India Diesel Genset (Generator) Market (2021-2027) | Size, industry, Growth, Revenue, Forecast, Trends, Value, Analysis, Outlook & COVID-19 IMPACT

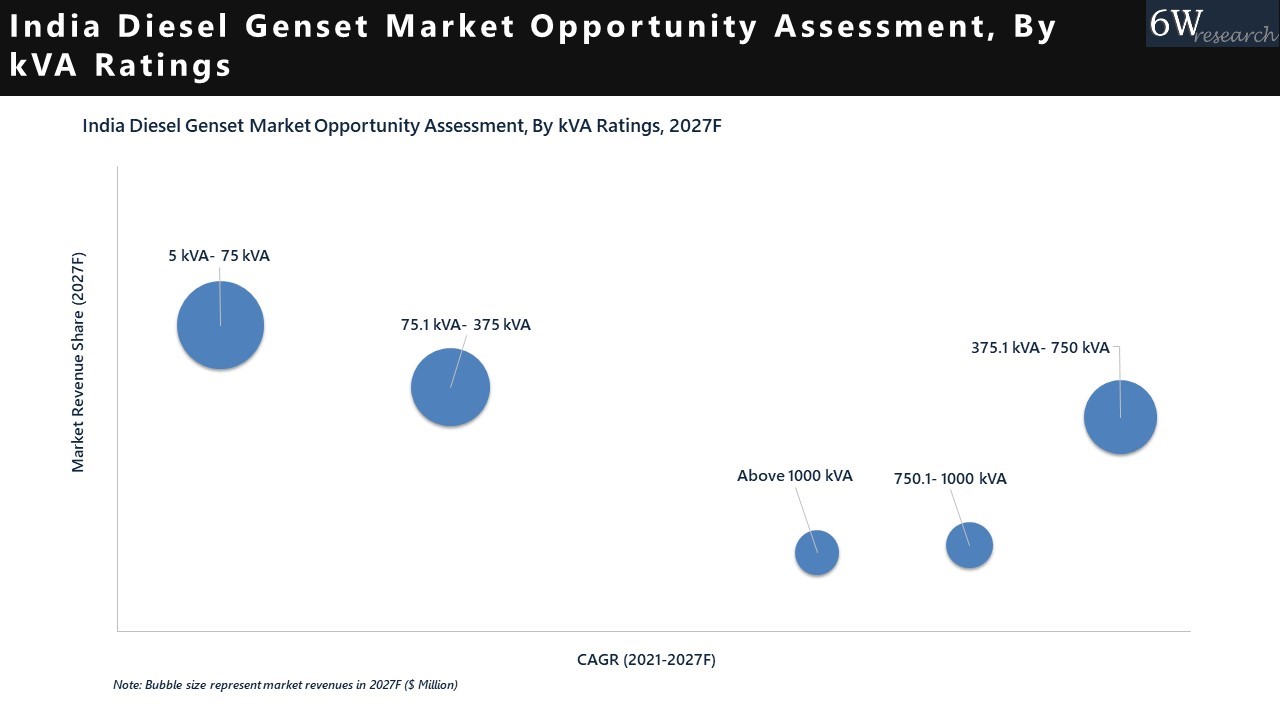

Market Forecast By KVA (5 - 75 KVA, 75.1 - 375 KVA, 375.1 - 750 KVA, 750.1 - 1000 KVA, Above 1000 KVA), By Application (Residential, Commercial, Industrial, Transportation & Public Infrastructure) And Competitive Landscape

| Product Code: ETC090023 | Publication Date: Oct 2022 | Updated Date: Aug 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 90 | No. of Figures: 30 | No. of Tables: 15 |

India Diesel Genset Market | Country-Wise Share and Competition Analysis

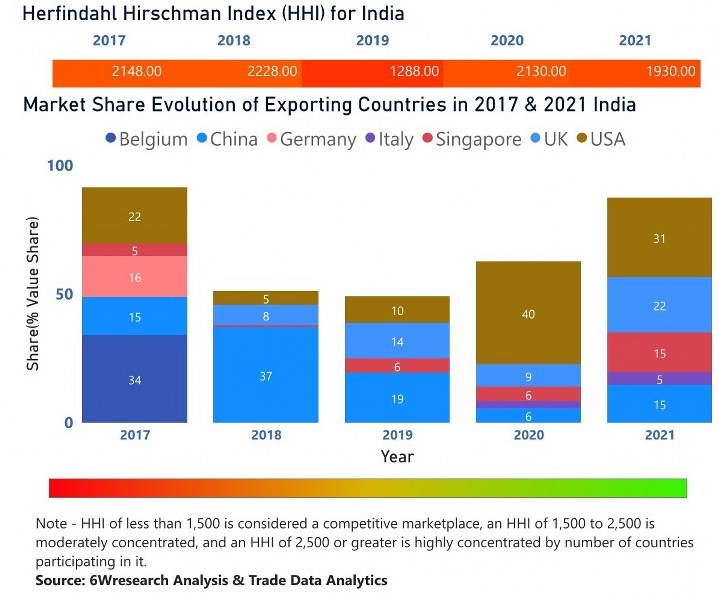

In the year 2021, USA was the largest exporter in terms of value, followed by UK. It has registered a decline of -38.92% over the previous year. While UK registered a growth of 97.4% as compare to the previous year. In the year 2017 Belgium was the largest exporter followed by USA. In term of Herfindahl Index, which measures the competitiveness of countries exporting, India has the Herfindahl index of 2148 in 2017 which signifies moderately concentrated also in 2021 it registered a Herfindahl index of 1930 which signifies moderately concentrated in the market.

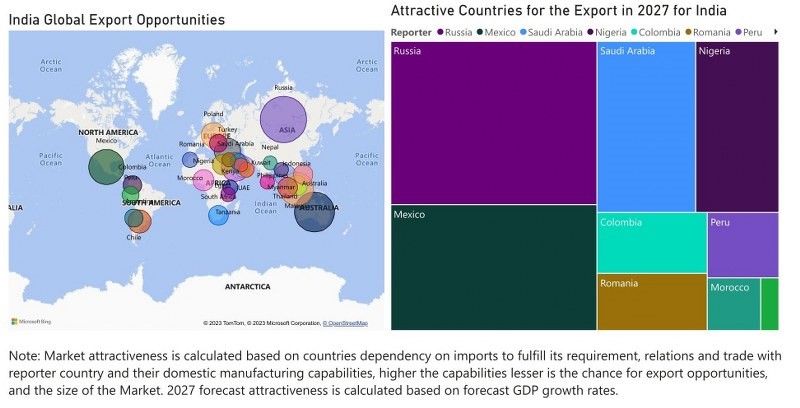

India Diesel Genset Market - Export Market Opportunities

Latest (2024) Development of the India Diesel Genset (Generator) Market

India Diesel Genset (Generator) Market is set to experience notable advancements, reflecting the country's growing energy needs and infrastructure development. The constant expansion of the industrial, commercial, and residential sectors is fueling demand for dependable power backup solutions. With frequent power outages still a challenge, especially in rural and semi-urban areas, diesel gensets remain an essential part of India's energy landscape.

The market is witnessing a shift towards eco-friendly and energy-efficient models, driven by stringent environmental regulations, and increasing customer awareness. Moreover, the Government of India's initiatives to boost the manufacturing sector and improve power grid reliability are expected to further propel the Diesel Generator Market Share in India. Leading manufacturers are focusing on enhancing product durability and performance while offering cost-effective solutions to cater to the diverse needs of the Indian market.

India Diesel Genset (Generator) Market Synopsis

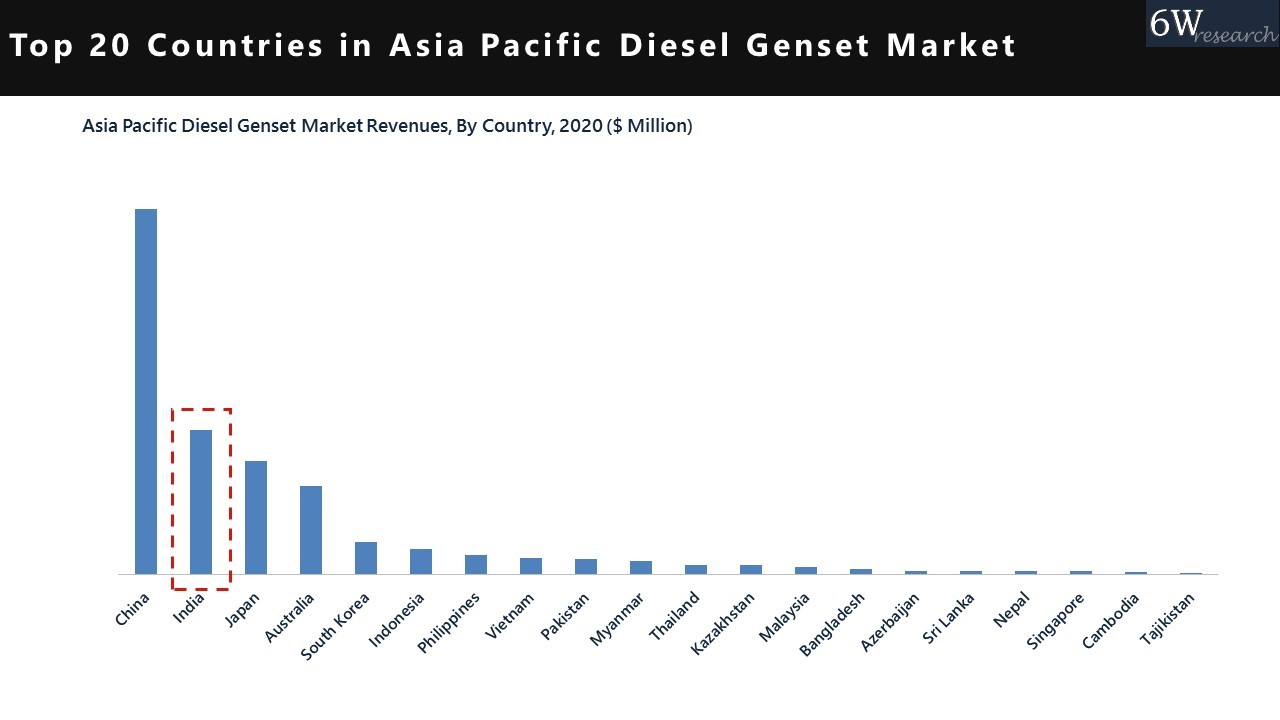

India Diesel Genset (Generator) Market is projected to experience good growth on the back of the manufacturing and infrastructural push from both the private and public sectors compounded with the telecom sector and industrial parks being established in the country. India which has set to become a manufacturing country of the world and will be leaving its competitors behind will give a huge push to construction activity and is considered a major driving force for the Genset market in India. India Diesel Generator Market holds 2nd position in terms of the market size in the Asia-Pacific Diesel Genest Market. And is also one of the largest in the world.

According to 6Wresearch, India Diesel Genset (Generator) Market size is projected to grow at a CAGR of 3.4% during 2021-2027. Diesel Genset provides the customers with an uninterrupted power supply which creates a variety of options for the product to be used, such as construction, agriculture, and power generation in commercial places which require a high amount of voltage and current with no disruption possible quota. These make them very popular in the country for their reliability and low cost of operation.

India Diesel Genset (Generator) Market Highlights

| Report Name | India Diesel Genset (Generator) Market |

| Base Year | 2020 |

| Historical Period | 2017-2020 |

| Forecast Period | 2021-2027 |

| Market size value in 2021 | XXXX |

| Revenue forecast in 2028 | XXXX |

| Growth rate | XXXX |

| Report Coverage | Revenues & Volume, Market Trends, Drivers & Challenges, Market Forecast, Market Share |

| Segment Coverage | By KVA, By Application |

| Customization Scope | 100% customized reports available along with reliable data. Moreover, you can alter the segments, countries, and regions according to your needs. For further details, you can contact our research expert at sales@6wresearch.com |

| Pricing and Purchase Options | Avail customization purchase option to know the exact pricing of your research needs |

Government policies and schemes introduced in the India Diesel Genset Market

The government has announced initiatives to improve power generation and transmission. The Smart Cities Mission, the Pradhan Mantri Sahaj Bijli Har Ghar Yojana – Saubhagya, and R-APDRP are some of the programs aimed at alleviating some of the challenges the diesel genset market faces. Additionally, in line with the Paris Agreement, India has committed to reducing its carbon footprint. To that end, the government has introduced regulations that mandate the usage of cleaner fuels, including natural gas, in diesel gensets. The Indian government has launched various initiatives to boost the diesel genset industry, with the primary one being the Power for All program. This program aims to address the power deficit in the country by increasing the renewable energy sources' share in the overall energy mix. Additionally, the government has encouraged fuel diversification, which incentivizes the use of cleaner fuels like LNG, to reduce the reliance on diesel.

Key Drivers, Developments, and Trends of India Diesel Genset (Generator) Market

DG set market size in India is driven, dependent on, and supported due to many factors such as construction activity, agriculture, development of new infrastructure around the country, and Government institutions also creating a huge demand for the Genest due to inherit benefit of its constant power supply.

Construction activity is rising in the country due to multiple factors such as the rising population of the country, surging GDP through which per capita income of the individuals is increasing, and foreign companies and foreign investment are also growing due to India’s ease of doing business improving to a great extent.

Farmers also require a stable power supply at any given point of time for irrigation, harvesting, plowing, and pest controlling due to such demand in the agriculture sector Genset proved to be a vital appliance for them.

New infrastructure pipeline projects by the Indian government and Make in India initiatives are major drivers for the Genset market share in India. Due to its eased and supporting policy for new construction and incentives to create a new industry in the country and exporting policy. As these industries and complexes require constant power with stable voltage, this acts as a major push factor for the India Diesel Genset Market Growth.

Additionally, retailers, Offices, airports, and Malls create also require power constantly, and they are prone to power outages. Genset provides backup in case of power outages which created more demand for the market.

However, the emissions from diesel gensets are a major environmental concern. The Indian government has been working to reduce the emissions from diesel gensets through a variety of measures, including fuel quality standards and emissions testing.

Impact of COVID-19 on India Diesel Genset (Generator) Market

COVID-19 has stagnated the Global diesel Genset market growth due to its strict lockdown which halted manufacturing, construction, and various other activities of business complexes, hotels, restaurants, airports, and apartment buildings. This reduced the demand for the Genset to a great extent and also reduced the prices of the Genset. This gave the market a great blow. However, post-pandemic holds great potential for the market as construction and manufacturing normalize.

Future Growth Potential of India Diesel Genset (Generator) Market

The Diesel Genset Industry in India holds tremendous potential for further future growth as the country's power sector is anticipated to go through a growth curve in the forecasted years with a vital role played by diesel gensets in meeting the expected growth of the power sector. They are the ideal choice for many industries and players as they can be used in a variety of applications and are reliable and efficient in performing the set task with low cost comparatively at the same time.

The Indian government has launched a national action plan for the power sector by providing setup cost benefits and targeting to increase the electricity generation capacity by almost threefold by 2030. The commitment requires investment in the creation of new power plants and transmission facilities. Diesel Genset can provide the set power backup option for these new setup facilities. Thus, giving a boost to the Genset market.

Several technological advancements in the Genset market such as new oiling advancements, and material science advancements stop the current leakage from the system creating new potential by lowering the cost of the product and increasing its efficiency to a great extent.

Due to increasing urbanization in the country, demand for new business start-ups and new complexes surrounding them is increasing which helps in increasing standards of living and increasing productivity. This will be requiring an uninterrupted power supply to these new business complexes, and diesel Genset provides a reliable source for them. This holds great future growth potential for the Diesel Generator Market Size in India.

Market Analysis based on KVA

Based on KVA, the 5-75KVA segment holds a key share in the India Diesel Genset Market Revenue as they have higher demand among retailers, residents, restaurants, small industries, and telecom towers.

Market Analysis Based on Applications

Based on Applications, the Commercial segment has the largest Genset market share in India owing to more demand from hotels, office complexes, and telecom towers due to fiber optic setup in them, construction areas, industrial parks, and trains and airports.

Geographical Presence of India Diesel Genset (Generator) Market

The Indian diesel Genset market is present across various regions in the country, such as the North, South, East, and West. The market in the North region is expected to grow at a greater pace during the forecast period. This is due to the surging demand for power in this region. The South region is also anticipated to witness significant growth over the projected period. This is attributed to the growing urbanization and industrialization in this region.

Consumption Patterns of Various Regions

The consumption pattern of India diesel Genset market varies from region to region. In the northern region, the market is driven by the commercial and industrial sectors. In the southern region, the market is driven by the agricultural sector. In the eastern region, the market is driven by the power sector. And in the western region, the market is driven by the transportation sector.

Each region has different diesel Genset manufacturers that cater to their specific needs. In the northern region, some of the leading manufacturers are Cummins, Caterpillar, and Kirloskar. In the southern region, some of the leading manufacturers are Mahindra, Ashok Leyland, and Tata Motors. In the eastern region, some of the leading manufacturers are Bharat Forge, Hindustan Motors, and Bajaj Auto. And in the western region, some of the leading manufacturers are Volvo, Hyundai, and Volkswagen.

Competitive Analysis of India Diesel Genset (Generator) Market

The Indian diesel Genset market is highly competitive with many players. They hold a key presence in the market and offer a huge variety of products.

The market is also fragmented with many small and medium-sized players. The small players are mostly local manufacturers who have a limited product range. The medium-sized players have a moderate product range and are mostly present in the domestic market.

The competition in the market is intense due to continuous innovation and the introduction of new products. The key players are also investing heavily in marketing and advertising to create brand awareness and increase their market share.

Key players in India Diesel Genset (Generator) Market

Some of the key players active in the market are:

- Cummins

- Caterpillar

- Generac

- Kohler

- Briggs & Stratton

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020.

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- India Diesel Genset Market Outlook

- Market Size of India Diesel Genset Market, 2020

- Forecast of India Diesel Genset Market, 2027

- Historical Data and Forecast of India Diesel Genset Revenues & Volume for the Period 2017-2027

- India Diesel Genset Market Trend Evolution

- India Diesel Genset Market Drivers and Challenges

- India Diesel Genset Price Trends

- India Diesel Genset Porter's Five Forces

- India Diesel Genset Industry Life Cycle

- Historical Data and Forecast of India Diesel Genset Market Revenues & Volume By KVA for the Period 2017-2027

- Historical Data and Forecast of India Diesel Genset Market Revenues & Volume By 5 - 75 KVA for the Period 2017-2027

- Historical Data and Forecast of India Diesel Genset Market Revenues & Volume By 75.1 - 375 KVA for the Period 2017-2027

- Historical Data and Forecast of India Diesel Genset Market Revenues & Volume By 375.1 - 750 KVA for the Period 2017-2027

- Historical Data and Forecast of India Diesel Genset Market Revenues & Volume By 750.1 - 1000 KVA for the Period 2017-2027

- Historical Data and Forecast of India Diesel Genset Market Revenues & Volume By Above 1000 KVA for the Period 2017-2027

- Historical Data and Forecast of India Diesel Genset Market Revenues & Volume By Application for the Period 2017-2027

- Historical Data and Forecast of India Diesel Genset Market Revenues & Volume By Residential for the Period 2017-2027

- Historical Data and Forecast of India Diesel Genset Market Revenues & Volume By Commercial for the Period 2017-2027

- Historical Data and Forecast of India Diesel Genset Market Revenues & Volume By Industrial for the Period 2017-2027

- Historical Data and Forecast of India Diesel Genset Market Revenues & Volume By Transportation & Public Infrastructure for the Period 2017-2027

- India Diesel Genset Import Export Trade Statistics

- Market Opportunity Assessment By KVA

- Market Opportunity Assessment By Application

- India Diesel Genset Top Companies Market Share

- India Diesel Genset Competitive Benchmarking By Technical and Operational Parameters

- India Diesel Genset Company Profiles

- India Diesel Genset Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following Market segments:

By KVA Rating:

- Up to 75 kVA

- 75.1 - 375 kVA

- 375.1 - 750 kVA

- 750 - 1000 kVA

- More than 1000 kVA

By Application:

- Residential

- Commercial

- Industrial

- Transportation & Infrastructure Application

India Diesel Genset (Generator) Market: FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 India Diesel Genset Market Overview |

| 3.1 India Country Macro Economic Indicators |

| 3.2 India Diesel Genset Market Revenues & Volume, 2020 & 2027F |

| 3.3 India Diesel Genset Market - Industry Life Cycle |

| 3.4 India Diesel Genset Market - Porter's Five Forces |

| 3.5 India Diesel Genset Market Revenues & Volume Share, By KVA, 2020 & 2027F |

| 3.6 India Diesel Genset Market Revenues & Volume Share, By Application, 2020 & 2027F |

| 4 India Diesel Genset Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing demand for reliable power backup solutions due to frequent power outages in India |

| 4.2.2 Growth in industrial and commercial sectors leading to higher adoption of diesel gensets |

| 4.2.3 Expansion of the construction sector and infrastructure development projects requiring continuous power supply |

| 4.3 Market Restraints |

| 4.3.1 Stringent emission regulations leading to higher costs for diesel genset manufacturers |

| 4.3.2 Rising popularity of renewable energy sources impacting the demand for diesel gensets |

| 4.3.3 Fluctuating diesel prices affecting the operational costs of diesel gensets |

| 5 India Diesel Genset Market Trends |

| 6 India Diesel Genset Market, By Types |

| 6.1 India Diesel Genset Market, By KVA |

| 6.1.1 Overview and Analysis |

| 6.1.2 India Diesel Genset Market Revenues & Volume, By KVA, 2017 - 2027F |

| 6.1.3 India Diesel Genset Market Revenues & Volume, By 5 - 75 KVA, 2017 - 2027F |

| 6.1.4 India Diesel Genset Market Revenues & Volume, By 75.1 - 375 KVA, 2017 - 2027F |

| 6.1.5 India Diesel Genset Market Revenues & Volume, By 375.1 - 750 KVA, 2017 - 2027F |

| 6.1.6 India Diesel Genset Market Revenues & Volume, By 750.1 - 1000 KVA, 2017 - 2027F |

| 6.1.7 India Diesel Genset Market Revenues & Volume, By Above 1000 KVA, 2017 - 2027F |

| 6.2 India Diesel Genset Market, By Application |

| 6.2.1 Overview and Analysis |

| 6.2.2 India Diesel Genset Market Revenues & Volume, By Residential, 2017 - 2027F |

| 6.2.3 India Diesel Genset Market Revenues & Volume, By Commercial, 2017 - 2027F |

| 6.2.4 India Diesel Genset Market Revenues & Volume, By Industrial, 2017 - 2027F |

| 6.2.5 India Diesel Genset Market Revenues & Volume, By Transportation & Public Infrastructure, 2017 - 2027F |

| 7 India Diesel Genset Market Import-Export Trade Statistics |

| 7.1 India Diesel Genset Market Export to Major Countries |

| 7.2 India Diesel Genset Market Imports from Major Countries |

| 8 India Diesel Genset Market Key Performance Indicators |

| 9 India Diesel Genset Market - Opportunity Assessment |

| 9.1 India Diesel Genset Market Opportunity Assessment, By KVA, 2020 & 2027F |

| 9.2 India Diesel Genset Market Opportunity Assessment, By Application, 2020 & 2027F |

| 10 India Diesel Genset Market - Competitive Landscape |

| 10.1 India Diesel Genset Market Revenue Share, By Companies, 2020 |

| 10.2 India Diesel Genset Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero