Asia Pacific (APAC) Chocolate Market (2019-2025) | industry, Share, Trends, Revenue, Analysis, Forecast, Growth & Outlook

Market Forecast By Product Type (Dark Chocolate, Milk Chocolate, White Chocolate), By Chocolate Type (Count Lines & Straight Lines, Molded or Bar Chocolates, Choco-Panned & Sugar Panned and Others including Box Chocolates and Novelties), By Distribution Channels (Supermarket and Hypermarkets, Convenience Stores, Online Channels, Grocery/ Mom n Pop Stores and Others including Specialized Retailers, Pharmacy, etc), By Counties (India, China, Japan, Indonesia, and Others) and Competitive Landscape

| Product Code: ETC001355 | Publication Date: Sep 2022 | Product Type: Report | ||

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 200 | No. of Figures: 19 | No. of Tables: 12 |

Latest Development (2022) in Asia Pacific (APAC) Chocolate Market

The Asia-Pacific Chocolate Market is witnessing innovation as manufacturers are adding new ingredients such as the introduction of savory over sweet flavors, such as salted caramel and sea salt. The industry's most unique flavor combinations include chilly, turmeric, and ginger. With inventive thinking in the chocolate sector, sugar substitutes have exploded in popularity. Organic ingredients are considered more natural and healthier, therefore demand for organic cocoa and chocolate ingredients continues to grow. Manufacturers are cutting down the usage of chemical additives Cargill has gone a step ahead and removed lecithin from its cocoa and chocolate offerings. Ruby chocolate which is developed from the discovery of the ruby cocoa bean and the creation of a totally new flavor experience was launched in Asia by Nestle, with Japan and Korea as the major markets.

Increasing penetration towards adoption of dark chocolates, especially by Indian consumers owing to rising awareness regarding the benefits associated with it. Rising demand for hazelnut beverages is also proliferating the growth of the industry. Moreover, the surging penetration towards improving health along with the rising risk of cardiovascular disease is adding to the APAC Chocolate Market. Evolving eating habits coupled with increasing demand for confectionary is proliferating the development of the industry. The rising trend of gifting chocolates on special occasions is also providing lucrative opportunities for the growth of the market

Mergers And Acquisition:

- On 29 July 2019, The Ferrero Group finalized the previously announced purchase of Kellogg Company's cookie, fruit, and fruit-flavored snack, ice cream cone, and pie crust operations.

- On 30 April 2021, Nestlé and KKR reached an agreement in which Nestlé will buy The Bountiful Company's key brands.

- On 26 May 2021, Chipita S.A. agreed to be acquired by Mondelez International, Inc.

- On 5 Jan 2021, Hu was acquired by Mondelez International.

- On 28 June 2021, Lily's, a high-growth developer of low-sugar confectionery items, was acquired by Hershey Company.

Asia Pacific (APAC) Chocolate Market Synopsis

Asia Pacific chocolate market report comprehensively covers the market by product type, distribution channels, chocolate type, and key countries including Japan, China, India, Indonesia, and the Rest of Asia Pacific. The Asia Pacific chocolate market outlook report provides an unbiased and detailed analysis of the Asia Pacific chocolate market trends, Asia Pacific Chocolate market share, opportunities, high growth areas, and market drivers which would help the stakeholders device and align their market strategies according to the current and future market dynamics.

Growing awareness of health concerns, adulteration issues in traditional sweets as well as changing taste preferences of consumers are resulting in a shift towards the adoption of chocolates. Additionally, increasing disposable income, changing lifestyles, and availability of sugar-free and dark chocolates are further contributing to the growth of the chocolate market in the Asia Pacific region. Moreover, the growing trend of gifting premium custom-packed chocolates for occasions such as New Year would propel the demand for chocolates during the forecast period.

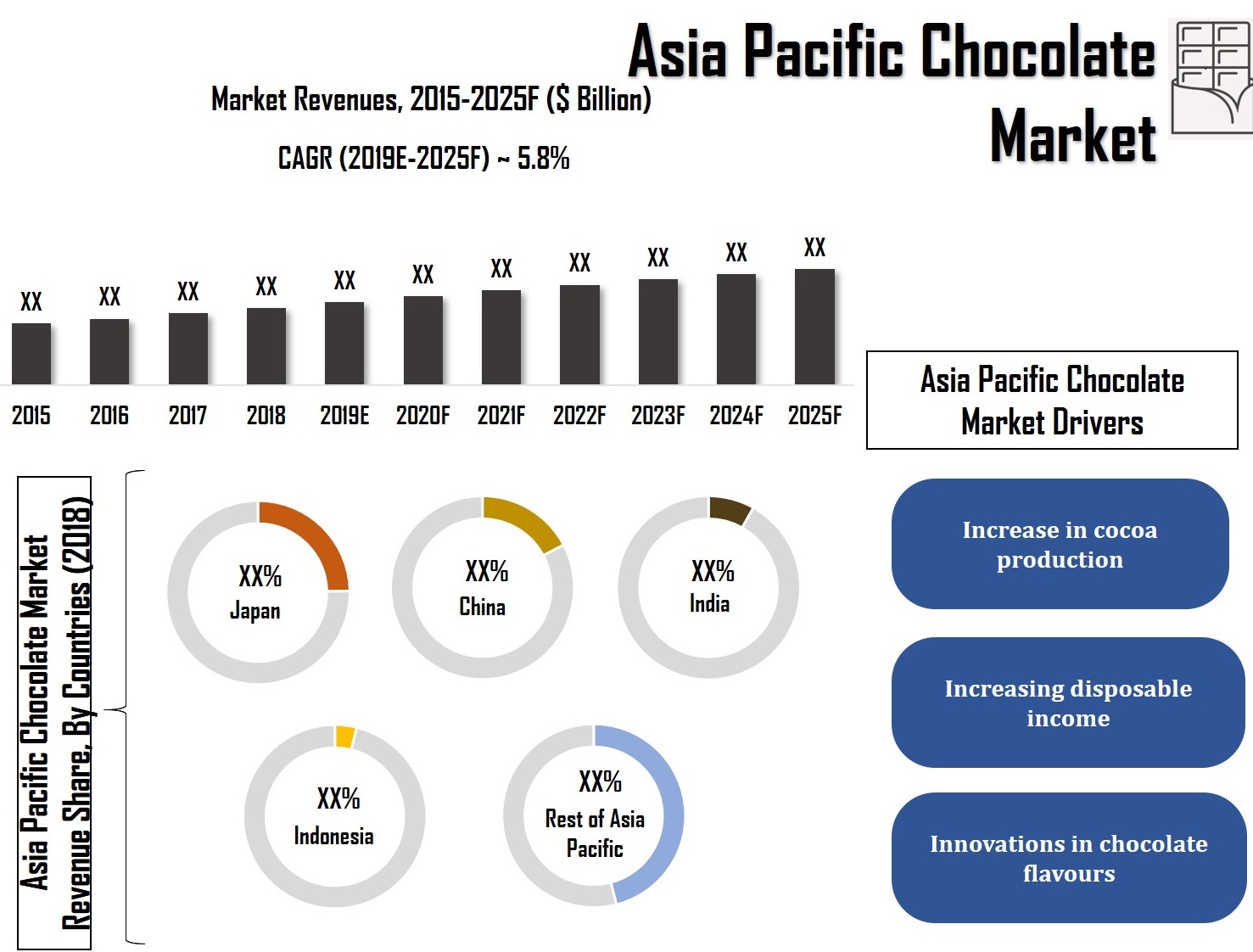

According to 6Wresearch, the Asia Pacific chocolate market size is projected to grow at a CAGR of 5.8% during 2019–2025. Increasing expansion of the food industry along with the entrance of key market players are proliferating the APAC Chocolate Market Share. Moreover, the surging disposable income is driving the demand for premium chocolate further creating lucrative opportunities for the growth of the industry.

Shifting consumer perception towards premium products, increasing independent outlets and growing online retail market are the key factors catalyzing the growth of the chocolate market in the Asia Pacific region. Increasing demand for organic and sugar-free chocolates would be the key growth opportunity for companies in the region.

Chocolates have been bringing about a spark of taste to the taste buds of not only children but also adults and are gaining much popularity. Seasonal gifting traditions are also shaping the market competitive landscape of the Asia Pacific chocolate market. Offering chocolates at the time of festivities is leading to an increase in the demand for chocolates especially in India where a large number of traditional festivals are celebrated and as a result is leading to an increase in the demand for premium and exclusive chocolate ranges and is expected to trigger significant growth of the Asia Pacific chocolate market in the coming timeframe.

Market Analysis By Country

In the overall Asia Pacific region, Japan and China have captured the majority of the market revenues in 2018, however, India is expected to lead the market over the coming years owing to rapid urbanization and increasing demand for novelty chocolates. Further, growing investment by the Indian government to support new start-ups as well as manufacturing enterprises under the pretense of a “Make in India” campaign, would positively influence the market growth.

Market Analysis By Product Type

The Milk chocolate segment captured the majority of the Asia Pacific chocolate market share in 2018; however dark chocolate is anticipated to witness substantial growth during the forecast period owing to growing awareness regarding the health benefits of dark chocolates.

Key Players in the Asia Pacific Chocolate Market

Some of the key players in the Asia Pacific Chocolate Market are:

- Ferrero Group

- Mars Incorporated

- Mondelez International

- The Hershey Company

- Nestle S.A.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2016 to 2019.

- Base Year: 2019.

- Forecast Data until 2025.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Asia Pacific Chocolate Market Overview

- Asia Pacific Chocolate Market Outlook

- Asia Pacific Chocolate Market Forecast

- Historical Data of Asia Pacific Chocolate Market Revenues for the Period 2015-2018

- Asia Pacific Chocolate Market Size & Asia Pacific Chocolate Market Forecast of Revenues, Until 2025

- Historical Data of Asia Pacific Chocolate Market Revenues, By Product Type, for the Period 2015-2018

- Market Size & Forecast of Asia Pacific Chocolate Market Revenues, By Product Type, Until 2025

- Historical Data of Asia Pacific Chocolate Market Revenues, By Distribution Channels, for the Period 2015-2018

- Market Size & Forecast of Asia Pacific Chocolate Market Revenues, By Distribution Channels, Until 2025

- Historical Data of Asia Pacific Chocolate Market Revenues, By Chocolate Type, for the Period 2015-2018

- Market Size & Forecast of Asia Pacific Chocolate Market Revenues, By Chocolate Type, Until 2025

- Historical Data of Japan Chocolate Market Revenues and Volume, for the Period 2015-2018

- Market Size & Forecast of Japan Chocolate Market Revenues, Until 2025

- Historical Data of China Chocolate Market Revenues and Volume, for the Period 2015-2018

- Market Size & Forecast of the China Chocolate Market Revenues, Until 2025

- Historical Data of India Chocolate Market Revenues and Volume, for the Period 2015-2018

- Market Size & Forecast of the India Chocolate Market Revenues, Until 2025

- Historical Data of Indonesia Chocolate Market Revenues and Volume, for the Period 2015-2018

- Market Size & Forecast of the Indonesia Chocolate Market Revenues, Until 2025

- Market Drivers and Restraints

- Asia Pacific Chocolate Market Price Trends

- Asia Pacific Chocolate Market Trends and Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- Asia Pacific Chocolate Market Share, By Countries

- Asia Pacific Chocolate Market Share, By Players

- Asia Pacific Chocolate Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Markets Covered

The Asia Pacific Chocolate Market report provides a detailed analysis of the following market segments:

By Product Type

- Milk Chocolate

- White Chocolate

- Dark Chocolate

By Distribution Channels

- Supermarkets/ Hypermarkets

- Grocery/ Mom n Pop Stores

- Convenience Stores

- Online Channel

- Others (Specialized Retailers, pharmacy, etc.)

By Chocolate Type

- Count lines & Straight-lines

- Molded or Bar Chocolates

- Choco-panned & Sugar panned

- Others (Box chocolates, novelties)

By Countries

- China

- India

- Japan

- Indonesia

- Rest of APAC

Asia Pacific (APAC) Chocolate Market: FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of The Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Asia Pacific Chocolate Market Overview |

| 3.1 Asia Pacific Country Indicators |

| 3.2 Asia Pacific Chocolate Market Revenues, 2015-2025F |

| 3.3 Asia Pacific Chocolate Market Revenue Share, By Product Type, 2015-2025F |

| 3.4 Asia Pacific Chocolate Market Revenue Share, By Distribution Channel, 2015-2025F |

| 3.5 Asia Pacific Chocolate Market Revenue Share, By Chocolate Type, 2015-2025F |

| 3.6 Asia Pacific Chocolate Market Revenue Share, By Countries, 2018 & 2025F |

| 3.7 Asia Pacific Chocolate Market Industrial Life Cycle |

| 3.8 Asia Pacific Chocolate Market Porter’s Five Force Model |

| 4 Asia Pacific Chocolate Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Asia Pacific Chocolate Market Trends |

| 6 Japan Chocolate Market Overview |

| 6.1 Japan Chocolate Market Revenues, 2015-2025F |

| 6.2 Japan Chocolate Market Revenue Share, By Product Type, 2015-2025F |

| 6.2.1 Japan Milk Chocolate Market Revenues, 2015-2025F |

| 6.2.2 Japan White Chocolate Market Revenues, 2015-2025F |

| 6.2.3 Japan Dark Chocolate Market Revenues, 2015-2025F |

| 6.3 Japan Chocolate Market Revenue Share, By Distribution Channel, 2015-2025F |

| 6.3.1 Japan Chocolate Market Revenues, By Supermarkets/ Hypermarkets, 2015-2025F |

| 6.3.2 Japan Chocolate Market Revenues, By Grocery/ Mom n Pop Stores, 2015-2025F |

| 6.3.3 Japan Chocolate Market Revenues, By Convenience Stores, 2015-2025F |

| 6.3.4 Japan Chocolate Market Revenues, By Online Channel, 2015-2025F |

| 6.3.5 Japan Chocolate Market Revenues, By Other Distribution Channel, 2015-2025F |

| 6.4 Japan Chocolate Market Revenue Share, By Chocolate Type, 2015-2025F |

| 6.4.1 Japan Chocolate Market Revenues, By Countlines & Straight-lines, 2015-2025F |

| 6.4.2 Japan Chocolate Market Revenues, By Moulded or Bar, 2015-2025F |

| 6.4.3 Japan Chocolate Market Revenues, By Box Chocolates and Novelties, 2015-2025F |

| 6.4.4 Japan Chocolate Market Revenues, By Other Chocolate Type, 2015-2025F |

| 7 China Chocolate Market Overview |

| 7.1 China Chocolate Market Revenues, 2015-2025F |

| 7.2 China Chocolate Market Revenue Share, By Product Type, 2015-2025F |

| 7.2.1 China Milk Chocolate Market Revenues, 2015-2025F |

| 7.2.2 China White Chocolate Market Revenues, 2015-2025F |

| 7.2.3 China Dark Chocolate Market Revenues, 2015-2025F |

| 7.3 China Chocolate Market Revenue Share, By Distribution Channel, 2015-2025F |

| 7.3.1 China Chocolate Market Revenues, By Supermarkets/ Hypermarkets, 2015-2025F |

| 7.3.2 China Chocolate Market Revenues, By Grocery/ Mom n Pop Stores, 2015-2025F |

| 7.3.3 China Chocolate Market Revenues, By Convenience Stores, 2015-2025F |

| 7.3.4 China Chocolate Market Revenues, By Online Channel, 2015-2025F |

| 7.3.5 China Chocolate Market Revenues, By Other Distribution Channel, 2015-2025F |

| 7.4 China Chocolate Market Revenue Share, By Chocolate Type, 2015-2025F |

| 7.4.1 China Chocolate Market Revenues, By Count lines & Straight-lines, 2015-2025F |

| 7.4.2 China Chocolate Market Revenues, By Moulded or Bar, 2015-2025F |

| 7.4.3 China Chocolate Market Revenues, By Choco-Panned & Sugar Panned, 2015-2025F |

| 7.4.4 China Chocolate Market Revenues, By Other Chocolate Type, 2015-2025F |

| 8 India Chocolate Market Overview |

| 8.1 India Chocolate Market Revenues, 2015-2025F |

| 8.2 India Chocolate Market Revenue Share, By Product Type, 2015-2025F |

| 8.2.1 India Milk Chocolate Market Revenues, 2015-2025F |

| 8.2.2 India White Chocolate Market Revenues, 2015-2025F |

| 8.2.3 India Dark Chocolate Market Revenues, 2015-2025F |

| 8.3 India Chocolate Market Revenue Share, By Distribution Channel, 2015-2025F |

| 8.3.1 India Chocolate Market Revenues, By Supermarkets/ Hypermarkets, 2015-2025F |

| 8.3.2 India Chocolate Market Revenues, By Grocery/ Mom n Pop Stores, 2015-2025F |

| 8.3.3 India Chocolate Market Revenues, By Convenience Stores, 2015-2025F |

| 8.3.4 India Chocolate Market Revenues, By Online Channel, 2015-2025F |

| 8.3.5 India Chocolate Market Revenues, By Other Distribution Channel, 2015-2025F |

| 8.4 India Chocolate Market Revenue Share, By Chocolate Type, 2015-2025F |

| 8.4.1 India Chocolate Market Revenues, By Countlines & Straight-lines, 2015-2025F |

| 8.4.2 India Chocolate Market Revenues, By Moulded or Bar, 2015-2025F |

| 8.4.3 India Chocolate Market Revenues, By Choco-Panned & Sugar Panned, 2015-2025F |

| 8.4.4 India Chocolate Market Revenues, By Other Chocolate Type, 2015-2025F |

| 9 Indonesia Chocolate Market Overview |

| 9.1 Indonesia Chocolate Market Revenues, 2015-2025F |

| 9.2 Indonesia Chocolate Market Revenue Share, By Product Type, 2015-2025F |

| 9.2.1 Indonesia Milk Chocolate Market Revenues, 2015-2025F |

| 9.2.2 Indonesia White Chocolate Market Revenues, 2015-2025F |

| 9.2.3 Indonesia Dark Chocolate Market Revenues, 2015-2025F |

| 9.3 Indonesia Chocolate Market Revenue Share, By Distribution Channel, 2015-2025F |

| 9.3.1 Indonesia Chocolate Market Revenues, By Supermarkets/ Hypermarkets, 2015-2025F |

| 9.3.2 Indonesia Chocolate Market Revenues, By Grocery/ Mom n Pop Stores, 2015-2025F |

| 9.3.3 Indonesia Chocolate Market Revenues, By Convenience Stores, 2015-2025F |

| 9.3.4 Indonesia Chocolate Market Revenues, By Online Channel, 2015-2025F |

| 9.3.5 Indonesia Chocolate Market Revenues, By Other Distribution Channel, 2015-2025F |

| 9.4 Indonesia Chocolate Market Revenue Share, By Chocolate Type, 2015-2025F |

| 9.4.1 Indonesia Chocolate Market Revenues, By Countlines & Straight-lines, 2015-2025F |

| 9.4.2 Indonesia Chocolate Market Revenues, By Moulded or Bar, 2015-2025F |

| 9.4.3 Indonesia Chocolate Market Revenues, By Choco-Panned & Sugar Panned, 2015-2025F |

| 9.4.4 Indonesia Chocolate Market Revenues, By Other Chocolate Type, 2015-2025F |

| 10 Rest of Asia Pacific Chocolate Market Overview |

| 10.1 Rest of Asia Pacific Chocolate Market Revenues, 2015-2025F |

| 11 Asia Pacific Chocolate Market – Key Performance Indicators |

| 12 Asia Pacific Chocolate Market – Opportunity Assessment |

| 12.1 Asia Pacific Chocolate Market Opportunity Assessment, By Countries |

| 13 Asia Pacific Chocolate Market Competitive Landscape |

| 13.1 Asia Pacific Chocolate Market Revenue Share, By Company |

| 13.1.1 Japan Chocolate Market Revenue Share, By Companies, 2018 |

| 13.1.2 China Chocolate Market Revenue Share, By Companies, 2018 |

| 13.1.3 India Chocolate Market Revenue Share, By Companies, 2018 |

| 13.1.4 Indonesia Chocolate Market Revenue Share, By Companies, 2018 |

| 13.2 Asia Pacific Chocolate Market Competitive Benchmarking, By Operating & Technical Parameters |

| 14 Company Profiles |

| 15 Key Strategic Recommendations |

| 16 Disclaimer |

| LIST OF FIGURES |

| Figure 1. Asia Pacific Chocolate Market Revenues, 2015-2025F ($ Billion) |

| Figure 2. Asia Pacific Chocolate Market Revenue Share, By Countries, 2018 |

| Figure 3. Japan Chocolate Market Revenues, 2015-2025F ($ Million) |

| Figure 4. Japan Chocolate Market Revenue Share, By Product Type, 2018 & 2025F |

| Figure 5. Japan Chocolate Market Revenue Share, By Distribution Channel, 2018 & 2025F |

| Figure 6. Japan Chocolate Market Revenue Share, By Chocolate Type, 2018 & 2025F |

| Figure 7. China Chocolate Market Revenues, 2015-2025F ($ Million) |

| Figure 8. China Chocolate Market Revenue Share, By Product Type, 2018 & 2025F |

| Figure 9. China Chocolate Market Revenue Share, By Distribution Channel, 2018 & 2025F |

| Figure 10. China Chocolate Market Revenue Share, By Chocolate Type, 2018 & 2025F |

| Figure 11. India Chocolate Market Revenues, 2015-2025F ($ Million) |

| Figure 12. India Chocolate Market Revenue Share, By Product Type, 2018 & 2025F |

| Figure 13. India Chocolate Market Revenue Share, By Distribution Channel, 2018 & 2025F |

| Figure 14. India Chocolate Market Revenue Share, By Chocolate Type, 2018 & 2025F |

| Figure 15. Indonesia Chocolate Market Revenues, 2015-2025F ($ Million) |

| Figure 16. Indonesia Chocolate Market Revenue Share, By Product Type, 2018 & 2025F |

| Figure 17. Indonesia Chocolate Market Revenue Share, By Distribution Channel, 2018 & 2025F |

| Figure 18. Indonesia Chocolate Market Revenue Share, By Chocolate Type, 2018 & 2025F |

| Figure 19. Asia Pacific Market Opportunity Assessment, By Countries, 2025F |

| LIST OF TABLES |

| Table 1. Japan Chocolate Market Revenues, By Product Type, 2015-2025F ($ Million) |

| Table 2. Japan Chocolate Market Revenues, By Distribution Channel, 2015-2025F ($ Million) |

| Table 3. Japan Chocolate Market Revenues, By Chocolate Type, 2015-2025F ($ Million) |

| Table 4. China Chocolate Market Revenues, By Product Type, 2015-2025F ($ Million) |

| Table 5. China Chocolate Market Revenues, By Distribution Channel, 2015-2025F ($ Million) |

| Table 6. China Chocolate Market Revenues, By Chocolate Type, 2015-2025F ($ Million) |

| Table 7. India Chocolate Market Revenues, By Product Type, 2015-2025F ($ Million) |

| Table 8. India Chocolate Market Revenues, By Distribution Channel, 2015-2025F ($ Million) |

| Table 9. India Chocolate Market Revenues, By Chocolate Type, 2015-2025F ($ Million) |

| Table 10. Indonesia Chocolate Market Revenues, By Product Type, 2015-2025F ($ Million) |

| Table 11. Indonesia Chocolate Market Revenues, By Distribution Channel, 2015-2025F ($ Million) |

| Table 12. Indonesia Chocolate Market Revenues, By Chocolate Type, 2015-2025F ($ Million) |

- Single User License$ 4,560

- Department License$ 5,055

- Site License$ 5,595

- Global License$ 6,000

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero