India Industrial Heat Pump Market (2021-2027) | Size, Share, industry, Growth, Forecast, Revenue, Trend, Analysis, Outlook & COVID-19 IMPACT

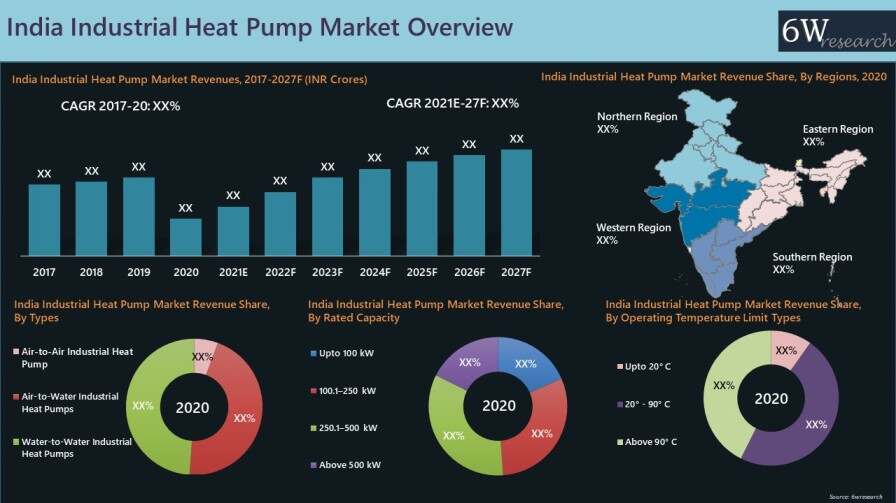

Market Forecast By Types(Air-to-Air, Air-to-Water, Water-to-Water), By Rated Capacity (Up to 100 kW, 100.1-250 kW, 250.1-500 kW, Above 500 kW), Rated Capacity, By Compressor Types (Scroll Compressor, Screw Compressor), By Operating Temperature Limit (Up to 20C, 20- 90C, Above 90C), By Industry Types (Manufacturing and Automotive, Pharmaceutical, Textile, Chemical & Others (Food, Dairy and miscellaneous)), By Regions (Northern, Southern, Eastern, Western) and competitive landscape

| Product Code: ETC054437 | Publication Date: Aug 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 87 | No. of Figures: 19 | No. of Tables: 8 |

Latest Development (2022) in India Industrial Heat Pump Market

India Industrial Heat Pump Market is expected to gain proliferation during the upcoming years on account of the growing demand for energy-efficient cost-effective appliances in various sectors. The growing initiatives taken by the government such as providing tax rebates and corporate tax credits are expected to flourish the India Industrial Heat Pump Market Growth. Moreover, increasing renewable rebate programs in the country are also driving the development of the market. Moreover, the advantages offered by the manufacturers such as low maintenance requirements, low carbon footprints, and high life-span is also contributing to the Industrial Heat pump market share.

India Industrial Heat Pump Market report thoroughly covers the market by types, rated capacity, operating temperature limit, regions, and industry types. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

India Industrial Heat Pump Market Synopsis

The India industrial heat pump market witnessed moderate growth during the period 2017-2019 as a result of the rising efforts by the industrial sector to reduce the costs of energy and environmental effects due to the emission of large amounts of carbon from industrial processes. Installation of heat pumps in the industrial sector has emerged as a viable option to save energy and reduce carbon footprint. Further, the continued government support in the form of initiatives and policies such as the “Make in India” initiative gave a boost to the manufacturing sector in the country, which in turn, bolstered the demand for industrial heat pumps in India during the recent past.

According to 6Wresearch, India Industrial Heat Pump Market size is projected to grow at a CAGR of 13.6% during 2021-2027. Industries are giving more emphasis on cost efficiency, and energy efficiency and making efforts to reduce their carbon footprints which would propel the demand for industrial heat pumps in the coming years with the rising applications in several industries including pharmaceutical, chemical, and food & beverage.

Market Analysis By Type

By type, the market is segmented into air-to-air, air-to-water, and water-to-water types of industrial heat pumps. The water-to-water and air-to-water segments have currently a dominating revenue share in the market with a cumulative market share of around 80% of the total market revenues in 2020. The water-to-water segment has the highest dominance in the overall market revenues as they require less electricity, city and provide high efficiency. By regions, the market is segmented into Northern, Southern, Eastern, and Western regions. The Southern region of India is currently at the top of the market due to the presence of a large number of industries in that area that are the end-users of the industrial heat pump market like pharmaceutical, textile, and many more.

Market Analysis By Operating Temperature Limit

On the basis of operating temperature limit, the up to 20°C and 20°C - 90° C segment captured the maximum share in the India industrial heat pump market in 2020. The 20°C- 90°C segment has dominated the overall market revenues in 2020 and is anticipated to continue to have the maximum share in the forecast period as the operating temperature limit of up to 20° C does not give efficient energy outcomes, thus most of the industries prefer to use heat pumps at an operating temperature that lies between 20° - 90° C.

COVID-19 Impact on India Industrial Heat Pump Market

On account of the outbreak of the COVID-19 pandemic, the industrial heat pump market in India saw a stark decline in market revenues due to the closure of industries and supply chain disruptions caused by the lockdown. Despite the decline in market revenues during 2020, the market is anticipated to recover by 2021 and return to a normal growth trajectory thereafter on account of several projects in the development pipeline such as the Atal Nagar Health ATMS project, Active Pharmaceutical Ingredients project, Dahej Hydrazine Hydrate project and several other projects in the chemical and pharmaceutical industry.

Key Players in the market

Some of the key players in the India Industrial Heat Pump Market are:

- Brio Energy Pvt. Ltd

- Carrier Air Conditioning & Refrigeration Ltd.

- EcoTech Solutions

- Flamingo Heat Pumps

- GEA Group Aktiengesellschaft

- Johnson Controls International plc

- Midea Group Co. Ltd.

- Mitsubishi Electric Hydronics & IT Cooling Systems S.p.A.

- Swegon Bluebox Private Limited

- Trane Technologies plc

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- India Industrial Heat Pump Market Overview

- India Industrial Heat Pump Market Outlook

- India Industrial Heat Pump Market Forecast

- Historical Data and Forecast of India Industrial Heat Pump Market Revenues for the Period 2017-2027.

- Historical Market Data and Forecast of India Industrial Heat Pump Market Revenues, by Types for the Period 2017-2027.

- Historical Market Data and Forecast of India Industrial Heat Pump Market Revenues, by Rated Capacity for the Period 2017-2027.

- Historical Market Data and Forecasts of India Industrial Heat Pump Market Revenues, by Compressor Types, for the Period 2017-2027.

- Historical Market Data and Forecasts of India Industrial Heat Pump Market Revenues, by Operating Temperature Limit, for the Period 2017-2027.

- Historical Market Data and Forecasts of India Industrial Heat Pump Market Revenues, by Regions, for the Period 2017-2027.

- Market Drivers and Restraints

- Market Trends

- Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- India Industrial Heat Pump Market Share, By Companies

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By Types

- Air-to-Air

- Air-to-Water

- Water-to-Water

By Rated Capacity

- Up to 100 kW

- 100.1-250 kW

- 250.1-500 kW

- Above 500 kW

By Compressor Types

- Scroll Compressor

- Screw Compressor

By Operating Temperature Limit

- Up to 20 C

- 20 - 90 C

- Above 90 C

By Industry Types

- Manufacturing and Automotive

- Pharmaceutical

- Textile

- Chemical & Others FoodDairy and miscellaneous

By Regions

- Northern

- Southern

- Eastern

- Western

India Industrial Heat Pump Market: FAQs

| TABLE OF CONTENT |

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of The Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. India Industrial Heat Pump Market Overview |

| 3.1. India Industrial Heat Pump Market Revenues and Volume, 2017-2027F |

| 3.2. India Industrial Heat Pump Market Industry Life Cycle |

| 3.3. India Industrial Heat Pump Market Sales Cycle |

| 3.4. India Industrial Heat Pump Market Ecosystem |

| 3.5. India Industrial Heat Pump Market Porter’s Five Forces Model |

| 3.6. India Industrial Heat Pump Market Revenue Share, By Types, 2020 & 2027F |

| 3.7. India Industrial Heat Pump Market Revenue and Volume Share, By Rated Capacity, 2020 & 2027F |

| 3.8. India Industrial Heat Pump Market Revenue Share, By Operating Temperature Limit, 2020 & 2027F |

| 3.9. India Industrial Heat Pump Market Revenue Share, By Regions, 2020 & 2027F |

| 3.10. India Industrial Heat Pump Market Revenue Share, By Industry Types, 2020 & 2027F |

| 4. Covid-19 Impact Analysis on India Industrial Heat Pump Market |

| 5. India Industrial Heat Pump Market Dynamics |

| 5.1. Impact Analysis |

| 5.2. Market Drivers |

| 5.2.1 Government initiatives promoting energy efficiency and sustainability in industries |

| 5.2.2 Increasing focus on reducing carbon footprint and greenhouse gas emissions |

| 5.2.3 Rising demand for industrial heat pumps as a cost-effective and eco-friendly heating and cooling solution |

| 5.3. Market Restraints |

| 5.3.1 High initial investment cost of industrial heat pump systems |

| 5.3.2 Lack of awareness and understanding about the benefits of industrial heat pumps among industrial players |

| 5.3.3 Limited availability of skilled professionals for installation and maintenance of industrial heat pump systems |

| 6. India Industrial Heat Pump Market Trends |

| 7. India Industrial Heat Pump Market Overview, By Types |

| 7.1. India Industrial Heat Pump Market Revenues, By Types, 2017-2027F |

| 7.1.1. India Air-to-Air Industrial Heat Pump Market Revenues, 2017-2027F |

| 7.1.2. India Air-to-Water Industrial Heat Pump Market Revenues, 2017-2027F |

| 7.1.3. India Water-to-Water Industrial Heat Pump Market Revenues, 2017-2027F |

| 7.2. India Industrial Heat Pump Market Analysis for Types, By Operating Temperature |

| 8. India Industrial Heat Pump Market Overview, By Rated Capacity |

| 8.1. India Industrial Heat Pump Market Revenues, By Rated Capacity, 2017-2027F |

| 8.1.1. India Up to 100 kW Industrial Heat Pump Market Revenues, 2017-2027F |

| 8.1.2. India 100.1-250 kW Industrial Heat Pump Market Revenues, 2017-2027F |

| 8.1.3. India 250.1-500 kW Industrial Heat Pump Market Revenues, 2017-2027F |

| 8.1.4. India Above 500 kW Industrial Heat Pump Market Revenues, 2017-2027F |

| 8.2. India Industrial Heat Pump Market Volume, By Rated Capacity, 2017-2027F |

| 8.2.1. India Up to 100 kW Industrial Heat Pump Market Volume, 2017-2027F |

| 8.2.2. India 100.1-250 kW Industrial Heat Pump Market Volume, 2017-2027F |

| 8.2.3. India 250.1-500 kW Industrial Heat Pump Market Volume, 2017-2027F |

| 8.2.4. India Above 500 kW Industrial Heat Pump Market Volume, 2017-2027F |

| 8.3. India Industrial Heat Pump Market Analysis for Rated Capacity, By Compressor Types |

| 8.3.1. India Industrial Heat Pump Market Share for Rated Capacity, By Compressor Types, 2020 & 2027F |

| 8.3.2. India Industrial Heat Pump Market Revenues for Rated Capacity, By Compressor Types, 2017-2027F |

| 8.3.2.1. India Industrial Heat Pump Market Revenues for Rated Capacity, By Scroll Compressor, 2017-2027F |

| 8.3.2.2. India Industrial Heat Pump Market Revenues for Rated Capacity, By Screw Compressor, 2017-2027F |

| 9. India Industrial Heat Pump Market Overview, By Operating Temperature Limit |

| 9.1. India Industrial Heat Pump Market Revenues, By Operating Temperature Limit, 2017-2027F |

| 9.1.1. India Up to 20 C Industrial Heat Pump Market Revenues, 2017-2027F |

| 9.1.2. India 20 -90 C Industrial Heat Pump Market Revenues, 2017-2027F |

| 9.1.3. India Above 90 C Industrial Heat Pump Market Revenue, 2017-2027F |

| 10. India Industrial Heat Pump Market Overview, By Regions |

| 10.1. India Industrial Heat Pump Market Revenues, By Regions, 2017-2027F |

| 10.1.1 India Northern Region Industrial Heat Pump Market Revenues, 2017-2027F |

| 10.1.2. India Southern Region Industrial Heat Pump Market Revenues, 2017-2027F |

| 10.1.3. India Eastern Region Industrial Heat Pump Market Revenues, 2017-2027F |

| 10.1.4. India Western Region Industrial Heat Pump Market Revenues, 2017-2027F |

| 11. India Industrial Heat Pump Market Overview, By Industry Types |

| 11.1. India Industrial Heat Pump Market Revenues, By Industry Types, 2017-2027F |

| 11.1.1 India Industrial Heat Pump Market Revenues, By Manufacturing & Automotive Industry, 2017-2027F |

| 11.1.2. India Industrial Heat Pump Market Revenues, By Pharmaceutical Industry, 2017-2027F |

| 11.1.3. India Industrial Heat Pump Market Revenues, By Textile Industry, 2017-2027F |

| 11.1.4. India Industrial Heat Pump Market Revenues, By Chemical Industry, 2017-2027F |

| 11.1.5. India Industrial Heat Pump Market Revenues, By Others (Food, Dairy and miscellaneous) Industry, 2017-2027F |

| 12. India Industrial Heat Pump Market Key Performance Indicators |

| 13. India Industrial Heat Pump Market Opportunity Assessment |

| 13.1. India Industrial Heat Pump Market Opportunity Assessment, By Types, 2027F |

| 13.2. India Industrial Heat Pump Market Opportunity Assessment, By Rated Capacity, 2027F |

| 13.3. India Industrial Heat Pump Market Opportunity Assessment, By Operating Temperature Limit, 2027F |

| 13.4. India Industrial Heat Pump Market Opportunity Assessment, By Regions, 2027F |

| 14. India Industrial Heat Pump Market Price Trend Analysis |

| 14.1. India Industrial Heat Pump Market Average Selling Price, By Rated Capacity |

| 15. India Industrial Heat Pump Market Competitive Landscape |

| 15.1. India Industrial Heat Pump Market Revenue Share, By Origin, 2020 & 2027F |

| 15.2. India Industrial Heat Pump Market Revenue Share Ranking, By Companies, 2020 |

| 15.3. India Industrial Heat Pump Market Competitive Benchmarking, By Technical Parameters |

| 15.4. India Industrial Heat Pump Market Competitive Benchmarking, By Operating Parameters |

| 16. Company Profiles |

| 16.1. Carrier Air Conditioning & Refrigeration Ltd. |

| 16.2. GEA Group Aktiengesellschaft |

| 16.3. Johnson Controls International plc |

| 16.4. Midea Group Co. Ltd. |

| 16.5. Trane Technologies plc |

| 16.6. Mitsubishi Electric Hydronics & IT Cooling Systems S.p.A. |

| 16.7. Swegon Bluebox Private Limited |

| 16.8. Flamingo Heat Pumps |

| 16.9. Brio Energy Pvt. Ltd |

| 16.10. EcoTech Solutions |

| 17. Key Strategic Recommendations |

| 18. Disclaimer |

| LIST OF FIGUERS |

| 1. India Industrial Heat Pump Market Revenues and Volume, 2017-2027F (INR Crores, Units) |

| 2. India Industrial Heat Pump Market Revenue Share, By Types, 2020 & 2027F |

| 3. India Industrial Heat Pump Market Revenue Share, By Rated Capacity, 2020 & 2027F |

| 4. India Industrial Heat Pump Market Volume Share, By Rated Capacity, 2020 & 2027F |

| 5. India Industrial Heat Pump Market Revenue Share, By Operating Temperature Limit, 2020 & 2027F |

| 6. India Industrial Heat Pump Market Revenue Share, By Regions, 2020 & 2027F |

| 7. India Industrial Heat Pump Market Revenue Share, By Industry Types, 2020 & 2027F |

| 8. Market Size of India Chemical Sector, 2017-2022F ($ Billion) |

| 9. Indian Pharmaceutical Sector, 2015-2019 (US $ Billion) |

| 10. India’s annual CO2 emissions, 2016-2019 (MtCO2) |

| 11. India Industrial Heat Pump Market Analysis for Rated Capacity, by Compressor Types |

| 12. GVA of Manufacturing at basic current prices, FY’16-FY’20 ($ billion) |

| 13. Gross Capital Formation of Manufacturing Sector at current prices, FY’16-FY20 ($ Billion) |

| 14. Annual Automotive Production- Two Wheelers and Cars, 2016-2025F (Thousand Units) |

| 15. Share of each segment in Total Automotive Production Volume (FY 2020) |

| 16. Revenue of Indian Textile and Apparel Sector 2020 and 2026F ($ billion) |

| 17. India’s Textile Trade FY 2016- FY 2020 ($ billion) |

| 18. India Industrial Heat Pump Market Opportunity Assessment, By Types, 2027F |

| 19. India Industrial Heat Pump Market Opportunity Assessment, By Rated Capacity, 2027F |

| 20. India Industrial Heat Pump Market Opportunity Assessment, By Operating Temperature Limit, 2027F |

| 21. India Industrial Heat Pump Market Opportunity Assessment, By Regions, 2027F |

| 22. India Industrial Heat Pump Market Average Selling Price, By Rated Capacity, 2017-2027F (INR Lakhs) |

| 23. India Industrial Heat Pump Market Revenue Share, By Origin, 2020 & 2027F |

| 24. India Industrial Heat Pump Market Revenue Ranking, By Companies, 2020 |

| 25. India Industrial Heat Pump Market Leading Domestic Manufacturers, 2020 |

| LIST OF TABLES |

| 1. India Industrial Heat Pump Market Revenues, By Types, 2017-2027F (INR Crores) |

| 2. India Industrial Heat Pump Market Revenues, By Rated Capacity, 2017-2027F (INR Crores) |

| 3. India Industrial Heat Pump Market Volume, By Rated Capacity, 2017-2027F (Units) |

| 4. India Industrial Heat Pump Market Revenue Share for Rated Capacity, by Compressor Types, 2020 & 2027F |

| 5. India Industrial Heat Pump Market Revenues for Rated Capacity, by Compressor Types, 2017-2027F (INR Crores) |

| 6. India Industrial Heat Pump Market Revenues, By Operating Temperature Limit, 2017-2027F (INR Crores) |

| 7. India Industrial Heat Pump Market Revenues, By Regions, 2017-2027F (INR Crores) |

| 8. India Industrial Heat Pump Market Revenues, By Industry Types, 2017-2027F (INR Crores) |

| 9. Upcoming Pharmaceutical Projects in India |

| 10. Ongoing Projects in India Chemical Sector |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero