Ethiopia Construction Equipment Market (2019-2025) | industry, Growth, Size, Forecast, Revenue, Share, Analysis & Outlook

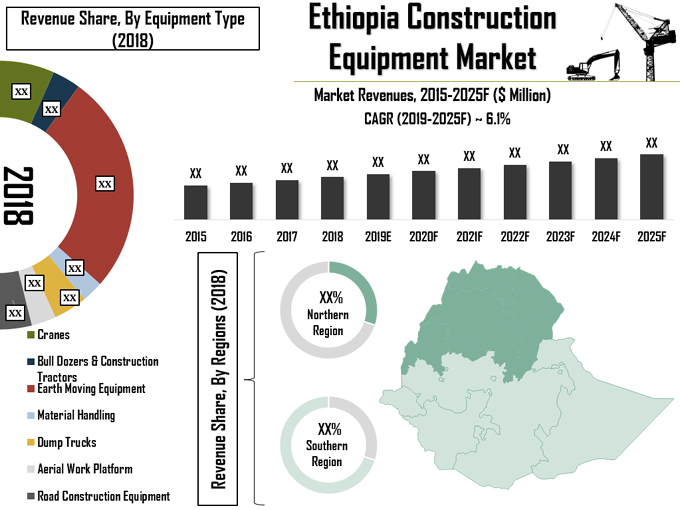

Market Forecast By Equipment Type (Crane (Mobile Crane, Crawler Crane, and Tower Crane), Construction Tractors & Bulldozers, Earth Moving (Loader (Backhoe Loader, Wheeled Loader, Skid Steer Loader, and Compact Track Loader), Excavator (Tracked Excavator, Mini Excavator, and Wheeled Excavator) and Motor Grader), Material Handling (Forklift and Telescopic Handler), Dump Trucks, Aerial Work Platform (Articulated Boom Lift, Telescopic Boom Lift, and Scissor Lifts), Road Construction Equipment (Paver and Road Roller)), By Applications (Construction, Mining and Others), By Regions (Northern and Southern) and Competitive Landscape.

| Product Code: ETC000628 | Publication Date: Feb 2023 | Product Type: Report | ||

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 90 | No. of Figures: 42 | No. of Tables: 16 |

Ethiopia construction equipment market report thoroughly covers the market by equipment type, applications, and regions. The Ethiopia construction equipment market outlook report provides an unbiased and detailed analysis of the ongoing Ethiopian construction equipment market trends, opportunities/ high growth areas, and market drivers which would help the stakeholders to decide and align their market strategies accordingly to the current and future market dynamics.

Latest 2023 Development of Ethiopia Construction Equipment Market

Ethiopia Construction Equipment Market is expanding rapidly due to increased investment in infrastructure and real estate projects. Also, the government has been investing heavily in the construction sector, which has resulted in cumulative demand for construction equipment. The market is developing over the years. Some of the primary development of this market include government investment in road construction projects which has resulted in high demand for heavy construction equipment such as excavators and road rollers.

The real estate sector in Ethiopia is also expanding by the growing middle class leading to a high demand for construction equipment such as concrete mixers, cranes, and bulldozers. Ethiopia has several dam construction projects underway. For instance, the Grand Ethiopian Renaissance Dam is one of the largest hydroelectric power projects in Africa. Moreover, the mining sector in Ethiopia is growing rapidly, and the government has been investing in the development of mineral resources such as platinum, gold, and nickel. Overall, the construction equipment market in Ethiopia is augmenting in the coming years by increased investment in infrastructure and real estate projects.

Ethiopia construction equipment market Synopsis

Ethiopia construction equipment market is driven by the extensive road network expansion plans by the government of Ethiopia. Rapid development has created an opportunity for Chinese and European construction equipment companies to invest in the country. Local manufacturing of construction equipment in the country is non-existent and the market is primarily import-driven.

According to 6Wresearch, Ethiopia construction equipment market size is projected to grow at a CAGR of 6.1% during 2019-2025. The rising development of infrastructure coupled with the growing shortage of labour is driving the Ethiopia Construction Equipment Market Growth. Growing demand owing to the increasing establishment of buildings, malls, shopping complexes, and commercial offices backed by the surging number of construction projects. Growing development in various industries such as commercial and industrial is also proliferating Ethiopia Construction Share.

Ethiopia Construction Equipment Market includes earthmoving machinery, material handling machinery, roadway machinery, and others. Earthmoving equipment is used to move heavy equipment such as dig foundations and landscape areas material handling equipment is used to move raw, waste material from one place to another; and roadway machineries such as graders, road rollers, and pavers, are used in the proper construction of roads.

Ethiopia construction equipment market is expected to register sound revenues in the foreseeable future backed by the rapid change in the modernization era coupled with an increase in transportation infrastructures such as railways and road construction through using construction equipment and is expected to acquire high sales revenues in the coming years. Moreover, on the basis of end-users, the power utility industry is expected to dominate the overall market revenues owing to rising hydroelectricity projects such as the Hydroelectric power plant installation in the country which would instigate the deployment of construction equipment and would spur the progressive growth of Ethiopia construction equipment market in the coming years.

Ethiopia contribution equipment market is estimated to gain momentum in the forthcoming years backed by the rise in the growth of population has led to the increasing construction of the house. Moreover, the rising industrial landscape is also estimated to witness substantial growth in construction equipment.

The major key players operating in the Ethiopia construction equipment market include Adrighen & Al Dibiki, CRANES Co., Denyo Egypt Co., Mantrac Egypt, Flash Cranes & Equipment, and Big Rental Egypt.

Ethiopia construction equipment market is estimated to register sound revenues in the coming timeframe on the back of the rise in the growth of the EXIM industry in the country. Additionally, the increase in the export of coffee, pulses, and leather products. On the other hand, the top importing countries are Asia, Europe, and the united states tend to import aircraft where cranes are proven evident in loading and unloading heavy cartons and products and are estimated to instigate the use of construction equipment and would benefit the Growth of the Ethiopia construction equipment market in the upcoming six years.

Market Analysis by Application

The construction application segment is the key revenue-generating segment in the overall Ethiopia construction equipment market share owing to the widespread expansion and development of the road networks in the country. Further, government initiatives such as Ethiopia Vision 2025, Growth and Transformation Plan - II, and massive infrastructure projects such as The Great Renaissance Dam would lead to growth in demand for construction equipment in Ethiopia.

Market Analysis by equipment type

The earthmoving equipment type accounted for the highest share in terms of market revenues; however, other equipment types such as cranes, material handling, and road construction equipment are considered the key growing construction equipment types.

Key Highlights of the Report:

- Ethiopia Construction Equipment Market Overview

- Ethiopia Construction Equipment Market Outlook

- Ethiopia Construction Equipment Market Forecast

- Ethiopia Construction Equipment Market Size and Ethiopia Construction Equipment Market Forecast, Until 2025

- Historical data of Ethiopia Construction Equipment Market for the Period 2015-2018.

- Market Size & Forecast of Ethiopia Construction Equipment Market until 2025.

- Historical data of Ethiopia Cranes Market for the Period 2015-2018.

- Market Size & Forecast of Ethiopia Cranes Market until 2025.

- Historical data of Ethiopia Bull Dozers & Construction Tractors Market for the Period 2015-2018.

- Market Size & Forecast of Ethiopia Bull Dozers & Construction Tractors Market until 2025.

- Historical data of Ethiopia Earthmoving Equipment Market for the Period 2015-2018.

- Market Size & Forecast of Ethiopia Earthmoving Equipment Market until 2025.

- Historical data of Ethiopia Material Handling Market for the Period 2015-2018.

- Market Size & Forecast of Ethiopia Material Handling Market until 2025.

- Historical data of Ethiopia Dump Trucks Market for the Period 2015-2018.

- Market Size & Forecast of Ethiopia Dump Trucks Market until 2025.

- Historical data of Ethiopia Aerial Work Platform Market for the Period 2015-2018.

- Market Size & Forecast of Ethiopia Aerial Work Platform Market until 2025.

- Historical data of Ethiopia Road Construction Equipment Market for the Period 2015-2018.

- Market Size & Forecast of Ethiopia Road Construction Equipment Market until 2025.

- Historical and Forecast data of Ethiopia Construction Equipment Market Revenue, By Applications for the Period 2015-2025.

- Historical and Forecast data of Ethiopia Construction Equipment Market Revenue, By Regions for the Period 2015-2025

- Market Drivers and Restraints

- Ethiopia Construction Equipment Market Trends and Development

- Ethiopia Construction Equipment Market Share, By Players

- Ethiopia Construction Equipment Market Overview on Competitive Benchmarking

- Company Profiles

- Strategic Recommendations

Markets Covered:

The Ethiopia construction equipment market report provides a detailed analysis of the following market segments:

By Equipment Type

1. Crane

- Mobile Crane

- Crawler Crane

- Tower Crane

2. Construction Tractors & Bulldozers

3. Earthmoving

Loader

- Backhoe Loader

- Wheeled Loader

- Skid Steer Loader

- Compact Track Loader

Excavator

- Tracked Excavator

- Mini Excavator

- Wheeled Excavator

Material Handling

- Forklift

- Telescopic Handler

- Dump Trucks

- Aerial Work Platform

Articulated Boom Lift

- Telescopic Boom Lift

- Scissor Lifts

Road Construction Equipment

Paver

Road Roller

By Applications

- Construction

- Mining

- Others

By Regions

- Northern

- Southern

Ethiopia Construction Equipment Market: FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Robust Forecasting Model |

| 2.6 Assumptions |

| 3 Ethiopia Construction Equipment Market Overview |

| 3.1 Ethiopia Country Indicators |

| 3.2 Ethiopia Construction Equipment Market Revenues & Volume (2015-2025F) |

| 3.3 Ethiopia Construction Equipment Market Industry Life Cycle, 2018 |

| 3.4 Ethiopia Construction Equipment Market Value Chain & Ecosystem |

| 3.5 Ethiopia Construction Equipment Market Porter’s Five Forces Model, 2018 |

| 3.6 Ethiopia Construction Equipment Market Revenue and Volume Share, By Equipment Types (2018 & 2025F) |

| 3.7 Ethiopia Construction Equipment Market Revenue Share, By Applications (2018 & 2025F) |

| 3.8 Ethiopia Construction Equipment Market Revenue Share, By Regions (2018 & 2025F) |

| 4 Ethiopia Construction Equipment Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Ethiopia Construction Equipment Market Trends |

| 6 Ethiopia Cranes Market Overview |

| 6.1 Ethiopia Cranes Market Revenues & Volume (2015-2025F) |

| 6.2 Ethiopia Cranes Market Revenues & Volume Share, By Types (2018 & 2025F) |

| 6.2.1 Ethiopia Mobile Cranes Market Revenues & Volume (2015-2025F) |

| 6.2.2 Ethiopia Crawler Cranes Market Revenues & Volume (2015-2025F) |

| 6.2.3 Ethiopia Tower Cranes Market Revenues & Volume (2015-2025F) |

| 7 Ethiopia Construction Tractors & Bulldozers Market Overview |

| 7.1 Ethiopia Construction Tractors & Bulldozers Market Revenues & Volume (2015-2025F) |

| 8 Ethiopia Earth Moving Equipment Market Overview |

| 8.1 Ethiopia Earth Moving Equipment Market Revenues & Volume (2015-2025F) |

| 8.2 Ethiopia Earth Moving Equipment Market Revenues & Volume Share, By Types (2018 & 2025F) |

| 8.2.1 Ethiopia Loaders Market Revenues & Volume (2015-2025F) |

| 8.2.2 Ethiopia Loaders Market Revenues & Volume Share, By Types (2018 & 2025F) |

| 8.2.2.1 Ethiopia Wheeled Loaders Market Revenues & Volume (2015-2025F) |

| 8.2.2.2 Ethiopia Skid Steer Loaders Market Revenues & Volume (2015-2025F) |

| 8.2.2.3 Ethiopia Backhoe Loaders Market Revenues & Volume (2015-2025F) |

| 8.2.2.4 Ethiopia Compact Track Loaders Market Revenues & Volume (2015-2025F) |

| 8.2.3 Ethiopia Excavators Market Revenues & Volume (2015-2025F) |

| 8.2.4 Ethiopia Excavators Market Revenues & Volume Share, By Types (2018 & 2025F) |

| 8.2.4.1 Ethiopia Tracked Excavators Market Revenues & Volume (2015-2025F) |

| 8.2.4.2 Ethiopia Mini Excavators Market Revenues & Volume (2015-2025F) |

| 8.2.4.3 Ethiopia Wheeled Excavators Market Revenues & Volume (2015-2025F) |

| 8.2.5 Ethiopia Motor Grader Market Revenues & Volume (2015-2025F) |

| 9 Ethiopia Material Handling Equipment Market Overview |

| 9.1 Ethiopia Material Handling Equipment Market Revenues & Volume (2015-2025F) |

| 9.2 Ethiopia Material Handling Equipment Market Revenues & Volume Share, By Types (2018 & 2025F) |

| 9.2.1 Ethiopia Forklift Market Revenues & Volume (2015-2025F) |

| 9.2.2 Ethiopia Telescopic Handler Market Revenues & Volume (2015-2025F) |

| 10 Ethiopia Dump Trucks Market Overview |

| 10.1 Ethiopia Dump Trucks Market Revenues & Volume (2015-2025F) |

| 11 Ethiopia Aerial Work Equipment Market Overview |

| 11.1 Ethiopia Aerial Work Platform Market Revenues & Volume (2015-2025F) |

| 11.2 Ethiopia Aerial Work Platform Market Revenues & Volume Share, By Types (2018 & 2025F) |

| 11.2.1 Ethiopia Articulated Boomlift Market Revenues & Volume (2015-2025F) |

| 11.2.2 Ethiopia Scissor Lift Market Revenues & Volume (2015-2025F) |

| 11.2.3 Ethiopia Telescopic Boom lift Market Revenues & Volume (2015-2025F) |

| 12 Ethiopia Road Construction Equipment Market Overview |

| 12.1 Ethiopia Road Construction Market Revenues & Volume (2015-2025F) |

| 12.2 Ethiopia Road Construction Market Revenues & Volume Share, By Types (2018 & 2025F) |

| 12.2.1 Ethiopia Paver Market Revenues & Volume (2015-2025F) |

| 12.2.2 Ethiopia Road Roller Market Revenues & Volume (2015-2025F) |

| 13 Ethiopia Construction Equipment Market Overview, By Applications |

| 13.1 Ethiopia Construction Equipment Market Revenues, By Construction Application (2015-2025F) |

| 13.2 Ethiopia Construction Equipment Market Revenues, By Mining Application (2015-2025F) |

| 13.3 Ethiopia Construction Equipment Market Revenues, By Other Applications (2015-2025F) |

| 14 Ethiopia Construction Equipment Market Overview, By Regions |

| 14.1 Ethiopia Construction Equipment Market Revenues, By Northern Region (2015-2025F) |

| 14.2 Ethiopia Construction Equipment Market Revenues, By Southern Region (2015-2025F) |

| 15 Ethiopia Construction Equipment Market - Key Performance Indicators |

| 16 Ethiopia Construction Equipment Market Opportunity Assessment |

| 16.1 Ethiopia Construction Equipment Market Opportunity Assessment, By Types (2024F) |

| 16.2 Ethiopia Construction Equipment Market Opportunity Assessment, By Applications (2024F) |

| 17 Ethiopia Construction Equipment Market Competitive Landscape |

| 17.1 Ethiopia Construction Equipment Market, Company Ranking (2018) |

| 17.2 Ethiopia Construction Equipment Market, Competitive Benchmarking, By Operating Parameters |

| 18 Company Profiles |

| 18.1 Volvo CE |

| 18.2 Caterpillar Inc. |

| 18.3 Komatsu Ltd. |

| 18.4 Hitachi Ltd. |

| 18.5 J C Bamford Excavators Limited |

| 18.6 Doosan Infracore Co., Ltd. |

| 18.7 Xuzhou Construction Machinery Group Co., Ltd. |

| 18.8 Kobelco Construction Machinery Co., Ltd. |

| 18.9 SANY Group |

| 18.10 Metso Corporation |

| 19 Key Strategic Recommendations |

| 20 Disclaimer |

| List of Figures |

| 1. Ethiopia Construction Equipment Market Revenues & Volume, 2015 - 2025F ($ Million, Hundred Units) |

| 2. Ethiopia Construction Equipment Market - Industry Life Cycle, 2018 |

| 3. Ethiopia Construction Equipment Market Revenue Share, By Equipment Type, 2018 & 2025F |

| 4. Ethiopia Construction Equipment Rental Market Volume Share, By Equipment Type, 2018 & 2025F |

| 5. Ethiopia Construction Equipment Market Revenue Share, By Applications, 2018 & 2025F |

| 6. Ethiopia Construction Equipment Market Revenue Share, By Regions, 2018 & 2025F |

| 7. Ethiopia Industrial Sector Growth Rate, 2016-2021F (%) |

| 8. Ethiopia Cranes Market Revenues & Volume, 2015-2025F ($ Million, Units) |

| 9. Ethiopia Cranes Market Revenue Share, By Types, 2018 & 2025F |

| 10. Ethiopia Cranes Market Volume Share, By Types, 2018 & 2025F |

| 11. Ethiopia Construction Tractors & Bulldozers Market Revenues & Volume, 2015-2025F ($ Million, Units) |

| 12. Ethiopia Earth Moving Equipment Market Revenues & Volume, 2015-2025F ($ Million, Units) |

| 13. Ethiopia Earth Moving Equipment Market Revenue Share, By Types, 2018 & 2025F |

| 14. Ethiopia Earth Moving Equipment Market Volume Share, By Types, 2018 & 2025F |

| 15. Ethiopia Loaders Market Revenues & Volume, 2015-2025F ($ Million, Units) |

| 16. Ethiopia Loaders Market Revenue Share, By Types, 2018 & 2025F |

| 17. Ethiopia Loaders Market Volume Share, By Types, 2018 & 2025F |

| 18. Ethiopia Excavators Market Revenues & Volume, 2015-2025F ($ Million, Units) |

| 19. Ethiopia Excavators Market Revenue Share, By Types, 2018 & 2025F |

| 20. Ethiopia Excavators Market Volume Share, By Types, 2018 & 2025F |

| 21. Ethiopia Motor Grader Market Revenues & Volume, 2015-2025F ($ Million, Units) |

| 22. Ethiopia Material Handling Market Revenues & Volume, 2015-2025F ($ Million, Units) |

| 24. Ethiopia Material Handling Market Revenue Share, By Types, 2018 & 2025F |

| 24. Ethiopia Material Handling Market Volume Share, By Types, 2018 & 2025F |

| 26. Ethiopia Dump Trucks Market Revenues & Volume, 2015-2025F ($ Million, Units) |

| 26. Ethiopia Aerial Work Market Revenues & Volume, 2015-2025F ($ Million, Units) |

| 27. Ethiopia Aerial Work Market Revenue Share, By Types, 2018 & 2025F |

| 28. Ethiopia Aerial Work Market Volume Share, By Types, 2018 & 2025F |

| 29. Ethiopia Road Construction Equipment Market Revenues & Volume, 2015-2025F ($ Million, Units) |

| 30. Ethiopia Road Construction Equipment Market Revenue Share, By Types, 2018 & 2025F |

| 31. Ethiopia Road Construction Equipment Market Volume Share, By Types, 2018 & 2025F |

| 32. Ethiopia Construction Equipment Market Revenue Share, By Applications, 2018 & 2025F |

| 33. Ethiopia Construction Application Construction Equipment Market Revenues, 2015-2025F ($ Million) |

| 34. Ethiopia Mining Application Construction Equipment Market Revenues, 2015-2025F ($ Million) |

| 35. Ethiopia Other Application Construction Equipment Market Revenues, 2015-2025F ($ Million) |

| 36. Ethiopia Construction Equipment Market Revenue Share, By Regions, 2018 & 2025F |

| 37. Ethiopia Northern Region Construction Equipment Market Revenues, 2015-2025F ($ Million) |

| 38. Ethiopia Southern Region Construction Equipment Market Revenues, 2015-2025F ($ Million) |

| 39. Ethiopia Actual Government Spending Vs Actual Government Revenues, 2015-2024F (Ethiopian Birr Billion) |

| 40. Ethiopia Construction Equipment Market Opportunity Assessment, By Equipment Type, 2025F |

| 41. Ethiopia Construction Equipment Market Opportunity Assessment, By Applications, 2025F |

| 42. Ethiopia Construction Equipment Market, Company Ranking, 2018 |

| List of Tables |

| 1. Upcoming Construction Projects in Ethiopia |

| 2. Construction Equipment Prices of Used Products |

| 3. Ethiopia Cranes Market Revenues, By Types, 2015-2025F ($ Million) |

| 4. Ethiopia Cranes Market Volume, By Types, 2015-2025F (Units) |

| 5. Ethiopia Loaders Market Revenues, By Types, 2015-2025F ($ Million) |

| 6. Ethiopia Loaders Market Volume, By Types, 2015-2025F (Units) |

| 7. Ethiopia Excavators Market Revenues, By Types, 2015-2025F ($ Million) |

| 8. Ethiopia Excavators Market Volume, By Types, 2015-2025F (Units) |

| 9. Ethiopia Material Handling Market Revenues, By Types, 2015-2025F ($ Million) |

| 10. Ethiopia Material Handling Market Volume, By Types, 2015-2025F (Units) |

| 11. Ethiopia Aerial Work Market Revenues, By Types, 2015-2025F ($ Million) |

| 12. Ethiopia Aerial Work Market Volume, By Types, 2015-2025F (Units) |

| 13. Ethiopia Road Construction Market Revenues, By Types, 2015-2025F ($ Million) |

| 14. Ethiopia Road Construction Market Volume, By Types, 2015-2025F (Units) |

| 15. Hotel Chain Development Pipelines in Africa, 2018 |

| 16. New Highways or Expressways |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero