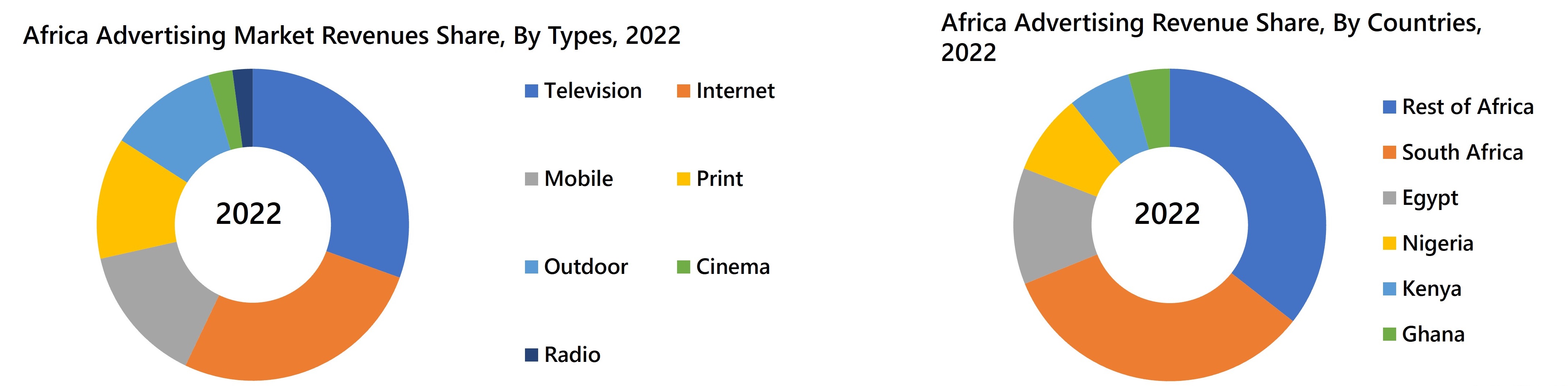

Market Forecast By Types (Television, Print (Newspaper & Magazine), Radio, Outdoor, Internet (Search, Display, Classifies, Video), Mobile, Cinema), By Countries (South Africa, Nigeria, Kenya, Ghana, Egypt, Rest of Africa)And Competitive Landscape

| Product Code: ETC435230 | Publication Date: Nov 2022 | Updated Date: Aug 2023 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 100 | No. of Figures: 45 | No. of Tables: 6 |

Africa Advertising Market Synopsis

The Africa Advertising Market has experienced significant growth due to its diverse population and increasing access to mobile technology and the internet. This digital revolution has opened new avenues for advertising, including mobile marketing, social media platforms, and content creation. The middle class in Africa has greatly expanded, increasing consumer spending power and advertising demands. Through social media platforms, digital content, and mobile advertising, the digital revolution has given advertisers new ways to connect with customers. Access to worldwide media and advertising campaigns has increased due to the rise of media outlets, including television, radio, and internet platforms. African entrepreneurs and companies are looking for specialized services as a result of the growth of local and regional brands that have disrupted the advertising environment. Due to this, local ad companies and creative talent are expanding and providing culturally relevant and effective ads.

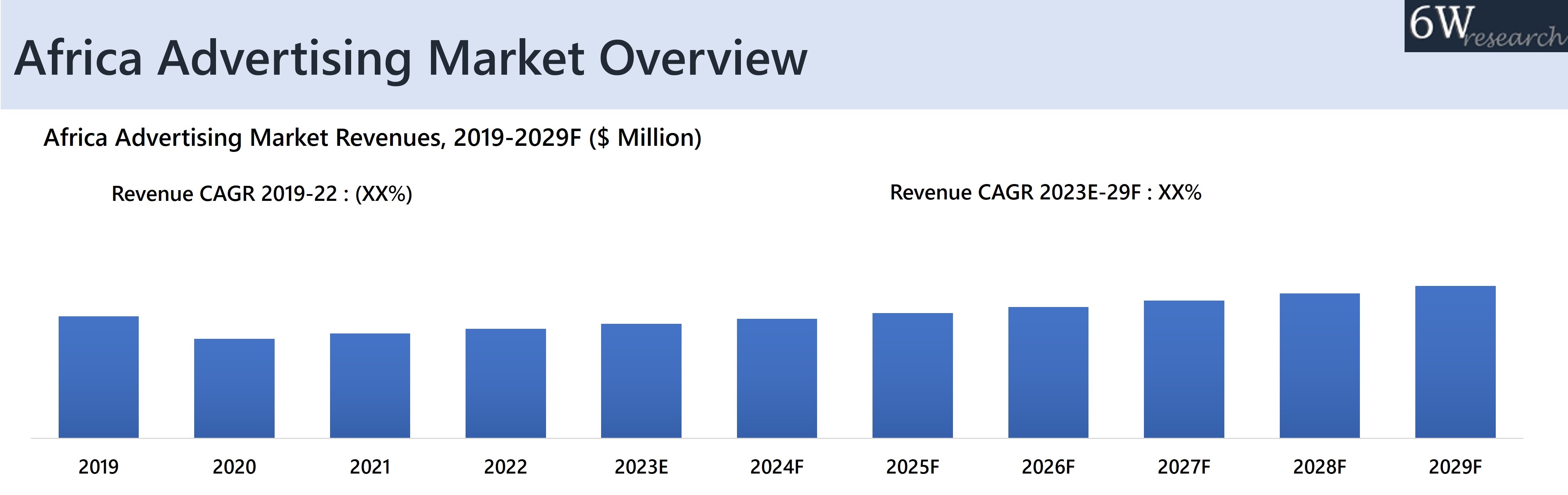

According to 6Wresearch, Africa Advertising market size is projected to grow at a CAGR of 4.9% during 2023-2029 owing to fixed broadband subscriptions in Africa have grown from 28 million in 2020 to 32.1 million today, highlighting the need for digital infrastructure expansion in the post-pandemic era. Digitization would increase consumer goods' potential audience, increasing advertising costs for companies. By 2025, Sub-Saharan Africa mobile consumer is poised to grow with a growth rate of 4.5%, which would attain 613 million mobile customers. Moreover, E-commerce is expected to grow at a CAGR of 13.3%, transforming Africa's advertising business. The proliferation of smartphones and easy internet access through content creators and e-commerce would further expand advertising space for agencies.

According to 6Wresearch, Africa Advertising market size is projected to grow at a CAGR of 4.9% during 2023-2029 owing to fixed broadband subscriptions in Africa have grown from 28 million in 2020 to 32.1 million today, highlighting the need for digital infrastructure expansion in the post-pandemic era. Digitization would increase consumer goods' potential audience, increasing advertising costs for companies. By 2025, Sub-Saharan Africa mobile consumer is poised to grow with a growth rate of 4.5%, which would attain 613 million mobile customers. Moreover, E-commerce is expected to grow at a CAGR of 13.3%, transforming Africa's advertising business. The proliferation of smartphones and easy internet access through content creators and e-commerce would further expand advertising space for agencies.

![Africa Advertising Market Revenues Share]() Market by Types

Market by Types

Television owns the majority of the advertising market in the African region owing to the widespread consumption and popularity of television for content consumption. However, the trend is changing, and internet advertising is outshining television in terms of growth, and it is expected that by 2029, internet would lead the advertising market in terms of revenue generation.

Market by Countries

In 2022, South Africa had the largest advertising market in Africa. It is considered the regional hub for advertising and has a well-developed industry with a significant presence of multinational advertising agencies and a wide range of media platforms. Owing to a relatively concentrated population along with high digital penetration, South Africa Advertising Industry would continue to dominate the African market.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 11 Years Market Numbers.

- Historical Data Starting from 2019 to 2022.

- Base Year: 2022

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Africa Advertising Market Overview

- Africa Advertising Market Outlook

- Africa Advertising Market Forecast

- Historical Data and Forecast of Africa Advertising Market Revenues for the Period 2019-2029F

- Historical Data and Forecast of Africa Advertising Market Revenues By Type, for the Period 2019-2029F

- Historical Data and Forecast of Africa Advertising Market Revenues By Country, for the Period 2019-2029F

- Market Drivers and Restraints

- Africa Advertising Market Trends

- Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- Africa Advertising Market Revenue Ranking, By Companies

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By Types

- Television

- Print (Newspaper & Magazine)

- Radio

- Outdoor

- Internet (Search, Display, Classifies, Video)

- Mobile

- Cinema

By Countries

- South Africa

- Nigeria

- Kenya

- Ghana

- Egypt

- Rest of Africa

Africa Advertising Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3 Industry Scope & Segmentation |

| 2.4 Methodology |

| 2.5 Assumptions |

| 3. Africa Advertising Market Overview |

| 3.1 Africa Advertising Market Revenues (2019 – 2029F) |

| 3.2 Africa Advertising Market, Industry Life Cycle |

| 3.3 Africa Advertising Market Porter’s Five Forces |

| 3.4 Africa Advertising Market Revenues Share, By Types |

| 3.5 Africa Advertising Market Revenues Share, By Countries |

| 4. Impact Analysis of Covid-19 on Africa Advertising Market |

| 5. Africa Advertising Market Dynamics |

| 5.1 Impact Analysis |

| 5.2 Market Drivers |

| 5.3 Market Restraint |

| 6. Africa Advertising Market Overview, Trends and Evolution |

| 7. Africa Advertising Market Revenues, By Types |

| 7.1 Africa Advertising Market Revenues, Television (2019 – 2029F) |

| 7.2 Africa Advertising Market Revenues, Print (2019 – 2029F) |

| 7.3 Africa Advertising Market Revenues, Radio (2019 – 2029F) |

| 7.4 Africa Advertising Market Revenues, Outdoor (2019 – 2029F) |

| 7.5 Africa Advertising Market Revenues, Internet (2019 – 2029F) |

| 7.6 Africa Advertising Market Revenues, Mobile (2019 – 2029F) |

| 7.7 Africa Advertising Market Revenues, Cinema (2019 – 2029F) |

| 8. South Africa Advertising Market Revenues |

| 8.1 South Africa Advertising Market Revenues (2019 – 2029F) |

| 8.2 South Africa Advertising Market Revenues, By Types |

| 8.2.1 South Africa Advertising Market Revenues, Television (2019 – 2029F) |

| 8.2.2 South Africa Advertising Market Revenues, Print (2019 – 2029F) |

| 8.2.3 South Africa Advertising Market Revenues, Radio (2019 – 2029F) |

| 8.2.4 South Africa Advertising Market Revenues, Outdoor (2019 – 2029F) |

| 8.2.5 South Africa Advertising Market Revenues, Internet (2019 – 2029F) |

| 8.2.6 South Africa Advertising Market Revenues, Mobile (2019 – 2029F) |

| 8.2.7 South Africa Advertising Market Revenues, Cinema (2019 – 2029F) |

| 8.3 South Africa Advertising Market- Key Performance Indicator |

| 8.4 South Africa Advertising Market- Opportunity Assessment, By Types (2029F) |

| 9. Nigeria Advertising Market Revenues |

| 9.1 Nigeria Advertising Market Revenues (2019 – 2029F) |

| 9.2 Nigeria Advertising Market Revenues, By Types |

| 9.2.1 Nigeria Advertising Market Revenues, Television (2019 – 2029F) |

| 9.2.2 Nigeria Advertising Market Revenues, Print (2019 – 2029F) |

| 9.2.3 Nigeria Advertising Market Revenues, Radio (2019 – 2029F) |

| 9.2.4 Nigeria Advertising Market Revenues, Outdoor (2019 – 2029F) |

| 9.2.5 Nigeria Advertising Market Revenues, Internet (2019 – 2029F) |

| 9.2.6 Nigeria Advertising Market Revenues, Mobile (2019 – 2029F) |

| 9.2.7 Nigeria Advertising Market Revenues, Cinema (2019 – 2029F) |

| 9.3 Nigeria Advertising Market- Key Performance Indicator |

| 9.4 Nigeria Advertising Market- Opportunity Assessment, By Types (2029F) |

| 10. Kenya Advertising Market Revenues |

| 10.1 Kenya Advertising Market Revenues (2019 – 2029F) |

| 10.2 Kenya Advertising Market Revenues, By Types |

| 10.2.1 Kenya Advertising Market Revenues, Television (2019 – 2029F) |

| 10.2.2 Kenya Advertising Market Revenues, Print (2019 – 2029F) |

| 10.2.3 Kenya Advertising Market Revenues, Radio (2019 – 2029F) |

| 10.2.4 Kenya Advertising Market Revenues, Outdoor (2019 – 2029F) |

| 10.2.5 Kenya Advertising Market Revenues, Internet (2019 – 2029F) |

| 10.2.6 Kenya Advertising Market Revenues, Mobile (2019 – 2029F) |

| 10.2.7 Kenya Advertising Market Revenues, Cinema (2019 – 2029F) |

| 10.3 Kenya Advertising Market- Key Performance Indicator |

| 10.4 Kenya Advertising Market- Opportunity Assessment, By Types (2029F) |

| 11. Ghana Advertising Market Revenues |

| 11.1 Ghana Advertising Market Revenues (2019 – 2029F) |

| 11.2 Ghana Advertising Market Revenues, By Types |

| 11.2.1 Ghana Advertising Market Revenues, Television (2019 – 2029F) |

| 11.2.2 Ghana Advertising Market Revenues, Print (2019 – 2029F) |

| 11.2.3 Ghana Advertising Market Revenues, Radio (2019 – 2029F) |

| 11.2.4 Ghana Advertising Market Revenues, Outdoor (2019 – 2029F) |

| 11.2.5 Ghana Advertising Market Revenues, Internet (2019 – 2029F) |

| 11.2.6 Ghana Advertising Market Revenues, Mobile (2019 – 2029F) |

| 11.2.7 Ghana Advertising Market Revenues, Cinema (2019 – 2029F) |

| 11.3 Ghana Advertising Market- Key Performance Indicator |

| 11.4 Ghana Advertising Market- Opportunity Assessment, By Types (2029F) |

| 12. Egypt Advertising Market Revenues |

| 12.1 Egypt Advertising Market Revenues (2019 – 2029F) |

| 12.2 Egypt Advertising Market Revenues, By Types |

| 12.2.1 Egypt Advertising Market Revenues, Television (2019 – 2029F) |

| 12.2.2 Egypt Advertising Market Revenues, Print (2019 – 2029F) |

| 12.2.3 Egypt Advertising Market Revenues, Radio (2019 – 2029F) |

| 12.2.4 Egypt Advertising Market Revenues, Outdoor (2019 – 2029F) |

| 12.2.5 Egypt Advertising Market Revenues, Internet (2019 – 2029F) |

| 12.2.6 Egypt Advertising Market Revenues, Mobile (2019 – 2029F) |

| 12.2.7 Egypt Advertising Market Revenues, Cinema (2019 – 2029F) |

| 12.3 Egypt Advertising Market- Key Performance Indicator |

| 12.4 Egypt Advertising Market- Opportunity Assessment, By Types (2029F) |

| 13. Africa Top Advertiser Market (Top Ad Spenders) |

| 13.1 South Africa Advertiser Company Ranking, By Top 5 Companies (2022) |

| 13.2 Egypt Advertiser Company Ranking, By Top 5 Companies (2022) |

| 13.3 Nigeria Advertiser Company Ranking, By Top 5 Companies (2022) |

| 13.4 Kenya Advertiser Company Ranking, By Top 5 Companies (2022) |

| 13.5 Ghana Advertiser Company Ranking, By Top 5 Companies (2022) |

| 14. Africa Advertising Market- Competitive Landscape |

| 14.1 South Africa Advertising Market Revenues Share, By Top 3 Companies (2022) |

| 14.2 Nigeria Advertising Market Revenues Share, By Top 3 Companies (2022) |

| 14.3 Kenya Advertising Market Revenues Share, By Top 3 Companies (2022) |

| 14.4 Ghana Advertising Market Revenues Share, By Top 3 Companies (2022) |

| 14.5 Egypt Advertising Market Revenues Share, By Top 3 Companies (2022) |

| 14.6 Africa Advertising Market Key Companies Competitive Benchmarking, By Operating Parameters |

| 15. Company Profiles |

| 15.1 Insight Publicis |

| 15.2 Ogilvy South Africa |

| 15.3 DDB Lagos Limited |

| 15.4 Scanad Kenya Limited |

| 15.5 M&C Saatchi Abel Proprietary Limited |

| 15.6 Metropolitan Republic |

| 15.7 TBWA Worldwide Inc. |

| 15.8 Wanderman Thompson |

| 15.9 FCB Africa |

| 15.10 McCann World Group |

| 16. Key Strategic Recommendation |

| 17. Disclaimer |

| List of Figures |

| 1. Africa Advertising Market Revenues, 2019-2029F ($ Million) |

| 2. Africa Advertising Market Revenues Share, By Types, 2022 & 2029F |

| 3. Africa Advertising Market Revenues Share, By Countries, 2022 & 2029F |

| 4. Africa Mobile Subscription, 2019-2020, Million |

| 5. Sub-Saharan Africa Internet Penetration, 2019-2021 |

| 6. Sub-Saharan Africa GDP, 2018-2020, $ Trillion |

| 7. Africa Fixed Broadband Penetration, 2020-2030F |

| 8. Sub-Saharan Africa Unique Mobile Subscribers, Million, (2021-2030F) |

| 9. Africa E-Commerce Revenues, $ Billion, 2021-2025F |

| 10. Africa Smartphone Penetration, 2021-2025F |

| 11. Africa Investment Requirement for Universal Connectivity, $ Billion |

| 12. South Africa Advertising Market Revenues, 2019-2029F ($ Million) |

| 13. South Africa IT Spending, 2017-2022, (USD Billion) |

| 14. Spending on Public Cloud Computing in South Africa, 2017-2022, (USD Million) |

| 15. South Africa Market Opportunity Assessment, By Types, 2029F |

| 16. Nigeria Advertising Market Revenues, 2019-2029F ($ Million) |

| 17. Nigeria Spending on ICT Sector, 2020 & 2023F ($ Billion) |

| 18. Nigeria ICT Sector GDP Contribution, 2019-Q2’2022 |

| 19. Nigeria Market Opportunity Assessment, By Types, 2029F |

| 20. Kenya Advertising Market Revenues, 2019-2029F ($ Million) |

| 21. Kenya ICT Output Values, 2017–2020, (In Billion) |

| 22. Kenya Digital Infrastructure Resource Requirement, 2022 – 2027F (In USD Million) |

| 23. Kenya Market Opportunity Assessment, By Types, 2029F |

| 24. Ghana Advertising Market Revenues, 2019-2029F ($ Million) |

| 25. Ghana Rising Internet Penetration, FY 2020-2023, (In Percentage) |

| 26. Social Media Users in Ghana, FY 2023, (In Millions) |

| 27. Ghana Market Opportunity Assessment, By Types, 2029F |

| 28. Egypt Advertising Market Revenues, 2019-2029F ($ Million) |

| 29. Number of People Using Internet in Egypt, 2017-2022, (In Million) |

| 30. Number of Active Social Media Users in Egypt, 2017-2022 (In Million) |

| 31. Egypt Market Opportunity Assessment, By Types, 2029F |

| 32. South Africa Advertiser Company Ranking, By Companies, 2022 |

| 33. Egypt Advertiser Company Ranking, By Companies, 2022 |

| 34. Nigeria Advertiser Company Ranking, By Companies, 2022 |

| 35. Kenya Advertiser Company Ranking, By Companies, 2022 |

| 36. Ghana Advertiser Company Ranking, By Companies, 2022 |

| 37. South Africa Advertising Market Company Ranking, By Companies, 2022 |

| 38. Egypt Advertising Market Company Ranking, By Companies, 2022 |

| 39. Nigeria Advertising Market Company Ranking, By Companies, 2022 |

| 40. Kenya Advertising Market Company Ranking, By Companies, 2022 |

| 41. Ghana Advertising Market Company Ranking, By Companies, 2022 |

| 42. Africa Key Countries Internet Penetration, 2021 |

| 43. Number of Languages in Africa Key Countries, 2022 |

| 44. Number of Internet Users in Key African Countries, 2022, (Million Users) |

| 45. Key African Countries on Political Stability Index, 2021 |

| List of Tables |

| 1. Africa Advertising Market Revenues, By Types, 2019-2029F ($ Million) |

| 2. South Africa Advertising Market Revenues, By Types, 2019-2029F ($ Million) |

| 3. Nigeria Advertising Market Revenues, By Types, 2019-2029F ($ Million) |

| 4. Kenya Advertising Market Revenues, By Types, 2019-2029F ($ Million) |

| 5. Ghana Advertising Market Revenues, By Types, 2019-2029F ($ Million) |

| 6. Egypt Advertising Market Revenues, By Types, 2019-2029F ($ Million) |

- Single User License$ 4,560

- Department License$ 5,055

- Site License$ 5,595

- Global License$ 6,000

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero