Egypt White Cement Market (2025-2031) | Outlook, Companies, Growth, Revenue, Forecast, Share, Value, Industry, Trends, Size, Analysis

Market Forecast By Grade (Type I, Type III, Others), By Application (Architectural, Flooring, Tile grouting, Others), By End Use (Residential, Commercial, Industrial) And Competitive Landscape

| Product Code: ETC352912 | Publication Date: Aug 2022 | Updated Date: Jan 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 | |

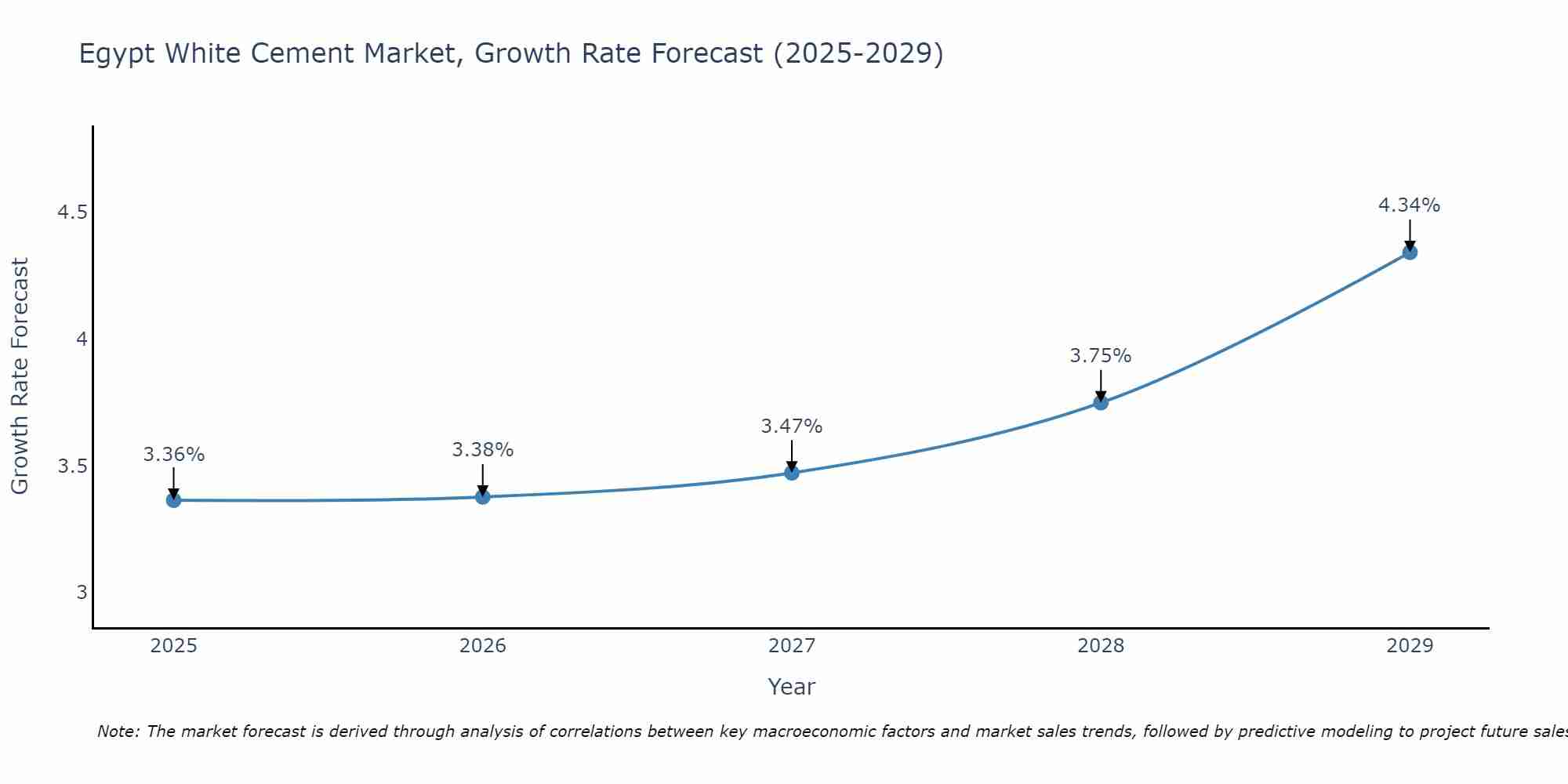

Egypt White Cement Market Size Growth Rate

The Egypt White Cement Market is poised for steady growth rate improvements from 2025 to 2029. Commencing at 3.36% in 2025, growth builds up to 4.34% by 2029.

Egypt White Cement Market Highlights

| Report Name | Egypt White Cement Market |

| Forecast Period | 2025-2031 |

| CAGR | 5.4% |

| Growing Sector | Commercial |

Topics Covered in the Egypt White Cement Market Report

Egypt White Cement Market report thoroughly covers the market by grade, by application, and by end use. The market outlook report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Egypt White Cement Market Synopsis

The Egypt white cement market has gained significant traction over recent years, driven by the country's increasing urbanization and the booming construction sector. White cement is widely used for aesthetic purposes in building and construction projects due to its ability to produce brightly colored concretes and mortars. With its superior strength and durability, it has become a material of choice for high-value projects including architectural and structural applications.

According to 6Wresearch, the Egypt White Cement Market size is projected to reach at a CAGR of 5.4% during the forecast period 2025-2031. The growing demand for aesthetic building materials in the construction of commercial and residential buildings. Additionally, the rise in restoration and renovation activities of historical buildings, where the use of white cement is prevalent for its compatibility with older materials, further boosts the market. The government's push towards infrastructure development projects also plays a crucial role in stimulating demand. Innovations in manufacturing technologies aimed at reducing the environmental footprint of white cement production are trending within the industry. Additionally, there is a growing emphasis on sustainability, driving the adoption of eco-friendly materials and practices in the white cement market. The development of new formulations that enhance the properties of white cement, such as increased resistance to weathering and discoloration, is also a key trend, helping to expand its applications in diverse construction projects is estimated to boost the Egypt White Cement Market growth.

Government Initiatives Introduced in the Egypt White Cement Market

The Egyptian government has launched several initiatives to boost the white cement industry, focusing on energy efficiency and sustainability. These initiatives include subsidies for the use of renewable energy in manufacturing processes and incentives for companies adopting environmentally friendly production methods. Additionally, regulations have been put in place to ensure that all new constructions comply with green building standards, thereby increasing the demand for white cement.

Key Players in the Egypt White Cement Market

The white cement market in Egypt features a competitive landscape with both local and international players. Prominent companies such as Sinai White Portland Cement, Royal Cement, and Lafarge Cement Egypt lead the market, due to their consistent quality, extensive distribution networks, and brand reputation.

Future Insights of the Egypt White Cement Market

The Egypt white cement industry looks promising, with expectations of steady growth driven by the construction industry's revival. Urban development projects, infrastructural enhancements, and the increasing popularity of aesthetic construction materials are set to propel the demand for white cement. Additionally, technological advancements in manufacturing processes and a growing focus on sustainability are likely to open new avenues for eco-friendly and energy-efficient white cement solutions.

Market Analysis by Application

According to Dhaval, Research Manager, 6Wresearch, the "Architectural" application segment is experiencing significant growth. This upward trend is largely driven by the increasing demand for aesthetic and durable construction materials in both residential and commercial projects.

Market Analysis by End Users

Based on the end users, the commercial application dominating the Egypt White Cement Market share, driven by the expanding commercial infrastructure, including corporate buildings, shopping centers, and the hospitality industry, which demands high-quality, aesthetically pleasing construction materials such as white cement.

Key attractiveness of the report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024

- Base Year: 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Egypt White Cement Market Outlook

- Market Size of Egypt White Cement Market, 2024

- Forecast of Egypt White Cement Market, 2031

- Historical Data and Forecast of Egypt White Cement Revenues & Volume for the Period 2020 - 2031

- Egypt White Cement Market Trend Evolution

- Egypt White Cement Market Drivers and Challenges

- Egypt White Cement Price Trends

- Egypt White Cement Porter's Five Forces

- Egypt White Cement Industry Life Cycle

- Historical Data and Forecast of Egypt White Cement Market Revenues & Volume By Grade for the Period 2020 - 2031

- Historical Data and Forecast of Egypt White Cement Market Revenues & Volume By Type I for the Period 2020 - 2031

- Historical Data and Forecast of Egypt White Cement Market Revenues & Volume By Type III for the Period 2020 - 2031

- Historical Data and Forecast of Egypt White Cement Market Revenues & Volume By Others for the Period 2020 - 2031

- Historical Data and Forecast of Egypt White Cement Market Revenues & Volume By Application for the Period 2020 - 2031

- Historical Data and Forecast of Egypt White Cement Market Revenues & Volume By Architectural for the Period 2020 - 2031

- Historical Data and Forecast of Egypt White Cement Market Revenues & Volume By Flooring for the Period 2020 - 2031

- Historical Data and Forecast of Egypt White Cement Market Revenues & Volume By Tile grouting for the Period 2020 - 2031

- Historical Data and Forecast of Egypt White Cement Market Revenues & Volume By Others for the Period 2020 - 2031

- Historical Data and Forecast of Egypt White Cement Market Revenues & Volume By End Use for the Period 2020 - 2031

- Historical Data and Forecast of Egypt White Cement Market Revenues & Volume By Residential for the Period 2020 - 2031

- Historical Data and Forecast of Egypt White Cement Market Revenues & Volume By Commercial for the Period 2020 - 2031

- Historical Data and Forecast of Egypt White Cement Market Revenues & Volume By Industrial for the Period 2020 - 2031

- Egypt White Cement Import Export Trade Statistics

- Market Opportunity Assessment By Grade

- Market Opportunity Assessment By Application

- Market Opportunity Assessment By End Use

- Egypt White Cement Top Companies Market Share

- Egypt White Cement Competitive Benchmarking By Technical and Operational Parameters

- Egypt White Cement Company Profiles

- Egypt White Cement Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Grade

- Type I

- Type III

- Others

By Application

- Architectural

- Flooring

- Tile Grouting

- Others

By End Use

- Residential

- Commercial

- Industrial

Egypt White Cement Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Egypt White Cement Market Overview |

| 3.1 Egypt Country Macro Economic Indicators |

| 3.2 Egypt White Cement Market Revenues & Volume, 2021 & 2031F |

| 3.3 Egypt White Cement Market - Industry Life Cycle |

| 3.4 Egypt White Cement Market - Porter's Five Forces |

| 3.5 Egypt White Cement Market Revenues & Volume Share, By Grade, 2021 & 2031F |

| 3.6 Egypt White Cement Market Revenues & Volume Share, By Application, 2021 & 2031F |

| 3.7 Egypt White Cement Market Revenues & Volume Share, By End Use, 2021 & 2031F |

| 4 Egypt White Cement Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Egypt White Cement Market Trends |

| 6 Egypt White Cement Market, By Types |

| 6.1 Egypt White Cement Market, By Grade |

| 6.1.1 Overview and Analysis |

| 6.1.2 Egypt White Cement Market Revenues & Volume, By Grade, 2021 - 2031F |

| 6.1.3 Egypt White Cement Market Revenues & Volume, By Type I, 2021 - 2031F |

| 6.1.4 Egypt White Cement Market Revenues & Volume, By Type III, 2021 - 2031F |

| 6.1.5 Egypt White Cement Market Revenues & Volume, By Others, 2021 - 2031F |

| 6.2 Egypt White Cement Market, By Application |

| 6.2.1 Overview and Analysis |

| 6.2.2 Egypt White Cement Market Revenues & Volume, By Architectural, 2021 - 2031F |

| 6.2.3 Egypt White Cement Market Revenues & Volume, By Flooring, 2021 - 2031F |

| 6.2.4 Egypt White Cement Market Revenues & Volume, By Tile grouting, 2021 - 2031F |

| 6.2.5 Egypt White Cement Market Revenues & Volume, By Others, 2021 - 2031F |

| 6.3 Egypt White Cement Market, By End Use |

| 6.3.1 Overview and Analysis |

| 6.3.2 Egypt White Cement Market Revenues & Volume, By Residential, 2021 - 2031F |

| 6.3.3 Egypt White Cement Market Revenues & Volume, By Commercial, 2021 - 2031F |

| 6.3.4 Egypt White Cement Market Revenues & Volume, By Industrial, 2021 - 2031F |

| 7 Egypt White Cement Market Import-Export Trade Statistics |

| 7.1 Egypt White Cement Market Export to Major Countries |

| 7.2 Egypt White Cement Market Imports from Major Countries |

| 8 Egypt White Cement Market Key Performance Indicators |

| 9 Egypt White Cement Market - Opportunity Assessment |

| 9.1 Egypt White Cement Market Opportunity Assessment, By Grade, 2021 & 2031F |

| 9.2 Egypt White Cement Market Opportunity Assessment, By Application, 2021 & 2031F |

| 9.3 Egypt White Cement Market Opportunity Assessment, By End Use, 2021 & 2031F |

| 10 Egypt White Cement Market - Competitive Landscape |

| 10.1 Egypt White Cement Market Revenue Share, By Companies, 2024 |

| 10.2 Egypt White Cement Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero