Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Market Forecast By Excavator Type (Crawler Excavators, Wheeled Excavators, Mini Excavators), By Excavator Tonnage (Upto 5 Tons, 6-15 Tons, 16-30 Tons, Above 30 Tons), By Crane Type (Mobile Cranes, Tower Cranes, Crawler Cranes, Truck-Mounted Cranes), By Crane Capacity (Upto 25 Tons, 26-100 Tons, 101-300 Tons, Above 300 Tons), By Wheel Loaders (Medium Wheel Loaders, Large Wheel Loaders), By Wheel Loaders Payload Type (3-5 Tons, 10-15 Tons, >15 Tons), By Application (Construction & Infrastructure, Mining, Oil & Gas, Industrial), and Competitive Landscape

| Product Code: ETC13413769 | Publication Date: Sep 2025 | Updated Date: Sep 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 94 | No. of Figures: 35 | No. of Tables: 14 | |

Topics Covered in Angola Excavator, Crane, and Wheel Loaders Market Report

Angola Excavator, Crane, and Wheel Loaders Market Report thoroughly covers the market by Excavator Type, Excavator Tonnage, Crane Type, Crane Capacity, Wheel Loaders, Wheel Loaders Payload Type, and Application. Angola Excavator, Crane and Wheel Loaders Market Outlook report provides an unbiased and detailed analysis of the ongoing Angola Excavator, Crane and Wheel Loaders Market trends, opportunities/high growth areas, and market drivers. This would help stakeholders devise and align their market strategies according to the current and future market dynamics.

Angola Excavator, Crane and Wheel Loaders Market Synopsis

The Angola excavator, crane and wheel loaders market experienced growth during the past years, supported by a revival in infrastructure development, mining expansion, and urbanization initiatives. The government’s focus on diversifying the economy beyond oil, coupled with investments in roads, bridges, and solar power plants, created sustained demand for heavy construction machinery. At the same time, rising global interest in Angola diamond, copper, lithium, and rare earth resources under improved regulatory frameworks attracted foreign investments, stimulating the need for advanced mining equipment. Additionally, the World Bank–backed urban rehabilitation program and private-sector investments in residential housing, hotels, and commercial facilities further accelerated equipment deployment for earthmoving, lifting, and material handling.

According to 6Wresearch, Angola Excavator, Crane, and Wheel Loaders Market revenue size is projected to grow at a CAGR of 7.2% during 2025-2031, driven by international investment across infrastructure, real estate, and mining. In 2022, DAMAC Properties signed an MoU to explore high-end residential, hotel, and commercial projects, reflecting rising private sector confidence. Complementing this, the SNL cement and clinker factory in Catumbela would strengthen material supply, enabling faster housing and commercial development requiring extensive use of excavators, cranes, and wheel loaders. Major transport projects are also shaping demand.

In July 2024, China Road and Bridge Corporation secured a contract to build Angola’s first motorway, a corridor connecting the north and south while improving cross-border trade with Namibia and the DRC. Portuguese firms such as Mota-Engil, Teixeira Duarte, and Soares da Costa remain key players, with projects in waterfronts, housing, and border infrastructure requiring significant equipment fleets. In mining, UK-based Pensana’s Longonjo Rare Earth Project and Shining Star’s Mavoio-Tetelo copper project highlight Angola’s growing role in critical minerals, driving sustained demand for excavator, crane, and wheel loaders market.

Market Segmentation By Excavator Type

Crawler excavators are expected to witness the highest growth rate in Angola excavator market during 2025–2031 due to their strong suitability for heavy-duty mining, infrastructure, and oil & gas projects, which dominate the country’s economy. Their ability to operate on rough terrains, higher stability, and efficiency in large-scale earthmoving make them the preferred choice over other types. Additionally, ongoing government investments in construction and resource extraction further fuel their demand.

Market Segmentation By Excavator Tonnage

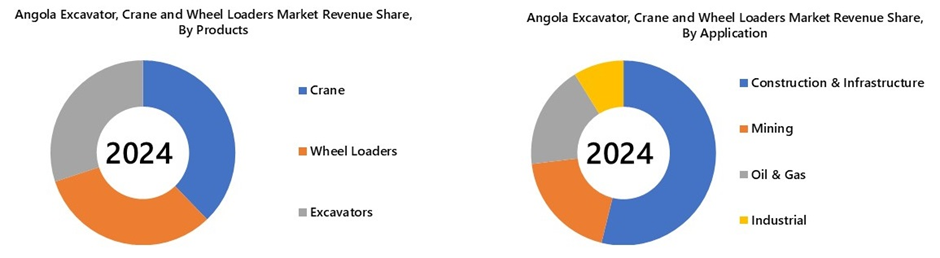

In 2024, excavators above 30 tons accounted for the largest revenue share due to their extensive use in Angola’s large-scale infrastructure and mining projects. These high-capacity machines are indispensable for road building, motorway construction, and bridge works, which demand deep excavation and heavy lifting capabilities.

Market Segmentation By Crane Capacity

In 2024, cranes with a lifting capacity of up to 25 tons accounted for a significant share of the market. This segment is preferred for its suitability in light to medium-duty applications, including residential construction, small-scale infrastructure projects, maintenance works, and material handling in warehouses and factories. Their compact size, cost-effectiveness, and ease of mobility make them an attractive choice for contractors and businesses.

Market Segmentation By Wheel Loaders Payload Type

3-5 tons acquired the highest revenue share in 2024 owing to their wide use in construction, urban infrastructure, and material handling at logistics yards and quarries. Moreover, their affordability and versatility make them the workhorse segment.

Market Segmentation By Wheel Loaders Application

In 2024, the Construction & Infrastructure sector dominated the segment, supported by Angola accelerating investments in large-scale housing, commercial complexes, and transport infrastructure. Wheel loaders remained indispensable for material handling, road construction, and site preparation, enabling faster project execution and cost efficiency.

Market Segmentation By Application

In 2024, the Construction & Infrastructure segment accounted for the major revenue share of the excavator market. This dominance is primarily driven by Angola’s large-scale infrastructure developments, including the motorway project awarded to China Road and Bridge Corporation, extensive housing and commercial real estate projects, and the expansion of urban transport networks.

Market Segmentation By Crane Type

Tower cranes are projected to register the highest growth rate in the Angola crane market during 2025–2031, owing to rapid urbanization, high-rise construction, and commercial infrastructure projects in major cities. Their ability to handle heavy loads at great heights makes them essential for modern building developments. Increasing government focus on housing and commercial real estate further boosts their adoption.

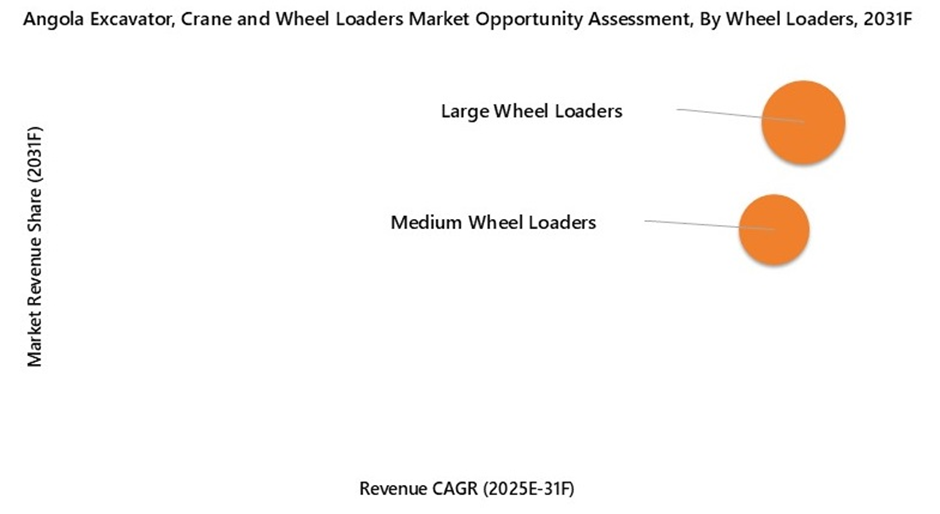

Market Segmentation By Wheel Loaders

Large wheel loaders are expected to record the highest growth rate in the Angola wheel loader market during 2025–2031 due to their extensive use in mining, quarrying, and large-scale infrastructure projects. Their high loading capacity and efficiency in handling bulk materials make them ideal for Angola’s resource-driven economy. Rising investments in mining and construction activities further strengthen their demand.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data: Starting from 2021 to 2024

- Base Year: 2024

- Forecast Data until 2031

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Angola Excavator, Crane and Wheel Loaders Market Overview

- Angola Excavator, Crane and Wheel Loaders Market Outlook

- Angola Excavator, Crane and Wheel Loaders Market Forecast

- Historical Data and Forecast of Angola Excavator, Crane and Wheel Loaders Market Revenues and Volume for the Period 2021-2031F

- Historical Data and Forecast of Angola Excavator, Crane and Wheel Loaders Market Revenues and Volume, By Excavator, for the Period 2021-2031F

- Historical Data and Forecast of Angola Excavator, Crane and Wheel Loaders Market Revenues and Volume, By Crane, for the Period 2021-2031F

- Historical Data and Forecast of Angola Excavator, Crane and Wheel Loaders Market Revenues and Volume, By Wheel Loaders, for the Period 2021-2031F

- Historical Data and Forecast of Angola Excavator, Crane and Wheel Loaders Market Revenues, By Application, for the Period 2021-2031F

- Industry Life Cycle

- Porter’s Five Force Analysis

- Angola Excavator, Crane and Wheel Loaders Market Drivers and Restraints

- Market Trends & Evolution

- Market Opportunity Assessment

- Angola Excavator, Crane and Wheel Loaders Market Revenue Ranking, By Top 3 Companies

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Excavator Type

- Crawler Excavators

- Wheeled Excavators

- Mini Excavators

By Excavator Tonnage

- Upto 5 Tons

- 6-15 Tons

- 16-30 Tons

- Above 30 Tons

By Crane Type

- Mobile Cranes

- Tower Cranes

- Crawler Cranes

- Truck-Mounted Cranes

By Crane Capacity

- Upto 25 Tons

- 26-100 Tons

- 101-300 Tons

- Above 300 Tons

By Wheel Loaders

- Medium Wheel Loaders

- Large Wheel Loaders

By Wheel Loaders Payload Type

- 3-5 Tons

- 10-15 Tons

- >15 Tons

By Application

- Construction & Infrastructure

- Mining

- Oil & Gas

- Industrial

Angola Excavator, Crane, and Wheel Loaders Market (2025-2031): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Global Excavator, Crane and Wheel Loaders Market Overview |

| 3.1. Global Excavator, Crane and Wheel Loaders Market Revenues and Volume, 2021 - 2031F |

| 4. Angola Excavator, Crane and Wheel Loaders Market Overview |

| 4.1. Angola Excavator, Crane and Wheel Loaders Market Revenues and Volume, 2021 - 2031F |

| 4.2. Angola Excavator, Crane and Wheel Loaders Market - Industry Life Cycle |

| 4.3. Angola Excavator, Crane and Wheel Loaders Market - Porter's Five Forces |

| 4.4. Angola Excavator, Crane and Wheel Loaders Market - Macroeconomic Indicators |

| 5. Angola Excavator, Crane and Wheel Loaders Market Dynamics |

| 5.1. Impact Analysis |

| 5.2. Market Drivers |

| 5.3. Market Restraints |

| 6. Angola Excavator, Crane and Wheel Loaders Market Trends and Evolution |

| 7. Angola Excavator, Crane and Wheel Loaders Market Overview, By Excavator Type |

| 7.1 Angola Excavator, Crane and Wheel Loaders Market Revenue Share and Volume Share, By Excavator Type, 2024 & 2031F |

| 7.2 Angola Excavator, Crane and Wheel Loaders Market Revenues and Volume, By Excavator Type, 2021-2031F |

| 7.2.1. Angola Excavator, Crane and Wheel Loaders Market Revenues and Volume, By Crawler Excavators, 2021-2031F |

| 7.2.2. Angola Excavator, Crane and Wheel Loaders Market Revenues and Volume, By Wheeled Excavators, 2021-2031F |

| 7.2.3. Angola Excavator, Crane and Wheel Loaders Market Revenues and Volume, By Mini Excavators, 2021-2031F |

| 7.3 Angola Excavator, Crane and Wheel Loaders Market Revenue Share and Revenues, By Excavator Tonnage, 2021-2031F |

| 7.3.1. Angola Excavator, Crane and Wheel Loaders Market Revenues, By Upto 5 Tons, 2021-2031F |

| 7.3.2. Angola Excavator, Crane and Wheel Loaders Market Revenues, By 6-15 Tons, 2021-2031F |

| 7.3.3. Angola Excavator, Crane and Wheel Loaders Market Revenues, By 16-30 Tons, 2021-2031F |

| 7.3.4. Angola Excavator, Crane and Wheel Loaders Market Revenues, By Above 30 Tons, 2021-2031F |

| 7.4 Angola Excavator, Crane and Wheel Loaders Market Revenue Share and Revenues, By Excavator Application, 2021-2031F |

| 7.4.1. Angola Excavator, Crane and Wheel Loaders Market Revenues, By Construction & Infrastructure, 2021-2031F |

| 7.4.2. Angola Excavator, Crane and Wheel Loaders Market Revenues, By Mining, 2021-2031F |

| 7.4.3. Angola Excavator, Crane and Wheel Loaders Market Revenues, By Oil & Gas, 2021-2031F |

| 7.4.4. Angola Excavator, Crane and Wheel Loaders Market Revenues, By Industrial, 2021-2031F |

| 8. Angola Excavator, Crane and Wheel Loaders Market Overview, By Crane Type |

| 8.1 Angola Excavator, Crane and Wheel Loaders Market Revenue Share and Volume Share, By Crane Type, 2024 & 2031F |

| 8.2 Angola Excavator, Crane and Wheel Loaders Market Revenues and Volume, By Crane Type, 2021-2031F |

| 8.2.1. Angola Excavator, Crane and Wheel Loaders Market Revenues and Volume, By Mobile Cranes, 2021-2031F |

| 8.2.2. Angola Excavator, Crane and Wheel Loaders Market Revenues and Volume, By Tower Cranes, 2021-2031F |

| 8.2.3. Angola Excavator, Crane and Wheel Loaders Market Revenues and Volume, By Crawler Cranes, 2021-2031F |

| 8.2.4. Angola Excavator, Crane and Wheel Loaders Market Revenues and Volume, By Truck-Mounted Cranes, 2021-2031F |

| 8.3 Angola Excavator, Crane and Wheel Loaders Market Revenue Share and Revenues, By Crane Capacity, 2021-2031F |

| 8.3.1. Angola Excavator, Crane and Wheel Loaders Market Revenues, By Upto 25 Tons, 2021-2031F |

| 8.3.2. Angola Excavator, Crane and Wheel Loaders Market Revenues, By 26-100 Tons, 2021-2031F |

| 8.3.3. Angola Excavator, Crane and Wheel Loaders Market Revenues, By 101-300 Tons, 2021-2031F |

| 8.3.4. Angola Excavator, Crane and Wheel Loaders Market Revenues, By Above 300 Tons, 2021-2031F |

| 8.4 Angola Excavator, Crane and Wheel Loaders Market Revenue Share and Revenues, By Crane Application, 2021-2031F |

| 8.4.1. Angola Excavator, Crane and Wheel Loaders Market Revenues, By Construction & Infrastructure, 2021-2031F |

| 8.4.2. Angola Excavator, Crane and Wheel Loaders Market Revenues, By Mining, 2021-2031F |

| 8.4.3. Angola Excavator, Crane and Wheel Loaders Market Revenues, By Oil & Gas, 2021-2031F |

| 8.4.4. Angola Excavator, Crane and Wheel Loaders Market Revenues, By Industrial, 2021-2031F |

| 9. Angola Excavator, Crane and Wheel Loaders Market Overview, By Wheel Loaders |

| 9.1 Angola Excavator, Crane and Wheel Loaders Market Revenue Share and Volume Share, By Wheel Loaders, 2024 & 2031F |

| 9.2 Angola Excavator, Crane and Wheel Loaders Market Revenues and Volume, By Wheel Loaders, 2021-2031F |

| 9.2.1. Angola Excavator, Crane and Wheel Loaders Market Revenues and Volume, By Medium Wheel Loaders, 2021-2031F |

| 9.2.2. Angola Excavator, Crane and Wheel Loaders Market Revenues and Volume, By Large Wheel Loaders, 2021-2031F |

| 9.3 Angola Excavator, Crane and Wheel Loaders Market Revenue Share and Revenues, By Wheel Loaders Payload Type, 2021-2031F |

| 9.3.1. Angola Excavator, Crane and Wheel Loaders Market Revenues, By 3-5 Tons, 2021-2031F |

| 9.3.2. Angola Excavator, Crane and Wheel Loaders Market Revenues, By 10-15 Tons, 2021-2031F |

| 9.3.3. Angola Excavator, Crane and Wheel Loaders Market Revenues, By >15 Tons, 2021-2031F |

| 9.4 Angola Excavator, Crane and Wheel Loaders Market Revenue Share and Revenues, By Wheel Loaders Application, 2021-2031F |

| 9.4.1. Angola Excavator, Crane and Wheel Loaders Market Revenues, By Construction & Infrastructure, 2021-2031F |

| 9.4.2. Angola Excavator, Crane and Wheel Loaders Market Revenues, By Mining, 2021-2031F |

| 9.4.3. Angola Excavator, Crane and Wheel Loaders Market Revenues, By Oil & Gas, 2021-2031F |

| 9.4.4. Angola Excavator, Crane and Wheel Loaders Market Revenues, By Industrial, 2021-2031F |

| 10. Angola Excavator, Crane and Wheel Loaders Market Key Performance Indicators |

| 11. Angola Excavator, Crane and Wheel Loaders Market Opportunity Assessment |

| 11.1. Angola Excavator, Crane and Wheel Loaders Market Opportunity Assessment, By Excavator Type, 2031F |

| 11.2. Angola Excavator, Crane and Wheel Loaders Market Opportunity Assessment, By Crane Type, 2031F |

| 11.3. Angola Excavator, Crane and Wheel Loaders Market Opportunity Assessment, By Wheel Loaders, 2031F |

| 12. Angola Excavator, Crane and Wheel Loaders Market Import Analysis |

| 13. Angola Excavator, Crane and Wheel Loaders Market Competitive Landscape |

| 13.1. Angola Excavator, Crane and Wheel Loaders Market Revenue Ranking, By Top 3 Companies, CY2024 |

| 13.2. Angola Excavator, Crane and Wheel Loaders Market Competitive Benchmarking, By Technical Parameters |

| 13.3. Angola Excavator, Crane and Wheel Loaders Market Competitive Benchmarking, By Operating Parameters |

| 14. Company Profiles |

| 14.1. Caterpillar |

| 14.2. Komatsu Ltd. |

| 14.3. J C Bamford Excavators Ltd. |

| 14.4. XCMG Group |

| 14.5. SANY Group |

| 14.6. Hitachi Construction Machinery Co., Ltd. |

| 14.7. The Manitowoc Company, Inc. |

| 14.8. HD Hyundai Construction Equipment Co.,Ltd. |

| 14.9. The Liebherr Group |

| 14.10. Liugong Machinery Co., Ltd. |

| 15. Key Strategic Recommendations |

| 16. Disclaimer |

| List of Figures |

| 1. Global Excavator, Crane and Wheel Loaders Market Revenues and Volume, 2021-2031F ($ Billion, Thousand Units) |

| 2. Angola Excavator, Crane and Wheel Loaders Market Revenues and Volume, 2021-2031F ($ Million, Units) |

| 3. Angola Real GDP Growth, YOY Change, 2021-2026F & 2030F, (in %) |

| 4. Angola Total Investment, 2021-2026F & 2030F, (% of GDP) |

| 5. Angola Urban Population Growth, 2024 & 2050F, (million) |

| 6. Angola Excavator, Crane and Wheel Loaders Market Revenue Share, By Excavator Type, 2024 & 2031F |

| 7. Angola Excavator, Crane and Wheel Loaders Market Volume Share, By Excavator Type, 2024 & 2031F |

| 8. Angola Excavator, Crane and Wheel Loaders Market Revenue Share, By Excavator Tonnage, 2024 & 2031F |

| 9. Angola Excavator, Crane and Wheel Loaders Market Revenue Share, By Excavator Application, 2024 & 2031F |

| 10. Angola Excavator, Crane and Wheel Loaders Market Revenue Share, By Crane Type, 2024 & 2031F |

| 11. Angola Excavator, Crane and Wheel Loaders Market Volume Share, By Crane Type, 2024 & 2031F |

| 12. Angola Excavator, Crane and Wheel Loaders Market Revenue Share, By Crane Capacity, 2024 & 2031F |

| 13. Angola Excavator, Crane and Wheel Loaders Market Revenue Share, By Crane Application, 2024 & 2031F |

| 14. Angola Excavator, Crane and Wheel Loaders Market Revenue Share, By Wheel Loaders, 2024 & 2031F |

| 15. Angola Excavator, Crane and Wheel Loaders Market Volume Share, By Wheel Loaders, 2024 & 2031F |

| 16. Angola Excavator, Crane and Wheel Loaders Market Revenue Share, By Wheel Loaders Payload Type, 2024 & 2031F |

| 17. Angola Excavator, Crane and Wheel Loaders Market Revenue Share, By Wheel Loaders Application, 2024 & 2031F |

| 18. Angola Real Growth in Value of Construction Industry, 2024-2029F, (%) |

| 19. Angola Value of Construction Industry as % of GDP, 2024-2031F, (%) |

| 20. Angola’s Revenue from Diamond Production, 2024-2027F, ($ billion) |

| 21. Angola’s Diamond Production, 2021-2027F, (million carats) |

| 22. Angola Excavator, Crane and Wheel Loaders Market Opportunity Assessment, By Excavator Type, 2031F |

| 23. Angola Excavator, Crane and Wheel Loaders Market Opportunity Assessment, By Crane Type, 2031F |

| 24. Angola Excavator, Crane and Wheel Loaders Market Opportunity Assessment, By Wheel Loaders, 2031F |

| 25. Share of Top 3 Import Partners, 2024 |

| 26. Angola Excavator Import Data, By Country, 2024 (in $ Thousand) |

| 27. Share of Top 3 Import Partners, 2024 |

| 28. Angola Tower Crane Import Data, By Country, 2024 (in $ Thousand) |

| 29. Share of Top 3 Import Partners, 2024 |

| 30. Angola Mobile & Crawler Crane Import Data, By Country, 2024 (in $ Thousand) |

| 31. Share of Top 3 Import Partners, 2024 |

| 32. Angola Truck Mounted Crane Import Data, By Country, 2024 (in $ Thousand) |

| 33. Share of Top 3 Import Partners, 2024 |

| 34. Angola Wheel Loader Import Data, By Country, 2024 (in $ Thousand) |

| 35. Angola Excavator, Crane and Wheel Loaders Market Revenue Ranking, By Companies, CY2024 |

| List of tables |

| 1. Angola Key Figures, 2024-2025E & 2030F |

| 2. Angola Upcoming Hotel Openings |

| 3. Angola Excavator, Crane and Wheel Loaders Market Revenues, By Excavator Type, 2021-2031F, ($ million) |

| 4. Angola Excavator, Crane and Wheel Loaders Market Volume, By Excavator Type, 2021-2031F (Units) |

| 5. Angola Excavator, Crane and Wheel Loaders Market Revenues, By Excavator Tonnage, 2021-2031F ($ million) |

| 6. Angola Excavator, Crane and Wheel Loaders Market Revenues, By Excavator Application, 2021-2031F ($ million) |

| 7. Angola Excavator, Crane and Wheel Loaders Market Revenues, By Crane Type, 2021-2031F, ($ million) |

| 8. Angola Excavator, Crane and Wheel Loaders Market Volume, By Crane Type, 2021-2031F (Units) |

| 9. Angola Excavator, Crane and Wheel Loaders Market Revenues, By Crane Capacity, 2021-2031F ($ million) |

| 10. Angola Excavator, Crane and Wheel Loaders Market Revenues, By Crane Application, 2021-2031F ($ million) |

| 11. Angola Excavator, Crane and Wheel Loaders Market Revenues, By Wheel Loaders, 2021-2031F, ($ million) |

| 12. Angola Excavator, Crane and Wheel Loaders Market Volume, By Wheel Loaders, 2021-2031F (Units) |

| 13. Angola Excavator, Crane and Wheel Loaders Market Revenues, By Wheel Loaders Payload Type, 2021-2031F ($ million) |

| 14. Angola Excavator, Crane and Wheel Loaders Market Revenues, By Wheel Loaders Application, 2021-2031F ($ million) |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero