India Aluminium Market (2025-2031) | Forecast, Analysis, Trends, Companies, Size, Value, Share, Revenue, Growth & Industry

Market Forecast By End-Use (Construction, Transportation, Packaging, Electrical, Consumer Durables, Machinery & Equipment, Others) And Competitive Landscape

| Product Code: ETC248964 | Publication Date: Aug 2023 | Updated Date: Nov 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

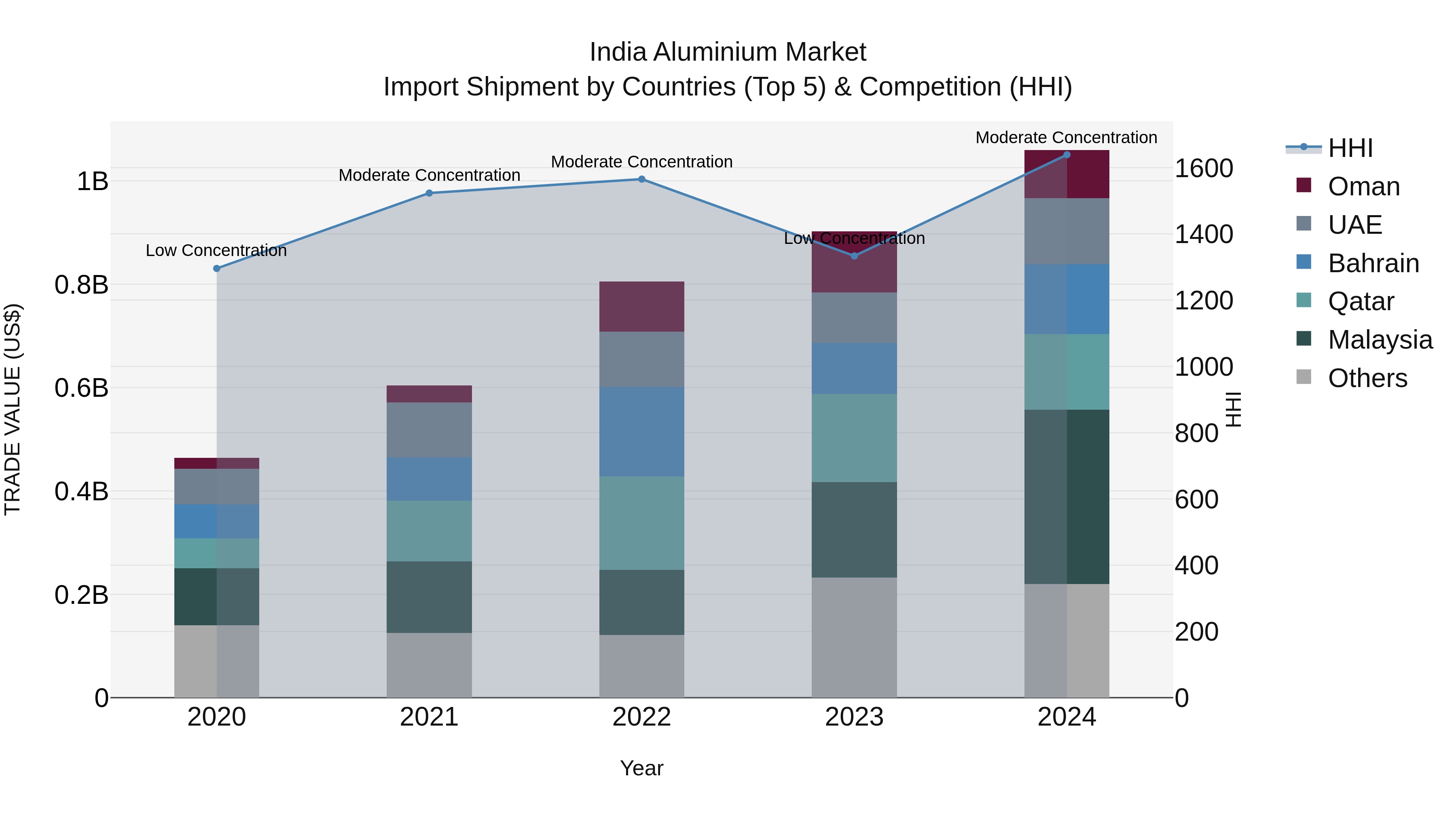

India Aluminium Market Top 5 Importing Countries and Market Competition (HHI) Analysis

India`s aluminium import shipments in 2024 saw significant growth, with Malaysia, Qatar, Bahrain, UAE, and Oman emerging as the top exporting countries. The shift from low to moderate concentration in the Herfindahl-Hirschman Index (HHI) indicates a consolidation in the market. The compound annual growth rate (CAGR) from 2020 to 2024 stood at an impressive 22.94%, while the growth rate from 2023 to 2024 was recorded at 17.46%, reflecting a robust expansion in India`s aluminium import market.

India Aluminium Market Growth Rate

According to 6Wresearch internal database and industry insights, the India Aluminium Market is projected to grow at a compound annual growth rate (CAGR) of 5.2% during the forecast period (2025-2031).

India Aluminium Market Highlights

| Report Name | India Aluminium Market |

| Forecast period | 2025-2031 |

| CAGR | 5.2% |

| Growing Sector | Construction |

Topics Covered in the India Aluminium Market Report

The India Aluminium Market report thoroughly covers the market by End-User. The report provides an unbiased and detailed analysis of ongoing market trends, opportunities/high growth areas, and market drivers, which would help stakeholders to devise and align their market strategies according to the current and future market dynamics.

India Aluminium Market Synopsis

The India Aluminium Market is forecasted to see substantial growth in recent years, driven by rising demand across sectors such as construction, transportation, and packaging. The increasing focus on sustainable and eco-efficient solutions has led to the surge in the demand of aluminium across various industries. The government’s push towards infrastructure development and increased foreign investment in the country further fuels the market demand for aluminum.

Evaluation of Growth Drivers in the India Aluminium Market

Below are some prominent drivers and their influence on the market dynamics:

| Driver | Primary Segments Affected | Why it Matters |

| Public Infrastructure Investments | Construction, Transportation | Large infrastructure projects are driving the demand for aluminium products. |

| Automotive & Electric Vehicles | Transportation | Growth in electric vehicles has increased the need for lightweight and strong aluminium. |

| Packaging Industry Growth | Packaging | Aluminium's use in food and beverage packaging is growing due to its recyclability and lightness. |

| Government Regulations on Sustainability | All sectors | Regulatory frameworks promoting the use eco-efficient materials, has led to aluminium adoption in packaging. |

| Growth in Consumer Durables | Consumer Durables | Growing demand for aluminium in electronics and appliances is driven by its durability and lightweight nature. |

The India Aluminium Market is projected to grow at a CAGR of 5.2% during the forecast period of 2025-2031. The growth is bolstered by the ongoing government infrastructure projects, rising use in the automotive sector, and a growing demand for packaging materials. Along with that, aluminium market in India is also supported by the increasing trend towards the adoption of sustainable and eco-friendly materials. Moreover, the progression of the construction industry and rising use of aluminium in electrical applications due to their lightweight, durable and excellent conductivity features especially in urban areas is another contributing factor fueling the India aluminium market growth.

Evaluation of Restraints in the India Aluminium Market

Below are some major restraints and their influence on the market dynamics:

| Restraint | Primary Segments Affected | What this Means |

| High Production Costs | All sectors | Heavy cost of aluminium production, driven by energy-intensive processes and raw material prices, limits market growth. |

| Raw Material Shortages | All sectors | Lack of bauxite and raw materials interrupt with supply chains, leading to price fluctuation. |

| Price Fluctuations | All sectors | Price volatility in aluminium due to changing demand and supply can hinder long-term investments. |

| Competition from Substitutes | Packaging, Consumer Durables | Aluminium faces competition from plastics and steel in some applications, limiting its market expansion. |

| Environmental Concerns in Production | All sectors | The energy-intensive nature of aluminium production raises concerns over carbon emissions and environmental impact. |

India Aluminium Market Challenges

The India Aluminium Industry confronts several challenges that could hamper with its growth. High production costs and energy requirements for aluminium manufacturing may limit its use in price-sensitive sectors. Additionally, global supply chain interruption, including the shortage of raw materials like bauxite, could create market instability and limit aluminium production capacity. The rising competition pressure from plastic and steel in packaging and construction further obstructs with the market growth.

India Aluminium Market Trends

Some emerging trends shaping the market landscape are:

- Electrification of Transportation The increasing demand for electric vehicles (EVs) is propelling the need for lightweight materials like aluminium in vehicle manufacturing.

- Solutions and Sustainability Aluminium’s recyclability is becoming increasingly crucial, with manufacturers going for recycled aluminium to meet sustainability targets.

- Smart Packaging Solutions Increasing demand for smart, eco-friendly packaging solutions in the food and beverage industry is generating more aluminium-based packaging advancement.

- Digitalization in Manufacturing The use of smart technologies, such as automation and AI in manufacturing, enhance efficiency and reduce costs in the aluminium production process.

Investment Opportunities in the India Aluminium Industry

Some of the key investment opportunities in the India Aluminium Market are:

- Development of Aluminium Recycling Facilities Investment in recycling infrastructure can help meet growing demand and reduce reliance on virgin aluminium.

- Expansion in Electric Vehicle Manufacturing With the rise in electric vehicle manufacture, investing in aluminium production for automotive components presents significant opportunities.

- Sustainable Aluminium Production Innovations in energy-efficient and sustainable aluminium production processes, such as the use of renewable energy, can attract investments.

- Aluminium in Packaging As packaging continues to move towards sustainable materials, there is ample opportunity for investment in the aluminium packaging sector, especially in food and beverages.

Top 5 Leading Companies in the India Aluminium Market

Here is a comprehensive list of key players dominating the India Aluminium Market Share includes:

1. Hindalco Industries Limited

| Company Name | Hindalco Industries Limited |

|---|---|

| Headquarters | Mumbai, India |

| Established Year | 1958 |

| Official Website | Click Here |

Hindalco is India’s largest aluminium producer, offering a wide range of products in the automotive, packaging, and construction industries.

2. National Aluminium Company Limited (NALCO)

| Company Name | National Aluminium Company Limited (NALCO) |

|---|---|

| Headquarters | Bhubaneswar, India |

| Established Year | 1981 |

| Official Website | Click Here |

NALCO is a leading producer of aluminium and one of the largest exporters of the metal in India. The company is involved in mining, refining, and producing a wide range of aluminium products.

3. Jindal Aluminium Ltd

| Company Name | Jindal Aluminium Ltd |

|---|---|

| Headquarters | Bangalore, India |

| Established Year | 1970 |

| Official Website | Click Here |

Jindal Aluminium is a key player in the manufacturing of aluminium extrusions, sheets, and foils.

4. Vedanta Resources Limited

| Company Name | Vedanta Resources Limited |

|---|---|

| Headquarters | London, United Kingdom |

| Established Year | 1976 |

| Official Website | Click Here |

Vedanta is a major player in the aluminium production sector, with a significant presence in India.

5. Balco (Bharat Aluminium Company)

| Company Name | Balco (Bharat Aluminium Company) |

|---|---|

| Headquarters | Korba, India |

| Established Year | 1965 |

| Official Website | Click Here |

Balco, a subsidiary of Vedanta, is one of India’s leading producers of aluminium and has a strong market presence in the automotive, construction, and electrical sectors.

Government Regulations Introduced in the India Aluminium Market

According to Indian government data, the market growth has been reshaped by several actions taken by the authorities. The government has put forward an array of rules and programs to boost the growth of the aluminum market in India. Some examples include the National Mineral Policy which supports the manufacturing of domestic aluminium by easing mining regulations, and the Make in India initiative encourages foreign companies to invest in aluminium manufacturing. Additionally, tax incentives and subsidies are provided for the adoption of environmentally friendly aluminium solutions in the automotive and construction sectors.

Future Insights of the India Aluminium Market

The India Aluminum Market is forecasted to grow steadily with the increasing demand for aluminium in various industries such as construction and transportation. Rising concentration on sustainability and the adoption of low-emission and electric vehicles will further propel the demand for aluminium in India. Additionally, with the government’s urge for infrastructure development and the booming packaging industry, the aluminium market is set for substantial growth.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

Construction to Dominate the Market - By End-Use

According to Mansi Ahuja, Senior Research Analyst at 6Wresearch, the construction industry drives the demand for aluminium, particularly in high-rise buildings, bridges, and infrastructure projects, due to its lightweight, durability, and corrosion resistance properties.

Key Attractiveness of the Report

- 10 Years of Market Numbers

- Historical Data Starting from 2021 to 2024

- Base Year: 2024

- Forecast Data until 2031

- Key Performance Indicators Impacting the Market

- Major Upcoming Developments and Projects

Key Highlights of the Report:

- India Aluminium Market Outlook

- Market Size of India Aluminium Market, 2024

- Forecast of India Aluminium Market, 2031

- Historical Data and Forecast of India Aluminium Revenues & Volume for the Period 2021 - 2031

- India Aluminium Market Trend Evolution

- India Aluminium Market Drivers and Challenges

- India Aluminium Price Trends

- India Aluminium Porter's Five Forces

- India Aluminium Industry Life Cycle

- Historical Data and Forecast of India Aluminium Market Revenues & Volume By End-Use for the Period 2021 - 2031

- Historical Data and Forecast of India Aluminium Market Revenues & Volume By Construction for the Period 2021 - 2031

- Historical Data and Forecast of India Aluminium Market Revenues & Volume By Transportation for the Period 2021 - 2031

- Historical Data and Forecast of India Aluminium Market Revenues & Volume By Packaging for the Period 2021 - 2031

- Historical Data and Forecast of India Aluminium Market Revenues & Volume By Electrical for the Period 2021 - 2031

- Historical Data and Forecast of India Aluminium Market Revenues & Volume By Consumer Durables for the Period 2021 - 2031

- Historical Data and Forecast of India Aluminium Market Revenues & Volume By Machinery & Equipment for the Period 2021 - 2031

- Historical Data and Forecast of India Aluminium Market Revenues & Volume By Others for the Period 2021 - 2031

- India Aluminium Import Export Trade Statistics

- Market Opportunity Assessment By End-Use

- India Aluminium Top Companies Market Share

- India Aluminium Competitive Benchmarking By Technical and Operational Parameters

- India Aluminium Company Profiles

- India Aluminium Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By End-Use

- Construction

- Transportation

- Packaging

- Electrical

- Consumer Durables

- Machinery & Equipment

- Others

India Aluminium Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 India Aluminium Market Overview |

| 3.1 India Aluminium Market Revenues & Volume, 2021 - 2031F |

| 3.2 India Aluminium Market - Industry Life Cycle |

| 3.3 India Aluminium Market - Porter's Five Forces |

| 3.4 India Aluminium Market Revenues & Volume Share, By End-Use, 2021 & 2031F |

| 4 India Aluminium Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Growth in the construction industry in India leading to increased demand for aluminum in infrastructure projects. |

| 4.2.2 Adoption of aluminum in automotive manufacturing due to its lightweight and fuel-efficient properties. |

| 4.2.3 Government initiatives promoting the use of aluminum in various sectors to boost domestic production and reduce imports. |

| 4.3 Market Restraints |

| 4.3.1 Fluctuating global aluminum prices impacting the cost competitiveness of Indian aluminum manufacturers. |

| 4.3.2 Environmental concerns related to aluminum production processes leading to regulatory challenges. |

| 4.3.3 Competition from other materials like steel and composites posing a threat to the aluminum market. |

| 5 India Aluminium Market Trends |

| 6 India Aluminium Market Segmentation |

| 6.1 India Aluminium Market, By End-Use |

| 6.1.1 Overview and Analysis |

| 6.1.2 India Aluminium Market Revenues & Volume, By End-Use, 2021- 2031F |

| 6.1.3 India Aluminium Market Revenues & Volume, By Construction, 2021- 2031F |

| 6.1.4 India Aluminium Market Revenues & Volume, By Transportation, 2021- 2031F |

| 6.1.5 India Aluminium Market Revenues & Volume, By Packaging, 2021- 2031F |

| 6.1.6 India Aluminium Market Revenues & Volume, By Electrical, 2021- 2031F |

| 6.1.7 India Aluminium Market Revenues & Volume, By Consumer Durables, 2021- 2031F |

| 6.1.8 India Aluminium Market Revenues & Volume, By Machinery & Equipment, 2021- 2031F |

| 7 India Aluminium Market Import-Export Trade Statistics |

| 7.1 India Aluminium Market Export to Major Countries |

| 7.2 India Aluminium Market Imports from Major Countries |

| 8 India Aluminium Market Key Performance Indicators |

| 8.1 Average capacity utilization rate of aluminum manufacturing plants in India. |

| 8.2 Percentage of aluminum recycling rate in India. |

| 8.3 Number of new product innovations utilizing aluminum in different industries. |

| 8.4 Energy efficiency improvements in aluminum production processes. |

| 8.5 Export-to-import ratio of aluminum products in India. |

| 9 India Aluminium Market - Opportunity Assessment |

| 9.1 India Aluminium Market Opportunity Assessment, By End-Use, 2021 & 2031F |

| 10 India Aluminium Market - Competitive Landscape |

| 10.1 India Aluminium Market Revenue Share, By Companies, 2024 |

| 10.2 India Aluminium Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Switchgear Market Outlook (2026 - 2032) | Size, Share, Trends, Growth, Revenue, Forecast, Analysis, Value, Outlook

- Pakistan Contraceptive Implants Market (2025-2031) | Demand, Growth, Size, Share, Industry, Pricing Analysis, Competitive, Strategic Insights, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Companies, Challenges

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero