Egypt Antioxidants Market (2025-2031) | Outlook, Analysis, Revenue, Share, Size, Companies, Industry, Value, Trends, Growth & Forecast

Market Forecast By Type (Natural Antioxidants, Synthetic Antioxidants), By Form (Dry, Liquid), By Application (Food and Feed Additives, Pharmaceuticals and Personal Care Products, Fuel and Lubricant Additives, Plastic, Rubber, Latex Additives) And Competitive Landscape

| Product Code: ETC312892 | Publication Date: Aug 2022 | Updated Date: Jan 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 | |

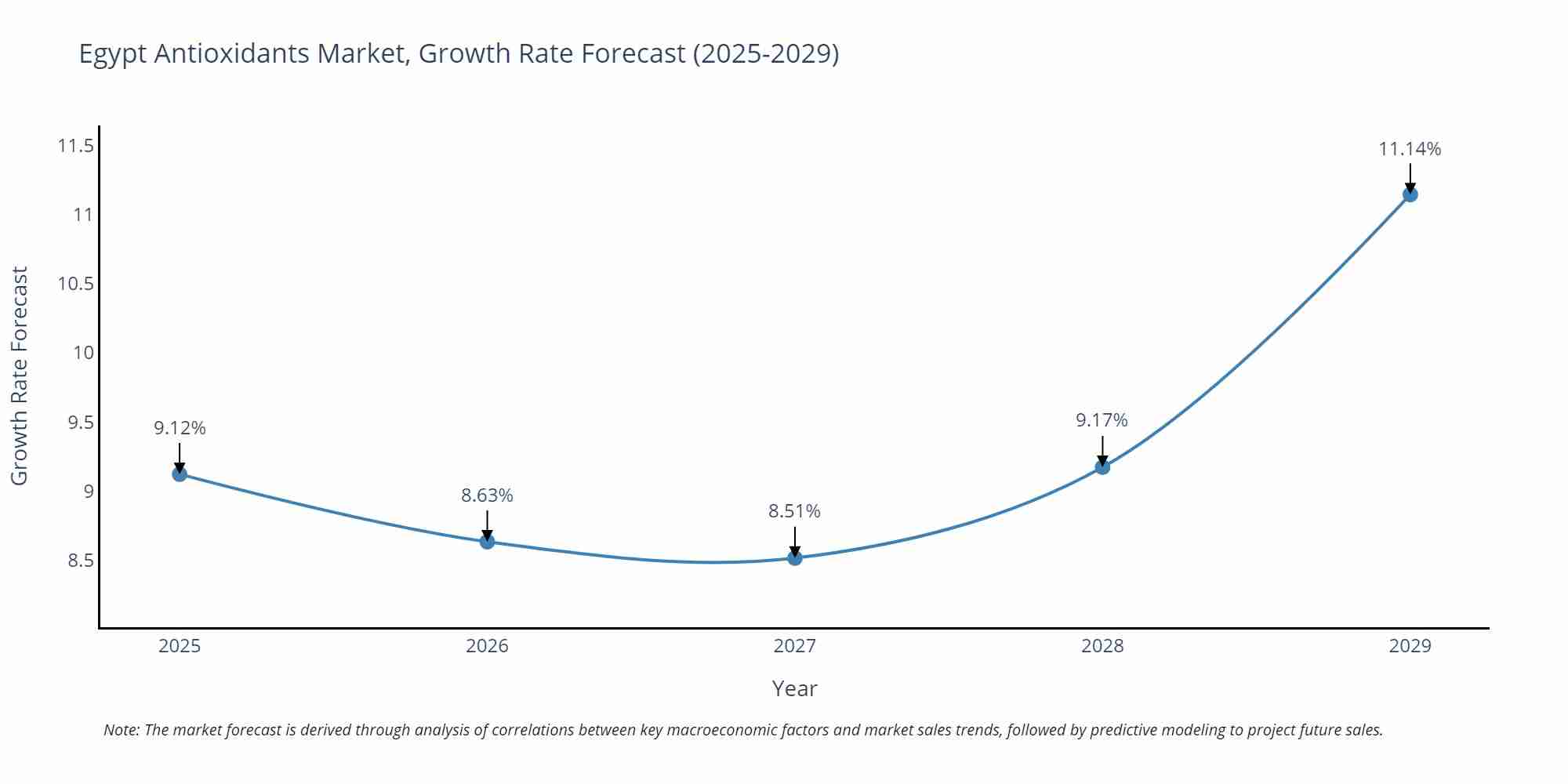

Egypt Antioxidants Market Size Growth Rate

The Egypt Antioxidants Market is projected to witness mixed growth rate patterns during 2025 to 2029. From 9.12% in 2025, the growth rate steadily ascends to 11.14% in 2029.

Egypt Antioxidants Market Highlights

| Report Name | Egypt Antioxidants Market |

| Forecast period | 2025-2031 |

| CAGR | 7.9% |

| Growing Sector | Food & Beverages |

Topics Covered in the Egypt Antioxidants Market Report

Egypt Antioxidants Market report thoroughly covers the market by type, by form, and by application. The market outlook report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Egypt Antioxidants Market Synopsis

The antioxidants market in Egypt is experiencing growth as awareness of health, wellness, and the role of nutrition in preventing chronic diseases increases. Antioxidants, which are substances that can prevent or slow damage to cells caused by free radicals, are becoming increasingly popular in dietary supplements and as additives in food and beverage products.

According to 6Wresearch, the Egypt Antioxidants Market size is estimated to grow at a CAGR of 7.9% during the forecast period 2025-2031. One of the primary drivers of this market is the expanding health-conscious consumer base in Egypt, seeking to improve their overall health and mitigate the effects of aging. Additionally, the growing food and beverage industry, with a focus on healthier product options, is fuelling the demand for antioxidants. The rise in disposable income among Egyptians is also enabling more people to invest in quality health supplements. Recent trends indicate a shift towards natural antioxidants derived from plants, in response to the increasing consumer preference for natural and organic products. There has also been notable research and development in the extraction and application of antioxidants from indigenous Egyptian plants, tapping into the rich biodiversity of the country is estimated to bolster the growth of the Egypt Antioxidants industry in the coming years.

Government Initiatives Introduced in the Egypt Antioxidants Market

The Egyptian government has introduced several initiatives aimed at bolstering local businesses. These include subsidies and tax incentives for companies that engage in research and development of natural antioxidants, as well as those utilizing local biodiversity. Furthermore, the government is actively promoting collaborations between private sectors and academic institutions to pioneer advancements in antioxidant applications.

Key Players in the Egypt Antioxidants Market

The Egypt antioxidants market is supported by a mix of international and local key players. Leading global brands continue to have a strong presence, while domestic companies such as Pharco Pharmaceuticals and Eva Pharma are steadily making inroads through a combination of strategic partnerships and innovation in antioxidant-based products.

Future Insights of the Egypt Antioxidants Market

The Egypt Antioxidants Market growth is poised to grow substantially in the future. As science continues to uncover the role antioxidants play in health and wellness, demand is expected to rise. Emphasis on sustainable extraction methods and a potential surge in exportation due to improved product quality are also anticipated trends that could shape the future of this burgeoning market.

Market Analysis by Type

According to Dhaval, Research Manager, 6Wresearch, natural antioxidants are experiencing a singular rise in demand. This growth is largely attributed to increasing consumer awareness and preference for natural ingredients in their dietary supplements, cosmetics, and food products.

Market Analysis by Application

Based on the application, the pharmaceuticals and personal care products sector that stands out for its growth. The increasing demand for antioxidants within this sector is attributable to a rising health and skin care consciousness among the Egyptian populace. There is a particular emphasis on preventive healthcare, which has led to a surge in the consumption of antioxidant-enriched pharmaceuticals.

Key attractiveness of the report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Egypt Antioxidants Market Outlook

- Market Size of Egypt Antioxidants Market, 2024

- Forecast of Egypt Antioxidants Market, 2031

- Historical Data and Forecast of Egypt Antioxidants Revenues & Volume for the Period 2021 - 2031

- Egypt Antioxidants Market Trend Evolution

- Egypt Antioxidants Market Drivers and Challenges

- Egypt Antioxidants Price Trends

- Egypt Antioxidants Porter's Five Forces

- Egypt Antioxidants Industry Life Cycle

- Historical Data and Forecast of Egypt Antioxidants Market Revenues & Volume By Type for the Period 2021 - 2031

- Historical Data and Forecast of Egypt Antioxidants Market Revenues & Volume By Natural Antioxidants for the Period 2021 - 2031

- Historical Data and Forecast of Egypt Antioxidants Market Revenues & Volume By Synthetic Antioxidants for the Period 2021 - 2031

- Historical Data and Forecast of Egypt Antioxidants Market Revenues & Volume By Form for the Period 2021 - 2031

- Historical Data and Forecast of Egypt Antioxidants Market Revenues & Volume By Dry for the Period 2021 - 2031

- Historical Data and Forecast of Egypt Antioxidants Market Revenues & Volume By Liquid for the Period 2021 - 2031

- Historical Data and Forecast of Egypt Antioxidants Market Revenues & Volume By Application for the Period 2021 - 2031

- Historical Data and Forecast of Egypt Antioxidants Market Revenues & Volume By Food and Feed Additives for the Period 2021 - 2031

- Historical Data and Forecast of Egypt Antioxidants Market Revenues & Volume By Pharmaceuticals and Personal Care Products for the Period 2021 - 2031

- Historical Data and Forecast of Egypt Antioxidants Market Revenues & Volume By Fuel and Lubricant Additives for the Period 2021 - 2031

- Historical Data and Forecast of Egypt Antioxidants Market Revenues & Volume By Plastic for the Period 2021 - 2031

- Historical Data and Forecast of Egypt Antioxidants Market Revenues & Volume By Rubber for the Period 2021 - 2031

- Historical Data and Forecast of Egypt Antioxidants Market Revenues & Volume By Latex Additives for the Period 2021 - 2031

- Egypt Antioxidants Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Form

- Market Opportunity Assessment By Application

- Egypt Antioxidants Top Companies Market Share

- Egypt Antioxidants Competitive Benchmarking By Technical and Operational Parameters

- Egypt Antioxidants Company Profiles

- Egypt Antioxidants Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Type

- Natural Antioxidants

- Synthetic Antioxidants

By Form

- Dry

- Liquid

By Application

- Food And Feed Additives

- Pharmaceuticals And Personal Care Products

- Fuel And Lubricant Additives

- Plastic

- Rubber

- Latex Additives

Egypt Antioxidants Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Egypt Antioxidants Market Overview |

| 3.1 Egypt Country Macro Economic Indicators |

| 3.2 Egypt Antioxidants Market Revenues & Volume, 2021 & 2031F |

| 3.3 Egypt Antioxidants Market - Industry Life Cycle |

| 3.4 Egypt Antioxidants Market - Porter's Five Forces |

| 3.5 Egypt Antioxidants Market Revenues & Volume Share, By Type, 2021 & 2031F |

| 3.6 Egypt Antioxidants Market Revenues & Volume Share, By Form, 2021 & 2031F |

| 3.7 Egypt Antioxidants Market Revenues & Volume Share, By Application, 2021 & 2031F |

| 4 Egypt Antioxidants Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Egypt Antioxidants Market Trends |

| 6 Egypt Antioxidants Market, By Types |

| 6.1 Egypt Antioxidants Market, By Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 Egypt Antioxidants Market Revenues & Volume, By Type, 2021 - 2031F |

| 6.1.3 Egypt Antioxidants Market Revenues & Volume, By Natural Antioxidants, 2021 - 2031F |

| 6.1.4 Egypt Antioxidants Market Revenues & Volume, By Synthetic Antioxidants, 2021 - 2031F |

| 6.2 Egypt Antioxidants Market, By Form |

| 6.2.1 Overview and Analysis |

| 6.2.2 Egypt Antioxidants Market Revenues & Volume, By Dry, 2021 - 2031F |

| 6.2.3 Egypt Antioxidants Market Revenues & Volume, By Liquid, 2021 - 2031F |

| 6.3 Egypt Antioxidants Market, By Application |

| 6.3.1 Overview and Analysis |

| 6.3.2 Egypt Antioxidants Market Revenues & Volume, By Food and Feed Additives, 2021 - 2031F |

| 6.3.3 Egypt Antioxidants Market Revenues & Volume, By Pharmaceuticals and Personal Care Products, 2021 - 2031F |

| 6.3.4 Egypt Antioxidants Market Revenues & Volume, By Fuel and Lubricant Additives, 2021 - 2031F |

| 6.3.5 Egypt Antioxidants Market Revenues & Volume, By Plastic, 2021 - 2031F |

| 6.3.6 Egypt Antioxidants Market Revenues & Volume, By Rubber, 2021 - 2031F |

| 6.3.7 Egypt Antioxidants Market Revenues & Volume, By Latex Additives, 2021 - 2031F |

| 7 Egypt Antioxidants Market Import-Export Trade Statistics |

| 7.1 Egypt Antioxidants Market Export to Major Countries |

| 7.2 Egypt Antioxidants Market Imports from Major Countries |

| 8 Egypt Antioxidants Market Key Performance Indicators |

| 9 Egypt Antioxidants Market - Opportunity Assessment |

| 9.1 Egypt Antioxidants Market Opportunity Assessment, By Type, 2021 & 2031F |

| 9.2 Egypt Antioxidants Market Opportunity Assessment, By Form, 2021 & 2031F |

| 9.3 Egypt Antioxidants Market Opportunity Assessment, By Application, 2021 & 2031F |

| 10 Egypt Antioxidants Market - Competitive Landscape |

| 10.1 Egypt Antioxidants Market Revenue Share, By Companies, 2024 |

| 10.2 Egypt Antioxidants Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero