India Hot Melt Adhesive Market (2023-2029) | Analysis, Industry, Size, Share, Revenue, Forecast, Trends, Outlook & COVID-19 IMPACT

Market Forecast By Product Type (Ethylene Vinyl Acetate, Styrenic Block Copolymers, Polyolefin, Polyurethane, Polyester, Others), By End Users Industry (Building and Construction, Paper, Board, and Packaging, Woodworking and Joinery, Transportation, Footwear and Leather, Healthcare, Electrical and Electronic Appliances, Book Binding, Others), By Region (Northern, Southern, Eastern, Western)And Competitive Landscape

| Product Code: ETC002312 | Publication Date: Mar 2023 | Updated Date: Nov 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 69 | No. of Figures: 23 | No. of Tables: 1 |

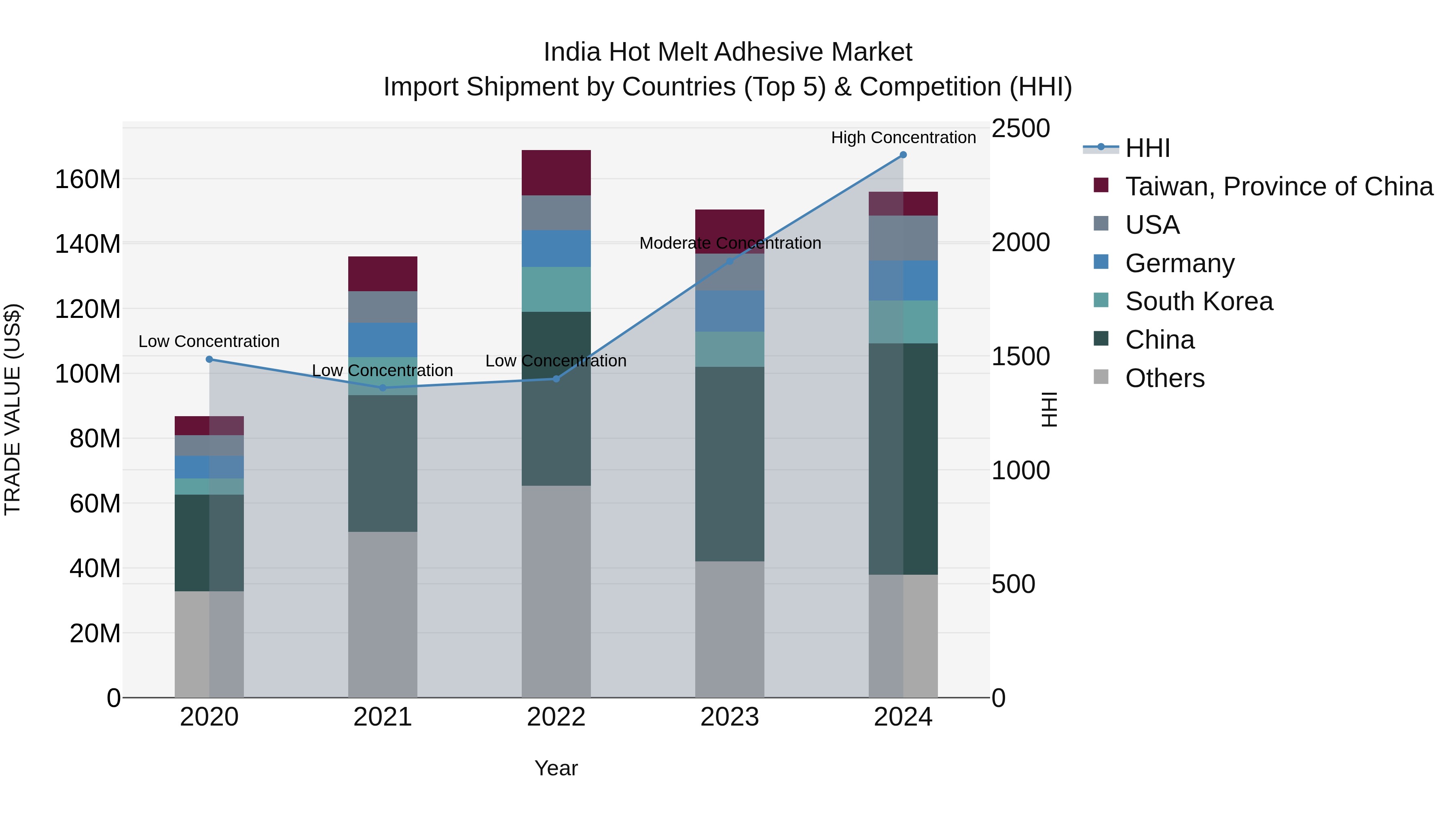

India Hot Melt Adhesive Market Top 5 Importing Countries and Market Competition (HHI) Analysis

India`s hot melt adhesive import shipments in 2024 saw a notable increase in concentration, with the top exporting countries being China, USA, South Korea, Germany, and Italy. The Herfindahl-Hirschman Index (HHI) shifted from moderate to high concentration, indicating a more focused market. The compound annual growth rate (CAGR) from 2020 to 2024 stood at an impressive 15.81%, with a growth rate of 3.64% from 2023 to 2024. This data suggests a dynamic and evolving landscape for hot melt adhesive imports in India, reflecting changing market dynamics and global trade patterns.

India Hot Melt Adhesive Market Synopsis

India Hot Melt Adhesive Market was growing fairly in the past on account of urbanization, developments in residential and commercial sector and growth in industrial output. However, in 2020 the market faced degrowth due to pandemic caused contraction in the economy. As there were restrictions on physical contact, and cash crunch in the MSMEs of India, the hot melt industry witnessed demand shock contributing to fell in revenues. However, the India Hot Melt Adhesive Industry recovered in the following years as the government released restrictions, it reflects the products, that is, hot melt’s strong demand fundamentals as it is required in nearly every industry in some form.

According to 6Wresearch, India Hot Melt Adhesive Market size is anticipated to grow at a CAGR of 8.6% during 2023-2029. India’s economy is experiencing rapid constructions and developments in the infrastructure sector, as for the sustenance of the country, infrastructure gap is required to be filled. Hence, there is a massive planned pipeline of infrastructure projects worth $1.4 trillion in the country at present which would reflect in the country’s construction sector in the coming years. These developments would also cause expansion in the commercial and residential sector, levelling up the market potential of furniture and woodworking applications of hot melt adhesives. Furthermore, the rapidly growing India’s appliances and electronics market with aggressive promotion of electronics and IT hardware manufacturing would increase the growth and potential in the electrical and electronic appliances sector, and efforts on faster adoption and manufacturing of hybrid and electric vehicle would enhance the growth and potential in the transportation sector.

According to 6Wresearch, India Hot Melt Adhesive Market size is anticipated to grow at a CAGR of 8.6% during 2023-2029. India’s economy is experiencing rapid constructions and developments in the infrastructure sector, as for the sustenance of the country, infrastructure gap is required to be filled. Hence, there is a massive planned pipeline of infrastructure projects worth $1.4 trillion in the country at present which would reflect in the country’s construction sector in the coming years. These developments would also cause expansion in the commercial and residential sector, levelling up the market potential of furniture and woodworking applications of hot melt adhesives. Furthermore, the rapidly growing India’s appliances and electronics market with aggressive promotion of electronics and IT hardware manufacturing would increase the growth and potential in the electrical and electronic appliances sector, and efforts on faster adoption and manufacturing of hybrid and electric vehicle would enhance the growth and potential in the transportation sector.

![India Hot Melt Adhesive Market Revenue Share]() Market by Product Type

Market by Product Type

Ethylene vinyl acetate dominates the market as it is the most cost-effective compared to other types of adhesives which makes it preferred option for manufacturers to maintain low manufacturing costs. Polyolefin accounts for the second largest share owing to its wide range of applications making it ideal for use in various industries such as packaging, woodworking, textiles, and automotive

Market by End Users Industry

Paper, Board and Packaging Industry is a star industry in the hot melt market as it is expected to retain its dominant position in terms of market size with also registering the highest growth in the forecast period.

Market by Region

Western region dominates the Hot Melt Adhesive Market in India as the region is the hub of industries such as packaging, automotive, textiles, and footwear and the trend would sustain in future due to the Gujarat and Maharashtra’s investment attractiveness attributing to the growth of manufacturing sector.

![India Hot Melt Adhesive Market Opportunity Assessment]() Key Attractiveness of the Report

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 11 Years Market Numbers.

- Historical Data Starting from 2019 to 2022.

- Base Year: 2022

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- India Hot Melt Adhesive Market Overview

- India Hot Melt Adhesive Market Outlook

- India Hot Melt Adhesive Market Forecast

- Historical Data and Forecast of India Hot Melt Adhesive Market Revenues for the Period 2019-2029F

- Historical Data and Forecast of India Hot Melt Adhesive Market Revenues By Product Type, for the Period 2019-2029F

- Historical Data and Forecast of India Hot Melt Adhesive Market Revenues By End User Industry, for the Period 2019-2029F

- Historical Data and Forecast of India Hot Melt Adhesive Market Revenues By Region, for the Period 2019-2029F

- Market Drivers and Restraints

- India Hot Melt Adhesive Market Trends

- Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- India Hot Melt Adhesive Market Revenue Ranking, By Companies

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By Product Type

- Ethylene Vinyl Acetate

- Styrenic Block Copolymers

- Polyolefin

- Polyurethane

- Polyester

- Others

By End Users Industry

- Building and Construction

- Paper, Board, and Packaging

- Woodworking and Joinery

- Transportation

- Footwear and Leather

- Healthcare

- Electrical and Electronic Appliances

- Book Binding

- Others

By Region

- Northern

- Southern

- Eastern

- Western

India Hot Melt Adhesives Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Methodology Adopted & Key Data Points |

| 2.5 Assumptions |

| 3. India Hot Melt Adhesive Market Overview |

| 3.1 India Hot Melt Adhesive Market Revenues, 2019-2029F |

| 3.2 India Hot Melt Adhesive Market Industry Life Cycle |

| 3.3 India Hot Melt Adhesive Market Ecosystem |

| 3.4 India Hot Melt Adhesive Market Porter’s Five Forces |

| 4. COVID-19 Impact Analysis on India Hot Melt Adhesive Market |

| 5. India Hot Melt Adhesive Market Dynamics |

| 5.1 Impact Analysis |

| 5.2 Market Drivers |

| 5.2.1 Increasing demand for packaging solutions in various industries |

| 5.2.2 Growth in the automotive and construction sectors |

| 5.2.3 Advantages of hot melt adhesives such as fast curing time and bonding strength |

| 5.3 Market Restraints |

| 5.3.1 Fluctuating raw material prices |

| 5.3.2 Competition from other adhesive technologies |

| 5.3.3 Impact of stringent regulations on chemical usage |

| 6. India Hot Melt Adhesive Market Trends and Evolution |

| 7. India Hot Melt Adhesive Market Overview, By Product Type |

| 7.1 India Hot Melt Adhesive Market Revenues and Revenue Share, By Product Type, 2022 & 2029F |

| 7.1.1 India Ethylene Vinyl Acetate Market Revenues and Revenue Share, 2019-2029F |

| 7.1.2 India Styrenic Block Copolymers Market Revenues and Revenue Share, 2019-2029F |

| 7.1.3 India Polyolefin Market Revenues and Revenue Share, 2019-2029F |

| 7.1.4 India Polyurethane Market Revenues and Revenue Share, 2019-2029F |

| 7.1.5 India Polyester Market Revenues and Revenue Share, 2019-2029F |

| 7.1.6 India Others Market Revenues and Revenue Share, 2019-2029F |

| 8. India Hot Melt Adhesive Market Overview, By End User Industry |

| 8.1 India Hot Melt Adhesive Market Revenues and Revenue Share, By End User Industry, 2022 & 2029F |

| 8.1.1 India Building and Construction Market Revenues and Revenue Share, 2019-2029F |

| 8.1.2 India Paper, Board, and Packaging Market Revenues and Revenue Share, 2019-2029F |

| 8.1.3 India Woodworking and Joinery Market Revenues and Revenue Share, 2019-2029F |

| 8.1.4 India Transportation Market Revenues and Revenue Share, 2019-2029F |

| 8.1.5 India Footwear and Leather Market Revenues and Revenue Share, 2019-2029F |

| 8.1.6 India Healthcare Market Revenues and Revenue Share, 2019-2029F |

| 8.1.7 India Electrical and Electronic Appliances Market Revenues and Revenue Share, 2019-2029F |

| 8.1.8 India Book Binding Market Revenues and Revenue Share, 2019-2029F |

| 8.1.9 India Others Market Revenues and Revenue Share, 2019-2029F |

| 9. India Hot Melt Adhesive Market Overview, By Region |

| 9.1 India Hot Melt Adhesive Market Revenues and Revenue Share, By Region, 2022 & 2029F |

| 9.1.1 India Hot Melt Adhesive Market Revenues and Revenue Share, By Northern Region, 2019-2029F |

| 9.1.2 India Hot Melt Adhesive Market Revenues and Revenue Share, By Western Region, 2019-2029F |

| 9.1.3 India Hot Melt Adhesive Market Revenues and Revenue Share, By Southern Region, 2019-2029F |

| 9.1.4 India Hot Melt Adhesive Market Revenues and Revenue Share, By Eastern Region, 2019-2029F |

| 10. India Hot Melt Adhesive Market Key Performance Indicators |

| 11. India Hot Melt Adhesive Market Opportunity Assessment |

| 11.1 India Hot Melt Adhesive Market Opportunity Assessment, By Product Type, 2029F |

| 11.2 India Hot Melt Adhesive Market Opportunity Assessment, By End User Industry, 2029F |

| 11.3 India Hot Melt Adhesive Market Opportunity Assessment, By Region, 2029F |

| 12. India Hot Melt Adhesive Market Competitive Landscape |

| 12.1 India Hot Melt Adhesive Market Revenue Share, By Companies, 2022 |

| 12.2 India Hot Melt Adhesive Market Competitive Benchmarking, By Technical Parameters |

| 12.3 India Hot Melt Adhesive Market Competitive Benchmarking, By Operating Parameters |

| 13. Company Profiles |

| 14. Key Strategic Recommendations |

| 15. Disclaimer |

| List of Figures |

| 1: India Hot Melt Adhesive Market Revenues, 2019-2029F (INR Crore) |

| 2: India Auto Production, INR Crore (2019-2021) |

| 3: India Auto Market, INR Crore (2019-2021) |

| 4: India Industry Value Added (including construction), $ Billion (2019-2021) |

| 5: Nation Infrastructure Pipeline projected sector-wise investment allocation during, (2020-2025F) in INR Lakh Crore |

| 6: India Budget 2022-23 Investment Allocation in INR Crore |

| 7: India Appliances and Electronics Market, (2019-2025F) in INR Lakh Crore |

| 8: India Consumer Adhesives Alternatives, Market, FY21, INR Billion |

| 9: India Hot Melt Adhesive Market Revenue Share, By Product Type, 2022 |

| 10: India Hot Melt Adhesive Market Revenue Share, By Product Type, 2029F |

| 11: India Hot Melt Adhesive Market Revenue Share, By End User Industry, 2022 |

| 12: India Hot Melt Adhesive Market Revenue Share, By End User Industry, 2029F |

| 13: India Hot Melt Adhesive Market Revenue Share, By Region, 2022 |

| 14: India Hot Melt Adhesive Market Revenue Share, By Region, 2029F |

| 15: India Demand Projection for Furniture Industry, (2019-2035F), INR Thousand Crore |

| 16: India Furniture Output, (2019-2035F), INR Thousand Crore |

| 17: India Packaging Market, (2019 & 2025F), INR Lakh Crore |

| 18: India Packaging Materials and Machinery in terms of Volume, 2019 |

| 19: India Hot Melt Adhesive Market Opportunity Assessment, By Product Type, 2029F (INR crore) |

| 20: India Hot Melt Adhesive Market Opportunity Assessment, By End User Industry, 2029F (INR crore) |

| 21: India Hot Melt Adhesive Market Opportunity Assessment, By Region, 2029F (INR crore) |

| 22: India Hot Melt Adhesive Companies Revenue Share, 2022 |

| 23: Western Region Food & Beverage and Pharmaceutical Clusters, 2022 |

| List of Tables |

| 1: India Hot Melt Adhesive Market Revenues, By Product Type, 2019-2029F (INR Crore) |

| 2: India Hot Melt Adhesive Market Revenues, By End User Industry, 2019-2029F (INR Crore) |

| 3: India Hot Melt Adhesive Market Revenues, By Region, 2019-2029F (INR Crore) |

Market Forecast By Types (Ethylene Vinyl Acetate (EVA), Styrenic Block Copolymer (SBC), Amorphous Poly-Alpha-Olefin (AMOP), Metallocene Polyolefins (MPO), Polyurethane (PU), Polyamide (PA), Polyester), By Application (Packaging, Disposables, Pressure Sensitive Products, Book Binding, Furniture, Footwear, Automobile, Textile, Electronics) And Competitive Landscape

| Product Code: ETC002312 | Publication Date: Mar 2023 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Latest 2023 Development of the India Hot Melt Adhesives Market

India Hot Melt Adhesives Market is forecast to grow continuously in the upcoming timeframe. The hot melt adhesives market in India is witnessing steady growth due to the increasing applications of hot melt adhesives in packaging, woodworking, construction, and automotive industries. The market is driven by increasing demand from various end-use industries, such as packaging, automotive, construction, and woodworking, among others. Some of the latest developments and projects in the India hot melt adhesives market include the expansion of manufacturing capacities to meet the growing demand for hot melt adhesives.

Moreover, there is a growing demand for eco-friendly hot melt adhesives in India due to increasing environmental concerns. Also, there is increasing use of hot melt adhesives in automotive applications as this industry is a significant consumer of hot melt adhesives in India. Furthermore, several companies are collaborating with local players to expand their presence in the India hot melt adhesives industry. With the increasing popularity of e-commerce, the demand for packaging materials, including hot melt adhesives, is expected to proliferate in the coming years. With the increasing disposable income of consumers, the demand for high-quality products is anticipated to grow in the future years.

India Hot Melt Adhesives Market Synopsis

India Hot Melt Adhesives Market has witnessed growth due to growing demand from the packaging and automotive industry. The major factors boosting the growth of the hot melt adhesive market in India are increasing environmental concerns about solvent-borne adhesives, rising demand from industrial manufacturers, and fast processing.

According to 6wresearch, the India Hot Melt Adhesives Market size is expected to grow during 2020-2026. During the first quarter of 2020, the Indian market is anticipated to witness negative growth in the economy on account of the coronavirus pandemic which has a worse impact on worldwide business. However, during the second half of 2020-2026, the market in India is anticipated to witness recovery and healthy growth in the economic scenario. In terms of types, the Ethylene Vinyl Acetate segment is expected to dominate the hot melt adhesives market in India owing to increasing penetration of the products in a wide range of industries and growing government support towards the usage of Volatile Organic Compound (VOC) adhesives.

Based on the application, the packaging segment is expected to lead a major revenue share in the hot melt adhesives market during the forecast period in India on account of the rising usage of hot melt adhesives in packaging applications, majorly food packaging. Moreover, India has the fifth-largest packaging industry in the world. India’s packaging industry is primarily driven by upgrading technology in industries to make their products portable and compact.

India hot melt adhesive market is expected to register sound revenues in the coming years backed by the rising packaging industry. Increased manufacturing of products required proper packaging of products in huge cartons by using a hot melt adhesive gun which ensures tightly packed cartons and ensures smooth supply is expected to proliferate the deployment of Hot melt adhesive instruments in the country. Further, a rise in the need for manufacturers in the fast packaging process instigates the rapid use of hot melt adhesive products and would instigate the prominent growth of India hot melt adhesive market in the coming years.

India hot melt adhesives market is estimated to gain traction in the forthcoming years on the back of the increase in the scope of the wide application of the product in the growing industrial landscape. Further, the increase in electronics manufacturing in the country due to the rising purchase of consumer electronics with the growing middle-class family population concurrently increases the use of hot melt adhesives in the manufacturing, sealing, and labelling process and is estimated to bolster the demand for hot melt adhesive glue. Also, woodwork at a large scale in the country with the growing furniture demand is acting as another growth proliferating factor for hot melt adhesives glue used in product assembling and sealing process and is expected to pioneer the impressive growth of the Indian hot melt adhesive market in the coming timeframe.

Key Highlights of the Report:

- India Communication Test Equipment Market Overview

- India Communication Test Equipment Market Outlook

- India Communication Test Equipment Market Forecast

- India Communication Test Equipment Market Size and India Communication Test Equipment Market Forecast, until 2026

- Historical Data of India Communication Test Equipment Market Revenues, By Type, 2016-2019

- Market Size & Forecast of India Communication Test Equipment Market Revenues, By Type, until 2026

- Historical Data of India Communication Test Equipment Market Revenues, By Application, 2016-2019

- Market Size & Forecast of India Communication Test Equipment Market Revenues, By Application, until 2026

- India Communication Test Equipment Market Trends

- Market Drivers and Restraints

- Porter's Five Force Analysis and Market Opportunity Assessment

- India Communication Test Equipment Market Share, By Players

- India Communication Test Equipment Market Overview on Competitive Benchmarking

- Company Profiles

- Strategic Recommendations

Markets Covered:

The India Communication Test Equipment market report provides a detailed analysis of the following market segments:

By Types

- EVA (Ethylene-Vinyl Acetate)

- SBC (Styrenic Block Copolymers)

- PU (Polyurethane)

- Amorphous Poly-Alpha-Olefin (AMOP)

- Metallocene Polyolefins (MPO)

- Polyamide (PA)

- Polyester

By Applications

- Packaging

- Disposables

- Pressure Sensitive Products

- Book Binding

- Furniture

- Footwear

- Automobile

- Textile

- Electronics

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero