Asia Pacific Power & Distribution Transformer Market (2025-2031) | Analysis, Forecast, Companies, Value, Industry, Revenue, Share, Size, Trends, Growth & Outlook

Market Forecast By Types(Power Transformer,Distribution Transformer), By Rating (Power Transformer(1 MVA – 50 MVA, 50.1 MVA – 160 MVA, 160.1 MVA – 350 MVA, Above 350 MVA),Distribution Transformer(Up to 100 kVA, 100.1 – 315 kVA, 315.1 – 5 MVA)),ByCooling System(Dry Type,Liquid Type), By Applications (Power Utilities,Industrial) and competitive Landscape, By Countries (Australia, China, Japan, India, Indonesia, Malaysia, Singapore, Philippines, Thailand and Rest of APAC) and Competitive Landscape

| Product Code: ETC001774 | Publication Date: Dec 2023 | Updated Date: Oct 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Asia Pacific Power & Distribution Transformer Market Size & Growth Rate

According to 6Wresearch internal database and industry insights, the Asia Pacific Power & Distribution Transformer Market Size was estimated at USD 18.95 billion in 2024 and projected to reach USD 38.1 billion by 2031, growing at a compound annual growth rate (CAGR) of 10.4% during the forecast period 2025-2031.

Asia Pacific Power & Distribution Transformer Market Highlights

| Report Name | Asia Pacific Power & Distribution Transformer Market |

| Forecast Period | 2025-2031 |

| CAGR | 10.4% |

| Market Size | USD 38.1 billion by 2031 |

| Growing Sector | Power Utilities and Industrial Sector |

Topics Covered in the Asia Pacific Power & Distribution Transformer Market Report

The Asia Pacific Power & Distribution Transformer Market report thoroughly covers the market by types, by rating, by cooling system, by applications, and by countries. The market report provides an unbiased and detailed analysis of ongoing market trends, growth opportunities, and driving factors, enabling stakeholders to align their strategies according to future market dynamics.

Asia Pacific Power & Distribution Transformer Market Synopsis

Asia Pacific Power & Distribution Transformer Market has shown robust expansion over the past few years. As such, power & distribution transformers play a crucial role in providing reliable and efficient energy supply. Mainly, this region is growing due to rapid industrialization, urban electrification, and the integration of renewable energy projects across emerging countries such as India, China, Indonesia, and Vietnam. Nations who have settled such as Japan and Australia are emphasizing focus on upgrading aging grid networks and adopting smart transformer technologies to improve consistency and efficiency.

Evaluation of Growth Drivers in the Asia Pacific Power & Distribution Transformer Market

Below mentioned are some major drivers and their impacts on the market dynamics:

| Drivers | Primary Segments Affected | Why it Matters (Evidence) |

| Renewable Power Integration | Power Transformers | The surge in projects related to wind, solar, and hydro across China, India, and Southeast Asia requires large-scale power transformers for grid connectivity. |

| Electrification of Rural & Semi-Urban Areas | Distribution Transformers | Initiatives are issued by government such as “Saubhagya Scheme” in India and rural electrification programs in India are driving demand for compact distribution transformers. |

| Industrial Expansion | Power & Distribution Transformers | Manufacturing hubs in India, Malaysia, and Vietnam are increasing demand for reliable and efficient transformer systems to sustain industrial operations. |

| Grid Modernization & Smart Infrastructure | Power Transformers | Grid automation projects and the adoption of digital substations across Japan and Singapore are enhancing the need for smart power transformers. |

| EV Infrastructure & Data Centres | Distribution Transformers | EV charging networks and hyperscale data centres are rapidly expanding which require advanced distribution transformers for stable power flow and minimal downtime. |

Asia Pacific Power & Distribution Transformer Market Size is expected to grow steadily at a CAGR of 10.4% during the forecast period 2025-2031. There are numbers of the growth factors which are contributing in the expansion of the power & transformer Asia market for instance increasing demand for electricity from industrial, residential, and renewable sectors, combined with the transition toward sustainable energy systems, has accelerated market adoption across the region. The focus is emphasizing on sustainable transmission networks and smart grids that will continue to create lucrative opportunities for transformer manufacturers.

Evaluation of Restraints in the Asia Pacific Power & Distribution Transformer Market

Below mentioned are some major restraints and their influence on the market dynamics:

| Restraints | Primary Segments Affected | What This Means (Evidence) |

| High Capital Cost | Power Transformers | Developing power transformers require significant investment, limiting adoption among smaller utilities. |

| Volatile Raw Material Prices | All Segments | Fluctuating costs of copper, aluminium, and steel affect manufacturing expenses and profit margins. |

| Complex Supply Chain | Power Transformers | There is high dependence on imports for high-capacity components in developing economies delays production and deployment. |

| Limited Skilled Workforce | Distribution Transformers | Due to lack of skilled technicians for installation and maintenance, project timelines are affected. |

| Environmental Regulations | Liquid Type Transformers | Stricter regulations on oil-based transformers encourage expensive transitions to eco-friendly alternatives. |

Asia Pacific Power & Distribution Transformer Market Challenges

Asia Pacific Power & Distribution Transformer Market is affected by the prevalence of challenges such as high obtaining and maintenance costs, inconsistent grid standards, and complex interconnection policies across countries. There are many developing economies still face delays in upgrading the legacy infrastructure, while the transition to digital and eco-friendly transformer systems remains gradual. Further, occurring blockages in supply chain, particularly in components like cores and insulation materials, add to another layer of difficulties on production timelines. Furthermore, the lack of harmonized energy regulations across countries complicates transformer standardization and integration.

Asia Pacific Power & Distribution Transformer Market Trends

Some major trends are noticed in the market which include:

- Smart & IoT-Enabled Transformers: Digital monitoring systems are increasingly deployed due to feature of predictive maintenance and improved energy efficiency across grids.

- Rise in Renewable Integration: Solar and wind projects in China, India, and Australia are increasing the need for grid-supportive power transformers.

- Eco-Friendly Transformer Oils: Shift toward biodegradable and ester-based oils in liquid-type transformers is accelerating due to tightening environmental policies.

- Decentralized Energy Systems: Growing popularity of microgrids and distributed generation requires smaller, flexible distribution transformers.

- Surge in Data Centre Power Demand: The rise of cloud infrastructure in countries like Singapore and Japan is pushing demand for high-capacity distribution transformers.

Investment Opportunities in the Asia Pacific Power & Distribution Transformer Industry

There are numbers of opportunities existing in the Asia Pacific Power & Distribution Transformer Industry, including:

- Rural Electrification Programs: Electricity access is growing in Southeast Asian countries which offers opportunities for low-capacity distribution transformer suppliers.

- Smart Grid Projects: Current grid automation projects in Japan, Singapore, and Australia open markets for intelligent power transformers.

- Green Transformer Solutions: SF6-free is more preferred among consumers, ester oil-based transformers align with Asia’s sustainability targets.

- Local Manufacturing & Joint Ventures: In India and Indonesia, governments are encouraging local transformer production with the implementation of Make-in-Asia initiatives, creating manufacturing opportunities.

- Renewable Power Integration: Comprehensive renewable projects and interconnection of solar and wind plants are expected to drive substantial transformer investments.

Top 5 Leading Players in the Asia Pacific Power & Distribution Transformer Market

The comprehensive list of major companies in the market is:

Hitachi Energy Ltd.

| Company Name | Hitachi Energy Ltd. |

| Established Year | 1988 |

| Headquarters | Zurich, Switzerland |

| Official Website | Click Here |

This company offers advanced power and distribution transformers with integrated monitoring systems, emphasizing sustainability and grid automation across Asia Pacific.

Toshiba Energy Systems & Solutions Corporation

| Company Name | Toshiba Energy Systems & Solutions Corporation |

| Established Year | 1875 |

| Headquarters | Tokyo, Japan |

| Official Website | _ |

Thia company has a diverse range of transformers, including ultra-high-voltage and smart monitoring units, with a strong footprint across Japan, India, and Southeast Asia.

Siemens Energy AG

| Company Name | Siemens Energy AG |

| Established Year | 1847 |

| Headquarters | Munich, Germany |

| Official Website | Click Here |

This company specialized in digital power transformers and grid solutions tailored for renewable integration and industrial applications across the Asia Pacific region.

Hyundai Electric & Energy Systems Co., Ltd.

| Company Name | Hyundai Electric & Energy Systems Co., Ltd. |

| Established Year | 1977 |

| Headquarters | Seoul, South Korea |

| Official Website | Click Here |

Hyundai Electric is a leading supplier of liquid-type transformers, catering to utilities and heavy industries across East Asia and Oceania with advanced manufacturing facilities.

Crompton Greaves Power and Industrial Solutions Ltd. (CG Power)

| Company Name | Crompton Greaves Power and Industrial Solutions Ltd. (CG Power) |

| Established Year | 1937 |

| Headquarters | Mumbai, India |

| Official Website | Click Here |

This company provides efficient distribution and power transformers, focusing on domestic manufacturing and export to Southeast Asian and Middle Eastern markets.

Government Regulations Introduced in the Asia Pacific Power & Distribution Transformer Market

Across Asia Pacific, government is playing a crucial role in the expansion of Asia Pacific transformer landscape to enforce the regulations & polices. Greater economies like India, China, and Japan have introduced various standards based on energy efficiency and green transformer policies which are promoting the use of low-loss cores and eco-friendly insulation materials. In India, initiatives such as Bureau of Energy Efficiency (BEE) Star Rating, Energy Labelling Program of China, and Top Runner Standards of Japan emphasize the efficient power consumption. Moreover, various national networks are setting targets for smart substation deployment and renewable integration, leading to continuous transformer modernization.

Future Insights of the Asia Pacific Power & Distribution Transformer Market

During the forecast period, Asia Pacific Power & Distribution Transformer Market Growth is expected to rise. In the coming years, this industry is driven by rapid industrialization, renewable expansion, and digital grid transformation. Aside from this, government investments are growing in smart infrastructure and electrification, demand for both power and distribution transformers will continue to surge. The future will also witness wider adoption of eco-friendly materials, IoT-enabled monitoring systems, and modular transformer designs. China, India, and Japan are likely to contribute their role in the transformation towards energy-efficient and sustainable power distribution networks.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories:

Power Transformer to Dominate the Market – By Types

According to Anjali, Senior Research Analyst, 6Wresearch, power transformers are expected to dominate due to their extensive application in high-capacity transmission networks and renewable energy projects across China, India, and Australia. Distribution transformers, while growing rapidly, are largely concentrated in utility and rural electrification projects.

1 MVA - 50 MVA Category to Lead – By Rating (Power Transformer)

Within the power transformer segment, the 1 MVA-50 MVA range dominates due to widespread usage in regional substations and renewable power plants. These transformers offer optimal performance for mid-scale generation and transmission, balancing cost and efficiency for grid modernization projects.

Up to 100 kVA Category to Dominate the Marekt – By Rating (Distribution Transformer)

The Up to 100 kVA range leads within distribution transformers due to its significant demand in rural and semi-urban electrification programs. Compact size, cost efficiency, and reliability make it ideal for residential, agricultural, and local distribution networks.

Liquid Type to Dominate the Marekt – By Cooling System

Liquid-type transformers dominate the market due to their superior thermal management and efficiency in high-load environments. They are widely adopted in industrial and power utility sectors, while dry-type transformers are gaining momentum in commercial and indoor installations for enhanced fire safety.

China to Dominate the Market – By Countries

Among the Asia Pacific countries, China is set to capture the largest Asia Pacific (APAC) Switchgear Market Share due to large-scale investments in ultra-high-voltage transmission, renewable energy, and smart grid technologies. India follows closely with industrialization and rural electrification initiatives. Japan, Australia, and Southeast Asian nations like Indonesia and Vietnam are also witnessing rapid adoption.

Power Utilities to Dominate the Market – By Applications

Power utilities hold the largest share of the market as most countries in the region are investing heavily in grid expansion, substation automation, and renewable integration. Industrial applications also exhibit strong growth due to continuous manufacturing and infrastructure expansion across Asia.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Historical Data of Asia Pacific Power & distribution transformer market Revenues for the Period 2021-2031.

- Market Size & Forecast of Asia Pacific Power & distribution transformer market Revenues until 2031.

- Historical Data of Asia Pacific Power & distribution transformer market Revenues, by type, for the Period 2021-2031.

- Market Size & Forecast of Asia Pacific Power & distribution transformer market Revenues, by type, until 2031.

- Historical Data of Asia Pacific Power & distribution transformer market Revenues, by the cooling system, for the Period 2021-2031.

- Market Size & Forecast of Asia Pacific Power & distribution transformer market Revenues, by the cooling system, until 2031.

- Historical Data of Asia Pacific Power & distribution transformer market Revenues, by rating, for the Period 2021-2031.

- Market Size & Forecast of Asia Pacific Power & distribution transformer market Revenues, by rating, until 2031.

- Historical Data of Asia Pacific Power & distribution transformer market Revenues, by applications, for the Period 2021-2031.

- Market Size & Forecast of Asia Pacific Power & distribution transformer market Revenues, by applications, until 2031.

- Historical Data of India Power & distribution transformer market Revenues for the Period 2021-2031.

- Market Size & Forecast of India Power & distribution transformer market Revenues until 2031.

- Historical Data of China Power & distribution transformer market Revenues for the Period 2021-2031.

- Market Size & Forecast of China Power & distribution transformer market Revenues until 2031.

- Historical Data of Japan Power & distribution transformer market Revenues for the Period 2021-2031.

- Market Size & Forecast of Japan Power & distribution transformer market Revenues until 2031.

- Historical Data of Australia Power & distribution transformer market Revenues for the Period 2021-2031.

- Market Size & Forecast of Australia Power & distribution transformer market Revenues until 2031.

- Historical Data of Indonesia Power & distribution transformer market Revenues for the Period 2021-2031.

- Market Size & Forecast of Indonesia Power & distribution transformer market Revenues until 2031.

- Historical Data of Singapore Power & distribution transformer market Revenues for the Period 2021-2031.

- Market Size & Forecast of Singapore Power & distribution transformer market Revenues until 2031.

- Historical Data of Thailand Power & distribution transformer market Revenues for the Period 2021-2031.

- Market Size & Forecast of Thailand Power & distribution transformer market Revenues until 2031.

- Historical Data of Malaysia Power & distribution transformer market Revenues for the Period 2021-2031.

- Market Size & Forecast of Malaysia Power & distribution transformer market Revenues until 2031.

- Historical Data of Philippines Power & distribution transformer market Revenues for the Period 2021-2031.

- Market Size & Forecast of Philippines Power & distribution transformer market Revenues until 2031.

- Historical Data of the rest of APAC Power & distribution transformer market Revenues for the Period 2021-2031.

- Market Size & Forecast of rest of APAC Power & distribution transformer market Revenues until 2031.

- Market Drivers and Restraints.

- Market Trends and Developments.

- Player Market Share and Competitive Landscape.

- Company Profiles.

- Key Strategic Recommendations.

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Type

- Power Transformer

- Distribution Transformer

By Rating

- Power Transformer

- 1 MVA - 50 MVA

- 50.1 MVA – 160 MVA

- 160.1 MVA - 350 MVA

- Above 350 MVA

- Distribution Transformer

- Upto 100 kVA

- 100.1 kVA – 315 kVA

- 315.1 kVA – 5 MVA

By Cooling System

- Dry Type

- Liquid Type

By Applications

- Power Utilities

- Industrial

By Countries

- Australia

- China

- Japan

- India

- Indonesia

- Malaysia

- Singapore

- Philippines

- Thailand

- Rest of APAC

Asia Pacific Power & Distribution Transformer Market (2025-2031): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Asia Pacific Power & Distribution Transformer Market Overview |

| 3.1. Asia Pacific Power & Distribution Transformer Market Revenues, 2021-2031F |

| 3.2. Asia Pacific Power & Distribution Transformer Market - Industry Life Cycle, 2024 |

| 3.3. Asia Pacific Power & Distribution Transformer Market - Porter’s Five Forces |

| 3.4. Asia Pacific Power & Distribution Transformer Market Revenue Share, By Type, 2021 & 2031F |

| 3.5. Asia Pacific Power & Distribution Transformer Market Revenue Share, By Rating, 2021 & 2031F |

| 3.6. Asia Pacific Power & Distribution Transformer Market Revenue Share, By Cooling System, 2021 & 2031F |

| 3.7. Asia Pacific Power & Distribution Transformer Market Revenue Share, By Application, 2021 & 2031F |

| 3.8. Asia Pacific Power & Distribution Transformer Market Revenue Share, By Region, 2021 & 2031F |

| 4. Asia Pacific Power & Distribution Transformer Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.3. Market Restraints |

| 5. Asia Pacific Power & Distribution Transformer Market Trends |

| 6. China Power & Distribution Transformer Market Overview |

| 6.1. China Power & Distribution Transformer Market Revenues, 2021-2031F |

| 6.2. China Power & Distribution Transformer Market Overview, By Type |

| 6.2.1. China Power & Distribution Transformer Market Revenues, By Power Transformer, 2021-2031F |

| 6.2.2. China Power & Distribution Transformer Market Revenues, By Distribution Transformer, 2021-2031F |

| 6.3. China Power & Distribution Transformer Market Overview, By Rating |

| 6.3.1. China Power & Distribution Transformer Market Revenues, By Power Transformer |

| 6.3.1.1. China Power Transformer Market Revenues, 1 -50 MVA, 2021-2031F |

| 6.3.1.2. China Power Transformer Market Revenues, 50.1-160 MVA, 2021-2031F |

| 6.3.1.3. China Power Transformer Market Revenues, 160.1-350 MVA, 2021-2031F |

| 6.3.1.4. China Power Transformer Market Revenues, Above 350 MVA, 2021-2031F |

| 6.3.2. China Power & Distribution Transformer Market Revenues, By Distribution Transformer |

| 6.3.2.1. China Distribution Transformer Market Revenues, Upto 100 KVA, 2021-2031F |

| 6.3.2.2. China Distribution Transformer Market Revenues, 100.1-315 KVA, 2021-2031F |

| 6.3.2.3. China Distribution Transformer Market Revenues, 315.1 KVA- 5 MVA, 2021-2031F |

| 6.4. China Power & Distribution Transformer Market Overview, By Cooling System |

| 6.4.1. China Power & Distribution Transformer Market Revenues, By Dry Type, 2021-2031F |

| 6.4.2. China Power & Distribution Transformer Market Revenues, By Liquid Type, 2021-2031F |

| 6.5. China Power & Distribution Transformer Market Overview, By Applications |

| 6.5.1. China Power & Distribution Transformer Market Revenues, By Power Utilities Application, 2021-2031F |

| 6.5.2. China Power & Distribution Transformer Market Revenues, By Industrial Application, 2021-2031F |

| 7. Japan Power & Distribution Transformer Market Overview |

| 7.1. Japan Power & Distribution Transformer Market Revenues, 2021-2031F |

| 7.2. Japan Power & Distribution Transformer Market Overview, By Type |

| 7.2.1. Japan Power & Distribution Transformer Market Revenues, By Power Transformer, 2021-2031F |

| 7.2.2. Japan Power & Distribution Transformer Market Revenues, By Distribution Transformer, 2021-2031F |

| 7.3. Japan Power & Distribution Transformer Market Overview, By Rating |

| 7.3.1. Japan Power & Distribution Transformer Market Revenues, By Power Transformer |

| 7.3.1.1. Japan Power Transformer Market Revenues, 1 -50 MVA, 2021-2031F |

| 7.3.1.2. Japan Power Transformer Market Revenues, 50.1-160 MVA, 2021-2031F |

| 7.3.1.3. Japan Power Transformer Market Revenues, 160.1-350 MVA, 2021-2031F |

| 7.3.1.4. Japan Power Transformer Market Revenues, Above 350 MVA, 2021-2031F |

| 7.3.2. Japan Power & Distribution Transformer Market Revenues, By Distribution Transformer |

| 7.3.2.1. Japan Distribution Transformer Market Revenues, Upto 100 KVA, 2021-2031F |

| 7.3.2.2. Japan Distribution Transformer Market Revenues, 100.1-315 KVA, 2021-2031F |

| 7.3.2.3. Japan Distribution Transformer Market Revenues, 315.1 KVA- 5 MVA, 2021-2031F |

| 7.4. Japan Power & Distribution Transformer Market Overview, By Cooling System |

| 7.4.1. Japan Power & Distribution Transformer Market Revenues, By Dry Type, 2021-2031F |

| 7.4.2. Japan Power & Distribution Transformer Market Revenues, By Liquid Type, 2021-2031F |

| 7.5. Japan Power & Distribution Transformer Market Overview, By Applications |

| 7.5.1. Japan Power & Distribution Transformer Market Revenues, By Power Utilities Application, 2021-2031F |

| 7.5.2. Japan Power & Distribution Transformer Market Revenues, By Industrial Application, 2021-2031F |

| 8. Australia Power & Distribution Transformer Market Overview |

| 8.1. Australia Power & Distribution Transformer Market Revenues, 2021-2031F |

| 8.2. Australia Power & Distribution Transformer Market Overview, By Type |

| 8.2.1. Australia Power & Distribution Transformer Market Revenues, By Power Transformer, 2021-2031F |

| 8.2.2. Australia Power & Distribution Transformer Market Revenues, By Distribution Transformer, 2021-2031F |

| 8.3. Australia Power & Distribution Transformer Market Overview, By Rating |

| 8.3.1. Australia Power & Distribution Transformer Market Revenues, By Power Transformer |

| 8.3.1.1. Australia Power Transformer Market Revenues, 1 -50 MVA, 2021-2031F |

| 8.3.1.2. Australia Power Transformer Market Revenues, 50.1-160 MVA, 2021-2031F |

| 8.3.1.3. Australia Power Transformer Market Revenues, 160.1-350 MVA, 2021-2031F |

| 8.3.1.4. Australia Power Transformer Market Revenues, Above 350 MVA, 2021-2031F |

| 8.3.2. Australia Power & Distribution Transformer Market Revenues, By Distribution Transformer |

| 8.3.2.1. Australia Distribution Transformer Market Revenues, Upto 100 KVA, 2021-2031F |

| 8.3.2.2. Australia Distribution Transformer Market Revenues, 100.1-315 KVA, 2021-2031F |

| 8.3.2.3. Australia Distribution Transformer Market Revenues, 315.1 KVA- 5 MVA, 2021-2031F |

| 8.4. Australia Power & Distribution Transformer Market Overview, By Cooling System |

| 8.4.1. Australia Power & Distribution Transformer Market Revenues, By Dry Type, 2021-2031F |

| 8.4.2. Australia Power & Distribution Transformer Market Revenues, By Liquid Type, 2021-2031F |

| 8.5. Australia Power & Distribution Transformer Market Overview, By Applications |

| 8.5.1. Australia Power & Distribution Transformer Market Revenues, By Power Utilities Application, 2021-2031F |

| 8.5.2. Australia Power & Distribution Transformer Market Revenues, By Industrial Application, 2021-2031F |

| 9. Vietnam Power & Distribution Transformer Market Overview |

| 9.1. Vietnam Power & Distribution Transformer Market Revenues, 2021-2031F |

| 9.2. Vietnam Power & Distribution Transformer Market Overview, By Type |

| 9.2.1. Vietnam Power & Distribution Transformer Market Revenues, By Power Transformer, 2021-2031F |

| 9.2.2. Vietnam Power & Distribution Transformer Market Revenues, By Distribution Transformer, 2021-2031F |

| 9.3. Vietnam Power & Distribution Transformer Market Overview, By Rating |

| 9.3.1. Vietnam Power & Distribution Transformer Market Revenues, By Power Transformer |

| 9.3.1.1. Vietnam Power Transformer Market Revenues, 1 -50 MVA, 2021-2031F |

| 9.3.1.2. Vietnam Power Transformer Market Revenues, 50.1-160 MVA, 2021-2031F |

| 9.3.1.3. Vietnam Power Transformer Market Revenues, 160.1-350 MVA, 2021-2031F |

| 9.3.1.4. Vietnam Power Transformer Market Revenues, Above 350 MVA, 2021-2031F |

| 9.3.2. Vietnam Power & Distribution Transformer Market Revenues, By Distribution Transformer |

| 9.3.2.1. Vietnam Distribution Transformer Market Revenues, Upto 100 KVA, 2021-2031F |

| 9.3.2.2. Vietnam Distribution Transformer Market Revenues, 100.1-315 KVA, 2021-2031F |

| 9.3.2.3. Vietnam Distribution Transformer Market Revenues, 315.1 KVA- 5 MVA, 2021-2031F |

| 9.4. Vietnam Power & Distribution Transformer Market Overview, By Cooling System |

| 9.4.1. Vietnam Power & Distribution Transformer Market Revenues, By Dry Type, 2021-2031F |

| 9.4.2. Vietnam Power & Distribution Transformer Market Revenues, By Liquid Type, 2021-2031F |

| 9.5. Vietnam Power & Distribution Transformer Market Overview, By Applications |

| 9.5.1. Vietnam Power & Distribution Transformer Market Revenues, By Power Utilities Application, 2021-2031F |

| 9.5.2. Vietnam Power & Distribution Transformer Market Revenues, By Industrial Application, 2021-2031F |

| 10. Thailand Power & Distribution Transformer Market Overview |

| 10.1. Thailand Power & Distribution Transformer Market Revenues, 2021-2031F |

| 10.2. Thailand Power & Distribution Transformer Market Overview, By Type |

| 10.2.1. Thailand Power & Distribution Transformer Market Revenues, By Power Transformer, 2021-2031F |

| 10.2.2. Thailand Power & Distribution Transformer Market Revenues, By Distribution Transformer, 2021-2031F |

| 10.3. Thailand Power & Distribution Transformer Market Overview, By Rating |

| 10.3.1. Thailand Power & Distribution Transformer Market Revenues, By Power Transformer |

| 10.3.1.1. Thailand Power Transformer Market Revenues, 1 -50 MVA, 2021-2031F |

| 10.3.1.2. Thailand Power Transformer Market Revenues, 50.1-160 MVA, 2021-2031F |

| 10.3.1.3. Thailand Power Transformer Market Revenues, 160.1-350 MVA, 2021-2031F |

| 10.3.1.4. Thailand Power Transformer Market Revenues, Above 350 MVA, 2021-2031F |

| 10.3.2. Thailand Power & Distribution Transformer Market Revenues, By Distribution Transformer |

| 10.3.2.1. Thailand Distribution Transformer Market Revenues, Upto 100 KVA, 2021-2031F |

| 10.3.2.2. Thailand Distribution Transformer Market Revenues, 100.1-315 KVA, 2021-2031F |

| 10.3.2.3. Thailand Distribution Transformer Market Revenues, 315.1 KVA- 5 MVA, 2021-2031F |

| 10.4. Thailand Power & Distribution Transformer Market Overview, By Cooling System |

| 10.4.1. Thailand Power & Distribution Transformer Market Revenues, By Dry Type, 2021-2031F |

| 10.4.2. Thailand Power & Distribution Transformer Market Revenues, By Liquid Type, 2021-2031F |

| 10.5. Thailand Power & Distribution Transformer Market Overview, By Applications |

| 10.5.1. Thailand Power & Distribution Transformer Market Revenues, By Power Utilities Application, 2021-2031F |

| 10.5.2. Thailand Power & Distribution Transformer Market Revenues, By Industrial Application, 2021-2031F |

| 11. Indonesia Power & Distribution Transformer Market Overview |

| 11.1. Indonesia Power & Distribution Transformer Market Revenues, 2021-2031F |

| 11.2. Indonesia Power & Distribution Transformer Market Overview, By Type |

| 11.2.1. Indonesia Power & Distribution Transformer Market Revenues, By Power Transformer, 2021-2031F |

| 11.2.2. Indonesia Power & Distribution Transformer Market Revenues, By Distribution Transformer, 2021-2031F |

| 11.3. Indonesia Power & Distribution Transformer Market Overview, By Rating |

| 11.3.1. Indonesia Power & Distribution Transformer Market Revenues, By Power Transformer |

| 11.3.1.1. Indonesia Power Transformer Market Revenues, 1 -50 MVA, 2021-2031F |

| 11.3.1.2. Indonesia Power Transformer Market Revenues, 50.1-160 MVA, 2021-2031F |

| 11.3.1.3. Indonesia Power Transformer Market Revenues, 160.1-350 MVA, 2021-2031F |

| 11.3.1.4. Indonesia Power Transformer Market Revenues, Above 350 MVA, 2021-2031F |

| 11.3.2. Indonesia Power & Distribution Transformer Market Revenues, By Distribution Transformer |

| 11.3.2.1. Indonesia Distribution Transformer Market Revenues, Upto 100 KVA, 2021-2031F |

| 11.3.2.2. Indonesia Distribution Transformer Market Revenues, 100.1-315 KVA, 2021-2031F |

| 11.3.2.3. Indonesia Distribution Transformer Market Revenues, 315.1 KVA- 5 MVA, 2021-2031F |

| 11.4. Indonesia Power & Distribution Transformer Market Overview, By Cooling System |

| 11.4.1. Indonesia Power & Distribution Transformer Market Revenues, By Dry Type, 2021-2031F |

| 11.4.2. Indonesia Power & Distribution Transformer Market Revenues, By Liquid Type, 2021-2031F |

| 11.5. Indonesia Power & Distribution Transformer Market Overview, By Applications |

| 11.5.1. Indonesia Power & Distribution Transformer Market Revenues, By Power Utilities Application, 2021-2031F |

| 11.5.2. Indonesia Power & Distribution Transformer Market Revenues, By Industrial Application, 2021-2031F |

| 12. Singapore Power & Distribution Transformer Market Overview |

| 12.1. Singapore Power & Distribution Transformer Market Revenues, 2021-2031F |

| 12.2. Singapore Power & Distribution Transformer Market Overview, By Type |

| 12.2.1. Singapore Power & Distribution Transformer Market Revenues, By Power Transformer, 2021-2031F |

| 12.2.2. Singapore Power & Distribution Transformer Market Revenues, By Distribution Transformer, 2021-2031F |

| 12.3. Singapore Power & Distribution Transformer Market Overview, By Rating |

| 12.3.1. Singapore Power & Distribution Transformer Market Revenues, By Power Transformer |

| 12.3.1.1. Singapore Power Transformer Market Revenues, 1 -50 MVA, 2021-2031F |

| 12.3.1.2. Singapore Power Transformer Market Revenues, 50.1-160 MVA, 2021-2031F |

| 12.3.1.3. Singapore Power Transformer Market Revenues, 160.1-350 MVA, 2021-2031F |

| 12.3.1.4. Singapore Power Transformer Market Revenues, Above 350 MVA, 2021-2031F |

| 12.3.2. Singapore Power & Distribution Transformer Market Revenues, By Distribution Transformer |

| 12.3.2.1. Singapore Distribution Transformer Market Revenues, Upto 100 KVA, 2021-2031F |

| 12.3.2.2. Singapore Distribution Transformer Market Revenues, 100.1-315 KVA, 2021-2031F |

| 12.3.2.3. Singapore Distribution Transformer Market Revenues, 315.1 KVA- 5 MVA, 2021-2031F |

| 12.4. Singapore Power & Distribution Transformer Market Overview, By Cooling System |

| 12.4.1. Singapore Power & Distribution Transformer Market Revenues, By Dry Type, 2021-2031F |

| 12.4.2. Singapore Power & Distribution Transformer Market Revenues, By Liquid Type, 2021-2031F |

| 12.5. Singapore Power & Distribution Transformer Market Overview, By Applications |

| 12.5.1. Singapore Power & Distribution Transformer Market Revenues, By Power Utilities Application, 2021-2031F |

| 12.5.2. Singapore Power & Distribution Transformer Market Revenues, By Industrial Application, 2021-2031F |

| 13. Philippines Power & Distribution Transformer Market Overview |

| 13.1. Philippines Power & Distribution Transformer Market Revenues, 2021-2031F |

| 13.2. Philippines Power & Distribution Transformer Market Overview, By Type |

| 13.2.1. Philippines Power & Distribution Transformer Market Revenues, By Power Transformer, 2021-2031F |

| 13.2.2. Philippines Power & Distribution Transformer Market Revenues, By Distribution Transformer, 2021-2031F |

| 13.3. Philippines Power & Distribution Transformer Market Overview, By Rating |

| 13.3.1. Philippines Power & Distribution Transformer Market Revenues, By Power Transformer |

| 13.3.1.1. Philippines Power Transformer Market Revenues, 1 -50 MVA, 2021-2031F |

| 13.3.1.2. Philippines Power Transformer Market Revenues, 50.1-160 MVA, 2021-2031F |

| 13.3.1.3. Philippines Power Transformer Market Revenues, 160.1-350 MVA, 2021-2031F |

| 13.3.1.4. Philippines Power Transformer Market Revenues, Above 350 MVA, 2021-2031F |

| 13.3.2. Philippines Power & Distribution Transformer Market Revenues, By Distribution Transformer |

| 13.3.2.1. Philippines Distribution Transformer Market Revenues, Upto 100 KVA, 2021-2031F |

| 13.3.2.2. Philippines Distribution Transformer Market Revenues, 100.1-315 KVA, 2021-2031F |

| 13.3.2.3. Philippines Distribution Transformer Market Revenues, 315.1 KVA- 5 MVA, 2021-2031F |

| 13.4. Philippines Power & Distribution Transformer Market Overview, By Cooling System |

| 13.4.1. Philippines Power & Distribution Transformer Market Revenues, By Dry Type, 2021-2031F |

| 13.4.2. Philippines Power & Distribution Transformer Market Revenues, By Liquid Type, 2021-2031F |

| 13.5. Philippines Power & Distribution Transformer Market Overview, By Applications |

| 13.5.1. Philippines Power & Distribution Transformer Market Revenues, By Power Utilities Application, 2021-2031F |

| 13.5.2. Philippines Power & Distribution Transformer Market Revenues, By Industrial Application, 2021-2031F |

| 14. Malaysia Power & Distribution Transformer Market Overview |

| 14.1. Malaysia Power & Distribution Transformer Market Revenues, 2021-2031F |

| 14.2. Malaysia Power & Distribution Transformer Market Overview, By Type |

| 14.2.1. Malaysia Power & Distribution Transformer Market Revenues, By Power Transformer, 2021-2031F |

| 14.2.2. Malaysia Power & Distribution Transformer Market Revenues, By Distribution Transformer, 2021-2031F |

| 14.3. Malaysia Power & Distribution Transformer Market Overview, By Rating |

| 14.3.1. Malaysia Power & Distribution Transformer Market Revenues, By Power Transformer |

| 14.3.1.1. Malaysia Power Transformer Market Revenues, 1 -50 MVA, 2021-2031F |

| 14.3.1.2. Malaysia Power Transformer Market Revenues, 50.1-160 MVA, 2021-2031F |

| 14.3.1.3. Malaysia Power Transformer Market Revenues, 160.1-350 MVA, 2021-2031F |

| 14.3.1.4. Malaysia Power Transformer Market Revenues, Above 350 MVA, 2021-2031F |

| 14.3.2. Malaysia Power & Distribution Transformer Market Revenues, By Distribution Transformer |

| 14.3.2.1. Malaysia Distribution Transformer Market Revenues, Upto 100 KVA, 2021-2031F |

| 14.3.2.2. Malaysia Distribution Transformer Market Revenues, 100.1-315 KVA, 2021-2031F |

| 14.3.2.3. Malaysia Distribution Transformer Market Revenues, 315.1 KVA- 5 MVA, 2021-2031F |

| 14.4. Malaysia Power & Distribution Transformer Market Overview, By Cooling System |

| 14.4.1. Malaysia Power & Distribution Transformer Market Revenues, By Dry Type, 2021-2031F |

| 14.4.2. Malaysia Power & Distribution Transformer Market Revenues, By Liquid Type, 2021-2031F |

| 14.5. Malaysia Power & Distribution Transformer Market Overview, By Applications |

| 14.5.1. Malaysia Power & Distribution Transformer Market Revenues, By Power Utilities Application, 2021-2031F |

| 14.5.2. Malaysia Power & Distribution Transformer Market Revenues, By Industrial Application, 2021-2031F |

| 15. Asia Pacific Power & Distribution Transformer Market Opportunity Assessment |

| 15.1. Asia Pacific Power & Distribution Transformer System Market Opportunity Assessment, By Country |

| 15.1.1. China Power & Distribution Transformer System Market Opportunity Assessment (2031F) |

| 15.1.2. Australia Power & Distribution Transformer System Market Opportunity Assessment (2031F) |

| 15.1.3. Indonesia Power & Distribution Transformer System Market Opportunity Assessment (2031F) |

| 15.1.4. Vietnam Power & Distribution Transformer System Market Opportunity Assessment (2031F) |

| 15.1.5. Malaysia Power & Distribution Transformer System Market Opportunity Assessment (2031F) |

| 15.1.6. Thailand Power & Distribution Transformer System Market Opportunity Assessment (2031F) |

| 15.1.7. Japan Power & Distribution Transformer System Market Opportunity Assessment (2031F) |

| 15.1.8. Singapore Power & Distribution Transformer System Market Opportunity Assessment (2031F) |

| 15.1.9. Philippines Power & Distribution Transformer System Market Opportunity Assessment (2031F) |

| 16. Asia Pacific Power & Distribution Transformer Market Competitive Landscape |

| 16.1 Asia Pacific Power & Distribution Transformer Market Competitive Benchmarking, By Operating Parameters |

| 16.2 Asia Pacific Power & Distribution Transformer Market Revenue Share/Ranking, By Country |

| 16.2.1. Singapore Power & Distribution Transformer System Market Revenue Share/Ranking, By Company, 2024 |

| 16.2.2. China Power & Distribution Transformer System Market Revenue Share/Ranking, By Company, 2024 |

| 16.2.3. Japan Power & Distribution Transformer System Market Revenue Share/Ranking, By Company, 2024 |

| 16.2.4. Vietnam Power & Distribution Transformer System Market Revenue Share/Ranking, By Company, 2024 |

| 16.2.5. Thailand Power & Distribution Transformer System Market Revenue Share/Ranking, By Company, 2024 |

| 16.2.6. Malaysia Power & Distribution Transformer System Market Revenue Share/Ranking, By Company, 2024 |

| 16.2.7. Australia Power & Distribution Transformer System Market Revenue Share/Ranking, By Company, 2024 |

| 16.2.8. Philippines Power & Distribution Transformer System Market Revenue Share/Ranking, By Company, 2024 |

| 16.2.9. Thailand Power & Distribution Transformer System Market Revenue Share/Ranking, By Company, 2024 |

| 17. Company Profiles |

| 18. Key Strategic Recommendations |

| 19. Disclaimer |

Market Forecast By Types (Power Transformer, Distribution Transformer), By Rating (Power Transformer (1 MVA – 50 MVA, 50.1 MVA – 160 MVA, 160.1 MVA – 350 MVA, Above 350 MVA), Distribution Transformer (Up to 100 kVA, 100.1 – 315 kVA, 315.1 – 5 MVA)), By Cooling System (Dry Type, Liquid Type), By Applications (Power Utilities, Industrial) and competitive Landscape, By Countries (Australia, China, Japan, India, Indonesia, Malaysia, Singapore, Philippines, Vietnam, Thailand and Rest of APAC) and Competitive Landscape

| Product Code: ETC001774 | Publication Date: Mar 2020 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 200 | No. of Figures: 90 | No. of Tables: 35 |

Asia Pacific power & distribution transformer market is expected to register growth in revenues in the coming years owing to the increasing rate of urbanization along with rising government efforts towards increasing rural electrification in developed countries across the APAC region. Increasing financial support by the government towards the development of efficient energy supply to remote areas of the developing and underdeveloped countries in the region is anticipated to showcase potential growth for the APAC power & distribution transformer market in the coming years.

According to 6Wresearch, Asia Pacific (APAC) Power & Distribution Transformer Market size is anticipated to register growth during 2019-26F. China's power & distribution transformer market is expected to dominate the overall APAC power & distribution transformer market owing to substantial power demand in the country. Furthermore, India and Indonesia's power & distribution transformer markets are expected to witness potential growth in the coming years owing to increased government involvement in order to increase energy efficiency in these countries.

Based on applications, the power utilities segment of the APAC power & distribution transformer markets market is expected to witness sound revenues in the coming years owing to increased electricity consumption in households coupled with industrial energy consumption. Further, on the basis of products, power transformers are expected to dominate the revenues in the APAC power & distribution transformer market owing to increased energy consumption demand in the developed countries across the region.

The Asia Pacific Power & distribution transformer market report thoroughly covers the market by types, cooling system, rating, applications, and key countries including India, China, Japan, Australia, Indonesia, Malaysia, Singapore, Vietnam, Philippines, Thailand, and the Rest of Asia Pacific. The Asia Pacific Power & distribution transformer market outlook report provides an unbiased and detailed analysis of the on-going Asia Pacific Power & distribution transformer market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

With the increase in the electrification rate and a rise in the consumption level of power, the demand for power and distribution has been steadily rising. A spur in the rural electrification rate in economically developing countries especially India, Cambodia, Laos, and Myanmar, the demand for power and distribution transformer is increasing at a compound rate owing to a rise in the growth of power grid infrastructure as a mechanism to satiate the rising demand for power in the aforementioned countries and as a result, is expected to be of great importance for bringing in superior growth prospects for the Asia Pacific power & distribution transformer market in the next five to ten years.

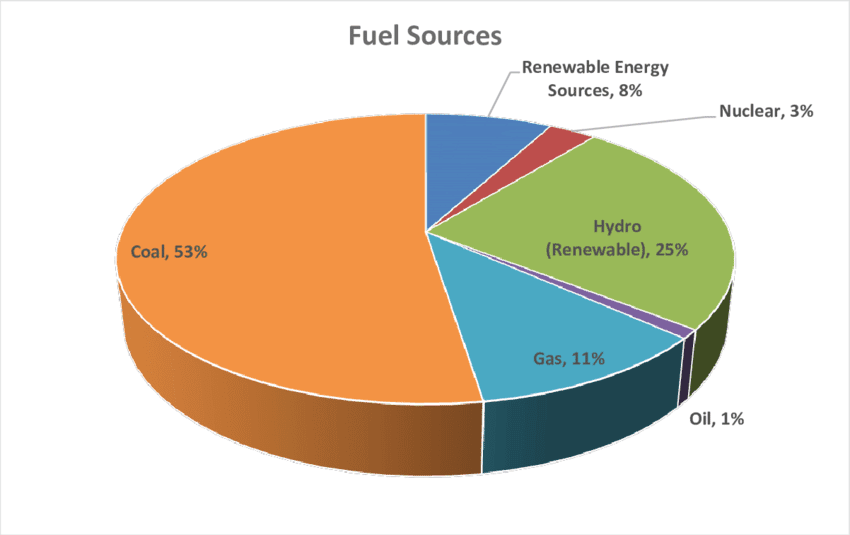

Asia pacific power & distribution transformers market is projected to gain momentum in the coming timeframe backed by rising urbanization has led to a demand for regular energy access especially in japan. power and distribution transformers continue to rise due to the high energy consumption rate domestically. Which is expected to shape the residential sector and simultaneously strengthening power and distribution transformers. Additionally, the Indian power & distribution transformers market is expected to generate high sales revenues in the country owing to increased government initiative towards rising renewable energy generation to ensure less carbon emission in the country. And increased power grid infrastructure where rising transformers deployment and helps in transferring electricity. Here below is given an energy generation source ratio which shows how moderate growth of renewable energy generation helps in securing the demand for transformers.

Asia Pacific Power & Distribution Transformer Market is expected to register sound revenues in the upcoming six years on the back of the rising need for regular electricity supply across the region. Additionally, on the basis of country, India power and distribution transformers market is expected to gain traction owing to increased government initiative by investing in power utility sector infrastructure especially in rural areas, and with increased electrification access concurrently rising power and distribution transformers installation in rural areas in order to ensure regular electricity supply, therefore this driver is acts as growth proliferating factor which is expected leave positive impact over the India power and distribution transformer market resulting, the massive growth of the entire Asia Pacific region in the upcoming six years.

Key Highlights of The Reports

- Historical Data of Asia Pacific Power & distribution transformer market Revenues for the Period 2016-2019.

- Market Size & Forecast of Asia Pacific Power & distribution transformer market Revenues until 2026.

- Historical Data of Asia Pacific Power & distribution transformer market Revenues, by type, for the Period 2016-2019.

- Market Size & Forecast of Asia Pacific Power & distribution transformer market Revenues, by type, until 2026.

- Historical Data of Asia Pacific Power & distribution transformer market Revenues, by the cooling system, for the Period 2016-2019.

- Market Size & Forecast of Asia Pacific Power & distribution transformer market Revenues, by the cooling system, until 2026.

- Historical Data of Asia Pacific Power & distribution transformer market Revenues, by rating, for the Period 2016-2019.

- Market Size & Forecast of Asia Pacific Power & distribution transformer market Revenues, by rating, until 2026.

- Historical Data of Asia Pacific Power & distribution transformer market Revenues, by applications, for the Period 2016-2019.

- Market Size & Forecast of Asia Pacific Power & distribution transformer market Revenues, by applications, until 2026.

- Historical Data of India Power & distribution transformer market Revenues for the Period 2016-2019.

- Market Size & Forecast of India Power & distribution transformer market Revenues until 2026.

- Historical Data of China Power & distribution transformer market Revenues for the Period 2016-2019.

- Market Size & Forecast of China Power & distribution transformer market Revenues until 2026.

- Historical Data of Japan Power & distribution transformer market Revenues for the Period 2016-2019.

- Market Size & Forecast of Japan Power & distribution transformer market Revenues until 2026.

- Historical Data of Australia Power & distribution transformer market Revenues for the Period 2016-2019.

- Market Size & Forecast of Australia Power & distribution transformer market Revenues until 2026.

- Historical Data of Indonesia Power & distribution transformer market Revenues for the Period 2016-2019.

- Market Size & Forecast of Indonesia Power & distribution transformer market Revenues until 2026.

- Historical Data of Singapore Power & distribution transformer market Revenues for the Period 2016-2019.

- Market Size & Forecast of Singapore Power & distribution transformer market Revenues until 2026.

- Historical Data of Vietnam Power & distribution transformer market Revenues for the Period 2016-2019.

- Market Size & Forecast of Vietnam Power & distribution transformer market Revenues until 2026.

- Historical Data of Thailand Power & distribution transformer market Revenues for the Period 2016-2019.

- Market Size & Forecast of Thailand Power & distribution transformer market Revenues until 2026.

- Historical Data of Malaysia Power & distribution transformer market Revenues for the Period 2016-2019.

- Market Size & Forecast of Malaysia Power & distribution transformer market Revenues until 2026.

- Historical Data of Philippines Power & distribution transformer market Revenues for the Period 2016-2019.

- Market Size & Forecast of Philippines Power & distribution transformer market Revenues until 2026.

- Historical Data of the rest of APAC Power & distribution transformer market Revenues for the Period 2016-2019.

- Market Size & Forecast of rest of APAC Power & distribution transformer market Revenues until 2026.

- Market Drivers and Restraints.

- Market Trends and Developments.

- Player Market Share and Competitive Landscape.

- Company Profiles.

- Key Strategic Recommendations.

Markets Covered

The Asia Pacific Power & distribution transformer market report provides a detailed analysis of the following market segments:

- By Type

- Power Transformer

- Distribution Transformer

- By Rating

- Power Transformer

- 1 MVA - 50 MVA

- 50.1 MVA – 160 MVA

- 160.1 MVA - 350 MVA

- Above 350 MVA

- Distribution Transformer

- Upto 100 kVA

- 100.1 kVA – 315 kVA

- 315.1 kVA – 5 MVA

- Power Transformer

- By Cooling System

- Dry Type

- Liquid Type

- By Applications

- Power Utilities

- Industrial

- By Countries

- Australia

- China

- Japan

- India

- Indonesia

- Malaysia

- Singapore

- Philippines

- Vietnam

- Thailand

- Rest of APAC

- Single User License$ 4,560

- Department License$ 5,055

- Site License$ 5,595

- Global License$ 6,000

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero