India Air Cooler Market (2021-2027) | Outlook, Size, Share, Revenue, Analysis, Forecast, Growth, Trends, industry & COVID-19 IMPACT

Market Forecast By Applications (Residential and Commercial sector), By Product Types (Desert Air Cooler, Window Air Cooler, Tower Air Cooler, Personal Air Cooler), By Regions (Northern, Western, Eastern, and Southern), and by Competitive Landscape

| Product Code: ETC060821 | Publication Date: Aug 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 82 | No. of Figures: 27 | No. of Tables: 8 |

Latest Development 2023 in India Air Cooler Market

India Air Cooler Market is expected to gain proliferation during the upcoming years on account of rising urbanization. Rising disposable income coupled with surging purchasing power, especially among the middle-class population is driving the India Air Cooler Market Growth. Moreover, the increasing innovation of products by the manufacturers along with the advancement of technology is adding to the development of the India Air Cooler Industry. Rising temperature has led to the adoption of air coolers as a necessity which is further proliferating the India Air Cooler Market Share. Increasing efforts by the government in order to develop the agriculture and industrial sector is also flourishing the growth of the market.

Air Cooler Market in India is a key part of the Asia Pacific Air Cooler Market. The sector in the country is driven by numerous factors. The India Air Cooler Market share is constantly growing as this industry has taken the most crucial role in the lives of people living in the country.

India Air Cooler Market Synopsis

India Air Cooler Market has been encountering significant growth over the past few years on the back of rising temperatures, increasing urbanization, growing lower middle-class population, surging infrastructural development, strengthening the residential sector, burgeoning rural electrification program, and rising disposable income.

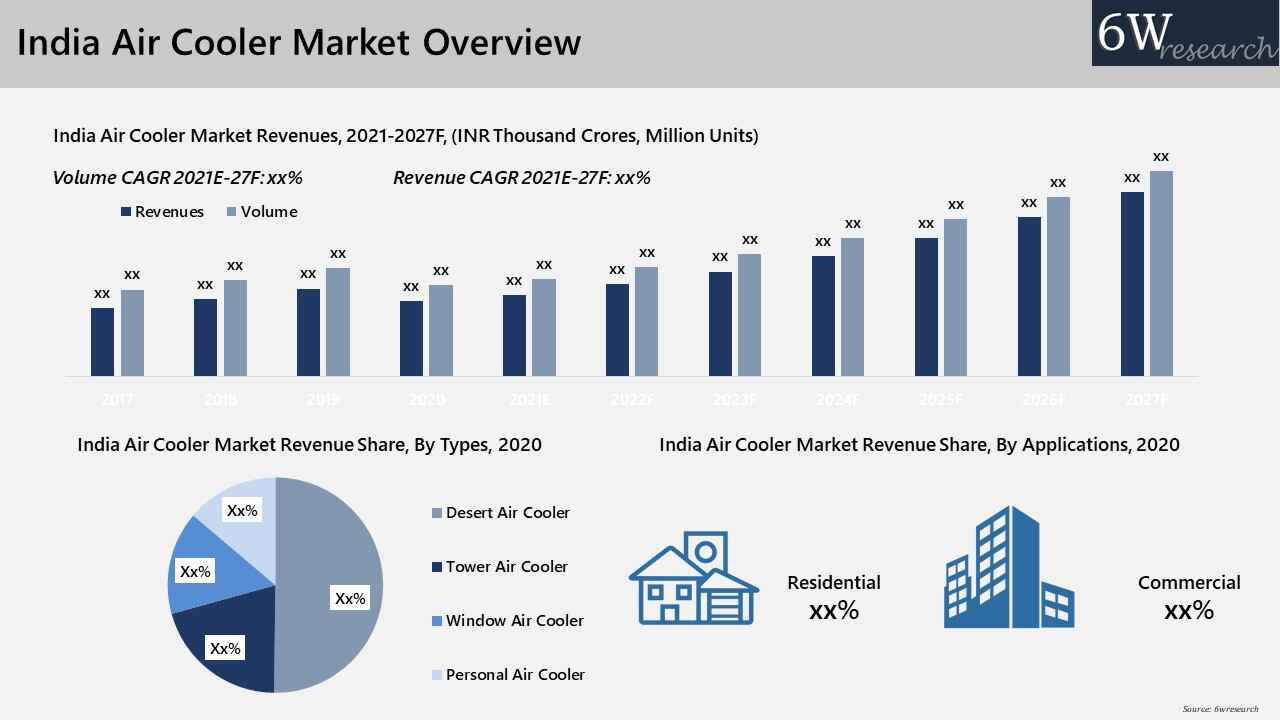

According to 6Wresearch, India Air Cooler Market size is projected to grow at a CAGR of 14.6% during 2021-2027. With the rising middle-class population, increasing heatwave, growing work-from-home culture, better availability of electricity in villages, and a comparative price edge of the air coolers over the air conditioners, the air cooler market forecast is expected to show positive growth in the future. In terms of market segment by types, desert coolers dominated the air cooler market in 2020 owing to their large capacity, affordable prices, and easy availability and accessibility in both the organized and the unorganized sectors of the market. The government initiatives for rural upliftment, rising urbanization and discretionary spending, and amended industrial norms coupled with the upcoming stream of projects in the residential sector are expected to drive the demand for desert air coolers in the country over the coming years. Further tower and personal air coolers could also see a splurge in their share in the coming years owing to the changing consumer preferences towards new and innovative products, surging e-commerce sales increased brand variants, and stock-keeping units (SKUs).

Market Analysis By Type

Based on types, Desert coolers dominated the India air cooler market revenues and volume during the year 2020 with a CAGR of 2.2%. Owing to its large capacity, affordable prices, and easy availability and accessibility in both the organized and the unorganized sector of the market, desert coolers are anticipated to gain growth in India Air Cooler Market. The price-value proposition and the exemplary effectiveness of desert air coolers in dry climatic conditions proved to be the major contributors to the growth of desert coolers in India. Further government initiatives for rural upliftment such as Pradhan Mantri Gramin Awaas Yojana, electronic National Agriculture Market (eNAM), amended industrial norms coupled with the upcoming stream of projects in the residential sector are expected to drive the demand for desert air coolers in the country over the coming years.

Market Analysis By Applications

Based on the applications, the residential sector has dominated the air cooler market revenues and volume in 2020 and is likely to maintain its dominance in the market over the coming years, due to the large proportion of the population in the lower- and middle-income class that prefers to buy air coolers over air conditioners as these are relatively inexpensive. With the low purchasing and operational cost of air coolers and the rising government initiative to meet the housing and development requirements including “Housing for All” and the “Smart City Project”, the residential sector held a dominant share in the overall air cooler market revenues in India.

COVID-19 Impact on India Air Cooler Market

The outbreak of COVID-19 during the year 2020 has resulted in the degradation of sales as a result of supply chain disruptions, irregular working days, shorter operational hours, and the closure of the organized retail sector, including malls and big retail chains. Additionally, changes in the spending priorities of the consumers and deferring purchase behaviour during the first wave of covid- 19, contributed to the misery even more.

Key players in the market

- Some of the key players in the India Air Cooler Market are:

- Symphony Limited

- Bajaj Electricals Limited

- Usha International Limited

- Ken Lifestyles Private Limited

- Orient Electric Limited

- Voltas Limited

- Ram Coolers

- Groupe SEB India Private Limited (Maharaja Whiteline)

- Blue Star Limited

- Havells India Limited.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects

Key Highlights of the Report:

- India Air Cooler Outlook

- Market Size of India Air Cooler Market, 2020

- Forecast of India Air Cooler Market, 2027

- Historical Data and Forecast of India Air Cooler Revenues & Volume for the Period 2017-2027

- India Air Cooler Trend Evolution

- India Air Cooler Drivers and Challenges

- India Air Cooler Price Trends

- India Air Cooler Porter's Five Forces

- India Air Cooler Industry Life Cycle

- Historical Data and Forecast of India Air Cooler Revenues & Volume By Product Types for the Period 2017-2027

- Historical Data and Forecast of India Air Cooler Revenues & Volume By Desert Air Cooler

- Historical Data and Forecast of India Air Cooler Revenues & Volume By Window Air Cooler for the Period 2017-2027

- Historical Data and Forecast of India Air Cooler Revenues & Volume By Tower Air Cooler for the Period 2017-2027

- Historical Data and Forecast of India Air Cooler Revenues & Volume By Personal Air Cooler for the Period 2017-2027

- Historical Data and Forecast of India Air Cooler Revenues & Volume By Application for the Period 2017-2027

- Historical Data and Forecast of India Air Cooler Revenues & Volume By Residential Sector for the Period 2017-2027

- Historical Data and Forecast of India Air Cooler Revenues & Volume By Commercial Sector for the Period 2017-2027

- Historical Data and Forecast of India Air Cooler Revenues & Volume By Regions for the Period 2017-2027

- Historical Data and Forecast of India Air Cooler Revenues & Volume By Northern for the Period 2017-2027

- Historical Data and Forecast of India Air Cooler Revenues & Volume By Western for the Period 2017-2027

- Historical Data and Forecast of India Air Cooler Revenues & Volume By Eastern for the Period 2017-2027

- Historical Data and Forecast of India Air Cooler Revenues & Volume By Southern for the Period 2017-2027

- India Air Cooler Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Application

- Market Opportunity Assessment By Regions

- India Air Cooler Top Companies Market Share

- India Air Cooler Competitive Benchmarking By Type ,Application and Regions

- India Air Cooler Company Profiles

- India Air Cooler Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Applications

- Residential

- Commercial sector

By Product Types

- Desert Air Cooler

- Window Air Cooler

- Tower Air Cooler

- Personal Air Cooler

By Regions

- Northern

- Western

- Eastern

- Southern

India Air Cooler Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. India Air Cooler Market Overview |

| 3.1. India Air Cooler Market Revenues and Volume, 2017-2027F |

| 3.2. India Air Cooler Market - Industry Life Cycle |

| 3.3. India Air Cooler Market - Ecosystem |

| 3.4. India Air Cooler Market - India Air Cooler Market - Porter’s Five Forces |

| 3.5. India Air Cooler Market Revenue Share, By Types, 2020 & 2027F |

| 3.6. India Air Cooler Market Revenue Share, By Applications, 2020 & 2027F |

| 3.7. India Air Cooler Market Revenue Share, By Regions, 2020 & 2027F |

| 4. India Air Cooler Market - Impact Analysis of Covid 19 |

| 5. India Air Cooler Market Dynamics |

| 5.1. Impact Analysis |

| 5.2. Market Drivers |

| 5.2.1 Increasing temperatures in India leading to higher demand for air coolers |

| 5.2.2 Rising disposable income and urbanization driving the adoption of air coolers |

| 5.2.3 Energy efficiency and eco-friendliness of air coolers compared to air conditioners |

| 5.3. Market Restraints |

| 5.3.1 Competition from air conditioners and other cooling technologies |

| 5.3.2 Seasonal nature of air cooler demand in India |

| 5.3.3 Infrastructure challenges and power supply issues impacting usage of air coolers |

| 6. India Air Cooler Market Trends and Evolution |

| 7. India Air Cooler Market Overview, By Types |

| 7.1. India Air Cooler Market Revenues and Volume, By Desert Air Coolers, 2017-2027F |

| 7.2. India Air Cooler Market Revenues and Volume, By Tower Air Coolers, 2017-2027F |

| 7.3. India Air Cooler Market Revenues and Volume, By Personal Air Coolers, 2017-2027F |

| 7.4. India Air Cooler Market Revenues and Volume, By Window Air Coolers, 2017-2027F |

| 8. India Air Cooler Market Overview, By Applications |

| 8.1. India Air Cooler Market Revenues and Volume, By Residential Application, 2017-2027F |

| 8.2. India Air Cooler Market Revenues and Volume, By Commercial Application, 2017-2027F |

| 9. India Air Cooler Market Overview, By Regions |

| 9.1. India Air Cooler Market Revenues and Volume, By Northern Region, 2017-2027F |

| 9.2. India Air Cooler Market Revenues and Volume, By Southern Region, 2017-2027F |

| 9.3. India Air Cooler Market Revenues and Volume, By Eastern Region, 2017-2027F |

| 9.4. India Air Cooler Market Revenues and Volume, By Western Region, 2017-2027F |

| 10. India Air Cooler Market - Key Performance Indicators |

| 11. India Air Cooler Market - Opportunity Assessment |

| 11.1. India Air Cooler Market Opportunity Assessment, By Types, 2027F |

| 11.2. India Air Cooler Market Opportunity Assessment, By Applications, 2027F |

| 11.3. India Air Cooler Market Opportunity Assessment, By Regions, 2027F |

| 12. India Air Cooler Market Competitive Landscape |

| 12.1. India Air Cooler Market Volume Share, By Companies, 2020 |

| 12.2. India Air Cooler Market Competitive Benchmarking, By Technical Parameters |

| 12.3. India Air Cooler Market Competitive Benchmarking, By Operating Parameters |

| 13. Company Profiles |

| 13.1. Groupe SEB India Private Limited (Maharaja Whiteline) |

| 13.2. Orient Electric Limited |

| 13.3. Bajaj Electricals Limited |

| 13.4. Usha International Limited |

| 13.5. Crompton Greaves Consumer Electricals Limited |

| 13.6. Kenstar |

| 13.7. Symphony Limited |

| 13.8. Voltas Limited |

| 13.9. Hindware Appliances |

| 13.10. Havells India Limited |

| 14. Key Strategic Recommendations |

| 15. Disclaimer |

| List of Figures |

| 1. India Air Cooler Revenues and Volume, 2017-2027F (INR Thousand Crores, Million Units) |

| 2. Industry Life Cycle of India Air Cooler Market |

| 3. India Air Cooler Market Revenue Share, By Types, 2020 & 2027F |

| 4. India Air Cooler Market Volume Share, By Types, 2020 & 2027F |

| 5. India Air Cooler Market Revenue Share, By Applications, 2020 & 2027F |

| 6. India Air Cooler Market Volume Share, By Applications, 2020 & 2027F |

| 7. India Air Cooler Market Revenue Share, By Regions, 2020 & 2027F |

| 8. India Air Cooler Market Volume Share, By Regions, 2020 & 2027F |

| 9. Urban population of India, 2016-2027 (Millions) |

| 10. India Per Capita Income, 2010-2019 (current $) |

| 11. India Urban and Rural Areas in Consumer Durables Market Revenue, 2019 |

| 12. Number of Hotel Sites/ Outlets in India, (2018- 2023F) |

| 13. Market Size of the Retail Industry, 2016- 2026F (INR Lakh Crores) |

| 14. India Online Retail Market, 2017-2022F (INR Thousand Crores) |

| 15. Market Size of the Retail Industry, 2016- 2026F (INR Billion) |

| 16. Market Share of the Retail Industry, 2019 & 2021F |

| 17. India Real Estate Market Size, 2017- 2030F (INR Lakh Crores) |

| 18. India Healthcare Sector Growth, 2017 & 2022F (INR Lakh Crore) |

| 19. Sector- Wise Share of Goods Sold On E- Commerce Platform, 2020 |

| 20. Total Number of Internet Users in India (Million) |

| 21. India Air Cooler Market Opportunity Assessment, By Types, 2027F |

| 22. India Air Cooler Market Opportunity Assessment, By Applications, 2027F |

| 23. India Air Cooler Market Opportunity Assessment, By Region, 2027F |

| 24. India Desert Air Cooler Market Volume Share, By Companies, 2020 |

| 25. India Tower Air Cooler Market Volume Share, By Companies, 2020 |

| 26. India Window Air Cooler Market Volume Share, By Companies, 2020 |

| 27. India Personal Air Cooler Market Volume Share, By Companies, 2020 |

| List of Tables |

| 1. List of Major Upcoming Residential Projects in India |

| 2. India Air Cooler Market Revenues, By Types, 2017-2027F (INR Crores) |

| 3. India Air Cooler Market Volume, By Types, 2017-2027F (Thousand Units) |

| 4. India Air Cooler Market Revenues, By Applications, 2017-2027F (INR Crores) |

| 5. India Air Cooler Market Volume, By Applications, 2017-2027F (Thousand Units) |

| 6. India Air Cooler Market Revenues, By Regions, 2017-2027F (INR Crores) |

| 7. India Air Cooler Market Volume, By Regions, 2017-2027F (Thousand Units) |

| 8. India Upcoming Malls in Major Cities, by 2022 |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero