Cambodia Pumps Market (2025-2031) | Share, Analysis, Revenue, Companies, Outlook, Forecast, Size, Value, Industry, Growth & Trends

Market Forecast By Product (Portable, Stationary), By Position (Submersible, Non-submersible), By Driving Force (Engine Driven, Electrical Driven), By Technology (Centrifugal Pumps, Diaphragm Pumps), By Application (Mining, Building & Construction, Oil & Gas, Industrial, Municipal) And Competitive Landscape

| Product Code: ETC017513 | Publication Date: Jun 2023 | Updated Date: Jan 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

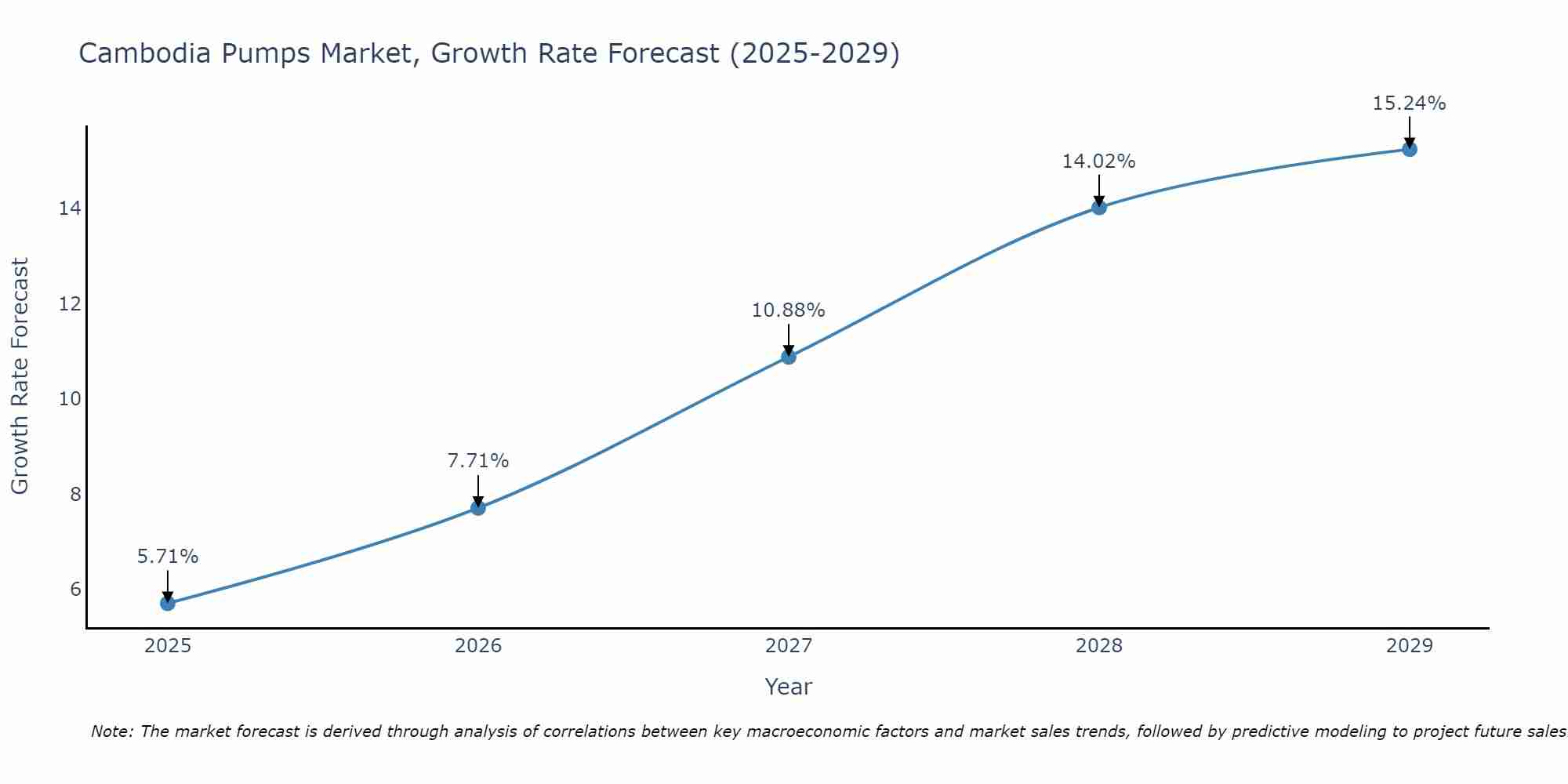

Cambodia Pumps Market Size Growth Rate

The Cambodia Pumps Market is poised for steady growth rate improvements from 2025 to 2029. From 5.71% in 2025, the growth rate steadily ascends to 15.24% in 2029.

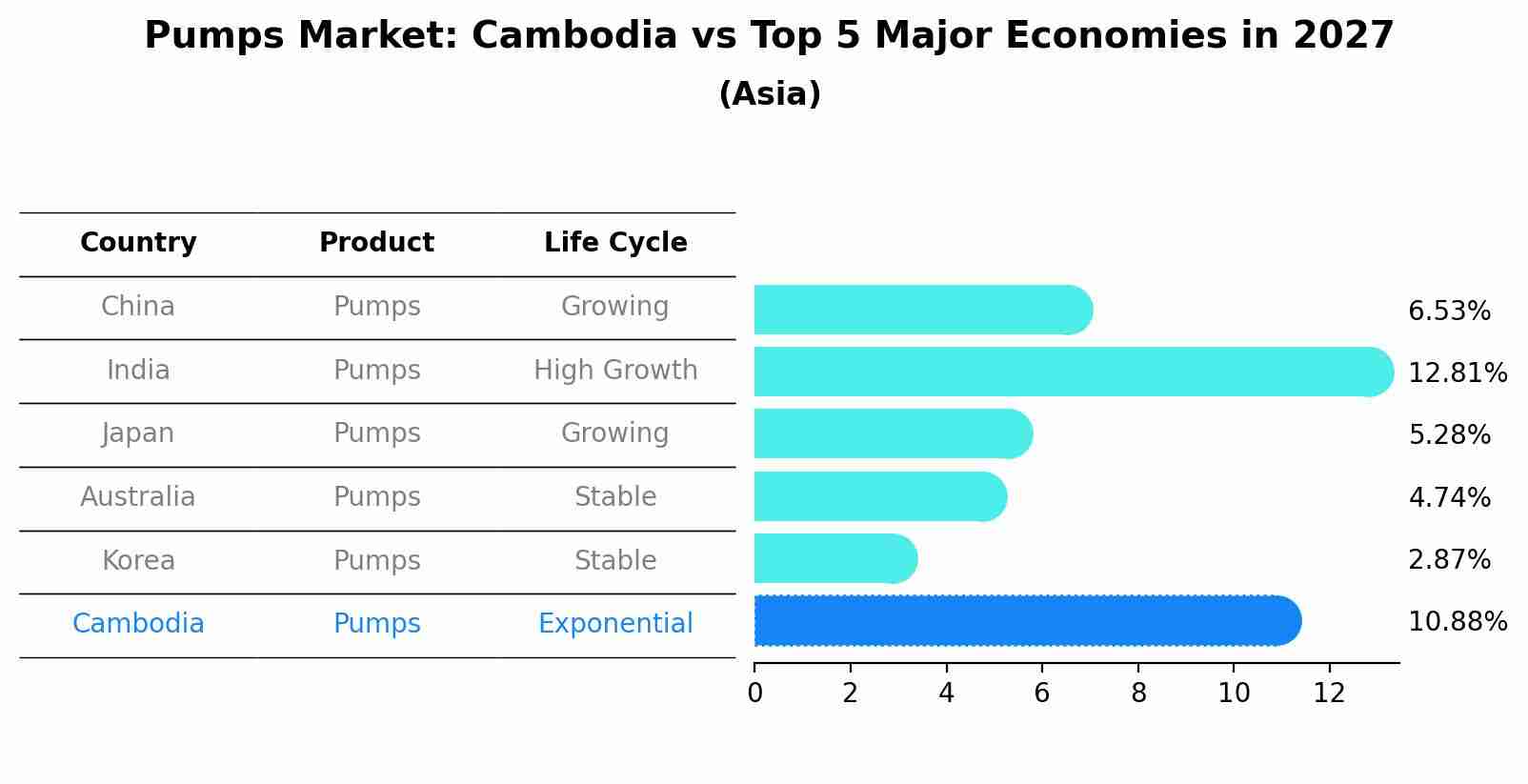

Pumps Market: Cambodia vs Top 5 Major Economies in 2027 (Asia)

In the Asia region, the Pumps market in Cambodia is projected to expand at a high growth rate of 10.88% by 2027. The largest economy is China, followed by India, Japan, Australia and South Korea.

Cambodia Pumps Market Highlights

| Report Name | Cambodia Pumps Market |

| Forecast period | 2025-2031 |

| CAGR | 7.2% |

| Growing Sector | Municipal |

Topics Covered in the Cambodia Pumps Market Report

Cambodia Pumps Market report thoroughly covers the market by product, by position, by driving force, by technology and by application. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Cambodia Pumps Market Synopsis

Cambodia Pumps Market is experiencing steady growth owing to the surging demand across key sectors such as agriculture, construction, and manufacturing. Rapid urbanization and industrial expansion are driving the need for advanced pumping solutions to support water supply, wastewater management, and irrigation systems. The adoption of energy-efficient and high-performance pumps is gaining traction, as industries increasingly focus on cost savings and sustainability. Furthermore, government investments in infrastructure projects and efforts to modernize agricultural practices are significantly boosting the demand for pumps. These factors collectively contribute to the robust growth trajectory of the Cambodia pumps market, solidifying its pivotal role in the nation’s development.

According to 6Wresearch, the Cambodia Pumps Market is estimated to grow at a CAGR of 7.2% during the forecast period 2025-2031. This growth is attributed to the increasing investments in infrastructure development and modernization of agricultural practices, which are key drivers for pump adoption across the nation. Additionally, the rising urban population and expanding industrial base are creating a heightened demand for efficient water management systems, including advanced pumps. The government’s initiatives to improve water resource management and promote energy-efficient solutions further bolster the Cambodia Pumps Market Growth. With these favorable market dynamics, the pumps sector is poised to play an essential role in Cambodia’s sustainable growth and economic development in the coming years.

However, the Cambodia Pumps Industry faces certain challenges that could hinder its growth potential. One of the primary obstacles is the high initial cost of advanced pumping systems, which can be prohibitive for small-scale farmers and businesses. Limited awareness and technical knowledge regarding energy-efficient and modern pump technologies further impede widespread adoption. Additionally, inadequate infrastructure in rural areas, such as unreliable electricity supply and poor transportation networks, poses a significant barrier to market penetration. The industry also confronts environmental concerns, including over-extraction of groundwater and the need for sustainable water resource management practices. Addressing these challenges will require coordinated efforts from the government, private sector, and development agencies to ensure inclusive and sustainable growth in the market.

Cambodia Pumps Market Trends

Cambodia Pumps Market is currently witnessing significant trends that highlight its evolving dynamics. The increasing adoption of solar-powered pumps reflects the shift towards renewable energy solutions, driven by the need for sustainable and cost-efficient water management systems. Government initiatives and international funding to improve agricultural productivity and rural water supply are further spurring demand for innovative pumping technologies.

There is a growing preference for energy-efficient and smart pumps equipped with IoT capabilities, allowing for remote monitoring and optimal performance. Additionally, urbanization and industrialization are contributing to the rising demand for pumps in construction and manufacturing sectors. These trends underscore the market's potential for growth while emphasizing the need for continued innovation to meet Cambodia's diverse and expanding requirements.

Investment Opportunities in the Cambodia Pumps Market

Investment opportunities in the Cambodia Pumps Industry are abundant, driven by the country's increasing focus on sustainable infrastructure and technological advancement. The rising demand for solar-powered and energy-efficient pumping systems presents a lucrative avenue for investors, especially in the agricultural and rural water supply sectors. Additionally, the integration of IoT-enabled smart pumps creates opportunities for tech-driven solutions in both urban and industrial applications.

With government-backed initiatives and international funding supporting the adoption of innovative water management systems, the market is primed for significant growth. Investors can also explore opportunities in construction and manufacturing, as urbanization and industrialization continue to fuel the need for advanced pumping technologies, making Cambodia an attractive destination for forward-thinking enterprises.

Top of Form

Leading Players in the Cambodia Pumps Market

Leading players in the Cambodia Pumps Market include both global and regional manufacturers actively contributing to the industry's growth. Companies such as Grundfos, Xylem Inc., KSB, and Wilo dominate the market with their innovative and energy-efficient solutions tailored to meet the country's needs. Additionally, local players are establishing their presence by offering cost-effective and durable products, especially for rural and agricultural applications. The competitive landscape is further enhanced by partnerships, government collaborations, and ongoing research and development efforts that focus on sustainability and smart technologies, ensuring a diverse and dynamic market ecosystem.

Government Regulations

Government regulations play a pivotal role in shaping the Cambodia Pumps Market Growth, ensuring quality standards, environmental compliance, and sustainable development. Authorities have implemented policies aimed at encouraging the adoption of energy-efficient and environmentally friendly pump technologies to address the nation’s growing water management and agricultural needs. Regulations also promote fair competition by setting guidelines for imports, exports, and the certification of pumps, protecting both consumers and local manufacturers. Additionally, government incentives and initiatives, such as subsidies for solar-powered pumps and infrastructure development projects, further stimulate market growth while aligning with global sustainability goals. These regulatory measures create a supportive framework that enables innovation and attracts investment in the sector.

Future Insights of the Cambodia Pumps Market

Cambodia Pumps Market is poised for significant growth driven by advancements in technology, increasing urbanization, and the rising demand for sustainable water management solutions. With the government’s continued focus on renewable energy initiatives, such as solar-powered pumps, and the expansion of infrastructure in rural areas, the market is expected to witness a surge in adoption rates. Emerging smart pump technologies, combined with improved access to financing options for small and medium enterprises, will further accelerate market evolution. Additionally, rising awareness about energy efficiency and environmental preservation is likely to influence consumer preferences, fostering innovation and creating new opportunities for both local and international players in the sector.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

Stationary Pumps to Dominate the Market-By Product

According to Vasudha, Senior Research Analyst, 6Wresearch, the stationary pumps segment dominates the market due to their widespread application in permanent installations for infrastructure projects and industrial use. These pumps are preferred for applications requiring high durability and consistent performance, such as municipal water management and large-scale irrigation systems. On the other hand, portable pumps are gaining traction in niche applications like emergency water pumping and small-scale agricultural use.

Submersible pumps to Dominate the Market-By Position

Submersible pumps lead the market in this category, driven by their efficiency in underwater operations and their ability to handle challenging environments. They are extensively used in applications such as wastewater treatment and deep well drilling, where non-submersible pumps cannot perform efficiently. Their ability to provide high efficiency with minimal maintenance further cements their top position.

Electrical-driven pumps to Dominate the Market-By Driving Force

Electrical-driven pumps dominate this segment due to the increasing availability of stable electricity in urban and semi-urban regions, along with their cost-effectiveness and ease of maintenance. However, engine-driven pumps remain essential in remote areas with limited electricity access, especially for agricultural irrigation and emergency response during power outages.

Centrifugal pumps to Dominate the Market-By Technology

Centrifugal pumps account for the largest share, attributed to their versatility and reliability across multiple applications. Their ability to handle high-flow rates and various fluid types makes them indispensable in industries such as construction, oil & gas, and municipal water supply. Diaphragm pumps, while used in specific industrial processes, are limited by their smaller operational capacity and higher costs.

Municipal segment to Dominate the Market-By Application

The municipal segment is the dominant application area, driven by the increasing demand for water supply and waste management infrastructure in Cambodia's urban areas. Government initiatives focusing on sustainable water solutions and infrastructure development have significantly bolstered municipal demand. However, industrial applications, including mining and construction, also contribute substantially, especially with the country's ongoing development projects and resource extraction activities. Oil & gas, while a smaller segment, plays a pivotal role in specialized operations requiring reliable pump systems.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024

- Base Year: 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Cambodia Pumps Market Outlook

- Market Size of Cambodia Pumps Market, 2024

- Forecast of Cambodia Pumps Market, 2031

- Historical Data and Forecast of Cambodia Pumps Revenues & Volume for the Period 2021 - 2031

- Cambodia Pumps Market Trend Evolution

- Cambodia Pumps Market Drivers and Challenges

- Cambodia Pumps Price Trends

- Cambodia Pumps Porter's Five Forces

- Cambodia Pumps Industry Life Cycle

- Historical Data and Forecast of Cambodia Pumps Market Revenues & Volume By Product for the Period 2021 - 2031

- Historical Data and Forecast of Cambodia Pumps Market Revenues & Volume By Portable for the Period 2021 - 2031

- Historical Data and Forecast of Cambodia Pumps Market Revenues & Volume By Stationary for the Period 2021 - 2031

- Historical Data and Forecast of Cambodia Pumps Market Revenues & Volume By Position for the Period 2021 - 2031

- Historical Data and Forecast of Cambodia Pumps Market Revenues & Volume By Submersible for the Period 2021 - 2031

- Historical Data and Forecast of Cambodia Pumps Market Revenues & Volume By Non-submersible for the Period 2021 - 2031

- Historical Data and Forecast of Cambodia Pumps Market Revenues & Volume By Driving Force for the Period 2021 - 2031

- Historical Data and Forecast of Cambodia Pumps Market Revenues & Volume By Engine Driven for the Period 2021 - 2031

- Historical Data and Forecast of Cambodia Pumps Market Revenues & Volume By Electrical Driven for the Period 2021 - 2031

- Historical Data and Forecast of Cambodia Pumps Market Revenues & Volume By Technology for the Period 2021 - 2031

- Historical Data and Forecast of Cambodia Pumps Market Revenues & Volume By Centrifugal Pumps for the Period 2021 - 2031

- Historical Data and Forecast of Cambodia Pumps Market Revenues & Volume By Diaphragm Pumps for the Period 2021 - 2031

- Historical Data and Forecast of Cambodia Pumps Market Revenues & Volume By Application for the Period 2021 - 2031

- Historical Data and Forecast of Cambodia Pumps Market Revenues & Volume By Mining for the Period 2021 - 2031

- Historical Data and Forecast of Cambodia Pumps Market Revenues & Volume By Building & Construction for the Period 2021 - 2031

- Historical Data and Forecast of Cambodia Pumps Market Revenues & Volume By Oil & Gas for the Period 2021 - 2031

- Historical Data and Forecast of Cambodia Pumps Market Revenues & Volume By Industrial for the Period 2021 - 2031

- Historical Data and Forecast of Cambodia Pumps Market Revenues & Volume By Municipal for the Period 2021 - 2031

- Cambodia Pumps Import Export Trade Statistics

- Market Opportunity Assessment By Product

- Market Opportunity Assessment By Position

- Market Opportunity Assessment By Driving Force

- Market Opportunity Assessment By Technology

- Market Opportunity Assessment By Application

- Cambodia Pumps Top Companies Market Share

- Cambodia Pumps Competitive Benchmarking By Technical and Operational Parameters

- Cambodia Pumps Company Profiles

- Cambodia Pumps Key Strategic Recommendations

Markets Covered

The report provides a detailed analysis of the following market segments:

By Product

- Portable

- Stationary

By Position

- Submersible

- Non-Submersible

By Driving Force

- Engine Driven

- Electrical Driven

By Technology

- Centrifugal Pumps

- Diaphragm Pumps

By Application

- Mining

- Building & Construction

- Oil & Gas

- Industrial

- Municipal

Cambodia Pumps Market (2025-2031):FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Cambodia Pumps Market Overview |

| 3.1 Cambodia Country Macro Economic Indicators |

| 3.2 Cambodia Pumps Market Revenues & Volume, 2021 & 2031F |

| 3.3 Cambodia Pumps Market - Industry Life Cycle |

| 3.4 Cambodia Pumps Market - Porter's Five Forces |

| 3.5 Cambodia Pumps Market Revenues & Volume Share, By Product, 2021 & 2031F |

| 3.6 Cambodia Pumps Market Revenues & Volume Share, By Position, 2021 & 2031F |

| 3.7 Cambodia Pumps Market Revenues & Volume Share, By Driving Force, 2021 & 2031F |

| 3.8 Cambodia Pumps Market Revenues & Volume Share, By Technology, 2021 & 2031F |

| 3.9 Cambodia Pumps Market Revenues & Volume Share, By Application, 2021 & 2031F |

| 4 Cambodia Pumps Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Cambodia Pumps Market Trends |

| 6 Cambodia Pumps Market, By Types |

| 6.1 Cambodia Pumps Market, By Product |

| 6.1.1 Overview and Analysis |

| 6.1.2 Cambodia Pumps Market Revenues & Volume, By Product, 2021 - 2031F |

| 6.1.3 Cambodia Pumps Market Revenues & Volume, By Portable, 2021 - 2031F |

| 6.1.4 Cambodia Pumps Market Revenues & Volume, By Stationary, 2021 - 2031F |

| 6.2 Cambodia Pumps Market, By Position |

| 6.2.1 Overview and Analysis |

| 6.2.2 Cambodia Pumps Market Revenues & Volume, By Submersible, 2021 - 2031F |

| 6.2.3 Cambodia Pumps Market Revenues & Volume, By Non-submersible, 2021 - 2031F |

| 6.3 Cambodia Pumps Market, By Driving Force |

| 6.3.1 Overview and Analysis |

| 6.3.2 Cambodia Pumps Market Revenues & Volume, By Engine Driven, 2021 - 2031F |

| 6.3.3 Cambodia Pumps Market Revenues & Volume, By Electrical Driven, 2021 - 2031F |

| 6.4 Cambodia Pumps Market, By Technology |

| 6.4.1 Overview and Analysis |

| 6.4.2 Cambodia Pumps Market Revenues & Volume, By Centrifugal Pumps, 2021 - 2031F |

| 6.4.3 Cambodia Pumps Market Revenues & Volume, By Diaphragm Pumps, 2021 - 2031F |

| 6.5 Cambodia Pumps Market, By Application |

| 6.5.1 Overview and Analysis |

| 6.5.2 Cambodia Pumps Market Revenues & Volume, By Mining, 2021 - 2031F |

| 6.5.3 Cambodia Pumps Market Revenues & Volume, By Building & Construction, 2021 - 2031F |

| 6.5.4 Cambodia Pumps Market Revenues & Volume, By Oil & Gas, 2021 - 2031F |

| 6.5.5 Cambodia Pumps Market Revenues & Volume, By Industrial, 2021 - 2031F |

| 6.5.6 Cambodia Pumps Market Revenues & Volume, By Municipal, 2021 - 2031F |

| 7 Cambodia Pumps Market Import-Export Trade Statistics |

| 7.1 Cambodia Pumps Market Export to Major Countries |

| 7.2 Cambodia Pumps Market Imports from Major Countries |

| 8 Cambodia Pumps Market Key Performance Indicators |

| 9 Cambodia Pumps Market - Opportunity Assessment |

| 9.1 Cambodia Pumps Market Opportunity Assessment, By Product, 2021 & 2031F |

| 9.2 Cambodia Pumps Market Opportunity Assessment, By Position, 2021 & 2031F |

| 9.3 Cambodia Pumps Market Opportunity Assessment, By Driving Force, 2021 & 2031F |

| 9.4 Cambodia Pumps Market Opportunity Assessment, By Technology, 2021 & 2031F |

| 9.5 Cambodia Pumps Market Opportunity Assessment, By Application, 2021 & 2031F |

| 10 Cambodia Pumps Market - Competitive Landscape |

| 10.1 Cambodia Pumps Market Revenue Share, By Companies, 2024 |

| 10.2 Cambodia Pumps Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero