India Access Control Market (2025-2031) | Analysis, Trends, Growth, Revenue, Forecast, Industry, Value, Segmentation & Outlook

Market Forecast By Access Control Market Types (Card Reader Access Control System (Contact Card, Contactless Card), Biometric Access Control System (Fingerprint, IRIS And Others)), By Applications (Banking and Financials, Government and Transportation, Retail and logistics, Commercial offices, Industrial and Manufacturing, Residential, Hospitality and Healthcare, Educational Institutions And Others), By Regions (Northern Region, Southern Region, Eastern Region, Western Region) And Competitive Landscape.

| Product Code: ETC001426 | Publication Date: Dec 2019 | Updated Date: Nov 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

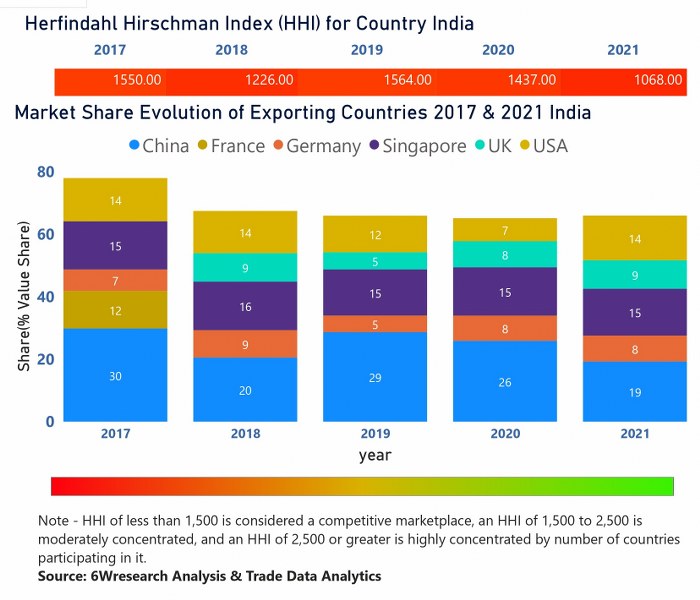

India Access Control Market Top 5 Importing Countries and Market Competition (HHI) Analysis

India`s access control import market witnessed significant growth in 2024, with top exporting countries being China, USA, Mexico, Germany, and Vietnam. The high Herfindahl-Hirschman Index (HHI) indicates a concentrated market landscape. The compound annual growth rate (CAGR) from 2020 to 2024 stood at an impressive 19.42%, showcasing a thriving market. The growth rate from 2023 to 2024 was recorded at 6.91%, indicating sustained momentum in the industry. These trends suggest a promising outlook for the access control import sector in India.

India Access Control Market | Country-Wise Share and Competition Analysis

In the year 2021, China was the largest exporter in terms of value, followed by Singapore. It has registered a decline of -29.01% over previous year. While Singapore registered a decline of -7.36% over previous year. While in 2017 China was the largest exporter followed by Singapore. In term of Herfindahl Index, which measures the competitiveness of countries exporting, India has Herfindahl index of 1550 in 2017 which signifies moderately concentrated while in 2021 it registered a Herfindahl index of 1068 which signifies high competitiveness in the market

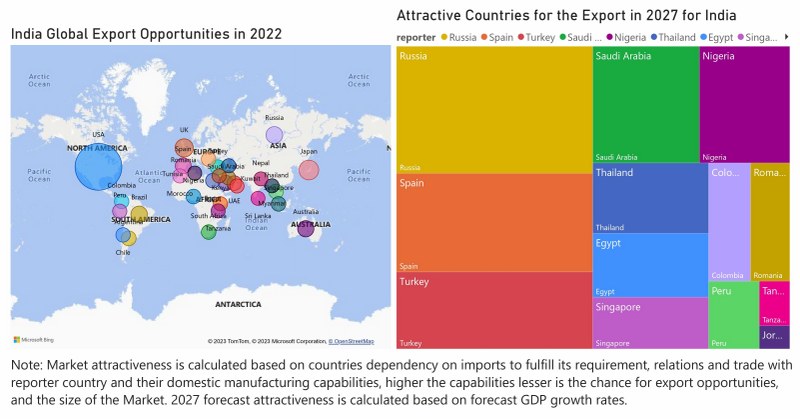

India Access Control Market - Export Market Opportunities![India Access Control Market - Export Market Opportunities]()

India Access Control Market Highlights

| Report Name | India Access Control Market |

| Forecast Period | 2025-2031 |

| CAGR | 11% |

| Growing Sector | Security |

Topics Covered in the India Access Control Market Report

The India Access Control Market report comprehensively covers the market by Access Control Market Types, Applications, and Regions. The report offers an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers that would help stakeholders in making and aligning their market strategies according to the present and future market dynamics.

India Access Control Market Synopsis

The India Access Control Market is anticipated to witness rapid growth in the forecast period. The increasing need for enhanced security measures, growing urbanisation and industrialization, rising adoption of advanced technologies such as biometric access control systems, and government regulations mandating the use of access control systems in commercial buildings are some of the factors driving the growth of the market.

According to 6Wresearch, the India Access Control Market is projected to grow at a CAGR of 11% 2025-2031. The growth of the India Access Control Market can be attributed to various factors such as an increasing need for enhanced security measures, growing urbanisation and industrialization, and government regulations mandating the use of access control systems. Another major driver of market growth is the rising adoption of advanced technologies like biometric access control systems, which offer a higher level of security compared to traditional methods. Additionally, with the rise in cybercrimes and data breaches, there has been an increased focus on implementing secure access control systems across different industries such as banking, healthcare, and education. Furthermore, the usage of AI and Internet of Things are also contributing to the growth of the market.

Despite the positive growth prospects, the India Access Control Market also faces some challenges. One of the major challenges is the high initial cost associated with implementing advanced access control systems, which may limit their adoption among small and medium-sized enterprises. Additionally, lack of awareness and technical expertise in handling these systems can also hinder market growth. Biometric data collected by access control systems can be vulnerable to cyber-attacks and breaches if proper measures are not taken to secure them.

India Access Control Market: Key Players

Key players in the market include Honeywell International Inc., Bosch Limited, Johnson Controls-Hitachi Air Conditioning India Ltd., Cisco Systems India Pvt. Ltd., 3M India Limited, ZKTeco Co. Ltd., HID Global Corporation, Suprema Inc., Smart I Electronics Systems Pvt. Ltd., and Matrix Comsec Pvt. Ltd. These companies are continuously investing in R&D activities to develop innovative products and expand their market presence. Currently, Honeywell International Inc. holds the largest share in the market.

India Access Control Market: Government Regulations

The Indian government has implemented various regulations and policies to promote the adoption of advanced access control systems. For instance, the Bureau of Civil Aviation Security (BCAS) mandates the use of biometric-based passenger identification systems at airports across the country. Additionally, under the Real Estate (Regulation and Development) Act 2016, all residential buildings with more than eight apartments must have a security system in place for visitor management and entry/exit monitoring.

Future Insights of the Market

The India Access Control Market is expected to witness continued growth in the coming years with advancements in technology and increasing adoption of smart security solutions. The demand for cloud-based access control systems is also expected to grow, driven by its benefits such as remote access and scalability. Moreover, the integration of IoT and AI technologies into access control systems will further enhance their capabilities, providing a more secure and efficient solution for businesses. Additionally, innovations such as face recognition are also expected to gain popularity in the market.

Market Forecast By Access Control Market Types

According to Dhaval, Research Manager, 6Wresearch, the Card Reader Access Control System segment holds the largest market share due to its wide range of applications and high consumer demand.

Market Forecast By Applications

The Banking and Financials segment is expected to witness significant growth in the forecast period, driven by increasing concerns about protecting critical infrastructure and public safety.

Market Forecast By Regions

The Northern Region is expected to dominate the India Access Control Market during the forecast period.

Key Attractiveness of the Report

- 10 Years of Market Numbers

- Historical Data Starting from 2021 to 2024

- Base Year: 2024

- Forecast Data until 2031

- Major Upcoming Projects and Developments

Key Highlights of the Report:

- India Access Control Market Overview

- India Access Control Market Outlook

- India Access Control Market Forecast

- Historical Data of India Access Control Market Revenues & Volume for the Period 2021-2031

- India Access Control Market Size and India Access Control Market Forecast of Revenues & Volume, Until 2031

- Historical Data of India Access Control Market Revenues & Volume, by Types, for the Period 2021-2031

- Market Size & Forecast of India Access Control Market Revenues & Volume, by Types, Until 2031

- Historical Data of India Access Control Market Revenues & Volume, by Applications, for the Period 2021-2031

- Market Size & Forecast of India Access Control Market Revenues & Volume, by Applications, Until 2031

- Historical Data of India Access Control Market Revenues & Volume, by Regions, for the Period 2021-2031

- Market Size & Forecast of India Access Control Market Revenues & Volume, by Regions, Until 2031

- Market Drivers and Restraints

- India Access Control Market Trends and Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- India Access Control Market Share, By Players

- India Access Control Market Share, By Regions

- India Access Control Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Segmentation

The market study offers an exhaustive analysis of the following market segments:

By Access Control Market Types

- Card Reader Access Control System

- Biometric Access Control System

By Applications

- Banking and Financials

- Government and Transportation

- Retail and Logistics

- Commercial Offices

- Industrial and Manufacturing

- Residential

- Hospitality and Healthcare

- Educational Institutions

- Others

By Regions

- Northern Region

- Southern Region

- Eastern Region

- Western Region

India Access Control Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of The Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. India Access Control Market Overview |

| 3.1 India Access Control Market Revenues and Volume 2021-2031F |

| 3.2 India Access Control Market Revenue Share, By Types, 2021-2031F |

| 3.3 India Access Control Market Revenue Share, By Applications, 2021-2031F |

| 3.4 India Access Control Market Revenue Share, By Regions, 2021-2031F |

| 3.5 India Access Control Market - Industry Life Cycle |

| 3.6 India Access Control Market - Porter’s Five Forces |

| 4. India Access Control Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing concerns about security and safety |

| 4.2.2 Rising adoption of smart technologies |

| 4.2.3 Growing demand for access control solutions in various sectors |

| 4.3 Market Restraints |

| 4.3.1 High initial investment cost |

| 4.3.2 Lack of awareness and understanding about access control systems |

| 4.3.3 Integration challenges with existing infrastructure |

| 5. India Access Control Market Trends |

| 6. India Access Control Market Overview, By Types |

| 6.1 India Access Control Market Revenues and Volume, By Card Reader Access Control System, 2021-2031F |

| 6.1.1 India Access Control Market Revenues and Volume, By Contact Card, 2021-2031F |

| 6.1.2 India Access Control Market Revenues and Volume, By Contactless Card, 2021-2031F |

| 6.2 India Access Control Market Revenues and Volume, By Biometric Access Control System, 2021-2031F |

| 6.2.1 India Access Control Market Revenues and Volume, By Fingerprint, 2021-2031F |

| 6.2.2 India Access Control Market Revenues and Volume, By IRIS, 2021-2031F |

| 6.2.3 India Access Control Market Revenues and Volume, By Others, 2021-2031F |

| 7. India Access Control Market Overview, By Applications |

| 7.1 India Access Control Market Revenues, By Banking and Financials, 2021-2031F |

| 7.2 India Access Control Market Revenues, By Government and Transportation, 2021-2031F |

| 7.3 India Access Control Market Revenues, By Retail and logistics, 2021-2031F |

| 7.4 India Access Control Market Revenues, By Commercial offices, 2021-2031F |

| 7.5 India Access Control Market Revenues, By Industrial and Manufacturing, 2021-2031F |

| 7.6 India Access Control Market Revenues, By Residential, 2021-2031F |

| 7.7 India Access Control Market Revenues, By Hospitality and Healthcare, 2021-2031F |

| 7.8 India Access Control Market Revenues, By Educational Institutions, 2021-2031F |

| 7.9 India Access Control Market Revenues, By Others, 2021-2031F |

| 8. India Access Control Market Overview, By Regions |

| 8.1 India Access Control Market Revenues, By Northern Region, 2021-2031F |

| 8.2 India Access Control Market Revenues, By Southern Region, 2021-2031F |

| 8.3 India Access Control Market Revenues, By Eastern Region, 2021-2031F |

| 8.4 India Access Control Market Revenues, By Western Region, 2021-2031F |

| 8.5 India Access Control Market Revenues, By Central Region, 2021-2031F |

| 9. India Access Control Market - Key Performance Indicators |

| 9.1 Number of new installations of access control systems |

| 9.2 Percentage increase in demand for biometric access control solutions |

| 9.3 Average time taken for implementation of access control projects |

| 10. India Access Control Market - Opportunity Assessment |

| 10.1 India Access Control Market Opportunity Assessment, By Types, 2031F |

| 10.2 India Access Control Market Opportunity Assessment, By Applications, 2031F |

| 11. India Access Control Market Competitive Landscape |

| 11.1 India Access Control Market Revenue Share, By Companies, 2031 |

| 11.2 India Access Control Market Competitive Benchmarking, By Operating & Technical Parameters |

| 12. Company Profiles |

| 13. Key Recommendations |

| 14. Disclaimer |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Pakistan Contraceptive Implants Market (2025-2031) | Demand, Growth, Size, Share, Industry, Pricing Analysis, Competitive, Strategic Insights, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Companies, Challenges

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero