India Active LED Market (2023-2029) | Share, Size, Analysis, Growth, Trends, Revenue, Industry, Segmentation, Outlook

Market Forecast By Application (Indoor, Outdoor),By Pixel Pitch (Indoor Pixel Pitch, Outdoor Pixel Pitch),By Indoor Technology (COB LED, IMD LED, SMD LED),By Product Category (Cabinet, Module),By Region (Northern, Southern, Western, Eastern) And Competitive Landscape

| Product Code: ETC4378006 | Publication Date: Mar 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 171 | No. of Figures: 44 | No. of Tables: 12 |

India Active LED Market Size & Growth Rate

India Active LED Market is projected to grow at a CAGR of 19.0% during 2023–2029, driven by rising government infrastructure spending, increased demand for digital advertising, and widespread adoption of indoor applications in retail and corporate sectors, with Northern region and SMD LED technology leading the market.

India Active LED Market Synopsis

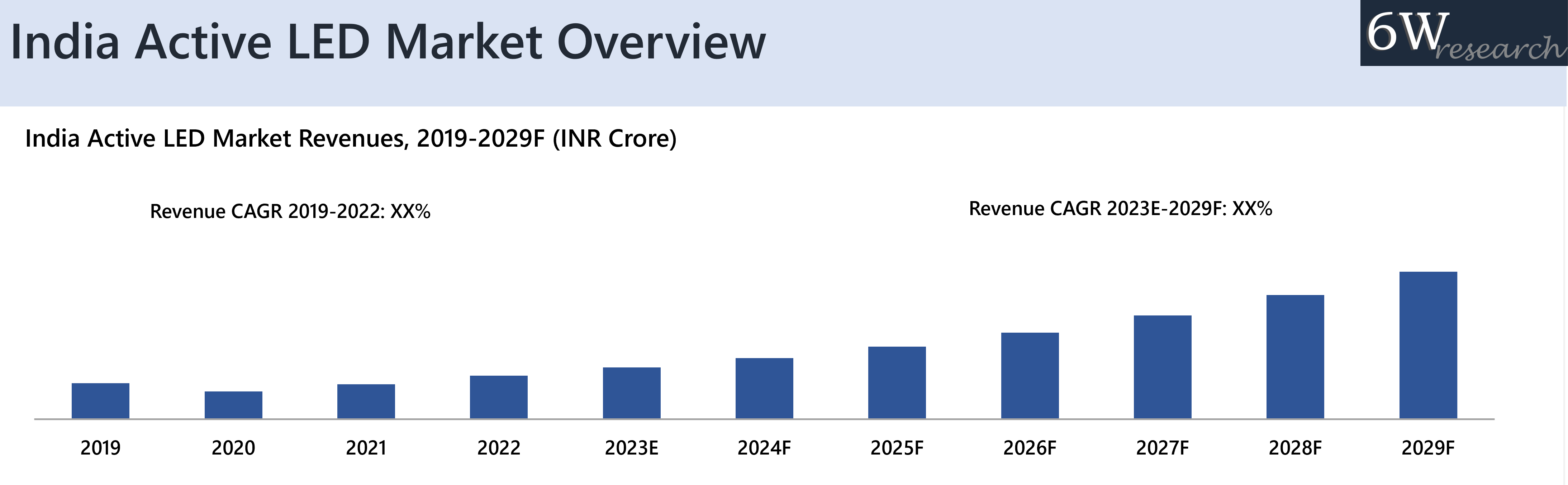

India Active LED Market grew significantly during 2019 on account of rising advertising expenditure. However, during 2020, covid-19 significantly impacted the overall Active LED market as the country faced a nationwide lockdown that led to the shutting down of international borders and impacted the supply chain in the market which has resulted in the decline in Out of Home (OOH) advertising industry by 55% in H1, 2020. Most of the commercial spaces, shopping malls, cinemas, and stadiums were closed where LED Videowall screens are heavily deployed which impacted the market demand during that year. Moreover, the Indian media and entertainment sector witnessed a degrowth of 24% during 2020 which further reduced the demand for LED screens in that sector. Additionally, the Delhi government approved a proposal in January 2022 to install 600 LED screens which would display graphic films, pollution data, social messages, health awareness campaigns, and information on government policies of public interest, thereby contributing to India Active LED Market Growth.

According to 6Wresearch, India Active LED market size is projected to grow at a CAGR of 19.0% during 2023–29. The market is expected to witness significant growth in the coming years owing to rising spending expenditure of the government on infrastructure projects and advertisement spending. The government is building 100 airports by the end of 2024 which would augment the demand for Active LED Videowalls. Also, the central government presented a roadmap to invest ?91,000 crore to develop new airports and upgrading existing ones in different parts of India by the year 2025 which would boost the Active LED Videowall market in India in coming years. The Active LED Market in India is also growing owing to its increased demand for digitized promotion of products and services and rapid technological advancements in the field of LED Videowall products in order to produce high quality viewing experience.

According to 6Wresearch, India Active LED market size is projected to grow at a CAGR of 19.0% during 2023–29. The market is expected to witness significant growth in the coming years owing to rising spending expenditure of the government on infrastructure projects and advertisement spending. The government is building 100 airports by the end of 2024 which would augment the demand for Active LED Videowalls. Also, the central government presented a roadmap to invest ?91,000 crore to develop new airports and upgrading existing ones in different parts of India by the year 2025 which would boost the Active LED Videowall market in India in coming years. The Active LED Market in India is also growing owing to its increased demand for digitized promotion of products and services and rapid technological advancements in the field of LED Videowall products in order to produce high quality viewing experience.

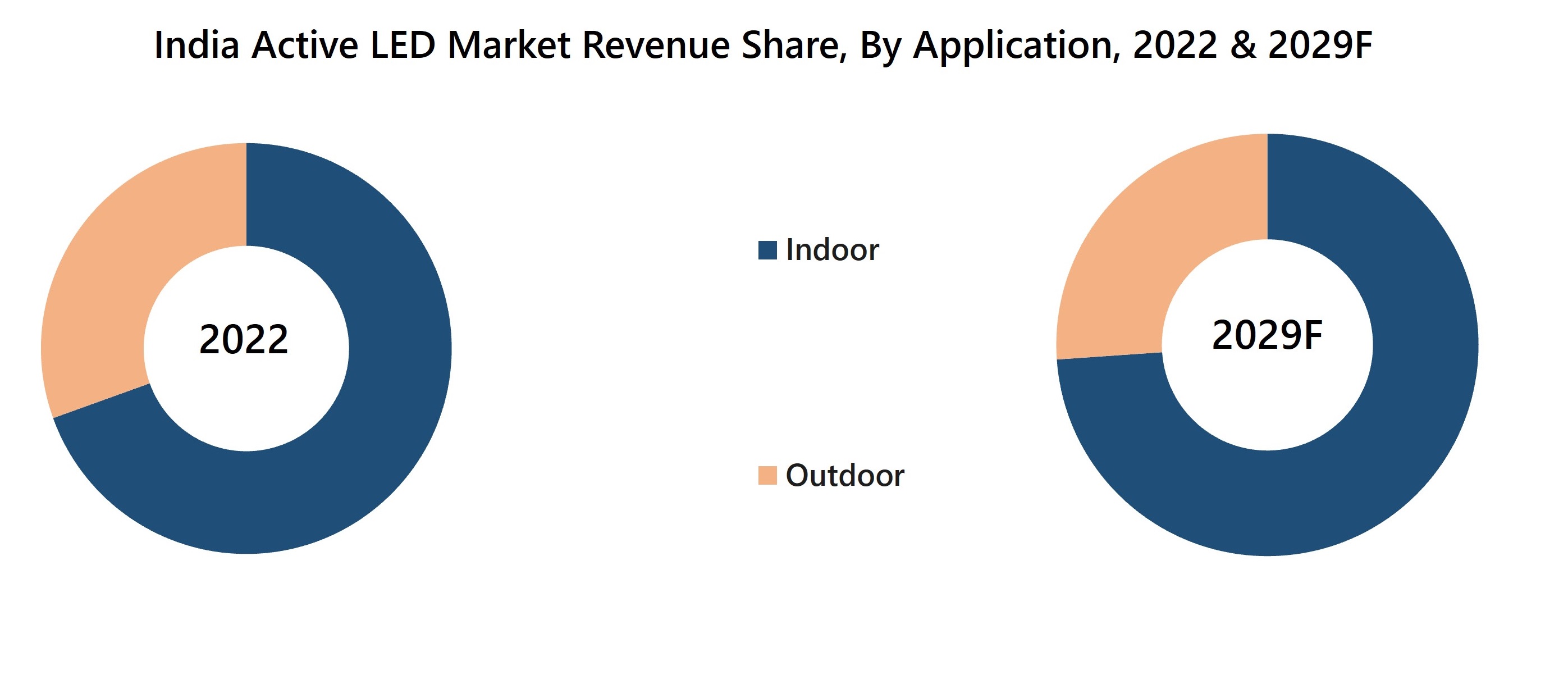

![India Active LED Market Revenue Share]() Market by Application

Market by Application

Indoor application acquired major revenue share in 2022 as retail sector in India are prioritizing advertisement and thus demand for Indoor LED Videowalls would grow in future. Moreover, Indoor LED videowall is becoming common in corporate lobbies, boardrooms and customer experience centres along with increase in demand in transportation sector to display information regarding flights and trains.

Market by Pixel Pitch

Based on outdoor pixel pitch, the 4.1-8 mm accounted for major revenue share and same trend is expected to follow on account of increase in production of P4 and P6 LED panels as a result of higher demand due to better display quality. Based on indoor pixel pitch, the Between 1-3mm accounted for major revenue share in 2022 and same trend would continue in future as mostly P2.5 is preferred by the consumers as they offer high resolution while allowing owners of retail businesses, restaurants, conference rooms and exhibitors to feature their products.

Market by Indoor Technology

SMD LED accounted for majority of revenue share in India Active LED market in the year 2022 owing to their application in both indoor and outdoor due to high durability, low power consumption and high reliability and the same segment will continue to dominate the India Active LED Industry.

Market by Product Category

Cabinet finds its prominent application in outdoor applications on account of better-quality control, better thermal management, dust proof, waterproof, among others. The similar segment is projected to grow in the coming years.

Market by Region

Northern Region garnered majority of revenue share in India Active LED Market in 2022, and same trend would continue in future because of rise in government spending in advertisement due to G20 meeting 2023 in northern cities such as Delhi, Srinagar, Varanasi, and other cities there is increase in government tenders. Additionally, Southern region would also grow as there would be demand from out of home (OH) and Corporate in areas such as Bangalore and Hyderabad.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 11 Years Market Numbers.

- Historical Data Starting from 2019 to 2022.

- Base Year: 2022

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- India Active LED Market Overview

- India Active LED Market Outlook

- India Active LED Market Forecast

- Historical Data and Forecast of India Active LED Market Revenues for the Period 2019-2029F

- Historical Data and Forecast of India Active LED Market Revenues, By Regions, for the Period 2019-2029F

- Historical Data and Forecast of India Active LED Market Revenues, By Pixel Pitch, for the Period 2019-2029F

- Historical Data and Forecast of India Active LED Market Revenues, By Application, for the Period 2019-2029F

- India Active LED Competitor Analysis

- India Active LED Industries Analysis

- India Active LED Customer Preference Analysis

- Market Drivers and Restraints

- Industry Life Cycle

- Porter’s Five Force Analysis

- Impact Analysis of COVID-19

- Market Trends

- India Active LED Market Revenue Share, By Companies

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By Application

- Indoor

- Outdoor

By Pixel Pitch

- Indoor Pixel Pitch

- Outdoor Pixel Pitch

By Indoor Technology

- COB LED

- IMD LED

- SMD LED

By Product Category

- Cabinet

- Module

By Region

- Northern

- Southern

- Western

- Eastern

India Active LED Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. India Active LED Market Overview |

| 3.1 India Active LED Market Revenues |

| 3.2 India Active LED Market Industry Life Cycle |

| 3.3 India Active LED Market Porter’s Five Forces Model |

| 4. Global Active LED Market Overview |

| 4.1 Global Active LED Market Revenues |

| 4.2 Global Active LED Market Industry Life Cycle |

| 4.3 Global Active LED Market Porter’s Five Forces |

| 5.Impact Analysis of Covid-19 on India Active LED Market |

| 6.India Active LED Market Dynamics |

| 6.1 India Active LED Market Dynamics Impact Analysis |

| 6.2 India Active LED Market Dynamics Market Drivers |

| 6.2.1 Increasing adoption of energy-efficient lighting solutions in India |

| 6.2.2 Government initiatives promoting LED usage for energy conservation |

| 6.2.3 Growing demand for smart lighting solutions in urban areas |

| 6.3 India Active LED Market Dynamics Market Restraints |

| 6.3.1 High initial investment costs associated with LED technology |

| 6.3.2 Lack of awareness and education about the benefits of LED lighting |

| 6.3.3 Challenges related to the disposal and recycling of LED products |

| 7. India Active LED Market Trends |

| 8. India Active LED Market, Revenue Share and Revenues(2019-2029), by Application |

| 8.1 India Active LED Market, Revenue Share and Revenues, by Outdoor, 2019-2029F |

| 8.2 India Active LED Market, Revenue Share and Revenues, by Indoor, 2019-2029F |

| 9. India Active LED Market, Revenue Share and Revenues(2019-2029), , by Pixel Pitch |

| 9.1 India Active LED Market, Revenue Share and Revenues, by Outdoor Pixel Pitch, 2019-2029F |

| 9.2 India Active LED Market, Revenue Share and Revenues, by Indoor Pixel Pitch, 2019-2029F |

| 10. India Active LED Market, Revenue Share and Revenues(2019-2029), by Indoor Technology |

| 10.1 India Active LED Market, Revenue Share and Revenues, by SMD LED, 2019-2029F |

| 10.2 India Active LED Market, Revenue Share and Revenues, by COB LED, 2019-2029F |

| 10.3 India Active LED Market, Revenue Share and Revenues, by IMD LED, 2019-2029F |

| 11. India Active LED Market, Revenue Share and Revenues(2019-2029), by Product Category |

| 11.1 India Active LED Market, Revenue Share and Revenues, by Cabinet, 2019-2029F |

| 11.2 India Active LED Market, Revenue Share and Revenues, by Module, 2019-2029F |

| 12. India Active LED Market, Revenue Share and Revenues(2019-2029), by Regions |

| 12.1 India Active LED Market, Revenue Share and Revenues, by North |

| 12.2 India Active LED Market, Revenue Share and Revenues, by West |

| 12.3 India Active LED Market, Revenue Share and Revenues, by South |

| 12.4 India Active LED Market, Revenue Share and Revenues, by East |

| 13. India Active LED Market - Key Performance Indicators |

| 13.1 Energy savings achieved through LED installations |

| 13.2 Number of government projects and incentives supporting LED adoption |

| 13.3 Growth in the number of smart lighting installations in commercial and residential sectors |

| 14. India Active LED Market - Import Statistics |

| 15. India Active LED Market - Import Price Analysis |

| 16. India Active LED Market - Industries Analysis |

| 17. India Active LED Market - Customer Behavioral and Preference Analysis |

| 18. India Active LED Market - Key Buying Factors |

| 18.1 Analyzing Several Use Cases for Active LED and Performance Benchmarking Required to Meet the Required Solution |

| 18.2 Key Benchmarking Product Features and Key Buying Factors for Major Competitors |

| 19. India Active LED Market - Detailed Use Cases Analysis |

| 19.1 Insight on Various Use Cases and Expected Use Cases across Different Industries |

| 20. India Active LED Market -Who Supplies to Whom Analysis |

| 21. India Active LED Market - Competitor Analysis |

| 21.1 Product Pricing Analysis across Key Competitors |

| 21.2 India Active LED Market Revenue Share |

| 22. India Active LED Market Competitive Benchmarking |

| 22.1 India Active LED Market Competitive Benchmarking-By Operating Parameters |

| 23. India Active LED Market - Key Company Profiles |

| 23.1 LG Electronics |

| 23.2 Samsung Electronics Co. Ltd |

| 23.3 Panasonic Life Solutions India Pvt. Ltd. |

| 23.4 Xtreme Media Pvt. Ltd. |

| 23.5 Delta Electronics |

| 23.6 Leyard Group |

| 23.7 Christie Digital Systems, Inc |

| 23.8 Barco |

| 23.9 Shenzhen Absen Optoelectronic Co. Ltd |

| 23.10 Unilumin |

| 24. India Active LED Market STP and BCG Matrix Analysis |

| 25. Key Strategic Recommendations |

| 26. Disclaimer |

| List of Figures |

| 1. India Active LED Market Revenues, 2019-2029F (INR Crore) |

| 2. Global Active LED Market Revenues, 2019-2029F ($ Billion) |

| 3. India Out of Home (OOH) Media Industry (INR crore), 2019-2023F |

| 4. India Advertisement Expenditure (INR crore), 2019-2025F |

| 5. India Current Investment Trends in Airport Infrastructure ($ Million), 2015-2040F |

| 6. India Active LED Market Revenue Share, By Application, 2022 & 2029F |

| 7. India Outdoor Active LED Market Revenue Share, By Pixel Pitch, 2022 & 2029F |

| 8. India Indoor Active LED Market Revenue Share, By Pixel Pitch, 2022 & 2029F |

| 9. India Active LED Market Revenue Share, By Indoor Technology, 2022 & 2029F |

| 10. India Active LED Market Revenue Share, By Product Category, 2022 & 2029F |

| 11. India Active LED Market Revenue Share, By Regions, 2022 & 2029F |

| 12. Upcoming Projects in Hospitality Sector as of July 2022 |

| 13.India New Office Space Supply, By Cities, Jan-June 2021-2022 (Million sq. ft.) India New Office Space Supply, By Cities, Jan-June 2021-2022 (Million sq. ft.) |

| 14. Retail market in India, 2020-2025 (INR Lakh Crore) |

| 15. Share of Top 3 Import Partners, 2020 |

| 16. Import Data of Product HS Code 84714190, By Country, 2020 (in $ Thousand) |

| 17. Share of Top 3 Import Partners, 2021 |

| 18. Import Data of Product HS Code 85285200, By Country, 2021 (in $ Million) |

| 19. Share of Top 3 Import Partners, 2021 |

| 20. Import Data of Product HS Code 85285900, By Country, 2021 (in $ Million) |

| 21. Share of Top 3 Import Partners, 2021 |

| 22. Import Data of Product HS Code 85229000, By Country, 2021 (in $ Thousand) |

| 23. Share of Top 3 Import Partners, 2021 |

| 24. Import Data of Product HS Code 94059900, By Country, 2021 (in $ Thousand) |

| 25. Revenue Share of Existing and Emerging Industry, 2022 |

| 26. Revenue Share of Existing Industry, 2022 |

| 27. Revenue Share of Emerging Industry, 2022 |

| 28. Motivation Factor for Outdoor Adoption of Active LED among Industries |

| 29. Motivation Factor for Indoor Adoption of Active LED among Industries |

| 30. Influential Factor for Replacement or Upgradation of Active LED products |

| 31. Restraining Factor among customers which restrict them to upgrade to Active LED solution |

| 32. New Needs Among Customer Regarding Active LED Products |

| 33. Ranking Based on Price Competitiveness, By Companies |

| 34. Ranking Based on Brand Value, By Companies |

| 35. Ranking Based on After Sales Services, By Companies |

| 36. Ranking Based on Annual Maintenance Cost, By Companies |

| 37. Ranking Based on Life Span of LED, By Companies |

| 38. Ranking Based on Availability, By Companies |

| 39. Ranking Based on Display Quality, By Companies |

| 40. Ranking Based on Warranty, By Companies |

| 41. India Active LED Outdoor Market Revenue Share, By Companies, 2022 |

| 42. India Active LED Indoor Market Revenue Share, By Companies, 2022 |

| 43. India Active LED Market Revenue Share, By Companies, 2022 |

| 44. Growth of Hotel Rooms Supply across Major Cities (2021/22-2026/27) |

| List of Tables |

| 1. Ongoing and Upcoming Airport Projects in India |

| 2. India Active LED Market Revenues, By Application, 2019-2029F (INR Crore) |

| 3. India Outdoor Active LED Market Revenues, By Pixel Pitch, 2019-2029F (INR Crore) |

| 4. India Indoor Active LED Market Revenues, By Pixel Pitch, 2019-2029F (INR Crore) |

| 5. India Active LED Market Revenues, By Indoor Technology, 2019-2029F (INR Crore) |

| 6. India Active LED Market Revenues, By Product Category, 2019-2029F (INR Crore) |

| 7. India Active LED Market Revenues, By Regions, 2019-2029F (INR Crore) |

| 8. Major Ongoing Hotel Projects in India |

| 9. Indian New Office Completion Rate, 2020 & 2021 (Million Sq ft.) |

| 10. Import Price of LED Videowall, 2020 |

| 11. Import Price of LED Videowall, 2021 |

| 12. Import Price of LED Videowall, 2022 |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2026-2032) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero