Australia Household Cleaning Products Market (2025-2031) | Outlook, Size, Revenue, Value, Growth, Companies, Trends, Forecast, Industry, Analysis & Share

Market Forecast By Product Type (Laundry Detergents, Surface Cleaners, Dishwashing Products, Toilet Cleaners, Others) And Competitive Landscape

| Product Code: ETC264695 | Publication Date: Aug 2022 | Updated Date: Apr 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 5 |

Australia Household Cleaning Products Market Size Growth Rate

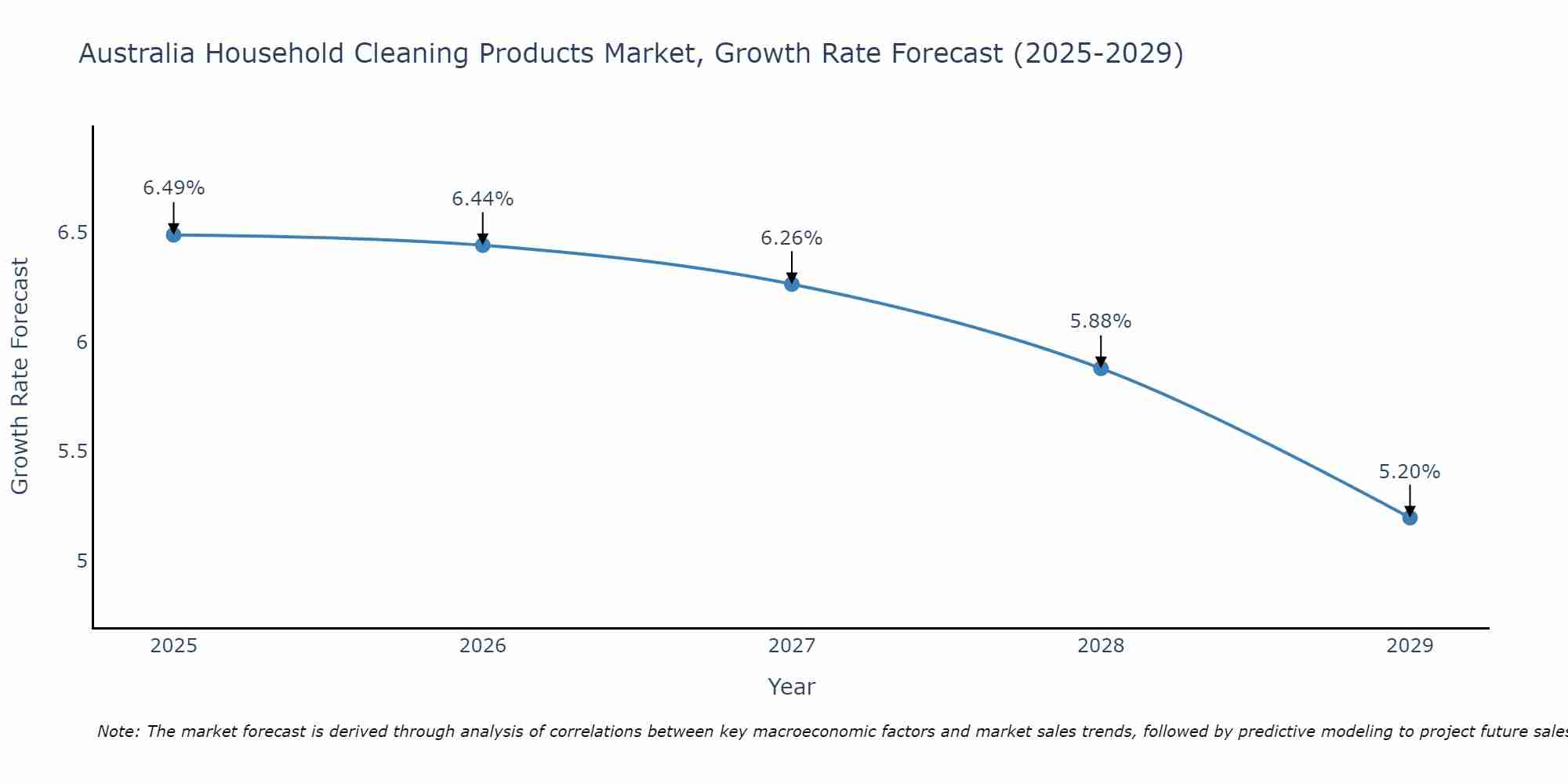

The Australia Household Cleaning Products Market could see a tapering of growth rates over 2025 to 2029. Starting high at 6.49% in 2025, the market steadily declines to 5.20% by 2029.

Australia Household Cleaning Products Market Highlights

| Report Name | Australia Household Cleaning Products Market |

| Forecast period | 2025-2031 |

| CAGR | 5% |

| Growing Sector | Household |

Topics Covered in the Australia Household Cleaning Products Market Report

Australia Household Cleaning Products Market report thoroughly covers the market by product type. The market outlook report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Australia Household Cleaning Products Market Synopsis

Australia Household Cleaning Products Market is navigating through a complex blend of challenges and opportunities. Faced with stiff competition from emerging brands and growing environmental concerns, established companies are pushed towards innovation and sustainability. The increasing demand for eco-friendly, biodegradable products has sparked a shift in the market, encouraging manufacturers to invest in green solutions. Opportunities lie in leveraging technology to enhance product efficiency and consumer convenience, particularly in the realm of smart homes. Additionally, the trend towards organic and natural cleaners offers a fertile ground for brands willing to align with contemporary consumer values focusing on health and environmental responsibility. The push for innovative, recyclable packaging further reflects a market that, despite challenges, is ripe with potential for growth and transformation.

According to 6Wresearch, the Australia Household Cleaning Products Market size is projected to grow at the CAGR of 5% during the forecast period of 2025-2031. One of the major drivers for the growth of the household cleaning products market in Australia is the increasing awareness about personal and environmental health. The rise in concerns over bacteria and germs, particularly during the COVID-19 pandemic, has led to a surge in demand for household cleaning products. In addition, there is a growing trend towards using eco-friendly and natural cleaning products, which is driving the market growth in Australia. Another important driver for the market is the increase in disposable incomes and changing consumer lifestyles. With higher disposable incomes, consumers are willing to spend more on high-quality and premium household cleaning products. In addition, there has been a shift towards smaller households, leading to an increase in demand for convenient and easy-to-use cleaning solutions. The rise of e-commerce has also played a significant role in the growth of the market, making it easier for consumers to access a wide range of products and compare prices. Moreover, online platforms offer discounts and deals, further attracting consumers towards purchasing household cleaning products online. One of the major challenges faced by the household cleaning products market in Australia is the increasing competition from private label brands. These brands offer similar products at lower prices, making it difficult for established brands to maintain their market share. Another challenge is the increasing concerns over the environmental impact of household cleaning products. With consumers becoming more environmentally conscious, there is a growing demand for sustainable and biodegradable alternatives to traditional cleaning products. This has led to additional costs for manufacturers who need to invest in research and development to create eco-friendly products.

Government policies and schemes introduced in the Australia Household Cleaning Products Market

In Australia, the government has introduced various policies and schemes aimed at ensuring the safety and efficacy of household cleaning products. Regulations pertaining to the chemical composition of these products are strictly enforced to minimize environmental impact and ensure consumer safety. Additionally, the Australian Competition and Consumer Commission (ACCC) oversees the market to prevent misleading claims about the sustainability or organic nature of products, fostering a transparent and trustworthy market environment.

Leading players in the Australia Household Cleaning Products Market

The Australia household cleaning products industry is dominated by several key players that have established strong brand recognition and loyalty among consumers. These include multinational corporations such as Unilever, Procter & Gamble, and Reckitt Benckiser, as well as local Australian companies like White King and Earth Choice. These companies are continuously innovating and expanding their product lines to include eco-friendly and natural cleaning solutions, responding to the growing consumer demand for sustainable products.

Future Insight of the Australia Household Cleaning Products Market

The future of the Australia household cleaning products market looks promising, with a notable shift towards green and sustainable cleaning solutions. Consumers are increasingly aware of the environmental impact of their choices and are seeking products that align with their values. This trend is expected to drive innovation in the sector, with companies investing in research and development to produce effective, eco-friendly cleaning products. Furthermore, the rise of e-commerce platforms and online shopping is likely to enhance accessibility and convenience for consumers, further leading to Australia Household Cleaning Products Market Growth.

Market analysis by product Type

According to Dhaval, Research Manager, 6Wresearch, the laundry detergents segment is expected to grow due to the increasing need for hygiene and cleanliness in households, along with advancements in technology leading to better and more efficient products. Additionally, the rise of e-commerce has made it easier for consumers to access a wide variety of laundry detergents from different brands, further contributing to the growth of this segment

Key attractiveness of the report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Australia Household Cleaning Products Market Outlook

- Market Size of Australia Household Cleaning Products Market, 2024

- Forecast of Australia Household Cleaning Products Market, 2031

- Historical Data and Forecast of Australia Household Cleaning Products Revenues & Volume for the Period 2021-2031

- Australia Household Cleaning Products Market Trend Evolution

- Australia Household Cleaning Products Market Drivers and Challenges

- Australia Household Cleaning Products Price Trends

- Australia Household Cleaning Products Porter's Five Forces

- Australia Household Cleaning Products Industry Life Cycle

- Historical Data and Forecast of Australia Household Cleaning Products Market Revenues & Volume By Product Type for the Period 2021-2031

- Historical Data and Forecast of Australia Household Cleaning Products Market Revenues & Volume By Laundry Detergents for the Period 2021-2031

- Historical Data and Forecast of Australia Household Cleaning Products Market Revenues & Volume By Surface Cleaners for the Period 2021-2031

- Historical Data and Forecast of Australia Household Cleaning Products Market Revenues & Volume By Dishwashing Products for the Period 2021-2031

- Historical Data and Forecast of Australia Household Cleaning Products Market Revenues & Volume By Toilet Cleaners for the Period 2021-2031

- Historical Data and Forecast of Australia Household Cleaning Products Market Revenues & Volume By Others for the Period 2021-2031

- Australia Household Cleaning Products Import Export Trade Statistics

- Market Opportunity Assessment By Product Type

- Australia Household Cleaning Products Top Companies Market Share

- Australia Household Cleaning Products Competitive Benchmarking By Technical and Operational Parameters

- Australia Household Cleaning Products Company Profiles

- Australia Household Cleaning Products Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Product Type

- Laundry Detergents

- Surface Cleaners

- Dishwashing Products

- Toilet Cleaners

- Others

Australia Household Cleaning Products Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Australia Household Cleaning Products Market Overview |

| 3.1 Australia Country Macro Economic Indicators |

| 3.2 Australia Household Cleaning Products Market Revenues & Volume, 2021 & 2031F |

| 3.3 Australia Household Cleaning Products Market - Industry Life Cycle |

| 3.4 Australia Household Cleaning Products Market - Porter's Five Forces |

| 3.5 Australia Household Cleaning Products Market Revenues & Volume Share, By Product Type, 2021 & 2031F |

| 4 Australia Household Cleaning Products Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Australia Household Cleaning Products Market Trends |

| 6 Australia Household Cleaning Products Market, By Types |

| 6.1 Australia Household Cleaning Products Market, By Product Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 Australia Household Cleaning Products Market Revenues & Volume, By Product Type, 2021-2031F |

| 6.1.3 Australia Household Cleaning Products Market Revenues & Volume, By Laundry Detergents, 2021-2031F |

| 6.1.4 Australia Household Cleaning Products Market Revenues & Volume, By Surface Cleaners, 2021-2031F |

| 6.1.5 Australia Household Cleaning Products Market Revenues & Volume, By Dishwashing Products, 2021-2031F |

| 6.1.6 Australia Household Cleaning Products Market Revenues & Volume, By Toilet Cleaners, 2021-2031F |

| 6.1.7 Australia Household Cleaning Products Market Revenues & Volume, By Others, 2021-2031F |

| 7 Australia Household Cleaning Products Market Import-Export Trade Statistics |

| 7.1 Australia Household Cleaning Products Market Export to Major Countries |

| 7.2 Australia Household Cleaning Products Market Imports from Major Countries |

| 8 Australia Household Cleaning Products Market Key Performance Indicators |

| 9 Australia Household Cleaning Products Market - Opportunity Assessment |

| 9.1 Australia Household Cleaning Products Market Opportunity Assessment, By Product Type, 2021 & 2031F |

| 10 Australia Household Cleaning Products Market - Competitive Landscape |

| 10.1 Australia Household Cleaning Products Market Revenue Share, By Companies, 2024 |

| 10.2 Australia Household Cleaning Products Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero