India Bus Market (2025-2031) | Trends, Size, Value, Forecast, Growth, Share, Companies, Analysis, Revenue & Industry

Market Forecast By Type (Single Deck, Double Deck), By Application (Transit, Coaches, Others), By Fuel Type (Diesel, Electric and Hybrid, Others), By Seat Capacity (15-30 Seats, 31-50 Seats, More than 50 Seats) And Competitive Landscape

| Product Code: ETC361104 | Publication Date: Nov 2024 | Updated Date: Nov 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

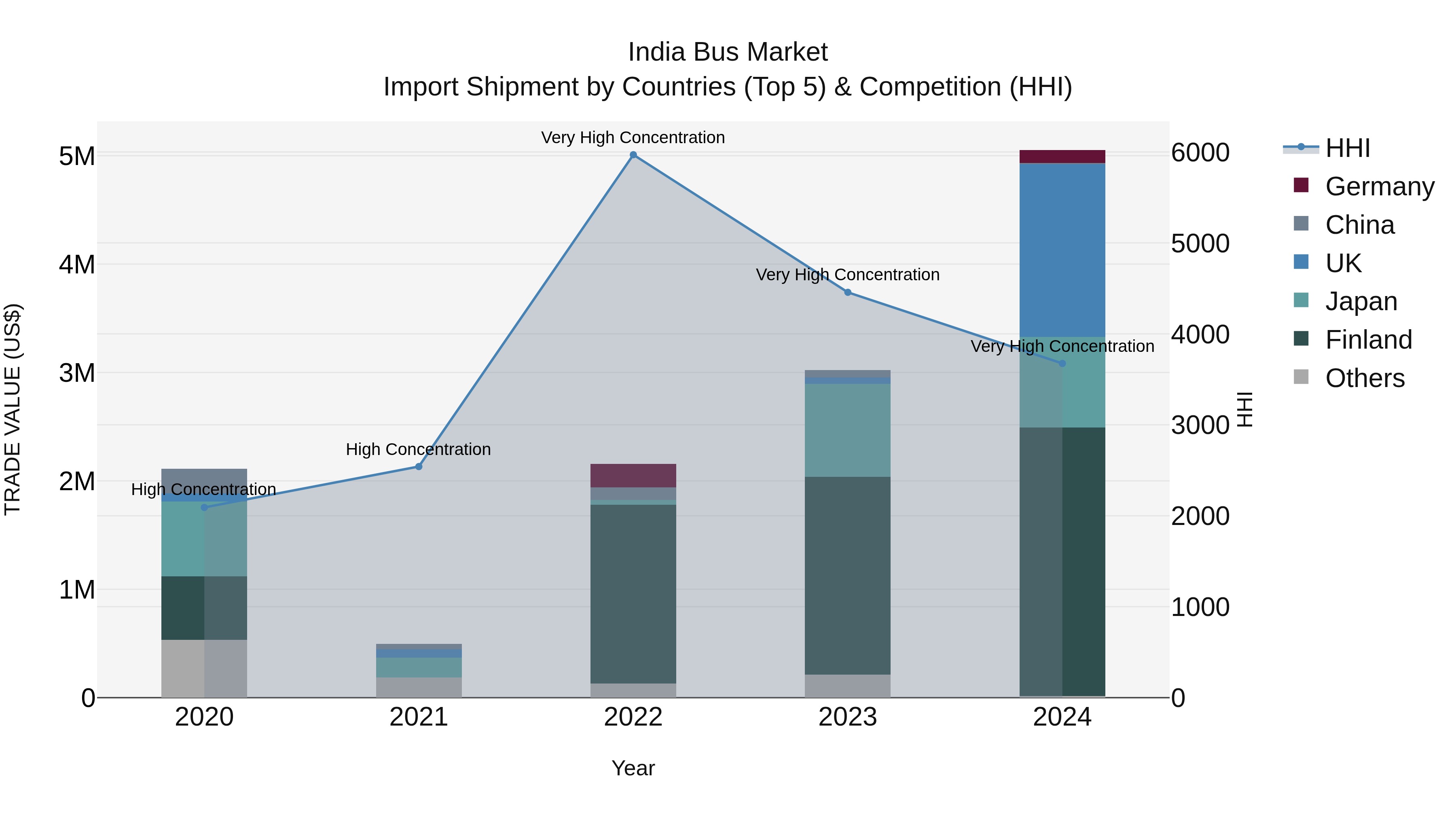

India Bus Market Top 5 Importing Countries and Market Competition (HHI) Analysis

India`s bus import market in 2024 continued to see strong growth, with Finland, UK, Japan, and Germany leading the way as top exporting countries. The high Herfindahl-Hirschman Index (HHI) indicates a concentrated market, with significant contributions from key players. The impressive compound annual growth rate (CAGR) from 2020 to 2024 at 24.36% demonstrates sustained expansion, while the remarkable growth rate of 67.22% from 2023 to 2024 underscores the sector`s rapid development. This data suggests a promising outlook for the bus import industry in India, with continued opportunities for international trade and market expansion.

India Bus Market Growth Rate

According to 6Wresearch internal database and industry insights, the India Bus Market is growing at a compound annual growth rate (CAGR) of 6.8% during the forecast period (2025-2031).

India Bus Market Highlights

| Report Name | India Bus Market |

| Forecast Period | 2025-2031 |

| CAGR | 6.% |

| Growing Sector | Electric & Hybrid Buses |

Five Year Growth Trajectory of the India Bus Market with Core Drivers

Below mentioned are the evaluation of year wise growth rate along with key drivers:

| Year | Est. Annual Growth | Growth Drivers |

| 2020 | 3.5% | Rising urban mobility demand and fleet upgrades |

| 2021 | 4.2% | Growth in intercity coach travel and tourism fleet expansion |

| 2022 | 5.0% | Infrastructure rollout and regional connectivity push |

| 2023 | 5.8% | Electrification and alternate fuel bus adoption |

| 2024 | 0.065 | Government fleet modernisation and private operator expansion |

Topics Covered in the India Bus Market Report

India Bus Market report thoroughly covers the market by type, application, fuel type and seat capacity. The market report provides an unbiased and detailed analysis of ongoing market trends, opportunities/high growth areas, and market drivers, which would help stakeholders devise and align their market strategies according to the current and future market dynamics.

India Bus Market Synopsis

The India bus market is expected to experience steady growth. The market is driven by rising public transit use in urban areas, increasing fleet renewal by state transport undertakings (STUs) and private operators, and adoption of electric and hybrid buses. Government schemes to expand regional connectivity and incentives for bus manufacturing support this expansion. Growing seat capacity demand, coach travel for tourism, and electric bus procurement further influence the market.

Evaluation of Growth Drivers in the India Bus Market

Below mentioned some growth drivers and their impact on market dynamics:

| Drivers | Primary Segments Affected | Why It Matters |

| Fleet modernisation & connectivity push | Transit, Coaches | Large scale renewal increases new bus supply. |

| Electrification & alternate fuel adoption | Fuel Type (Electric/Hybrid) | Reduces operating cost and meets emission norms. |

| Regional travel & tourism growth | Seat Capacity (More than 50 Seats) | Expands coach segment demand. |

| Government transport policies & manufacturing incentives | All types/applications | Boosts production and procurement activity. |

The India Bus Market is projected to grow significantly, at CAGR of 6.8% during the forecast period of 2025 2031. The India Bus Market is propelled mainly by the increasing demand for intercity and regional travel, the swift modernization of the fleet, and state subsidies for electric and hybrid buses. The market is taking a favorable turn owing to the rise in intercity coach travel, tourist-related services, and the expansion of private operators. Furthermore, the use of digital ticketing, IoT-monitoring fleet management, and luxury buses are among the factors that sustain the growth. The projects linking up different regions and the emission reduction policies prompt the operators to renew their fleets with the latest technologies.

Evaluation of Restraints in the India Bus Market

Below mentioned are some major restraints and their influence on market dynamics:

| Restraints | Primary Segments Affected | What This Means |

| High upfront cost for electric/hybrid buses | Fuel Type (Electric/Hybrid) | Slows adoption in cost sensitive fleets. |

| Fragmented private operator market | Application (Coaches, Others) | Limits scale and standardisation. |

| Infrastructure limitations for charging and maintenance | Type (Single Deck, Double Deck) | Constrains deployment of modern fleets. |

| Regulatory/regional policy inconsistencies | Application (Transit, Others) | Adds complexity and delays procurement. |

India Bus Market Challenges

Challenges in the India Bus Market include high upfront costs for electric and hybrid buses, limiting adoption among cost-sensitive operators. Fragmented private operators restrict scale and standardisation. Limited charging infrastructure and maintenance facilities constrain deployment of modern fleets. Regulatory inconsistencies across regions add complexity to procurement. Competition from alternative transport modes, such as ride-sharing and rail, further impacts market growth. Additionally, operator reluctance to adopt new technologies can slow fleet modernisation initiatives.

India Bus Market Trends

Here are some major trends contributing to India Bus Market Growth:

- Electric & Hybrid Bus Adoption: Reduces emissions and operating costs while supporting sustainable urban transport initiatives.

- Intercity & Premium Coach Expansion: Premium coaches enhance comfort and safety for intercity and tourism travel.

- Digital Ticketing & Private Sector Participation: Online booking and private fleets improve convenience and operational efficiency.

- High-Capacity & Double Deck Buses: Optimises passenger load and route efficiency in urban corridors.

- Connected & Smart Fleet Management: IoT and telematics enable real-time monitoring and improved passenger experience.

Investment Opportunities in the India Bus Market

Here are some investment opportunities in the India Bus Industry:

- Electric/hybrid bus manufacturing: Investing in production facilities for next gen buses catering to STUs and private fleets.

- Charging infrastructure & battery ecosystem: Establishing stations and battery swap/charging solutions for bus fleets.

- Coach and premium segment buses: Targeting tourism and inter city travel demand with high capacity and comfort oriented buses.

- Fleet upgrade & service models: Offering modernisation services, retrofit kits and fleet management solutions to operators.

- Regional connectivity and last mile transport: Investing in smaller bus types and seat capacity targeted services for tier 2 and tier 3 cities.

Top 5 Leading Players in the India Bus Market

Here are some top companies contributing to India Bus Market Share:

1. Ashok Leyland

| Company Name | Ashok Leyland |

| Established Year | 1948 |

| Headquarters | Chennai, Tamil Nadu, India |

| Official Website | Click Here |

Ashok Leyland is a major Indian bus manufacturer, offering a wide range of city, intercity and coach buses used by state transport undertakings and private operators.

2. Tata Motors

| Company Name | Tata Motors |

| Established Year | 1945 |

| Headquarters | Mumbai, Maharashtra, India |

| Official Website | Click Here |

Tata Motors provides buses across urban transit, inter city travel and electric mobility segments, delivering modern fleets and electric bus solutions leveraged by Indian public transport operators.

3. Volvo Buses India

| Company Name | Volvo Buses India |

| Established Year | 2001 |

| Headquarters | Bengaluru, Karnataka, India |

| Official Website | Click Here |

Volvo Buses India supplies premium coaches and high capacity buses in India, known for advanced safety features, comfort and luxury segment highway applications and state transport deployments.

4. JBM Auto

| Company Name | JBM Auto |

| Established Year | 2012 |

| Headquarters | Gurugram, Haryana, India |

| Official Website | Click Here |

JBM Auto manufactures electric and conventional buses, focusing on inter city and electric coach segments, supplying state orders and private operators with modern, lower emission bus solutions.

5. Olectra Greentech

| Company Name | Olectra Greentech |

| Established Year | 2001 |

| Headquarters | Hyderabad, Telangana, India |

| Official Website | Click Here |

Olectra Greentech is a leader in electric bus manufacturing in India, producing zero emission buses and serving state transport fleets under national electric mobility and fleet modernisation programmes.

Government Regulations Introduced in the India Bus Market

According to Indian government data, Government laws profoundly impact the evolution of the Indian Bus Market. The FAME II Scheme promotes the production and utilization of electric buses via monetary incentives. The PM e Bus Campaign advocates for extensive electrification of public transportation fleets in prominent Indian cities. The nationwide implementation of BS VI emission standards guarantees cleaner and more efficient buses, advancing India’s sustainability objectives and facilitating the transition to greener, modern public transportation networks.

Future Insights of the India Bus Market

The India Bus Market is expected to have a positive scenario, with gradual growth predicted for transit, coach, electric, and hybrid segments. The new capital infusion is being driven by the increasing focus on green mobility and the opening up of city connectivity projects. Moreover, the rise in private fleet participation and the setting up of local manufacturing hubs backed by the nascent battery ecosystem are seen to form robust chances for the likes of bus makers, component suppliers, and transport service providers to flourish in the years to come.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

Electric & Hybrid Buses to Dominate the Market – By Fuel Type

According to Guneet Kaur, Senior Research Analyst, 6Wresearch, electric and hybrid buses are the fastest-growing segment due to rising government incentives, environmental concerns, and increasing adoption by urban transit fleets for sustainable and energy-efficient public transportation solutions.

Coaches to Dominate the Market – By Application

Coaches are emerging as the fastest-growing application segment, catering to intercity travel, private tours, and long-distance transportation. Enhanced comfort, premium features, and growing demand for safe and efficient travel boost their adoption across regional and private fleet operators.

Single Deck Buses to Dominate the Market – By Type

Single deck buses are the fastest-growing type segment, widely used in city transit and regional routes. Their flexible seating, easy maneuverability, and lower operational costs make them highly preferred for urban and semi-urban transportation services.

31-50 Seats to Dominate the Market – By Seat Capacity

Buses with 31-50 seats are witnessing fastest growth due to optimal passenger capacity, cost-efficiency, and suitability for city-to-city transit and intercity travel. Operators prefer this segment to balance passenger demand with operational and fuel efficiency.

Key attractiveness of the report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- India Bus Market Outlook

- Market Size of India Bus Market, 2024

- Forecast of India Bus Market, 2031

- Historical Data and Forecast of India Bus Market Revenues & Volume for the Period 2021 - 2031F

- India Bus Market Trend Evolution

- India Bus Market Drivers and Challenges

- India Bus Price Trends

- India Bus Porter's Five Forces

- India Bus Industry Life Cycle

- Historical Data and Forecast of India Bus Market Revenues & Volume By Type for the Period 2021 – 2031F

- Historical Data and Forecast of India Bus Market Revenues & Volume By single deck for the Period 2021 – 2031F

- Historical Data and Forecast of India Bus Market Revenues & Volume By double deck for the Period 2021 – 2031F

- Historical Data and Forecast of India Bus Market Revenues & Volume By Applications for the Period 2021 – 2031F

- Historical Data and Forecast of India Bus Market Revenues & Volume By transit bus for the Period 2021 - 2031F

- Historical Data and Forecast of India Bus Market Revenues & Volume By coaches for the Period 2021 – 2031F

- Historical Data and Forecast of India Bus Market Revenues & Volume By others for the Period 2021 - 2031F

- Historical Data and Forecast of India Bus Market Revenues & Volume By Fuel Type for the Period 2021 - 2031F

- Historical Data and Forecast of India Bus Market Revenues & Volume By diesel for the Period 2021 - 2031F

- Historical Data and Forecast of India Bus Market Revenues & Volume By electric & hybrid for the Period 2021 – 2031F

- Historical Data and Forecast of India Bus Market Revenues & Volume By others for the Period 2021 - 2031F

- Historical Data and Forecast of India Bus Market Revenues & Volume By Seat Capacity for the Period 2021 - 2031F

- Historical Data and Forecast of India Bus Market Revenues & Volume By 15-30 seats for the Period 2021 – 2031F

- Historical Data and Forecast of India Bus Market Revenues & Volume By 31-50 seats for the Period 2021 – 2031F

- Historical Data and Forecast of India Bus Market Revenues & Volume By more than 50 seats for the Period 2021 – 2031F

- India Bus Market - Key Performance Indicators

- India Bus Market - Import Export Trade Statistics

- India Bus Market - Opportunity Assessment By Type

- India Bus Market - Opportunity Assessment By Fuel Type

- India Bus Market - Opportunity Assessment By Seat Capacity

- India Bus Market - Top Companies Market Share

- India Bus Market - Top Companies Profiles

- India Bus Market - Comparison of Players in Technical and Operating Parameters

- India Bus Market - Strategic Recommendations

Market Covered

The market report has been segmented and sub segmented into the following categories:

By Type

- Single deck

- Double deck

By Applications

- Transit bus

- coaches

- others

By Fuel Type

- Diesel

- electric & hybrid

- other

By Seat Capacity

- 15-30 seats

- 31-50 seats

- more than 50 seats

India Bus Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 India Bus Market Overview |

| 3.1 India Country Macro Economic Indicators |

| 3.2 India Bus Market Revenues & Volume, 2021 & 2031F |

| 3.3 India Bus Market - Industry Life Cycle |

| 3.4 India Bus Market - Porter's Five Forces |

| 3.5 India Bus Market Revenues & Volume Share, By Type, 2021 & 2031F |

| 3.6 India Bus Market Revenues & Volume Share, By Application, 2021 & 2031F |

| 3.7 India Bus Market Revenues & Volume Share, By Fuel Type, 2021 & 2031F |

| 3.8 India Bus Market Revenues & Volume Share, By Seat Capacity, 2021 & 2031F |

| 4 India Bus Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Government initiatives and investments in public transportation infrastructure |

| 4.2.2 Growth in urbanization leading to increased demand for public transportation |

| 4.2.3 Rising awareness about environmental sustainability driving the adoption of buses as a greener mode of transport |

| 4.3 Market Restraints |

| 4.3.1 Fluctuating fuel prices impacting operating costs for bus operators |

| 4.3.2 Challenges in obtaining financing for bus fleet expansion and modernization |

| 4.3.3 Competition from alternative modes of transportation like ride-sharing services and private vehicles |

| 5 India Bus Market Trends |

| 6 India Bus Market, By Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 India Bus Market Revenues & Volume, By Single Deck, 2021 - 2031F |

| 6.1.3 India Bus Market Revenues & Volume, By Double Deckt, 2021 - 2031F |

| 6.2 India Bus Market, By Application |

| 6.2.1 Overview and Analysis |

| 6.2.2 India Bus Market Revenues & Volume, By Transit, 2021 - 2031F |

| 6.2.3 India Bus Market Revenues & Volume, By Coaches, 2021 - 2031F |

| 6.2.4 India Bus Market Revenues & Volume, By Others, 2021 - 2031F |

| 6.3 India Bus Market, By Fuel Type |

| 6.3.1 Overview and Analysis |

| 6.3.2 India Bus Market Revenues & Volume, By Diesel, 2021 - 2031F |

| 6.3.3 India Bus Market Revenues & Volume, By Electric And Hybrid, 2021 - 2031F |

| 6.3.4 India Bus Market Revenues & Volume, By Others, 2021 - 2031F |

| 6.4 India Bus Market, By Seat Capacity |

| 6.4.1 Overview and Analysis |

| 6.4.2 India Bus Market Revenues & Volume, By 15-30 Seats, 2021 - 2031F |

| 6.4.3 India Bus Market Revenues & Volume, By 31-50 Seats, 2021 - 2031F |

| 6.4.4 India Bus Market Revenues & Volume, By More Than 50 Seats, 2021 - 2031F |

| 7 India Bus Market Import-Export Trade Statistics |

| 7.1 India Bus Market Export to Major Countries |

| 7.2 India Bus Market Imports from Major Countries |

| 8 India Bus Market Key Performance Indicators |

| 8.1 Average passenger load factor on buses |

| 8.2 Adoption rate of alternative fuels in the bus fleet |

| 8.3 Number of new routes or expansions in the bus network |

| 8.4 Average age of the bus fleet |

| 8.5 Customer satisfaction ratings for bus services |

| 9 India Bus Market - Opportunity Assessment |

| 9.1 India Bus Market Opportunity Assessment, By Type, 2021 & 2031F |

| 9.2 India Bus Market Opportunity Assessment, By Application, 2021 & 2031F |

| 9.3 India Bus Market Opportunity Assessment, By Fuel Type, 2021 & 2031F |

| 9.4 India Bus Market Opportunity Assessment, By Seat Capacity, 2021 & 2031F |

| 10 India Bus Market - Competitive Landscape |

| 10.1 India Bus Market Revenue Share, By Companies, 2024 |

| 10.2 India Bus Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

Market Forecast By Type (Single Deck, Double Deck), By Application (Transit, Coaches, Others), By Fuel Type (Diesel, Electric and Hybrid, Others), By Seat Capacity (15-30 Seats, 31-50 Seats, More than 50 Seats) And Competitive Landscape

| Product Code: ETC361104 | Publication Date: Aug 2022 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 |

India Bus Market Highlights

| Report Name | India Bus Market |

| Base Year | 2022 |

| Historical Period | 2019-2022 |

| Forecast Period | 2023-2029 |

| Growth Rate | 4.04% |

| Report Coverage | Revenues & Volume, Market Trends, Drivers & Challenges, Market Forecast, Market Share |

| Segment Coverage | By Type, By Application, By Fuel Type, By Seat Capacity |

| Customization Scope | 100% customized reports available along with reliable data. Moreover, you can alter the segments, countries, and regions according to your needs. For further details, you can contact our research expert at sales@6wresearch.com |

| Pricing and Purchase Options | Avail customization purchase option to know the exact pricing of your research needs |

Topics Covered in India Bus Market Report

India Bus Market report thoroughly covers the market by type, application, fuel type, and seat capacity. The market report provides an unbiased and detailed analysis of the on-going market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

India Bus Market Synopsis

The India bus market is anticipated to grow more on account of increasing government spending on public transport infrastructure development along with investments made by cities across India towards improving urban mobility services through buses & other mass transit systems like metro rail networks being set up nationwide. Additionally, initiatives taken by various governments towards encouraging private players into bus manufacturing sector also contribute significantly toward a flourishing business landscape over the foreseeable future.

According to 6Wresearch, the India Bus Market size is estimated to grow at a growth rate of around 4.04% during the forecast period 2023-2029. The India bus market is experiencing growth due to several key drivers that contribute to the demand for public and private transportation solutions. Firstly, rapid urbanization and population growth have increased the need for efficient and sustainable public transportation options. Buses play a crucial role in providing affordable and mass transit solutions, easing the burden on congested road networks. Secondly, government initiatives and policies aimed at promoting public transport and reducing carbon emissions have led to increased investments in public bus transportation systems. Initiatives such as smart cities and clean energy adoption have driven the demand for modern and environmentally friendly buses. Moreover, the growth of the tourism industry and the rise in inter-city travel have further contributed to the demand for long-distance luxury and semi-sleeper buses. Additionally, the advancement in bus manufacturing technologies, including electric and hybrid buses, has attracted investments from both domestic and international bus manufacturers. As the need for sustainable and efficient transportation solutions continues to grow, the India bus market is expected to witness further expansion in the coming years. The Electric Bus Market in India is also growing at a faster pace.

The India bus market encounters several challenges that impact its growth and development. Firstly, the inadequate public transportation infrastructure and limited funding for transportation projects pose challenges to the expansion of the bus market. Many regions still lack well-connected and efficient bus networks, which can limit the demand for new buses. Secondly, the high cost of acquiring buses, especially for state transport corporations, can lead to delays in fleet renewal and modernization efforts. Financial constraints may result in buses being used beyond their ideal operational life, leading to maintenance issues and increased operational costs. Moreover, the preference for individual modes of transport, such as two-wheelers and cars, can reduce the demand for public buses, especially in urban areas. Additionally, the rapid urbanization and congestion in cities can create challenges for bus operators in providing timely and efficient services. Addressing these challenges requires increased investments in public transportation infrastructure, providing adequate funding support to state transport corporations, and promoting awareness about the benefits of public bus transport over individual vehicles. These challenges can pose the India Bus Market Growth.

COVID-19 Impact on India Bus Industry

The COVID-19 pandemic had a profound impact on the India bus market, particularly in the public transportation segment. During the pandemic`s peak, strict lockdown measures and travel restrictions resulted in a sharp decline in bus operations, leading to reduced demand for new buses. With people staying at home and avoiding public transport, the inter-city and inter-state travel demand also plummeted, affecting the demand for long-distance luxury buses. Additionally, the financial stress faced by transport operators due to decreased ridership and revenue losses posed challenges for bus fleet modernization and replacement plans. However, as restrictions were gradually lifted and economic activities resumed, there was a gradual recovery in the bus market. The government`s focus on promoting public transportation and encouraging electric mobility provided opportunities for electric buses to gain traction in the post-pandemic era. Furthermore, the emphasis on sanitation and safety in public transportation during the pandemic has led to the adoption of hygiene measures and improved bus designs, which could boost demand for modern buses with better amenities and features. As the country moves towards post-pandemic recovery, the India bus market is expected to witness growth, driven by the need for sustainable public transportation solutions and the renewal of bus fleets.

Leading Players in India Bus Market

The India bus market is characterized by the presence of several key players who contribute to providing a diverse range of buses for both public and private transportation purposes. Some of the major key players in this market include Tata Motors, Ashok Leyland, and Mahindra & Mahindra. These companies are renowned for their extensive portfolio of buses, catering to various segments such as city buses, inter-city coaches, and school buses. They have a strong network of dealerships and service centers across the country, ensuring seamless aftersales support for their customers. Additionally, international bus manufacturers such as Volvo Buses and Scania also have a significant presence in the India market, offering premium and luxury buses known for their safety features and advanced technologies. These key players actively collaborate with state governments, transport corporations, and private operators to supply buses for public transportation and fleet modernization initiatives. Their focus on product innovation, sustainability, and meeting government regulations has established them as leading players in the India bus market.

Bus Market in India: Government Initiatives

One key initiative has been the FAME (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) scheme. Under FAME, subsidies and initiatives have been provided in order to boost the adoption of electric as well as hybrid buses. This not only addresses concerns linked to air quality and pollution but also aligns with global efforts in order to reduce carbon emissions. However, the Smart Cities Mission, launched by the government, focuses on the transform urban areas into sustainable, citizen-friendly spaces. This initiative focuses on the development of efficient public transportation systems, including bus networks, in order to reduce traffic congestion and enhance urban mobility. Additionally, a number of states and cities in the country have been implementing Bus Rapid Transit (BRT) systems, which prioritize dedicated bus lanes, intelligent traffic management, and smart bus stations.

Bus Market Share in India

Bus market share in the country is rising and it will continue to expand more in the future. This market is the central part of the Asia Pacific Bus Market and it has been experiencing significant growth since it is one of the most crucial public transports. The faster rise in population and urbanization have increased the demand for efficient as well as sustainable public transportation options. The government of the nation has been taking a number of initiatives, which helps in boosting the share of the market. There are a number of key players adding value to the growth of the market and they will continue to help in motivating the growth of the market in the near future. Electric bus market will also rise which will contribute to the growth of the Electric Bus Market Share in India.

Market by Type

On the basis of type, single deck dominates the market and it is likely to dominate the market in the coming years. It is a kind of public transport which has one level for passengers and it is used for city transit systems, school buses, shuttle services, and many other forms of public transport.

Market by Application

On the basis of application, transit bus holds the largest share in the market. A transit bus is a huge motor vehicle which is designed to transport multiple passengers. It follows predetermined routes with designated stop. This type of bus is also designed to be accessible to people with disabilities as it has wheelchair ramps or lifts, low floors, and designated seating for passengers with mobility challenges.

Market by Fuel Type

On the basis of fuel type, diesel segment currently holds the largest share in the market. There is no wonder that diesel is one of the most commonly used fuels. Diesel buses are equipped with internal combustion engines which operate on diesel fuel. Diesel engines are popular for their durability as well as fuel efficiency, which make them them an effective choice for larger vehicles like buses.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2019 to 2022.

- Base Year: 2022

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- India Bus Market Outlook

- Market Size of India Bus Market, 2022

- Forecast of India Bus Market, 2029

- Historical Data and Forecast of India Bus Revenues & Volume for the Period 2019 - 2029

- India Bus Market Trend Evolution

- India Bus Market Drivers and Challenges

- India Bus Price Trends

- India Bus Porter's Five Forces

- India Bus Industry Life Cycle

- Historical Data and Forecast of India Bus Market Revenues & Volume By Type for the Period 2019 - 2029

- Historical Data and Forecast of India Bus Market Revenues & Volume By Single Deck for the Period 2019 - 2029

- Historical Data and Forecast of India Bus Market Revenues & Volume By Double Deck for the Period 2019 - 2029

- Historical Data and Forecast of India Bus Market Revenues & Volume By Application for the Period 2019 - 2029

- Historical Data and Forecast of India Bus Market Revenues & Volume By Transit for the Period 2019 - 2029

- Historical Data and Forecast of India Bus Market Revenues & Volume By Coaches for the Period 2019 - 2029

- Historical Data and Forecast of India Bus Market Revenues & Volume By Others for the Period 2019 - 2029

- Historical Data and Forecast of India Bus Market Revenues & Volume By Fuel Type for the Period 2019 - 2029

- Historical Data and Forecast of India Bus Market Revenues & Volume By Diesel for the Period 2019 - 2029

- Historical Data and Forecast of India Bus Market Revenues & Volume By Electric and Hybrid for the Period 2019 - 2029

- Historical Data and Forecast of India Bus Market Revenues & Volume By Others for the Period 2019 - 2029

- Historical Data and Forecast of India Bus Market Revenues & Volume By Seat Capacity for the Period 2019 - 2029

- Historical Data and Forecast of India Bus Market Revenues & Volume By 15-30 Seats for the Period 2019 - 2029

- Historical Data and Forecast of India Bus Market Revenues & Volume By 31-50 Seats for the Period 2019 - 2029

- Historical Data and Forecast of India Bus Market Revenues & Volume By More than 50 Seats for the Period 2019 - 2029

- India Bus Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Application

- Market Opportunity Assessment By Fuel Type

- Market Opportunity Assessment By Seat Capacity

- India Bus Top Companies Market Share

- India Bus Competitive Benchmarking By Technical and Operational Parameters

- India Bus Company Profiles

- India Bus Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Type

- Single Deck

- Double Deck

By Application

- Transit

- Coaches

- Others

By Fuel Type

- Diesel

- Electric And Hybrid

- Others

By Seat Capacity

- 15-30 Seats

- 31-50 Seats

- More Than 50 Seats

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero