Bangladesh Aluminum Market (2025-2029) | Forecast, Companies, Value, Share, Revenue, Outlook, Trends, Analysis, Size, Growth & Industry

Market Forecast By Type (Primary, Secondary), By Product Type (Flat Rolled, Castings , Extrusions , Forgings , Pigments & Powder, Rod & Bar), By End-users (Transport, Building & Construction, Electrical Engineering, Consumer Goods, Foil & Packaging, Machinery & Equipment, Others) And Competitive Landscape

| Product Code: ETC034432 | Publication Date: Jun 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

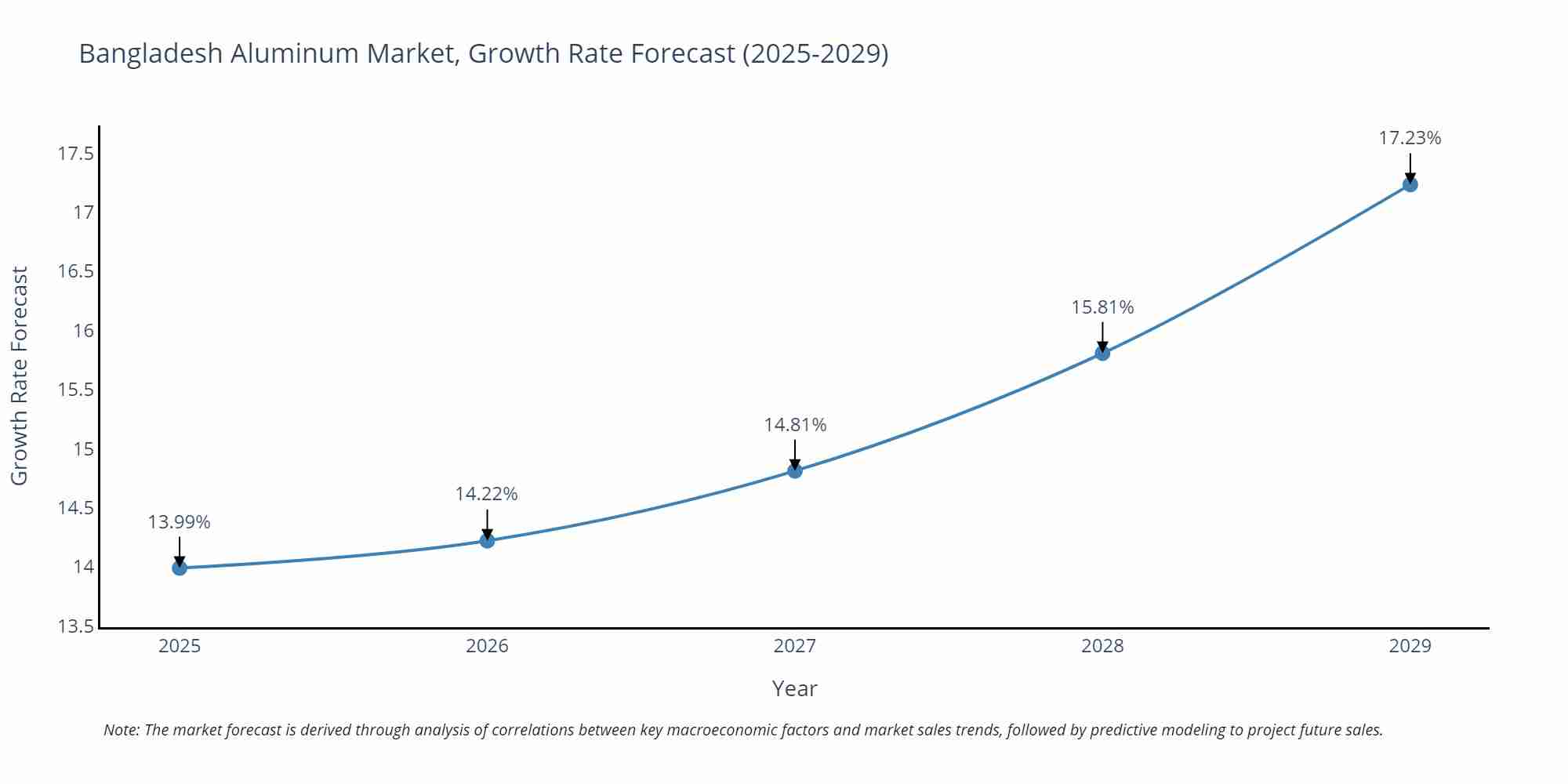

Bangladesh Aluminum Market Size Growth Rate

The Bangladesh Aluminum Market is likely to experience consistent growth rate gains over the period 2025 to 2029. The growth rate starts at 13.99% in 2025 and reaches 17.23% by 2029.

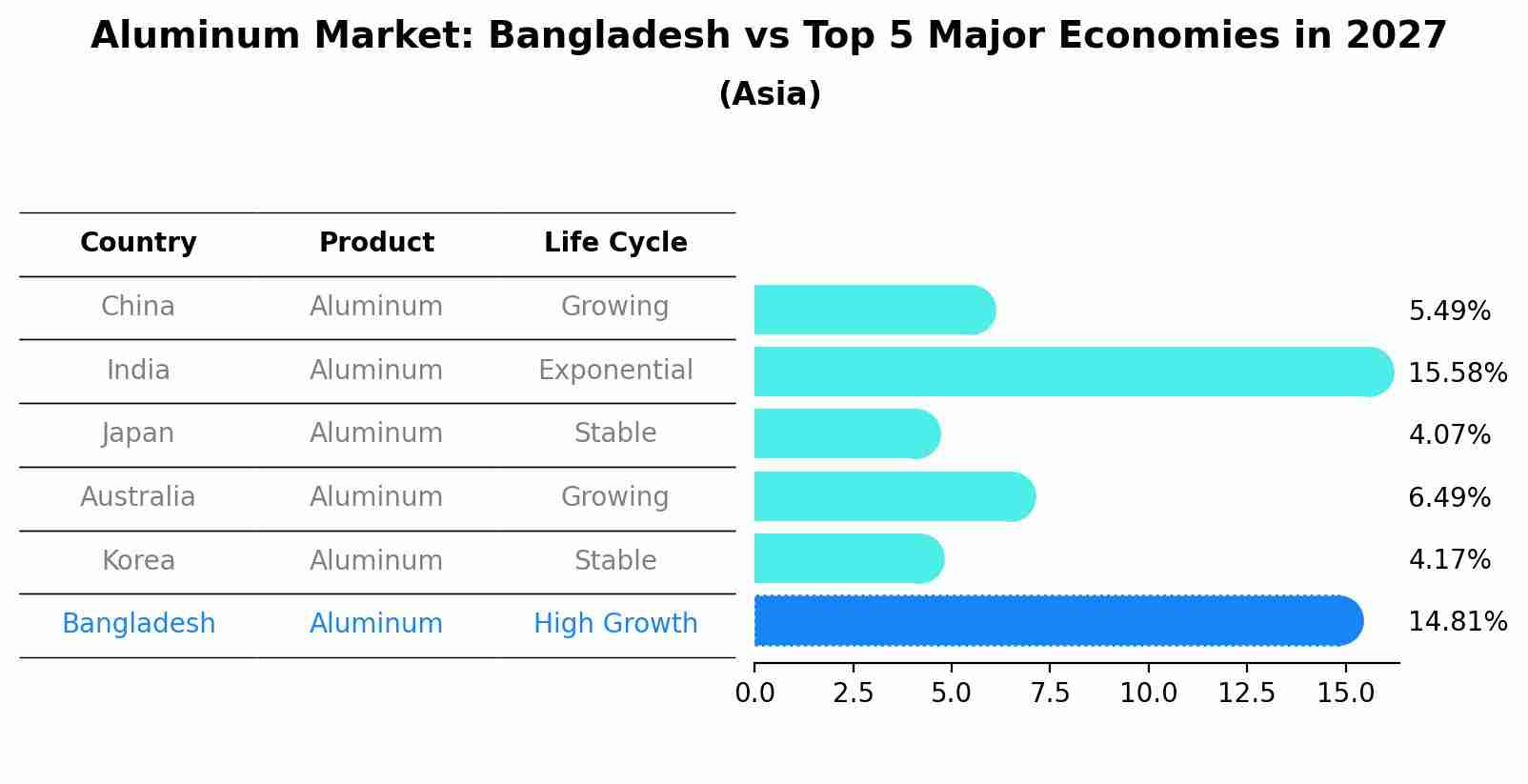

Aluminum Market: Bangladesh vs Top 5 Major Economies in 2027 (Asia)

Bangladesh's Aluminum market is anticipated to experience a high growth rate of 14.81% by 2027, reflecting trends observed in the largest economy China, followed by India, Japan, Australia and South Korea.

Bangladesh Aluminum Market Highlights

| Report Name | Bangladesh Aluminum Market |

| Forecast Period | 2025-2029 |

| Market Size | USD 1.3 Billion by 2029 |

| CAGR | 6.8% |

| Growing Sector | Manufacturing and Infrastructure |

Topics Covered in the Bangladesh Aluminum Market Report

The Bangladesh Aluminum Market report thoroughly covers the segmentation by type, product type, and end-users. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Bangladesh Aluminum Market Size & Analysis

The Bangladesh Aluminum Market Size was valued at approximately USD 0.9 billion and is projected to reach USD 1.3 billion by 2029, growing at a CAGR of 6.8% over the forecast period. This growth is driven by increasing demand in various sectors like transportation, construction, and packaging. The market is significantly supported by infrastructural developments, growing industrialization, and government initiatives to promote manufacturing industries. The construction of new buildings and the expansion of industrial zones are particularly contributing to the increased consumption of aluminum. With advancements in aluminum recycling technology and an increased focus on sustainability, the Bangladesh Aluminum Market is expected to expand further.

Bangladesh Aluminum Market Synopsis

The Bangladesh Aluminum Market has experienced substantial growth due to rising industrial demand, particularly in sectors such as transportation, construction, and packaging. The growing focus on sustainable building practices and energy-efficient materials has boosted the demand for aluminum products. Additionally, the government’s push for urbanization and infrastructure development has further contributed to the market’s growth. Increasing consumer preference for lightweight materials, particularly in the automotive and transportation sectors, has led to a rise in aluminum usage. Bangladesh’s aluminum market is expected to continue to grow as new production facilities and technologies are introduced, meeting the demands of both domestic and international markets.

According to 6Wresearch, the Bangladesh Aluminum Market is expected to grow at a significant CAGR of 6.8% during the forecast period 2025-2029. Several factors are driving the growth of the Bangladesh Aluminum Market. One of the key drivers is the rapid urbanization and infrastructure development taking place in the country. The rise in residential, commercial, and industrial construction projects has increased the demand for aluminum, particularly for use in building materials like windows, doors, and facades. Additionally, the growing automotive and transportation sectors are driving the demand for lightweight materials such as aluminum, which offer energy efficiency and performance benefits. The government’s focus on sustainable building practices and eco-friendly construction materials is also a major contributing factor, as aluminum is considered a sustainable and recyclable material. The growth in manufacturing capabilities and aluminum recycling also supports the sector’s development, contributing to Bangladesh Aluminum Market growth.

Despite the growth opportunities, the Bangladesh Aluminum Market faces several challenges. One of the main obstacles is the high cost of aluminum production, particularly for primary aluminum, which depends on raw material imports such as bauxite. Fluctuating global aluminum prices and supply chain disruptions pose additional challenges to the market’s stability. Furthermore, the market faces competition from alternative materials like steel and plastics, which are often used in place of aluminum in certain applications. The lack of domestic bauxite reserves also hinders the long-term sustainability of the aluminum industry in Bangladesh. Furthermore, the slow pace of technological adoption in some sectors and limited infrastructure for aluminum recycling present barriers to further growth.

Bangladesh Aluminum Market Trends

The Bangladesh Aluminum Market is witnessing several key trends, particularly in terms of technological advancements and consumer behavior. Companies in the sector are adopting modern technologies to improve production efficiency and meet the growing demand for high-quality aluminum products. Digital platforms and automation technologies are increasingly being used to streamline manufacturing processes and enhance customer engagement. Aluminum producers are focusing on developing lightweight and durable products to meet the demands of the automotive and aerospace sectors. Another important trend is the growing focus on sustainability, with manufacturers investing in green technologies such as aluminum recycling and energy-efficient production processes. These advancements are aligned with global sustainability goals, positioning the aluminum sector in Bangladesh for long-term growth.

Investment Opportunities in the Bangladesh Aluminum Market

There are several promising investment opportunities in the Bangladesh Aluminum Market. One key area is the development of aluminum recycling infrastructure. With the growing demand for sustainable practices, there is an opportunity for investors to contribute to the expansion of aluminum recycling operations in Bangladesh. This could help reduce the reliance on primary aluminum production and improve the environmental footprint of the industry. Additionally, investments in the construction and automotive sectors present significant growth opportunities for aluminum producers. As demand for lightweight, energy-efficient materials increases, companies focusing on developing new alloys and advanced aluminum products will find substantial market potential. The ongoing industrialization and urbanization trends offer further opportunities for investment in aluminum manufacturing, particularly in relation to infrastructure development.

Leading Players in the Bangladesh Aluminum Market

Key players in the Bangladesh Aluminum Market include prominent companies such as Bangladesh Aluminum Company Limited (BACL), Marubeni Corporation, and Abul Khair Group. These companies are playing a significant role in the market by driving innovation and expanding their manufacturing capabilities to meet the growing demand for aluminum products. They focus on providing high-quality, sustainable aluminum solutions for various sectors, including construction, transportation, and consumer goods. These players are also actively investing in research and development to enhance their product offerings and improve production efficiency.

Government Regulations in the Bangladesh Aluminum Market

The government of Bangladesh has implemented several initiatives to support the growth of the aluminum industry. The country’s national industrial policy encourages the development of the manufacturing sector, including aluminum production, by offering various incentives such as tax exemptions and subsidies for local manufacturers. Furthermore, the government is actively promoting sustainable development through policies that encourage the use of recyclable and eco-friendly materials. There are also regulations that ensure the quality and safety of aluminum products, as well as initiatives to improve the infrastructure for aluminum recycling. These regulatory frameworks are essential for maintaining industry standards and promoting the growth of the aluminum sector in Bangladesh.

Future Insights of the Bangladesh Aluminum Market

The Bangladesh Aluminum industry is expected to experience continued growth in the coming years, driven by the ongoing expansion of infrastructure projects and industrial activities. The demand for lightweight, durable, and sustainable materials will continue to rise, particularly in the construction and automotive sectors. As technological advancements in aluminum production and recycling progress, the market is likely to become more efficient and environmentally friendly. Additionally, the increased focus on sustainability, coupled with government incentives, will foster the development of a more competitive and innovative aluminum industry. With emerging applications in renewable energy technologies and electric vehicles, the Bangladesh Aluminum Market is set to play a key role in the country’s industrial transformation.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

Secondary to Dominate the Market - By Type:

According to Ashutosh, Senior Research Analyst, 6Wresearch, the Secondary aluminum segment is anticipated to be the fastest-growing in the Bangladesh Aluminum Market. The emphasis on cost-efficiency and environmental sustainability supports this category's expansion. Enhanced recycling initiatives and a focus on reducing environmental impact further stimulate growth, with the Secondary aluminum market projected to reach USD 500 million in 2025.

Extrusions to Dominate the Market - By Product Type:

Among product types, the Extrusions segment is set for rapid advancement. Key drivers include rising demand from the building and construction sectors, which require lightweight and adaptable materials. This growth path is projected to help the extrusions market secure USD 450 million in market value by 2025, underscoring its significant role in the industry.

Transport to Dominate the Market - By End-users:

The Transport industry stands out as the fastest-growing end-user segment, driven primarily by the integration of lightweight aluminum materials to enhance vehicle efficiency and reduce fuel consumption. This sector is expected to grow considerably, commanding USD 700 million in 2025, benefiting from both local manufacturing demands and export possibilities.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Bangladesh Aluminum Market Outlook

- Market Size of Bangladesh Aluminum Market, 2024

- Forecast of Bangladesh Aluminum Market, 2029

- Historical Data and Forecast of Bangladesh Aluminum Revenues & Volume for the Period 2019-2029

- Bangladesh Aluminum Market Trend Evolution

- Bangladesh Aluminum Market Drivers and Challenges

- Bangladesh Aluminum Price Trends

- Bangladesh Aluminum Porter's Five Forces

- Bangladesh Aluminum Industry Life Cycle

- Historical Data and Forecast of Bangladesh Aluminum Market Revenues & Volume By Type for the Period 2019-2029

- Historical Data and Forecast of Bangladesh Aluminum Market Revenues & Volume By Primary for the Period 2019-2029

- Historical Data and Forecast of Bangladesh Aluminum Market Revenues & Volume By Secondary for the Period 2019-2029

- Historical Data and Forecast of Bangladesh Aluminum Market Revenues & Volume By Product Type for the Period 2019-2029

- Historical Data and Forecast of Bangladesh Aluminum Market Revenues & Volume By Flat Rolled for the Period 2019-2029

- Historical Data and Forecast of Bangladesh Aluminum Market Revenues & Volume By Castings for the Period 2019-2029

- Historical Data and Forecast of Bangladesh Aluminum Market Revenues & Volume By Extrusions for the Period 2019-2029

- Historical Data and Forecast of Bangladesh Aluminum Market Revenues & Volume By Forgings for the Period 2019-2029

- Historical Data and Forecast of Bangladesh Aluminum Market Revenues & Volume By Pigments & Powder for the Period 2019-2029

- Historical Data and Forecast of Bangladesh Aluminum Market Revenues & Volume By Rod & Bar for the Period 2019-2029

- Historical Data and Forecast of Bangladesh Aluminum Market Revenues & Volume By End-users for the Period 2019-2029

- Historical Data and Forecast of Bangladesh Aluminum Market Revenues & Volume By Transport for the Period 2019-2029

- Historical Data and Forecast of Bangladesh Aluminum Market Revenues & Volume By Building & Construction for the Period 2019-2029

- Historical Data and Forecast of Bangladesh Aluminum Market Revenues & Volume By Electrical Engineering for the Period 2019-2029

- Historical Data and Forecast of Bangladesh Aluminum Market Revenues & Volume By Consumer Goods for the Period 2019-2029

- Historical Data and Forecast of Bangladesh Aluminum Market Revenues & Volume By Foil & Packaging for the Period 2019-2029

- Historical Data and Forecast of Bangladesh Aluminum Market Revenues & Volume By Machinery & Equipment for the Period 2019-2029

- Historical Data and Forecast of Bangladesh Aluminum Market Revenues & Volume By Others for the Period 2019-2029

- Bangladesh Aluminum Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Product Type

- Market Opportunity Assessment By End-users

- Bangladesh Aluminum Top Companies Market Share

- Bangladesh Aluminum Competitive Benchmarking By Technical and Operational Parameters

- Bangladesh Aluminum Company Profiles

- Bangladesh Aluminum Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the following market segments:

By Type:

- Primary Aluminum

- Secondary Aluminum

By Product Type:

- Flat Rolled

- Castings

- Extrusions

- Forgings

- Pigments & Powder

- Rod & Bar

By End-users:

- Transport

- Building & Construction

- Electrical Engineering

- Consumer Goods

- Foil & Packaging

- Machinery & Equipment

- Others

Bangladesh Aluminum Market (2025-2029): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Bangladesh Aluminum Market Overview |

| 3.1 Bangladesh Country Macro Economic Indicators |

| 3.2 Bangladesh Aluminum Market Revenues & Volume, 2019 & 2029F |

| 3.3 Bangladesh Aluminum Market - Industry Life Cycle |

| 3.4 Bangladesh Aluminum Market - Porter's Five Forces |

| 3.5 Bangladesh Aluminum Market Revenues & Volume Share, By Type, 2019 & 2029F |

| 3.6 Bangladesh Aluminum Market Revenues & Volume Share, By Product Type, 2019 & 2029F |

| 3.7 Bangladesh Aluminum Market Revenues & Volume Share, By End-users, 2019 & 2029F |

| 4 Bangladesh Aluminum Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Bangladesh Aluminum Market Trends |

| 6 Bangladesh Aluminum Market, By Types |

| 6.1 Bangladesh Aluminum Market, By Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 Bangladesh Aluminum Market Revenues & Volume, By Type, 2019 - 2029F |

| 6.1.3 Bangladesh Aluminum Market Revenues & Volume, By Primary, 2019 - 2029F |

| 6.1.4 Bangladesh Aluminum Market Revenues & Volume, By Secondary, 2019 - 2029F |

| 6.2 Bangladesh Aluminum Market, By Product Type |

| 6.2.1 Overview and Analysis |

| 6.2.2 Bangladesh Aluminum Market Revenues & Volume, By Flat Rolled, 2019 - 2029F |

| 6.2.3 Bangladesh Aluminum Market Revenues & Volume, By Castings , 2019 - 2029F |

| 6.2.4 Bangladesh Aluminum Market Revenues & Volume, By Extrusions , 2019 - 2029F |

| 6.2.5 Bangladesh Aluminum Market Revenues & Volume, By Forgings , 2019 - 2029F |

| 6.2.6 Bangladesh Aluminum Market Revenues & Volume, By Pigments & Powder, 2019 - 2029F |

| 6.2.7 Bangladesh Aluminum Market Revenues & Volume, By Rod & Bar, 2019 - 2029F |

| 6.3 Bangladesh Aluminum Market, By End-users |

| 6.3.1 Overview and Analysis |

| 6.3.2 Bangladesh Aluminum Market Revenues & Volume, By Transport, 2019 - 2029F |

| 6.3.3 Bangladesh Aluminum Market Revenues & Volume, By Building & Construction, 2019 - 2029F |

| 6.3.4 Bangladesh Aluminum Market Revenues & Volume, By Electrical Engineering, 2019 - 2029F |

| 6.3.5 Bangladesh Aluminum Market Revenues & Volume, By Consumer Goods, 2019 - 2029F |

| 6.3.6 Bangladesh Aluminum Market Revenues & Volume, By Foil & Packaging, 2019 - 2029F |

| 6.3.7 Bangladesh Aluminum Market Revenues & Volume, By Machinery & Equipment, 2019 - 2029F |

| 7 Bangladesh Aluminum Market Import-Export Trade Statistics |

| 7.1 Bangladesh Aluminum Market Export to Major Countries |

| 7.2 Bangladesh Aluminum Market Imports from Major Countries |

| 8 Bangladesh Aluminum Market Key Performance Indicators |

| 9 Bangladesh Aluminum Market - Opportunity Assessment |

| 9.1 Bangladesh Aluminum Market Opportunity Assessment, By Type, 2019 & 2029F |

| 9.2 Bangladesh Aluminum Market Opportunity Assessment, By Product Type, 2019 & 2029F |

| 9.3 Bangladesh Aluminum Market Opportunity Assessment, By End-users, 2019 & 2029F |

| 10 Bangladesh Aluminum Market - Competitive Landscape |

| 10.1 Bangladesh Aluminum Market Revenue Share, By Companies, 2024 |

| 10.2 Bangladesh Aluminum Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero