India Hydrogen Generator Market Outlook (2021-2027) | Analysis, Share, Companies, Revenue, Industry, Trends, COVID-19 IMPACT, Size, Forecast, Growth & Value

Market Forecast By Technology (Ammonia Cracker Hydrogen Generator, Methanol Cracker Hydrogen Generator, Steam Methane Reforming Hydrogen Generator, Electrolysis Hydrogen Generator) and competitive landscape.

| Product Code: ETC150363 | Publication Date: Feb 2022 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 90 | No. of Figures: 23 | No. of Tables: 13 |

India Hydrogen Generator Market Size & Growth Rate

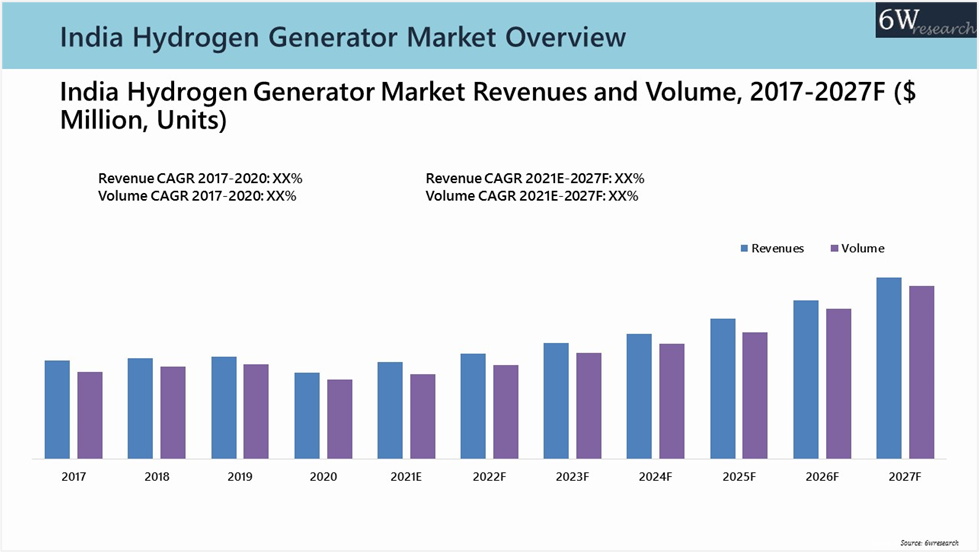

The India Hydrogen Generator Market is projected to grow at a CAGR of 11.0% during 2021–2027, driven by increasing government initiatives like the National Hydrogen Mission, rising adoption of hydrogen in key industries, and strategic investments by major corporations in clean fuel technologies.

India Hydrogen Generator Market report thoroughly covers market by technology. The market report provides an unbiased and detailed analysis of the on-going market trends, opportunities/high growth areas and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

India Hydrogen Generator Market Synopsis

India hydrogen generator market witnessed significant growth during the 2017-2019 period owing to growth in key application sectors such as refining sector, petrochemical, and edible oil industries. Further, the period witnessed increased adoption of new technologies such as electrolysis and methanol cracking.

COVID-19 pandemic led measures, lockdowns and restriction on international trade resulted in a slight slowdown in the hydrogen generator market due to supply chain disruption as India hydrogen generator market is import driven. However, with upliftment of lockdown restrictions and regulatory measures to revive economic activity, demand for hydrogen generators returned to its growth trajectory in third quarter of 2020.

According to 6Wresearch, India Hydrogen Generator Market revenue size is projected to grow at a CAGR of 11.0% during 2021-2027. Hydrogen gas is considered as a potential solution to the world’s sustainability challenges, India’s National Hydrogen Mission aims to cut down carbon emissions by increasing the use of renewable sources of energy to align India with global practices in terms of technology, policy & regulations, and intends to produce three-fourths of its hydrogen production from renewable resources by 2050. Furthermore, government and private firms such as Indian oil, NTPC, Reliance group and Adani group have ambitious plans to embrace hydrogen as a fuel on account of the nation transitions towards carbon-free fuel. Additionally, government institutite Indian Oil Corporation IOC is also working on a technology to develop hydrogen-spiked compressed natural gas, or H-CNG to use hydrogen as a transportation fuel. In addition to that, government initiatives such as Renewable and Clean Hydrogen Program, Advanced Hydrogen and Fuel Cell Program would further augment the demand for hydrogen generators in country.

Market by Technology Analysis

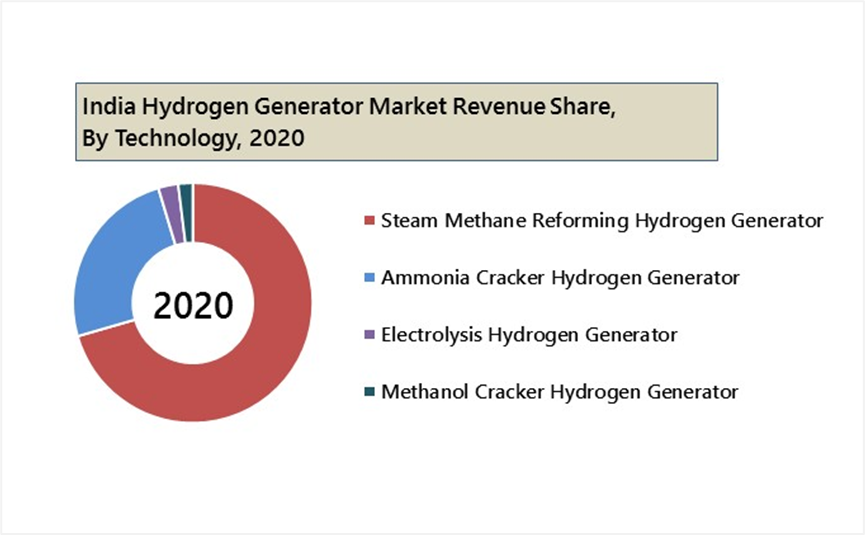

In terms of Technology, steam methane reforming hydrogen generator has captured 65.9% of the market revenues in 2020. steam methane reforming hydrogen generator accounted for maximum revenue share in 2020 due to the rise in oil & gas production, petrochemical production. Further, since major application industries such as refineries, petrochemical processing were operating during the nation-wide lockdown demand for steam methane reforming hydrogen generator held up in India.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- India Hydrogen Generator Market Overview

- India Hydrogen Generator Market Outlook

- India Hydrogen Generator Market Forecast

- Historical Data and Forecast of India Hydrogen Generator Market Revenues and Volume, for the Period 2017-2027F.

- Historical Market Data and Forecast of India Hydrogen Generator Market Revenues and Volume, By Technology, for the Period 2017-2027F.

- Market Drivers and Restraints

- Market Trends

- Industry Life Cycle

- Porter’s Five Force Analysis

- Importer List

- Key Potential Customers List

- Government Regulations

- Key Potential Companies List for Mergers and Acquisitions

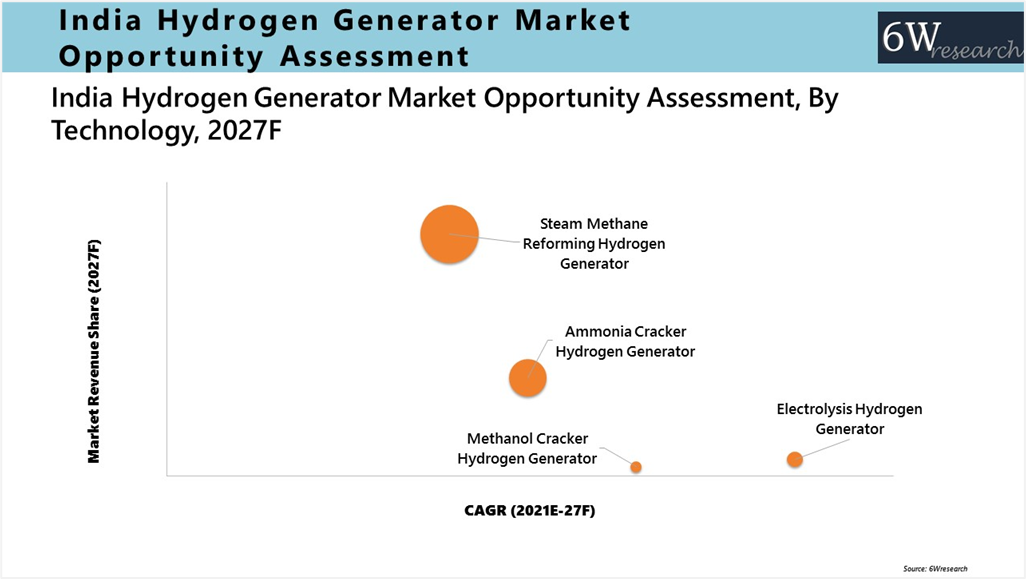

- Market Opportunity Assessment

- India Hydrogen Generator Market Ranking, By Companies

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

- By Technology

- Ammonia Cracker Hydrogen Generator

- Methanol Cracker Hydrogen Generator

- Steam Methane Reforming Hydrogen Generator

- Electrolysis Hydrogen Generator

India Hydrogen Generator Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of The Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. India Hydrogen Generator Market Overview |

| 3.1 India Hydrogen Generator Market Revenues & Volume, 2017-2027F |

| 3.2 India Hydrogen Generator Market - Industry Life Cycle |

| 3.3 India Hydrogen Generator Market - Porter’s Five Forces |

| 3.4 India Hydrogen Generator Market Revenue & Volume Share, By Technology, 2020 & 2027F |

| 3.5 Impact Analysis of COVID-19 on India Hydrogen Generator Market |

| 4. India Hydrogen Generator Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing focus on clean energy sources and sustainability initiatives in India |

| 4.2.2 Growth in industrial applications such as chemical processing, electronics, and fuel cells |

| 4.2.3 Government support and incentives for the adoption of hydrogen generators in India |

| 4.3 Market Restraints |

| 4.3.1 High initial investment and operational costs associated with hydrogen generator technology |

| 4.3.2 Lack of infrastructure and distribution networks for hydrogen in India |

| 4.3.3 Limited awareness and understanding of hydrogen generator technology among end-users |

| 5. India Hydrogen Generator Market Trends |

| 6. India Hydrogen Generator Market Overview, By Technology |

| 6.1 India Ammonia Cracker Hydrogen Generator Market Revenues & Volume, 2017-2027F |

| 6.2 India Methanol Cracker Hydrogen Generator Market Revenues & Volume, 2017-2027F |

| 6.3 India Steam Methane Reforming Hydrogen Generator Market Revenues & Volume, 2017-2027F |

| 6.4 India Electrolysis Hydrogen Generator Market Revenues & Volume, 2017-2027F |

| 7. India Hydrogen Generator Market Price Trend Analysis |

| 8. India Hydrogen Generator Market Key Performance Indicators |

| 8.1 Number of government policies and incentives supporting hydrogen generator adoption |

| 8.2 Growth in the number of partnerships and collaborations between hydrogen generator manufacturers and Indian companies |

| 8.3 Increase in research and development investments in hydrogen generator technology in India |

| 9. India Hydrogen Generator Market Potential Industries for Market Development |

| 10. India Hydrogen Generator Market Key Potential Customers |

| 10.1 India Hydrogen Generator Market Key Potential Customers List |

| 11. India Hydrogen Generator Market Government Regulations and Purity Requirements |

| 11.1 India Hydrogen Generator Market India Government Certifications for Hydogen Generators |

| 11.2 India Hydrogen Generator Market Purity Requirements for Hydogen Generator |

| 11.3 India Hydrogen Generator Market Different Technologies for Hydrogen Production |

| 12. India Hydrogen Generator Market Key Potential Companies for Mergers and Acquisitions |

| 12.1 India Hydrogen Generator Market Key Potential Companies for Mergers and Acquisitions List |

| 12.2 India Hydrogen Generator Market Key Potential Companies for Mergers and Acquisitions, By Manufacturing Permission & License or Contract |

| 13. India Hydrogen Generator Market Opportunity Assessment |

| 13.1 India Hydogen Generator Market Opportunity Assessment, By Technology, 2027F |

| 14. India Hydogen Generator Market Competitive Landscape |

| 14.1 India Hydrogen Generator Market Revenue Ranking, By Companies, 2020 |

| 14.2 India Hydrogen Generator Market Competitive Benchmarking, By Technical Parameters |

| 14.3 India Hydrogen Generator Market Competitive Benchmarking, By Operating Parameters |

| 14.4 India Hydrogen Generator Market Competitive Benchmarking, By Manufacturing Permission & License or Contract |

| 15. Company Profiles |

| 15.1 Praxair India Pvt. Ltd. |

| 15.2 Gaztron Engineering Pvt. Ltd. |

| 15.3 Sam Gas Projects Pvt. Ltd. |

| 15.4 Nuberg Engineering Ltd |

| 15.5 Linde Engineering India Ltd. Pvt. |

| 15.6 Inox Air Products Inc. |

| 15.7 MVS Engineering Pvt. Ltd. |

| 15.8 L’Air Liquide S.A. |

| 15.9 Honeywell International Inc. |

| 15.10 Molsieve Designs Limited |

| 15.11 Gastek Engineering Private Limited |

| 16. Key Strategic Recommendations |

| 17. Disclaimer |

| List of Figures |

| 1. India Hydrogen Generator Market Revenues and Volume, 2017-2027F ($ Million, Units) |

| 2. India Hydrogen Generator Market Revenues Share, By Technology, 2020 & 2027F |

| 3. India Hydrogen Generator Market Volume Share, By Technology, 2020 & 2027F |

| 4. Cumulative Production of Petroleum Products by Refineries, Crude-Oil, and Natural Gas, FY2019-20 vs FY2020-21 |

| 5. Indian Crude Steel Production, 2019 vs 2020 (MT) |

| 6. India Refining Capacity, 2021-2040F (Million Barrels Per Day) |

| 7. India Oil Demand, 2019 and 2040F (Million Barrels Per Day) |

| 8. India Domestic consumption of Total Finished Steel (MT) |

| 9. India Rural Consumption Of Steel, 2021 and 2030-31F (kg/per capita) |

| 10. India Hydrogen Generator Market Average Selling Price Trend, 2017-2027F ($/Unit) |

| 11. India Petrochemicals Market, 2020 and 2025F ($ Billion) |

| 12. Indian Chemical Market, 2018/19- 2024/25F ($ Billion) |

| 13. Indian Cosmetics and Cosmeceutical Market, 2020 - 2025F ($ Billion) |

| 14. India Steel Production, September 2020- August 2021 (Thousand Tons) |

| 15. India Rural Consumption Of Steel, 2021 and 2030-31F (kg/per capita) |

| 16. India Float Glass Market Expansion Plans, 2020- 2023F |

| 17. India Float Glass Market- Percentage Usage by End Users, 2020 |

| 18. India Container Glass Market Expansion Plans, 2021E-2022F |

| 19. India Float Glass Market Expansion Plans, 2020- 2023F |

| 20. India Industrial Hydrogen Generator Market Opportunity Assessment, By Technology, 2027F |

| 21. India Hydrogen Generator Market Revenue Ranking, By Companies, 2020 |

| 22. India Hydrogen Generator Market Revenue Share, 2027F (In Percentage) |

| 23. India Electrolysis Hydrogen Generator Market Growth (2020 & 2027F) |

| List of Table |

| 1. India Ongoing Mining Projects |

| 2. India Industrial Hydrogen Generator Market Revenues, By Technology, 2017-2027F ($ Million) |

| 3. India Industrial Hydrogen Generator Market Volume, By Technology, 2017-2027F (Units) |

| 4. Key Hydrogen Development Programs by Government of India, 2021 |

| 5. India Hydrogen Generator Market Key Potential Customers List (Contd.) |

| 6. Quality Certificates Required for Setting Up of Hydrogen Generation Plant - PAN India (2021) |

| 7. Purity Requirements Hydrogen Generator (2021) |

| 8. Technologies Comparison for Hydrogen Generation(2021) |

| 9. India Hydrogen Generator Market Key Potential Companies List (Contd.) |

| 10. India Hydrogen Generator Market Key Potential Companies List, By Manufacturing Permission & License or Contract (Contd.)Contd.) |

| 11. Product Mix Matrix |

| 12. Comparison between Electrolysis and Steam Methane Reforming |

| 13. Comparison between Alkaline Electrolyzer and PEM Electrolyzer |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2026-2032) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero