India LED Lighting Market (2024-2030) | Revenue, Size, Trends, Companies, Value, Share, Analysis, Forecast, Growth & Industry

Market Forecast By Types (Lamps, Luminaires), By Applications (Indoor, Outdoor), By Sales Channels (B2C (includes Brick & Mortar and Ecommerce), B2B (includes Traditional Channels i.e. Distribution & Trade), Institutional (includes Private & Government Projects)),By Regions (Northern, Southern, Eastern, Western)And Competitive Landscape

| Product Code: ETC4454725 | Publication Date: Jan 2025 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 88 | No. of Figures: 28 | No. of Tables: 11 |

India LED Lighting Market Size & Growth Rate

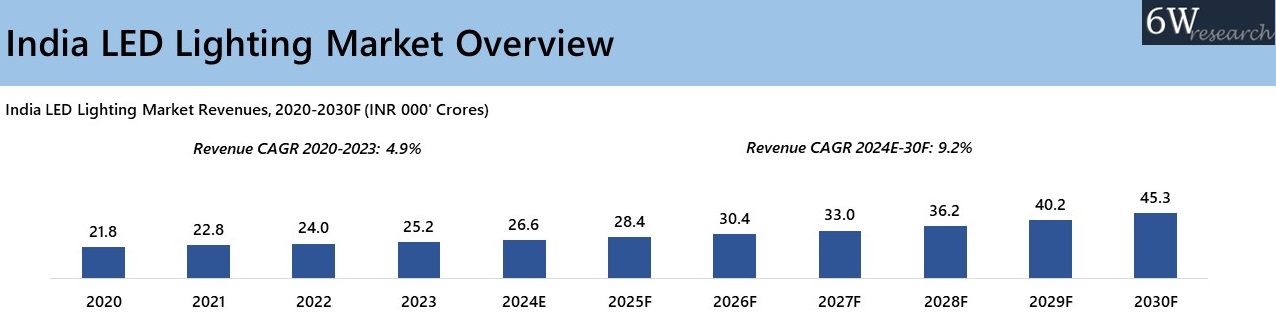

According to 6Wresearch, the India LED Lighting Market is projected to grow at a CAGR of 9.2% during 2024–2030, fueled by government initiatives like Smart Cities Mission, UJALA, and SLNP, rising real estate and smart home developments, and growing demand for energy-efficient and IoT-integrated lighting solutions across residential, commercial, and infrastructure sectors.

Topics Covered in India LED Lighting Market Report

India LED Lighting Market Report thoroughly covers the market by types, applications, sales channels and regions. India LED Lighting Market Outlook report provides an unbiased and detailed analysis of the ongoing India LED Lighting Market trends, opportunities/high growth areas, and market drivers. This would help stakeholders devise and align their market strategies according to the current and future market dynamics.

India LED Lighting Market Synopsis

India LED lighting market experienced significant growth in recent years, driven by rising government investments in schemes such as UJALA, PLI and SLNP along with an increased focus on smart cities and rural electrification. However, the market faced a temporary setback in 2019 due to the COVID-19 pandemic owing to which the demand for LED lighting products declined moderately as there was a nationwide lockdown imposed by the government and disruptions happened in the supply chain, resulting in the suspension of manufacturing operations. However, the market recovered post pandemic after ease of lockdown restrictions. Further, the growth of the LED lighting market was driven by significant increase in the residential, office and hospitality sectors. For instance, the real estate sector grew with rising housing unit completions from 2.5 lakh units in 2018 to 4.35 lakh units in 2023. Moreover, India's energy demand is expected to rise by 8.6%, reaching 11,02,887 MU in 2023-24, compared to 10,15,908 MU in 2022. This growth in demand of energy-efficient solutions, combined with the shift to smart, IoT-integrated lighting systems and energy-saving LED lights, has been driving the growth for LED lighting in the Indian market.

According to 6Wresearch, India LED Lighting Market is projected to grow at a CAGR of 9.2% during 2024-2030. The Indian government’s Smart Cities Mission which aims to transform 100 existing cities in India into smart cities has been positively influencing the LED lighting market since 2015 and the initiative has been extended till 2025. This would assist in increasing the market size. Along with this, the housing demand in India is projected to surge, reaching an estimated 93 million units by 2036. Additionally, in 2023, the country had 13 million smart houses, and it is anticipated that the installation of smart home solutions would increase by 12.8% by 2025. Further, hospitality sector is expected to witness growth with the upcoming 177 hospitality projects to be completed by 2025. This upward trajectory would increase the demand for LED lighting products during the forecast period.

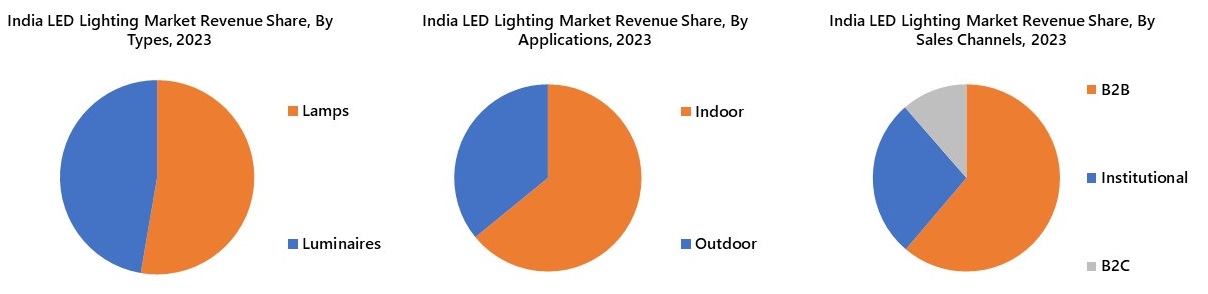

Market Segmentation By Types

Luminaires are expected to experience a higher growth rate in the coming years due to the rising trend of incorporating landscape lighting in infrastructure design, along with increasing demand for floodlights in stadiums. For instance, in Sep 2024, the Uttar Pradesh government announced plans to build 1,000 playgrounds and 18 stadiums, along with mini-stadiums in nearly 825 development blocks. Additionally, India's bid for the 2036 Olympics is likely to drive the construction of more stadiums in the coming years, with the Gujarat government already planning to build five international-standard stadiums in Ahmedabad. These initiatives would increase the deployment of Luminaires in the years to come.

Market Segmentation By Applications

Indoor application is expected to see higher growth in India’s LED lighting market due to the rising trend of using energy efficient LED lighting products in commercial retail malls, office spaces, hotels and high-end residential units. For instance, smart homes market is projected to grow by 9.14% to reach a market value of INR 0.7 Lakh Crores by 2028. Moreover, 120 million square feet of office spaces is schedule for completion by 2025 across the nation which would further contribute to drive the demand for LED lights in indoor segment.

Market Segmentation By Sales Channels

The institutional sales channel is anticipated to experience a higher growth rate than B2B and B2C channels during the forecast period owing to government initiatives, such as UJALA and SLNP which have been assisting in driving mass procurement, leveraging institutional partnerships, and facilitating large-scale distribution. Additionally, large-scale infrastructure projects in roadways, airports, and railways are expected to increase demand, supporting the extensive deployment of energy-efficient LED lighting.

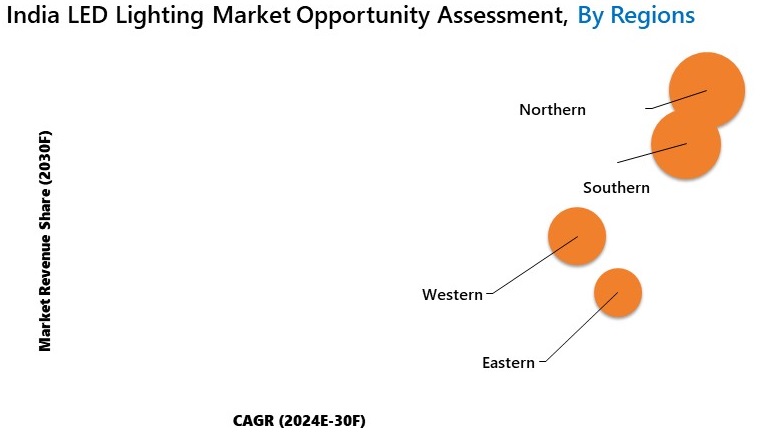

Market Segmentation By Regions

The Northern region is projected to experience rapid growth in the coming years, driven by rising peak electricity demand which is expected to increase from 73 GW in 2021-22 to 127 GW by 2031F-32F, the highest among all regions. This surge in demand, coupled with a steady influx of real estate projects, especially in Delhi-NCR, is anticipated to further boost the need for LED lighting products across the region in the coming years.

India LED Lighting Market Trends

The India LED Lighting Market has experienced significant expansion over time driven by multiple changing trends. Advancements and growing awareness about energy efficiency propel innovation and push market growth. Below are the key trends shaping LED lighting market in India:

Energy Efficiency Awareness: Due to lower power costs and environmental effects, two groups of energy users, residential and commercial, have started to pay attention to energy efficiency issues and are moving towards LED lighting.

Government Initiatives: The use of LEDs is being accelerated nationwide by initiatives like UJALA (Unnat Jyoti by Affordable LEDs for All) and infrastructure modernisation.

Demand for Smart Lighting: The overall growth in demand for smart lighting systems is being followed by the modernisation of smart cities and IoT-enabled infrastructure.

Cost-Effectiveness: As a result of production improvements and economies of scale, LED light prices are now more reasonably priced. This additional ease of adoption has spread rapidly in larger cities as well as in rural regions, tier-2 and tier-3 cities, and other places.

Expanding Uses: LED lighting is becoming widely used in industries including retail, healthcare, and automobiles, not just in homes and businesses. LEDs are used in automobile manufacture to improve visibility and aesthetics, while in the medical field, they are crucial for surgical procedures and patient care—mostly through improved illumination.

Investment Opportunities in the India LED Lighting Market

Smart Lighting Solutions: IoT and AI-driven technology is evolving the India LED Lighting Market From motion-sensing street lights to voice-controlled home lighting, investors can benefit from the growing demand for automated and energy-efficient solutions in residential and commercial spaces.

Rural Electrification Projects: Government initiatives to improve rural infrastructure have created a huge demand for cost-effective and durable LED lighting solutions. With millions of under-served households and businesses looking for affordable energy, companies investing in rural-friendly LED products will have large-scale deployment opportunities.

Energy Efficiency Programs: As sustainability and carbon footprint reduction become a concern, businesses and consumers are looking at energy-efficient lighting. Innovations like solar-powered LEDs and low-wattage solutions are gaining traction, this is a good investment avenue for eco-friendly and regulatory-compliant products.

Growth in Emerging Segments: Industries like agriculture and education are increasingly using LED lighting for specific applications. The rise of indoor farming has created a demand for grow lights and schools as well as universities are investing in flicker-free, high-efficiency LEDs to improve learning environments. These niche markets are untapped space for sector-specific LED solutions.

Export Potential: India’s competitive manufacturing ecosystem and growing global demand for cost-effective LED products make the country a key player in the global market. With increasing exports to the Middle East, Africa and Southeast Asia, investors can look at scaling up production and distribution for global reach.

Premium Lighting Segments: Urbanization and growing disposable income are driving demand for high-end, decorative and customisable LED lighting. From luxury home interiors to designer commercial spaces, the market for stylish, smart-enabled lighting solutions is growing, this is a good space for premium brands.

Leading Players in the India LED Lighting Market

India LED Lighting Market is controlled by several major players that create wealth through innovation, product diversification, and strategic market expansion. These companies fuel competition and growth by utilizing advanced technology and catering to changing consumer needs. Here are some key players that help shape the market:

Philips Lighting: This company is a leader in connecting smart lighting solutions worldwide, from devices to energy-efficient smart lighting solutions. It continues to remain on the leading edge of the market through sustainability and IoT-enabled lighting.

Havells India Ltd.: This is a well-established brand known for its comprehensive LED lighting portfolio, emphasising affordability, long-lasting performance, and eco-friendly solutions. Its strong distribution network enhances accessibility across urban and rural markets.

Crompton Greaves Consumer Electricals Ltd.: This is a trusted name in the industry, providing high-quality LED lighting with a focus on durability and energy efficiency. The brand is known for its customer-centric approach and reliable after-sales service.

SYSKA LED Lights: Staying up-to-date with both premium and mass-market LED solutions that deliver the best value for money, SYSKA LED lights set a new standard in LED solutions. Its widespread presence in metropolitan as well as semi-urban regions further strengthens its hold in the industry.

Wipro Consumer Lighting: This company is known as a frontrunner in smart lighting systems designed for modern workplaces and connected homes. Its expertise in intelligent automation and sustainable solutions aligns with the growing demand for high-tech LED products.

Government Regulations of The Report

Government rules have played a key role in shaping the India LED lighting industry. The Unnat Jyoti by Affordable LEDs for All (UJALA) plan, which started in 2015, has been crucial to push energy-saving lights across the country. UJALA gives out LED bulbs at lower prices, which has led to many more homes using them. This has helped save a lot of energy and cut down on carbon emissions.

Along with UJALA, the Street Lighting National Programme (SLNP) has been important in switching old streetlights to LED ones. This plan has made public lighting better and helped towns save a lot of energy. To boost the industry even more, the government has put into action the Production Linked Incentive (PLI) Scheme for White Goods, which includes LED lighting products. This scheme encourages domestic manufacturing by giving financial perks to companies that make components and sub-assemblies of LED lights. This helps cut down on imports and strengthens the local ecosystem. Also, the Energy Conservation Act of 2001, which was set up by the Bureau of Energy Efficiency (BEE) creates performance standards and labelling rules for appliances, including lighting products. When manufacturers follow these standards, they make sure they produce LED offerings that are safe and reliable for consumers to use.

Future Insights of the India LED Lighting Market

The LED lighting market in India is set to grow in the next few years. This growth is driven by expansion of cities, advance technology and rising awareness about saving energy. Smart lighting is getting more popular, and the use of the Internet of Things and better controls will likely propel change in the industry. Current trends show that people need custom designs and current styles of lights for homes and businesses. Additionally, more solar-powered LED lights are coming out, which fits with India's plan to use more clean energy. Investment in research will lead to new tech for different uses, from street lights to factory lights.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2020 to 2023.

- Base Year: 2023

- Forecast Data until 2030.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- India LED Lighting Market Overview

- India LED Lighting Market Outlook

- India LED Lighting Market Forecast

- Historical Data and Forecast of India LED Lighting Market Revenues for the Period 2020-2030F

- Historical Data and Forecast of Market Revenues, By Types, for the Period 2020-2030F

- Historical Data and Forecast of Market Revenues, By Applications, for the Period 2020-2030F

- Historical Data and Forecast of Market Revenues, By Sales Channels, for the Period 2020-2030F

- Historical Data and Forecast of Market Revenues, By Regions, for the Period 2020-2030F

- India LED Lighting Market Drivers and Restraints

- Industry Life Cycle

- Porter’s Five Force Analysis

- SWOT Analysis

- India LED Lighting Market Evolution & Trends

- Market Opportunity Assessment

- India LED Lighting Market Revenue Share, By Top B2B & B2C Companies

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By Types

- Lamps

- Luminaires

By Applications

- Indoor

- Outdoor

By Sales Channels

- B2C (includes Brick & Mortar and Ecommerce)

- B2B (includes Traditional Channels i.e. Distribution & Trade)

- Institutional (includes Private & Government Projects)

By Regions

- Northern (includes Ladakh, Jammu & Kashmir, Himachal Pradesh, Punjab, Haryana, Delhi, Rajasthan, Uttar Pradesh, Uttarakhand)

- Southern (includes Telangana, Andhra Pradesh, Karnataka, Kerala, Tamil Nadu)

- Eastern (includes Bihar, Odisha, Jharkhand, West Bengal, Sikkim, Meghalaya, Tripura, Mizoram, Manipur, Nagaland, Arunachal Pradesh, Assam)

- Western (includes Gujarat, Maharashtra, Goa, Madhya Pradesh, Chhattisgarh)

India LED Lighting Market (2025-2031): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. India LED Lighting Market Overview |

| 3.1. India LED Lighting Market Revenues, 2020-2030F |

| 3.2. India LED Lighting Market - Industry Life Cycle |

| 3.3. India LED Lighting Market - Porter’s Five Forces |

| 3.4. India LED Lighting Market – SWOT Analysis |

| 4. India LED Lighting Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.2.1 Increasing government initiatives promoting energy-efficient lighting solutions in India |

| 4.2.2 Growing awareness about the benefits of LED lighting in terms of energy efficiency and cost savings |

| 4.2.3 Rise in demand for smart lighting solutions and IoT integration in lighting systems |

| 4.3. Market Restraints |

| 4.3.1 High initial installation costs of LED lighting systems compared to traditional lighting options |

| 4.3.2 Lack of consumer awareness about the long-term cost benefits of LED lighting |

| 4.3.3 Challenges related to the disposal and recycling of LED lighting components |

| 5. India LED Lighting Market Trends |

| 6. India LED Lighting Market Overview, By Types |

| 6.1 India LED Lighting Market Revenue Share, By Types, 2023 & 2030F |

| 6.1.1 India LED Lighting Market Revenues, By Lamps, 2020-2030F |

| 6.1.2 India LED Lighting Market Revenues, By Luminaires, 2020-2030F |

| 7. India LED Lighting Market Overview, By Applications |

| 7.1 India LED Lighting Market Revenue Share, By Applications, 2023 & 2030F |

| 7.1.1 India LED Lighting Market Revenues, By Outdoor Lighting, 2020-2030F |

| 7.1.2 India LED Lighting Market Revenues, By Indoor Lighting, 2020-2030F |

| 8. India LED Lighting Market Overview, By Sales Channels |

| 8.1 India LED Lighting Market Revenue Share, By Sales Channels, 2023 & 2030F |

| 8.1.1 India LED Lighting Market Revenues, By B2B, 2020-2030F |

| 8.1.2 India LED Lighting Market Revenues, By B2C, 2020-2030F |

| 8.1.3 India LED Lighting Market Revenues, By Institutional, 2020-2030F |

| 9. India LED Lighting Market Overview, By Regions |

| 9.1 India LED Lighting Market Revenue Share, By Regions, 2023 & 2030F |

| 9.1.1 India LED Lighting Market Revenues, By Northern, 2020-2030F |

| 9.1.2 India LED Lighting Market Revenues, By Western, 2020-2030F |

| 9.1.3 India LED Lighting Market Revenues, By Southern, 2020-2030F |

| 9.1.4 India LED Lighting Market Revenues, By Eastern, 2020-2030F |

| 10. India LED Lighting Market Key Performance Indicators |

| 10.1 Energy savings achieved through the adoption of LED lighting solutions |

| 10.2 Number of government projects implementing LED lighting systems |

| 10.3 Adoption rate of smart lighting solutions in India |

| 10.4 Percentage of commercial and residential buildings using LED lighting |

| 10.5 Number of manufacturers offering sustainable and eco-friendly LED lighting options |

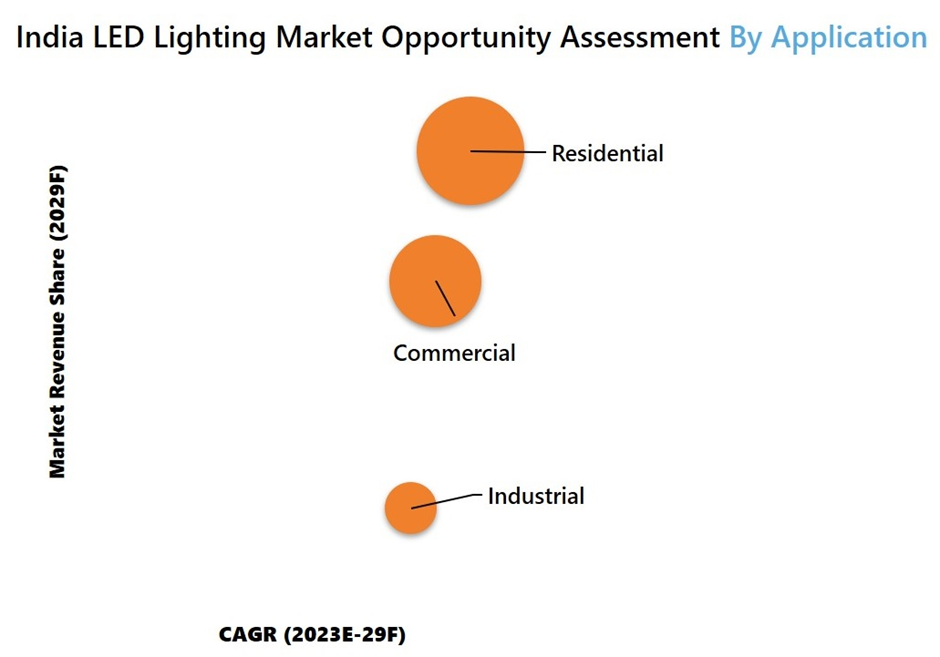

| 11. India LED Lighting Market Opportunity Assessment |

| 11.1. India LED Lighting Market Opportunity Assessment, By Types, 2030F |

| 11.2. India LED Lighting Market Opportunity Assessment, By Applications, 2030F |

| 11.3. India LED Lighting Market Opportunity Assessment, By Sales Channels, 2030F |

| 11.4. India LED Lighting Market Opportunity Assessment, By Regions, 2030F |

| 12. India LED Lighting Market Competitive Landscape |

| 12.1 India LED Lighting Market Revenue Share, By Top B2B & B2C Companies, 2023 |

| 12.2 India LED Lighting Market Competitive Benchmarking, By Operating Parameters |

| 13. Company Profiles |

| 13.1 Crompton Greaves Consumer Electricals Ltd. |

| 13.2 Havells India Ltd. |

| 13.3 Surya Roshni Ltd. |

| 13.4 Orient Electric Ltd. |

| 13.5 Wipro Lighting |

| 13.6 Syska Led Lights Private Limited |

| 13.7 Bajaj Electricals Ltd. |

| 13.8 Halonix Technologies Private Limited |

| 13.9 Eveready Industries India Limited |

| 13.10 Signify Innovations India Limited |

| 13.11 HPL Electric & Power Limited |

| 13.12 Panasonic Life Solutions India Pvt. Ltd. |

| 13.13 LEDVANCE India |

| 13.14 RR Kabel Ltd. |

| 13.15 Polycab India Limited |

| 14. Key Strategic Recommendations |

| 15. Disclaimer |

| List of Figures |

| 1. India LED Lighting Market Revenues, 2020-2030F (INR 000' Crores) |

| 2. India Real Estate Market Value, 2017-2030F, (INR Lakh Crores) |

| 3. India Real Estate Sector Contribution to GDP, Oct 2024 & 2047F |

| 4. India Budget Allocation under National Infrastructure Pipeline (FY2020-FY2025F) |

| 5. India Construction Sector GDP Contribution, 2020-2025F |

| 6. India Region-wise Electricity Demand Projection (2021-22 to 2031-32): Energy Requirement (in 1000 MU) |

| 7. India Region-wise Electricity Demand Projection (2021-22 to 2031-32): Peak Demand (in GW) |

| 8. India Region-wise Number of Villages Electrified under DDUGJY (till 1st Aug 2024) |

| 9. India LED Lighting Market Revenue Share, By Types, 2023 & 2030F |

| 10. India LED Lighting Market Revenue Share, By Applications, 2023 & 2030F |

| 11. India LED Lighting Market Revenue Share, By Sales Channels, 2023 & 2030F |

| 12. India LED Lighting Market Revenue Share, By Regions, 2023 & 2030F |

| 13. India Hotel Transaction Volume, (%), 2023 |

| 14. Existing Supply of Hotel Rooms across Major Cities, (Units), 2019-21 |

| 15. Total Contribution of Indian Hotel Industry to GDP (INR Lakh Crores), 2022-47F |

| 16. India Luxury and First-Class Hotel Projects, 2022-2025F (Units) |

| 17. India Office Demand, 2020-2025F (Million Sqft) |

| 18. India Expected Office Area Completion, By Cities, 2024-2025F |

| 19. Number of Houses under India Pradhan Mantri Awas Yojana (Urban), 2023 (In Lakhs) |

| 20. India Top 7 Cities Housing Sales and Launches in H1 2024, (In Thousand units) |

| 21. India Retail Market Size, 2023-2030F (INR Lakh Crores) |

| 22. India Shopping Mall Total Supply by Top 7 States (H2 2023-2027F) |

| 23. India LED Lighting Market Opportunity Assessment, By Types, 2030F |

| 24. India LED Lighting Market Opportunity Assessment, By Applications, 2030F |

| 25. India LED Lighting Market Opportunity Assessment, By Sales Channels, 2030F |

| 26. India LED Lighting Market Opportunity Assessment, By Regions, 2030F |

| 27. India LED Lighting Market Revenue Share, By Organized B2B Companies, 2023 |

| 28. India LED Lighting Market Revenue Share, By Organized B2C Companies, 2023 |

| List of tables |

| 1. India Number Of LED Bulbs Distributed Under UJALA Scheme (till June 2024) |

| 2. India Number of LED Street Lights Installed Under SLNP (till 30 June 2024) |

| 3. India’s State-wise Number of Villages Electrified under DDUGJY (till 1st Aug’2024) |

| 4. Key Highlights of India Smart City Mission |

| 5. India LED Lighting Market Revenues, By Types, 2020-2030F (INR 000' Crores) |

| 6. India LED Lighting Market Revenues, By Applications, 2020-2030F (INR 000' Crores) |

| 7. India LED Lighting Market Revenues, By Sales Channels, 2020-2030F (INR 000' Crores) |

| 8. India LED Lighting Market Revenues, By Regions, 2020-2030F (INR 000' Crores) |

| 9. India Upcoming Hotel Projects 2025F-2028F |

| 10. India Retail Supply In Malls, 2027F (Million sq ft) |

| 11. India LED Lighting Market Top Companies, B2B & B2C LED Lighting Revenue Split, 2023 |

Market Forecast By Types (Self-Ballasted LED Lamps, Down Lighters LED, Street-Lights LED, Indoor Luminaires (Excluding Down Lighter), Outdoor Luminaires (Floodlight), By End-User (Indoor Lighting, Outdoor Lighting), By Application (Commercial, Residential, Industrial), By Sales Channel (Retail/Wholesaler, Direct sales/Distributor, E-Commerce), By Region (Northern, Southern, Western, Eastern) And Competitive Landscape

| Product Code: ETC4454725 | Publication Date: Apr 2024 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 79 | No. of Figures: 21 | No. of Tables: 11 |

India LED Lighting Market Synopsis

The India LED Lighting Market has experienced growth in recent years, driven by government initiative like UJALA, PLI scheme and Street Lighting National Programme along with an increased focus on smart cities and growing technological awareness among individuals. This growth is in line with the Smart Cities Mission, launched on June 25, 2015, as a collaborative effort between the Ministry of Housing and Urban Affairs (MoHUA) and all state and Union territory (UT) governments. The mission aims to transform 100 existing cities in India into smart cities, which, in turn, has positively influenced the LED lighting market in the country. However, in 2020, the outbreak of the coronavirus had a detrimental impact on the growth of the LED lighting market in India. The demand for LED lighting products declined significantly due to the nationwide lockdown imposed by the government and disruptions in the supply chain, resulting in the suspension of manufacturing operations. Although, the market has shown signs of recovery owing to growth in the luxury real estate sector, with ultra-luxury properties valued at INR 40 – 70 Cr in Mumbai, recording a notable 64% growth, and 64 units were sold in H1 FY 22 to H1 FY indicating a positive trend.

According to 6Wresearch, the India LED Lighting Market is projected to grow at a CAGR of 13.9% from 2023 to 2029F. The growing hospitality sector with the upcoming 177 hospitality projects which are expected to be completed by 2025 would further increase the demand for LED lighting products to enhance the overall ambiance, comfort, and aesthetics of hotels. Currently, the country has 13 million smart houses, and it is anticipated that the installation of smart home solutions would increase by 12.8% by 2025. This upward trend is expected to drive the demand for smart lighting LED products during the forecast period. India is experiencing a sharp increase in urbanization, with approximately 600 million people expected to reside in cities by 2030. These urban areas are projected to account for 70% of the Indian GDP. This substantial shift towards urban living would create a significant market opportunity for India LED Lighting Industry.

In the upcoming years, the India LED Lighting Market would experience growth on account of the growing real estate sector, as India real estate is estimated to be worth INR 83.3 Lakh Crores by 2030, a significant increase from INR 16.67 Lakh Crores in 2021. Furthermore, it is anticipated that a significant number of office projects, totaling over 120 million square feet, will be completed by 2024-25. Among these, Bangalore, Hyderabad, and Pune are expected to collectively contribute approximately 62% of the total completion areas. This surge in office construction activity is poised to fuel the demand for LED lighting in office spaces in the upcoming years. The major hospitality brands Hilton and the Dangayach Group would launch hotels such as Aravalli Hills, Waldorf Astoria Jaipur, and Fairmont Hotels & Resorts which would propel the demand for LED lighting, therby contributing to the India LED Lighting Market Growth.

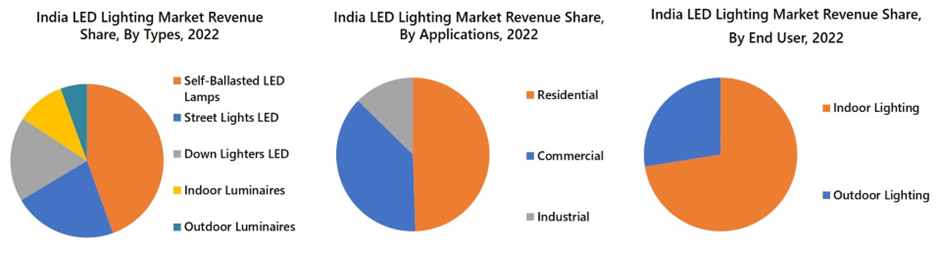

Market Segmentation by Type

By Type, Self-ballasted LED lamps have emerged as a significant revenue contributor in India's LED lighting market due to several key factors. Firstly, these lamps offer a convenient and cost-effective lighting solution as they do not require separate ballasts or fixtures, simplifying the installation process for consumers. Additionally, under the government's UJALA scheme, approximately 368 million LED bulbs and tube lights were distributed by June 2023, which contributed to the segment growth.

Market Segmentation by Application

In terms of application, Residential segment dominated the LED Lighting market share, As more households seek modern lighting solutions, the demand for LED lighting in residential spaces has surged. Moreover, witnessing a total of 271,818-unit sales, representing a significant 25% increase over the previous peak observed in 2010, which had contributed to the demand for LED lights in the residential sector.

Market Segmentation by End-User

By End-User, Indoor lighting has emerged as the leading revenue generator among end users owing to increasing urbanization and rapid development of residential and commercial infrastructure across India have fueled the demand for indoor lighting solutions.

Market Segmentation by Sales Channel

By Sales Channel, retailers and wholesalers holds a significant share, as retailers and wholesalers offer extensive distribution networks, reaching both urban and rural areas effectively. Their widespread presence ensures accessibility of LED lighting products to a diverse range of consumers across the country.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2020 to 2023.

- Base Year: 2023.

- Forecast Data until 2030.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- India LED Lighting Market Overview

- India LED Lighting Market Outlook

- India LED Lighting Market Forecast

- Industry Life Cycle

- Porter’s Five Force Analysis

- Historical Data and Forecast of India LED Lighting Market Revenues for the Period 2019-2029F

- Historical Data and Forecast of Market Revenues, By Types, for the Period 2019-2029F

- Historical Data and Forecast of Market Revenues, By End User, for the Period 2019-2029F

- Historical Data and Forecast of Market Revenues, By Applications, for the Period 2019-2029F

- Historical Data and Forecast of Market Revenues, By Sales Channels, for the Period 2019-2029F

- Historical Data and Forecast of Market Revenues, By Regions, for the Period 2019-2029F

- Market Drivers and Restraints

- India LED Lighting Market Evolution & Trends

- Market Opportunity Assessment

- India LED Lighting Company Ranking, By Companies

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Types

- Self-Ballasted LED Lamps

- Down Lighters LED

- Street-Lights LED

- Indoor Luminaires (Excluding Down Lighter)

- Outdoor Luminaires (Floodlight)

By End-User

- Indoor Lighting

- Outdoor Lighting

By Application

- Commercial

- Residential

- Industrial

By Sales Channel

- Retail/Wholesaler

- Direct sales/Distributor

- E-Commerce

By Region

- Northern

- Southern

- Western

- Eastern

Market Forecast By Installation (New, Retrofit), By Product Type (Lamps, Luminaires), By Sales Channel (Retail/Wholesale, Direct Sales, E-Commerce), By Application (Indoor, Outdoor) And Competitive Landscape

| Product Code: ETC4454725 | Publication Date: Jul 2023 | Product Type: Report | |

| Publisher: 6wresearch | No. of Pages: 85 | No. of Figures: 45 | No. of Tables: 25 |

Topics Covered in the India LED Lighting Market

India LED Lighting Market report thoroughly covers the market by installation, by product type, by sales channels, and by applications. The market outlook report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

India LED Lighting Market Synopsis

India LED Lighting Market is estimated to register sound growth over the coming years owing to the various growing factors such as increasing awareness of energy-efficient concepts, replacement of traditional lighting with advanced LED lighting ranges, and surging urbanization in the country. Additionally, climate change has resulted in an increased environmental concern among the population, which has further resulted in an increase in eco-friendly LED lighting solutions. Also, technological advancements in LED lighting have led to enhanced performance and durability, making LED lights more appealing to consumers. These factors are likely to surge the growth of the LED Lighting Market in India.

According to 6Wresearch, the India LED Lighting Market size is estimated to rise at a CAGR of 7.80% during the forecast period 2023-2029. The market has been growing in the country rapidly with the growing disposable income, which allows consumers to spend more on premium LED lights. Moreover, LED lighting is more durable compared to other traditional lights, this also reduces maintenance & replacement aspects and acts as an appealing feature for consumers and businesses. Moreover, India's rapid urbanization and infrastructure development have surged the demand for LED lighting in both commercial and residential sectors. With the rapid industrial expansion, consumers are becoming aware of reducing high energy cost, hence the adoption of LED lights have been increasing, leading to boosting the India LED Lighting Market growth in the country.

COVID-19 Influence on the India LED Lighting Market

COVID-19 has affected the India LED Lighting Market which is a part of the Asia Pacific LED lighting market. The strict lockdown in the country caused a major interruption in the product supply, especially due to the factory shutdown and logistic challenges. In addition to this, there was a delay in the manufacturing process backed by the shortage of raw materials, leading to less product availability in the Indian market. many lighting projects including streetlight upgradation and retrofitting were delayed due to labor shortages. Some manufacturers were seen to be shift from LED lighting to other products such as personal protective equipment (PPE) has resulted in a reduction in LED lighting production.

Government Initiatives introduced in the India LED Lighting Market

India LED Lighting Market is estimated to witness considerable growth in the coming years on the back of the rising various government initiatives such as, Unnat Jyoti by Affordable LEDs for All (UJALA) Scheme, under this scheme LED bulbs are offered to consumers at subsidized prices by, making it more accessible. Street Lighting National Programme (SLNP), under this scheme government aim to decrease energy consumption by replacing traditional streetlights with energy-efficient LED lights. This scheme has also played a role in improving the illumination of rural areas streets. Perform, Achieve, and Trade (PAT) Scheme plays a crucial role across industries, where maintaining energy efficient targets, in turn, helps the adoption of LED lighting. These are some initiatives of the government to help widen the use of LED lighting in the country, leading to a massive growth of the India LED Lighting industry.

Key Players of the India LED Lighting Market

Below mentioned are some leading market players who are offering an advanced range of products to their customers in order to cater for their diverse requirements. Some of them are listed below:

- Philips Lighting India (Signify) is a global leader in lighting solutions and has a strong presence in the country. They offer a spectrum range of LED lighting products at an affordable range.

- Syska LED Lights is a significant LED lighting brand known for its energy-efficient lighting solutions.

- Havells India is a diversified electrical equipment company established in the country and offers a comprehensive range of LED lighting products, including bulbs, tubes, and decorative lighting.

- Bajaj Electricals is a well-renowned Indian company that offers LED lighting for various applications and sectors including, residential and commercial.

Market Analysis by Applications

According to Nitesh Kumar, Research Manager, 6Wresearch, all the segments including, Commercial, Residential, and Industrial are generating high demand for LED lighting as all are expanding across the country. Increasing construction of commercial buildings and residential buildings with the growing population rate has impacted favourably on the product demand.

Market Analysis by Sales Channel

Based on the end users, both online have been experiencing steady growth in the market and dominating the India LED Lighting Market share, as people are more available on digital platforms for convenient shopping.

Key attractiveness of the report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2019 to 2022.

- Base Year: 2022.

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- India LED Lighting Market Outlook

- Market Size of India LED Lighting Market, 2022

- Forecast of India LED Lighting Market, 2029

- Historical Data and Forecast of India LED Lighting Revenues & Volume for the Period 2019 - 2029

- India LED Lighting Market Trend Evolution

- India LED Lighting Market Drivers and Challenges

- India LED Lighting Price Trends

- India LED Lighting Porter's Five Forces

- India LED Lighting Industry Life Cycle

- Historical Data and Forecast of India LED Lighting Market Revenues & Volume By Installation for the Period 2019-2029

- Historical Data and Forecast of India LED Lighting Market Revenues & Volume By New for the Period 2019-2029

- Historical Data and Forecast of India LED Lighting Market Revenues & Volume By Retrofit for the Period 2019-2029

- Historical Data and Forecast of India LED Lighting Market Revenues & Volume By Product Type for the Period 2019-2029

- Historical Data and Forecast of India LED Lighting Market Revenues & Volume By Lamps for the Period 2019-2029

- Historical Data and Forecast of India LED Lighting Market Revenues & Volume By Luminaires for the Period 2019-2029

- Historical Data and Forecast of India LED Lighting Market Revenues & Volume By Sales Channel for the Period 2019-2029

- Historical Data and Forecast of India LED Lighting Market Revenues & Volume By Retail/Wholesale for the Period 2019-2029

- Historical Data and Forecast of India LED Lighting Market Revenues & Volume By Direct Sales for the Period 2019-2029

- Historical Data and Forecast of India LED Lighting Market Revenues & Volume By E-Commerce for the Period 2019-2029

- Historical Data and Forecast of India LED Lighting Market Revenues & Volume By Application for the Period 2019-2029

- Historical Data and Forecast of India LED Lighting Market Revenues & Volume By Indoor for the Period 2019-2029

- Historical Data and Forecast of India LED Lighting Market Revenues & Volume By Outdoor for the Period 2019-2029

- India LED Lighting Import Export Trade Statistics

- Market Opportunity Assessment By Installation

- Market Opportunity Assessment By Product Type

- Market Opportunity Assessment By Sales Channel

- Market Opportunity Assessment By Application

- India LED Lighting Top Companies Market Share

- India LED Lighting Competitive Benchmarking By Technical and Operational Parameters

- India LED Lighting Company Profiles

- India LED Lighting Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Installation

- New

- Retrofit

By Product Type

- Lamps

- Luminaires

By Sales Channel

- Retail/Wholesale

- Direct Sales

- E-Commerce

By Application

- Indoor

- Outdoor

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2026-2032) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero