India Lead Acid Battery Market Outlook (2021-2027) | Outlook, Trends, Growth, Revenue, Analysis, Forecast, Size, Share & COVID-19 IMPACT

Market Forecast By Types (SLI (Starting Lighting Ignition), Stationary and Motive/Traction), By Construction Method (Flooded and VRLA), By Applications (Automotive, Telecommunications, UPS & Inverter, Electric Vehicles & Renewable Energy and Others), By Capacity (Up to 100 Ah, 100.1-200 Ah, 200.1-300 Ah and Above 300 Ah), By Regions (Northern, Western, Eastern and Southern) and Competitive Landscape

| Product Code: ETC150148 | Publication Date: Jan 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 80 | No. of Figures: 23 | No. of Tables: 4 |

India Lead Acid Battery Market Import Shipment Trend (2020-2024)

The India lead acid battery market import shipment demonstrated strong growth with a notable CAGR from 2020 to 2024. However, the growth rate between 2023 and 2024 experienced a slight decline, indicating a potential stabilization or slowdown in the market momentum towards the end of the period.

India Lead Acid Battery Market Size & Growth Rate

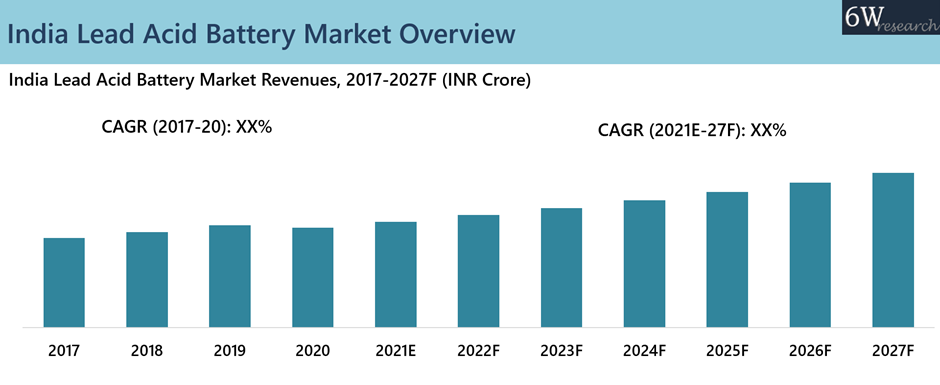

The India Lead Acid Battery Market is projected to grow at a CAGR of 6.5% from 2021 to 2027, driven by rising demand from the transportation sector, increasing adoption of backup power solutions for data centers and telecom, and strong government support for electric mobility and battery innovation through initiatives and collaborations with organizations like ALABC.

India Lead Acid Market | Country-Wise Share and Competition Analysis

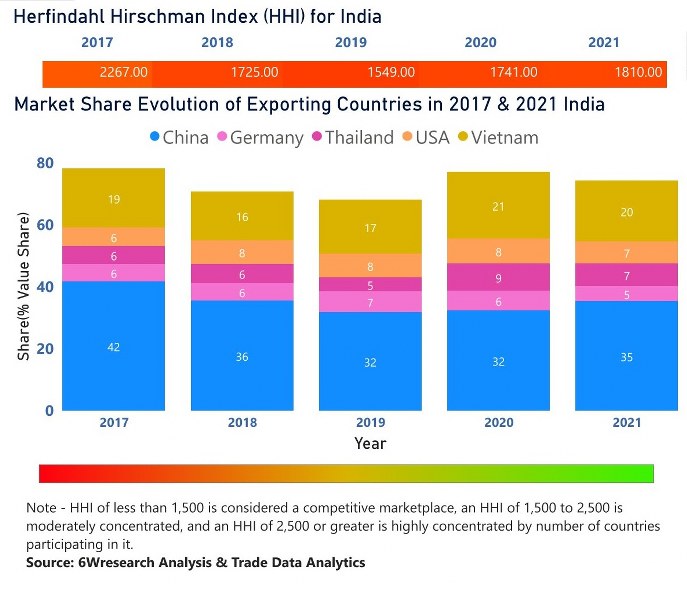

In the year 2021, China was the largest exporter in terms of value, followed by Viet Nam. It has registered a growth of 55.71% over the previous year. While Viet Nam registered a growth of 30.33% as compare to the previous year. In the year 2017 China was the largest exporter followed by Viet Nam. In term of Herfindahl Index, which measures the competitiveness of countries exporting, India has the Herfindahl index of 2267 in 2017 which signifies moderately concentrated also in 2021 it registered a Herfindahl index of 1810 which signifies moderately concentrated in the market.

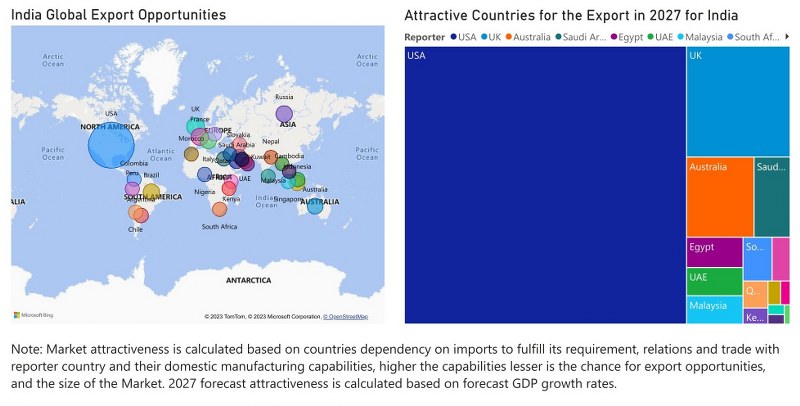

India Lead Acid Market - Export Market Opportunities

India Lead Acid Battery Market Latest Developments (2023)

India Lead Acid Battery Market has accomplished massive growth and the market is anticipated to grow more in the upcoming years since a number of developments are taking place in the sector which is aiding the market to become one of the huge markets in the country. The Advanced Lead–Acid Battery Consortium (ALABC) play an essential role in the growth of the Lead Acid Battery Market in India as it has been working constantly on the promotion and development of lead-based batteries for sustainable markets like start–stop automotive systems, grid-scale energy storage applications, and hybrid electric vehicles (HEV). ALABC also works on the addition of carbon to the negative plates in order to extend the battery life and improve the lead-acid battery dynamic charge acceptance.

corrosive sulfuric acid is used in lead–acid batteries, and during the change both hydrogen as well as oxygen evolved. Thus, special measures are required to prevent acid leakage as well as charging gas ignition and the players in this sector have been working to meet these requirements. The companies in this sector have been working to come up with energy-efficient lead-acid batteries. The government of India has been supportive of this sector and is anticipated to make significant developments in the market in the near future.

India Lead Acid Battery Market Synopsis

India Lead Acid Battery Market witnessed significant growth in recent years owing to its cost-effectiveness and high recyclability. The main drivers for lead acid battery in India are rising urbanization and increased focus on EVs by the government. Although, the Covid-19 outbreak resulted in a significant decline in the lead acid market on the back of the falling commercial sector in India during 2020 and the decline in automobile production.

Growing advancement in technology coupled with the strengthening of the telecommunication sector is adding to the Lead Acid Battery Industry in India. Moreover, the growing energy generation and rising demand for its storage are also the key factors fostering the growth of the market.

However, the spread of Covid-19 in 2020 resulted in a slight decline in the India lead acid Market Growth owing to a decline in the production of automobiles and the suspension of manufacturing plants during the lockdown period. Although, the demand for inverters and UPS saw a sudden rise during the year 2020 due to the adoption of work from a home culture which required people to install backup solutions at their homes for uninterrupted work.

According to 6Wresearch, the India Lead Acid Battery Market is projected to grow at a CAGR of 6.5% during 2021-2027. The primary reason for the projected growth would be rising data centres in the country, requiring uninterrupted battery backup solutions. Additionally, increased government initiatives in electrifying mobility, for instance, various tax deductions and subsidies make the India EV landscape promising, where lead-acid market is heavily used and hence it would increase market revenues during the forecast period.

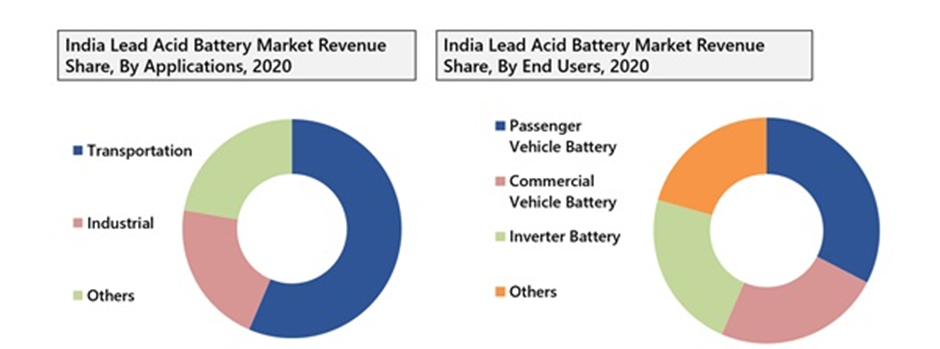

Market by Applications Analysis

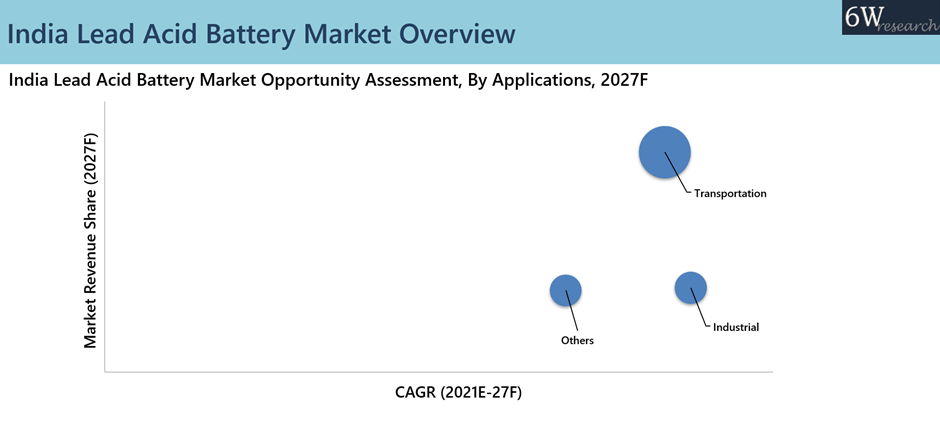

in terms of applications, the transportation segment has captured above 50% of the market revenues in 2020. Transportation has dominated the India lead acid battery market Share in terms of application owing to the large population of the country and the rising Indian automobile sector. About 22 million units of vehicles were produced in FY 2021 in the country which has augmented the lead-acid battery market in India. This trend is expected to persist in the coming years as well with the production of electric vehicles in India in addition to the internal combustion engine cars produced in India.

![India Lead Acid Battery Market Overview]() Market by End Users Analysis

Market by End Users Analysis

In India Lead Acid Battery market, passenger vehicle battery has led the overall market revenues accounting for more than 30% of the market revenues in 2020. Passenger vehicles were the highest revenue-generating segment for the lead-acid battery market of India in 2020 owing to the large number of passenger vehicles produced in the country in the respective year. Moreover, the battery replacement market for passenger vehicles also pushed the lead-acid battery market of the country in 2020.

Factors Stimulating the India Lead Acid Battery Industry Growth

Some key factors driving the growth of the Lead Acid Battery Market in India are the growth in the SLI applications in the automotive sector, the rise in renewable energy production, as well as the high demand for energy storage devices. The growth in the telecom sector of India is also fueling the growth of this market. The growth in the telecom sector is leading to high requirements for UPS systems as a power back up, which, in turn, is leading to greater adoption of these batteries as cost-competitive energy. These are some of the main factors making the market more efficient. The market has been propelling efficiently in the country.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

Key Highlights of the Report:

- India Lead Acid Battery Market Overview

- India Lead Acid Battery Market Outlook

- India Lead Acid Battery Market Forecast

- Historical Data and Forecast of India Lead Acid Battery Market Revenues for the Period 2017-2027F

- Historical Data and Forecast of India Lead Acid Battery Market Revenues By Types, for the Period 2017-2027F

- Historical Data and Forecast of India Lead Acid Battery Market Revenues By Construction Method, for the Period 2017-2027F

- Historical Data and Forecast of India Lead Acid Battery Market Revenues, By Applications, for the Period 2017-2027F

- Historical Data and Forecast of India Lead Acid Battery Market Revenues, By End Users, for the Period 2017-2027F

- Historical Data and Forecast of India Lead Acid Battery Market Revenues, By Regions, for the Period 2017-2027F

- Market Drivers

- Market Restraints

- Market Trends

- Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- Market Player’s Revenue Shares

- Market Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Types:

- Starting Lighting and Ignition (SLI)

- Motive

- Stationary

By Construction Method:

- Flooded

- Sealed

By Applications:

- Transportation

- Industrial

- Others (Residential and Commercial)

By End Users:

- Commercial Vehicle Battery

- Passenger Vehicle Battery

- Inverter Battery

- Others (Telecom, Railways, and other industries)

By Regions:

- Northern Region

- Southern Region

- Eastern Region

- Western Region

India Lead Acid Battery Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. India Lead Acid Battery Market Overview |

| 3.1 India Lead Acid Battery Market Revenues and Volume, 2017-2027F |

| 3.2 India Lead Acid Battery Market Industry Life Cycle |

| 3.3 India Lead Acid Battery Market Porter’s Five Forces |

| 4. Impact Analysis of Covid-19 on India Lead Acid Battery Market |

| 5. India Lead Acid Battery Market Dynamics |

| 5.1 Impact Analysis |

| 5.2 Market Drivers |

| 5.2.1 Increasing demand for uninterrupted power supply in various sectors such as telecommunications, healthcare, and IT. |

| 5.2.2 Growing adoption of electric vehicles and renewable energy systems which rely on lead acid batteries for energy storage. |

| 5.2.3 Expansion of the automotive industry in India leading to higher demand for lead acid batteries in vehicles. |

| 5.3 Market Restraints |

| 5.3.1 Competition from alternative energy storage technologies such as lithium-ion batteries. |

| 5.3.2 Environmental concerns related to lead-acid battery disposal and recycling. |

| 5.3.3 Fluctuating prices of lead and sulfuric acid, key components used in lead acid batteries. |

| 6. India Lead Acid Battery Market Trends |

| 7. India Lead Acid Battery Market Overview, By Types |

| 7.1 India Lead Acid Battery Market Revenues Share, By Types, 2020 & 2027F |

| 7.2 India Lead Acid Battery Market Revenues, By Types |

| 7.2.1 India Starting Lighting and Ignition (SLI) Lead Acid Battery Market Revenues, 2017-2027F |

| 7.2.2 India Stationary Lead Acid Battery Market Revenues, 2017-2027F |

| 7.2.3 India Motive Lead Acid Battery Market Revenues, 2017-2027F |

| 8. India Lead Acid Battery Market Overview, By Construction Method |

| 8.1 India Lead Acid Battery Market Revenue Share, By Construction Method, 2020 & 2027F |

| 8.1.1 India Flooded Lead Acid Battery Market Revenues, 2017-2027F |

| 8.1.2 India Sealed Lead Acid Battery Market Revenues, 2017-2027F |

| 9. India Lead Acid Battery Market Overview, By Applications |

| 9.1 India Lead Acid Battery Market Revenue Share, By Applications, 2020 & 2027F |

| 9.2 India Lead Acid Battery Market Revenues, By Applications, 2017-2027F |

| 9.2.1 India Transportation Lead Acid Battery Market Revenues, 2017-2027F |

| 9.2.2 India Industrial Lead Acid Battery Market Revenues, 2017-2027F |

| 9.2.3 India Other Applications Lead Acid Battery Market Revenues, 2017-2027F |

| 10. India Lead Acid Battery Market Overview, By End Users |

| 10.1 India Lead Acid Battery Market Revenue Share, By End Users, 2020 & 2027F |

| 10.2 India Lead Acid Battery Market Revenues, By End Users, 2017-2027F |

| 10.2.1 India Passenger Vehicle Lead Acid Battery Market Revenues, 2017-2027F |

| 10.2.2 India Commercial Vehicle Lead Acid Battery Market Revenues, 2017-2027F |

| 10.2.3 India Inverter Lead Acid Battery Market Revenues, 2017-2027F |

| 10.2.4 India Other Lead Acid Battery Market Revenues, 2017-2027F |

| 11. India Lead Acid Battery Market Overview, By Regions |

| 11.1 India Lead Acid Battery Market Revenue Share, By Regions, 2020 & 2027F |

| 11.2 India Lead Acid Battery Market Revenues, By Regions, 2017-2027F |

| 11.2.1 India Northern Region Lead Acid Battery Market Revenues, 2017-2027F |

| 11.2.2 India Southern Region Lead Acid Battery Market Revenues, 2017-2027F |

| 11.2.3 India Western Region Lead Acid Battery Market Revenues, 2017-2027F |

| 11.2.4 India Eastern Region Lead Acid Battery Market Revenues, 2017-2027F |

| 12. India Lead Acid Battery Market Key Performance Indicators |

| 13. India Lead Acid Battery Market Opportunity Assessment |

| 13.1 India Lead Acid Battery Market Opportunity Assessment, By Types (2027F) |

| 13.2 India Lead Acid Battery Market Opportunity Assessment, By Applications (2027F) |

| 13.3 India Lead Acid Battery Market Opportunity Assessment, By End Users (2027F) |

| 13.4 India Lead Acid Battery Market Opportunity Assessment, By Regions (2027F) |

| 14. India Lead Acid Battery Market Competitive Landscape |

| 14.1 India Lead Acid Battery Market Revenue Share, By Company (2020) |

| 14.2 India Lead Acid Battery Market Competitive Benchmarking, By Technical Parameters |

| 14.3 India Lead Acid Battery Market Competitive Benchmarking, By Operational Parameters |

| 15. Company Profiles |

| 15.1 Exide Industries Ltd. |

| 15.2 Amara Raja Group |

| 15.3 Luminous Power Technologies Pvt. Ltd. |

| 15.4 HBL Power Systems Ltd. |

| 15.5 Jayachandran Industries Ltd |

| 15.6 Livguard Energy Technologies Pvt Ltd |

| 15.7 OKAYA Power Group |

| 15.8 True Power Systems LLP |

| 16. Key Strategic Recommendations |

| 17. Disclaimer |

| List of Figures |

| Figure 1. India Lead Acid Battery Market Revenues, 2017-2027F (INR Crores) |

| Figure 2. India Automobile Production, 2015-2021 (Million units) |

| Figure 3. Number of telecom towers in India, 2019-2024F (Thousand Units) |

| Figure 4. India data center market size, 2020-2026F (Thousand Crores) |

| Figure 5. India’s colocation data center market size, 2020 H1 -2025F (MW) |

| Figure 6. Vehicle retail sales, July 2019 vs July 2021 (Thousand Units) |

| Figure 7. India Lead Acid Battery Market Revenue Share, By Types, 2020 & 2027F |

| Figure 8. India Lead Acid Battery Market Revenue Share, By Construction Method, 2020 & 2027F |

| Figure 9. India Lead Acid Battery Market Revenues, By Flooded Construction Method, 2017-2027F (INR Crores) |

| Figure 10. India Lead Acid Battery Market Revenues, By Sealed Construction Method, 2017-2027F (INR Crores) |

| Figure 11. India Lead Acid Battery Market Revenue Share, By Applications, 2020 & 2027F |

| Figure 12. India Lead Acid Battery Market Revenue Share, By End Users, 2020 & 2027F |

| Figure 13. India Lead Acid Battery Market Revenue Share, By Regions, 2020 & 2027F |

| Figure 14. India Automobile Industry Market Size, 2020-2026F (Lakh Crores) |

| Figure 15. City wise IT load capacity as of H1 2021 (MW) |

| Figure 16. Total Tower Count, License Service Area Wise, as of July 2019 (Units) |

| Figure 17. Residential Unit Sales in key cities of India, Q3 2020-Q1 2021 (Units) |

| Figure 18. India Lead Acid Battery Market Opportunity Assessment, By Types, 2027F |

| Figure 19. India Lead Acid Battery Market Opportunity Assessment, By Applications, 2027F |

| Figure 20. India Lead Acid Battery Market Opportunity Assessment, By End Users, 2027F |

| Figure 21. India Lead Acid Battery Market Opportunity Assessment, By Regions, 2027F |

| Figure 22. India Lead Acid Battery Market Revenue Share, By Companies, 2020 |

| Figure 23. India Electric Vehicle Sales, FY 2015-16 to FY 2019-20 (Units) |

| List of Tables |

| Table 1. India Lead Acid Battery Market Revenues, By Types, 2017-2027F (INR Crores) |

| Table 2. India Lead Acid Battery Market Revenues, By Applications, 2017-2027F (INR Crores) |

| Table 3. India Lead Acid Battery Market Revenues, By End Users, 2017-2027F (INR Crores) |

| Table 4. India Lead Acid Battery Market Revenues, By Regions, 2017-2027F (INR Crores) |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Switchgear Market Outlook (2026 - 2032) | Size, Share, Trends, Growth, Revenue, Forecast, Analysis, Value, Outlook

- Pakistan Contraceptive Implants Market (2025-2031) | Demand, Growth, Size, Share, Industry, Pricing Analysis, Competitive, Strategic Insights, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Companies, Challenges

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero

Market by End Users Analysis

Market by End Users Analysis