Australia Telehealth Market (2021-2027) | Size, Industry, Share, Revenue, Analysis, Forecast, Trends, Outlook & COVID-19 IMPACT

Market Forecast By Types (Tele Hospitals, Tele Homes, mHealth (Mobile Health)), By Components (Products (Software (Integrated, Standalone), Hardware (Medical Peripheral Devices, Monitors (HD, Full HD, 4K/8K)))), By Services (General Practitioner, Specialist Consultation, Mental Health Consultation, Nurse Practitioner Consultation, Allied Health Consultation) and competitive landscape

| Product Code: ETC065608 | Publication Date: Feb 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 84 | No. of Figures: 26 | No. of Tables: 6 |

Australia Telehealth Market Size & Growth Rate

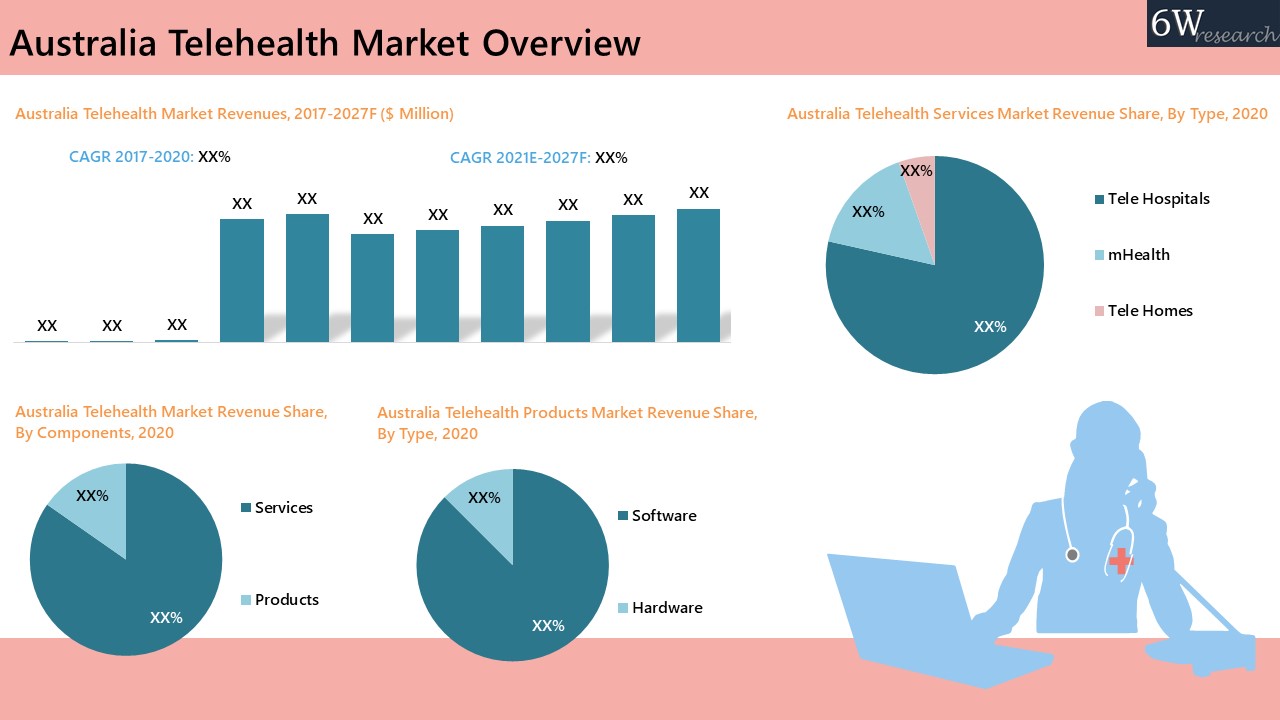

The Australia Telehealth Market is projected to grow at a CAGR of 0.7% during 2021–2027. Growth is driven by government subsidies, an aging population, and increased demand for remote healthcare services amid COVID-19.

Australia Telehealth Market Synopsis

Australia Telehealth Market witnessed significant growth during the period 2017-2020 underpinned by government initiatives to promote telehealth in Australia. Moreover, the outbreak of the COVID-19 pandemic acted as a boon for the telehealth market owing to the social distancing norms which accelerated the use of telehealth services as people were reluctant to visit hospitals for checkups due to the virus. Furthermore, the stringent lockdown imposed across the country forced the people to stay at home and step out only, if necessary, which pushed them to use self-monitoring devices for their routine checkups and video consultations from telehealth services for consulting doctors.

According to 6Wresearch, Australia Telehealth Market size is projected to grow at a CAGR of 0.7% during 2021-2027. Government support in the form of subsidies, a growing aged population, and benefits such as a reduction in waiting time and access to diagnosis & prescriptions from anywhere across the country would bolster the growth of telehealth across the country in the forthcoming years. The growth in the telehealth market in Australia can be further attributed to the factors such as the increasing number of people suffering from chronic diseases in the Australian population, overcrowding of hospitals and the need to reduce healthcare expenditure. Moreover, the technologies like IoT, artificial intelligence, cloud and machine learning would give a major boost to the market owing to the efficiency and security they can provide for the remote monitoring of patients.

The services segment led the Australian telehealth market in 2020 on account of the increasing number of doctors and hospitals joining the telehealth industry for providing healthcare services to patients remotely and the increased emphasis on patient monitoring for elderly people and covid-19 patients. This trend is anticipated to persist during the forecast period as well owing to the increasing adoption of virtual consultations, time convenience, booming internet penetration and companies coming up with innovative ideas for providing better services to patients remotely. The tele hospitals segment accounted for the largest revenue share in 2020 as major hospitals had started virtual consultations under the digitization model of the Australian government, especially during the critical times of COVID-19 when social distancing is a must. In the forecast period, tele hospitals are expected to retain their dominancy owing to the rising adoption of virtual consultations, ease of home delivery of medicines and faster and more convenient doctor appointments.

Market Analysis by Types

On the basis of types, the tele hospitals segment accounted for the largest revenue share in Australia telehealth market revenues in 2020 as major hospitals had started virtual consultations under the digitization model of the Australian government, especially during the critical times of covid-19 when social distancing is a must.

Market Analysis by Components

On the basis of components, Integrated software held the majority market share in the Australia telehealth software market in 2020 owing to its diversified functionalities as compared to standalone software. Integrated software has given an edge to service providers in providing multiple services through a single platform.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Australia Telehealth Market Overview

- Australia Telehealth Market Outlook

- Australia Telehealth Market Forecast

- Historical Data and Forecast of Australia Telehealth Market Revenues for the Period 2017-2027F

- Historical Data and Forecast Australia Telehealth Market Revenues By Type for the Period 2017-2027F

- Historical Data and Forecast Australia Telehealth Market Revenues By Components for the Period of 2017-2027F

- Market Drivers

- Market Restraints

- Market Trends

- Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- Market Player’s Revenue Shares/Ranking

- Market Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

- Market Forecast

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By Types

- Tele Hospitals

- Tele Homes

- mHealth (Mobile Health)

By Components

- Products (Software (Integrated, Standalone)

- Hardware (Medical Peripheral Devices, Monitors (HD, Full HD, 4K/8K))

By Services

- General Practitioner

- Specialist Consultation

- Mental Health Consultation

- Nurse Practitioner Consultation

- Allied Health Consultation

Australia Telehealth Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Australia Telehealth Market Overview |

| 3.1 Australia Telehealth Market Revenues, 2017-2027F |

| 3.2 Australia Telehealth Market Industry Life Cycle |

| 3.3 Australia Telehealth Market Porter’s Five Forces |

| 4. Australia Telehealth Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing demand for remote healthcare services due to the convenience and accessibility of telehealth platforms. |

| 4.2.2 Growing adoption of digital technologies and advancements in telecommunication infrastructure in Australia. |

| 4.2.3 Rising prevalence of chronic diseases and the need for continuous monitoring and management among the population. |

| 4.3 Market Restraints |

| 4.3.1 Limited reimbursement policies and regulatory challenges impacting the widespread adoption of telehealth services. |

| 4.3.2 Concerns regarding data privacy and security hindering trust among patients and healthcare providers. |

| 4.3.3 Unequal access to technology and digital literacy barriers among certain demographic groups in Australia. |

| 5. Australia Telehealth Market Trends |

| 6. Australia Telehealth Market Overview, By Types |

| 6.1 Australia Telehealth Market Revenue Share, By Types, 2020 & 2027F |

| 6.2 Australia Telehealth Market Revenues, By Types, 2017-2027F |

| 6.2.1 Australia Tele hospitals Market Revenues, 2017-2027F |

| 6.2.2 Australia mHealth Market Revenues, 2017-2027F |

| 6.2.3 Australia Tele homes Market Revenues, 2017-2027F |

| 7. Australia Telehealth Market Overview, By Components |

| 7.1 Australia Telehealth Market Revenue Share, By Components, 2020 & 2027F |

| 7.1.1 Australia Telehealth Market Revenues, By Components, 2017-2027F |

| 7.1.1.1 Australia Telehealth Products Market Revenues, 2017-2027F |

| 7.1.1.2 Australia Telehealth Services Market Revenues, 2017-2027F |

| 7.1.2 Australia Telehealth Products Market Revenue Share, By Type, 2020 & 2027F |

| 7.1.2.1 Australia Telehealth Products Market Revenues, By Type, 2017-2027F |

| 7.1.2.1.1 Australia Telehealth Software Market Revenues, 2017-2027F |

| 7.1.2.1.2 Australia Telehealth Hardware Market Revenues, 2017-2027F |

| 7.1.3 Australia Telehealth Software Market Revenue Share, By Type |

| 7.1.3.1 Australia Telehealth Standalone Software Market Revenues, 2017-2027F |

| 7.1.3.2 Australia Telehealth Integrated Software Market Revenues, 2017-2027F |

| 7.1.4 Australia Telehealth Hardware Market Revenue Share, By Types |

| 7.1.4.1 Australia Telehealth Medical Peripheral Devices Market Revenues, 2017-2027F |

| 7.1.4.2 Australia Telehealth Monitors Market Revenues, 2017-2027F |

| 7.1.4.2.1 Australia Telehealth Monitors Market Revenue Share, By Video System Resolution Types |

| 7.1.4.2.1.1 Australia Telehealth Monitors Market Revenues, By HD Resolution, 2017-2027F |

| 7.1.4.2.1.2 Australia Telehealth Monitors Market Revenues, By Full HD Resolution, 2017-2027F |

| 7.1.4.2.1.3 Australia Telehealth Monitors Market Revenues, By 4K/8K Resolution, 2017-2027F |

| 7.1.5 Australia Telehealth Services Market Revenue Share, By Type, 2020 & 2027F |

| 7.1.5.1 Australia Telehealth Services Market Revenues, By Type, 2017-2027F |

| 7.1.5.1.1 Australia Telehealth Services Market Revenues, By Specialist Consultation, 2017-2027F |

| 7.1.5.1.2 Australia Telehealth Services Market Revenues, By Mental Health Consultation, 2017-2027F |

| 7.1.5.1.3 Australia Telehealth Services Market Revenues, By General Practitioner, 2017-2027F |

| 7.1.5.1.4 Australia Telehealth Services Market Revenues, By Nurse Practitioner Consultation, 2017-2027F |

| 7.1.5.1.5 Australia Telehealth Services Market Revenues, By Allied Health Consultation, 2017-2027F |

| 8. Australia Telehealth Market Key Performance Indicators |

| 9. Australia Telehealth Market Opportunity Assessment |

| 9.1 Australia Telehealth Market Opportunity Assessment, By Type, 2027F |

| 9.2 Australia Telehealth Market Opportunity Assessment, By Components, 2027F |

| 9.3 Australia Telehealth Products Market Opportunity Assessment, By Type, 2027F |

| 9.4 Australia Telehealth Services Market Opportunity Assessment, By Service Type, 2027F |

| 10. Australia Telehealth Market Competitive Landscape |

| 10.1 Australia Telehealth Market Revenue Ranking, By Companies, 2021 |

| 10.2 Australia Telehealth Market Competitive Benchmarking |

| 10.2.1 Australia Telehealth Market Competitive Benchmarking, By Technical Parameters |

| 10.2.2 Australia Telehealth Market Competitive Benchmarking, By Operating Parameters |

| 11. Company Profiles |

| 11.1 GP2U Telehealth Pty Ltd. |

| 11.2 Visionflex Pty Ltd. |

| 11.3 Clintel System Pty Ltd. |

| 11.4 Doctoroo Australia Pty Ltd. |

| 11.5 Coviu Global Pty Ltd. |

| 11.6 Doctors on Demand Pty Ltd. |

| 11.7 Docto Holding Pty Ltd. |

| 11.8 SwiftDoc Pty Ltd. |

| 11.9 Red Guava Pty Ltd. |

| 11.10 Instant Consult Pty Ltd. |

| 11.11 Health Engine Pty Ltd. |

| 12. Key Strategic Recommendations |

| 13. Disclaimer |

| List of Figures |

| Figure 1. Australia Telehealth Market Revenues, 2017-2027F ($ Million) |

| Figure 2. Australia Telehealth Consultations since Covid-19, Mar202-Mar 2021 (Million) |

| Figure 3. Australia Telehealth General Practitioner Consultations, Mar 2020 – Mar 2021 (Million) |

| Figure 4. Australia Telehealth Mental Health Consultations, Mar 2020 – Mar 2021 (Thousands) |

| Figure 5. Australia Telehealth Specialist Consultations, Mar 2020 – Mar 2021 (Thousands) |

| Figure 6. Australia Telehealth Nurse Practitioner Consultations, Mar 2020 – Mar 2021 (Thousands) |

| Figure 7. Australia Telehealth Market Revenue Share, By Type, 2020 & 2027F |

| Figure 8. Australia Telehealth Market Revenue Share, By Components, 2020 & 2027F |

| Figure 9. Australia Telehealth Products Market Revenues, 2017-2027F ($ Million) |

| Figure 10. Australia Telehealth Services Market Revenues, 2017-2027F ($ Million) |

| Figure 11. Australia Telehealth Products Market Revenue Share, By Type, 2020 & 2027F |

| Figure 12. Australia Telehealth Software Market Revenues, 2017-2027F ($ Million) |

| Figure 13. Australia Telehealth Hardware Market Revenues, 2017-2027F ($ Million) |

| Figure 14. Australia Telehealth Software Market Revenue Share, By Type, 2020 & 2027F |

| Figure 15. Australia Telehealth Hardware Market Revenue Share, By Type, 2020 & 2027F |

| Figure 16. Australia Telehealth Monitors Market Revenue Share, By Video System Resolution Type, 2020 & 2027F |

| Figure 17. Australia Telehealth Services Market Revenue Share, By Types, 2020 & 2027F |

| Figure 18. Percentage of Internet Users in Australia, 2014-2020 |

| Figure 19. Number of Patients treated by telehealth providers, 2016 & 2020 (Million) |

| Figure 20. Number of Telehealth providers, 2018 & 2020 |

| Figure 21. Percentage of Urban Population in Australia, FY2015-FY2020 |

| Figure 22. Percentage of Population above 65 years in Australia, FY2000-FY2020 |

| Figure 23. Australia Telehealth Market Opportunity Assessment, By Types, 2027F |

| Figure 24. Australia Telehealth Market Opportunity Assessment, By Components, 2027F |

| Figure 25. Australia Telehealth Products Market Opportunity Assessment, By Type, 2027F |

| Figure 26. Australia Telehealth Services Market Opportunity Assessment, By Type, 2027F |

| List of Tables |

| Table 1. Services, Providers and Benefits Paid from July 1, 2017-December 31,2018 |

| Table 2. Australia Telehealth Market Revenues, By Type, 2017-2027F ($ Million) |

| Table 3. Australia Telehealth Software Market Revenues, By Type, 2017-2027F ($ Million) |

| Table 4. Australia Telehealth Hardware Market Revenues, By Type, 2017-2027F ($ Million) |

| Table 5. Australia Telehealth Monitors Market Revenues, By Video System Resolution Type, 2017-2027F ($ Million) |

| Table 6. Australia Telehealth Services Market Revenues, By Types, 2017-2027F ($ Million) |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero