France Air Purifier Market (2020-2026) | Size, Share, Growth, Revenue, Outlook, Analysis, Forecast, Trend & COVID-19 IMPACT

Market Forecast By Technology (Type-I (HEPA + Carbon), Type-II (HEPA + Carbon + Ionizer), Type-III (HEPA + Carbon+ UV), Type-IV (HEPA + Carbon + Electrostatic), Type-V (HEPA + Carbon + Ionizer + UV + Electrostatic), Other Technologies),By Applications (Residential, Commercial, Industrial),By CADR Values (Low (Up to 250 m3/h),Medium (251 to 500 m3/h),High (Above 500 m3/h))and competitive landscape

| Product Code: ETC002411 | Publication Date: Jul 2022 | Updated Date: Nov 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 10 | No. of Tables: 6 |

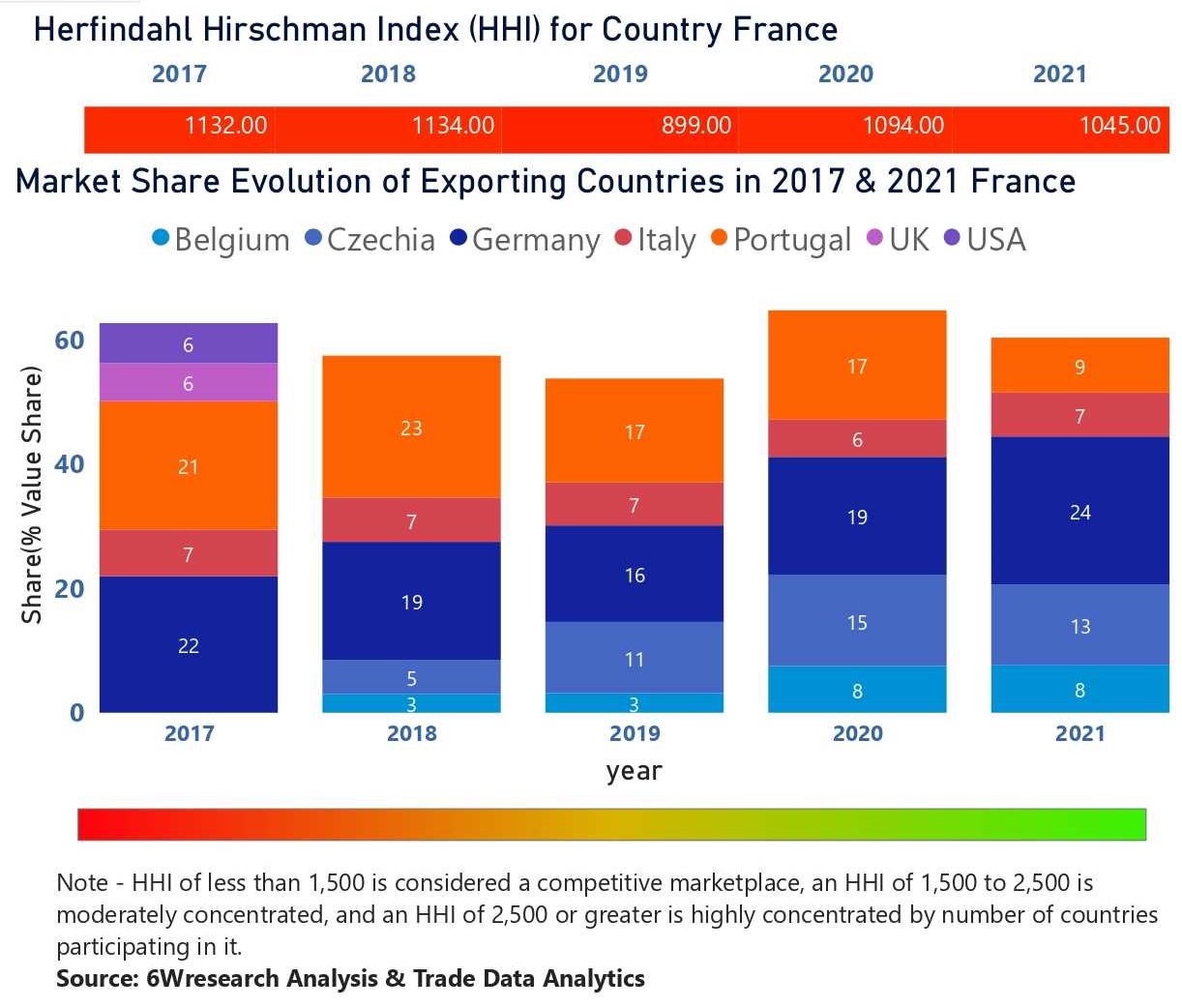

France Air Purifier Market Top 5 Importing Countries and Market Competition (HHI) Analysis

In 2024, France`s air purifier import market saw a shift towards diversification with top exporters being Germany, USA, Italy, China, and UK. The market showed a significant decrease in concentration levels from moderate to low, indicating a more balanced supplier base. The negative CAGR of -20.93% from 2020 to 2024 reflects a challenging period for the industry, while the steep decline in growth rate by -49.54% from 2023 to 2024 suggests a recent downturn in demand. Overall, the market dynamics indicate a need for adaptation and innovation among air purifier suppliers targeting the French market.

France Air Purifier Market | Country-Wise Share and Competition Analysis

In the year 2021, Germany was the largest exporter in terms of value, followed by Czechia. It has registered a growth of 35.59% over previous year. While Czechia registered a decline of -5% over previous year. While in 2017 Germany was the largest exporter followed by Portugal. In term of Herfindahl Index, which measures the competitiveness of countries exporting, France has Herfindahl index of 1132 in 2017 which signifies high competitiveness while in 2021 it registered a Herfindahl index of 1045 which signifies high competitiveness in the market

![France Air Purifier Market Country-Wise Share and Competition Analysis]() France Air Purifier Market - Export Market Opportunities

France Air Purifier Market - Export Market Opportunities![France Air Purifier Market - Export Market Opportunities]() Topics Covered in the France Air Purifier Market

Topics Covered in the France Air Purifier Market

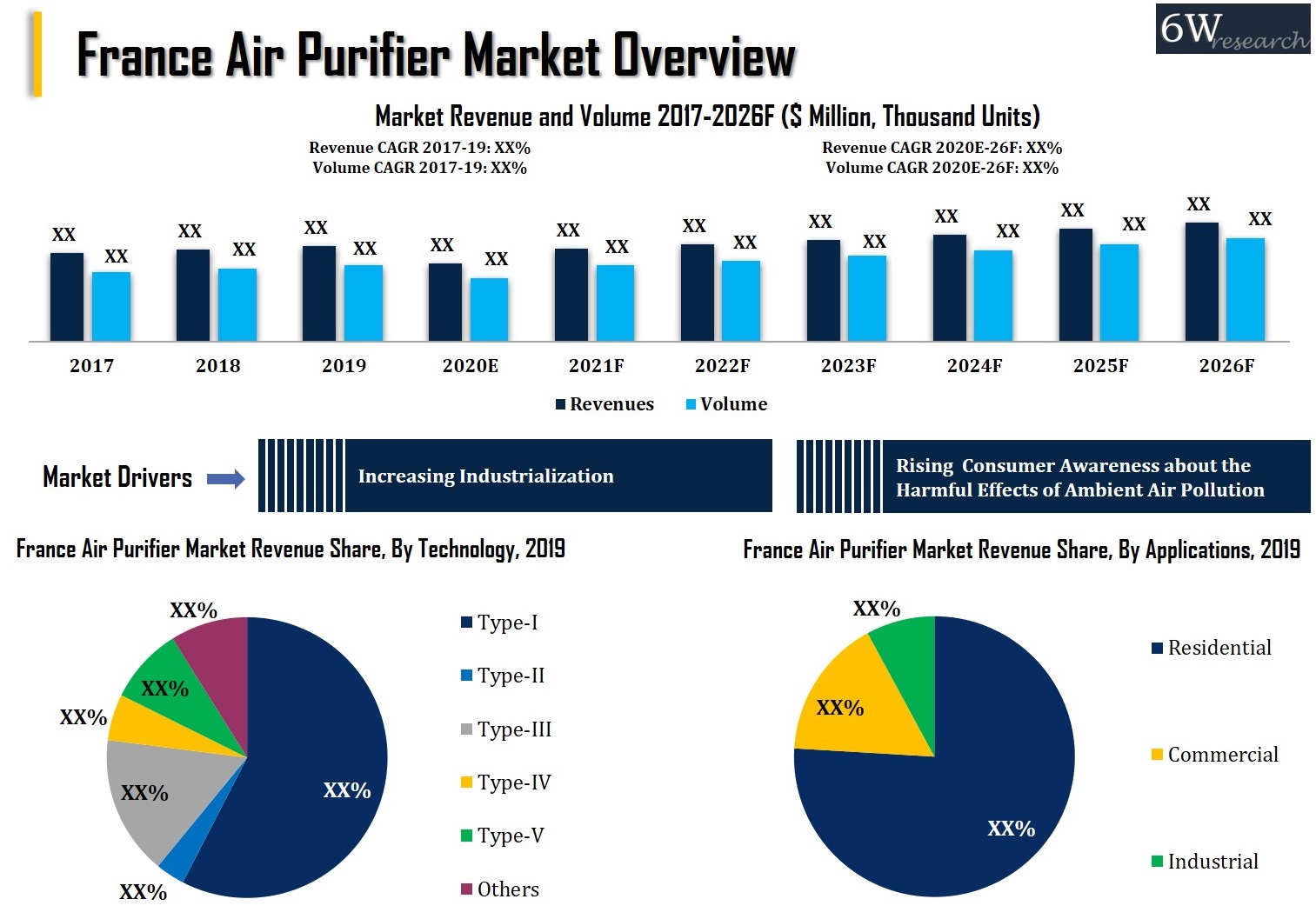

The France Air Purifier Market report thoroughly covers the market by technology, by applications, and by CADR Values. The market outlook report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Latest (2023) Development of the France Air Purifier Market

France Air Purifier Market is proliferating in the country underpinned by the rising respiratory diseases in all aged group people. The market is driven by some ongoing latest developments such as the rising smart air purifier manufacturing such as four air stage filtration systems backed by the prevalence of advanced technologies such as IoT (Internet of Things) and smart home technology. Also, the government initiative to use energy-efficient appliances, hence the development is ongoing to manufacture air purifiers with improved filtration systems and can reduce the energy consumption rate is estimated to dominate the France Air Purifier Market share. The companies are likely to continue investing in the R&D practice to facilitate more advanced and upgraded air purifiers equipped with smart technologies that can facilitate more than monitoring real-time air quality. These active developments in the country are likely to secure double-digit growth in the upcoming years.

France Air Purifier Market Synopsis

France Air Purifier Market is projected to expand at a healthier rate in the forecast period on account of increasing construction activity as it is directly proportional to the concentration of particulate matter in the air. People are expected to incline towards Air Purifiers in France for better air, given the multitude of upcoming construction projects in France. However, in 2020, the sales of air purifiers are expected to take a major blow 2020 owing to the coronavirus pandemic. This could be attributed to the hindrances faced on the supply and demand sides owing to the government-ordered nationwide lockdowns. The decline in the sales of automobiles due to the health emergency caused by the outburst of pandemic has declined the France Air Purifier Market Growth.

According to 6Wresearch, France Air Purifier Market size is projected to grow at a CAGR of 7.2% during 2020-2026. Rising harmful pollutants in the country due to the increasing level of pollution necessitate the usage of air purifiers. Moreover, the increasing aging population coupled with the surging number of people suffering from respiratory disease triggers the potential growth of France air purifier market share. The Air Purifier Market in France is relatively newer and smaller in size as air purifiers are not that prevalent in the country owing to the government’s inadequate air quality measuring system. Various authorities revealed that several areas in Buenos Aires have air pollution levels above the recommended thresholds set by the World Health Organization (WHO). However, increasing awareness about health hazards and rising per capita income would bode well for the air purifier market in the coming years. Moreover, Type-I is projected to have the highest growth in the coming years owing to Type-I being an entry-level product and in a relatively new market, consumers are more inclined toward buying affordable and entry-level products. Further, Type-I also held the top spot in terms of total revenue share in the applications segment in 2019.

COVID-19 Impact on the France Air Purifier Market

The COVID-19 pandemic had a mixed impact on the France air purifier market. With the spread of the virus in the country had increased demand for air purifiers for protection from harmful pollutants and airborne infections. However, some government measures imposed during the pandemic lockdown such as interruption in the raw material supply and trade restrictions led to delays in the manufacturing process and air purifier supply in the country. This affected the France Air Purifier Market growth.

Key Players in the France Air Purifier Market

The France Air Purifier Market is highly competitive, as some famous key companies are mentioned below, competing in the market which accessing customers to choose as per their needs:

- Dyson is a leading British technology company with a strong market presence in the country, which provides a spectrum range of home appliances and other electronic products, including air purifiers that are equipped with some advanced filtration technologies and smart.

- Philips is a Dutch multinational technology company having a strong presence in France, which provides a wide range of air purifiers featured with HEPA filters and advanced sensors.

- Blueair is a Swedish company who is supplying premium quality air purifiers in the country that are integrated with sensors to monitor real-time air quality.

- Honeywell is a well-known American multinational conglomerate having a strong market presence in the country that produces a comprehensive range of consumer electronic products like air purifiers.

- LG Electronics is a well-established company in the country and competing globally, which facilitates a spectrum range of air purifiers equipped with smart technologies.

Market Analysis by Applications

According to Dhaval, Research Manager, 6Wresearch, the residential sector is estimated to dominate the France Air Purifier Market revenue on account of the rising awareness about the health issues associated with poor air quality. On the other hand, the growing commercial sector is also gaining traction in the country with the rising need for pollutants and allergens-free air.

Market Analysis by Technology

On the basis of technology, Type I type technology air purifiers accumulated the majority of the market revenue share in the overall market revenues in 2019. Currently, smart air purifiers only form a small segment of the France Air Purifier Market, however, this number is anticipated to increase as more people are becoming aware of ‘state-of-the-art technological advancements in air purifier products. As compared to other countries, the smart air purifier market is projected to grow at a higher rate owing to the increasing advertisement by the major players in the industry. Further, Type-I acquired the majority of revenue and volume share in the technology segment in 2019, on account of the carbon filter’s ability to eradicate smoke and odors cost-effectively.

Market Analysis by CADR Values

On the basis of CADR values, Medium CADR air purifiers held the majority of the market share in 2019 due to comparatively large size of rooms in France. Further, this trend is expected to continue in the coming years. Apart from this, smart and automotive air purifier markets are also expected to gain momentum in terms of sales in the coming years on account of people’s changing inclination towards a better lifestyle.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2016 to 2019.

- Base Year: 2019

- Forecast Data until 2026.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- France Air Purifier Market Overview

- France Air Purifier Market Outlook

- France Air Purifier Market Forecast

- France Air Purifier Market Size

- Historical Data of the France Air Purifier Market Revenues and Volume for the period 2016-2019 & France Air Purifier Market Forecast of the Revenues and Volume for the period 2020F- 2026F

- Historical Data of the France Room Air Purifier Market Revenues and Volume for the period 2016-2019 & France Room Air Purifier Market Forecast of the Revenues and Volume for the period 2020F- 2026F

- Historical Data of the France Car Air Purifier Market Revenues and Volume for the Period 2016-2019 & France Car Air Purifier Market Forecast of the Revenues and Volume for the period 2020F- 2026F

- Historical Data of the France Commercial Air Purifier Market Revenues and Volume for the Period 2016-2019 & France Commercial Air Purifier Market Forecast of the Revenues and Volume for the Period 2020F- 2026F

- Historical Data of France Room Air Purifier Market Revenues and Volume & France room Air Purifier Market Forecast of the Revenues and Volume, By Technology for the period 2016-2026F

- Historical Data of France room air purifier market Revenues & France room air purifier market Forecast of the Revenues and Volume, By Regions for the period 2016-2026F

- Historical Data of France room air purifier market Volume & France room air purifier market Forecast of the Revenues and Volume, By Noise Level for the period 2016-2026F

- Historical Data of France room air purifier market Volume & France room air purifier market Forecast of the Revenues and Volume, By Area Applicability for the period 2016-2026F

- Historical Data of France room air purifier market Volume & France room air purifier market Forecast of the Revenues and Volume, By Weight for the period 2016-2026F

- Historical Data of France room air purifier market Volume & France room air purifier market Forecast of the Revenues and Volume, By Air Flow for the period 2016-2026F

- Historical Data of France room air purifier market Volume & France room air purifier market Forecast of the Revenues and Volume, By Height for the period 2016-2026F

- Historical Data of France room air purifier market Revenues & France room air purifier market Forecast of the Revenues and Volume, By Applications for the period 2016-2026F

- Historical Data of France room air purifier market Revenues & France room air purifier market Forecast of the Revenues and Volume, By Sales Channels for the period 2016-2026F

- France Air Purifier Market Drivers

- France Air Purifier Market Restraints

- France Air Purifier Market Trends and Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- France Air Purifier Market Share of Room, By Volume

- France Air Purifier Market Share of Car, By Volume

- France Air Purifier Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Technology:

- Type-I (HEPA + Carbon)

- Type-II (HEPA + Carbon + Ionizer)

- Type-III (HEPA + Carbon+ UV)

- Type-IV (HEPA + Carbon + Electrostatic)

- Type-V (HEPA + Carbon + Ionizer + UV + Electrostatic)

- Other Technologies

By Applications:

- Residential

- Commercial

- Industrial

By CADR Values:

- Low (Up to 250 m3/h)

- Medium (251 to 500 m3/h)

- High (Above 500 m3/h)

France Air Purifier Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Key Highlights of the Report |

| 2.2. Report Description |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. France Air Purifier Market Overview |

| 3.1. France Air Purifier Market Revenues & Volume, (2016-2026F) |

| 3.2. France Air Purifier Market Revenue & Volume Share, By Technology, 2019 & 2026F |

| 3.3. France Air Purifier Market Revenue Share, By Applications, 2019 & 2026F |

| 3.4. France Air Purifier Market Revenue & Volume Share, By CADR Values, 2019 & 2026F |

| 3.5. France Air Purifier Market – Industry Life Cycle |

| 3.6. France Air Purifier Market – Porter’s Five Forces |

| 4. France Air Purifier Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.2.1 Increasing awareness about indoor air pollution and its impact on health |

| 4.2.2 Growing concerns about allergies and respiratory diseases |

| 4.2.3 Implementation of stringent regulations and guidelines for indoor air quality control |

| 4.3. Market Restraints |

| 4.3.1 High initial cost associated with air purifiers |

| 4.3.2 Limited consumer awareness about the benefits of air purifiers |

| 4.3.3 Lack of standardization in the air purifier market |

| 5. France Air Purifier Market Trends |

| 6. France Air Purifier Market Overview, By Technology |

| 6.1. France Type-I (HEPA + Carbon) Air Purifier Market Revenues and Volume, 2016-2026F |

| 6.2. France Type-II (HEPA + Carbon + Ionizer) Air Purifier Market Revenues and Volume, 2016-2026F |

| 6.3. France Type-III (HEPA + Carbon+ UV) Air Purifier Market Revenues and Volume, 2016-2026F |

| 6.4. France Type-IV (HEPA + Carbon + Electrostatic) Air Purifier Market Revenues and Volume, 2016-2026F |

| 6.5. France Type-V (HEPA + Carbon + Ionizer + UV + Electrostatic) Air Purifier Market Revenues and Volume, 2016-2026F |

| 6.6. France Other Technologies Air Purifier Market Revenues and Volume, 2016-2026F |

| 7. France Air Purifier Market Overview, By Applications |

| 7.1. France Residential Air Purifier Market Revenues, 2016-2026F |

| 7.2. France Commercial Air Purifier Market Revenues, 2016-2026F |

| 7.3. France Industrial Air Purifier Market Revenues, 2016-2026F |

| 8. France Air Purifier Market Overview, By CADR Values |

| 8.1. France Low CADR Air Purifier Market Revenues and Volume, 2016-2026F |

| 8.2. France Medium CADR Air Purifier Market Revenues and Volume, 2016-2026F |

| 8.3. France High CADR Air Purifier Market Revenues Volume, 2016-2026F |

| 9. France Air Purifier Market Key Performance Indicators |

| 10. France Air Purifier Market Opportunity Assessment |

| 10.1. France Air Purifier Market Opportunity Assessment, By Technology |

| 10.2. France Air Purifier Market Opportunity Assessment, By Applications |

| 10.2. France Air Purifier Market Opportunity Assessment, By CADR Values |

| 11. France Air Purifier Market Competitive Landscape |

| 11.1. France Air Purifier Market Revenue Share, By Company, 2019 |

| 11.2. France Air Purifier Market Competitive Benchmarking, By Technical Parameters |

| 12. Company Profiles |

| 12.1. Daikin Industries Limited |

| 12.2. Dyson Group Plc |

| 12.3. Honeywell International Incorporation |

| 12.4. Panasonic Corporation |

| 12.5. Royal Philips Group |

| 12.6. Samsung Electronics Company Limited |

| 12.7. Sharp Corporation |

| 12.8. Unilever Group |

| 12.9. Woongjin Coway Company Limited |

| 12.10. Xiaomi Corporation |

| 13. Key Strategic Recommendations |

| 14. Disclaimer |

| List of Figures |

| Figure 1. France Air Purifier Market Revenues & Volume, 2016-2026F |

| Figure 2. France Air Purifier Market Revenue Share, By Technology, 2019 & 2026F |

| Figure 3. France Air Purifier Market Volume Share, By Technology, 2019 & 2026F |

| Figure 4. France Air Purifier Market Revenue Share, By Applications, 2019 & 2026F |

| Figure 5. France Air Purifier Market Revenue Share, By CADR Values, 2019 & 2026F |

| Figure 6. France Air Purifier Market Volume Share, By CADR Values, 2019 & 2026F |

| Figure 7. France Air Purifier Market Opportunity Assessment, By Technology |

| Figure 8. France Air Purifier Market Opportunity Assessment, By Applications |

| Figure 9. France Air Purifier Market Opportunity Assessment, By CADR Values |

| Figure 10. France Air Purifier Market Revenue Share, By Company, 2019 |

| List of Tables |

| Table 1. France Air Purifier Market Revenues, By Technology, 2016-2026F ($ Million) |

| Table 2. France Air Purifier Market Volume, By Technology, 2016-2026F (Thousand Units) |

| Table 3. France Air Purifier Market Revenues, By Applications, 2016-2026F ($ Million) |

| Table 4. France Under Construction Residential Projects, 2020-2022 |

| Table 5. France Air Purifier Market Revenues, By CADR Value, 2016-2026F ($ Million) |

| Table 6. France Air Purifier Market Volume, By CADR Value, 2016-2026F (Thousand Units) |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero