Australia Meat Market (2025-2031) | Industry, Companies, Revenue, Forecast, Analysis, Size, Trends, Share, Value, Growth & Outlook

Market Forecast By Product (Chicken, Beef, Pork, Mutton, Others), By Type (Raw, Processed), By Distribution Channel (Departmental Stores, Specialty Stores, Hypermarket/ Supermarket, Online Sales Channel, Others) And Competitive Landscape

| Product Code: ETC171354 | Publication Date: Jan 2022 | Updated Date: Jan 2026 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

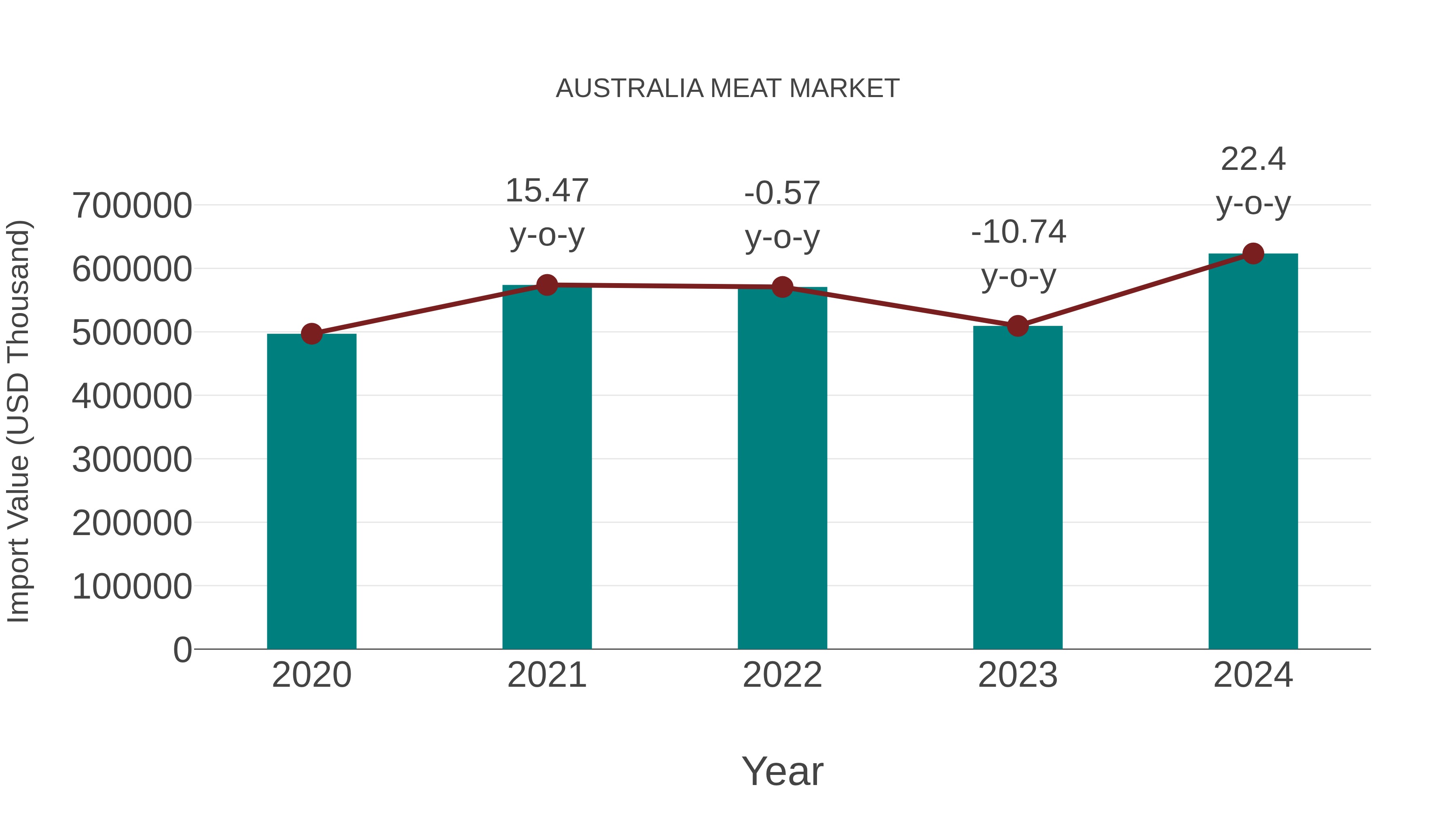

Australia Meat Market: Import Trend Analysis

In the Australia meat market, the import trend exhibited a notable growth rate of 22.4% from 2023 to 2024, with a compound annual growth rate (CAGR) of 5.83% from 2020 to 2024. This import momentum can be attributed to shifting consumer preferences towards premium meat products, indicating a potential demand shift towards higher-quality imports.

Australia Meat Market Highlights

| Report Name | Australia Meat Market |

| Forecast Period | 2025-2031 |

| CAGR | 5.8% |

| Growing Sector | Food Industry |

Topics Covered in the Australia Meat Market

Australia Meat Market report thoroughly covers the market by product, type and distribution channel. The market outlook report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Australia Meat Market Synopsis

Australia Meat Market is likely to grow in the forecast period as Australia is a major global supplier of meat, particularly beef and lamb, exporting to more than 100 countries around the world. Meat production is a significant contributor to the Australia economy, employing thousands of people and generating billions of dollars in revenue each year. One of the most significant trends in Australia's meat market is the increasing demand for high-quality, grass-fed beef and lamb, particularly in the Asia-Pacific region. Consumers are looking for healthier, sustainable meat options that are produced in an ethical manner. Another trend is the shift towards premium cuts of meat, which can command higher prices in international markets.

Moreover, the Australia meat market is currently experiencing significant shifts influenced by various key trends such as the sustainability and Eco-consciousness: A growing number of consumers and businesses are prioritizing sustainability, leading to increased demand for meat products sourced from eco-friendly and ethical practices. This has spurred innovations in animal feed, farming techniques, and waste management to reduce the environmental impact. Moreover, the plant-based meat alternatives are on the rise of vegetarianism. Veganism has introduced a competitive dynamic in the market with the emergence of plant-based meat alternatives. This trend is pushing traditional meat producers to diversify their product offerings to include plant-based options or to improve the sustainability of their meat production processes.

According to 6Wresearch, the Australia Meat Market size is projected to grow at the CAGR of 5.8% during the forecast period of 2025-2031. The meat industry in Australia is being driven by several factors, including the increasing demand for protein-rich diets and the rise in disposable income. As consumers become more health-conscious, they tend to choose higher-quality meat products, which is good news for Australian farmers who produce grass-fed beef and lamb. Also, the increasing demand for processed meat products, especially in emerging markets such as China and India, is fueling the growth of the meat market in Australia. The demand for meat has always been high in the country and abroad. Factors that fuel the growth of Australia's meat market are; the increase in the population of the country, the affluence of people, a shift in their food preferences and the rise in trade agreements with nations that buy Australian meat products. Although the market has seen significant growth over the years, there are still some challenges hindering the Australia Meat Market Growth. Australia's meat market faces challenges such as climate change, animal welfare-related issues, and stringent trade policies. Climate change affects the growth of plants used for animal feed as well as cattle welfare, leading to poor meat quality. Australia faces animal welfare-related challenges such as disease outbreaks, poor living conditions, and poor animal handling practices. Moreover, strict trade policies with countries that purchase meat from Australia affect the prices of exports.

Government policies and schemes introduced in the Australia Meat Market

The A government has implemented several initiatives to support Meat Market in Australia, including investment in research and development, infrastructure, pest and disease control, and animal welfare standards. The Livestock Export Program, for example, supports the export of livestock products to key markets and helps to maintain Australia's strong reputation for high-quality meat products. Australia's government provides support to the meat industry to boost production and improve the quality of its products. The government provides financial support to farmers who comply with strict regulations to help improve animal welfare and work towards sustainable farming practices. Government initiatives such as the establishment of the Australian Beef Sustainability Framework highlight the importance of sustainability in the meat industry. Factors such as the implementation of technology, changing consumer preferences, and innovations in farming practices will positively influence the growth of the industry. In addition, extended trade agreements with countries that purchase Australian meat products will drive the growth rate further.

Leading players in the Australia Meat Market

Australia meat industry is concentrated among a few key players. The largest companies in the sector include JBS, Teys, and AACo. These companies dominate the beef and lamb market, with JBS being the largest beef exporter globally. The pork market is also dominated by a few key players, including SunPork and Rivalea. Smaller players also exist, concentrating on niche markets such as organic or grass-fed meat. Moreover, the Australia meat industry is undergoing a significant transformation, driven by the converging trends of environmental sustainability, technological innovation, and shifting consumer preferences. Traditional meat producers are now contending with the rise of plant-based meat alternatives, compelling them to invest in sustainable practices and broaden their product lines to cater to a more diverse consumer base. Concurrently, advancements in production technology and a strategic pivot towards emerging international markets are creating new opportunities for growth and competition. Amidst these dynamics, the push towards health and nutrition awareness is further intensifying the race, as producers strive to meet the evolving demands for quality, transparency, and environmental responsibility. This intricate competitive environment underscores the industry’s resilience and adaptability in facing the challenges and opportunities of the 21st century.

Future Insight of the Australia Meat Market

The future of the meat industry in Australia looks bright, with the increasing global demand for high-quality meat products as the main driver. However, there are challenges that the industry must overcome, such as the environmental sustainability of the sector, and the increased scrutiny on animal welfare. We can expect to see an increase in technology that helps the industry reduce its environmental impact and becomes more productive.

Market analysis by Product

The chicken segment of Australia's meat market has been experiencing significant growth in recent years. Increased demand for lean protein sources, coupled with the relative affordability of chicken meat, has led to a surge in domestic consumption. Additionally, strong demand for Australian chicken meat in international markets, particularly in Asia, has been driving exports upwards

Market analysis by Type

According to Ravi Bhandari, Research Head, 6Wresearch, The processed meat segment of Australia's market is expected to experience significant growth in the coming years. With busy lifestyles and the convenience of ready-to-eat products, more consumers are opting for processed meat products such as sausages, cold cuts, and meatballs. Additionally, the rising popularity of charcuterie boards and deli-style meats has contributed to the growth of this segment.

Market analysis By Distribution Channel

The hypermarket/supermarket channel remains the dominant distribution channel for meat products in Australia. Consumers prefer to purchase meat products from trusted brands sold at established retail outlets. However, specialty stores and online sales channels have been gaining momentum in recent years. Specialty stores offer a wide range of high-quality meat products, often sourced from small-scale local producers. Online sales channels, on the other hand, offer convenience and a wider selection of products, making it easier for consumers to purchase meat products from the comfort of their homes.

Key attractiveness of the report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Australia Meat Market Outlook

- Market Size of Australia Meat Market, 2024

- Forecast of Australia Meat Market, 2031

- Historical Data and Forecast of Australia Meat Revenues & Volume for the Period 2021-2031

- Australia Meat Market Trend Evolution

- Australia Meat Market Drivers and Challenges

- Australia Meat Price Trends

- Australia Meat Porter's Five Forces

- Australia Meat Industry Life Cycle

- Historical Data and Forecast of Australia Meat Market Revenues & Volume By Product for the Period 2021-2031

- Historical Data and Forecast of Australia Meat Market Revenues & Volume By Chicken for the Period 2021-2031

- Historical Data and Forecast of Australia Meat Market Revenues & Volume By Beef for the Period 2021-2031

- Historical Data and Forecast of Australia Meat Market Revenues & Volume By Pork for the Period 2021-2031

- Historical Data and Forecast of Australia Meat Market Revenues & Volume By Mutton for the Period 2021-2031

- Historical Data and Forecast of Australia Meat Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of Australia Meat Market Revenues & Volume By Type for the Period 2021-2031

- Historical Data and Forecast of Australia Meat Market Revenues & Volume By Raw for the Period 2021-2031

- Historical Data and Forecast of Australia Meat Market Revenues & Volume By Processed for the Period 2021-2031

- Historical Data and Forecast of Australia Meat Market Revenues & Volume By Distribution Channel for the Period 2021-2031

- Historical Data and Forecast of Australia Meat Market Revenues & Volume By Departmental Stores for the Period 2021-2031

- Historical Data and Forecast of Australia Meat Market Revenues & Volume By Specialty Stores for the Period 2021-2031

- Historical Data and Forecast of Australia Meat Market Revenues & Volume By Hypermarket/ Supermarket for the Period 2021-2031

- Historical Data and Forecast of Australia Meat Market Revenues & Volume By Online Sales Channel for the Period 2021-2031

- Historical Data and Forecast of Australia Meat Market Revenues & Volume By Others for the Period 2021-2031

- Australia Meat Import Export Trade Statistics

- Market Opportunity Assessment By Product

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Distribution Channel

- Australia Meat Top Companies Market Share

- Australia Meat Competitive Benchmarking By Technical and Operational Parameters

- Australia Meat Company Profiles

- Australia Meat Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Product

- Chicken

- Beef

- Pork

- Mutton

- Others

By Type

- Raw

- Processed

By Distribution Channel

- Departmental Stores

- Specialty Stores

- Hypermarket/ Supermarket

- Online Sales Channel

- Others

Australia Meat Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Australia Meat Market Overview |

| 3.1 Australia Country Macro Economic Indicators |

| 3.2 Australia Meat Market Revenues & Volume, 2021 & 2031F |

| 3.3 Australia Meat Market - Industry Life Cycle |

| 3.4 Australia Meat Market - Porter's Five Forces |

| 3.5 Australia Meat Market Revenues & Volume Share, By Product, 2021 & 2031F |

| 3.6 Australia Meat Market Revenues & Volume Share, By Type, 2021 & 2031F |

| 3.7 Australia Meat Market Revenues & Volume Share, By Distribution Channel, 2021 & 2031F |

| 4 Australia Meat Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing consumer demand for high-quality meat products |

| 4.2.2 Growth in population and disposable income levels |

| 4.2.3 Rising preference for convenience and processed meat products |

| 4.3 Market Restraints |

| 4.3.1 Stringent regulations related to food safety and quality standards |

| 4.3.2 Health and environmental concerns related to meat consumption |

| 5 Australia Meat Market Trends |

| 6 Australia Meat Market, By Types |

| 6.1 Australia Meat Market, By Product |

| 6.1.1 Overview and Analysis |

| 6.1.2 Australia Meat Market Revenues & Volume, By Product, 2021-2031F |

| 6.1.3 Australia Meat Market Revenues & Volume, By Chicken, 2021-2031F |

| 6.1.4 Australia Meat Market Revenues & Volume, By Beef, 2021-2031F |

| 6.1.5 Australia Meat Market Revenues & Volume, By Pork, 2021-2031F |

| 6.1.6 Australia Meat Market Revenues & Volume, By Mutton, 2021-2031F |

| 6.1.7 Australia Meat Market Revenues & Volume, By Others, 2021-2031F |

| 6.2 Australia Meat Market, By Type |

| 6.2.1 Overview and Analysis |

| 6.2.2 Australia Meat Market Revenues & Volume, By Raw, 2021-2031F |

| 6.2.3 Australia Meat Market Revenues & Volume, By Processed, 2021-2031F |

| 6.3 Australia Meat Market, By Distribution Channel |

| 6.3.1 Overview and Analysis |

| 6.3.2 Australia Meat Market Revenues & Volume, By Departmental Stores, 2021-2031F |

| 6.3.3 Australia Meat Market Revenues & Volume, By Specialty Stores, 2021-2031F |

| 6.3.4 Australia Meat Market Revenues & Volume, By Hypermarket/ Supermarket, 2021-2031F |

| 6.3.5 Australia Meat Market Revenues & Volume, By Online Sales Channel, 2021-2031F |

| 6.3.6 Australia Meat Market Revenues & Volume, By Others, 2021-2031F |

| 7 Australia Meat Market Import-Export Trade Statistics |

| 7.1 Australia Meat Market Export to Major Countries |

| 7.2 Australia Meat Market Imports from Major Countries |

| 8 Australia Meat Market Key Performance Indicators |

| 8.1 Meat consumption per capita |

| 8.2 Consumer spending on meat products |

| 8.3 Number of new product launches in the meat market |

| 9 Australia Meat Market - Opportunity Assessment |

| 9.1 Australia Meat Market Opportunity Assessment, By Product, 2021 & 2031F |

| 9.2 Australia Meat Market Opportunity Assessment, By Type, 2021 & 2031F |

| 9.3 Australia Meat Market Opportunity Assessment, By Distribution Channel, 2021 & 2031F |

| 10 Australia Meat Market - Competitive Landscape |

| 10.1 Australia Meat Market Revenue Share, By Companies, 2024 |

| 10.2 Australia Meat Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2026-2032) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero