Brazil Set Top Box Market (2025-2031) | Forecast, Trends, Outlook, Revenue, Companies, Size, Industry, Value, Share, Growth & Analysis

Market Forecast By STB Type (Cable TV, DTH, and IPTV) and Regions (South, North-East, Central-West and South-East and North)

| Product Code: ETC000219 | Publication Date: Jan 2015 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | ||||

Brazil Set Top Box Market Highlights

| Report Name | Brazil Set Top Box Market |

| Forecast period | 2025-2031 |

| CAGR | 5.6% |

| Growing Sector | 4K & Above Content Quality |

Topics Covered in the Brazil Set Top Box Market Report

The Brazil Set Top Box Market report thoroughly covers the market by set top box types and regions. The report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high-growth areas, and market drivers to help stakeholders align their strategies with current and future market dynamics.

Brazil Set Top Box Market Synopsis

The Brazil Set Top Box Market is experiencing significant growth due to the country's transition to digital broadcasting and the increasing penetration of high-definition television services. The government's initiatives to promote digitalization, coupled with the rising disposable income of consumers, have led to a surge in demand for advanced set top boxes. Additionally, the growing popularity of over-the-top (OTT) platforms and the integration of internet-based services with traditional broadcasting are further propelling the market's expansion.

According to 6Wresearch, The Brazil Set Top Box Market is projected to growing at a CAGR of 5.6% during the forecast period 2025-2031. The Brazil Set Top Box Market is primarily driven by the government's push towards complete digitization of television services. Initiatives such as the purchase of 14 million set top boxes for low-income households have significantly boosted market growth. This move aims to ensure that all segments of the population have access to digital television, thereby increasing the demand for set top boxes. Another key driver is the increasing consumer preference for high-definition (HD) and ultra-high-definition (UHD) content.

As consumers become more accustomed to superior picture and sound quality, there is a growing demand for advanced set top boxes that support HD and UHD content. This trend is further supported by the rising sales of HD and UHD televisions in the country. The integration of over-the-top (OTT) services with traditional broadcasting is also contributing to market growth. Consumers are increasingly seeking flexible viewing options that combine traditional TV channels with internet-based content. Set top boxes that offer hybrid solutions, integrating OTT platforms with conventional broadcasting services, are gaining popularity among consumers. This trend is reflected in the Brazil Set Top Box Market Growth.

However, the market faces challenges such as the high cost of advanced set top boxes, which may be prohibitive for low-income households. Additionally, the rapid advancement of technology can lead to shorter product lifecycles, requiring continuous innovation from manufacturers. The presence of alternative platforms, such as smart TVs with built-in streaming capabilities, also poses a challenge to the traditional set top box market. Furthermore, the economic disparities across different regions of Brazil result in varying levels of access to digital services. While urban areas may readily adopt advanced set top boxes, rural regions may face challenges due to limited infrastructure and lower purchasing power. Addressing these disparities is crucial for the uniform growth of the market across the country.

Brazil Set Top Box Market Trends

A significant trend in the Brazil Set Top Box Market is the shift towards 4K and above content quality. Consumers are increasingly demanding higher resolution content, leading to a rise in the adoption of 4K set top boxes. This trend is expected to continue as more 4K content becomes available and 4K televisions become more affordable. Another notable trend is the growing integration of voice control and artificial intelligence (AI) features in set top boxes. These advancements enhance user experience by allowing for voice commands and personalized content recommendations. Manufacturers are focusing on incorporating these features to differentiate their products in the competitive market.

Investment Opportunities in the Brazil Set Top Box Market

The Brazil Set Top Box Market offers significant investment opportunities, particularly in the development and distribution of advanced set top boxes that support 4K and UHD content. Investors can capitalize on the growing demand for high-quality viewing experiences by investing in companies that produce or distribute these advanced devices. Additionally, there is potential for investment in hybrid set top boxes that integrate traditional broadcasting with OTT services. As consumer preferences shift towards flexible and personalized viewing options, companies that offer solutions combining linear TV with internet-based content are well-positioned for growth.

Leading Players in the Brazil Set Top Box Market

Prominent players in the Brazil Set Top Box Market include Cisco Systems Inc., Pace Brasil – Industria Electronica e Comercio Ltda, Technicolor SA, Skyworth Digital Technology Co., Kaon America Latina Ltda, and Humax do Brasil. These companies have established a strong presence in the market through continuous innovation and strategic partnerships. They offer a wide range of set top boxes catering to different consumer segments, from basic models to advanced devices supporting 4K content and integrated OTT services.

Government Regulations in the Brazil Set Top Box Market

The Brazilian government has implemented several regulations to facilitate the transition from analog to digital television broadcasting. The National Telecommunications Agency (Anatel) has set guidelines mandating the digitization of television services, aiming to enhance broadcast quality and free up spectrum for other telecommunications services. To support low-income households during this transition, the government initiated a program to distribute free set top boxes. This initiative ensures that economically disadvantaged populations continue to have access to television services post-digitization. Such programs have significantly boosted the adoption of set top boxes across the country. Additionally, the government has established technical standards for set top boxes to ensure compatibility and interoperability among devices from different manufacturers. These standards aim to provide consumers with a seamless viewing experience and prevent market fragmentation.

Future Insights of the Brazil Set Top Box Market

The future of the Brazil Set-Top Box Market looks promising, with advancements in technology playing a crucial role in shaping its trajectory. As the demand for high-resolution content continues to rise, manufacturers are expected to focus on developing cost-effective 4K and even 8K-ready set-top boxes. These devices will cater to the evolving preferences of consumers who seek superior picture and sound quality. Another key development expected in the future is the increasing adoption of hybrid set-top boxes. With the growing popularity of OTT platforms, set-top boxes that combine traditional broadcasting with streaming services will gain significant traction. This shift is driven by consumers’ preference for on-demand content, enabling them to switch seamlessly between live TV and internet-based platforms.

Market Segmentation Analysis

The report offers a comprehensive study of the following market segments and their leading categories:

Cable TV to Lead the Market – By STB Type

According to Ashutosh, Senior Research Analyst, 6Wresearch, Cable TV is expected to dominate the Brazil Set-Top Box Market due to its widespread availability and cost-effectiveness. Many households in Brazil still rely on cable TV services, as they offer stable and affordable access to entertainment. Service providers continue to upgrade their offerings with digital and high-definition channels, making cable TV a preferred choice for consumers. Although IPTV is gaining traction, cable TV remains the most accessible option, especially in regions with limited internet infrastructure.

South-East Region to Hold the Largest Market Share – By Region

The South-East region, including cities like São Paulo and Rio de Janeiro, is anticipated to lead the Brazil Set-Top Box Market. This region has the highest number of urban households, better internet penetration, and strong demand for digital entertainment services. With the increasing adoption of high-definition content and smart TVs, the demand for advanced set-top boxes is on the rise. Additionally, service providers in this region are actively upgrading their technology to offer IPTV and interactive TV services, further driving market growth.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2031 to 2024.

- Base Year: 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Brazil Set Top Box Market Market Outlook

- Market Size of Brazil Set Top Box Market Market, 2024

- Forecast of Brazil Set Top Box Market Market, 2031

- Historical Data and Forecast of Brazil Set Top Box Market Market Revenues & Volume for the Period 2021 - 2031

- Brazil Set Top Box Market Market Trend Evolution

- Brazil Set Top Box Market Market Drivers and Challenges

- Brazil Set Top Box Market Market Price Trends

- Brazil Set Top Box Market Market Porter's Five Forces

- Brazil Set Top Box Market Market Industry Life Cycle

- Historical Data and Forecast of Brazil Set Top Box Market Market Revenues and volume by Set Top Box Types for the Period 2021-2031

- Historical Data and Forecast of Brazil Set Top Box Market Market Revenues and volume by Cable TV Set Top Box for the Period 2021-2031

- Historical Data and Forecast of Brazil Set Top Box Market Market Revenues and volume by DTH Set Top Box for the Period 2021-2031

- Historical Data and Forecast of Brazil Set Top Box Market Market Revenues and volume by IPTV Set-Top Box for the Period 2021-2031

- Historical Data and Forecast of Brazil Set Top Box Market Market Revenues and volume by Regions for the Period 2021-2031

- Historical Data and Forecast of Brazil Set Top Box Market Market Revenues and volume by South-East Brazil for the Period 2021-2031

- Historical Data and Forecast of Brazil Set Top Box Market Market Revenues and volume by North-East Brazil for the Period 2021-2031

- Historical Data and Forecast of Brazil Set Top Box Market Market Revenues and volume by Central-West Brazil for the Period 2021-2031

- Historical Data and Forecast of Brazil Set Top Box Market Market Revenues and volume by South Brazil for the Period 2021-2031

- Brazil Set Top Box Market Market Import Export Trade Statistics

- Market Opportunity Assessment by KVA ratings

- Market Opportunity Assessment by Application

- Brazil Set Top Box Market Market Top Companies Market Share

- Brazil Set Top Box Market Market Competitive Benchmarking by Technical and Operational Parameters

- Brazil Set Top Box Market Market Company Profiles

- Brazil Set Top Box Market Market Key Strategic Recommendation

Markets Covered

The report offers a comprehensive analysis of the following market segments

Set Top Box Types:

- Cable TV Set Top Box

- DTH Set Top Box

- IPTV Set-Top Box

Regions:

Brazil Set Top Box Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Brazil Set Top Box Market Overview |

| 3.1 Brazil Country Macro Economic Indicators |

| 3.2 Brazil Set Top Box Market Revenues & Volume, 2021 & 2031F |

| 3.3 Brazil Set Top Box Market - Industry Life Cycle |

| 3.4 Brazil Set Top Box Market - Porter's Five Forces |

| 3.5 Brazil Set Top Box Market Revenues & Volume Share, By Resolution, 2021 & 2031F |

| 3.6 Brazil Set Top Box Market Revenues & Volume Share, By End-User, 2021 & 2031F |

| 3.6 Brazil Set Top Box Market Revenues & Volume Share, By Service Type, 2021 & 2031F |

| 3.6 Brazil Set Top Box Market Revenues & Volume Share, By Distribution, 2021 & 2031F |

| 4 Brazil Set Top Box Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing demand for digital entertainment services |

| 4.2.2 Growth in disposable income leading to higher consumer spending on home entertainment |

| 4.2.3 Technological advancements leading to the development of advanced set top box features and functionalities |

| 4.3 Market Restraints |

| 4.3.1 Competition from alternative technologies such as smart TVs and streaming devices |

| 4.3.2 Regulatory challenges impacting the market entry and operations |

| 4.3.3 Economic instability affecting consumer purchasing power |

| 5 Brazil Set Top Box Market Trends |

| 6 Brazil Set Top Box Market, Segmentations |

| 6.1 Brazil Set Top Box Market, By Resolution |

| 6.1.1 Overview and Analysis |

| 6.1.2 Brazil Set Top Box Market Revenues & Volume, By HD (High Definition), 2021 & 2031F |

| 6.1.3 Brazil Set Top Box Market Revenues & Volume, By SD (Standard Definition), 2021 & 2031F |

| 6.1.4 Brazil Set Top Box Market Revenues & Volume, By UHD (Ultra-High Definition), 2021 & 2031F |

| 6.2 Brazil Set Top Box Market, By End-User |

| 6.2.1 Overview and Analysis |

| 6.2.2 Brazil Set Top Box Market Revenues & Volume, By Residential, 2021 & 2031F |

| 6.2.3 Brazil Set Top Box Market Revenues & Volume, By Commercial, 2021 & 2031F |

| 6.2.3 Brazil Set Top Box Market Revenues & Volume, By Others 2021 & 2031F |

| 6.3 Brazil Set Top Box Market, By Servcie Type |

| 6.3.1 Overview and Analysis |

| 6.3.2 Brazil Set Top Box Market Revenues & Volume, By Pay TV, 2021 & 2031F |

| 6.3.3 Brazil Set Top Box Market Revenues & Volume, By Free-to-Air, 2021 & 2031F |

| 6.3.3 Brazil Set Top Box Market Revenues & Volume, By Others 2021 & 2031F |

| 6.4 Brazil Set Top Box Market, By Distribution |

| 6.4.1 Overview and Analysis |

| 6.4.2 Brazil Set Top Box Market Revenues & Volume, By Online Distribution, 2021 & 2031F |

| 6.4.3 Brazil Set Top Box Market Revenues & Volume, By Offline Distribution, 2021 & 2031F |

| 7 Brazil Set Top Box Market Import-Export Trade Statistics |

| 7.1 Brazil Set Top Box Market Export to Major Countries |

| 7.2 Brazil Set Top Box Market Imports from Major Countries |

| 8 Brazil Set Top Box Market Key Performance Indicators |

| 8.1 Average revenue per user (ARPU) for set top box services |

| 8.2 Percentage of households with access to digital entertainment services |

| 8.3 Adoption rate of advanced set top box features and functionalities |

| 8.4 Customer satisfaction and retention rates |

| 8.5 Average time spent on set top box entertainment per user |

| 9 Brazil Set Top Box Market - Opportunity Assessment |

| 9.1 Brazil Set Top Box Market Opportunity Assessment, By Resolution, 2021 & 2031F |

| 9.2 Brazil Set Top Box Market Opportunity Assessment, By End-User, 2021 & 2031F |

| 9.2 Brazil Set Top Box Market Opportunity Assessment, By Service Type, 2021 & 2031F |

| 9.2 Brazil Set Top Box Market Opportunity Assessment, By Distribution, 2021 & 2031F |

| 10 Brazil Set Top Box Market - Competitive Landscape |

| 10.1 Brazil Set Top Box Market Revenue Share, By Companies, 2024 |

| 10.2 Brazil Set Top Box Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

Brazil is one of the fastest-growing set-top box markets in the Latin American region. Changing government laws and policies, increasing TV penetration and the consumer acceptance of technologically advanced products are the key factors that are spurring the market for the set-top box in Brazil.

In the country, the market is primarily driven by Direct to home (DTH) set-top box followed by the cable TV set-top boxes due to the low pricing of these products. Technological advancement and coming up of new IPTV and Hybrid set-top boxes have further spurred the market growth. The key players in the market include-Cisco Systems, Pace Brasil, Sobre Technicolor, Skyworth Digital Technology, Kaon, Humax, Albis Technology, and Arris.

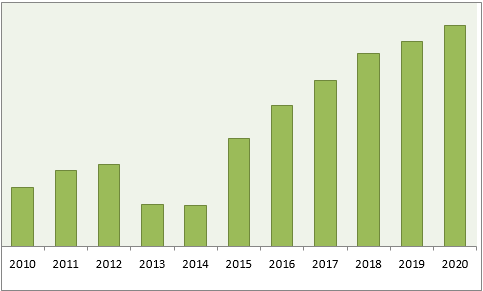

Figure 1: Brazil Set-Top Box Market Revenues, 2010-2020F ($ Million)

Source: 6Wresearch

Brazil set-top box market declined during the period 2013-14 on account of a lower number of new pay-TV subscriber additions and delay in the digitization of the cable TV network. Also, the availability of inventory with the market players restricted set-top box shipments in the country, thus affecting the growth of the Brazilian STB market. However, in the forecast period, the market is expected to gain momentum due to government initiative to purchase set-top boxes for low-income households and increasing penetration of IPTV networks.

“Brazil Set Top Box Market (2014-2020)” report estimates and forecast the overall Brazil set-top box market by revenue, by set-top box types such as cable TV, DTH, and IPTV set-top boxes by regions such as south, northeast, central-west and South East, and north. The report also gives insights on competitive landscape, market share by companies, market trends, company profiles, market drivers, and restraints.

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- UAE Building Thermal Insulation Market Outlook (2025-2031) | Revenue, Companies, Share, Trends, Growth, Size, Forecast, Industry, Analysis & Value

- Portugal Electronic Document Management Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero