Australia UPS Systems Market (2022-2028) | Outlook, Growth, COVID-19 IMPACT, Analysis, Size, Companies, Trends, Share, Forecast, Industry, Value & Revenue

Market Forecast By KVA Ratings (Below 1 KVA, 1.1-5 KVA, 5.1-20 KVA, 20.1-50 KVA, 50.1-200 KVA and Above 200 KVA), By Applications (Residential, Industrial and Commercial including Offices, Healthcare, BFSI, Hospitality, Education, Data Center and Others), By Regions (Northern, Southern, Central) and Competitive Landscape

| Product Code: ETC060966 | Publication Date: May 2022 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 80 | No. of Figures: 23 | No. of Tables: 7 |

Australia UPS Systems Market report comprehensively covers the market by kVA rating, applications, phases, and regions. Australia UPS systems market report provides an unbiased and detailed analysis of the on-going trends, opportunities/high growth areas, market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Australia UPS Systems Market Synopsis

Australia UPS Systems market is anticipated to grow significantly on the back of rapidly growing commercial sector. Also, presence of major industrial projects such as New South Wales Housing Project, Sydney Metro and Western Sydney Airport would boost the demand for UPS systems market in the region. However, the outbreak of COVID-19 pandemic led to a halt in the business operations, manufacturing activities and the stringent lockdown imposed in Australia decreased the overall output of the country. Additionally, the growth of the information technology sector along with construction of data centers and office spaces would drive the Australia UPS systems market growth in coming years.

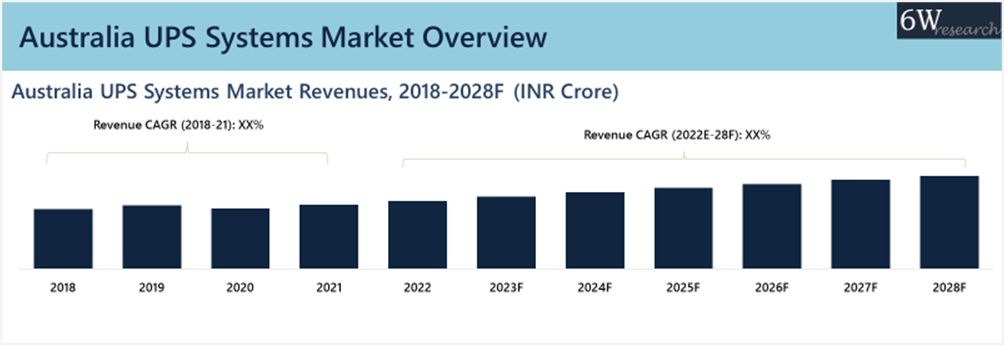

According to 6Wresearch, Australia UPS Systems Market size is projected to grow at a CAGR of 5.3% during 2022-2028. Due to the outbreak of coronavirus in 2020, which impacted the supply chain disruptions and difficulties in sourcing products which halted construction activities in the commercial and hospitality sector resulted in decline for UPS market. However, the market revived soon on the back of increasing government support towards growth and strengthening of healthcare system as well as data centers.

Market by Phases

3 phase UPS systems dominated the market revenue share in 2021, owing to their wide applicability across several domains such as the industrial and BFSI sectors. The growing number of data centers and the expanding industrial sector are expected to fuel demand for three-phase UPS systems across the country, and the segment is expected to continue to lead the market in the coming years.

Market by Applications

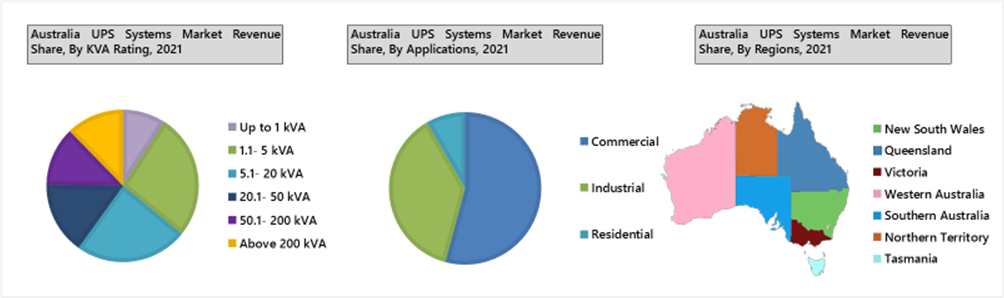

The commercial segment is dominating in Australia UPS systems market share in terms of revenue on account of its high application in data centers, and IT sector. Government efforts to strengthen the healthcare sector on account of pandemic also contributed to the rise in the application of UPS systems in the commercial sector. In the coming years, the commercial sector would continue to maintain a dominant position in the market on account of increasing investments in services such as BFSI, healthcare, communications & media services.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2018 to 2021.

- Base Year: 2021

- Forecast Data until 2028.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Australia UPS Systems Market Overview

- Australia UPS Systems Market Outlook

- Australia UPS Systems Market Forecast

- Historical Data and Forecast of Australia UPS Systems Market Revenues and Volume, for the Period 2018-2028F

- Historical Data and Forecast of Australia UPS Systems Market Revenues and Volume, By kVA Rating, for the Period 2018-2028F

- Historical Data and Forecast of Australia UPS Systems Market Revenues, By Phases, for the Period 2018-2028F

- Historical Data and Forecast of Australia UPS Systems Market Revenues, By Applications, for the Period 2018-2028F

- Historical Data and Forecast of Australia UPS Systems Market Revenues, By Regions, for the Period 2018-2028F

- Australia UPS Systems Market Drivers and Restraints

- Australia UPS Systems Market Trends

- Porter’s Five Forces Analysis

- Market Opportunity Assessment

- Australia UPS Systems Market Revenue Share, By Companies

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By KVA Ratings

- Below 1 KVA

- 1.1-5 KVA

- 5.1-20 KVA

- 20.1-50 KVA

- 50.1-200 KVA and

- Above 200 KVA

By Applications

- Residential

- Industrial and Commercial including Offices

- Healthcare

- BFSI

- Hospitality

- Education

- Data Center and

- Others

By Regions

- Northern

- Southern

- Central

Australia UPS Systems Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Methodology |

| 2.5. Assumptions |

| 3. Australia UPS Systems Market Overview |

| 3.1 Australia UPS Systems Market Revenues & Volume, 2018-2028F |

| 3.2 Australia UPS Systems Market Industry Life Cycle |

| 3.3 Australia UPS Systems Market Ecosystem |

| 3.4 Australia UPS Systems Market Porter’s Five Forces |

| 3.5 Australia UPS Systems Market Revenue & Volume Share, By kVA Rating, 2021 & 2028F |

| 3.6 Australia UPS Systems Market Revenue Share, By Phases, 2021 & 2028F |

| 3.7 Australia UPS Systems Market Revenue Share, By Applications, 2021 & 2028F |

| 3.8 Australia UPS Systems Market Revenue Share, By Regions, 2021 & 2028F |

| 4. Impact Analysis of Covid-19 on Australia UPS Systems Market |

| 5. Australia UPS Systems Market Dynamics |

| 5.1. Impact Analysis |

| 5.2. Market Drivers |

| 5.2.1 Increasing demand for reliable power supply solutions |

| 5.2.2 Growing adoption of cloud computing and data centers |

| 5.2.3 Government initiatives promoting green energy solutions |

| 5.3. Market Restraints |

| 5.3.1 High initial investment costs of UPS systems |

| 5.3.2 Limited awareness and understanding of UPS technology among end-users |

| 5.3.3 Intense competition from alternative power backup solutions |

| 6. Australia UPS Systems Market Trends & Evolution |

| 7. Australia UPS Systems Market Overview, By kVA Rating |

| 7.1 Australia UPS Systems Market Revenues and Volume, By Up to 1kVA, 2018-2028F |

| 7.2 Australia UPS Systems Market Revenues and Volume, By 1.1- 5kVA, 2018-2028F |

| 7.3 Australia UPS Systems Market Revenues and Volume, By 5.1-20kVA, 2018-2028F |

| 7.4 Australia UPS Systems Market Revenues and Volume, By 20.1-50kVA, 2018-2028F |

| 7.5 Australia UPS Systems Market Revenues and Volume, By 50.1-200kVA, 2018-2028F |

| 7.6 Australia UPS Systems Market Revenues and Volume, By Above 200kVA, 2018-2028F |

| 8. Australia UPS Systems Market Overview, By Phases |

| 8.1 Australia UPS Systems Market Revenues, By 1 Phase, 2018-2028F |

| 8.2 Australia UPS Systems Market Revenues, By 3 Phase, 2018-2028F |

| 9. Australia UPS Systems Market Overview, By Applications |

| 9.1 Australia Residential UPS Systems Market Revenues, 2018-2028F |

| 9.2 Australia Industrial UPS Systems Market Revenues, 2018-2028F |

| 9.3 Australia Commercial UPS Systems Market Revenues, 2018-2028F |

| 9.3.1 Australia UPS Systems Market Revenue Share, By Commercial Application, 2021 & 2028F |

| 9.3.2 Australia UPS Systems Market Revenues, By Commercial Application, 2018-2028F |

| 10. Australia UPS Systems Market Overview, By Regions |

| 10.1 Australia UPS Systems Market Revenues, By New South Wales, 2018-2028F |

| 10.2 Australia UPS Systems Market Revenues, By Queensland, 2018-2028F |

| 10.3 Australia UPS Systems Market Revenues, By Victoria, 2018-2028F |

| 10.4 Australia UPS Systems Market Revenues, By Western Australia, 2018-2028F |

| 10.5 Australia UPS Systems Market Revenues, By Southern Australia, 2018-2028F |

| 10.6 Australia UPS Systems Market Revenues, By Northern Territory, 2018-2028F |

| 10.7 Australia UPS Systems Market Revenues, By Tasmania, 2018-2028F |

| 11. Australia UPS Systems Market – Key Performance Indicators |

| 11.1 Energy efficiency improvements in UPS systems |

| 11.2 Adoption rate of UPS systems in critical infrastructure sectors |

| 11.3 Frequency of power outages and downtime reduction achieved with UPS installations |

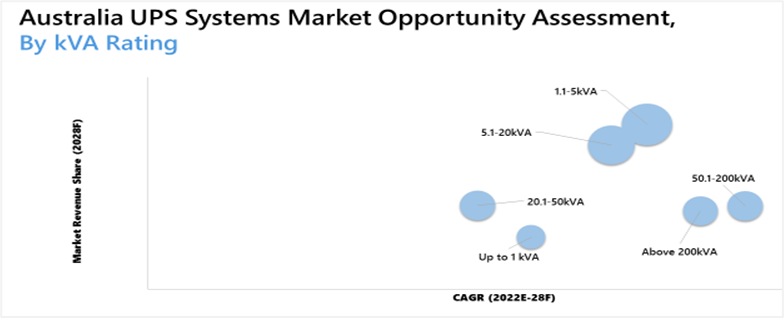

| 12. Australia UPS Systems Market Opportunity Assessment |

| 12.1 Australia UPS Systems Market Opportunity Assessment, By kVA Rating, 2028F |

| 12.2 Australia UPS Systems Market Opportunity Assessment, By Phases, 2028F |

| 12.3 Australia UPS Systems Market Opportunity Assessment, By Applications, 2028F |

| 12.4 Australia UPS Systems Market Opportunity Assessment, By Regions, 2028F |

| 13. Australia UPS Systems Market - Competitive Landscape |

| 13.1 Australia UPS Systems Market Revenue Share, By Companies, 2021 |

| 13.2 Australia UPS Systems Market Competitive Benchmarking, By Operating Parameters |

| 14. Company Profiles |

| 14.1 ABB Group |

| 14.2 Cyberpower Systems Inc. |

| 14.3 Delta Electronics (NZ) Ltd. |

| 14.4 Eaton Corporation plc |

| 14.5 Helios Power Solutions |

| 14.6 Riello UPS Ltd. |

| 14.7 Schneider Electric (NZ) Ltd. |

| 14.8 Socomec Group |

| 14.9 Legrand Group |

| 14.10 Vertiv Holdings LLC |

| 15. Key Strategic Recommendations |

| 16. Disclaimer |

| List of Figures |

| Figure 1: Australia UPS Systems Market Revenues & Volume, 2018-2028F ($ Million, Thousand Units) |

| Figure 2: Australia UPS Systems Market Revenue Share, By kVA Rating, 2021 & 2028F |

| Figure 3: Australia UPS Systems Market Volume Share, By kVA Rating, 2021 & 2028F |

| Figure 4: Australia UPS Systems Market Revenue Share, By Phases, 2021 & 2028F |

| Figure 5: Australia UPS Systems Market Revenue Share, By Applications, 2021 & 2028F |

| Figure 6: Australia UPS Systems Market Revenue Share, By Regions, 2021 & 2028F |

| Figure 7: Australia Data Center Infrastructure Overview, 2021 |

| Figure 8: Australia Annual Electricity Consumption (Terawatt hours), 2020-2021 |

| Figure 9: Urban Population in Australia (% of total population), 2010-2035 |

| Figure 10: Lead Prices (USD/ Metric Ton), 2021-2022 |

| Figure 11: Australia UPS Systems Market Revenue Share, By Commercial Application, 2021 & 2028F |

| Figure 12:City-wise Australia Upcoming First Class and Luxury Hotel Projects, 2021- 2024F (No. of Projects) |

| Figure 13: Australia Upcoming First Class & Luxury Hotel Projects, 2021-2024F, (No. of Projects) |

| Figure 14: Australia Upcoming Hotel Projects, 2022-2027F |

| Figure 15: Average Annual Investment in Australia, 2016-40F ($ Billion) |

| Figure 16: Infrastructure Investment in Australia, % of GDP, 2016-40F |

| Figure 17: Australia Total Health Spending Overview, 2014-2019 ($ Billion) |

| Figure 18: Australia UPS Systems Market Opportunity Assessment, By kVA Rating, 2028F |

| Figure 19: Australia UPS Systems Market Opportunity Assessment, By Phases, 2028F |

| Figure 20: Australia UPS Systems Market Opportunity Assessment, By Applications, 2028F |

| Figure 21: Australia UPS Systems Market Opportunity Assessment, By Regions, 2028F |

| Figure 22: Australia UPS Systems Market Revenue Share, By Companies, 2021 |

| Figure 23: Australia Industrial Rental Uplifts, By Cities, 2021 |

| List of Tables |

| Table 1: Australia UPS Systems Market Revenues, By kVA Rating, 2018-2028F ($ Million) |

| Table 2: Australia UPS Systems Market Volume, By kVA Rating, 2018-2028F (Thousand Units) |

| Table 3: Australia UPS Systems Market Revenues, By Phases, 2018-2028F ($ Million) |

| Table 4: Australia UPS Systems Market Revenues, By Applications, 2018-2028F ($ Million) |

| Table 5: Australia UPS Systems Market Revenues, By Commercial Applications, 2018-2028F ($ Million) |

| Table 6: Australia UPS Systems Market Revenues, By Regions, 2018-2028F ($ Million) |

| Table 7: Cumulative Infrastructure Investment Estimate in Australia, 2016-40F ($ Billion) |

Market Forecast By KVA Ratings (Up to 1 KVA, 1.1-5 KVA, 5.1-20 KVA, 20.1-50 KVA, 50.1-200 KVA and Above 200 KVA), By Applications (Residential, Industrial and Commercial including Offices, Healthcare, BFSI, Hospitality, Education, Data Center and Others), By Regions (New South Wales, Southern Australia, Western Australia, Queensland, Tasmania, Victoria and Northern Territory Australia) and Competitive Landscape

| Product Code: ETC060966 | Publication Date: Aug 2021 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 83 | No. of Figures: 22 | No. of Tables: 8 |

Australia UPS Systems Market report thoroughly covers the market by kVA rating, phases, applications and regions. The report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Australia UPS Systems Market Synopsis

Australia UPS Systems Market witnessed modest growth during the period 2017-2020 underpinned by rapid growth in the commercial sector on account of development in the information technology sector. An increasing number of data centers and colocation facilities in the country are the major drivers for UPS market in Australia. The growing application of UPS systems in government services, data centers, healthcare, and education are further going to contribute to the increasing demand for UPS systems in Australia. However, the outbreak of the COVID-19 pandemic led to a halt in business operations, manufacturing activities and the stringent lockdown imposed in Australia decreased the overall output of the country. The falling demand from commercial and manufacturing sectors have hampered the growth of the UPS market in IT/ ICT, and BFSI sector. Nevertheless, the commercial sector is expected to witness a fast recovery in the coming years owing to government support towards growth and strengthening of the healthcare system as well as data centers.

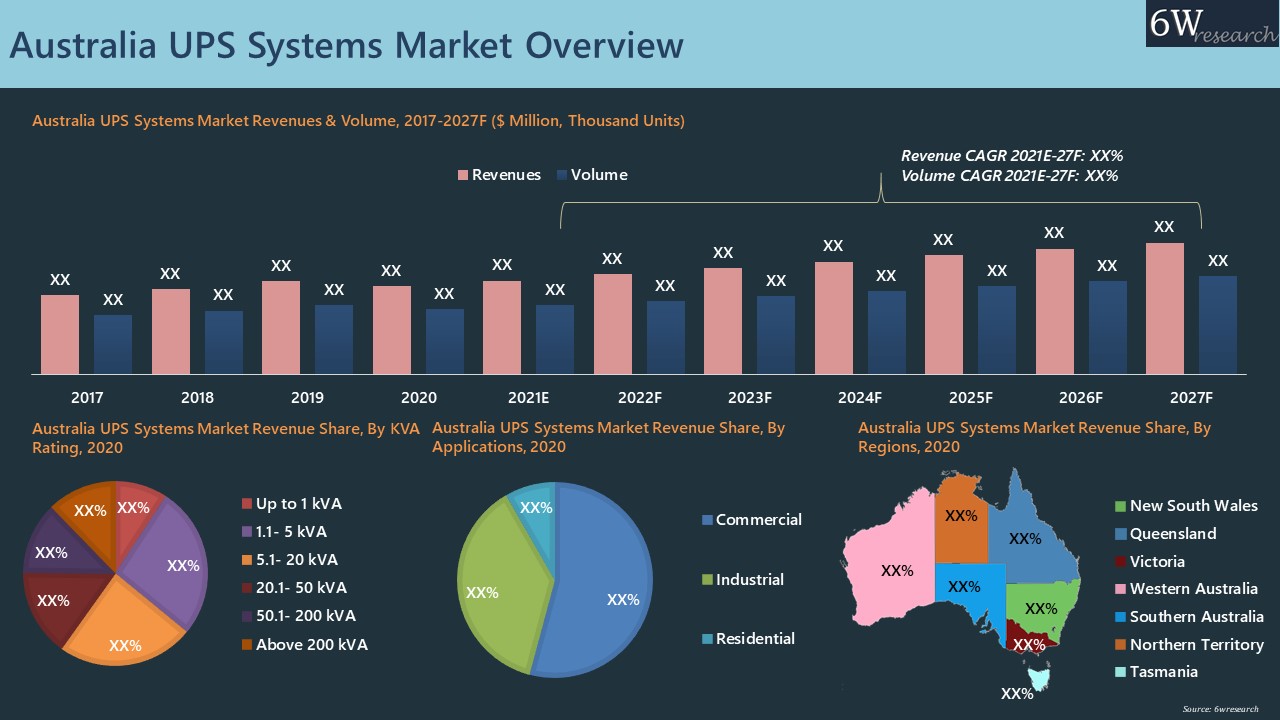

According to 6Wresearch, Australia UPS Systems Market size is projected to grow at CAGR of 5.8% during 2021-27. Rising investment in the IT sector along with the development of cloud computing and data centers augmented the market for UPS systems in 2020. Increasing spending by government in infrastructure and industrial projects such as New South Wales Housing Project, Sydney Metro, Western Sydney Airport, Amaroo Phosphate Project, Asian Renewable Energy Hub and Australia Vanadium Project would drive the demand of UPS systems in the industrial sector in Australia. In 2020, 3 Phase UPS systems garnered majority revenue size in the market and would continue to dominate the market on account of its application in upcoming data centers such as DCI and Macquarie data center. Moreover, the 3 Phase UPS systems would witness greater demand in the coming years owing to Australia’s Digital Economy Strategy, 2030 which would focus on cybersecurity, digitization of SME’s and non-profit organizations, and government services.

Market Analysis by kVA Rating

In terms kVA ratings, 1.1-5 kVA rating UPS systems had majority revenue share in 2020 and would continue to dominate the market during the forecast period owing to increasing application in household and small businesses for power back up of personal computer and other appliances.3 Phase UPS systems garnered majority revenue size in Australia UPS systems market and would continue to dominate the market on account of its application in upcoming data centres such as DCI and Macquarie data center. Moreover, the 3 Phase UPS systems would witness greater demand in the coming years owing to Australia’s Digital Economy Strategy, 2030 which would focus on cybersecurity, digitization of SME’s and non-profit organizations, and government services.

Market Analysis by Application

On the basis of application, the commercial sector captured the majority of market revenue share in 2020 and the segment is expected to dominate the overall market in the forecast period as well. The data centres, BFSI and healthcare sector are the key verticals generating major demand for UPS systems in commercial sector.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report

- Australia UPS Systems Market Overview

- Australia UPS Systems Market Outlook

- Australia UPS Systems Market Forecast

- Historical Data and forecast of Australia UPS Systems Market Revenues for the Period, 2017- 2027F

- Historical data and Forecast of Revenues, By kVA Rating, for the Period, 2017-2027F

- Historical data and Forecast of Revenues, By Phases, for the Period, 2017-2027F

- Historical data and Forecast of Revenues, By Applications, for the Period, 2017-2027F

- Historical data and Forecast of Revenues, By Regions, for the Period, 2017-2027F

- Market Drivers and Restraints

- Australia UPS Systems Market Trends

- Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- Australia UPS Systems Market Share, By Market Players

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

- By kVA Ratings:

- Upto 1 kVA

- 1-5 kVA

- 1-20 kVA

- 1-50 kVA

- 1-200 kVA

- Above 200 kVA

- By Phase:

- 1 Phase

- 3 Phase

- By Applications:

- Residential

- Commercial

- Industrial

- By Regions

- New South Wales

- Queensland

- Victoria

- Western Australia

- Southern Australia

- Northern Territory

- Tasmania

Frequently Asked Questions About the Market Study:

- Does the report consider COVID-19 impact?

The report not only has considered COVID-19 impact but also current market dynamics, trends and KPIs into consideration.

- How much growth is expected in the Australia UPS Systems Market over the coming years?

Australia UPS Systems Market revenue is anticipated to record a CAGR of 5.8% during 2021-27.

- Which segment has captured key share of the market?

Commercial segment has dominated the overall market revenues in the year 2020.

- Which segment is exhibited to gain traction over the forecast period?

1.1 - 5 KVA rating is expected to record key growth throughout the forecast period 2021-27.

- Who are key the key players of the market?

The key players of the market include- ABB Group, Cyberpower Systems Inc., Delta Electronics Pty Ltd., Eaton Corporation plc, Helios Power Solutions Group, Riello Power Systems GmBH, Schneider Electric Australia Pty Ltd., Socomec Group, Tripp-Lite, Vertiv Holdings LLC

- Is customization available in the market study?

Yes, we can do customization as per your requirements. Please feel free to write to us sales@6wresearch.com for any customized or any other requirements

- We also want to have market reports for other countries/regions.

6Wresearch has the database of more than 60 countries globally, which can make us your first choice of all your research needs.

Other Key Reports Available:

- India UPS Systems Market (2021-2027)

- Middle East UPS Systems Market (2021-2027)

- New Zealand UPS Systems Market (2021-2027)

- United States UPS Systems Market (2021-2027)

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Switchgear Market Outlook (2026 - 2032) | Size, Share, Trends, Growth, Revenue, Forecast, Analysis, Value, Outlook

- Pakistan Contraceptive Implants Market (2025-2031) | Demand, Growth, Size, Share, Industry, Pricing Analysis, Competitive, Strategic Insights, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Companies, Challenges

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero